This guide to hiring employees in Vietnam provides foreign investors with the essential legal and practical knowledge needed to build a compliant and successful team. Venturing into Vietnam's vibrant market offers immense opportunities, but navigating its specific labor laws is crucial for sustainable success. Understanding the different types of company in Vietnam is a prerequisite to determining your hiring capacity and compliance requirements. From establishing a legal entity and understanding mandatory benefits to managing payroll and sponsoring foreign experts, this article covers every critical step.

Why is company formation your first step to hiring

Before a single job offer is made, a foreign investor must establish a legal presence in Vietnam. This is a non-negotiable prerequisite, as only a registered business entity can lawfully engage in employment activities.

You cannot hire without a legal entity: A registered Vietnamese company is mandatory to perform essential employer actions, such as signing legal employment contracts, processing monthly payroll, and registering employees for mandatory social insurance. Without a formal entity, any hiring is considered non-compliant, exposing the investor to significant legal and financial penalties. The process typically takes two to four months to complete.

Foreign investors have several options for structuring their business, with the most common being:

- Limited Liability Company (LLC): This is the most popular structure for foreign investors in Vietnam. It offers straightforward setup, protects personal assets from business liabilities, and can be 100% foreign-owned in most sectors.

- Joint Stock Company (JSC): A JSC is suitable for larger enterprises or those planning to raise capital by issuing shares. It requires a minimum of three shareholders.

Before hiring, your business must secure two critical licenses from the Department of Planning and Investment (DPI) to legitimize its operations. These are:

- The Investment Registration Certificate (IRC): This certificate confirms your status as a foreign investor and authorizes your investment project in Vietnam.

- The Enterprise Registration Certificate (ERC): This document officially establishes your company as a legal entity in Vietnam and contains its tax identification number.

To expedite this, utilizing a professional Vietnam Incorporation Service can ensure your IRC and ERC are issued correctly, following the standard company setup process and requirements in Vietnam

Legal framework of employment in Vietnam

All employment relationships in Vietnam are governed by a single, comprehensive law. Understanding its core tenets is fundamental to compliant hiring and operations.

The Vietnamese Labor Code

The primary law governing employment is the Vietnamese Labor Code. This legislation outlines the rights and obligations of both employers and employees, covering everything from labor contracts and working hours to social insurance and termination procedures. Strict compliance is mandatory to avoid fines and legal disputes.

Types of labor contracts

The Labor Code specifies two primary types of employment contracts:

- Definite-term contracts: These contracts have a fixed duration of up to 36 months. A definite-term contract can only be renewed once for another fixed term. If the employee continues to work after the second term expires, the contract automatically converts to an indefinite-term contract.

- Indefinite-term contracts: As the name suggests, these contracts have no specified end date and continue until terminated by either party in accordance with legal procedures.

Labor Code specifies two primary types of employment contracts

All employment contracts must be in writing and include essential details such as the scope of work, salary, working hours, and social insurance obligations.

Probation periods: Probationary periods allow both parties to assess suitability. The rules are clear and based on the qualifications required for the position:

- The maximum probation period is 180 days for enterprise executive or managerial positions.

- The maximum probation period is 60 days for positions requiring a college degree or higher.

- The maximum probation period is 30 days for roles requiring intermediate vocational certificates or for skilled technicians.

- The maximum is 6 working days for all other jobs. During probation, an employee's salary must be at least 85% of the official gross salary for the job.

Mandatory employee benefits & insurance

Employees in Vietnam are legally required to contribute to a comprehensive social security system known as SHUI (Social Insurance, Health, and Unemployment Insurance) for their employees. These contributions are mandatory for both the employer and the employee.

The employer and employee contribution rates are as follows:

- Social insurance (SI): The employer contributes 17.5%, and the employee contributes 8%.

- Health insurance (HI): The employer contributes 3%, and the employee contributes 1.5%.

- Unemployment insurance (UI): The employer contributes 1%, and the employee contributes 1%. (Note: UI is typically mandatory only for Vietnamese employees).

- Trade union fee: Employers are also required to contribute 2% of the salary fund to the trade union, regardless of whether a union exists at the company.

Working hours, overtime, and leave

- Working hours: The standard working week in Vietnam is no more than 48 hours, typically structured as eight hours per day.

- Overtime: Overtime work requires employee consent and is strictly regulated. Overtime hours cannot exceed 40 hours per month and 200 hours per year in most cases. Pay rates are significantly higher: at least 150% of the normal hourly rate on weekdays, 200% on weekends, and 300% on public holidays.

- Leave: Employees are entitled to a minimum of 12 days of paid annual leave, in addition to public holidays. This entitlement increases by one day for every five years of continuous service with the employer. Female employees are entitled to six months of paid maternity leave.

Recruitment process and finding your talent in Vietnam

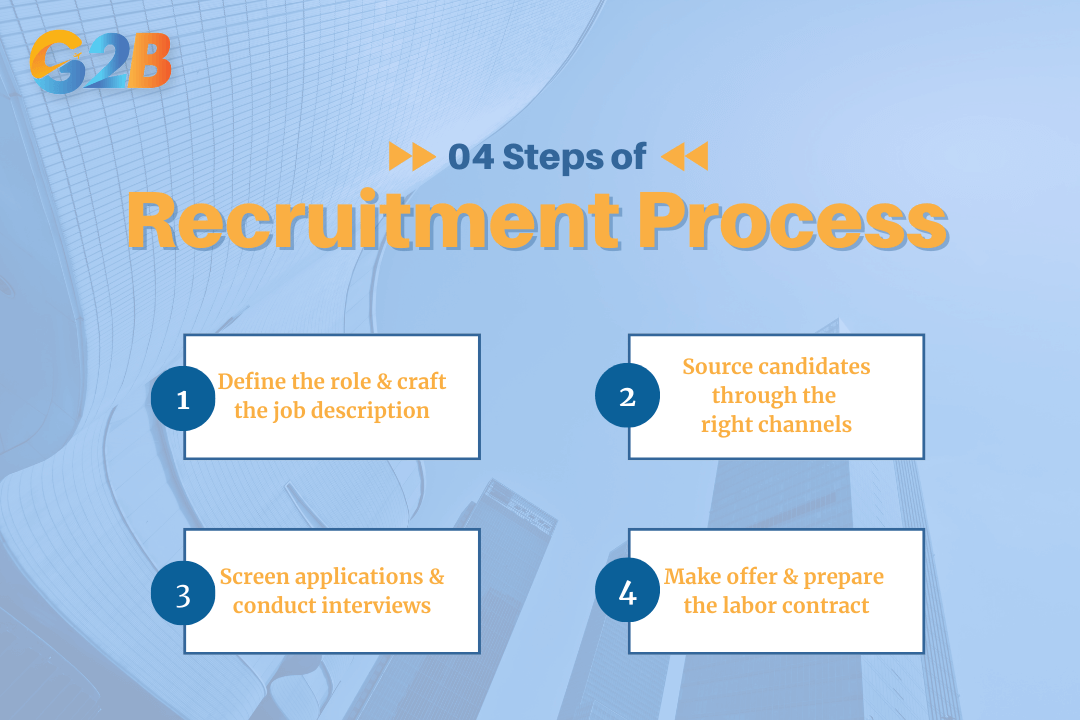

With a young and dynamic workforce, Vietnam is a rich talent pool. However, attracting and securing the right candidates requires a structured, localized approach. The following steps outline the process from defining your needs to making a successful hire.

Steps outline the process from defining your needs to making a successful hire

Step 1: Define the role and craft the job description

Before you can find the right person, you must define the role with precision. A clear and detailed job description is the foundational first step. It should precisely outline key responsibilities, mandatory qualifications, required skills, and the position's reporting lines within your organization. To attract serious and qualified candidates in the competitive Vietnamese market, it is highly recommended to be transparent about the salary range. This single piece of information helps manage expectations and ensures you attract applicants who are aligned with your compensation structure.

Step 2: Source candidates through the right channels

Once the job description is finalized, the next step is to broadcast the opportunity through the most effective channels. Employers in Vietnam can source talent through several effective methods, such as:

- Online job boards: These are the most popular method for reaching a wide audience. Leading platforms include VietnamWorks, TopCV, and CareerBuilder.vn. For specialized technology and IT roles, ITviec is a prominent and highly effective choice.

- Professional networks: LinkedIn is the primary platform for sourcing experienced professionals, managers, and executives. Building a strong employer brand on this platform can attract high-caliber passive candidates.

- Recruitment agencies: For senior-level management or highly specialized positions, leveraging a "headhunter" agency can be extremely effective. These firms possess deep local networks, market knowledge, and can screen candidates before they reach your desk, saving you valuable time.

Step 3: Screen applications and conduct interviews

With a pool of applicants, the screening and interview process begins. This stage is about assessing technical skills and cultural fit. Understanding local communication styles is key to a successful interview process.

- Screening: Filter applications based on the mandatory qualifications outlined in your job description.

- Interviewing & Cultural tips:

- Be aware that Vietnamese professionals often communicate indirectly to maintain harmony and show respect.

- It is common for interviewers to ask about personal topics like age or marital status; in a Vietnamese context, these questions are generally not considered sensitive and are often used to build rapport.

- During the interview, emphasize the non-salary benefits that candidates in Vietnam highly value, such as long-term stability, professional growth opportunities, and a positive company culture. Remember that the "thirteenth-month" bonus is a widely practiced and expected form of compensation, and confirming its existence can be a significant selling point.

Step 4: Make an offer and prepare the labor contract

After identifying the ideal candidate, the final step in the recruitment phase is to extend a formal offer. This should be followed promptly by the preparation of a legally compliant employment contract. The verbal offer should confirm the gross salary, start date, and other key benefits. The written labor contract will formalize these terms, serving as the legal foundation for the employment relationship, which leads directly into the payroll and compliance obligations covered in the following sections.

Payroll, tax, and financial obligations

Managing payroll in Vietnam involves several specific obligations that foreign employers must handle meticulously.

Understanding gross vs. net salary: A frequent point of confusion is the distinction between gross and net salary. While candidates often prefer to negotiate their "take-home" pay (Net salary), Vietnamese law requires that the employment contract must legally state the Gross salary. The employer is responsible for making all deductions from this gross amount.

Personal income tax (PIT)

- Vietnam uses a progressive tax system, where the tax rate increases with income. The brackets range from 5% to 35%.

- The employer holds the legal responsibility for withholding, reporting, and remitting the correct amount of PIT to the tax authorities every month on behalf of their employees.

Setting up your payroll system: An accurate and timely payroll system is critical for both legal compliance and employee morale. It must correctly calculate SHUI contributions, PIT, overtime, and any other allowances before disbursing the final net salary to employees. Managing these complex tax and payroll tasks often requires a qualified chief accountant in Vietnam to ensure full compliance with the General Department of Taxation

Special payroll requirement (public holidays): The law is very specific about compensation for work performed on public holidays. When an employee works on a public holiday, the employer is legally required to pay them at least 300% of their normal daily wage, in addition to their regular pay for that holiday.

Detailed rules on these payments can be found in our guide to payroll in public holiday in Vietnam

Special considerations: Hiring foreigners vs. locals

While the core legal framework applies to all employees, the process for hiring foreign nationals involves significant additional steps.

Hiring Vietnamese citizens Hiring local citizens is a straightforward process governed by the Labor Code regulations already discussed. It involves creating a compliant labor contract, registering the employee for SHUI, and managing payroll and tax obligations.

Hiring foreign employees The process for hiring expatriates is more complex and tightly controlled.

- The work permit requirement: For nearly all foreign nationals, a work permit is a mandatory legal requirement to work in Vietnam. Working without one can lead to fines for the employer and deportation for the employee.

- The key conditions for a foreign employee to obtain a work permit include holding a relevant university degree, having proven work experience (typically at least three years), possessing a clean criminal record, and passing a health check.

- Crucially, the employer is the sponsoring entity and is responsible for managing and submitting the entire work permit application to the Department of Labor, Invalids and Social Affairs (DoLISA) on behalf of the employee. The employer must first demonstrate a need to hire a foreigner by publicly announcing the vacancy to local job seekers.

Need to bring an expatriate manager or expert onto your team? G2B provides Work Permit / TRC / Visa service to help foreigners work and reside legally in Vietnam!

Navigating the complexities of Vietnamese labor law is a critical challenge for foreign investors. This guide provides a comprehensive roadmap, but successful implementation requires diligence and expertise.

- Company formation is the non-negotiable first step before you can legally hire anyone in Vietnam.

- Strict compliance with the Vietnamese Labor Code is essential for avoiding penalties and building a sustainable business.

- Understanding local recruitment channels and cultural nuances is key to attracting and retaining top talent.

Hiring employees in Vietnam requires a clear understanding of local labor regulations and a proactive compliance approach. By following the correct legal procedures from the outset, foreign investors can minimize risks, protect their business interests, and foster a stable workforce. In cases of workforce reduction, it's equally important to understand the legalities of terminating employees in Vietnam to avoid potential labor disputes in Vietnam. With proper planning and the right guidance, building a strong and legally compliant team in Vietnam can become a solid foundation for long-term growth and success.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom