An Employer Identification Number (EIN) is a critical component for running a business in the United States. Understanding the ins and outs of an EIN is a foundational step for any entrepreneur. This guide provides a clear overview of what an EIN is, who is required to obtain one, and how it supports both financial management and legal compliance for your business.

This article outlines the key aspects of the EIN to help businesses gain a clearer understanding. We specialize in company formation and do not provide financial advice. For financial matters, please consult a qualified legal or financial expert.

What is an EIN?

An EIN (Employer Identification Number) is a unique nine-digit number assigned by the IRS to businesses operating in the United States. Its primary function is for tax administration and administrative purposes, allowing the IRS to track business tax filings and reporting. This number is also commonly known as a Federal Tax Identification Number.

The simplest way to understand its role is by comparing it to an individual's Social Security Number (SSN). Just as an SSN is used to identify individual taxpayers, an EIN is used to identify business entities. The format of an EIN is distinct and always follows a nine-digit structure of XX-XXXXXXX. This formatting helps to easily differentiate it from an SSN, which is structured as XXX-XX-XXXX.

Who needs an EIN?

The IRS requires most certain business structures or situations to obtain an EIN for tax purposes. However, even when not strictly required, it is often highly recommended.

Businesses are required to have an EIN

Your business is required by the IRS to have an EIN if any of the following conditions apply:

- Having employees

- Operating your business as a Corporation or a Partnership

- Filing tax returns for Employment, Excise, or federal excise taxes related to Alcohol, Tobacco, and Firearms

- Withholding taxes on income, other than wages, paid to a non-resident alien

- Having a Keogh plan (a tax-deferred pension plan)

- Your business is a specific type of organization, such as a Limited Liability Company (LLC) (depending on the number of members and tax classification), non-profit organization, estate, or trust

When an EIN is not required but highly recommended

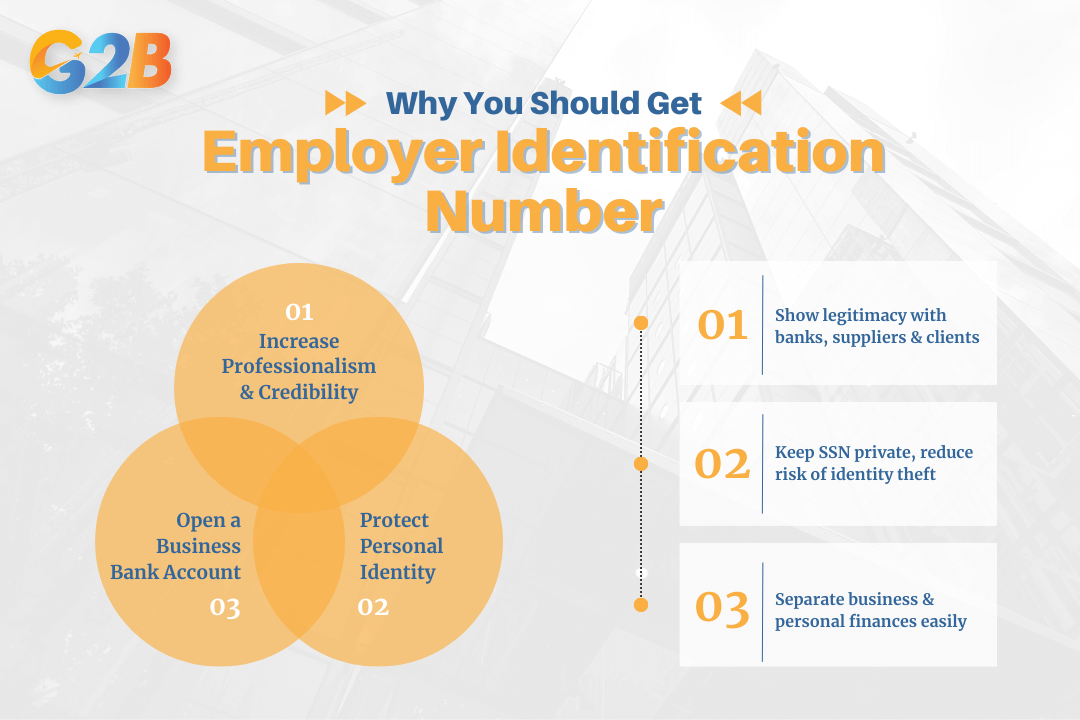

For some business structures, like Sole Proprietorships with no employees, an EIN is not legally required by the IRS. These business owners can often use their personal Social Security Number for business tax purposes. However, obtaining the EIN from the IRS is still a smart move for several key reasons:

Why you should obtain the EIN from the IRS

- Protect personal identity: The rise of identity theft is a significant concern for business owners. When you use your SSN on business documents like client contracts or vendor applications, you increase your risk. Using an EIN instead keeps your personal SSN private and secure, significantly reducing the threat of identity theft.

- Increase professionalism and credibility: An EIN legitimizes your business in the eyes of others. When you provide an EIN on applications and forms, it signals to banks, suppliers, and potential clients that you are a serious and established business entity. This can also help reinforce your status as an independent contractor rather than an employee.

- Open a business bank account: Most banks and financial institutions require an EIN to open a business checking account. This is a critical step for any business owner who wants to separate business and personal finances. Keeping finances separate not only simplifies bookkeeping and tax filing but also protects your personal assets.

What is an EIN used for?

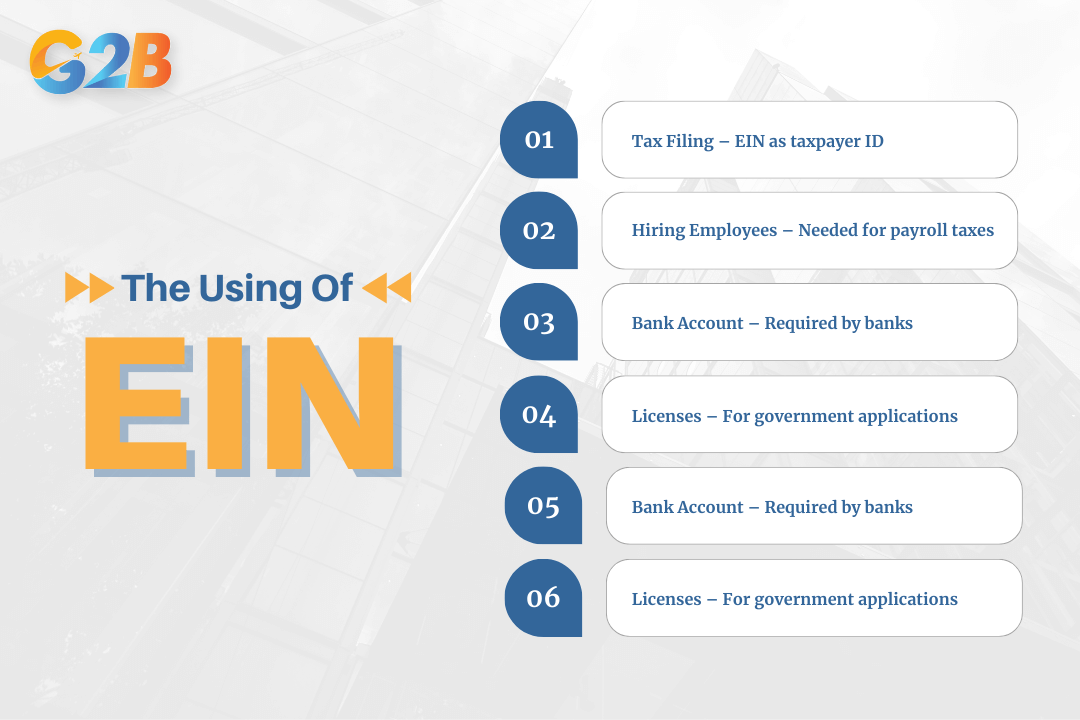

An EIN is more than just a number for tax forms; it's a key that unlocks numerous business functions. Here are the most common and critical uses for the Employer Identification Number.

5 Most common and critical uses for the Employer Identification Number

Tax filing

The primary purpose of an EIN is to serve as your business's taxpayer identification number for federal tax filings. The IRS uses this number to track your payroll tax, corporate income tax, and other business tax obligations at the federal level, and it may also be used for state tax purposes.

Hiring employees

If you plan to hire even one employee, you must have an EIN. It is essential for reporting payroll taxes, including federal income tax withholding, Social Security, and Medicare taxes, to the IRS.

Opening a business bank account

Separating your personal and business finances is a fundamental principle of good business management. Most banks and financial institutions require an EIN to open a dedicated business bank account, which is crucial for accurate financial tracking and protecting your personal liability.

Applying for business licenses & permits

When applying for various federal, state, and local licenses and permits, you will almost always be asked for your EIN on the application. It serves as a standard identifier for regulatory and government agencies at the federal, state, and local levels.

Building business credit

Just as your SSN is tied to your personal credit history, your EIN is the first step to building a credit profile for your company. Establishing business credit allows you to apply for loans, credit cards, and financing in the company's name, separate from your personal credit.

Establishing supplier and vendor accounts

Many suppliers and vendors require an EIN before they will extend a line of credit or establish an account with your business. It serves as proof that you are a legitimate business entity.

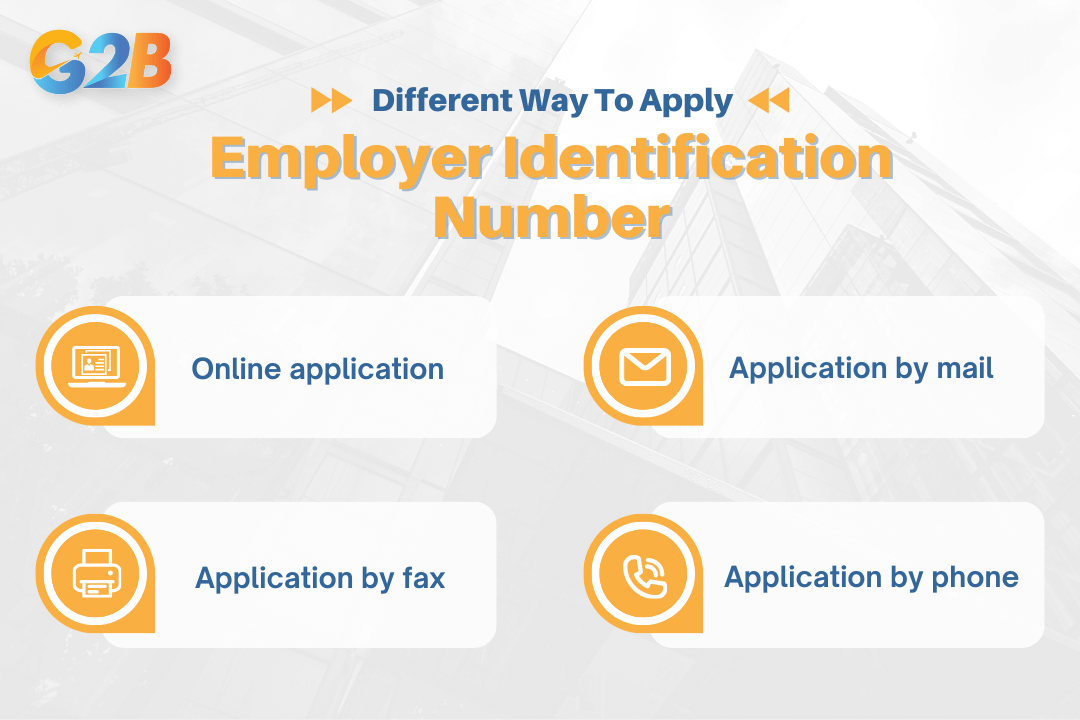

How to register for an EIN

Applying for an Employer Identification Number is a straightforward process. Be wary of third-party websites that charge a fee for this service, as it is unnecessary. Here are the different methods for applying for your EIN:

1. Online application (The recommended method)

This is the fastest and most efficient way to get your EIN.

- Process: Visit the official IRS website and complete the online application. The system guides you through a series of questions about your business and requires the applicant to have a valid Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or existing EIN to complete the application.

- Timeline: You will receive your EIN immediately upon successful completion of the online application.

- Note: This service is available for businesses whose principal operations are located within the United States. The online application session will time out after 15 minutes of inactivity, so you must complete it in one sitting.

2. Application by fax

- Process: You must fill out Form SS-4, "Application for Employer Identification Number." Once completed, you can fax it to the appropriate IRS number.

- Timeline: If you provide a return fax number, you can expect to receive your EIN back via fax in approximately four business days.

3. Application by mail

- Process: Complete Form SS-4 and mail it to the designated IRS processing center.

- Timeline: This is the slowest method. It typically takes around four to five weeks to receive your EIN.

4. Application by phone (International applicants)

- Process: This method is specifically for applicants whose principal business, office, or agency is located outside of the United States. International applicants can call a dedicated IRS phone number to obtain their EIN.

- Timeline: The IRS can typically assign an EIN over the phone during the call.

4 Different methods for applying for the EIN in the US

Important note: For most business entities, such as an LLC or Corporation, your business entity must be legally formed and registered with the state before applying for an EIN. However, some entities, like Sole Proprietorships or certain trusts can apply for an EIN without formal state registration. Attempting to apply for an EIN before your entity is officially formed can result in delays or rejection.

Securing an Employer Identification Number is a fundamental and non-negotiable step for establishing a company in Delaware. It is the key to proper tax compliance, financial management, and building a professional reputation. This number will enable you to hire employees, open bank accounts, build business credit, and protect your personal identity.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom