Joint stock company registration in Vietnam enables foreign entrepreneurs to establish scalable, investment-ready businesses with full legal protection under the Enterprise Law 2020. This guide cuts through the complexity with Vietnam-specific requirements, 2024 regulatory updates, and proven strategies to secure your Investment Registration Certificate (IRC) and Business Registration Certificate (ERC) on schedule.

What is a Joint Stock Company (JSC) in Vietnam?

A joint stock company (JSC) in Vietnam is a corporate structure where ownership is divided into tradable shares held by shareholders, governed strictly by the Enterprise Law 2020. Unlike limited liability companies (LLCs), JSCs have a more complex governance structure and allow shareholders to transfer shares freely, which facilitates capital raising activities such as public offerings (IPOs).

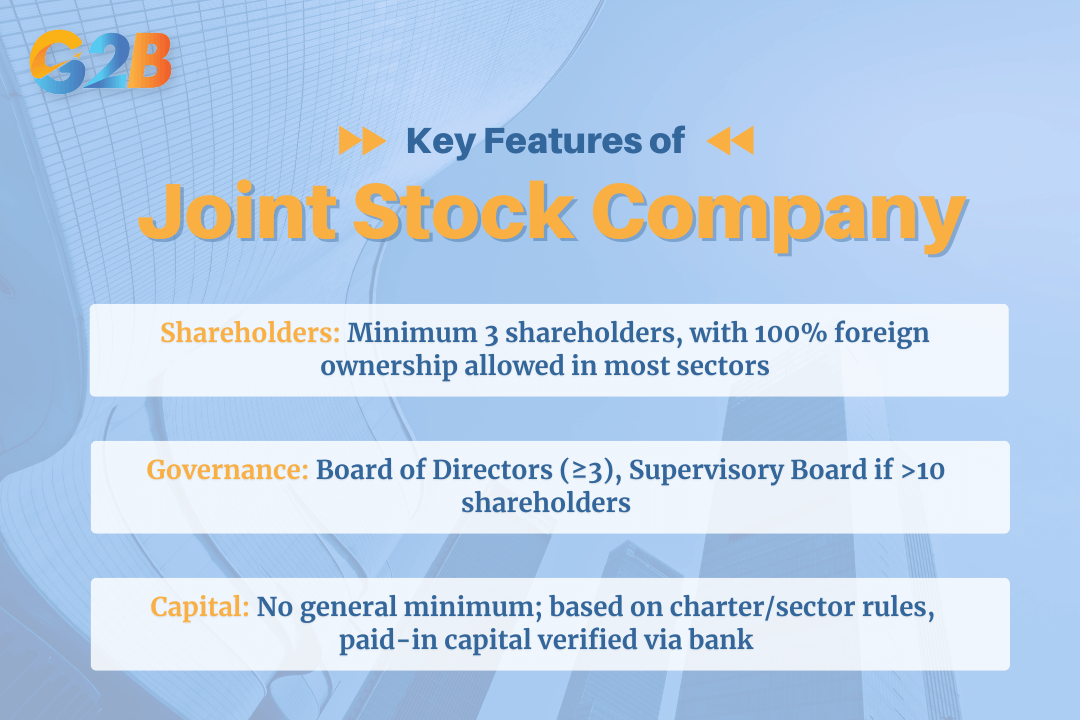

Key features under Vietnam’s Enterprise Law 2020

- Minimum 3 shareholders (individuals or entities), with 100% foreign ownership permitted in most sectors like technology, manufacturing, and services.

- Mandatory governance bodies: A Board of Directors (min. 3 members) and a Supervisory Board (required if >10 shareholders).

- Capital flexibility: Stated capital is determined by the company’s charter and sector-specific regulations, with no general minimum of VND 100 million (~$4,000), but actual paid-in capital is verified during bank account setup.

Key features of Joint Stock Company under Vietnam’s Enterprise Law 2020

JSC vs. LLC in Vietnam - Which fits your goals?

| Criteria | JSC | LLC |

|---|---|---|

| Min. owners | 3 shareholders | 1 member (foreigner allowed) |

| Capital | VND 100M+ (flexible) | VND 10M+ |

| Governance | Board of Directors + Supervisory Board | Single legal representative |

| Best for | Raising capital, IPOs, VC funding | SMEs, quick market entry |

| Foreign ownership | 100% allowed (most sectors) | 100% allowed (most sectors) |

Explore more about the differences between an LLC and a Corporation

Step-by-Step guide to registering a foreign-owned JSC in Vietnam

Establishing a foreign-owned Joint Stock Company (JSC) in Vietnam requires careful compliance with local regulations and a clear understanding of the legal process. The following step-by-step guide outlines the essential company formation procedure in Vietnam to help investors navigate registration smoothly and efficiently.

Pre-registration checklist (2025 updates)

Verify sector-specific restrictions:

- Real estate development may face ownership restrictions or licensing conditions. Specific rules depend on project type and location.

- Education and healthcare need Vietnamese partners (min. 51% ownership).

- Technology and manufacturing allow 100% foreign ownership.

Prepare non-negotiable documents: - Notarized passport copies of all shareholders.

- Shareholder agreement detailing capital contributions and voting rights.

- Business plan with sector classification (aligned with Vietnam’s Economic Classification System).

- Critical warning: 30% of DIY applications fail due to incomplete sector disclosures, especially in "gray zone" sectors like fintech or e-commerce logistics.

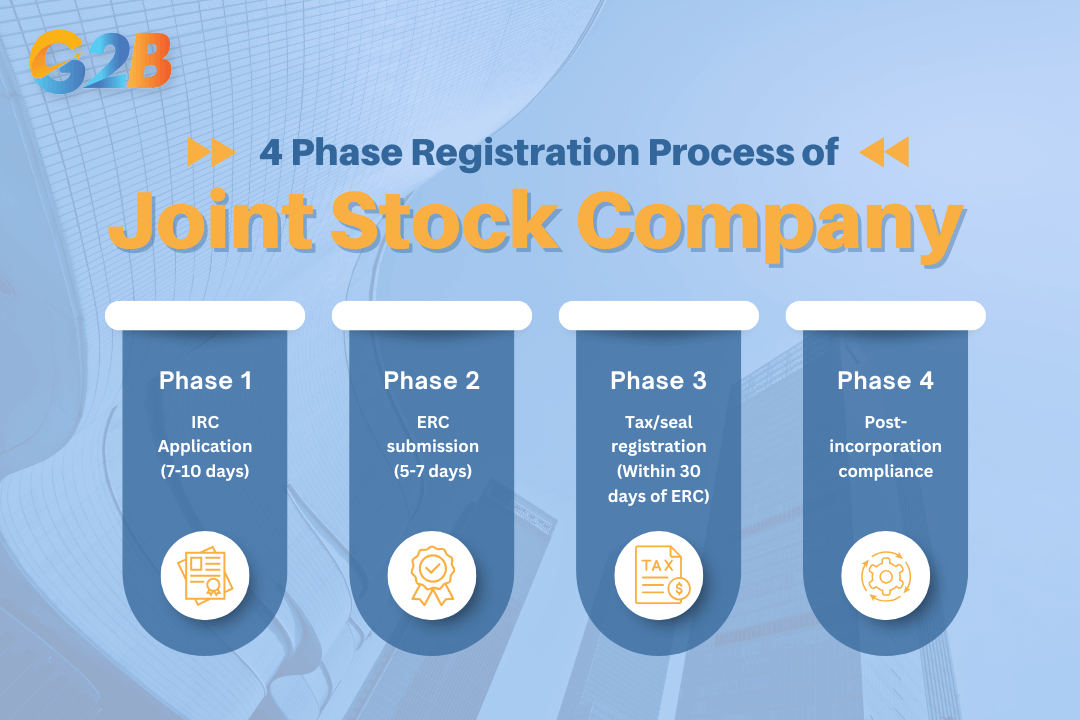

The 4-phase registration process

Phase 1: IRC Application (7-10 days)

Submit to the DPI:

- Investment registration dossier (Form I.D1).

- Shareholder identification documents.

- Business plan with capital allocation breakdown.

Phase 2: ERC submission (5-7 days)

After IRC approval, file with the DPI:

- Business registration dossier (Form II.D1).

- Company charter (must include share structure, governance rules).

- Board member appointments

Key 2024 update: Electronic submissions via National Business Registration Portal now mandatory, paper filings rejected.

Phase 3: Tax/seal registration (Within 30 days of ERC)

- Register company seal at local police department.

- Submit tax registration to General Department of Vietnam Taxation (GDVT).

- Open corporate bank account (banks verify paid-in capital within 90 days).

Phase 4: Post-incorporation compliance

- Monthly VAT and corporate tax filings.

- Annual financial statements (audited if revenue >VND 50B).

- Shareholder meeting minutes (at least once per year as required by law, with additional meetings as stipulated in the company charter or upon necessity)

The 4-phase registration process of JSCs

Top mistakes foreigners make with Vietnam JSCs

While Vietnam offers significant opportunities for foreign investors, many encounter challenges when setting up and managing a Joint Stock Company (JSC). To help avoid costly setbacks, we highlight some mistakes foreigners often make with Vietnam JSCs.

Mistake 1: Underestimating Capital Requirements

"Stated capital = paid-in capital" trips up 45% of foreign founders. Banks require proof of capital contribution within 90 days of ERC issuance, failure to comply may result in frozen bank accounts and monetary penalties. Example: A U.S. e-commerce startup stated VND 500M capital but transferred only VND 100M, frozen bank account and $2,000 penalty.

Maybe you are interested in capital

Mistake 2: Skipping Post-Incorporation Compliance

Late tax filings trigger fines up to 5% of owed tax + 0.05% daily interest. Example: A Singaporean manufacturer missed Q3 VAT filing, $8,200 penalty for $164,000 tax due.

FAQs about Vietnam Joint Stock Companies

Q: Can a foreigner be the sole shareholder of a Vietnam JSC?

A: No, min. 3 shareholders required.

Q: Can foreign shareholders hold <50% of voting rights?

A: Yes, but foreign ownership >49% requires MPI approval for "conditional" sectors like logistics.

Q: How are JSCs taxed in Vietnam?

A: Corporate tax is 20% for both JSCs and LLCs. VAT is generally 10% on goods and services, with some exceptions at 5% or 0%. Dividends are taxed at 5% for foreign shareholders.

Joint stock companies in Vietnam offer foreign entrepreneurs the optimal structure for scalable, investment-driven growth, but only with precise compliance. Avoid critical pitfalls like mismatched capital transfers or ignored residency rules that trigger fines up to 5% of owed tax. For international businesses, JSCs unlock VC funding and IPO pathways unavailable to LLCs.

Explore all aspects of Angel investors vs. Venture capital

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom