100% foreign owned company is the most preferred legal structure for international investors seeking complete control over their business operations in Vietnam. For decades, foreign investors were often forced into Joint Ventures (JV), limiting their decision-making power. Today, Vietnam’s commitment to the World Trade Organization (WTO) allows you to own 100% of the charter capital in most industries. This structure grants you absolute autonomy over profit repatriation, intellectual property protection, and strategic direction, making it the superior choice for serious market entry.

Legal framework & market access

Before initiating the registration process, investors must understand the regulatory landscape that governs a 100% foreign owned company (often referred to as a WFOE in other jurisdictions).

WTO commitments and the negative list

Vietnam adheres to its WTO commitments, which opened most economic sectors to full foreign ownership. However, the Law on Investment 2020 utilizes a "Negative List" approach. This means foreign investors can operate in any industry except those specifically prohibited or restricted.

Conditional business lines

Certain sectors are classified as "Conditional Business Lines." While you can still own 100% of the company, you must satisfy specific criteria before the Department of planning and investment (DPI) grants approval. These conditions often relate to:

- Sub-licenses: Required for education, recruitment, or specialized healthcare.

- Capital minimums: Specific industries like real estate or banking have statutory capital floors.

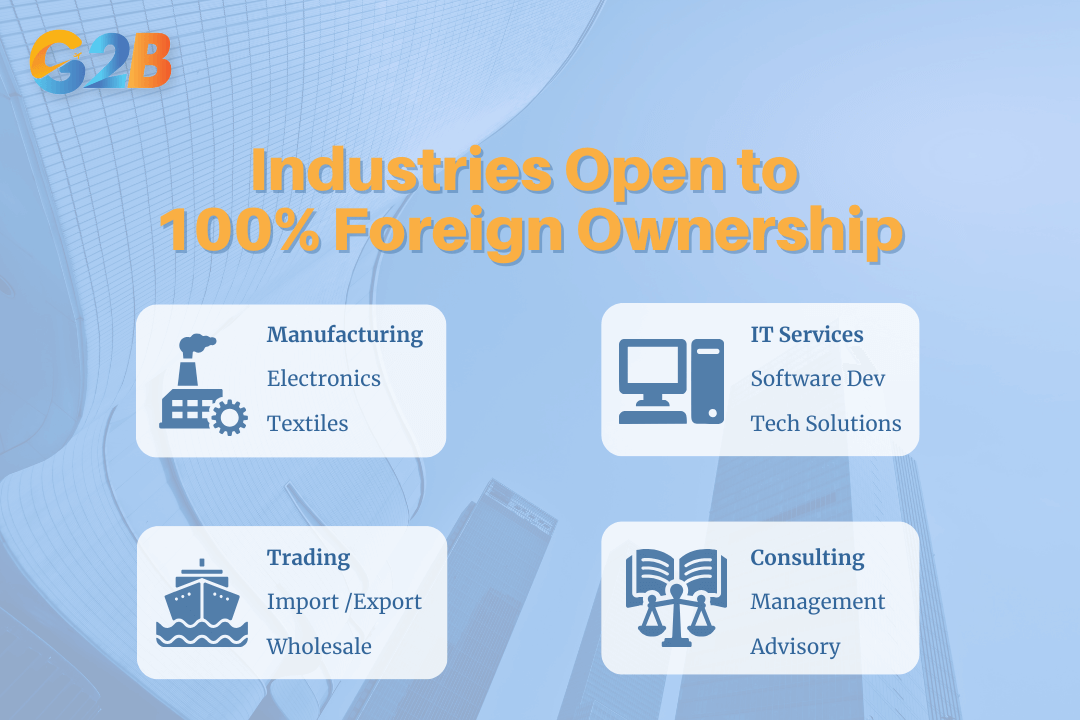

Permitted industries for 100% ownership

- Manufacturing: Production of electronics, textiles, and consumer goods.

- IT services: Software development and technology solutions.

- Trading (import/export): Wholesale and retail distribution (requires registration of HS Codes).

- Management consulting: Business advisory services.

Industries open to 100% foreign ownership under Vietnam’s WTO commitments

Structural options for investors

When setting up a 100% foreign owned company, you must choose a corporate structure that aligns with your shareholding complexity and future capitalization plans.

Single-member limited liability company (LLC)

Single-member limited liability company is the most common structure for SMEs and individual entrepreneurs.

- Ownership: Owned by one individual or one organization.

- Liability: Limited to the contributed capital.

- Structure: Simple management structure; the owner has full decision-making power.

Multi-member limited liability company (LLC)

Ideal for partners who do not wish to issue public shares.

- Ownership: Minimum of 2 and a maximum of 50 members.

- Liability: Limited to capital contribution.

- Governance: Decisions are made via a Members' Council.

Joint stock company (JSC)

A joint stock company is recommended for medium-to-large enterprises planning to list on the stock exchange.

- Ownership: Minimum of 3 shareholders (no maximum).

- Capital: Divided into shares.

- Flexibility: Easier to raise capital by issuing new shares or bonds.

Critical requirements for setup

To ensure your application is not rejected by the licensing authority, your dossier must meet specific legal and feasibility standards.

Charter capital requirements

Vietnamese law does not stipulate a minimum capital for most standard business lines (e.g., IT, Consulting, Trading). However, the Department of planning and investment (DPI) assesses whether your capital is "feasible" for your business scope.

- Legal recommendation: While $1 USD is theoretically possible, it is practically impossible to get approved.

- Feasible range: A minimum Charter Capital between $10,000 and $30,000 USD for service companies to demonstrate financial viability.

- Manufacturing: Requires capital commensurate with factory setup and machinery costs.

Resident director (legal representative)

Every company in Vietnam must have at least one Legal Representative.

- Residency: At least one legal rep must reside in Vietnam. If they leave the country, they must authorize another person via Power of Attorney.

- Nationality: The Legal Rep can be a foreigner or a Vietnamese national. If they are a foreigner, they will eventually need a work permit or exemption certificate.

Registered address

You must have a physical address to register the company.

- Service & trading: A commercial office lease is required.

- Manufacturing: A lease inside an Industrial Zone or a factory with proper land use rights.

- Virtual offices: While legally gray, some authorities accept them for service firms, but it triggers high scrutiny regarding tax compliance and physical presence verification.

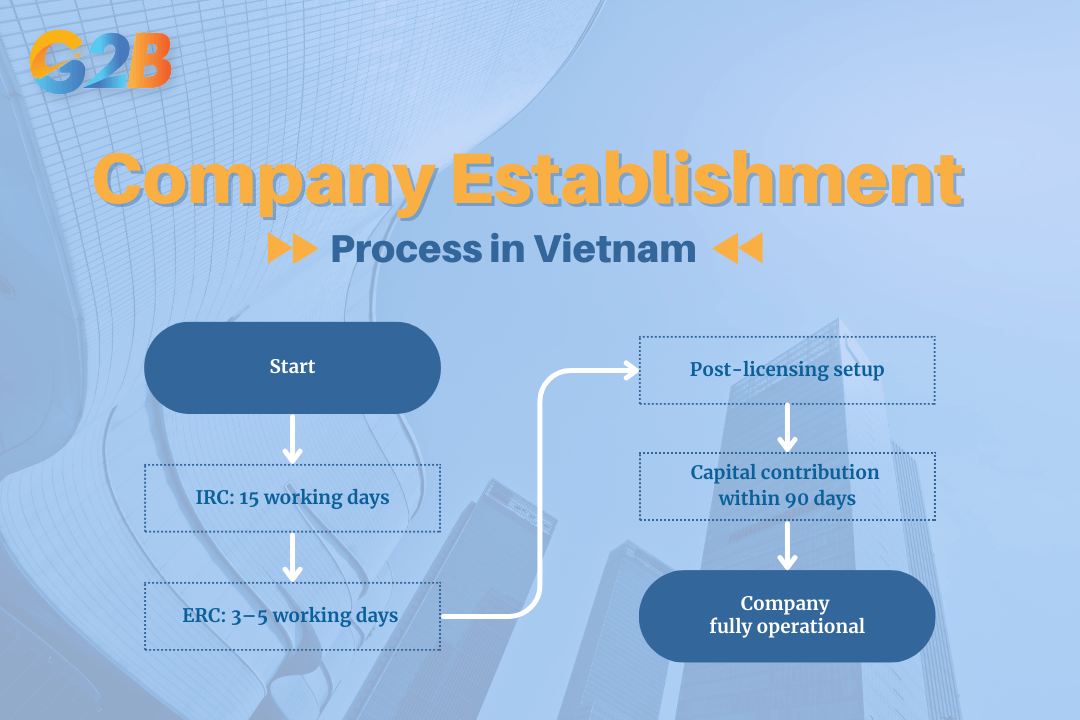

Step-by-step procedure

Establishing a 100% foreign owned company involves two distinct licensing stages. This process is more complex than for local companies due to national security and economic impact assessments.

Step 1: Investment Registration Certificate (IRC)

IRC is the "permission to invest"

- Authority: Department of Planning and Investment (DPI).

- Dossier: Investment proposal, proof of financial capacity (bank statements), and office lease.

- Duration: Approx. 15 working days.

Step 2: Enterprise Registration Certificate (ERC)

ERC is the "birth certificate" of the company.

- Authority: Business Registration Office (under DPI).

- Outcome: Issuance of the company tax code.

- Duration: Approx. 3-5 working days after IRC issuance.

Step 3: Post-licensing compliance

Once the ERC is issued, the company exists but is not yet operational. You must:

- Company seal: Engrave and register the legal seal.

- Public announcement: Publish company details on the National Business Registration Portal.

- Bank accounts: Open two types of accounts:

- Direct investment capital account (DICA): Strictly for receiving capital injection from overseas (mandatory for foreign-invested projects; closed after full contribution and VCC issuance).

- Current account: For daily operational transactions.

- Tax token: Purchase a digital signature token for e-filing.

- E-invoice: Register for VAT invoice (e-invoice) issuance.

Step 4: Capital contribution

Investors must transfer the full Charter capital into the DICA within 90 days from the date of issuance of the ERC. Failure to do so results in heavy fines and potential license revocation.

Key steps to establish a 100% foreign owned company in Vietnam

Timeline & costs

The following section outlines the key timeframes and expenses involved in the incorporation process, from initial application to full operational readiness.

Estimated timeline

- Document preparation: 1-2 weeks (Notarization and Consular Legalization of overseas documents).

- Licensing process (IRC + ERC): 20-30 working days standard.

- Total time: Expect 4-6 weeks from dossier submission to full operation.

Cost structure

Investors should distinguish between state fees and professional service fees.

- State fees: Nominal fees for ERC issuance and seal registration.

- Variable costs: Office lease deposits, legalization fees at embassies, and translation costs.

- Service fees: Vary based on the complexity of the business structure and industry conditions.

Taxation & compliance

Operating a 100% foreign owned company requires strict adherence to Vietnam's tax laws to avoid auditing penalties.

Corporate income tax (CIT)

- Standard rate: 20% on net profits.

- Incentives: Projects in High-tech zones or difficult socio-economic areas may enjoy tax holidays (e.g., 0% for 4 years, 50% reduction for 9 years).

Value added tax (VAT)

- Standard rate: 10% (previously reduced to 8% for certain sectors until mid-2024 per government decrees).

- Reporting: Monthly or quarterly filings are mandatory.

Profit repatriation

Foreign investors can remit profits abroad only after:

- Fulfilling all tax obligations (CIT paid).

- Submitting audited financial statements.

- Ensuring no accumulated losses from previous years.

Comparison: WFOE vs. JV vs. RO

Choosing the right entity is a strategic decision. Below is a comparison of the three most common entry vehicles.

| Feature | 100% Foreign owned company (WFOE) | Joint venture (JV) | Representative office (RO) |

|---|---|---|---|

| Ownership | 100% Foreign Investor | Shared (Foreign + Local) | Parent Company |

| Revenue generation | Allowed (Full billing rights) | Allowed | Prohibited (Cost center only) |

| Control | Total control | Shared/Diluted Control | Limited to market research |

| Risk | Full exposure to liability | Shared risk | Low risk |

| Setup time | Medium (4-6 weeks) | Medium/High (Negotiations) | Fast (2-3 weeks) |

| Taxation | CIT & VAT apply | CIT & VAT apply | No CIT (PIT applies to staff) |

Frequently asked questions

Can a foreigner own 100% of a company in Vietnam? Yes. Under WTO commitments and the Law on Investment 2020, foreigners can own 100% of the capital in most business lines, excluding specific sensitive sectors like national defense or news media.

Is a Vietnamese partner required to set up a company? No. For a 100% foreign owned company, a local partner is not required. You retain full equity and decision-making power.

Do I need to be physically present to set up the company in Vietnam? No. You can authorize via a Power of Attorney to submit the dossier and retrieve the licenses on your behalf. However, the Legal Representative will eventually need to be present to open the bank account and manage operations.

Is there a fixed minimum capital requirement? No, generally speaking. The law requires capital to be "sufficient" for the project. However, industries like Banking, Real Estate, and Travel Services have statutory minimums. For standard consulting or trading, $10,000+ is a safe benchmark.

Can a 100% foreign owned company own land? No. Foreign entities cannot own land freehold. They can only lease land or obtain Land Use Rights (LUR) for a specific duration (usually 50 years) coinciding with their project lifecycle.

Establishing a 100% foreign owned company in Vietnam is the gold standard for international investors seeking security, control, and long-term growth. While the administrative procedures involving the Department of Planning and Investment and the Tax Authority can be intricate, the reward is a fully independent legal entity capable of maximizing profits in one of Asia's fastest-growing economies.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom