Mergers and Acquisitions (M&A) have become the preferred market entry strategy for foreign investors looking to tap into Vietnam’s dynamic economy without starting from scratch. However, navigating the legal landscape can be daunting. Unlike Western jurisdictions, Vietnam treats "Mergers" and "Acquisitions" as distinct legal procedures with strict approval protocols.

This article highlights the key aspects of mergers and acquisitions to help businesses and investors gain a clearer understanding of the M&A landscape in Vietnam. We specialize in company formation and not provide legal, financial, or valuation advisory services related to M&A transactions. For detailed legal, financial, or due diligence matters, please consult qualified professional advisors.

What is "M&A" in Vietnam?

In the Vietnamese market, "M&A" is used broadly to describe any transaction where ownership of a business is transferred. This ranges from a foreign fund buying a 10% stake in a local startup, to a multinational corporation taking over a Vietnamese factory.

The legal reality

Vietnam does not have a single "Law on M&A." Instead, transactions are governed by three primary statutes:

- The Enterprise Law 2020: Governs corporate restructuring and shareholder rights.

- The Investment Law 2020: Governs market access conditions for foreign investors.

- The Competition Law 2018: Governs anti-monopoly thresholds and economic concentration.

Legally, the transactions are split into two categories:

A. The "merger"

In Vietnam, a "Merger" is a specific form of corporate restructuring. It is complex and less common than acquisitions.

- Merger: Company A absorbs Company B. Company B ceases to exist legally; Company A inherits all assets, liabilities, and labor contracts. In a merger, ensuring proper asset protection for the inherited property and intellectual rights is a top priority for the surviving entity.

- Consolidation: Company A and Company B combine to form a brand new Company C. Both A and B cease to exist.

- Key takeaway: These forms are primarily used for internal group restructuring or consolidating large entities, rather than for market entry.

B. The "acquisition"

When foreign investors speak of "Doing M&A in Vietnam," they are almost always referring to Acquisition techniques. Under Vietnamese law, these fall under "Capital Contribution" or "Share Purchase."

- Share deal: Buying equity (shares or capital contribution) from existing shareholders or subscribing to newly issued shares. The legal entity of the target company remains unchanged. The procedure varies slightly depending on whether the target is a Joint Stock Company or a Multi-member LLC

- Asset deal: Buying specific assets (e.g., a factory, machinery, or a real estate project) rather than the company shares. This provides a "cleaner" start but carries higher tax implications (such as VAT).

The transactions are split into two categories

When is M&A approval required?

Not every transaction requires prior approval from the government. However, the Department of Planning and Investment (DPI) requires a "Notice of Capital Contribution/Share Purchase" (often called M&A approval) in the following specific cases:

Trigger 1: The "50% foreign ownership" rule

Approval is mandatory if the transaction results in foreign investors holding over 50% of the charter capital. This applies if:

- Foreign ownership increases from less than 50% to over 50%.

- Foreign ownership is already over 50% and creates a further increase.

Trigger 2: Conditional business sectors

If the target company operates in a "Conditional Business Line" applicable to foreign investors (e.g., Real Estate, Logistics, Education, Retail, Tourism), M&A Approval is required regardless of the ownership percentage.

- Note: Even purchasing 1% of a logistics company requires this approval procedure to ensure the investor meets market access conditions. The key test is whether the line of business is listed as conditional for foreign investors in Vietnam’s Schedule of Commitments, WTO commitments, or specialized laws, not merely that it is “conditional” for domestic investors.

Navigating these sectors requires a clear understanding of the permitted business activities and specific market access restrictions

Trigger 3: Land use rights

Under the stricter scrutiny of the Land Law (2024), any M&A deal involving a target company that holds Land Use Rights (LUR) in border areas, islands, or coastal communes may be subject to national defense and security review under the Law on Investment and relevant land regulations and requires consultation with the Ministry of National Defense and Ministry of Public Security. This ensures the deal poses no threat to national defense. In practice, this review usually applies where foreign investors acquire controlling interests or where the land is located in sensitive geographic areas designated by the Government.

Trigger 4: Economic concentration

Independent of the DPI approval, if the deal is massive in terms of revenue, assets, or transaction value, it triggers a Competition Law notification to the National Competition Commission (NCC). Notification is required where the transaction meets the economic concentration thresholds on total assets, total revenue, transaction value, or combined market share as specified in Decree 35/2020/ND-CP.

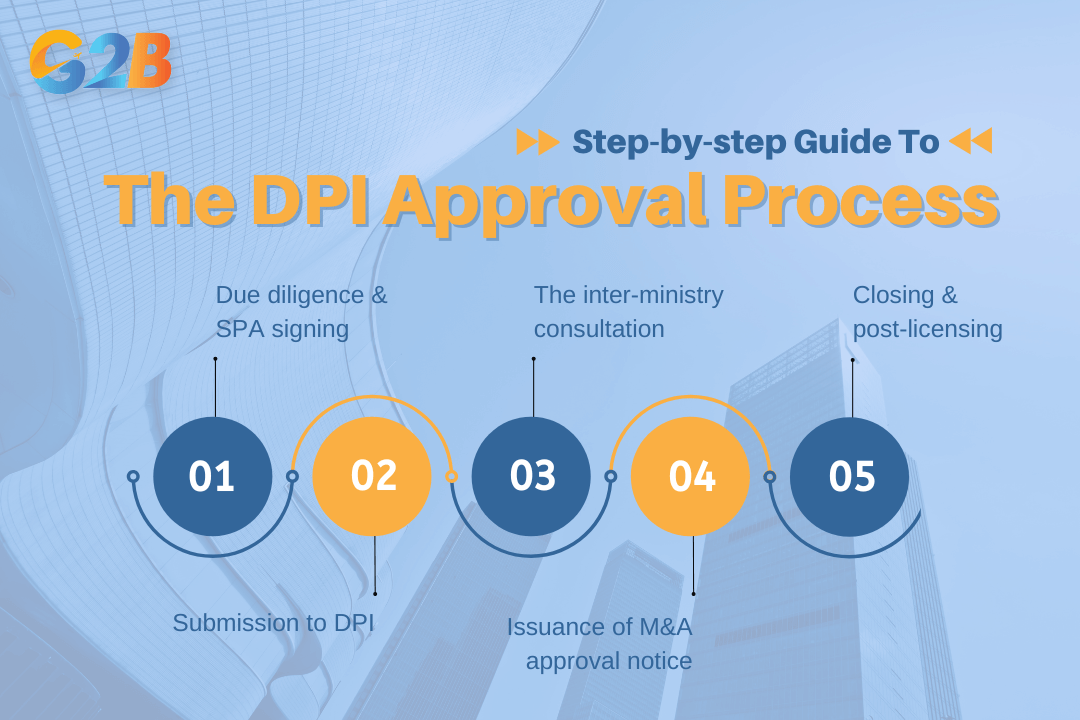

Step-by-step guide to the DPI approval process

Obtaining approval from the Department of Planning and Investment (DPI) is a critical step for investors and businesses when establishing or expanding operations in Vietnam. The following step-by-step guide outlines the DPI approval process, helping applicants understand key procedures, documentation requirements, and timelines involved.

Step 1: Due diligence & SPA signing

Before applying, parties must agree on terms. The Share Purchase Agreement (SPA) is usually signed at this stage.

- Crucial: The SPA must include a Condition Precedent (CP) clause, stating that the deal is only valid and payment will only be made after the M&A Approval is obtained.

Step 2: Submission to DPI

The investor submits the "Application for Approval of Capital Contribution or Share Purchase" dossier to the Department of Planning and Investment (DPI) where the target company is headquartered.

Step 3: The inter-ministry consultation

This is the most critical phase. If the target company has multiple business lines (especially conditional ones) or sensitive land, the DPI sends the file to relevant ministries (Ministry of National Defense, Ministry of Industry and Trade, etc.) for opinion.

Step 4: Issuance of M&A approval notice

Once cleared, the DPI issues a formal "Approval of Capital Contribution/Share Purchase" notice, permitting the foreign investor to contribute capital.

Step 5: Closing & post-licensing

- Fund transfer: The investor remits funds into the target company’s Direct Investment Capital Account (DICA).

- ERC amendment + Foreign Investor Certificate (FIC): The target company applies to update the Enterprise Registration Certificate (ERC) and issues a new Foreign Investor Registration Certificate (FIRC) to record the new foreign shareholder.

The investor must ensure they follow the correct protocols for opening a bank account in Vietnam to avoid issues with capital repatriation later

There are 5 steps to the DPI approval process

Step-by-step guide to the merger control process

The following step-by-step guide explains the merger control process, helping businesses understand key thresholds, filing requirements, and procedural stages involved.

Who must file?

Filings are required if the transaction meets the thresholds set by Decree 35/2020/ND-CP regarding:

- Total assets on the Vietnamese market (≥ 3,000 billion VND combined).

- Total turnover (Revenue) in Vietnam (≥ 3,000 billion VND combined).

- Transaction value (≥ 1,000 billion VND or 20% market share increase).

- Combined market share (≥ 30% or ≥ 50% depending on sector).

Parties must notify the National Competition Commission (NCC) prior to closing if any threshold is met.

The preliminary review (30 days)

The National Competition Commission (NCC) reviews the file.

- Safe harbor: If the NCC does not issue a notification within 30 days, the deal is considered cleared and can proceed.

The official review (60-90 days)

If the deal poses a potential risk of "Substantial Lessening of Competition," it moves to a full official review, which involves deep economic analysis.

Required documents for merger control notification:

To prepare a robust NCC notification (separate from DPI M&A approval), the following documents are essential:

- Notification form as per Decree 35/2020/ND-CP.

- Parties' financial statements (last 2 years), transaction agreements (SPA/MOU), market analysis, and competitive impact assessment.

- Target and buyer company details: ERC, IRC (if FDI), annual reports.

Note: Legalization/notarization is generally not required for NCC filings, unlike DPI procedures.

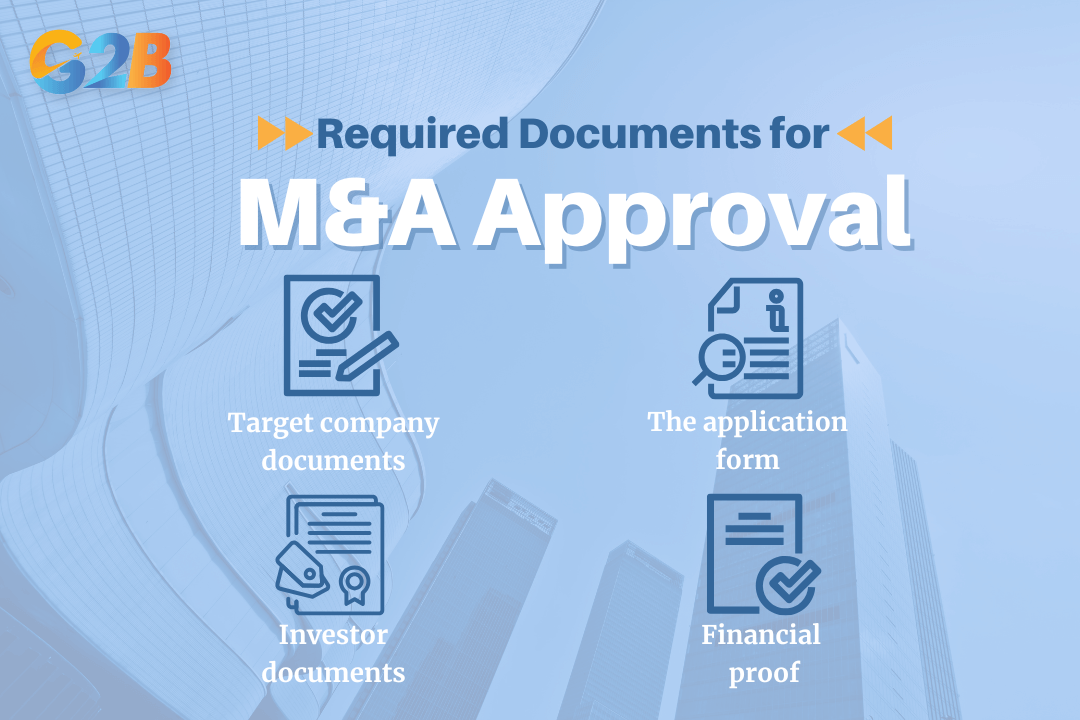

Required documents for M&A approval

To prepare a robust application, the following documents are essential:

- Target company documents:

- Enterprise Registration Certificate (ERC).

- Investment Registration Certificate (IRC) - if applicable.

- Land Use Right Certificates (LURC) - if land-related conditional business.

- Financial statements of the last 2 years.

- List of current shareholders and their ownership percentages.

- Investor documents:

- Corporate investor: Certificate of Incorporation and Charter (Legalized by the Vietnamese Embassy in the home country).

- Individual investor: Passport (Legalized copy).

- Financial proof: Bank balance statements or confirmation of funds equal to the investment amount.

- The application form: The standard form for "Approval of Capital Contribution/Share Purchase" per Appendix II, Decree 31/2021/ND-CP. Share Purchase Agreement (SPA) or Capital Contribution Agreement (original + 3 copies). Explanation of investment purpose and expected economic contribution.

4 documents are essential to prepare a robust application

Timeline and costs for M&A approval

- Statutory timeline: The law stipulates 15 working days for DPI approval.

- Practical timeline:

- Standard case: 3–4 weeks.

- Sensitive case (Defense/Ministry consultation): 2–3 months or longer.

- Costs: There is generally no state fee for the M&A Approval notice itself. However, costs include legal counsel fees, translation, and consular legalization fees.

Critical challenges & pitfalls in 2026

The following section highlights the critical challenges and common pitfalls that investors should anticipate and carefully navigate when planning and executing M&A transactions in Vietnam.

1. The "nominee structure" risk

Some investors try to bypass the M&A approval process by having a trusted local individual hold the shares (Nominee). Warning: The 2020 Investment Law specifically empowers authorities to terminate projects based on "sham transactions." This puts your entire investment at risk of total loss.

2. HS code mismatch

A target company often registers hundreds of business lines "just in case." If any of these lines are vague or do not match WTO commitments, the DPI will force a consultation with ministries, delaying the deal by months.

To mitigate these risks, the target company’s chief accountant in Vietnam should be involved early to audit the business lines and financial compliance

3. Payment timing

Never transfer the purchase price before the M&A Approval is issued. Vietnamese banks strictly monitor capital flows. If you transfer money before approval, the bank may reject the funds, or you may be unable to legally record the ownership change, leaving you in a legal limbo.

Frequently asked questions (FAQ)

This part will investigate the most frequently asked questions below. These questions address common concerns raised by both local and foreign investors about Merger & Acquisition in Vietnam.

1. Can I skip M&A approval if I am buying from another foreign investor? It depends. If the target company operates in non-conditional sectors and the transaction is purely between foreign investors, M&A approval might be waived. However, if the target has Land Use Rights in sensitive areas, approval is still safer. Always consult a lawyer.

2. Does a capital increase require M&A approval? Yes, if the capital contribution by the foreign investor causes their ownership to cross the 50% threshold, or if the company is in a conditional sector.

3. What happens if I complete the deal without approval? You face three consequences: administrative fines, the inability to update the ERC (meaning you are not a legal shareholder), and the inability to repatriate profits or capital in the future due to banking compliance failures.

Mergers and acquisitions in Vietnam present significant opportunities for both domestic and foreign investors seeking market expansion, restructuring, or strategic growth. However, the M&A landscape in Vietnam is governed by a multi-layered legal framework involving investment, enterprise, competition, and sector-specific regulations. Understanding the definitions, transaction structures, procedural steps, and approval requirements is essential to ensure compliance and deal efficiency. For those considering a fresh start instead of an acquisition, explore our guide on the company setup process and requirements in Vietnam.

Whether you are entering the market via a new Vietnam Incorporation Service or through a complex M&A transaction, G2B is your trusted partner for compliance

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom