Understanding the various types of business structures is essential for any entrepreneur evaluating the optimal legal and operational framework for a new or expanding venture. Each structure carries distinct implications in terms of liability, taxation, and governance. Let’s explore a comparative overview of five common business entities: Sole Proprietorship, Partnership, Limited Liability Company (LLC), C Corporation, and S Corporation in this G2B’s in-depth comparison.

An overview of business structures

In the intricate landscape of business, selecting the right legal entity is a critical decision, as the chosen structure dictates not only the operational flow but also the overall decision-making framework of the venture.

Definition and purpose of each structure

The choice of a business structure serves as the backbone for any enterprise, defining the division of personal liability, taxation, and the daily operational dynamics. At its core, a business structure is the legal framework within which a business operates. Each structure provides distinct levels of protection, financial benefits, and responsibilities that align with the strategic goals and operational needs of the business.

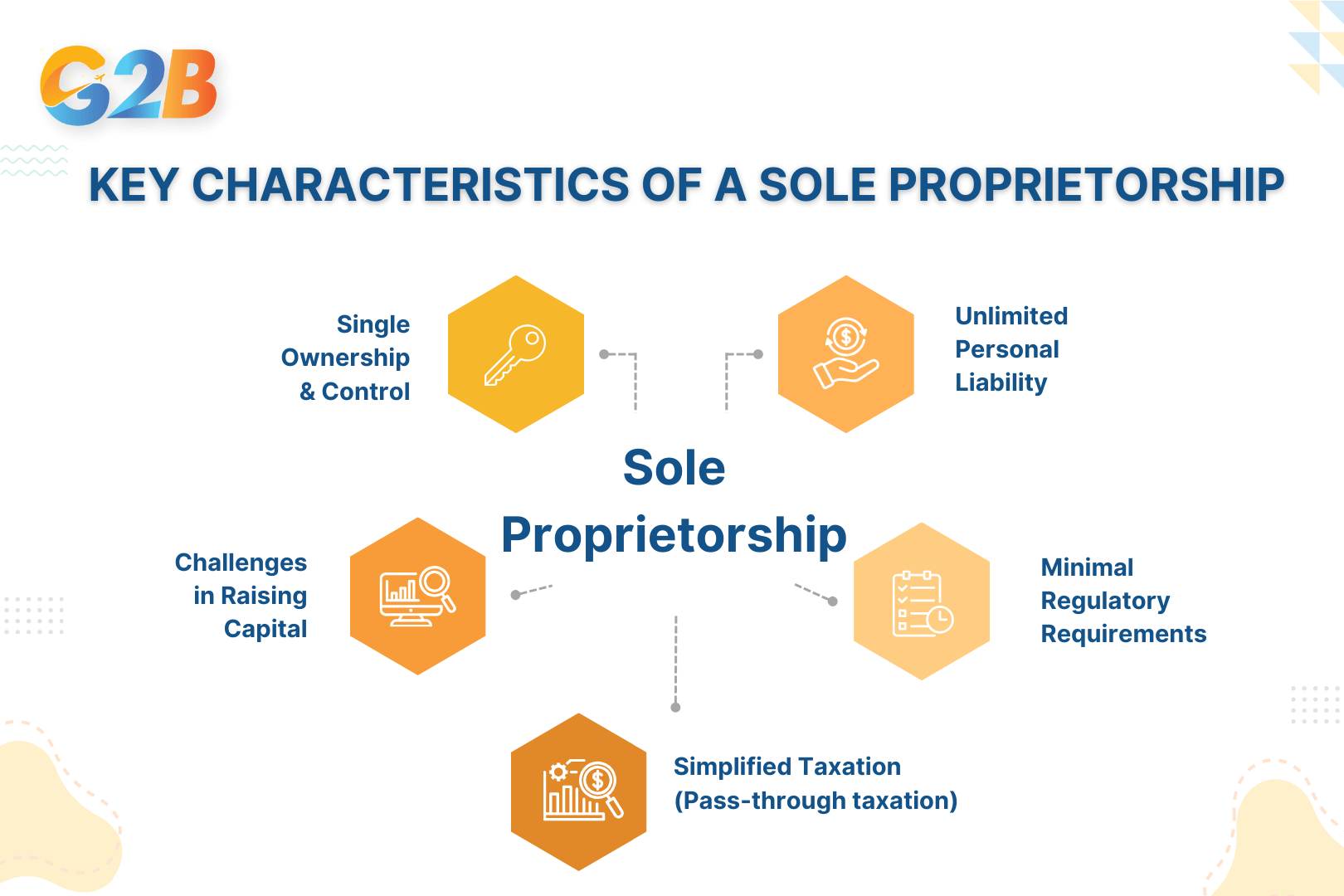

- Sole proprietorship: The simplest and most common form of business structure, a sole proprietorship is owned by one person. This setup offers complete control to the owner but comes with unlimited personal liability.

- Partnership: Involving two or more people, partnerships allow for shared responsibility and resources. However, similar to sole proprietorships, general partners bear unlimited liability.

- LLC (Limited liability company): Offering a blend of the operational flexibility of a partnership and the liability protection similar to a corporation, an LLC is popular among small to medium enterprises.

- Corporation (C Corp and S Corp): These entities offer strong liability protection and are considered separate legal entities. While a C Corp faces double taxation on earnings, an S Corp can pass income directly to shareholders, avoiding this tax burden.

Sole proprietorship is one of the simplest and most common forms of business structure

Importance of choosing the right structure

Selecting the right business structure is crucial for long-term success. It impacts everything from fundraising capabilities and regulatory compliance to tax obligations and personal liability.

- Liability protection: Structures like LLCs and corporations protect personal assets by treating the business as a separate legal entity.

- Tax efficiency: Different structures come with varying tax treatments. For instance, C Corporations face double taxation, but S Corporations and LLCs provide mechanisms for tax optimization.

- Regulatory requirements: Compliance levels, ongoing paperwork, and administrative overhead can vary significantly across structures. For instance, corporations often face stricter regulatory scrutiny compared to sole proprietorships or partnerships.

Common misconceptions

Despite its critical importance, several misconceptions around business structures can lead to costly errors.

- Liability is not total guarantees: Many entrepreneurs mistakenly believe that LLCs or corporations provide complete immunity from liability, whereas these protections can be pierced in cases of fraud or regulatory non-compliance.

- Complexity equals cost: Business owners sometimes perceive corporations as prohibitively complex and costly. However, while they do involve more paperwork, their financial benefits often outweigh the setup and maintenance costs.

- Tax reductions are uniform: Another misconception is that all business structures offer the same level of tax benefits. In truth, each has specific tax advantages and drawbacks, necessitating careful evaluation.

Detailed comparison of LLC, C corporation, and S corporation

This comparison explores distinct features across legal definition, tax implications, suitability for certain businesses, and more.

Legal definition and characteristics

A Limited Liability Company (LLC) is a hybrid structure, providing liability protection akin to corporations while offering flexibility typically seen in partnerships. Members of an LLC enjoy protection from personal liability for business debts, which is a significant advantage in risk mitigation. Particularly, C Corporations, or C Corps, are traditional business entities recognized for being separate from their owners. Shareholders have limited liability, but C Corps are subject to double taxation - profits are taxed at the corporate level and again as shareholder dividends.

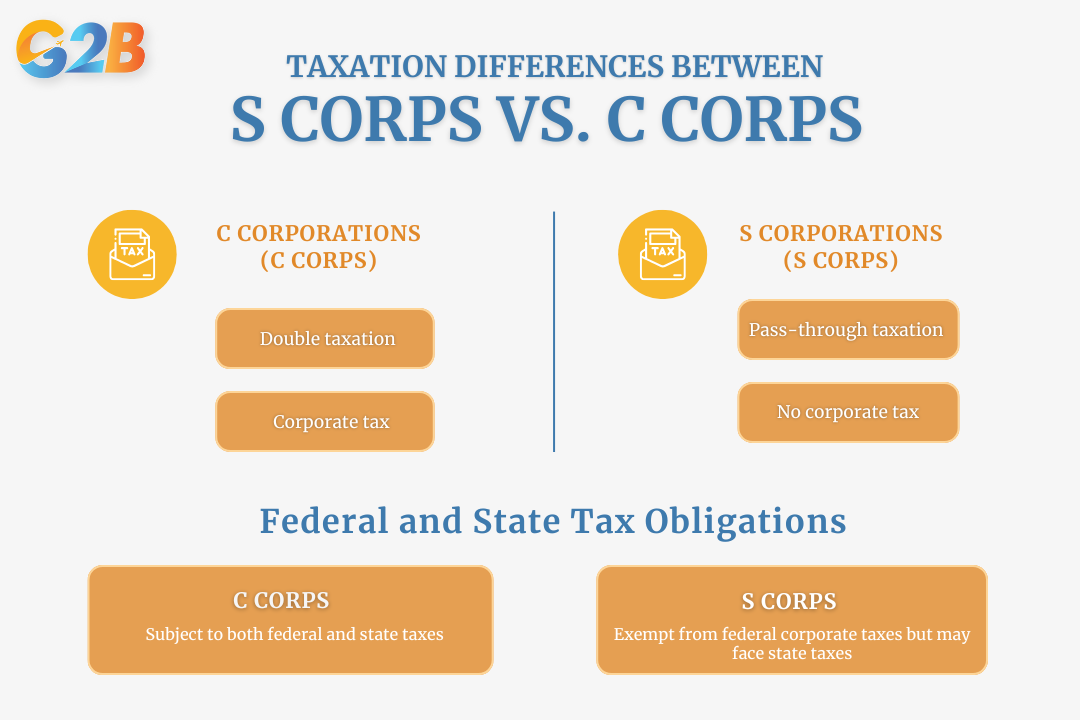

S Corporations, or S Corps, are similar to C Corps in their liability separation and structure. However, S Corps are unique due to their pass-through taxation: profits and losses are reported on shareholders' personal tax returns, avoiding the double taxation burden C Corps face. If you are choosing a Corporation for your business, explore a more detailed comparison between C Corps and S Corps

Pros and cons of each model

Each business structure offers unique benefits as well as potential drawbacks, depending on the nature and goals of the enterprise. The following comparison outlines the key advantages and limitations of each model to support strategic evaluation.

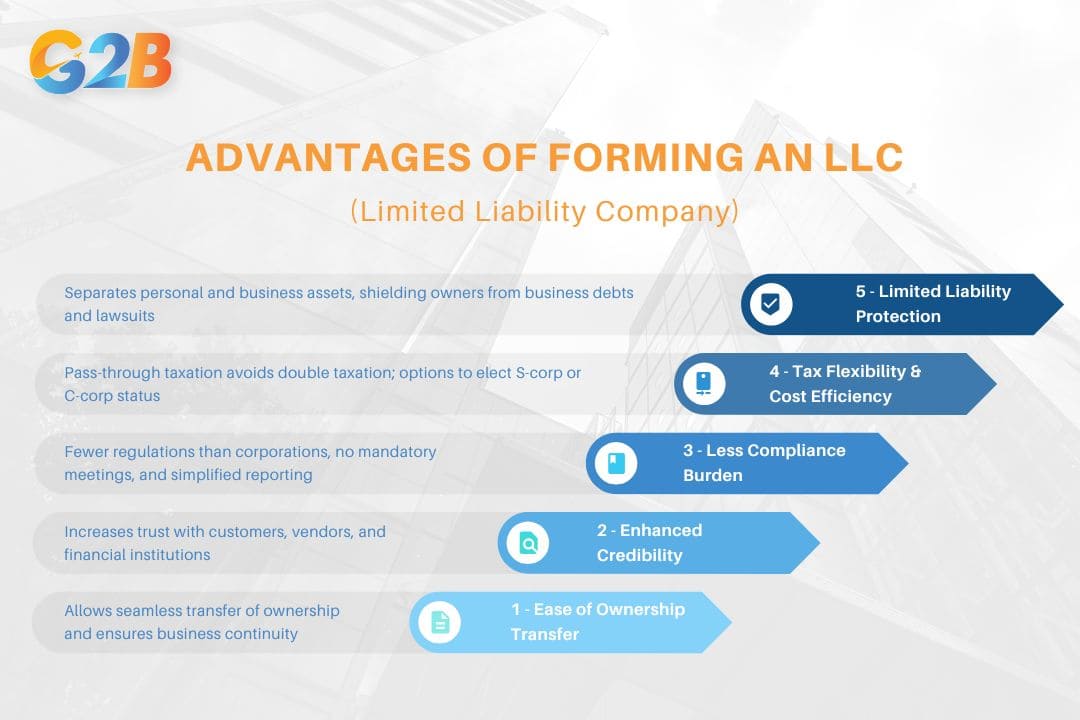

LLC advantages:

- Limited liability protection for owners

- Tax flexibility and cost efficiency

- Less compliance burden compared to corporations

- Credibility and trust in business transactions

- Ease of ownership transfer and business continuity

A Limited liability company offers many benefits for entrepreneurs

LLC disadvantages:

- Potentially higher formation and ongoing maintenance costs compared to a sole proprietorship.

- May not appeal to investors due to lack of stock issuance.

C Corporation advantages:

- Ability to attract investment through the sale of stock.

- Limited liability protection.

- Unlimited number of shareholders, enhancing growth potential.

C Corporation disadvantages:

- Double taxation of profits.

- Complex regulations and administrative requirements.

S Corporation advantages:

- Avoids double taxation through pass-through taxation.

- Limited liability with corporate structure benefits.

- Available to up to 100 shareholders, fostering a controlled ownership environment.

S Corporation disadvantages:

- Restrictive eligibility criteria (e.g., the number of shareholders and domestically registered status).

- Higher administrative burdens similar to C Corps.

Suitability for different types of businesses

LLCs are incredibly adaptable, suitable for small to medium-sized enterprises that benefit from flexibility and owner protection without the complexity of a corporation. This structure appeals to businesses seeking operational simplicity with liability safeguards, like family-owned businesses or real estate ventures. C Corporations are ideal for larger businesses or those planning significant growth through public offerings or external funding. The ability to issue stock makes C Corps particularly attractive to investors and venture capitalists.

S Corporations fit best with small to medium-sized domestic companies prioritizing tax efficiency while maintaining a corporate structure. This model works well for businesses that plan to keep shareholder numbers limited but still desire the liability protection a corporation offers. In general, the choice between an LLC, C Corporation, and S Corporation hinges on several factors: Business size and growth trajectory, tax preferences, investor expectations, and complexity tolerance.

Understanding partnerships and sole proprietorships

Each offers unique advantages and poses distinct challenges, making their exploration vital for any potential entrepreneur looking to align their personal goals with business operations.

Types of partnerships and their features

Several types of partnerships arise in the landscape, each characterized by varying degrees of complexity, liability, and financial commitment. Understanding these types can inform decisions about business formation and allocating managerial responsibilities and liabilities.

- General Partnership: In a general partnership, two or more individuals share the management, profits, and liabilities of a business equally or as determined by a partnership agreement. Each partner carries unlimited liability, meaning personal assets may be at risk if the business incurs debt or legal challenges.

- Limited Partnership (LP): An LP involves general partners who manage the business and assume liability, and limited partners who contribute capital without engaging in day-to-day operations. Limited partners enjoy liability limited to the extent of their contribution.

- Limited Liability Partnership (LLP): This structure provides liability protection for all partners, similar to that of a corporation, protecting personal assets from business debts and liabilities. Typically preferred by professionals like lawyers and accountants, LLPs allow all partners to have a say in management.

Advantages and disadvantages

Every business structure comes with its own set of advantages and disadvantages, and understanding these factors is essential for selecting the most suitable model.

Advantages:

- Simplicity and cost-effectiveness: Both partnerships and sole proprietorships are relatively inexpensive and straightforward to establish, requiring minimal legal formalities and paperwork.

- Tax benefits: Income from these structures is generally passed through to the owners, avoiding the double taxation seen in corporate structures.

- Operational flexibility: Owners have a high degree of control and can make swift, unilateral decisions, important for rapid response in a dynamic business environment.

Disadvantages:

- Unlimited liability: Sole proprietors and general partners are personally liable for business debts, which poses a considerable financial risk.

- Difficulties in capital raising: These structures may find it challenging to attract investment as they cannot issue stock, making expansion reliant on personal funds or loans.

- Continuity risks: Business continuity can be compromised by the departure or death of a partner or owner, necessitating a robust succession plan.

Comparison with corporate structures

While partnerships and sole proprietorships offer operational simplicity and direct management control, comparing them to corporate structures reveals several contrasts. This table highlights the key differences, particularly in liability and capital raising capabilities, vital for determining the ideal structure based on strategic business goals.

| Feature | Sole proprietorship & partnership | Corporation |

|---|---|---|

| Liability | Unlimited personal liability | Limited liability for shareholders |

| Taxation | Pass-through taxation | Subject to corporate taxes |

| Capital raising | Limited to personal funds and loans | Can issue stock to raise capital |

| Management | Direct management by owners | Oversight by the board and executives |

| Regulatory requirements | Minimal | Significant, including formal reporting |

Tax implications of different business structures

Each business structure - LLC, corporation, partnership, and sole proprietorship - has distinct tax treatments that influence an organization’s financial health and operational strategy.

Tax treatments for LLCs

Limited Liability Companies (LLCs) offer flexible tax treatment options, making them an attractive choice for many entrepreneurs. By default, single-member LLCs are treated as sole proprietorships for tax purposes, while multi-member LLCs are treated as partnerships. However, LLCs can elect to be taxed as either a C Corporation or an S Corporation by filing the appropriate forms with the IRS.

- Pass-through taxation: Under default treatment, LLCs do not pay federal income taxes. Instead, profits and losses are passed through to the owners’ personal tax returns. This avoids the double taxation faced by traditional C Corporations.

- Tax election flexibility: Choosing to be taxed as an S Corporation can provide additional benefits, such as allowing members to potentially save on self-employment taxes by receiving a portion of profits as dividends instead of salary.

Taxation for corporations

Corporations are subject to more complex taxation structures, depending on whether they are classified as C Corporations or S Corporations.

- C Corporation taxation: C Corporations are taxed at the corporate level, separate from their owners. This results in double taxation: once when the corporation earns income and again when dividends are distributed to shareholders.

- S Corporation taxation: S Corporations elect pass-through taxation, similar to LLCs and partnerships, where income is not taxed at the corporate level but instead is reported on the shareholders’ tax returns. However, there are restrictions on the number and type of shareholders. This structure can lead to tax savings, although compliance requires adherence to specific IRS requirements.

There are differences between a C Corporation and an S Corporation in taxation

Tax advantages in partnerships and sole proprietorships

Partnerships and sole proprietorships typically benefit from straightforward tax obligations, offering advantages primarily through pass-through taxation.

- Partnerships: In a partnership, income is passed directly to partners based on their share of ownership, and each partner reports their share of the profits on their personal tax return. This structure includes both general and limited partnerships, each with specific liabilities and responsibilities.

- Sole Proprietorships: As the simplest business structure, sole proprietorships reflect all business income and expenses on the owner's tax returns. Although this provides simplicity, it also means the owner is personally liable for all business taxes, and self-employment taxes must be paid in full.

Legal liability comparison among business models

This comparison draws attention to the varying levels of risk in terms of legal exposure and the importance of aligning a business model with the owner's risk and business objectives.

Limitation of liability in corporations

Corporations, both C Corporations and S Corporations, are structured to offer significant protection against personal liability for their shareholders. By law, a corporation is considered a separate legal entity, meaning that shareholders are typically not personally liable for the debts and obligations of the corporation, beyond their investment in the company. This limits personal risk and provides a robust shield for personal assets.

- C Corporations: In a C Corporation, the liability of shareholders is usually limited to the amount of money that they have invested in the company. This structure allows the corporation to engage in business transactions, contracts, and legal suits independently of its shareholders.

- S Corporations: Operating similarly to C Corporations in terms of liability protection, S Corporations also offer a limitation of liability. Shareholders enjoy the same protection, insulating personal assets from business losses and lawsuits.

The inherent protection offered by corporations makes them an attractive option for businesses seeking to minimize personal risk. However, this comes at the expense of potentially higher operational complexity and regulatory requirements.

Liability exposure in partnerships and sole proprietorships

Contrasting sharply with corporations, partnerships and sole proprietorships come with a higher level of personal liability. Owners are personally responsible for business debts and legal claims, which can be a significant deterrent for those wary of financial risk.

- Partnerships: In general partnerships, partners share equal responsibility for the business's liabilities. Each partner can be held personally liable for the debts and legal obligations of the business, potentially putting personal assets at risk. Limited partnerships offer some protection, as limited partners are only liable up to the extent of their investment, much like shareholders in a corporation; however, general partners remain fully liable.

- Sole Proprietorships: In a sole proprietorship, there is no legal distinction between the owner and the business. Consequently, the owner bears unlimited liability for debts and legal claims. Any legal action taken against the business impacts the owner's personal assets directly.

These structures, while simpler and less costly to set up, require entrepreneurs to weigh the benefits of simplicity against the risks of personal liability.

Strategies to mitigate legal risks

To mitigate legal risks, businesses can adopt various strategies, regardless of their structure. These strategies help in safeguarding assets and ensuring long-term operational viability:

- Insurance: Acquiring business insurance can help cover legal costs and any settlements that arise from lawsuits. Liability insurance, product liability insurance, and property insurance are common forms.

- Contractual agreements: Well-drafted contracts reduce exposure to liability by clearly outlining the responsibilities and indemnities of all parties involved, minimizing misunderstandings and disputes.

- Compliance and governance: Staying compliant with regulatory requirements and establishing robust corporate governance can further shield businesses from legal issues. Regular audits and adherence to industry standards also promote accountability.

- Structuring: Reassessing the business structure itself could be a preventative measure. For instance, converting a sole proprietorship to an LLC or corporation can offer enhanced liability protection.

Regulatory and compliance requirements

Different business structures have distinct regulatory landscapes that can significantly impact their daily operations and long-term stability.

Necessary documentation for each structure

Documentation forms the bedrock of regulatory compliance across business structures, serving as evidence of meeting legal obligations. For LLCs, essential documents include the Articles of Organization and an Operating Agreement, which outline the business's operational framework and member roles. In contrast, C Corporations require more extensive documentation, such as the Articles of Incorporation, Corporate Bylaws, and stock certificates, to formally define shareholder rights and organizational structure.

S Corporations, while similar to C Corporations, require a specific IRS form to elect S Corp status, which can influence their tax obligations. Partnerships rely on partnership agreements that delineate terms between partners, while sole proprietorships, though requiring minimal formal documents, still need local permits or licenses to operate legally. Each structure demands precise and timely documentation to comply with federal, state, and local regulations, underscoring the importance of a comprehensive understanding and accurate record-keeping.

Ongoing compliance obligations

Compliance is not a one-time effort but an ongoing responsibility that involves adhering to a range of legal and regulatory requirements. LLCs and corporations are mandated to file annual reports with their respective states, keeping business information up to date and signaling continued operation. C Corporations often face stricter compliance obligations, including board meeting records and more rigorous financial disclosures due to shareholder interests.

S Corporations, while benefiting from pass-through taxation, must also follow stringent requirements on shareholder limitations and profit distribution. Partnerships, especially limited partnerships, might be subject to regulatory compliance that requires periodic state filings and partnership renewals. Even sole proprietorships, typically the least regulated form, must ensure continued adherence to local business licenses and taxation requirements. Hence, continuous compliance not only protects businesses from legal action but also fosters trust with stakeholders.

Impact of regulatory factors on business operations

Regulatory factors significantly affect business operations, determining operational costs, administrative burdens, and strategic decision-making. For instance, the complexity and cost of compliance for C Corporations, with their extensive governance and reporting obligations, can be higher compared to simpler structures like LLCs or sole proprietorships. However, this complexity also imbues greater investor confidence due to stringent oversight and transparency, potentially facilitating easier capital raising and expansion.

In contrast, LLCs offer flexibility and a lower administrative burden while still providing liability protection, making them attractive for startups seeking regulatory simplicity. Partnerships must navigate the nuances of partner liabilities and governance, affecting operational dynamics and decision-making processes. Regulatory environments can thus either constrain or facilitate growth, impacting how businesses strategize, allocate resources, and manage risk.

Operational flexibility and management control

With each structure, specific control mechanisms, decision-making processes, and growth implications differ, influencing how a business adapts to changes and scales operations effectively.

Control mechanisms in different structures

- LLC (Limited Liability Company): An LLC offers flexibility in management control, where members can choose between member-managed or manager-managed structures. This flexibility supports operational adjustments as the business environment evolves while maintaining the protective features of a corporation, such as limited liability for its owners.

- C Corporation: In a C Corporation, management control is centralized in a board of directors, which is responsible for making major business decisions. Shareholders elect this board, separating ownership and control. This structure may limit operational flexibility but ensures stability and rigorous governance, often required for larger, public companies.

- S Corporation: Similar to C Corporations, S Corporations feature a centralized management structure with a board of directors. However, the S Corporation is limited to 100 shareholders, impacting potential operational scalability while retaining tax benefits through pass-through taxation.

- Partnership: Partnerships offer significant management flexibility, with partners directly involved in decision-making. This shared control enhances operational agility but can also lead to conflicts if roles and responsibilities aren't clearly defined.

- Sole Proprietorship: As a sole proprietor, the owner has complete control over all business decisions, enabling maximum flexibility in operations. However, this control comes with increased personal liability and potential challenges in scaling the business.

Impact on decision-making processes

- Decision-making speed: Business structures with fewer hierarchical layers (e.g., LLCs, partnerships) typically allow for faster decision-making compared to corporations, where decisions often require board approval.

- Conflict resolution: In partnerships, decision-making can be consensus-driven, which might slow down processes compared to the top-down approach in corporations, but can lead to more balanced outcomes.

- Operational responsiveness: LLCs and sole proprietorships enable quick responses to market changes due to fewer formalities and decision layers, whereas, in corporations, changing course could take considerable time due to the necessity of shareholder and board consensus.

Implications for business growth and change

- Scalability: Corporations, particularly C Corporations, offer structures conducive to growth due to their ability to raise unlimited capital through selling stock. However, they might be slower to adapt to rapid changes.

- Innovation and adaptation: LLCs and partnerships often thrive in environments that require innovation and frequent adaptation due to their flexible nature, although raising significant capital can be more challenging.

- Change management: In sole proprietorships, while control is maximal, growth might be difficult without transition planning to more formal structures like corporations or partnerships, especially when considering succession or larger-scale capital infusion.

Capital raising and financing in various structures

Different business structures provide distinct pathways and opportunities for obtaining the necessary funds. Understanding the nuances in these avenues is key for entrepreneurs to make informed decisions.

Financing options for LLCs and corporations

Limited Liability Companies (LLCs) and corporations, including both C Corporations and S Corporations, offer structured approaches to capital formation.

- Limited Liability Companies (LLC): LLCs benefit from flexibility in financing options, often appealing to small businesses due to their hybrid structure. They can raise capital through equity financing by bringing in new members or offering additional equity to existing members. Alternatively, LLCs may utilize debt financing, securing loans without the need to issue stock. This can include bank loans, lines of credit, and even small business grants, dependent on the LLC's creditworthiness and financial health.

- C Corporations: Known for their distinct advantage in capital raising, C Corporations can issue multiple classes of stock, attracting a diverse range of investors from venture capitalists to public shareholders. This structure is particularly favored by startups looking for venture capital or considering an Initial Public Offering (IPO) as it provides the ability to raise substantial sums with relative ease. Being a separate legal entity enhances its appeal to investors, as they face minimal liability risk.

- S Corporations: While S Corporations face limitations on the number of shareholders, thereby restricting some forms of equity financing, they can still attract investment through private placements. These entities focus on internal financing, such as retained earnings, or may resort to bank loans and lines of credit. Their appeal lies in the tax advantage offered, avoiding double taxation, which is a concern with C Corporations.

Attracting investment in partnerships

Partnerships, encompassing general partnerships (GPs), limited partnerships (LPs), and limited liability partnerships (LLPs), present a unique set of opportunities and challenges in attracting investment.

- General Partnerships (GPs): The simplicity of GPs often limits their financing options, as they largely depend on personal equity contributions from partners. External investors may be hesitant due to the unlimited liability faced by partners, making partnerships less appealing from a risk standpoint.

- Limited Partnerships (LPs) and Limited Liability Partnerships (LLPs): These structures have slightly more flexibility. Limited partners in LPs, for example, can invest without being involved in daily operations, attracting investors seeking to limit their liability. LLPs provide additional assurance with liability protection, which can increase their attractiveness to potential investors. However, like GPs, debt financing is a critical capital-raising strategy here, often through personal or business loans.

Challenges in sole proprietorships

Sole proprietorships, while straightforward and easy to manage, face significant hurdles in capital raising.

- Equity financing: Sole proprietors do not have the option to sell shares, inherently limiting the ability to attract capital through equity financing. The business is inextricably tied to the individual owner, reflecting their assets and creditworthiness.

- Debt financing: Sole proprietors often rely heavily on personal loans, credit cards, and lines of credit, with the individual's credit history playing a pivotal role in acquiring funds. This personal risk discourages significant external investment, posing a growth challenge.

Explore the formation process

The journey to establishing a business begins with choosing the right structure, and understanding the formation process and costs associated with each option is critical for making an informed decision.

Steps to incorporate or form an LLC

Establishing a business involves several key steps, whether forming an LLC or incorporating. For an LLC, the initial phase is often less complex, offering an attractive path for many business owners:

- Choose a business name: Select a unique, legally compliant name that reflects your brand. Ensure it's not already in use, check for trademarks, and secure a matching domain.

- Select a registered agent: Appoint a person or service with a physical address in your formation state to receive legal and tax documents on behalf of your LLC.

- File articles of organization: Submit the official formation document to the state, including key business and member details. Pay the applicable filing fee.

- Create an operating agreement (optional): Draft an internal document outlining ownership, profit sharing, roles, and operational procedures to help prevent future disputes.

- Get an EIN (employer identification number): Apply through the IRS (online or by mail) to obtain a free EIN, required for taxes, hiring, and opening a business bank account.

- Register for state taxes & business licenses: Register for applicable state taxes (e.g., sales or employment tax) and obtain necessary business licenses or permits based on your industry and location.

- Open a business bank account: Use your EIN and LLC documents to open a dedicated account, helping you separate personal and business finances and maintain liability protection.

- Maintain compliance: Stay in good standing by filing annual reports, renewing licenses, and keeping proper business records as required by your state.

Establishing an LLC company involves several key steps

In comparison, incorporating involves a slightly more intricate process:

- Name clearance and registration: Similar to LLCs, securing a unique name is the first step.

- Filing articles of incorporation: This document, detailing share structure and company purpose, creates the legal entity.

- Bylaws development: Corporations must draft bylaws, which outline governance and operational protocols.

- Stock issuance: Initial shares are issued to establish ownership percentages among shareholders.

- Meeting and registering: Conducting an initial board meeting is crucial for adopting bylaws and appointing officers.

- EIN application and licensing: As with LLCs, acquiring an EIN and necessary licenses is essential.

Potential pitfalls during formation

Despite following due process, entrepreneurs may encounter several challenges during business formation:

- Improper documentation: Incomplete or inaccurately prepared documents can lead to delays in registration and additional costs to rectify errors.

- Non-compliance with naming conventions: Failing to adhere to state-specific naming rules can result in rejected applications, necessitating additional rounds of submission.

- Ignoring operating agreements or bylaws: Skipping these critical documents can lead to internal disputes and operational inefficiencies later.

- Tax misinterpretations: Misclassifying the business entity for federal tax purposes can lead to unforeseen tax liabilities. Consulting tax professionals is advisable to avoid such missteps.

- Licensing oversights: Omitting necessary permits could result in fines or business suspension.

In conclusion, each business structure presents a unique combination of ownership, liability, taxation, and administrative complexity. Sole Proprietorships offer simplicity but full personal liability, while Partnerships allow shared ownership with similar risk exposure. LLCs provide flexibility and limited liability. Meanwhile, C Corporations support scalability and investment opportunities. S Corporations, on the other hand, combine limited liability with pass-through taxation. Understanding these core differences is key to selecting a structure that aligns with the business’s size, goals, and risk profile.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom