Capital is a fundamental concept in business, representing the financial resources and assets that drive a company’s operations, growth, and long-term sustainability. It serves as the foundation for investment, production, and expansion, influencing strategic decisions across all stages of a business lifecycle. This article explores the definition of capital, its critical functions in business, the ways it is structured, and the different forms it can take within an organization.

This article outlines essential aspects of capital to provide businesses with a clearer understanding of its definition and practical implications. We specialize in company formation and do not offer legal or financial advice. For tailored guidance or compliance-related matters concerning capital, please consult a qualified legal or financial expert.

What is capital in business?

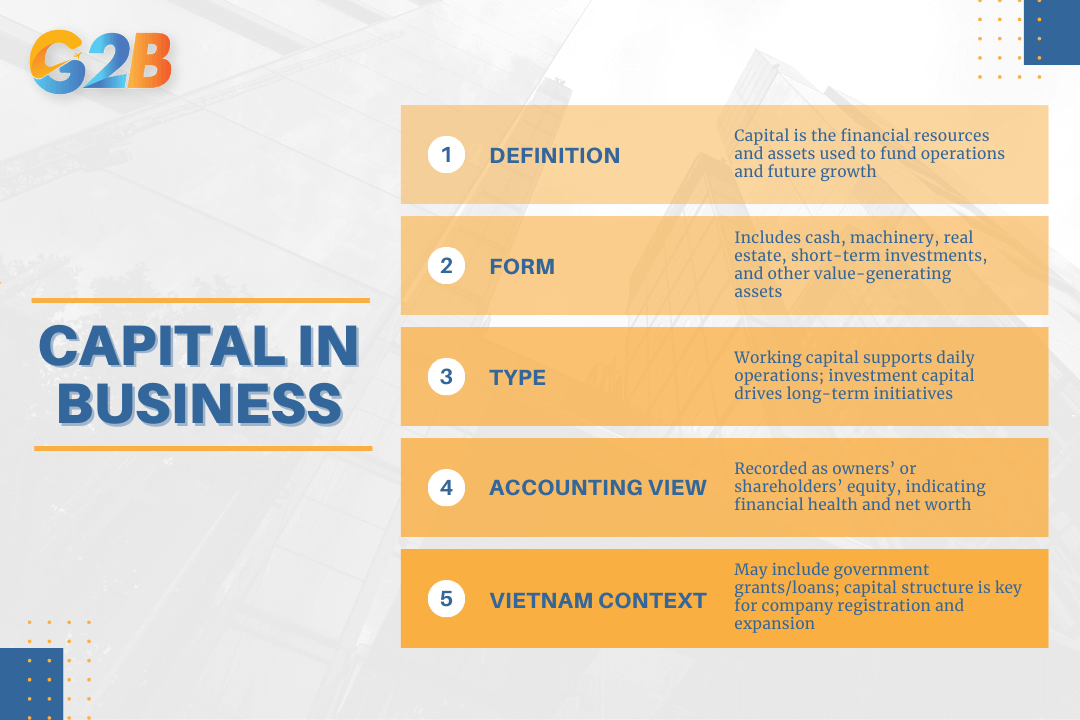

In business, capital refers to the financial resources and assets a company mobilizes to fund its daily operations and achieve its future growth objectives. It serves as the foundational support system that enables a business to acquire assets, invest in projects, and cover operational expenses. While often thought of as just money, capital encompasses a broader range of assets that a business can use to generate value and revenue.

Capital can exist in various physical and financial forms, including cash in the bank, machinery on the factory floor, real estate, and short-term investments. These assets are crucial for producing goods and services, which in turn generate revenue for the company. Effective management of these resources is essential for driving profitability and ensuring long-term sustainability. In addition, capital is often classified into working capital, which supports day-to-day operations, and investment capital, which is used for longer-term growth initiatives.

From an accounting perspective, capital is reflected on a company's balance sheet within the owner's or shareholders' equity. It represents the total value of the investments contributed to the business by its owners. This figure is a key indicator of the financial health and net worth of the company. In the Vietnamese market context, capital may also include government grants and loans, which play a significant role in supporting business development. For businesses planning to register a company in Vietnam, determining the appropriate capital structure is not only a regulatory requirement but also a strategic decision that can influence licensing, operations, and future expansion.

Capital refers to the financial resources and assets a company mobilizes to fund its daily operations

How is capital used in business?

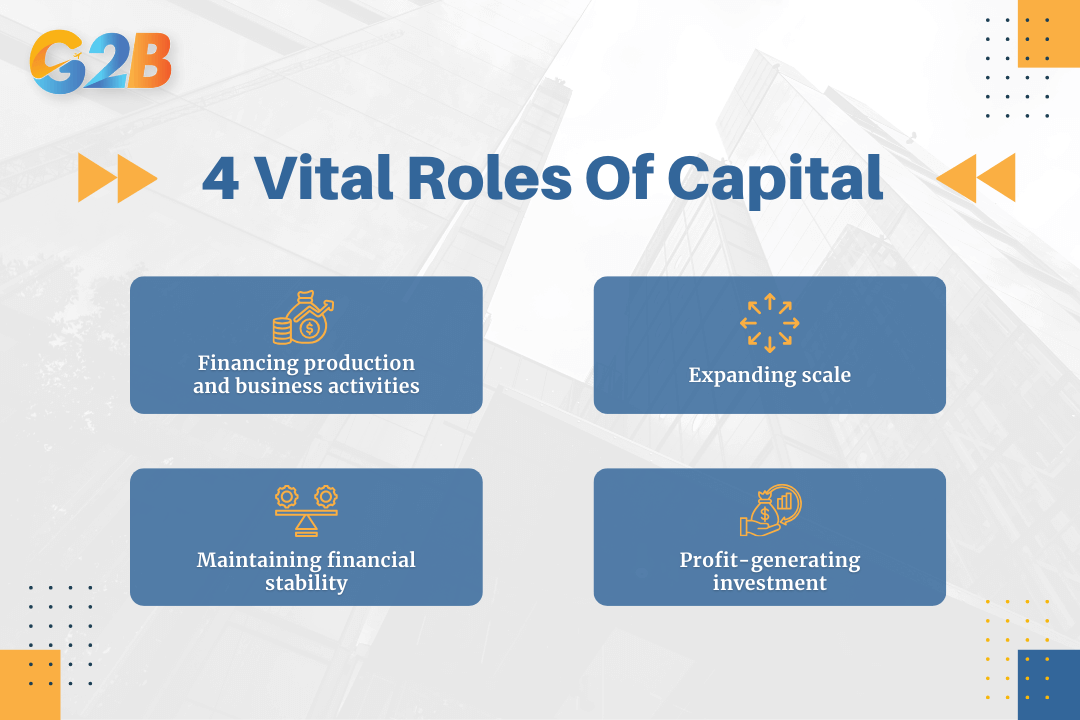

Capital plays four vital roles that ensure a business can operate smoothly, seize opportunities, and maintain financial health. These functions are interconnected and crucial for the sustainable success of any enterprise. The primary roles of capital include:

- Financing production and business activities: This is the most fundamental role of capital, as it is used to cover the day-to-day operational costs, including working capital necessary to maintain liquidity, and regulatory capital requirements in Vietnam. These expenses include purchasing raw materials and inventory, paying employee salaries, and funding marketing campaigns.

- Expanding scale: For a business to grow, it needs to invest in strategic initiatives, and capital makes this possible. It is used for ventures such as investing in new projects, developing innovative products, acquiring modern equipment, expanding facilities, and entering new markets to boost revenue.

- Maintaining financial stability: Capital is essential for managing a company's cash flow and ensuring it has sufficient liquidity. This allows a business to meet its short-term debt obligations on time, manage debt effectively, and navigate through unexpected financial challenges, economic fluctuations and market risks common in Vietnam.

- Profit-generating investment: Idle capital that is not immediately needed for operations can be strategically invested to create additional income streams. This can include activities like purchasing stocks, bonds, or other financial instruments.

Capital plays four vital roles that ensure a business can operate smoothly

Common types of capital in business

Depending on its origin and intended use, capital is classified into several types. Understanding these distinctions is crucial for effective financial management. The four main types of capital that businesses utilize are equity, debt, working, and trading capital.

Equity capital

- Definition: Equity capital is the funding that a business raises by selling ownership stakes to investors. These investors, who can be the business owners themselves, shareholders, angel investors, or venture capital funds, receive a share of the company in exchange for their investment. Common sources of equity capital include initial public offerings (IPOs), private equity placements, and retained earnings (which are internal funds generated from business operations), direct capital contributions from owners, and state capital in state-owned enterprises.

- Advantages: The primary benefit of equity capital is that the business has no mandatory repayment or interest payments, although equity holders expect dividends and capital gains, making equity generally a more costly source of capital compared to debt. This provides financial flexibility and reduces the risk of bankruptcy, as dividend payments can be skipped during difficult periods. It also enhances a company's creditworthiness, making it easier to secure loans in the future.

- Disadvantages: The main drawback of equity financing is ownership dilution, which means sharing control and future profits with new shareholders. The process of raising equity can also be more time-consuming and costly compared to other forms of financing.

Debt capital

- Definition: Debt capital refers to the funds that a business borrows and is obligated to repay over a specified period. This form of capital can be obtained from various sources, including financial institutions like banks, by issuing corporate bonds, or through government loan programs.

- Advantages: A significant advantage of debt capital is that it allows the original owners to retain full ownership and control of the business. Furthermore, the interest expenses paid on debt are often tax-deductible, which can lower the overall cost of capital.

- Disadvantages: The primary risk associated with debt capital is the obligation to make fixed payments, which increases financial pressure regardless of profitability. Failure to meet these repayment obligations can lead to default and potentially force the company into bankruptcy.

Working capital

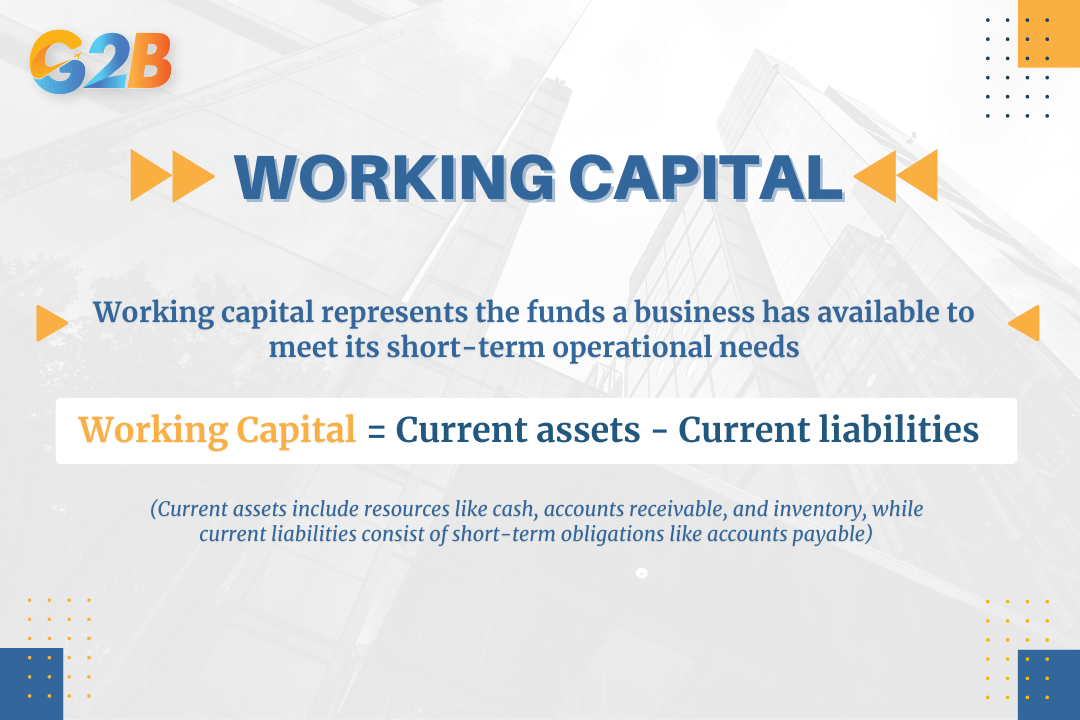

- Definition: Working capital represents the funds a business has available to meet its short-term operational needs. It is essential for maintaining liquidity and ensuring that a company can cover its day-to-day expenses, such as paying salaries and suppliers, without interruption.

- Calculation formula: The formula to calculate working capital is: Working Capital = Current assets - Current liabilities. Current assets include resources like cash, accounts receivable, and inventory, while current liabilities consist of short-term obligations like accounts payable.

- Purpose: The primary purpose of working capital is to support the continuous production and business cycle. Effective management of working capital is crucial for preventing cash flow shortages and maintaining financial health.

Working capital represents the funds a business available to meet its short-term operational needs

Trading capital

- Definition: Trading capital is a specialized type of capital primarily used by financial institutions, such as brokerage firms and investment banks. It is the money specifically allocated for the purpose of buying and selling financial assets like stocks, bonds, and currencies to generate profits from market fluctuations.

- Characteristics: This form of capital is less common for manufacturing or service-based businesses, as their primary operations do not involve trading securities. The amount of trading capital a financial firm holds is a key factor in its ability to participate in the markets and manage the risks associated with its trading activities.

Additional common capital type

There are some additional common classifications in Vietnam include:

- Charter capital (Legal capital): The capital stated in the company’s charter, defining owners’ responsibility scope.

- Foreign direct investment (FDI) capital: Capital invested by foreign investors subject to specific regulations in Vietnam.

- Voluntary or committed capital contributions: Depending on owners/shareholders’ commitments to contribute to the company.

Capital structure

Capital structure is the specific mix of debt and equity a company uses to finance its assets and operations. This combination is detailed on the company's balance sheet and is a critical component of its overall financial strategy. The main objective when determining a capital structure is to find the optimal ratio that minimizes the weighted average cost of capital (WACC) and maximizes the company's market value.

- Definition: The capital structure essentially shows how much of a company's financing comes from creditors versus how much comes from its owners. A company's choice of capital structure has significant implications for its risk profile, profitability, and financial flexibility.

- Objective: The goal is to achieve an optimal capital structure, which is the balance of debt and equity that results in the lowest possible WACC. A lower WACC increases the present value of the firm's future cash flows, thereby enhancing shareholder wealth.

- Common types of structures:

- Debt-dependent: The business relies heavily on borrowed funds to finance its operations. This can increase financial leverage but also elevate risk.

- Equity-dependent: The business prioritizes funding from its owners and investors, which is generally less risky but can be more expensive and lead to ownership dilution.

- Mixed structure: This approach seeks to balance the use of both debt and equity to take advantage of the benefits of each while mitigating their respective risks.

In Vietnam, many companies, especially SMEs, rely heavily on short-term bank loans which can lead to a higher proportion of short-term debt in the capital structure. Additionally, state-owned enterprises often have significant state capital that influences their capital structure, sometimes exceeding 50% ownership. These factors create distinctive capital structure characteristics in Vietnam compared to international norms.

- Influencing factors: The ideal capital structure varies between companies and industries and is influenced by several factors. These can include the industry's nature, the company's stage of growth, its risk tolerance, and prevailing market conditions like interest rates. Furthermore, the capital structure is also influenced by Vietnam’s fluctuating and relatively high interest rates, regulatory policies and state capital management rules, as well as corporate governance practices and financial transparency levels, which affect firms' access to and cost of capital.

Effective fundraising methods

To secure the necessary capital for business operations and growth, companies can employ a variety of fundraising methods. The choice of method often depends on the business's size, age, and specific needs. Here are some of the most common and effective ways to raise capital:

- Raise capital from own sources: Utilizing retained earnings for reinvestment is often the least risky approach. This method, also known as bootstrapping, allows a company to grow without taking on debt or diluting ownership. In Vietnam, many SMEs also rely on personal savings or family capital accumulation as internal funding sources alongside retained earnings.

- Borrow capital from family and friends: This is a common starting point for many startups and small businesses. These loans are often based on personal trust and may come with more flexible terms than traditional financing.

- Borrowing from banks: Securing a business loan from a bank is a traditional fundraising method suitable for companies with a solid credit history and, often, assets to offer as collateral. In Vietnam, bank loans involve complex procedures, high interest rates, and collateral requirements, which may limit access especially for SMEs.

- Initial Public Offering (IPO): For well-established companies, going public by listing on a stock exchange is a way to raise significant capital from a broad base of public investors. In Vietnam, IPO is mostly accessible to large firms, including state-owned enterprises undergoing equitization, due to regulatory and cost barriers for smaller businesses.

- Issuing corporate bonds: This involves borrowing long-term funds directly from the public. The company commits to making regular interest payments and repaying the principal amount at the bond's maturity. Vietnam’s corporate bond market is still developing, with requirements such as credit rating and regulatory compliance posing challenges, making this method more suitable for larger firms.

- Raising capital from angel investors: These are typically wealthy individuals who provide capital to startups in exchange for equity. They often bring valuable mentorship and industry connections in addition to their financial investment.

- Raising capital from venture capital funds: Venture capital funds are professional investment firms that provide capital to businesses with high growth potential. In return, they take a significant equity stake and often play an active role in the company's management.

- Crowdfunding: This method involves raising smaller amounts of money from a large number of people, usually through online platforms. It has become a popular way for startups to fund new products or ideas. In Vietnam, crowdfunding is emerging but still limited by regulatory framework and market maturity.

- Cooperating with strategic partners: Forming partnerships with customers, suppliers, or other companies in the same industry can be a way to secure capital. These partners often have a vested interest in the company's success.

A deep understanding and strategic management of capital are not just financial exercises; they are the cornerstones of sustainable growth and long-term success. For any business aiming to thrive, mastering its capital is the key to unlocking its full potential. By carefully considering the different types of capital, building a sound capital structure, and choosing the right fundraising methods, a business can position itself for a prosperous future.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom