Securing funding remains a central challenge for early-stage businesses navigating growth. While most focus on raising capital from investors, there is another valuable source that is often overlooked: Government grants, support programs, and innovation incentives. These options not only help reduce financial pressure but also offer access to expert networks and supportive policies. This article explores the landscape of startup grants and incentives, highlighting key funding options, eligibility considerations, and the application process.

This article is intended for general informational purposes to help startup founders and business owners better understand key concepts related to government grants, incentives, and funding programs. We are specialists in company formation and do not provide licensed financial or grant advisory services. Therefore, this information should not be taken as professional financial guidance. For personalized advice, please consult with a qualified grant consultant.

Introduction to startup grants and incentives

Startup grants and incentives provide non-dilutive funding, which means entrepreneurs can secure financial resources without giving away equity in their companies - although eligibility often depends on the legal entity type and business structure.

Overview of startup grants and incentives for early-stage businesses

Startup grants and incentives are diverse programs designed to support fledgling enterprises by offering cash awards, service support, and sometimes preferential tax treatment. These financial aids are pivotal, as nearly 40-50% of startups benefit from such assistance, according to reports by the U.S. Small Business Administration. This form of support ranges significantly, with grants varying from $10,000 to upwards of $1 million, adjusting based on the program's scope and the qualifying criteria. Primarily, these grants aid in covering expenses like research and development, prototyping, and other operational costs fundamental in the initial phases of a startup.

Importance of non-dilutive funding for startups

Non-dilutive funding stands as a key advantage for startups, offering capital without equity trade-offs. This is particularly beneficial in preserving the ownership structure and entrepreneurial autonomy. For entrepreneurs, non-dilutive funding reduces financial stress and affords them the flexibility to allocate resources towards essential business growth areas, such as scaling operations or expanding market reach. Additionally, non-dilutive funding often accompanies strategic support in the form of mentorship, access to networks, and technical guidance, all of which are invaluable resources that can propel startups toward success.

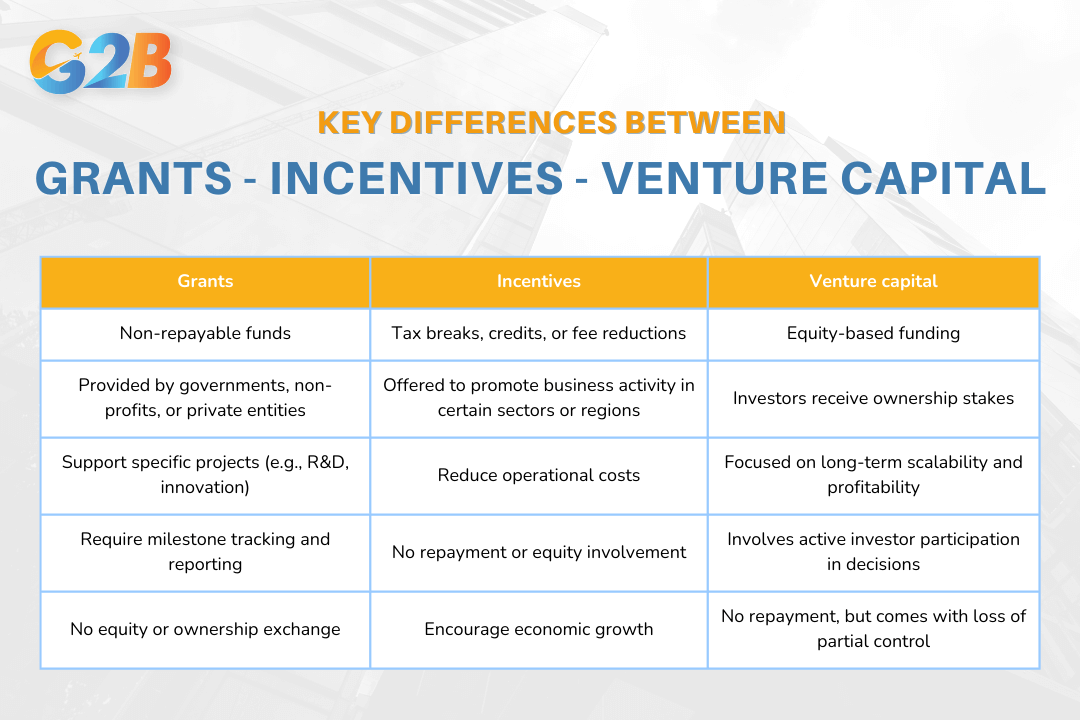

Differences between grants, incentives, and venture capital

It's imperative to distinguish between grants, incentives, and venture capital, as these funding streams serve different strategic purposes:

- Grants: Usually offered by government bodies, non-profits, or private entities, grants are typically non-repayable funds aimed at supporting specific projects or sectors. They focus on fostering innovation, research, and development with set milestones and reporting requirements.

- Incentives: These often include tax breaks, credits, or reductions that encourage business activities in specific industries or geographies. Incentives are typically structured to stimulate economic growth and are pivotal in reducing operational costs for startups.

- Venture capital: Unlike grants, venture capital involves equity investment whereby investors provide capital in exchange for ownership stakes. This form of funding introduces a collaborative partnership with a focus on long-term scalability and profitability, often involving the investors in business decisions.

In essence, while grants and incentives provide the startup with a financial boost without compromising ownership, venture capital offers significant capital injections but comes with trade-offs in equity and control. The strategic use of startup grants and incentives is instrumental in laying a robust foundation for growth, providing both the financial runway and resource support essential for navigating the competitive startup landscape.

However, before diving into these opportunities, if you are uncertain about the process of establishing a company in the US, feel free to contact G2B for expert advice and assistance with Delaware incorporation service to ensure a smooth and successful setup.*

It's imperative to distinguish between grants - incentives - venture capital

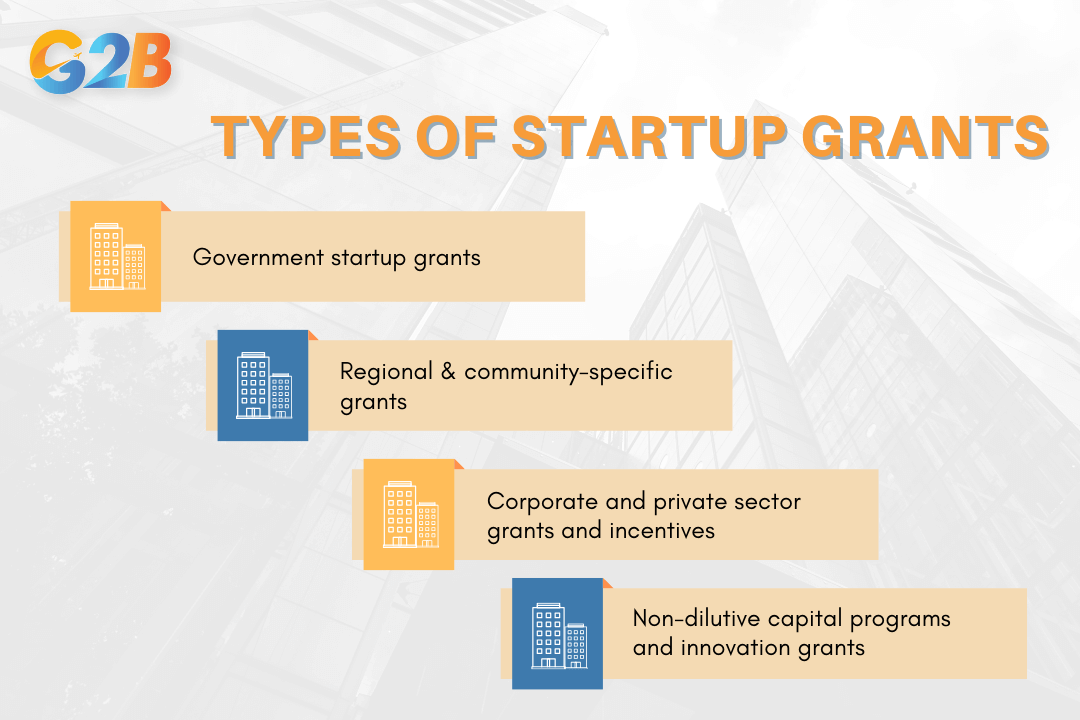

Types of startup grants

Delving into the world of startup grants reveals a multifaceted landscape, each offering distinct advantages and criteria. Understanding these types can significantly enhance a startup's strategy for securing non-dilutive funding.

Government startup grants: Federal, state, and local programs

Government startup grants form a crucial pillar in non-dilutive funding, whereby federal, state, and local governments aim to stimulate economic growth and innovation. These grants often come with fewer strings attached compared to private funding, making them an attractive option for early-stage startups.

- Federal grants: Administered by national agencies such as the Small Business Administration (SBA), these grants target specific goals from innovation to scientific research. Programs like the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) exemplify such options, encouraging research and development in high-tech ventures.

- State grants: Regional governments establish these grants to boost local economies. They are typically aimed at specific industrial needs, such as clean energy or biotechnology, allowing for targeted growth depending on regional capacities.

- Local grants: These are smaller-scale programs managed by local city councils or development offices. They usually cater to smaller businesses and community-driven projects, making them ideal for startups with a strong local market focus.

Regional and community-specific grants for startups

Regional and community-specific grants reflect a tailored approach to funding, recognizing unique local needs and opportunities. These grants support startups closely aligned with regional economic strategies or specific demographic groups.

- Community redevelopment grants: Targeting urban renewal or rural development, these grants support entrepreneurs committed to revitalizing challenged areas. Startups that align their mission with local socioeconomic needs can leverage these funds for mutual growth.

- Minority and women-owned business grants: These specialized grants aim to foster diversity in the entrepreneurial landscape by providing financial support to minority-owned and women-led businesses. Programs under organizations like the Minority Business Development Agency (MBDA) are instrumental in leveling the playing field.

Corporate and private sector grants and incentives

The private sector offers its own array of funding opportunities through corporate grants and incentives. Corporations sponsor startup competitions and innovation challenges to scout potential partnerships or solutions that align with their business goals.

- Innovation challenges: Often organized by industry giants like Google or Microsoft, these competitions encourage startups to develop solutions to specific problems. Winners receive not just funding but potentially crucial partnerships and market access.

- Corporate sponsorships: Corporations, eager to foster innovation within their sectors, provide sponsorship that includes not just funding but also mentoring, office space, and networking opportunities. These can be less formal but are strategic for gaining industry insights and enhancing credibility.

Non-dilutive capital programs and innovation grants

Non-dilutive capital programs and innovation grants are critical for startups seeking financial injections without relinquishing equity. These funds are generally provided with a focus on advancing technology or industry-specific innovations.

- Research and development grants: These grants, often provided by governmental agencies or private foundations, are tailored for startups involved in pioneering scientific research or breakthrough product development. They ensure that innovation isn't stifled by financial constraints.

- Industry-focused innovation grants: Sectors like healthcare, fintech, or renewable energy frequently support innovation through dedicated grants. These are designed to stimulate advancements in technologies that promise substantial sectoral impact.

Understanding the types of startup grants can significantly enhance a startup's strategy

Eligibility criteria for startup grants and incentives

When considering startup grants and incentives, the eligibility criteria form the cornerstone of any successful application. Comprehending and meeting these criteria is essential as they vary significantly across programs.

Common eligibility requirements across various programs

The eligibility criteria for startup grants and incentives often differ depending on the program's nature and objectives. However, some common requirements include:

- Business structure: Many programs require the applicant to have a legal business entity such as a corporation, partnership, or LLC. Sole proprietorships might be ineligible for several grants due to specific legal and financial requirements.

- Stage of development: Grants and incentives are typically targeted at specific stages of the business life cycle. Some programs are designed for early-stage startups seeking seed funding, while others cater to more developed businesses looking for expansion capital.

- Industry sector: Certain grants are industry-specific and aim to promote growth in sectors like technology, healthcare, renewable energy, or agriculture. Understanding these preferences is crucial for aligning applications with relevant programs.

- Geographical location: Many grants are offered by regional or local entities, requiring the business to operate within specific geographical boundaries to qualify. These regional criteria support local economic development and community growth.

- Financial health and viability: Financial statements, projections, and business plans are generally required to demonstrate the startup's financial health and long-term viability. This information helps assess the risk and potential return on investment for the granting entity.

How to determine startup readiness for grants and incentives

Assessing whether your startup is ready to apply for grants and incentives involves a thorough evaluation of its current state and future potential. Here are key considerations:

- Clear value proposition: Your startup should have a well-defined value proposition that addresses a distinct market need. The ability to validate your product or service within the market plays a crucial role in demonstrating readiness.

- Operational infrastructure: A robust operational infrastructure, including skilled personnel and efficient processes, indicates that your startup can utilize the grant effectively and achieve its project goals.

- Alignment with grant objectives: Ensure that your startup's mission and projects align with the specific goals and priorities of the potential grant. This alignment enhances the perceived impact and relevance of your application.

- Rigorous financial management: Showcase strong financial practices and controls with comprehensive accounting records and financial forecasts. This transparency builds confidence in your startup's ability to manage funds responsibly.

Industry-specific criteria for qualifying for startup funding

Certain industries have distinct requirements and opportunities for startup grants. Recognizing these peculiarities can improve eligibility and application success:

- Technology and innovation: In tech-focused grants, criteria often emphasize intellectual property, technological advancements, and innovation potential. Startups may need to demonstrate unique technologies or significant R\&D capabilities.

- Environment and sustainability: Environmental grants prioritize businesses that contribute to sustainability and reduce carbon footprints. Having certifications or sustainability-focused operations can be a critical eligibility factor.

- Healthcare and biotech: For healthcare-related grants, eligibility may involve regulatory compliance prerequisites, clinical trial data, or partnerships with healthcare institutions, reflecting the industry’s rigorous standards.

- Agriculture and food: These grants usually favor startups focusing on innovative agricultural practices, food safety, or sustainable food production systems. Eligibility might require collaboration with agricultural research entities.

Application process for startup grants and incentives

Securing startup grants and incentives can significantly boost an early-stage business, providing it with the necessary funds without involving equity dilution. However, the application process requires meticulous attention to detail and strategic planning.

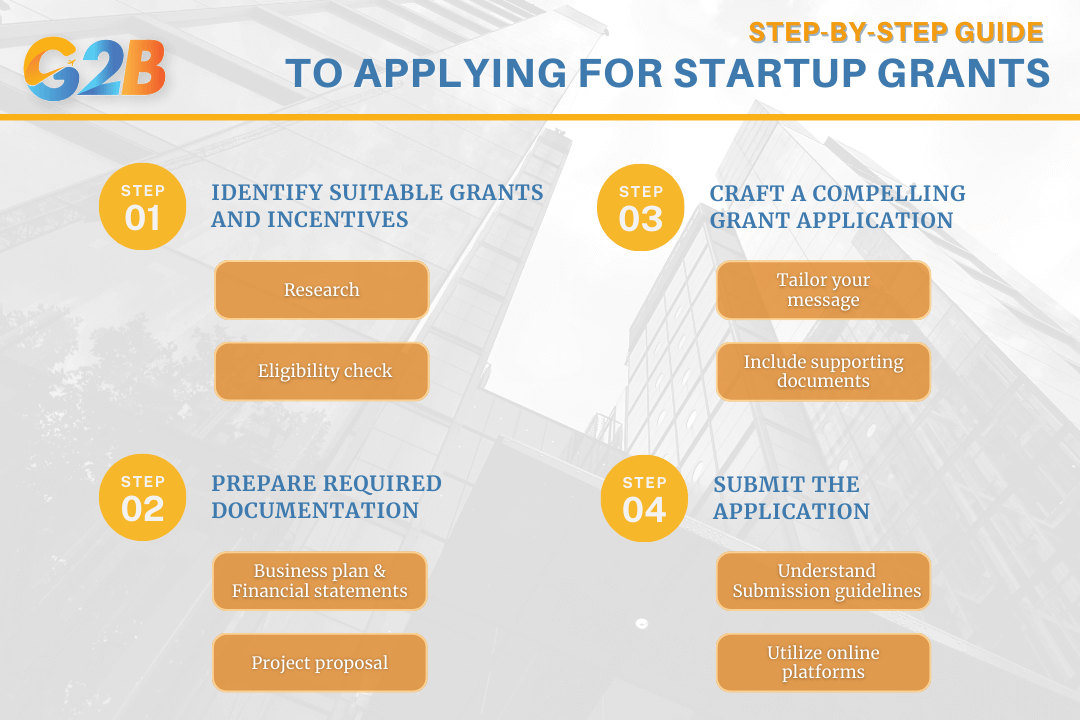

Step-by-step guide to apply for startup grants

Here’s a comprehensive instruction to help you navigate the complexities of this process with ease:

- Identify suitable grants and incentives:

- Research: Use resources such as government websites, economic development agency portals, and business incubators to identify available grants. Pay attention to industry-specific programs to increase your chances of qualifying.

- Eligibility check: Ensure your startup meets the eligibility criteria of the grant. This may involve factors such as business location, stage of development, and industry focus.

- Prepare required documentation:

- Business plan: Develop a comprehensive business plan highlighting your startup’s goals, market analysis, team qualifications, and financial projections. A well-documented plan can significantly enhance your application.

- Financial statements: Prepare accurate, up-to-date financial statements, including income statements, cash flow forecasts, and balance sheets.

- Project proposal: Clearly outline what the grant will be used for, detailing the project’s scope, timeline, and expected outcomes.

- Craft a compelling grant application:

- Tailor your message: Customize your application to align with the specific objectives of the grant. Address how your project will contribute to the funding organisation's goals.

- Include supporting documents: Attach any additional documents that could strengthen your application, such as letters of recommendation, partnership agreements, or market studies.

- Submit the application:

- Understand submission guidelines: Follow the application instructions carefully. Ensure all documents are correctly formatted and submitted within the deadline.

- Utilize online platforms: Many grants require applications to be submitted via online portals. Familiarize yourself with these platforms ahead of time to avoid technical issues.

Steps to help you navigate the process of applying for startup grants

Common application mistakes and tips for success

Here’s an in-depth overview of the most common application mistakes and expert tips to help you avoid pitfalls and maximize your chances of success throughout the process:

- Lack of clarity and focus:

- Be concise: Ensure your application is clear and free from unnecessary jargon. Clearly articulate your objectives and how the grant will be utilized.

- Avoid overpromising: Set realistic goals and expectations for what your startup can achieve with the funding.

- Ignoring deadlines:

- Timely submission: Keep track of all deadlines and plan your submission accordingly. Late submissions are rarely accepted, regardless of their content quality.

- Inadequate research:

- Understand the grantor: Research the organization's mission and past funding decisions. Tailor your application to reflect an understanding of their priorities.

- Leverage expert advice: Consult with financial advisors or mentors who have experience with grant applications to refine your proposal.

Understanding timelines and deadlines in the grant application process

Grasping the timelines associated with grant applications is crucial to maintaining a competitive edge:

- Pre-application phase:

- Research period: This is the stage where you identify potential grants. Allocate ample time for research and consultations with industry experts.

- Application submission:

- Application window: Know the opening and closing dates for submissions. Some grants have narrow windows, requiring precise timing.

- Review and decision-making:

- Assessment period: After submission, most grants undergo a rigorous review process. This can take several weeks to months, depending on the grantor.

- Notification and implementation: Successful applicants are notified within the stated timeline. Be prepared to commence the project as per the grantor's guidelines.

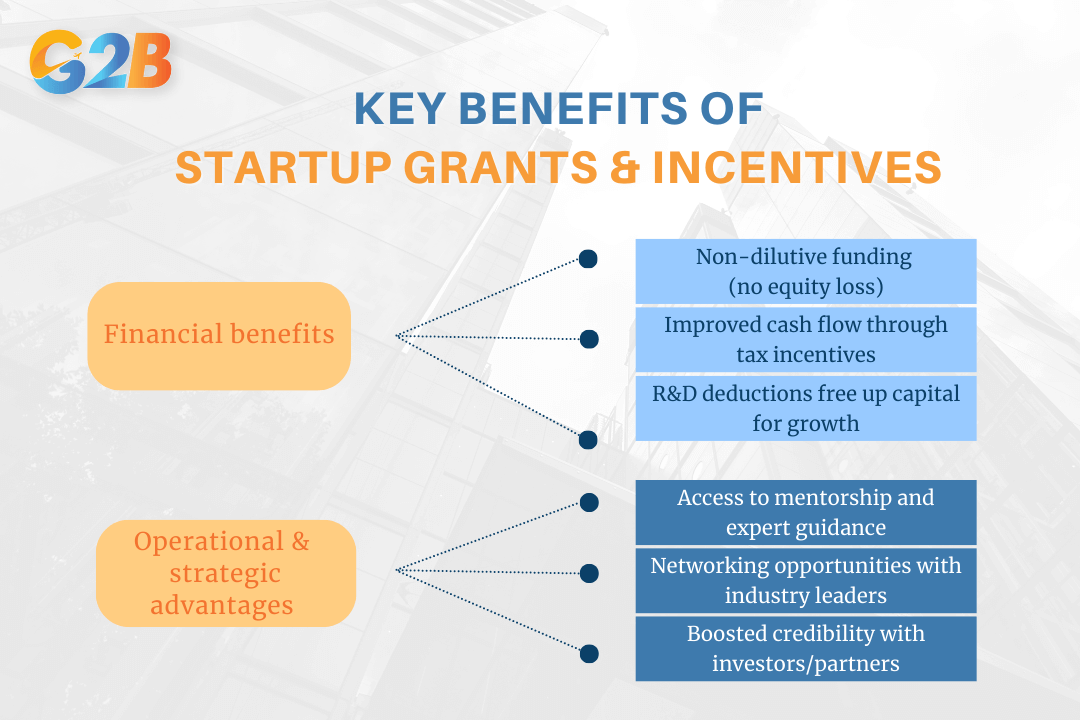

Benefits and limitations of startup grants and incentives

This part examines the pros and cons of startup grants and incentives, focusing on the financial advantages, the operational and strategic benefits for businesses, and the potential challenges and limitations that startups might encounter.

Startup grants and incentives bring financial benefits and strategic advantages

Financial benefits of obtaining grants and incentives

Startup grants and incentives serve as significant financial lifelines for early-stage companies. These financial aids come without the strings attached to equity, allowing founders to maintain full control over their ventures. Startups can leverage various tax incentive schemes that further enhance cash flow. For instance, deductions related to R\&D can free up critical resources for reinvestment into the business, fostering sustainable growth.

Operational and strategic advantages

Grants and incentives often bestow startups with strategic advantages. These programs frequently offer additional resources such as mentorship, networking opportunities, and technical assistance. A startup in a tech incubator might gain not only funding but also access to industry leaders and subject matter experts who provide invaluable guidance. Engaging in these programs can also bolster a startup's reputation, serving as a quality signal to future investors or partners. Furthermore, startups in regional or sector-specific programs can enjoy unique positioning benefits that align closely with governmental or community economic development goals.

Limitations and challenges startups face with grant funding

Despite the clear advantages, startups should be cognizant of the inherent limitations and challenges accompanying grants and incentives. Most prominently, the application process for these programs can be daunting. Eligibility criteria are stringent, often requiring evidence of innovation and potential for scale, which might sideline promising startups that are still in the ideation phase. The time-consuming nature of grant applications, which entails meticulous documentation and adherence to deadlines, can divert resources away from core business activities.

Moreover, grants are typically non-recurring; once awarded, the funding period concludes without guaranteed renewal, pressuring startups to secure alternative revenue streams swiftly. Startups may also face regulatory challenges once they accept grant funding. Compliance with specific administrative and financial reporting standards is mandatory, often necessitating additional administrative overhead. Non-compliance or failure to meet program milestones can result in financial penalties or the need to repay granted amounts, creating financial risk.

Regional grants directory

This part covers the advantages and drawbacks of startup grants and incentives, highlighting the financial rewards of securing funding, the operational and strategic benefits for startups, and the potential obstacles and limitations.

Comprehensive directory of regional grants for startups

Regional grants often provide tailored opportunities specific to the geographical and economic context of startups, making them vital for fostering innovation and growth. Such grants can range from modest financial aid to substantial contributions, aiding in everything from product development to marketing initiatives. Here's a look at some regions and the types of grants they offer:

- Silicon Valley, USA: Known for its vibrant tech ecosystem, Silicon Valley offers numerous grants focused on technology and innovation, backed by both the government and private sectors. Initiatives like the National Science Foundation's Small Business Innovation Research (SBIR) program are prevalent, providing grants that support the research and development phases of startups.

- Berlin, Germany: With its bustling startup scene, Berlin provides access to a variety of grants aimed at creative industries and sustainable technology. The city supports startups through programs like Investitionsbank Berlin (IBB), which offers financial instruments tailored to innovative SMEs.

- Bangalore, India: As a tech hub, Bangalore features government-backed grants aimed at the information technology and biotechnology sectors. Schemes such as the Karnataka Startup Policy and initiatives by various tech parks provide necessary financial support and incubation facilities.

- Melbourne, Australia: Known for its healthcare and clean energy sectors, Melbourne offers grants that focus on sustainability and health innovations. Programs such as the Victoria Government's startup grants are instrumental in supporting early-stage companies.

How to leverage local economic development agencies for startups

Local economic development agencies play a crucial role in connecting startups with regional grants and supportive ecosystems. Leveraging these agencies involves:

- Understanding agency mandates: Each agency may focus on specific sectors or goals. Understanding these can help align startup objectives with agency missions, increasing grant acquisition chances.

- Building relationships: Networking with agency representatives can provide insights into upcoming grants and funding opportunities. Attending workshops and seminars hosted by these agencies can also offer valuable connections.

- Tailoring proposals: Developing grant proposals that directly address regional economic priorities can enhance a startup's attractiveness to local agencies. Crafting applications that demonstrate societal impact, job creation, or innovation aligned with regional goals is often advantageous.

- Accessing additional resources: Many agencies provide more than just funding. They often offer business advisory services, networking opportunities, and technical assistance, which are invaluable for early-stage startups.

Expert tips and best practices

When navigating the complex landscape of startup grants and incentives, a strategic approach is essential. Here are some expert tips and best practices to help startup founders identify, apply for, and capitalize on these opportunities:

Strategies for identifying the best grant opportunities

- Conduct comprehensive research: Begin by exploring a wide range of sources such as government websites, economic development agencies, industry associations, and online grant directories. Resources like Grants.gov, your local Small Business Development Center (SBDC), and relevant trade organizations can be invaluable. Tailor your search to align with your startup's industry and geographic location.

- Leverage industry networks: Connect with other entrepreneurs, mentors, and experts in your field. Networking can provide insights into lesser-known grant opportunities and alert you to upcoming application rounds. Consider joining professional networks or online forums dedicated to startups to stay informed.

- Use grant matching services: Consider using platforms that match startups with grants based on their profile and business needs. These services can save time and increase your chances of finding a grant that fits perfectly with your startup’s mission and goals.

Building a compelling grant application

- Align with grant goals: Each grantor has specific objectives. Craft your application to clearly demonstrate how your startup's goals and operations align with the grantor's mission. This alignment shows evaluators that your project is worth investment.

- Craft a strong narrative: Beyond just answering questions, tell a compelling story about your startup. Highlight your vision, the problem you are solving, and the impact your business will have. Use data and testimonials to substantiate your claims.

- Polish your presentation: Pay attention to the details of your application. Ensure that it is professionally formatted, free of errors, and adheres to all guidelines. Visuals such as charts or infographics can make your application more engaging and easier to understand.

- Seek external review: Before submission, have your application reviewed by multiple parties, such as mentors or peers, to gain constructive feedback. They may catch errors you missed and provide insights that can enhance your application.

Securing mentorship and networking through grant programs

- Prioritize grants offering mentorship: Some grants include mentorship as part of their package. Programs that pair funding with advice from experienced entrepreneurs or industry experts can significantly amplify your chances of success by providing valuable guidance and insights.

- Engage with the granting community: Many grant programs hold events, workshops, and networking sessions for their recipients. Actively participate in these events to expand your network. Building relationships with other grant winners and stakeholders can lead to collaboration and support opportunities.

- Establish long-term relationships: Rather than viewing your interaction with grantors as a mere transaction, nurture a lasting relationship. Keep them updated on your progress, and express gratitude for their support. A positive relationship may lead to future opportunities.

- Utilize alumni networks: If the grant program has a network of past participants, engage with it actively. Alumni can provide insights into maximizing grant benefits and offer connections that could be pivotal for your startup's growth.

In conclusion, understanding the intricacies of startup grants and incentives is fundamental for emerging businesses seeking non-dilutive capital. By effectively navigating eligibility criteria, crafting compelling applications, and avoiding common pitfalls, startups can significantly enhance their chances of securing these valuable funding sources, thereby propelling their innovation and growth ambitions forward.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom