In the bustling world of commerce, from the smallest local startup to the largest multinational corporation, a constant flurry of activity drives progress and creates value. But what exactly are these "business activities"? At their heart, business activities are the fundamental actions a company takes to achieve its primary objectives, the most common of which is generating profit.

These are the processes and tasks that form the very foundation of a business, shaping its daily operations, long-term investments, and financial strategies. Understanding the different types of business activities is crucial for entrepreneurs, managers, and investors alike, as it provides a clear framework for making strategic decisions, optimizing resources, and ensuring a company's competitiveness and sustainability in the marketplace

What are business activities?

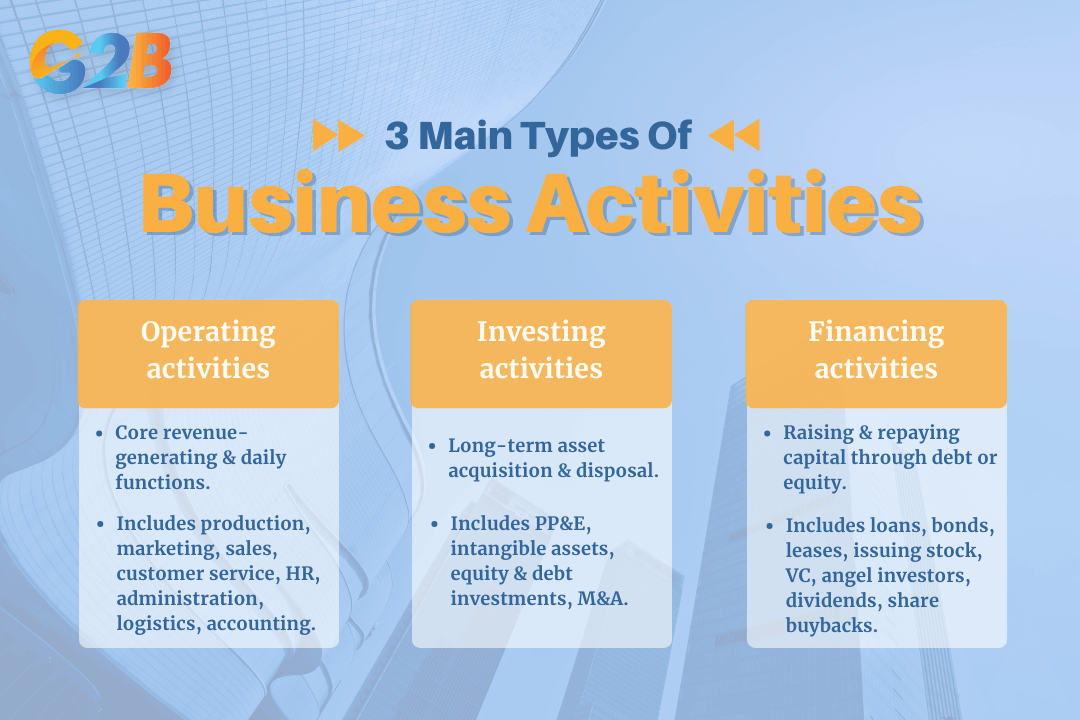

Business activities encompass all the actions a company undertakes to produce goods, provide services, and ultimately generate revenue. Broadly, these activities are categorized into three main types: Operating, investing, and financing. Each category represents a distinct yet interconnected facet of a company's financial and strategic life. Operating activities are the core functions that keep a business running and maintain its economic existence, while investing and financing activities support the company's growth and capital structure. To make these activities truly effective in the long run, the very first step is to establish your business correctly. This is why using a professional company formation service in Vietnam is essential for investors who want to build a strong and successful presence in the market.

Business activities encompass all the actions a company undertakes to produce goods

3 main types of business activities

Every single financial transaction a company makes can be classified into one of three distinct categories. This framework is essential for financial reporting, analysis, and strategic planning. The three main types are Operating Activities, Investing Activities, and Financing Activities.

Operational activities

Operational activities, often called operating activities, are the heart and soul of a business. They represent the principal revenue-producing functions and all other day-to-day actions that are not related to investing or financing. Think of these as the tasks required to keep the lights on, serve customers, and generate sales. Because they are tied directly to a company's core business activities, such as manufacturing, trading, or service provision, operating activities are a key indicator of the company’s capacity to generate sufficient cash flow to sustain and expand its operations, though companies may still rely on external financing.

Common operational activities include a wide range of functions, each vital to the business ecosystem:

- Production: This is the process of converting raw materials or components into finished goods or the development process for providing a service. For a bakery, it's baking bread; for a software company, it's writing code. It is the absolute core of value creation.

- Marketing: These activities are focused on communicating the value of a product or service to the target audience. It includes advertising campaigns, social media management, content creation, and market research, all aimed at attracting and retaining customers.

- Sales: The sales function involves converting leads into paying customers. It involves everything from prospecting and pitching to negotiating contracts and closing deals. Cash received from sales and accounts receivable collections is the primary inflow from operating activities.

- Customer service: This involves providing support to customers before, during, and after a purchase. Excellent customer service builds loyalty, encourages repeat business, and generates positive word-of-mouth, directly supporting ongoing revenue.

- Human resources (HR): Managing the workforce is a crucial operational activity. HR is responsible for recruiting, hiring, training, compensating, and managing employee relations. Employee salaries and wages are a major cash outflow in this category.

- Administration: This broad category includes the general management and oversight of the business. It covers tasks like accounting, payroll processing, office management, and ensuring regulatory compliance. These activities provide the essential support structure for the entire organization.

- Logistics & Supply chain management: This involves the management of the flow of goods, from the procurement of raw materials to the delivery of the final product to the consumer. Efficient logistics are key to managing costs and ensuring timely delivery.

- Accounting and auditing: This is the systematic recording, reporting, and analysis of financial transactions. It ensures that the company maintains accurate financial records, which are used for both internal decision-making and external reporting (like the statement of cash flows that outlines these very activities).

Investing activities

While operational activities focus on the current business operations, investing activities involve acquiring and disposing of long-term assets and investments aimed at supporting future growth. This category includes the purchase and sale of long-term assets and financial investments that are not part of a company's day-to-day operations. These are strategic decisions made by management to grow the company, improve efficiency, or expand into new markets over an extended period. Analyzing a company's investing activities reveals its strategy for long-term growth and capital allocation. A company consistently investing in new technology and equipment is likely focused on innovation and efficiency.

Investing activities primarily fall into two main categories:

1. Purchases and sales of long-term assets:

These are tangible and intangible assets expected to provide value for more than one year.

- Property, plant, and equipment (PP&E): This is the most common type of investing activity. It includes cash spent on buying land, constructing a new building, purchasing machinery, or upgrading equipment. Conversely, the cash received from selling off old equipment or an unused property is also an investing activity.

- Intangible assets: A company may invest in assets that lack physical substance but hold significant value. This includes purchasing patents, trademarks, copyrights, or software licenses that provide a long-term competitive advantage.

2. Investments in other entities:

This involves using the company's capital to invest in the financial instruments of other businesses.

- Equity investments: This refers to purchasing stocks or ownership shares in another company. The goal might be to generate investment income or to form a strategic partnership.

- Debt investments: This involves lending money to another entity by purchasing its bonds or providing a direct loan. The investing company earns interest income from these activities.

- Mergers and acquisitions (M&A): When a company acquires a majority stake in or the entirety of another company, it is often considered a significant investment activity, although in some accounting practices and standards in Vietnam, these transactions may be reported separately or under financing activities.

Financing activities

Financing activities provide capital to support both operating and investing activities. This category involves all transactions with the owners of the company and its creditors to raise and repay capital. Essentially, financing activities show how a company funds its operations and growth. These transactions involve debt, equity, and dividend payments. A deep dive into this section of the cash flow statement reveals a company's financial structure and its dependency on borrowing versus owner funding.

Financing activities are divided into two primary pathways:

1. Debt financing:

This involves borrowing funds that must be repaid over time, usually with interest.

- Loans: This is a classic financing activity where a company borrows money from a bank or another financial institution. The cash received from the loan is an inflow, while the repayment of the loan principal is an outflow.

- Bonds: Larger corporations often issue bonds to the public. Investors buy these bonds, effectively lending money to the company. The company receives cash upfront and makes interest payments over the life of the bond before repaying the principal at maturity.

- Leases: Depending on accounting treatment and contract terms, leases may be classified as financing or operating activities; in Vietnam, leasing classification follows the applicable accounting standards.

2. Equity financing:

This involves selling ownership stakes in the company to investors in exchange for cash.

- Issuing stock: A corporation can raise significant capital by issuing new shares of its stock to the public (in an Initial Public Offering, or IPO) or to existing shareholders. This cash inflow comes at the cost of diluting ownership.

- Retained earnings: Although representing internal funds reinvested into the business, retained earnings themselves do not generate cash flows and thus are not classified as financing activities in the cash flow statement.

- Venture capital (VC): Startups and early-stage companies often seek funding from venture capital firms. These firms provide capital in exchange for equity ownership, constituting equity financing transactions.

- Angel investors: These individuals provide capital through equity investments or convertible debt, representing forms of equity or debt financing. They are often among the first external investors in a new venture.

- Paying dividends & Share repurchases: A cash outflow from financing includes paying dividends to shareholders, which is a way of returning profits to owners. Another is a share buyback, where the company uses its cash to repurchase its stock from the market, reducing the number of outstanding shares.

There are 3 main types of business activities

Importance of business activities

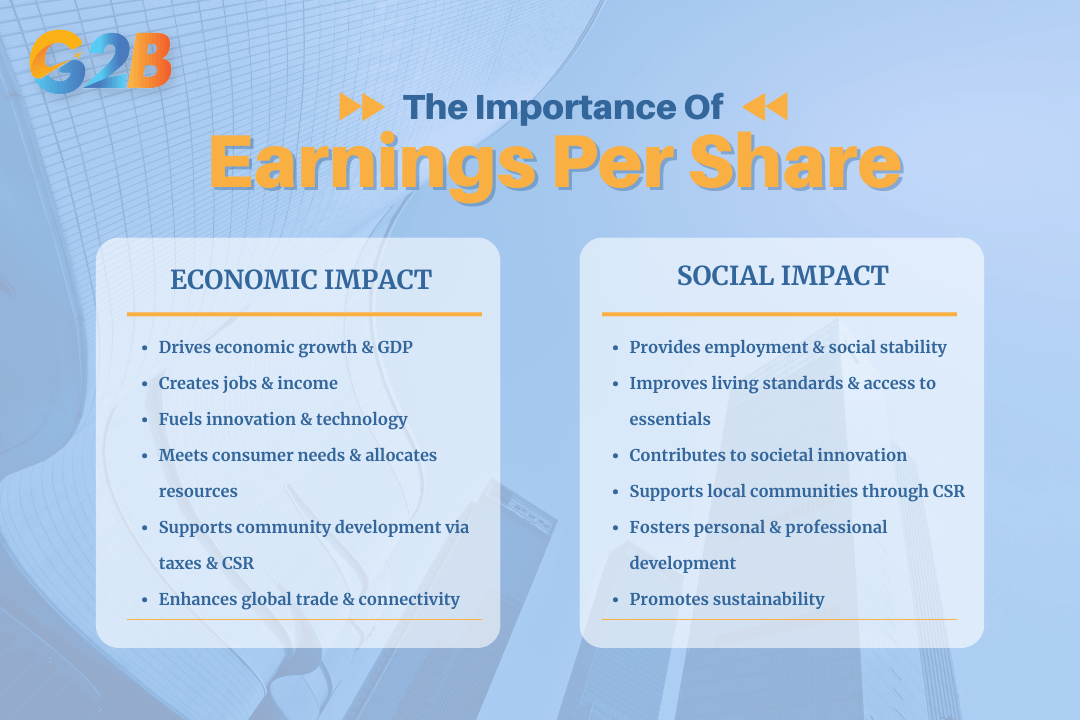

The collective impact of business activities extends far beyond the boundaries of a company's financial statements. They are fundamental drivers of economic growth, social development, and innovation at local, national, and global levels. By transforming ideas into products and services, businesses meet consumer needs, create wealth, and build the infrastructure of modern society. Their importance can be seen through two primary lenses: Their economic impact and their social impact.

Economic impact of business activities

- Catalyst for economic growth: Businesses are the primary engine of economic growth. Through the cycle of investment, production, and sales, they generate income and wealth that circulates throughout the economy, leading to increased prosperity.

- Contribution to GDP: The total value of goods and services produced by businesses within a country's borders is a primary component of its Gross Domestic Product (GDP). A thriving business sector directly translates to a robust national economy.

- Job creation: From small local shops to large multinational corporations, businesses are the main source of employment. They provide livelihoods, income, and financial stability for billions of people, reducing poverty and enabling consumer spending.

- Innovation and technological advancements: Competition and the pursuit of profit drive businesses to innovate. They invest heavily in research and development (R&D) to create new products, improve processes, and develop new technologies that increase productivity and can dramatically improve the quality of life.

- Meeting society’s needs: At the most basic level, businesses exist to fulfill consumer demand. They produce the food we eat, the clothes we wear, the technology we use, and the services we rely on daily, effectively allocating resources to where they are most needed.

- Community development: Businesses contribute to their local communities through tax payments, which fund public services such as schools, hospitals, and infrastructure development. Many also engage in corporate social responsibility (CSR), investing directly in local projects and social initiatives.

- Global connectivity and interdependence: In our interconnected world, businesses facilitate international trade and investment. They link economies, foster cultural exchange, and create a global supply chain that allows for specialization and efficiency on a massive scale.

Social impact of business activities

- Job creation and employment opportunities: Beyond the economic numbers, the creation of jobs has a profound social impact. Employment provides individuals with stable income, contributes to social stability, and helps improve community well-being.

- Innovation and societal benefit: Business-invested R&D contributes to innovations that benefit society as a whole. Innovations in medicine, communications, and renewable energy, for example, have their roots in business activities and have fundamentally improved human well-being.

- Meeting societal needs: The production and delivery of essential goods and services contribute to improving the standard of living. Businesses ensure that communities have access to everything from basic utilities and food to advanced healthcare and educational tools.

- Community development and social impact: Through CSR programs, businesses can become powerful agents for social good. They support local charities, fund educational programs, promote volunteerism among employees, and contribute to the vibrancy and well-being of their communities.

- Individual growth and development: Businesses are crucial platforms for personal and professional development. They provide training, mentorship, and career advancement opportunities, allowing individuals to build skills, gain experience, and achieve their full potential.

- Impact on environmental conservation: Recognizing their environmental impact, an increasing number of businesses are adopting sustainable practices. By adopting eco-friendly practices, developing green technologies, and promoting conservation, businesses can have a powerful positive impact on the environment.

The collective impact of business activities extends beyond the boundaries of a company's financial statements

Examples of business activities

The interplay of operating, investing, and financing activities comes to life when viewed through the lens of specific industries. Here’s how these activities manifest in various sectors:

- In e-commerce:

- Operating: Daily management of the online store, processing customer orders, managing digital marketing campaigns, paying for web hosting, and handling customer returns.

- Investing: Purchasing a new, larger warehouse to handle increased inventory; acquiring a smaller, competing e-commerce brand; investing in sophisticated new supply chain management software.

- Financing: Securing a round of venture capital funding to fuel expansion, taking out a bank loan to fund inventory purchases, and issuing shares through an Initial Public Offering (IPO) in compliance with Vietnamese regulations.

- In financial services:

- Operating: Providing financial advice to clients, processing loan applications, managing investment portfolios for a fee, and paying salaries to financial advisors and analysts.

- Investing: Using the firm's capital to buy a portfolio of stocks and bonds for long-term growth; acquiring a smaller fintech startup to integrate its technology.

- Financing: Issuing corporate bonds to raise capital for expansion; paying annual dividends to the firm's shareholders.

- In real estate:

- Operating: Paying commissions to agents, marketing listed properties, managing rental properties for clients, and performing administrative tasks.

- Investing: A real estate brokerage purchasing its office building instead of leasing; a developer buying a large parcel of land for a future housing project.

- Financing: A developer securing a large construction loan to fund a new project, forming a partnership to pool equity for a large purchase.

- In logistics:

- Operating: Managing daily transportation routes, paying driver salaries and fuel costs, managing warehouse inventory for clients, and tracking shipments.

- Investing: Purchasing a new fleet of more fuel-efficient trucks; buying a state-of-the-art automated sorting facility.

- Financing: Taking out a loan specifically to finance the new truck fleet; issuing new shares to fund the construction of a major distribution hub.

- In hospitality:

- Operating: Taking guest reservations, managing front desk services, purchasing food and beverage supplies, paying hotel staff, and running marketing promotions.

- Investing: A hotel chain purchasing and renovating an old independent hotel; investing in a new property-wide technology upgrade for guest services.

- Financing: Securing a mortgage to buy a hotel property and selling a stake in the hotel group to a private equity firm.

- In healthcare:

- Operating: Hospitals, whether public or private, diagnosing and treating patients, managing appointments, processing insurance claims, purchasing medical supplies, and paying doctors and nurses.

- Investing: Purchasing a new MRI machine; constructing a new hospital wing.

- Financing: A non-profit hospital or a public hospital receiving government funding and grants; a for-profit healthcare system paying dividends to its shareholders and possibly issuing corporate bonds under Vietnamese regulations.

In conclusion, the framework of operating, investing, and financing activities provides a powerful and universally accepted method for understanding the intricate workings of any business. Operating activities reveal the core health and day-to-day performance of a company. Investing activities offer a clear window into its long-term vision and growth strategies. Finally, financing activities explain how a company sources and manages the capital required to achieve its operational and investment goals. Recognizing the distinct role of each activity is the first step toward true business literacy.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom