There are approximately 1.4 million offshore companies worldwide, primarily concentrated in preferential tax zones across the Caribbean, Asia Pacific, and Western Europe. Understanding the distinctions between offshore and onshore companies is crucial for entrepreneurs and business owners aiming to optimize their operations. Let’s explore the key differences between these two types of corporate structures, examine their respective advantages, and discuss the importance of selecting the appropriate setup to align with your business objectives with G2B.

Understanding the basics about offshore and onshore companies

These two types of corporate structures offer unique advantages and challenges, and the choice between them can significantly impact a business's operational strategy, tax liabilities, and compliance requirements.

Definition and characteristics of offshore companies

An offshore company is a business entity registered in a country different from where its owners or main operations are located. They are often incorporated in jurisdictions known for low or zero tax rates, minimal regulatory hurdles, and favorable asset protection laws. These jurisdictions, often referred to as tax havens, include the Cayman Islands, Bermuda, and the Isle of Man. The primary allure of offshore companies lies in their ability to facilitate tax optimization and enhance privacy.

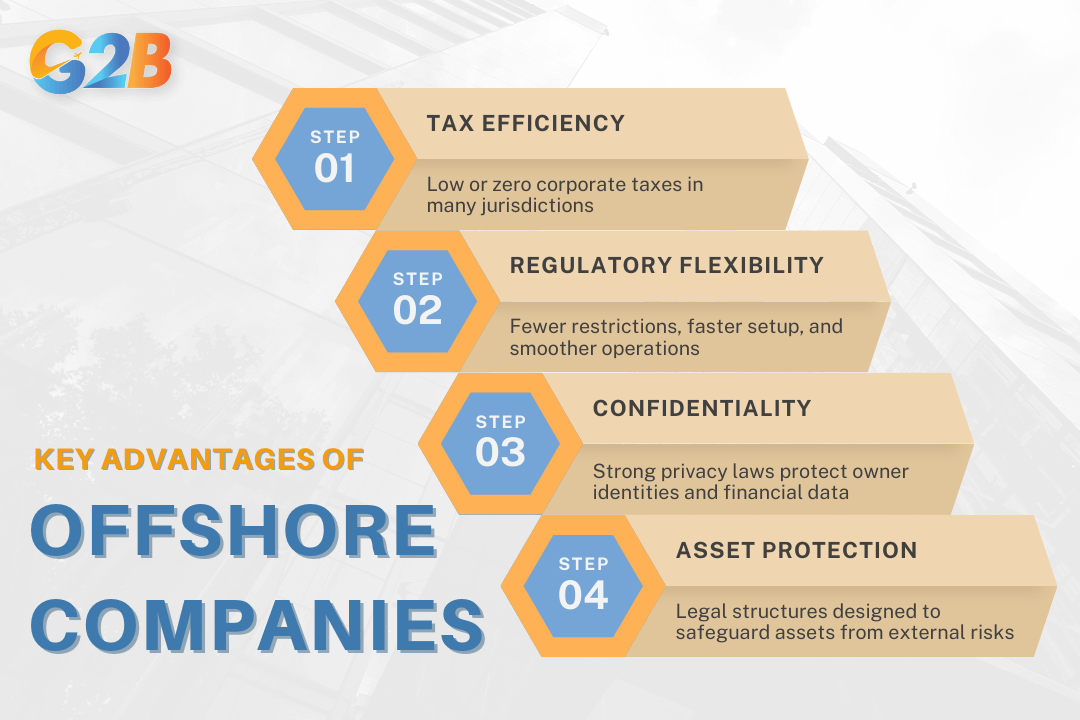

- Tax benefits: In many offshore jurisdictions, companies can benefit from significantly reduced tax liabilities, sometimes avoiding double taxation altogether. This aspect is particularly attractive to corporations and high-net-worth individuals seeking to minimize taxable income legally.

- Regulatory environment: Offshore companies typically operate under lenient regulatory requirements, making them appealing for businesses needing a flexible environment to manage international operations. This leniency can facilitate swift corporate formation and adaptation to global market changes.

- Confidentiality and asset protection: Offshore jurisdictions often provide strong confidentiality clauses, ensuring a high level of privacy and security for owners and stakeholders. Additionally, robust asset protection measures safeguard assets against potential claims and legal actions in their home countries.

Definition and characteristics of onshore companies

An onshore company is a business registered and operating in the same country where its owners or main business activities are located. They are subject to the local tax system, legal regulations, and government oversight of their home country. Countries such as the United States, Germany, and Japan are common locations for onshore registrations due to their market stability and legal credibility.

- Market legitimacy: Onshore companies generally enjoy higher credibility within the business community and among consumers. Being registered in a well-regulated environment often enhances a company's reputation, opening doors to better financing opportunities and strategic partnerships.

- Access to local resources: Businesses operating onshore can leverage local resources, including skilled labor markets, established supply chains, and governmental support programs. This access can be pivotal for companies aiming for significant local market penetration.

- Regulatory compliance and legal protections: Onshore companies must adhere to stringent regulatory requirements. While this can increase administrative burdens, it also ensures the companies are well-protected by comprehensive legal systems. This protection extends to intellectual property rights, contract enforcement, and dispute resolution mechanisms.

Key differences in setup and jurisdiction

The setup of an offshore company usually involves less bureaucratic red tape and can often be accomplished more swiftly than that of an onshore counterpart. However, the trade-off often lies in complying with international transparency standards and maintaining banking relationships that can recognize the legitimacy of offshore entities. Meanwhile, onshore companies, while typically subject to more extensive registration processes, benefit from operating within stable economic and legal environments. This stability can be particularly advantageous for long-term strategic planning, despite the potential for higher operational costs due to local taxes and compliance obligations.

Benefits and risks of offshore companies

Offshore companies are typically established in jurisdictions known for favorable fiscal environments and light regulatory frameworks. Let's delve into the nuanced landscape of offshore companies by examining their benefits and risks.

Tax benefits and regulatory flexibility

Offshore companies often benefit from significant tax advantages, a primary motivator for many international entrepreneurs. Jurisdictions such as the British Virgin Islands, Bermuda, and the Cayman Islands offer low or zero corporate tax rates. Furthermore, the regulatory environment in these regions is typically less stringent compared to onshore environments, offering businesses operational flexibility. This regulatory leniency can facilitate smoother business transactions, fewer bureaucratic hurdles, and swifter company formation processes.

Confidentiality and asset protection advantages

Confidentiality is another cornerstone benefit of offshore companies. Many jurisdictions enforce strict privacy laws, ensuring that business and financial information remains discreet. For instance, in Panama or Nevis, the names of directors and shareholders are not publicly disclosed, providing enhanced privacy for the entity's principals. This level of confidentiality can be crucial for individuals seeking to protect their identity and business strategies from competitors. Additionally, offshore companies can leverage comprehensive asset protection frameworks.

Discover the key benefits of offshore companies and how they support global business growth

Potential risks and compliance challenges

International regulatory bodies have increasingly scrutinized offshore jurisdictions, particularly in light of global tax evasion concerns. Furthermore, the reputational risk should not be underestimated. Businesses associated with offshore setups may face skepticism regarding their transparency and ethical practices. This reputational challenge can affect relationships with partners, investors, and customers who prioritize corporate responsibility.

Benefits and risks of onshore companies

Establishing an onshore company offers several advantages for businesses aiming to build a strong local presence. However, it also comes with certain obligations and risks that entrepreneurs should carefully consider.

Market credibility and legal protections

Onshore companies, by operating within the confines of their home countries, benefit from a marked advantage in terms of market credibility and legal protections. This is primarily due to their adherence to stringent local regulations, which boosts their reputation in the eyes of clients, investors, and legal entities. When a company is registered onshore, it signals compliance with national standards and laws, acting as a seal of legitimacy.

- Reputation and trust: An onshore company's compliance with domestic rules enhances its reputation. This trust is invaluable when engaging in partnerships, securing investments, or expanding to foreign markets. International entrepreneurs and investors often view onshore companies favorably, considering them less risky due to their transparent operations.

- Legal protections: Onshore companies benefit from robust legal frameworks that safeguard individuals' and organizations' rights. This includes protections against unfair trade practices and the assurance that disputes will be resolved under the jurisdiction of a credible legal system. Corporate lawyers often advise that such protections can make a substantial difference in the business environment, particularly during litigation.

Access to local resources and opportunities

Another significant advantage of maintaining an onshore company is the immediate access to local resources and opportunities. These resources range from workforce talent to industry-specific incentives offered by local governments.

- Human resources: Operating within a home market allows businesses to tap into a well of local talent, which is often more familiar with cultural nuances and customer expectations. This readily accessible workforce can be crucial for service-oriented businesses relying on local knowledge and expertise.

- Networking and partnerships: Onshore companies are well-placed to build networks within their local industries. Proximity to industry hubs and trade organizations opens doors to partnerships, joint ventures, and collaborative opportunities, cementing their position within the market.

- Economic incentives: Many governments offer incentives to onshore businesses, including tax reliefs, grants, and subsidies, encouraging innovation and economic growth. These incentives can play a vital role in reducing operational costs and driving competitive advantage.

Regulatory burden and tax obligations

Despite these advantages, onshore companies may face notable challenges, particularly regarding regulatory burdens and tax obligations. These factors can significantly influence the operational efficiency and profitability of a business.

- Compliance costs: The stringent regulatory frameworks that safeguard legal rights also entail substantial compliance costs. Businesses must invest heavily in maintaining necessary licenses, permits, and fulfilling regular reporting requirements imposed by regulatory bodies. These costs can accumulate rapidly, creating a financial burden, especially for startups and small to medium enterprises.

- Tax liabilities: Onshore companies are subject to the home country’s complete tax regime, which often includes corporate taxes, VAT, and other local duties. Although they benefit from credibility and resources, they cannot exploit tax optimization strategies as extensively as offshore companies might. Tax consultants often highlight that onshore tax rates can be significantly higher, impacting a company's bottom line.

Tax implications and regulatory requirements

Understanding the tax implications and regulatory requirements is pivotal when comparing offshore and onshore companies. Both structures offer distinct advantages and challenges, particularly regarding taxation and compliance.

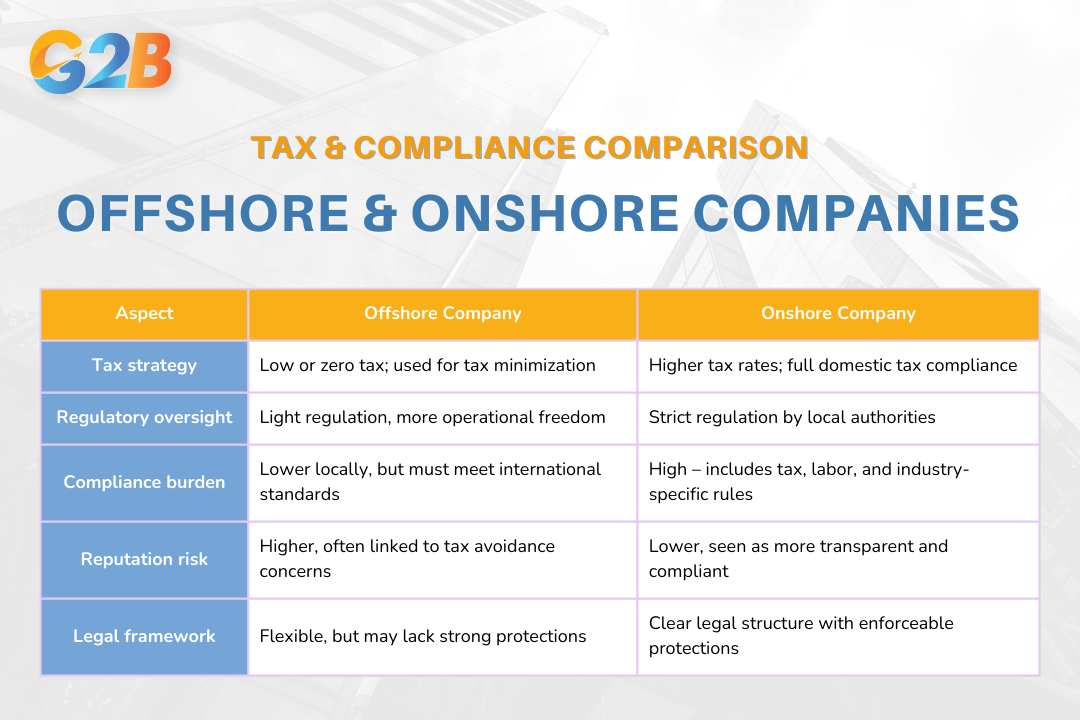

Offshore and onshore companies offer distinct advantages in taxation and regulatory requirements

Comparing tax optimization strategies

Tax optimization is often a primary motivation for choosing offshore and onshore structures. Offshore companies are attractive for tax planning due to their potential to minimize tax liabilities. Conversely, onshore companies, incorporated in home countries, are subject to domestic tax laws. While they may encounter higher corporate tax rates, these companies benefit from avoiding the scrutiny often focused on offshore entities. Compliance with local tax laws also ensures that onshore companies can prevent potential reputational risks associated with avoiding higher taxes.

Regulatory compliance in different jurisdictions

Compliance with regulatory requirements is another important aspect of deciding between offshore and onshore companies. Offshore jurisdictions are known for lighter regulatory oversight, which can offer operational flexibility. However, this reduced scrutiny does not exempt companies from adhering to international regulations such as anti-money laundering laws. Offshore companies must also stay compliant with the reporting standards of the jurisdictions where they conduct business, which can involve complex legal navigation.

Onshore companies, in contrast, operate within well-defined regulatory frameworks enforced by domestic authorities. This regulatory environment requires rigorous adherence to compliance standards, including labor laws, environmental regulations, and industry-specific guidelines. While this can lead to a significant regulatory burden, it also offers legal protections and enhances the credibility of the business. Operating within a familiar legal structure can simplify operations, particularly for businesses targeting local markets.

How international business laws impact company structure

International business laws significantly impact the choice between offshore and onshore structures. For offshore companies, evolving international guidelines like the OECD's Base Erosion and Profit Shifting (BEPS) initiative impose stricter transparency and reporting requirements. These regulations aim to curb tax avoidance, impacting how offshore companies strategize tax optimization and compliance.

On the other hand, onshore companies benefit from operating within legal frameworks that are respected globally. The transparency of onshore operations often aligns with international expectations, thereby reducing the risk of facing punitive measures from foreign regulatory bodies. Legal advisors often recommend onshore structures for companies that plan to engage in extensive cross-border activities due to this alignment with international norms.

Guidance on setting up a company

This guidance will provide insights into the essential aspects to consider when making this strategic choice.

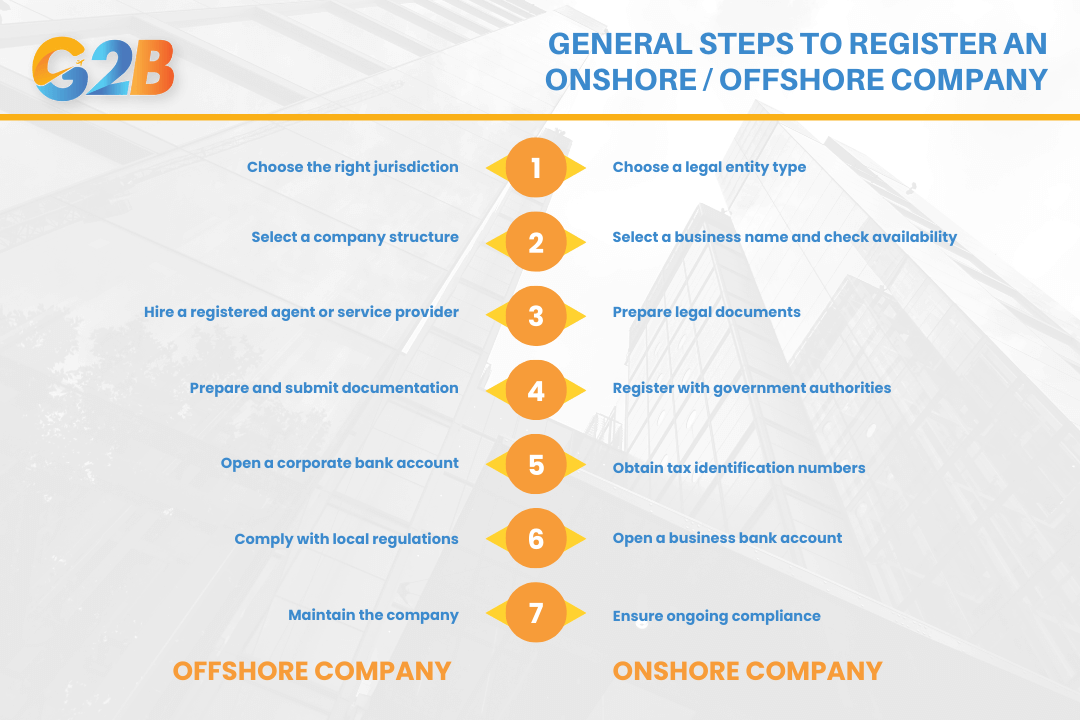

Explore the general steps to register an onshore and offshore company

General steps to register an offshore company

Setting up an offshore company can be a strategic move for entrepreneurs looking to optimize tax, protect assets, and expand internationally. While specific procedures may vary depending on the jurisdiction, the general process typically follows these steps:

- Choose the right jurisdiction: The first and most critical step is selecting a suitable offshore jurisdiction. Common options include the British Virgin Islands (BVI), Cayman Islands, Seychelles, and Belize. Consider factors such as taxation, political stability, legal structure, and reputation.

- Select a company structure: Most offshore companies are incorporated as International Business Companies (IBCs) or Limited Liability Companies (LLCs). The chosen structure will determine the regulatory requirements and flexibility in operations.

- Hire a registered agent or service provider: Offshore jurisdictions usually require companies to appoint a local registered agent. These agents assist with legal compliance, document filing, and act as intermediaries with local authorities.

- Prepare and submit documentation: Common documents include:

- Passport copies and proof of address for directors and shareholders

- Articles of incorporation

- Company name reservation

- Due diligence documents (to comply with anti-money laundering laws)

- Open a corporate bank account: Most offshore companies need a business bank account, often in a different jurisdiction from where the company is registered. Some service providers offer assistance with bank introductions.

- Comply with local regulations: While many offshore jurisdictions offer minimal reporting requirements, compliance with local laws, including substance regulations and economic presence, is increasingly important due to global tax reforms.

- Maintain the company: Annual renewal fees, maintaining a registered office, and submitting minimal filings (if required) are part of ongoing obligations.

General steps to register an onshore company

Unlike offshore companies, onshore companies are registered in the same country where business activities take place. The registration process is often more regulated and transparent, but offers the advantage of market access and legitimacy.

- Choose a legal entity type: Decide on the company structure based on your business goals. Options may include:

- Sole proprietorship

- Limited Liability Company *(LLC)

- Corporation

- Partnership

- Each type has different tax implications, reporting requirements, and liability exposure.

- Select a business name and check availability: Your business name must comply with the local naming guidelines and not conflict with existing registered entities. Most jurisdictions offer online tools to check name availability.

- Prepare legal documents: Typical documentation includes:

- Articles of incorporation or organization

- Identification documents for directors and shareholders

- Business address and contact details

- Industry-specific licenses or permits (if required)

- Register with government authorities: File your business documents with the local company registry (e.g., Companies House in the UK, Secretary of State in the US). Pay the necessary registration fees.

- Obtain tax identification numbers: Register with the local tax authority to receive a Tax Identification Number (TIN) or equivalent. This step is essential for tax reporting, invoicing, and payroll compliance.

- Open a business bank account: Most countries require a corporate bank account for local transactions. Banks may request incorporation documents, proof of address, and details about your business activities.

- Ensure ongoing compliance: Maintain good standing by fulfilling annual requirements, such as:

- Filing annual returns and financial statements

- Paying corporate taxes

- Updating company records as needed

FAQ

What is the difference between an offshore company and an onshore company?

Key differences include:

- Regulatory environment: Offshore companies benefit from lenient regulatory environments, whereas onshore companies must adhere to local regulations, which might be more stringent and demanding.

- Taxation: Typically, offshore companies enjoy reduced tax liabilities due to the favorable tax laws of their jurisdictions. In contrast, onshore entities are often subject to standard or higher tax rates.

- Confidentiality and credibility: Offshore entities often offer greater confidentiality but might face credibility issues, whereas onshore entities sacrifice some degree of privacy for stronger credibility and trust within the local market.

How can a business decide which structure is more suitable?

Choosing between an offshore and onshore company structure demands a thorough evaluation of the business’s strategic goals, regulatory requirements, and market ambitions. Below are key considerations that guide this decision:

- Business objectives:

- If a company is focused on penetrating and establishing credibility within a specific local market, an onshore structure might be more appropriate due to local familiarity and recognition.

- For businesses prioritizing tax optimization and operational flexibility, offshore structures offer compelling advantages.

- Tax considerations:

- Assess the tax implications and how each structure aligns with the company's tax planning strategies. Offshore companies could offer substantial tax benefits, but it’s essential to consider long-term sustainability against the backdrop of evolving international tax laws.

- Regulatory compliance:

- Evaluate the regulatory landscape both for incorporation and ongoing compliance. Onshore companies typically face stricter regulatory standards, which can impact operational efficiency but provide a robust legal framework.

- Professional advice:

- Consulting with experienced legal advisors and tax consultants is critical in navigating this complex decision. These professionals can provide insights specific to the business’s industry and operational context.

Deciding between an offshore and onshore company depends largely on a business's strategic objectives, compliance willingness, and market focus. Offshore companies are ideal for tax optimization and privacy, while onshore companies provide stronger local presence and legal reliability for market-focused operations. As businesses expand across borders, knowing the core differences between offshore and onshore companies is key to making strategic decisions about how to structure your operations internationally.

Hong Kong remains one of the most attractive offshore jurisdictions thanks to its low corporate tax rates (currently capped at 16.5%) and the absence of tax on foreign-sourced income. At G2B, we provide professional business support services, including offshore company formation in Hong Kong. Contact G2B today for a personalized consultation and discover how our team can help you establish your offshore company in Hong Kong efficiently!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom