A corporation is a legal entity created by shareholders that is separate and distinct from its owners, established to conduct business or trade. This structure allows it to enter into contracts, own assets, incur debt, and engage in legal actions, all under its own name. This comprehensive guide details what a corporation is, its various forms, the incorporation process in the U.S., and a direct comparison with its closest equivalent in the burgeoning economy of Vietnam.

What is a Corporation?

A corporation is a legal business structure that acts as a single, artificial person under the law. A corporation is created when an individual or group files "articles of incorporation" with a state government. This act establishes the corporation as a separate entity, by virtue of its status as a separate legal entity, shielding its owners from personal responsibility for the company's debts and liabilities. The defining characteristics of a corporation that make it a powerful tool for business include several key features, such as limited liability, perpetual existence, and transferable shares.

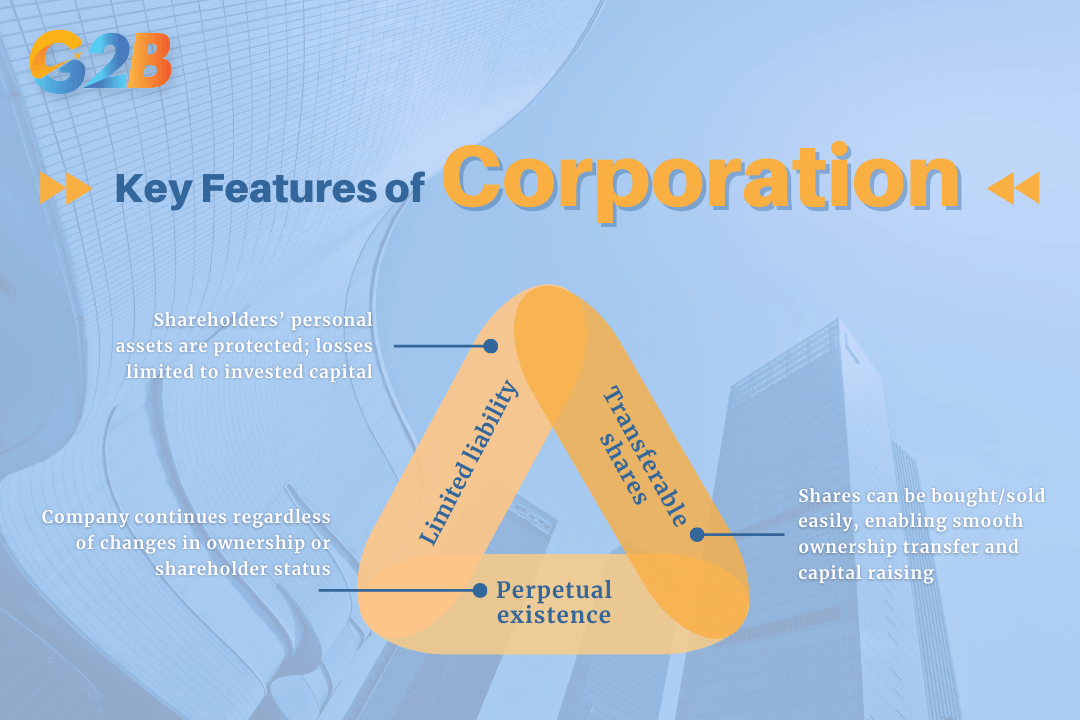

Key features

- Limited liability: This is a primary benefit of incorporation. It means that the owners (shareholders) are not personally responsible for the company's debts or legal liabilities. Their potential loss is limited to the amount they have invested in the company's stock, protecting their personal assets like homes and savings.

- Perpetual existence: A corporation has an unlimited life. Its existence is not tied to its owners; it can continue to operate indefinitely, even if shareholders die, sell their shares, or new shareholders come on board.

- Transferable shares: Ownership in a corporation is represented by shares of stock. These shares can be easily bought and sold, allowing for the transfer of ownership without disrupting business operations. This feature is crucial for raising capital from investors.

A corporation is a legal business structure with 3 key features

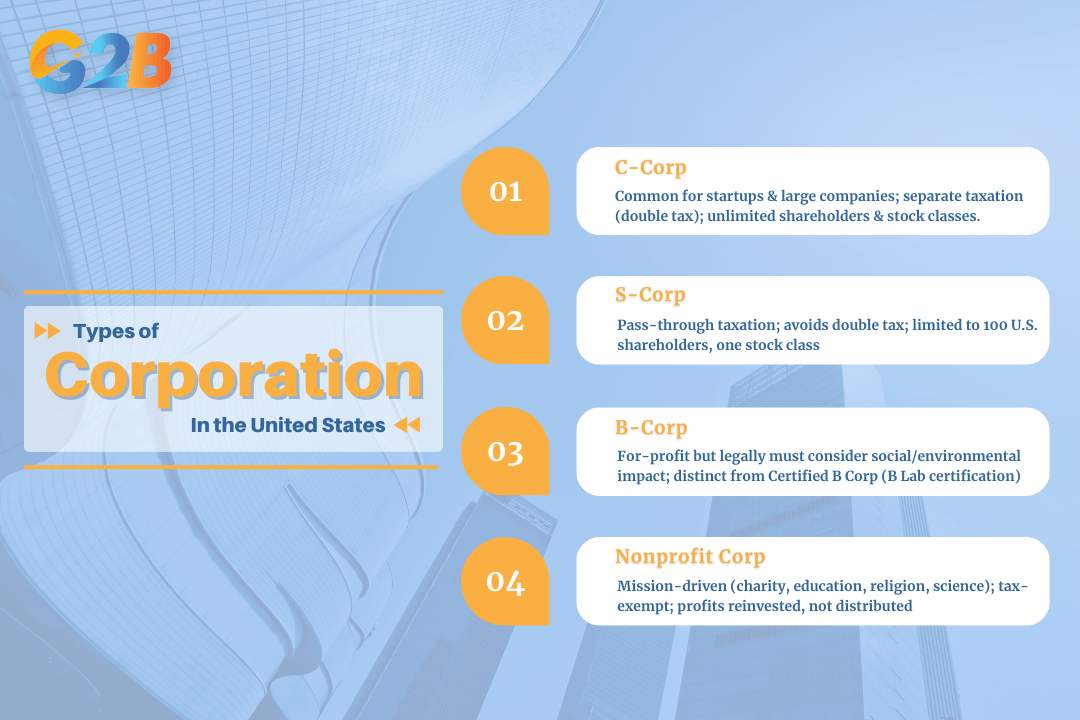

Types of Corporations (US focus)

In the United States, corporations are primarily governed by state law, and several types exist to accommodate different business goals regarding taxation, size, and social mission.

- C-Corporation (C-Corp): This is the most common corporate structure, especially for startups that plan to seek venture capital and for large, publicly-traded companies. C-Corps are taxed separately from their owners, which can lead to "double taxation" - the corporation pays taxes on its profits, and shareholders pay taxes on the dividends they receive. However, this structure allows for an unlimited number of shareholders and different classes of stock.

- S-Corporation (S-Corp): An S-corporation is designed to avoid the double taxation associated with C-Corps. It allows profits and losses to be passed directly through to the owners' personal income without being taxed at the corporate level. However, S-corps have stricter limitations, including being restricted to a single class of stock and no more than 100 shareholders, who must be U.S. citizens or residents and generally individuals, certain trusts, or estates but not corporations or partnerships.

- B-Corporation (B-Corp): A Benefit Corporation is a specific legal corporate form recognized in many U.S. states that requires directors to consider social and environmental impacts alongside profit. This is distinct from a "Certified B Corporation," which is a certification given by the nonprofit B Lab to companies that meet rigorous standards of social and environmental performance, accountability, and transparency. While still aiming for profit, a B-Corp's directors are legally required to consider the impact of their decisions on workers, customers, the community, and the environment.

- Nonprofit Corporation: This type of corporation is organized for charitable, educational, religious, or scientific purposes. Nonprofits must be registered under applicable nonprofit laws and comply with specific regulations to qualify for tax-exempt status; they do not distribute profits to owners or shareholders, instead reinvesting any earnings into the organization's public benefit mission. They are often exempt from federal and state taxes.

Corporations have several types existing in the United States

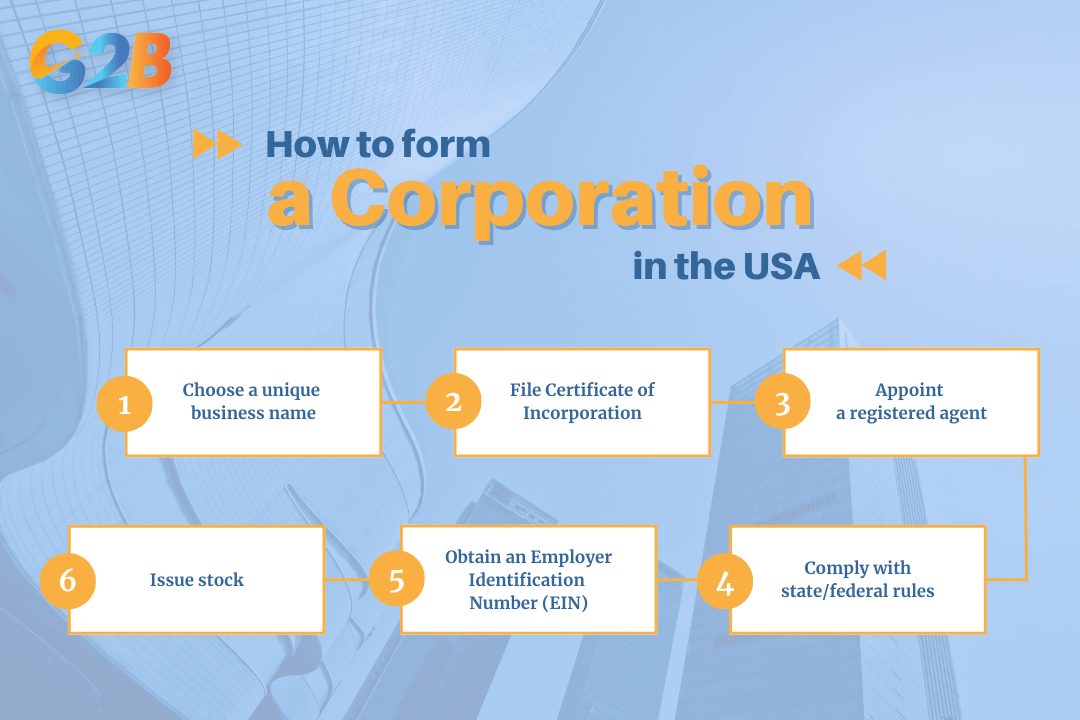

How to form a Corporation in the USA (Delaware example)

Forming a corporation involves a series of formal steps, and while specifics vary by state, the process generally follows a standard pattern. Delaware is a popular choice for incorporation due to its business-friendly laws and respected corporate court system. The step-by-step process to form a Delaware corporation includes several key actions, such as choosing a name, filing a Certificate of Incorporation (the formal incorporation document in Delaware, equivalent to Articles of Incorporation in other states), and appointing a registered agent.

- Choose a unique business name: The selected name must be distinguishable from other corporations on file in Delaware and typically must include a corporate designator like "Inc.," "Corporation," or "Company."

- File Certificate of Incorporation: This legal document is filed with the Delaware Secretary of State to officially create the corporation. It includes essential information like the corporate name, the amount of authorized stock, and the name and address of the registered agent.

- Appoint a registered agent: Every Delaware corporation must have a registered agent with a physical address in the state. This agent is responsible for receiving official legal and tax documents on behalf of the company.

- Issue stock: After incorporation, the initial board of directors will issue shares of stock to the founders and any initial investors, formalizing their ownership stakes.

- Obtain an Employer Identification Number (EIN): An EIN is a federal tax ID number issued by the Internal Revenue Service (IRS) required for the corporation to pay federal taxes, hire employees, and open a bank account.

- Comply with state/federal rules: Corporations must adhere to ongoing compliance requirements, such as holding annual board and shareholder meetings, keeping minutes, maintaining corporate records, updating state filings, and filing annual reports and paying franchise taxes.

How to form a Corporation in the USA

Why Delaware? Over 65% of Fortune 500 companies are incorporated in Delaware for compelling reasons. The state offers a flexible and modern corporate law statute (the Delaware General Corporation Law), a specialized business court called the Court of Chancery that resolves corporate disputes efficiently, and significant tax advantages, such as not levying corporate income tax on revenue earned outside the state.

Corporation vs LLC vs Partnership - Which to choose?

Choosing the right legal structure is a critical decision for any entrepreneur. A corporation is just one of several options, each with distinct features regarding liability, taxation, and administrative burden.

| Feature | Corporation | LLC | Partnership (general) |

|---|---|---|---|

| Limited Liability | Yes. Protects owners' personal assets from business debts and lawsuits. | Yes. Members' liability is generally limited to their investment in the company. | No. Partners are personally liable for the business's debts and obligations. |

| Taxation | Double taxation (C-Corp). The corporation pays taxes on profits, and shareholders pay taxes on dividends. | Pass-through. Profits and losses are passed through to members' personal tax returns, avoiding corporate-level tax. | Pass-through. Profits and losses are reported on the partners' personal tax returns. |

| Formalities | High. Requires a board of directors, regular meetings, minute-keeping, and annual reports. | Low-medium. Fewer formal requirements than a corporation, with more flexibility in management structure. | Low. Often formed by a simple agreement with minimal state filing requirements. |

| Best for | Scaling globally, raising capital. The ability to issue stock makes it ideal for businesses seeking venture capital. | Small businesses, solopreneurs. Offers liability protection with less complexity and more tax flexibility. | Joint ventures, professional services. Simple to establish for two or more co-owners. |

Explore more:

How does it compare to Vietnam?

As an entrepreneur looking at global opportunities, it's essential to understand how business structures translate across borders. In Vietnam, there is no direct one-to-one equivalent of the U.S. "corporation." The closest and most common structure for significant investment is a Joint Stock Company. A Joint Stock Company (JSC) is a legal entity where the charter capital is divided into shares held by at least three shareholders, with no maximum limit.

Key differences:

- No C-Corp/S-Corp distinction: Vietnamese law does not differentiate between corporate structures for tax purposes in the same way the U.S. does. JSCs have a standard tax structure. JSCs are subject to Vietnam’s standard corporate income tax system, as well as other applicable taxes depending on the business activities.

- Foreign ownership limitations: Unlike the U.S., Vietnam restricts foreign ownership levels in certain sectors. For example, foreign ownership may be capped at 49% in some conditional business lines, 34% in airlines, and 30% in banking. However, many other sectors, like manufacturing, are open to 100% foreign ownership.

- Investment Registration Certificate (IRC): Before establishing a business, foreign investors must first obtain an Investment Registration Certificate (IRC). This certificate is issued by the Department of Planning and Investment and serves as government approval for the investment project itself. This is a prerequisite step that does not exist in the U.S. formation process.

- Formation timeline: The process in Vietnam is more time-consuming. Securing an IRC and then the subsequent Enterprise Registration Certificate can take between 15 to 30 days, and sometimes longer. This contrasts with the highly efficient process in states like Delaware, where incorporation can be completed in just a few days, or even hours with expedited services.

Similarities:

Despite the differences, the core principles that make the corporate structure attractive are present in Vietnam's Joint Stock Company.

- Limited liability: Shareholders are only liable for the company's debts up to the amount of their capital contribution.

- Separate legal entity: A JSC has its own legal status, separate from its shareholders, from the date its business registration is issued.

- Can issue shares: JSCs are the only business entity in Vietnam authorized to issue shares and securities; however, to issue shares to the public, JSCs must comply with strict securities laws and obtain necessary approvals from regulatory authorities, making this suitable for large-scale ventures.

Should you form a Corporation (joint stock company) in Vietnam?

Deciding between a Joint Stock Company (JSC) and a Limited Liability Company (LLC) in Vietnam depends entirely on your business goals, scale, and long-term vision.

Yes, form a JSC if:

- You plan to scale your business significantly and require substantial capital from a wide range of investors.

- Your long-term strategy includes going public and listing on the stock exchange.

- You need a flexible capital structure that allows for easy transfer of ownership and bringing in new shareholders.

Consider an LLC if:

- You are a solo founder or have a small group of partners (an LLC can have from one (single-member LLC) to 50 members (multi-member LLC), with different management and liability rules for each type).

- You prefer a simpler management structure and less stringent compliance and reporting requirements.

- You do not intend to raise capital by issuing shares to the public.

Need help setting up in Vietnam?

Navigating the complexities of company formation in a foreign market can be challenging. At G2B, we specialize in helping international entrepreneurs establish companies in Vietnam. G2B offers expert consultancy for the company formation process, guiding entrepreneurs through the complexities of establishing operations in international markets. Our dedicated team ensures a seamless process from start to finish, to empower you to focus on what you do best - growing your business.

Choosing the right business entity is a foundational decision that impacts your company's liability, taxation, and ability to grow. The corporation, with its key features of limited liability and transferable ownership, remains a dominant structure for ambitious ventures in the U.S. and globally. In Vietnam, the Joint Stock Company offers a parallel structure for entrepreneurs aiming to build large-scale, high-growth enterprises. While the registration procedures and regulatory landscape differ, the fundamental principles of protecting owners and enabling capital investment hold true. By understanding these nuances, you can select the optimal structure to turn your entrepreneurial vision into a legally sound and scalable reality.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom