The legal framework governing real estate in Vietnam differs significantly from Western jurisdictions. The most fundamental concept investors must grasp is that foreign entities cannot own land in Vietnam. Instead, the state retains ownership, and investors acquire Land Use Rights (LURs) for a specific period, up to 70 years. Navigating this distinction, alongside the newly implemented Land Law 2024 requires precise legal navigation.

This article highlights the key aspects of acquiring land and factories in Vietnam to help investors gain a clearer understanding of the applicable regulations, procedures, and investment considerations. We specialize in company formation and not provide legal, real estate, or valuation advisory services. For detailed land acquisition, or factory leasing, please consult qualified legal or real estate professionals.

Understanding these regulations is the first step in a robust asset protection strategy for foreign manufacturers

Why invest in Vietnam’s industrial market in 2026?

Vietnam has solidified its position as the premier manufacturing hub in Southeast Asia. In 2026, three primary drivers dictate the market's attractiveness: Strategic Trade Access, Infrastructure Maturation, and Competitive Operational Costs. These factors continue to drive record levels of Foreign Direct Investment (FDI) into Vietnam’s manufacturing zones.

1. Strategic trade access via FTAs

Vietnam offers duty-free access to major global markets through 16 active Free Trade Agreements (FTAs). The most impactful agreements for manufacturers include the EU-Vietnam Free Trade Agreement (EVFTA), the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and the Regional Comprehensive Economic Partnership (RCEP). These frameworks reduce tariffs on manufactured goods, electronics, and textiles to near zero, providing a distinct competitive advantage over non-member nations.

2. Infrastructure connectivity

The government’s aggressive public spending has materialized into critical logistical arteries. The completion of the North-South Expressway has reduced transit times between economic zones by 40%. Furthermore, the Long Thanh International Airport (Phase 1 operational in 2026) has expanded air cargo capacity, directly benefiting high-value electronics manufacturers in the Southern Key Economic Zone. This infrastructure is seamlessly integrated with the extensive Vietnam port system, ensuring efficient global export routes.

3. Industrial rental rates

Despite rising demand, Vietnam remains cost-competitive compared to China and Thailand. However, regional price disparities exist:

- Northern region (Bac Ninh, Hai Phong, Hung Yen): Average land lease prices range from $135 to $145 per square meter per year. This region is the hub for electronics and heavy industry.

- Southern region (Binh Duong, Dong Nai, Long An): Prices are higher due to mature supply chains, averaging $175+ per square meter per year.

2024 Land law in Vietnam

The Land Law 2024, effective from August 1, 2024 (with specific provisions from 2026), fundamentally altered the landscape for Foreign Invested Enterprises (FIEs). It aims to modernize land valuation and increase liquidity in the industrial sector.

1. Market-based land pricing

Previously, land prices were determined by a government-issued "Land Price Frame" which often lagged behind market realities. The 2024 Law abolished this frame. Now, land valuation is determined by market-based principles with annual provincial land price tables. While this increases the transparency of transactions, it has led to a 10-15% increase in official land lease fees payable to the state, affecting the Total Cost of Ownership (TCO).

2. Payment flexibility: Annual vs. One-off

Investors now have greater flexibility in how they pay land use fees. However, the choice between Annual Rental Payments and a One-off Lump sum payment has critical legal implications for financing:

- Annual payments: Lower upfront capital expenditure. However, under the new law, both annual and lump sum LURs can be mortgaged to secure bank loans.

- One-off lump sum: Higher initial capex. The decisive advantage is that LURs paid via lump sum offer stronger collateral security.

3. Expanded rights for FIEs

The new law explicitly allows FIEs with LURs (paid via lump sum) to sub-lease land use rights and assets attached to the land. This provides an exit strategy or revenue diversification option that was previously legally ambiguous.

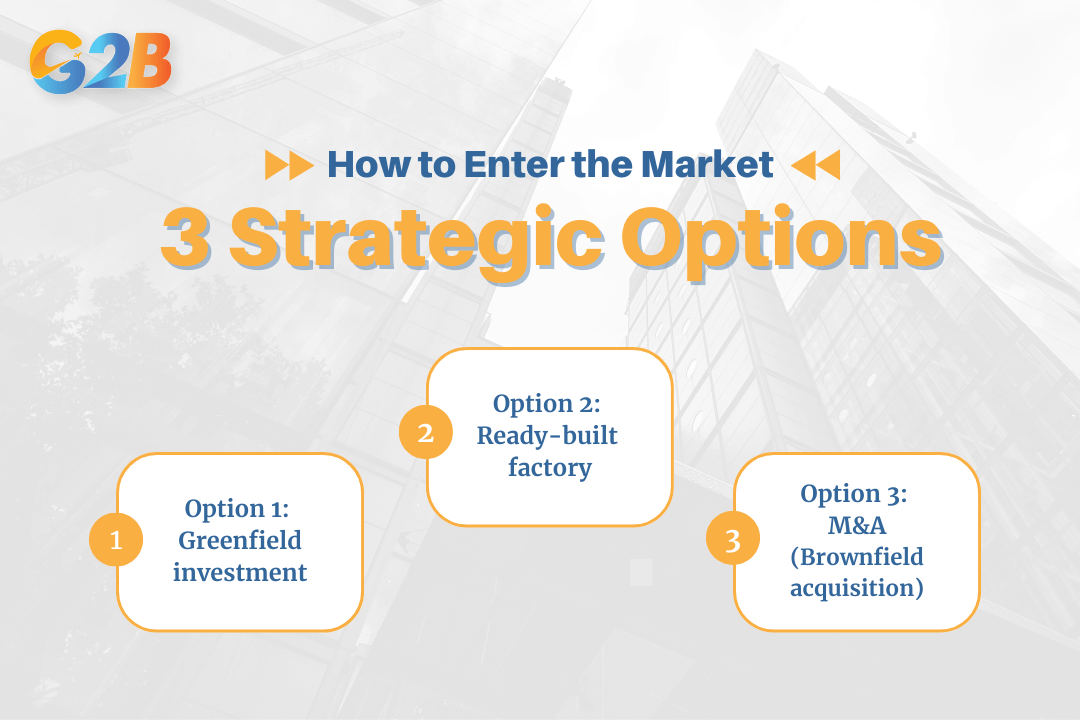

How to enter the market: 3 Strategic options

Selecting the right entry vehicle depends on your timeline, budget, and operational scale.

3 Strategic options to enter the market

Option 1: Greenfield investment (land lease)

This involves leasing raw land within an Industrial Park (IP) or Economic Zone (EZ) and constructing a custom facility.

- Pros: Full customization of the factory layout; eligibility for long-term Corporate Income tax (CIT) incentives; lower long-term operating costs.

- Cons: Long lead time of 12–18 months for permitting and construction; high initial capital outlay.

- Best for: Large-scale manufacturers with specific technical requirements (e.g., chemical processing, heavy machinery).

Option 2: Ready-built factory (RBF)

Leasing a pre-constructed standard factory.

- Pros: Rapid market entry within 1–2 months; flexible lease terms (min 3 years); lower initial capex.

- Cons: Higher rental rates ($5–$8) per square meter/month; limited customization; but still eligible for CIT incentives if in incentivized IP/EZ.

- Best for: SMEs, auxiliary suppliers, and companies testing the market.

Option 3: M&A (Brownfield acquisition)

Acquiring an existing factory or a company that holds LURs.

- Pros: Immediate access to assets, workforce, and machinery; existing licenses may be transferable.

- Cons: High risk of "legacy liabilities" (undisclosed tax debts, environmental violations); complex legal due diligence required.

- Best for: Investors requiring immediate production capacity and established supply chains.

Or you can find more information about M&A Approval in Vietnam

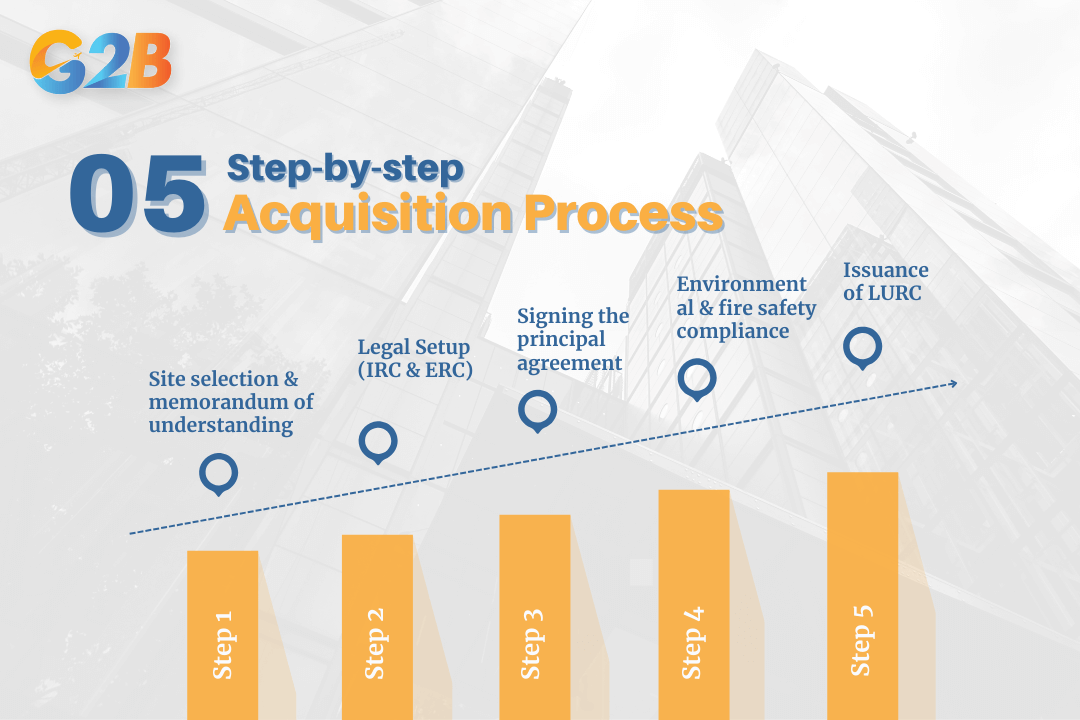

Step-by-step acquisition process

Acquiring industrial real estate is a rigorous process involving multiple government bodies, including the Department of Planning and Investment (DPI) and the Department of Natural Resources and Environment (DONRE).

Step-by-step acquisition process of acquiring industrial real estate

Step 1: Site selection & memorandum of understanding (MOU)

After identifying the location, the investor signs an MOU with the Industrial Park developer and pays a reservation deposit. This agreement reserves the land plot while the investor applies for the necessary licenses.

Step 2: Legal Setup (IRC & ERC)

IRC must be obtained first. Before signing the official lease, the foreign investor must establish a legal entity in Vietnam.

- Investment Registration Certificate (IRC): Issued by the DPI or the Industrial Zone Management Board. This document approves the project scope and capital.

- Enterprise Registration Certificate (ERC): This is the "birth certificate" of the company, allowing it to operate as a legal entity.

G2B provides a comprehensive Vietnam Incorporation Service with an excellent customer experience, helping you do right from the start and minimising risk when setting up a company in Vietnam.

Step 3: Signing the principal agreement

After obtaining IRC and ERC, the Land Sub-Lease Agreement (LSA) or Sale and Purchase Agreement (SPA) is signed. This contract outlines the payment schedule, usage terms, and infrastructure fees.

Step 4: Environmental & fire safety compliance

In 2026, compliance standards are stricter than ever.

- Environmental impact assessment (EIA): Must be approved by DONRE before construction begins.

- Fire prevention and fighting (PCCC): The most common bottleneck in 2026. Investors must obtain design approval and final acceptance from the Fire Prevention and rescue police department. Failure to meet new PCCC standards can delay operations by months.

Step 5: Issuance of LURC ("Pink Book")

After completing financial obligations, the state issues the Certificate of Land Use Rights, Ownership of House and Other Assets Attached to Land, commonly known as the "Pink Book." This is the ultimate proof of your rights to the land and factory.

The due diligence checklist

Skipping due diligence is the fastest way to incur financial loss. Here’s a comprehensive audit focusing on three pillars:

1. Legal due diligence

Verify the legal status of the land.

- Does the seller/landlord possess a valid Pink Book?

- Has the annual land tax been paid fully to the state?

- Is the land currently disputed or mortgaged to a third party?

2. Technical due diligence

Assess the physical conditions of the site.

- Geotechnical report: Verify soil conditions to determine piling costs.

- Infrastructure capacity: Check if the wastewater treatment plant, power substation capacity, and water supply meet your specific manufacturing needs.

3. Compliance due diligence

Crucial for M&A deals.

- Check for historical violations regarding customs duties, social insurance payments for labor, and environmental discharge records.

- Ensure the target company has a clean standing with the General Department of Taxation.

Financial considerations & taxes

Understanding the tax implications of asset acquisition is vital for accurately calculating return on investment, as taxes can significantly impact acquisition costs, cash flow, and long-term profitability.

Corporate income tax (CIT)

The standard CIT rate is 20%. However, projects in specific high-tech sectors or difficult socio-economic regions may qualify for the "Two-four" incentive:

- 4 years tax exemption + 50% reduction for 9 subsequent years (or 2+4 depending on location).

Value-added tax (VAT)

The standard VAT for industrial goods and services is 10%. Note that VAT on the transfer of LURs (land value) is often exempt, but VAT applies to infrastructure fees and construction costs. The 2% VAT reduction expired June 30, 2025.

Capital assignment/transfer tax

For M&A transactions involving foreign investors, the tax regime has tightened.

- Capital assignment tax: Foreign invested enterprises pay CIT 20% on capital gains from share transfers.

- Asset transfer tax: Under the new 2026 regulations, if a foreign seller transfers real estate assets directly, a 2% tax on the gross transfer price applies, replacing previous complex net-gain calculations for certain asset classes.

These tax implications are a critical component to consider when evaluating your company's capital structure during an acquisition

Frequently asked questions

This part will investigate the most frequently asked questions below. These questions address common concerns raised by both local and foreign investors.

Can foreign individuals own land in Vietnam?

No. Foreign individuals cannot own land. They can only own residential apartments (not the land itself) for 50 years. For industrial purposes, foreign investors must form a legal entity (FIE) to hold Land Use Rights (LURs). There are several types of company in Vietnam that foreign investors can choose from to facilitate land acquisition, with the LLC being the most popular

What happens when the land use right (LUR) lease term expires?

When acquiring land in an IP, you are leasing for the remaining years of the IP’s 50-year term. For example, if the IP was established in 2016 and you enter in 2026, you have 40 years remaining. Under the Land Law 2024, LURs can be considered for extension upon expiration, subject to land use planning and additional fee payments.

How long does it take to get an Investment Registration Certificate (IRC)?

Legally, the timeline is 15 working days upon submission of a complete dossier. However, in practice, this can take 30 to 45 days, depending on the complexity of the project and the workload of the local Department of Planning and Investment (DPI).

The industrial market in Vietnam offers unparalleled growth potential, driven by infrastructure maturity and trade connectivity. However, the path to entry - from the Investment Registration Certificate (IRC) to the strict Fire Safety (PCCC) compliance - is laden with regulatory hurdles. The Land Law 2024 provides new opportunities for financing through One-off lump sum payments, but also demands rigorous adherence to market-based pricing and environmental standards.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom