Asset protection encompasses a range of legal and financial strategies designed to preserve wealth and shield business and personal assets from potential risks. In Vietnam, this concept has gained significant attention as enterprises and high-net-worth individuals seek to navigate regulatory requirements while minimizing exposure to liabilities. By examining its definitions, core principles, and practical applications, this article explores how asset protection can be effectively implemented to enhance financial security and ensure sustainable business operations.

This article outlines essential aspects of asset protection in Vietnam to provide businesses with a clearer understanding of its principles and practical applications. We specialize in company formation and do not offer legal or financial advisory. For tailored strategies or compliance-related matters concerning asset protection, please consult a qualified legal or financial expert.

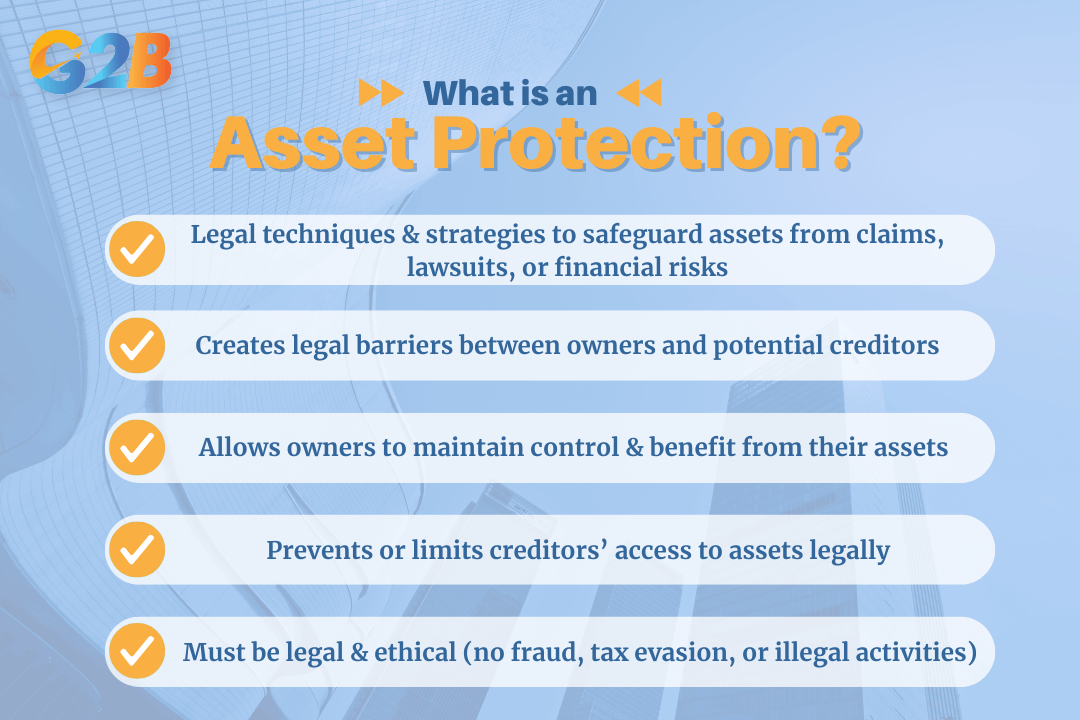

What is asset protection?

Asset protection is a set of legal techniques and strategies aimed at safeguarding the assets of individuals or businesses from claims, lawsuits, or other financial risks. These sophisticated planning methods are designed to create legal barriers between asset owners and potential creditors while maintaining the owners’ ability to benefit from and control their assets. The primary objective is to prevent or limit the ability of creditors or third parties to legitimately access or seize the owner's assets without violating the law.

This means implementing strategies that are completely legal and ethical, without engaging in fraud, tax evasion, or other illegal activities that could result in criminal charges or civil penalties. However, to build a solid foundation for asset protection, it is essential to first establish a business properly and legally - ideally with the support of professional consultants when registering a company in Vietnam. This ensures your business structure is compliant with local regulations, reducing potential legal risks in the future.

Asset protection is a set of legal strategies to safeguard assets from claims and financial risks

Purpose and importance of asset protection

- Protection from debts, lawsuits, bankruptcy, or legal disputes: Asset protection creates legal shields that make it difficult for creditors to reach a business’s personal wealth, even when business ventures fail or legal judgments are rendered against them.

- Maintaining financial stability and preserving asset value long-term: By implementing proper protection strategies, you ensure that market volatility, economic downturns, or individual financial setbacks don't completely destroy your accumulated wealth.

- Peace of mind for individuals and businesses against legal and financial risks: Knowing your assets are protected allows you to take calculated business risks, pursue growth opportunities, and sleep better at night without constantly worrying about potential lawsuits.

- Risk prevention is particularly crucial for high-asset individuals: Entrepreneurs, business owners, doctors, and investors face higher litigation risks due to their professional activities and wealth visibility, making protection strategies essential rather than optional.

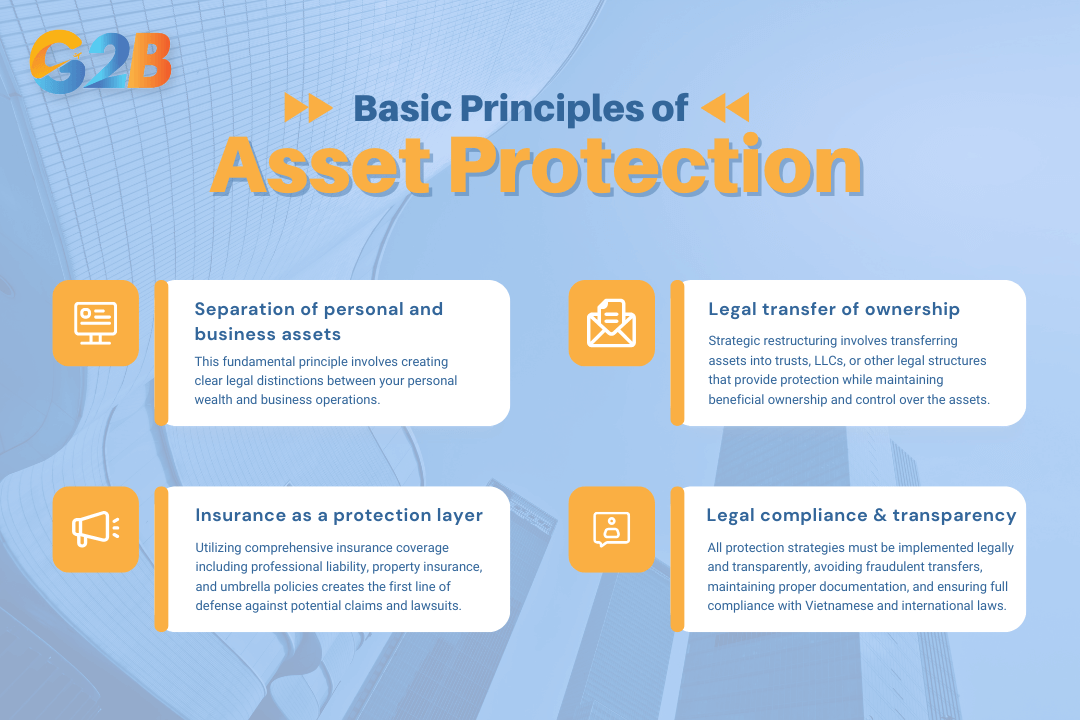

Basic principles of asset protection

- Separation of personal and business assets: This fundamental principle involves creating clear legal distinctions between your personal wealth and business operations, preventing business creditors from accessing personal assets like your home, personal investments, or family savings.

- Legal transfer of ownership: Strategic restructuring involves transferring assets into trusts, Limited Liability Companies (LLCs), or other legal structures that provide protection while maintaining beneficial ownership and control over the assets, in compliance with relevant laws to avoid fraudulent conveyance claims.

- Insurance as a protection layer: Utilizing comprehensive insurance coverage including professional liability, property insurance, and umbrella policies creates the first line of defense against potential claims and lawsuits.

- Legal compliance and transparency: All protection strategies must be implemented legally and transparently, avoiding fraudulent transfers, maintaining proper documentation, and ensuring full compliance with Vietnamese and international laws.

Asset protection is built on four basic principles that guide effective safeguarding of assets

Common methods and tools in asset protection

- Establishing separate legal entities: Creating LLCs, corporations, and trusts provides legal separation between different assets and activities, limiting liability exposure and creating barriers against creditor access.

- Using legal contracts: Implementing asset division agreements, protective interest contracts, and other legal instruments that clearly define ownership structures and limit transferability of assets during disputes.

- Liability insurance: Comprehensive professional liability insurance, property insurance, and general liability coverage serve as the primary defense against most common risks and potential lawsuits.

- Asset transfers: Strategic transfer of assets to family members, trusts, or other protected entities must be done properly and with sufficient time before any potential claims arise.

- Utilizing legal provisions for asset protection: Taking advantage of bankruptcy exemptions, homestead protections, retirement account shields, and other legal provisions that provide automatic protection for certain asset classes, within the bounds of the law.

Positive impacts and legal constraints

While asset protection can be a powerful tool for safeguarding wealth and maintaining financial security, its effectiveness depends on proper planning and legal compliance. Recognizing both the potential benefits and the inherent limitations is crucial to applying these strategies successfully.

Benefits of asset protection

- Minimizing risk of asset loss from lawsuits or debt collection: Proper protection strategies can reduce the likelihood of losing substantial assets even when facing significant legal judgments or creditor claims.

- Protection from unforeseen risks: Asset protection helps protect against risks you cannot predict or control, including economic crashes, regulatory changes, or industry-specific disasters.

- Increasing ability to maintain and grow assets: Protected assets can continue generating income and appreciating even during legal disputes, ensuring long-term wealth preservation and growth.

- Creating financial stability and peace of mind: Knowing assets are protected allows one to focus on business growth, family life, and personal goals without constant worry about potential financial devastation.

Limitations and risks to note of asset protection

- Cannot protect assets from legitimate debts or judgments that are already established by law: Asset protection strategies cannot be used to avoid paying existing debts or judgments that have already been rendered against you.

- Strategies must be implemented before disputes arise: Most protection techniques become ineffective or illegal if implemented after a creditor claim is made or legal action is initiated.

- High costs of establishing and maintaining structures: Professional legal and accounting fees, ongoing maintenance costs, and compliance requirements can be substantial, particularly for complex international structures.

- Legal compliance failures can void protection: Courts can "pierce the corporate veil" or void asset transfers if proper legal procedures aren't followed or if fraudulent intent is demonstrated.

How to apply asset protection in Vietnam

To safeguard assets in Vietnam, businesses should adopt a combination of legal structuring, international standards, insurance coverage, and professional risk management. The following methods offer practical ways to reduce exposure and ensure long-term financial security

There are 6 steps to apply asset protection in Vietnam

1. Implement TAPA standards and certifications for transported asset protection

Many companies, especially in logistics and high-value goods sectors, apply TAPA (Transported Asset Protection Association) standards to safeguard assets during transportation and storage.

TAPA offers three security classes:

- Class A: Highest security, typically for high-value goods

- Class B & Class C: Designed for lower-risk cargo

Companies certified by TAPA must implement strict security systems such as surveillance cameras, alarm systems, and access control measures. These protocols help reduce the risk of loss and theft during logistics operations.

2. Establish a separate legal entity to isolate assets

Entrepreneurs and investors often form a limited liability company (LLC) or joint stock company (JSC), or other legal entity forms permitted under Vietnamese law to separate personal assets from business assets. This legal structure limits the owner’s exposure to legal and financial liabilities. By maintaining a clear separation between personal and corporate finances, founders can shield personal assets from business-related debts and disputes.

3. Use professional asset protection services

A number of companies in Vietnam specialize in asset protection services (e.g., Protection Vietnam Co., Ltd., Global Asset Protection Service LLC). These firms provide tailored solutions for safeguarding both physical assets and sensitive business data. Their services often include on-site security, surveillance, risk management consulting, and theft prevention strategies-ideal for businesses in logistics, manufacturing, and retail.

4. Purchase business asset insurance

Vietnamese businesses frequently invest in asset insurance to mitigate risks such as fire, natural disasters, theft, and unexpected damage. Asset insurance provides financial stability and protects key infrastructure such as office buildings, machinery, inventory, and warehouses. Insurance companies and banks, such as ACB, offer various packages suited to different industries and company sizes.

5. Implement risk management and legal compliance protocols

A robust risk management framework is essential. This includes:

- Internal control systems

- Compliance with financial crime laws

- Anti-fraud and anti-corruption measures

Many companies work with legal or compliance consultants to build systems that align with government regulations and reduce exposure to regulatory penalties.

6. Manage assets and investments effectively

Enterprises, particularly in finance and insurance, are increasingly adopting professional asset management solutions to safeguard and grow corporate wealth. Strategic asset management not only reduces the risk of loss but also enhances the long-term value of the business.

Asset protection has become an essential component of financial planning for successful entrepreneurs and high-net-worth individuals. The combination of increasing litigation risks, economic volatility, and the complexity of modern business activities makes comprehensive asset protection strategies more important than ever. When properly structured and legally compliant, these strategies not only preserve wealth but also provide long-term financial security and stability.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom