Thinking about starting your business in the U.S? Choosing the right structure is key - and for many entrepreneurs, the S corporation (S corp) offers an ideal balance of tax advantages and legal protection. With pass-through taxation and limited liability, it’s a smart move for founders looking to minimize costs and maximize control. In this guide, we will break down how forming an S corp can align with your business goals and set up for long-term operation.

What is an S Corporation?

An S corporation is a special type of corporation that elects to pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes. S corps avoid the double taxation typical of C corporations while still providing owners with limited personal liability for business debts and claims.

Formal definition and legal meaning

S corporations must meet specific IRS requirements to qualify for and maintain their tax status:

- Must be a domestic corporation (formed within the United States)

- Cannot have more than 100 shareholders

- Must issue only one class of stock (though variations in voting rights are permitted)

- Cannot have non-resident aliens, partnerships, or other corporations as shareholders

- Must file Form 2553 (Election by a Small Business Corporation) with the IRS

These limitations ensure S corporations remain accessible primarily to small businesses and prevent complex ownership structures that might complicate the pass-through taxation model. The formal S corporation designation comes from Subchapter S of Chapter 1 of the Internal Revenue Code, which governs their taxation.

Simple explanation for entrepreneurs

For business owners, an S corporation offers two primary advantages:

- Pass-through taxation: Business profits and losses flow directly to shareholders' personal tax returns, avoiding corporate-level taxation. This eliminates the double taxation issue where both the company and shareholders pay taxes on the same earnings.

- Limited liability protection: Shareholders' personal assets remain protected from business creditors and legal claims, creating a separation between personal and business finances.

S corporation owners typically take two forms of compensation:

- A reasonable salary (subject to employment taxes)

- Dividend distributions (not subject to self-employment taxes)

This structure can result in significant tax savings compared to sole proprietorships or partnerships, where all earnings are subject to self-employment taxes.

Looking for a trustworthy Delaware incorporation service? Contact us to get dedicated guidance right from the start!

How S Corporations work: Key components and structure

S corporations maintain a unique operational structure that balances corporate formality with tax flexibility. This structure enables business owners to leverage liability protection while avoiding double taxation.

Key components: Forms and compliance

The foundation of S corporation compliance rests on proper documentation and timely filing with the IRS. Form 2553 (Election by a Small Business Corporation) serves as the gateway to S corp status and must be filed within specific deadlines - either within 2 months and 15 days after the beginning of the tax year or at any time during the preceding tax year.

Annual tax reporting occurs through Form 1120-S, which the corporation must file to report income, losses, deductions, and credits. This form generates Schedule K-1s for each shareholder, detailing their proportionate share of tax items. S corporations must also:

- Hold and document annual shareholder meetings

- Maintain accurate corporate minutes

- Keep detailed financial records

- Follow strict deadlines for tax filings

- Adhere to state-specific compliance requirements

Failure to maintain these compliance elements can result in the IRS revoking S corporation status, potentially creating significant tax consequences.

Shareholders, board of directors, and roles

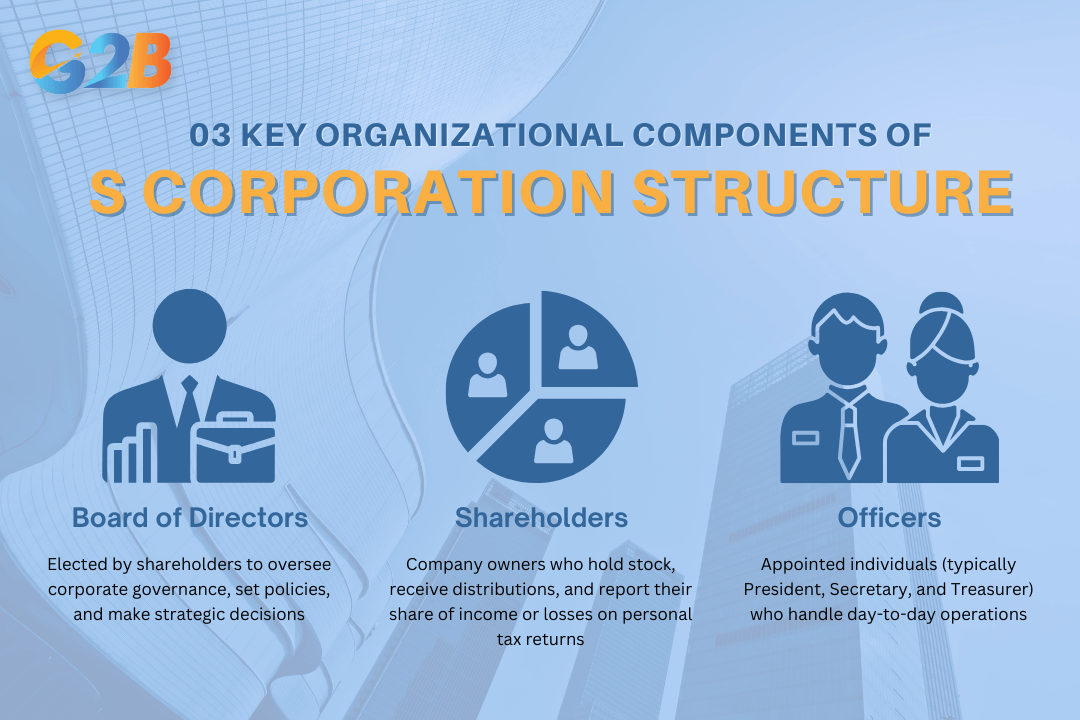

The S corporation structure features three key organizational components that mirror traditional corporations:

- Shareholders: Owners of the company who hold stock, receive distributions, and report their share of income or losses on personal tax returns.

- Board of Directors: Elected by shareholders to oversee corporate governance, set policies, and make strategic decisions.

- Officers: Appointed individuals (typically President, Secretary, and Treasurer) who handle day-to-day operations.

This hierarchical structure requires formal documentation through bylaws that define responsibilities and decision-making processes. Even when a single person holds multiple roles, maintaining proper separation of duties through documentation remains essential for preserving liability protection. Corporate formalities such as regular board meetings, proper authorization of significant transactions, and maintaining corporate records demonstrate that the business operates as a legitimate separate entity from its owners.

The S corporation structure features three key organizational components

Stock classes and ownership limits

S corporations operate under strict ownership constraints that distinguish them from C corporations. The IRS limits S corps to:

- A maximum of 100 shareholders (with family members counting as one shareholder in some cases)

- Only one class of stock with identical distribution and liquidation rights

- Eligible shareholders limited to U.S. citizens, resident aliens, certain trusts, and estates

| Eligible shareholders | Ineligible shareholders |

|---|---|

| U.S. citizens | Partnerships |

| Resident aliens | Corporations |

| Certain trusts | Non-resident aliens |

| Estates | Foreign individuals |

While S corps can issue varying voting rights among shares, all stock must provide identical financial rights. This single-class stock rule prevents the creation of preferred shares with special dividends or liquidation preferences. Multiple share types with identical economic rights but different voting powers remain permissible, allowing founders to maintain control while distributing ownership.

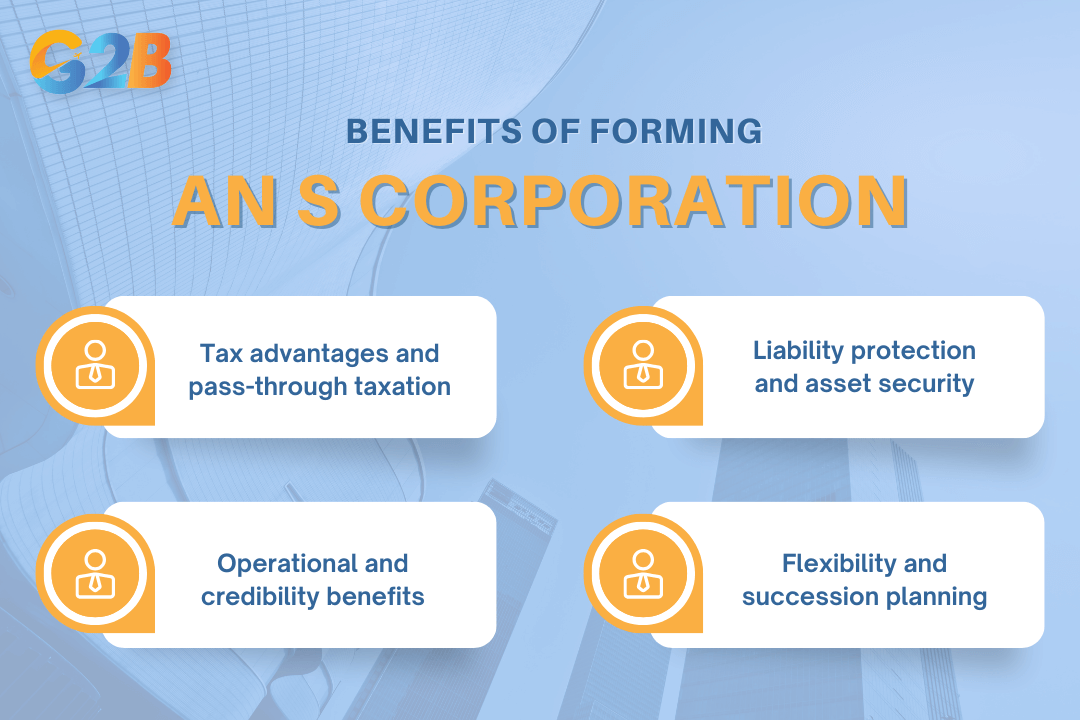

Benefits of forming an S Corporation

S corps provide entrepreneurs with significant advantages in taxation, liability protection, and operational flexibility. Small business owners choose this structure to minimize tax burdens while maintaining corporate-level protections.

S corps provide entrepreneurs with significant advantages

Tax advantages and pass-through taxation

S corporations deliver substantial tax savings through their pass-through taxation model. Unlike C corporations, income flows directly to shareholders who report it on their personal tax returns, eliminating corporate-level taxation. This structure avoids the double taxation dilemma faced by traditional corporations.

You can learn more about difference between S Corporations and C Corporations to know more detail

Owner-employees gain particular advantages by taking compensation in two forms: reasonable salary and distributions. While salaries remain subject to employment taxes (Social Security and Medicare), distributions escape these payroll taxes - potentially saving thousands annually. Many entrepreneurs reduce their overall tax burden by 15.3% on qualifying distributions compared to sole proprietorship earnings.

Key tax benefits:

- No federal corporate income taxes

- Potential qualification for 20% Qualified Business Income Deduction

- Avoidance of self-employment taxes on distributions

- Pass-through of business losses to offset personal income

- Single layer of taxation vs. double taxation of C corporations

Liability protection and asset security

S corporations create a legal barrier between business liabilities and shareholders' personal assets. This protection shields entrepreneurs from business debts, lawsuits, and other financial obligations. Personal homes, vehicles, savings accounts, and investments remain secure from business creditors. This separation provides peace of mind similar to C corporations while maintaining favorable tax treatment. However, this shield requires proper maintenance - regular meetings, detailed records, and clear separation of personal and business finances must be maintained to preserve the corporate veil.

Liability protection comparison:

| Structure | Personal asset protection | Notes |

|---|---|---|

| S Corporation | Strong | Requires corporate compliance |

| Sole Proprietorship | None | Complete personal liability |

| Partnership | Limited/None | Partners generally liable |

| C Corporation | Strong | Similar protection level to S corps |

Operational and credibility benefits

S corporations project enhanced credibility to customers, vendors, and financial institutions. The formal corporate structure signals stability and professionalism, often leading to improved business relationships and financing opportunities. These entities can issue stock to raise capital, though limited to 100 shareholders. The formal operational framework includes a board of directors, corporate officers, and regular shareholder meetings. This structure creates clear leadership roles and documented decision-making processes that enhance organizational effectiveness and accountability.

Required corporate formalities:

- Board of directors meetings

- Annual shareholder meetings

- Corporate bylaws

- Maintenance of meeting minutes

- Separate business banking accounts

- Proper documentation of major corporate decisions

Flexibility and succession planning

S corporations simplify business succession through straightforward stock transfers. Ownership changes occur without dissolving the business entity, maintaining operational continuity during transitions. The perpetual existence of S corporations allows businesses to continue beyond the original founders. Family businesses particularly benefit from this feature when planning generational transfers. Despite the one-class-of-stock limitation, entrepreneurs can still implement flexible income allocation strategies within IRS guidelines.

Succession planning benefits:

- Clean ownership transfer through stock sales or gifts

- Continuation of business operations during ownership changes

- Potential tax advantages during succession transitions

- Simplified documentation compared to asset transfers

- Clear valuation mechanisms for business interests

Disadvantages and limitations of S Corporations

While S corporations offer valuable tax advantages and liability protection, there are also several significant limitations before selecting this business structure. S corps impose restrictions that may create compliance burdens that need to be considered.

Shareholder and stock restrictions

S corporations face strict ownership limitations that can constrain business growth and financing options. The IRS limits S corps to no more than 100 shareholders, preventing larger-scale capital raising efforts. All shareholders must be U.S. citizens or permanent residents, which excludes foreign investors who might otherwise provide valuable funding.

Additionally, only individuals, certain trusts, and estates qualify as eligible shareholders - partnerships, corporations, and non-resident aliens cannot own shares. The single-class-of-stock requirement further limits financing flexibility, preventing the creation of preferred stock with different dividend rights or liquidation preferences. These restrictions often force growing businesses to eventually convert to C corporation status to accommodate diverse investor groups or implement complex equity structures.

Compliance and administrative burdens

S corporations must maintain strict compliance with IRS regulations and corporate formalities, creating administrative overhead for small business owners. Annual filing requirements include Form 1120-S (the S corporation tax return) and Schedule K-1 forms for each shareholder. Missing deadlines or filing incorrectly can result in penalties or potential loss of S corp status.

Corporate formalities require:

- Regular board meetings with documented minutes

- Maintaining separate business records and accounts

- Filing annual reports with state authorities

- Following corporate bylaws consistently

- Documenting major business decisions

These administrative demands often necessitate professional accounting and legal assistance, adding to operational costs. Many small business owners underestimate these ongoing compliance requirements when initially attracted to the tax benefits of S corporation status.

Potential tax and fringe benefit drawbacks

S corporations face several tax disadvantages that may outweigh benefits for certain businesses. Shareholder-employees must receive "reasonable compensation" before taking distributions, with the IRS closely scrutinizing salary levels to ensure employment taxes aren't being avoided. This scrutiny can limit tax-planning flexibility.

Other tax limitations include:

- Limited fringe benefits for shareholder-employees (health insurance premiums are taxable)

- Potential tax on built-in gains from appreciated assets if converting from a C corporation

- Excess passive income may trigger corporate-level taxes

- Strict basis rules limiting loss deductions for shareholders

- Inability to carry forward operating losses at the corporate level

Additionally, S corporations must allocate profits and losses strictly according to ownership percentages, preventing the income-shifting strategies available to partnerships. Some states also impose entity-level taxes on S corporations, potentially eliminating the federal tax advantage in those jurisdictions.

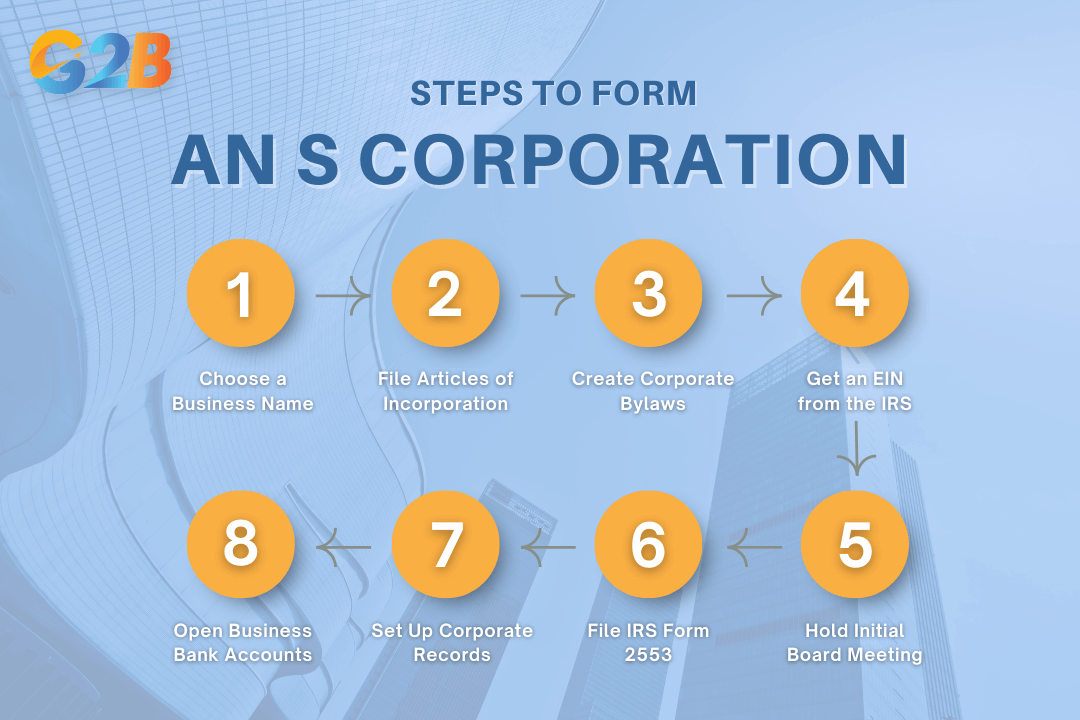

Step-by-step guide: How to form an S Corporation

Forming an S corp involves several critical steps that entrepreneurs must complete accurately. The process requires attention to both federal and state-specific requirements, with costs varying across jurisdictions.

Forming an S corp involves several critical steps to complete

Checklist: S Corporation formation steps

Start by selecting a unique business name that complies with your state's requirements. Conduct a thorough name search through the Secretary of State's database to ensure availability. Most states require corporation names to include terms like "Incorporated", "Corporation", or "Limited" to identify the business structure.

Next, prepare and file Articles of Incorporation with your state's Secretary of State office. This document establishes your business as a legal entity and must include information such as the corporation's name, purpose, registered agent, and number of authorized shares. After filing, create comprehensive corporate bylaws that outline operational procedures, management structure, and shareholder rights.

Complete these essential steps to finalize S corporation formation:

- Obtain an Employer Identification Number (EIN) from the IRS

- Appoint directors and officers at your initial board meeting

- Issue stock certificates to shareholders

- File Form 2553 "Election by a Small Business Corporation" with the IRS within 2 months and 15 days after incorporation

- Establish corporate record-keeping systems for meeting minutes and resolutions

- Open separate business banking accounts to maintain corporate veil protection

State-specific considerations and best jurisdictions

Delaware maintains its reputation as a premier incorporation jurisdiction due to its business-friendly Court of Chancery, well-established corporate law precedents, and favorable tax treatment for businesses without in-state operations. Many entrepreneurs choose Delaware for these advantages even when operating primarily in other states.

Nevada and Wyoming have emerged as competitive alternatives with benefits including:

- No state income taxes

- Strong privacy protections for corporate ownership

- Minimal reporting requirements

- Lower annual fees compared to other states

However, local operations may require registration as a foreign corporation in the state where the business primarily conducts activities, potentially negating some advantages. Businesses should evaluate whether the added complexity of multi-state compliance justifies potential benefits.

Cost breakdown: Fees and ongoing expenses

Initial formation expenses vary significantly based on jurisdiction and professional assistance requirements. State filing fees range from approximately $50 to $500, with Delaware charging $89 for standard processing and California requiring $100 plus an $800 franchise tax payment in the first year.

| Expense category | Typical cost range |

|---|---|

| State filing fees | $50-$500 |

| Registered agent services | $100-$300 annually |

| Attorney assistance | $500-$2,000 |

| Accounting setup | $200-$500 |

| EIN application | Free (self-filed) |

Ongoing maintenance costs include annual state fees, franchise taxes, and professional services for tax preparation. S corporations must file Form 1120S annually with the IRS and provide Schedule K-1 forms to each shareholder. Many businesses budget $1,000-$3,000 annually for professional accounting services to maintain compliance and maximize tax advantages.

Additional recurring expenses include:

- Annual reports or statements ($10-$300 depending on state)

- Business license renewals

- Corporate record maintenance

- Annual meeting documentation

- Registered agent fees (if using a service)

S Corporation vs. other business structures

Entrepreneurs should evaluate different business structures before choosing the optimal legal framework for their ventures. Understanding these differences helps business owners select a structure that aligns with their tax goals, liability concerns, and operational needs.

S Corp vs. C Corp

S corporations and C corporations share fundamental corporate characteristics but differ significantly in taxation and ownership structure. S corps avoid the double taxation issue that plagues C corporations. In an S corp, business income flows directly to shareholders who report it on their personal tax returns, while C corps face taxation at both the corporate level (21% federal rate) and again when dividends are distributed to shareholders.

Ownership restrictions create another major distinction. S corps cannot exceed 100 shareholders, all of whom must be U.S. citizens or residents. They cannot have partnerships, corporations, or non-resident aliens as owners. C corporations, conversely, allow unlimited shareholders of any nationality, including foreign investors and other business entities.

S corps must adhere to a single class of stock requirement (though voting differences are permitted), while C corporations enjoy the flexibility to issue multiple stock classes including preferred shares. This limitation impacts fundraising capabilities and exit strategies for S corps.

| Feature | S Corporation | C Corporation |

|---|---|---|

| Taxation | Pass-through (single layer) | Double taxation |

| Shareholder limit | 100 | Unlimited |

| Foreign ownership | Not allowed | Allowed |

| Stock classes | One class only | Multiple classes |

| Public trading | Cannot go public | Can go public |

S Corp vs. LLC and partnerships

S corporations and limited liability companies (LLCs) both protect owners' personal assets, but they differ in structure, formalities, and tax treatment. LLCs offer greater flexibility in management and ownership structure with no restrictions on member nationality or number. S corps require more formal governance including board meetings, minutes, and strict operational procedures.

The potential tax savings from S corporation status often exceeds LLC benefits for profitable businesses. S corp shareholders can minimize self-employment taxes by taking reasonable salaries plus distributions, while LLC members typically pay self-employment tax on all business income.

Partnerships share the pass-through taxation feature with S corps but lack the critical liability protection that shields owners from business debts and legal claims. This exposes partners' personal assets to business creditors - a significant disadvantage compared to S corporations, which maintain the corporate veil of protection while enjoying flow-through taxation benefits.

- LLCs provide more operational flexibility than S corps

- S corps often deliver greater self-employment tax savings

- Partnerships offer simplicity but sacrifice liability protection

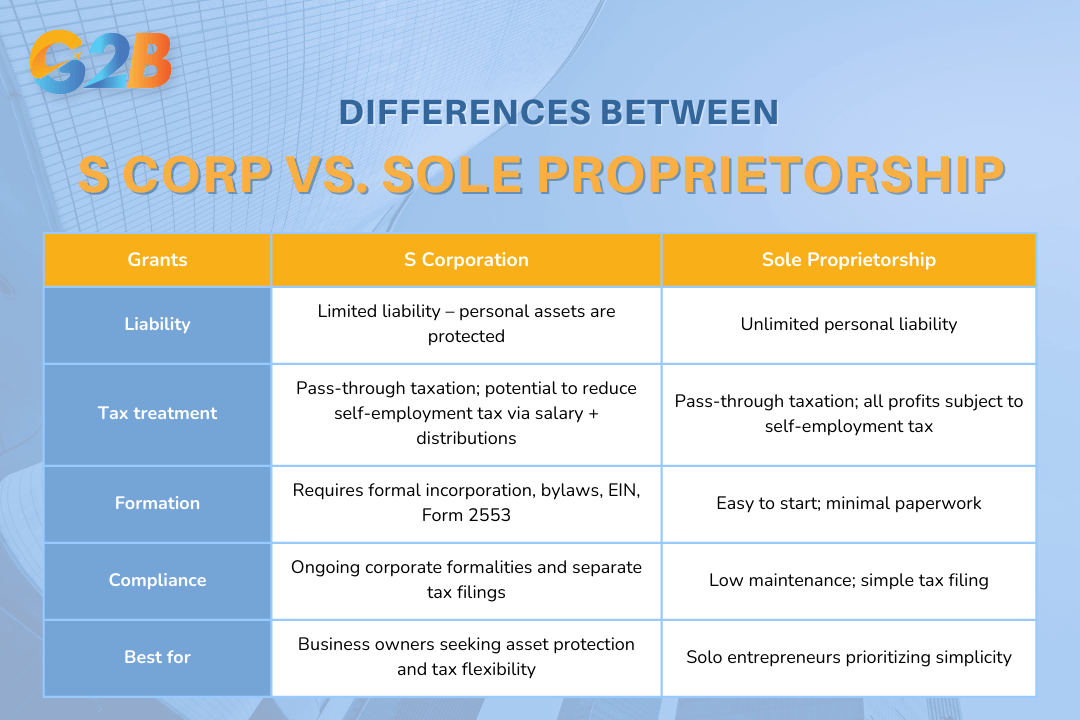

S Corp vs. Sole proprietorship

Sole proprietorships represent the simplest business structure, but this simplicity comes with significant drawbacks compared to S corporations. The most critical difference lies in liability protection. S corps create a legal separation between business and personal assets, while sole proprietorships offer no such distinction, leaving entrepreneurs personally responsible for all business debts and legal judgments.

Tax treatment also differs substantially. While both structures avoid entity-level taxation, S corporations allow owners to potentially reduce self-employment tax liability by taking reasonable salaries plus distributions. Sole proprietors must pay self-employment taxes on all business profits, potentially resulting in higher overall tax burdens.

Formation and maintenance requirements contrast sharply between these structures. S corporations require formal incorporation documents, ongoing compliance with corporate formalities, and separate tax filings. Sole proprietorships need minimal paperwork to establish and maintain, but this simplicity comes at the cost of increased personal risk and potentially higher tax obligations.

- S corps protect personal assets from business liabilities

- Sole proprietorships expose owners to unlimited personal liability

- S corps may reduce self-employment taxes through income splitting

- Sole proprietorships involve minimal formation and administrative requirements

The key difference between an S Corp and a Sole proprietorship

Common misconceptions about S Corporations

Entrepreneurs considering an S corp structure often encounter misleading information that complicates decision-making. These misconceptions can lead business owners to miss valuable opportunities or make costly compliance errors.

S Corporations are exempt from all taxes

S corporations offer significant tax advantages, but they do not provide complete tax exemption. The primary benefit lies in avoiding double taxation - where profits are taxed at both corporate and shareholder levels. Instead, S corps operate as pass-through entities with specific tax obligations:

- Income, losses, deductions, and credits flow through to shareholders' personal tax returns

- Shareholders pay income tax at their individual rates on their proportionate share of profits

- S corporations must file annual information returns (Form 1120-S) by March 15th

- Shareholders must report their share of income or loss on Schedule E of Form 1040

The IRS still requires S corporations to pay certain taxes. For instance, shareholder-employees must receive "reasonable compensation" subject to employment taxes. Some states also impose entity-level taxes or fees on S corporations regardless of federal pass-through status.

S Corporations are complicated and not worth the effort

Many entrepreneurs avoid S corporations due to perceived complexity. While S corporations do require adherence to certain formalities, the benefits often substantially outweigh the administrative requirements for eligible businesses.

S corporation management includes:

| Requirements | Benefits |

|---|---|

| Board meetings and minutes | Potential self-employment tax savings |

| Shareholder restrictions | Limited personal liability |

| Annual filing deadlines | Pass-through taxation |

| Single class of stock | Possible 20% qualified business income deduction |

| Reasonable compensation rules | Enhanced business credibility |

With proper guidance from accounting and legal professionals, most small business owners find S corporation compliance manageable. The structure works particularly well for businesses generating sufficient profit to benefit from the self-employment tax savings, which can amount to thousands of dollars annually. Business owners should evaluate the S corporation option based on their specific circumstances rather than generalized misconceptions. Common compliance requirements include:

- Maintaining corporate formalities (bylaws, meeting minutes)

- Filing timely annual returns

- Issuing K-1 forms to shareholders

- Following reasonable compensation guidelines

- Meeting eligibility requirements consistently

Start with confidence - our Delaware incorporation service is professional, supportive, and with you from day one!

Frequently Asked Questions (FAQs) about S Corporations

Entrepreneurs researching business structures often encounter specific questions about S corporations. This section addresses the most common inquiries about S corp formation, requirements, taxation, and costs to help business owners make informed decisions.

How do I form an S Corporation?

Forming an S corporation involves a two-step process: Establishing a corporation, then electing S corporation status.

Step-by-step formation process:

- File Articles of Incorporation with your state's business filing agency

- Create corporate bylaws

- Issue stock certificates to shareholders

- Hold the initial board of directors meeting

- File Form 2553 (Election by a Small Business Corporation) with the IRS within:

- 2 months and 15 days of incorporating, or

- The beginning of the tax year for an existing corporation

The IRS must approve the S corporation election before the business can operate under this status. Meeting all eligibility requirements before filing Form 2553 ensures a smoother approval process.

What are the requirements for an S Corporation?

S corporations must satisfy specific IRS requirements to qualify and maintain their status:

Eligibility criteria:

- Must be a domestic corporation

- Maximum of 100 shareholders

- Only eligible shareholders permitted:

- Individuals (U.S. citizens/residents)

- Certain trusts and estates

- Tax-exempt organizations

- One class of stock only (though voting rights may differ)

- Cannot be an ineligible corporation type (insurance companies, financial institutions, etc.)

Violating any of these requirements can result in the termination of S corporation status, potentially creating significant tax complications. Regular compliance reviews help maintain eligibility.

How does S Corp taxation work?

S corporation taxation follows the pass-through model, distinguishing it from traditional C corporations. The S corporation files an informational tax return (Form 1120-S) annually but doesn't pay corporate income tax. Instead, the business issues Schedule K-1 forms to each shareholder, showing their proportionate share of:

- Ordinary business income/loss

- Separately stated items (capital gains, charitable contributions, etc.)

- Tax credits

Shareholders report these amounts on their personal tax returns regardless of whether profits were distributed. This system creates a single layer of taxation at individual rates rather than double taxation at both corporate and personal levels.

Can an S Corporation have foreign shareholders?

S corporations cannot have non-resident alien shareholders. This represents one of the strictest eligibility requirements for S corporation status. Foreign investors seeking to participate in U.S. businesses must explore alternative structures such as C corporations or certain LLC arrangements. This restriction significantly impacts international investment strategies for businesses considering S corporation status.

An S corp stands as a beacon of opportunity for those seeking a harmonious blend of tax efficiency and legal protection, catering to the entrepreneurial spirit. With the allure of pass-through taxation and liability shields akin to those of a C corporation, S corp status transforms potential risks into calculated strategies. For entrepreneurs navigating the complexities of business structure, it underscores the promise of financial prudence and secure growth, painting a picture of ambition realized and futures safeguarded.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom