In the complex world of corporate finance and stock markets, understanding authorized stock is essential for investors and business leaders. Authorized stock represents the foundation of a company's equity structure and determines the maximum number of shares a corporation can legally issue to raise capital. This fundamental concept affects everything from fundraising capabilities to shareholder rights and potential dilution risks.

This article outlines essential aspects of authorized stock to provide businesses with a clearer understanding of its definition and practical implications. We specialize in company formation and do not offer legal or financial advice. For tailored guidance or compliance-related matters concerning authorized stock, please consult a qualified legal or financial expert.

What is Authorized Stock?

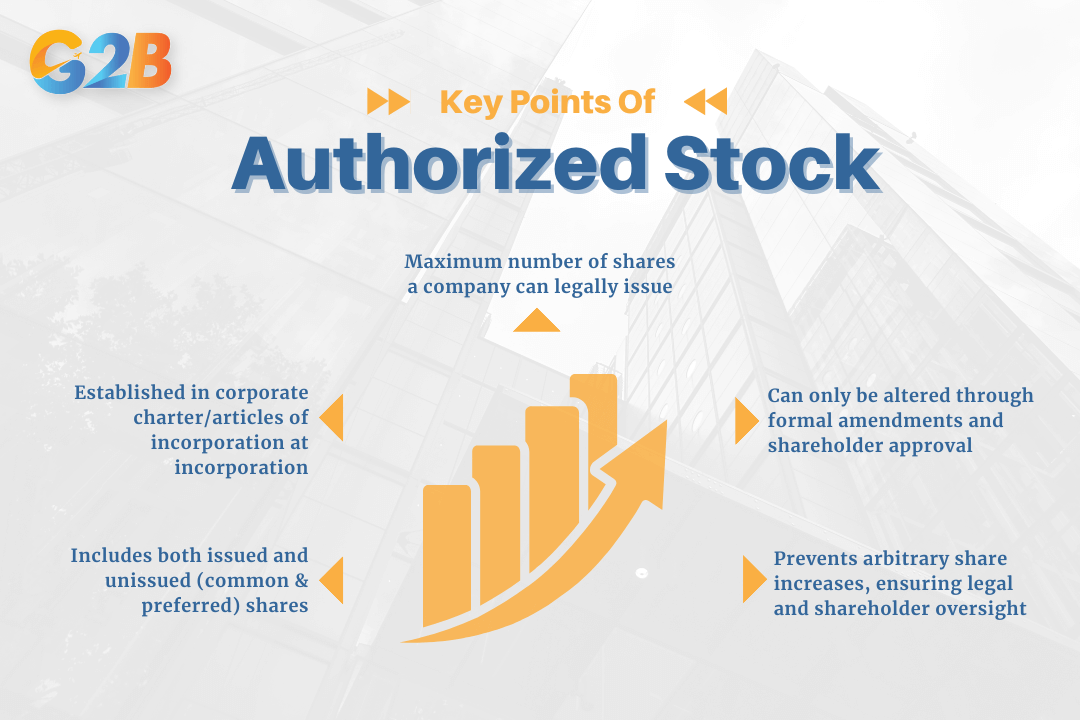

Authorized stock refers to the maximum number of shares that a company is legally permitted to issue, as specified in its corporate charter or articles of incorporation. This legal limit is established when a company is first incorporated and can only be changed through formal amendments to the company's governing documents. It serves as a legal limit on the total number of shares (including both common and preferred stock) a company is authorized to issue (whether or not those shares have been issued or are outstanding). This ceiling ensures that companies cannot arbitrarily increase their share count without proper legal procedures and shareholder approval.

Authorized stock refers to the maximum number of shares that a company is legally permitted to issue

Importance of Authorized Stock

Authorized stock plays an important role for businesses looking to optimize their capital structure and maintain operational efficiency. Properly managing authorized stock not only provides flexibility in raising capital but also supports strategic business operations and safeguards shareholder interests.

1. Capital raising flexibility

Authorized stock determines the maximum equity capital a company can raise through stock issuance. This legal framework provides companies with a clear understanding of their fundraising capacity and helps them plan long-term financial strategies. The authorization acts as a reservoir of potential capital that can be accessed when market conditions are favorable or when growth opportunities arise.

2. Strategic business operations

The authorized share structure provides flexibility for future fundraising, employee compensation through stock options, and corporate actions such as mergers and acquisitions. Companies can use unissued authorized shares for strategic purposes without immediately diluting existing shareholders. This flexibility is particularly valuable for growing businesses that need to respond quickly to market opportunities or competitive challenges.

3. Shareholder protection

Authorized stock helps protect the interests of existing shareholders by setting a limit on the maximum number of shares that can be issued without further shareholder approval, thereby providing a controlled framework to manage potential share dilution. Without this legal limit, companies could theoretically issue unlimited shares, which would severely dilute existing shareholders' ownership percentages and voting rights. The authorization requirement ensures that any significant increase in share count requires formal approval processes that protect investor interests.

Share classes linked to authorized stock

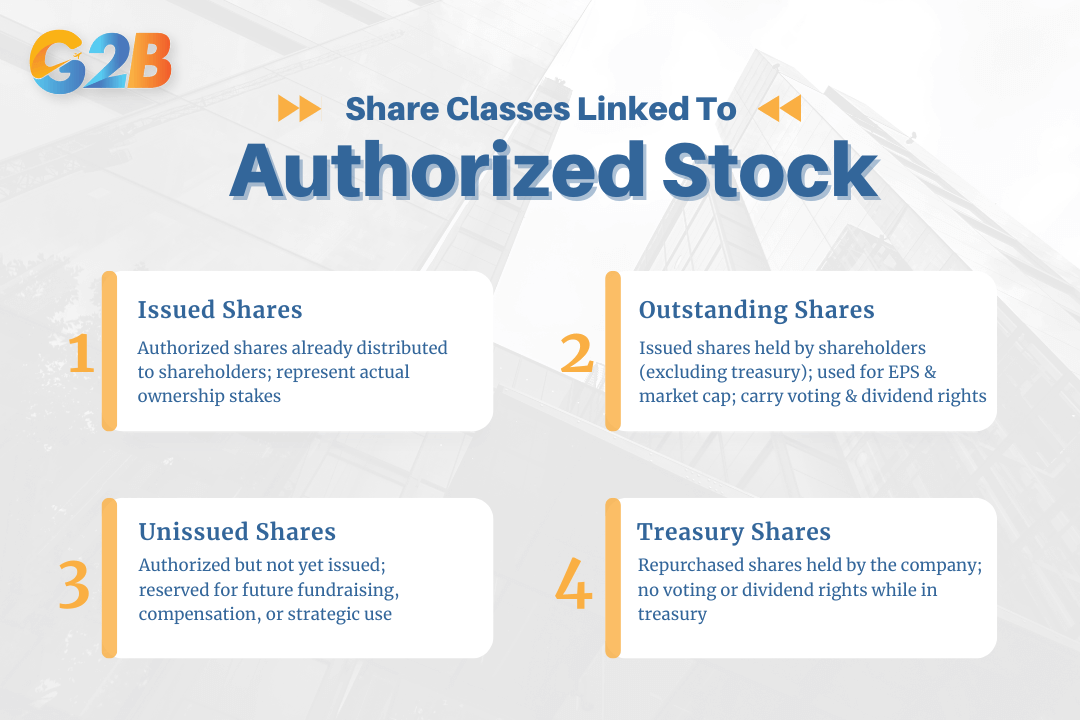

Understanding the different categories of shares within the scope of a company's authorized shares is essential for investors and business managers:

- Issued shares: The number of shares a company has actually issued or allocated to shareholders. These shares have been formally distributed and are held by investors, employees, or other parties. Issued shares represent the portion of authorized stock that has been converted into actual ownership stakes.

- Outstanding shares: Issued shares currently held by shareholders, excluding treasury shares. These are the shares actively traded in the market and used to calculate important metrics like earnings per share (EPS) and market capitalization. Outstanding shares represent the actual ownership units that carry voting rights and dividend entitlements.

- Unissued shares: The portion of authorized shares that have not yet been issued and remain available for future issuance. These shares exist only on paper as part of the company's authorized capacity but can be issued when needed for fundraising, employee compensation, or strategic transactions.

- Treasury shares: Previously issued shares that the company has repurchased and now holds in its treasury. These shares are not counted as outstanding and do not carry voting rights or dividend entitlements while held by the company.

Understanding 4 different categories of shares is essential for investors

How companies use authorized stock

Companies typically adopt a strategic approach to authorized stock utilization rather than issuing all shares immediately. Most corporations issue only a portion of their authorized shares during initial public offerings (IPOs) or private funding rounds, retaining the remainder for future strategic needs.

A typical example illustrates this approach: A company might authorize 1 million shares but issue only 500,000 during its IPO. The remaining 500,000 shares are held in reserve for future fundraising rounds, employee stock option programs, or potential acquisitions. This strategy provides management with flexibility while maintaining control over the company's ownership structure.

Retaining a portion of authorized shares unissued gives companies greater control over their equity structure and helps prevent hostile takeovers. Specifically, unissued authorized shares can be used as a defensive mechanism, allowing the company to issue new shares to dilute the ownership of an unwanted acquirer or to finance defensive maneuvers. This defensive strategy is particularly important for companies in competitive industries or those with valuable intellectual property.

Process for changing the number of authorized shares

Modifying the number of authorized shares requires formal legal procedures that protect shareholder interests. To increase authorized shares, a company must amend its articles of incorporation through a structured process that typically involves multiple approval stages.

Increasing authorized shares requires shareholder approval through a formal vote, often following a proposal or recommendation by the board of directors. The process often involves strict legal procedures, regulatory filings with appropriate securities commissions, and disclosure requirements to ensure transparency. Shareholders must be notified of proposed changes and given adequate time to review the implications before voting.

The amendment process varies by jurisdiction but generally requires a majority or supermajority vote from shareholders. This requirement ensures that existing shareholders have a say in decisions that could potentially dilute their ownership stakes or alter the company's capital structure.

Impact on shareholders and investors

The relationship between authorized and outstanding shares significantly affects shareholders through potential dilution risks and ownership considerations. When companies issue additional shares from their authorized pool, existing shareholders' ownership percentages decrease unless they participate proportionally in the new issuance.

Investors should carefully evaluate authorized stock levels to understand the risk of future dilution and its impact on ownership percentage, voting rights, and earnings per share (EPS). A large difference between authorized shares and issued shares may indicate potential for significant dilution, while a smaller difference suggests more limited dilution risk.

Smart investors analyze authorized stock data alongside other financial metrics to make informed investment decisions. Understanding the authorized share structure helps investors assess management's strategic flexibility and the potential for future capital raising that might affect stock price and ownership stakes.

Why do companies reserve a portion of authorized shares?

This practice helps companies manage regulatory and issuance procedures more efficiently, address potential market uncertainties, and reduce the legal costs and time associated with future share issuances within the limits of their authorized shares.

1. Reserving Shares for future issuance

Companies strategically retain unissued shares to prepare for future capital raising rounds, employee stock incentive programs, or mergers and acquisitions. This reservation strategy allows businesses to respond quickly to growth opportunities or market conditions without the delay and expense of authorizing additional shares. Employee stock option programs, in particular, require a steady supply of shares to attract and retain top talent.

2. Regulatory and issuance procedures

Share issuance must comply with comprehensive legal and regulatory requirements, including approval from shareholder meetings, registration with securities commissions, and disclosure through detailed prospectuses. These procedures can be time-consuming and expensive, making it impractical to seek authorization for every potential share issuance. By maintaining a reserve of authorized shares, companies can navigate regulatory requirements more efficiently.

3. Unfavorable market conditions

Market timing plays a crucial role in share issuance decisions. Many companies delay or suspend share issuance during bearish or illiquid market conditions when doing so may not serve shareholders' best interests. This flexibility is particularly important in volatile markets where timing can significantly impact the success of fundraising efforts and the company's long-term financial position.

4. Legal costs and time requirements

Public offerings involve substantial legal procedures, professional fees, and extended timelines that can strain company resources. Securities lawyers, investment banks, auditors, and regulatory compliance specialists all contribute to the complexity and cost of share issuance. As a result, companies often choose to issue shares in strategic stages rather than pursuing multiple smaller issuances that would multiply these costs.

5. Maintaining shareholder structure control

Retaining unissued shares allows companies to better manage their shareholder structure, avoid unnecessary dilution, and prevent hostile takeovers. Management can use reserved shares strategically to maintain control or to structure transactions that align with long-term business objectives. This control is particularly valuable for companies in competitive industries or those with significant intellectual property assets.

Regulatory differences in Vietnam and abroad

The regulations governing authorized shares vary significantly between Vietnam and other jurisdictions. Understanding these differences is essential for businesses to ensure compliance and optimize capital strategies.

Authorized shares in Vietnam

Authorized shares in Vietnam are subject to a well-defined regulatory framework designed to balance corporate fundraising needs with investor protection. For businesses considering company formation in Vietnam, gaining insight into how authorized shares are regulated is essential, as share structure decisions made at the incorporation stage can significantly impact future capital-raising activities:

- The Vietnamese regulatory environment for share issuance reflects the country's developing capital markets and emphasis on investor protection. The issuance of shares is strictly governed by the Law on Enterprises, the Law on Securities, and related government decrees and regulations that establish comprehensive frameworks for corporate governance and securities transactions.

- Vietnamese regulations specify timeframes for public share distribution, commonly requiring completion within approximately 90 days, subject to possible extensions based on regulatory approval. This time constraint ensures that share offerings are completed efficiently and reduces market uncertainty during the distribution process.

- Companies operating in Vietnam must publish detailed prospectuses to ensure transparency and provide sufficient information to investors. These disclosure requirements help protect investors by ensuring they have access to material information about the company's financial condition, business operations, and risk factors before making investment decisions.

- Public offerings in Vietnam generally require approval by the General Meeting of Shareholders and must meet specific conditions, including minimum distribution requirements to non-major shareholders, although certain offerings may be exempt based on prior approvals or company charter provisions.

- The Vietnamese stock market's volatility and developing nature have led many companies to delay or suspend planned issuances during unfavorable market conditions. This cautious approach reflects both regulatory flexibility and management's responsibility to act in shareholders' best interests.

- Vietnamese regulations also provide guidelines on handling odd-lot shares during trading and unsold shares from offering processes, which may be canceled or reallocated based on regulatory requirements and specific circumstances.

Authorized shares in Vietnam are subject to a well-defined regulatory framework

Authorized shares globally

Authorized shares are regulated differently across global markets, with each jurisdiction adopting its own approach to balance capital-raising efficiency and investor protection:

- International share issuance regulations vary significantly across jurisdictions, reflecting different legal traditions, market development levels, and regulatory philosophies. In many developed markets, regulations can be more flexible than Vietnam's framework, allowing companies greater discretion in timing and structure of share offerings, although some developed jurisdictions maintain strict regulatory requirements.

- Distribution timelines and procedures may be shorter or longer depending on the specific market and regulatory environment. Some jurisdictions prioritize speed and efficiency, while others emphasize comprehensive disclosure and investor protection measures that may extend the process.

- In certain jurisdictions, companies can issue shares privately or more quickly without requiring shareholder meeting approval, provided they meet specific conditions related to the number of investors, investment amounts, or investor sophistication levels. These private placement exemptions facilitate capital raising for smaller companies or specialized investment situations.

- The treatment of unissued shares or odd-lot shares (mainly a market trading issue) varies internationally and may not necessarily involve cancellation procedures. Some markets allow greater flexibility in handling incomplete offerings, while others have strict requirements similar to Vietnam's approach.

- In more developed markets, share issuance is often accompanied by comprehensive auditing, professional risk assessments, and stronger investor protection measures. These markets typically have more sophisticated regulatory frameworks, professional service providers, and institutional investor participation that can facilitate more complex transactions.

Understanding authorized stock is essential for anyone involved in corporate finance, investing, or business management, as it forms the legal foundation of a company’s equity structure. It provides strategic flexibility for fundraising, employee compensation, and corporate defence while protecting shareholders through legal limits and approval processes. Regulatory differences, such as those between Vietnam and developed markets, underscore the need to understand local laws when managing share issuance. For investors, authorized stock data reveals potential dilution risks and a company’s capital-raising capacity.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom