Expanding into the nonprofit sector presents unique opportunities for entrepreneurs. Hong Kong offer a strategic way to support social causes and establish credibility on a global scale. However, setting up an NPO in a foreign country involves navigating specific legal requirements and registration procedures. In this article, G2B - professional business support services - will provide a clear roadmap for nonprofit registration, offering a mid-level exploration of key processes and mandatory governance standards.

What is a Nonprofit Organization?

A Nonprofit Organization (NPO) is an entity that operates for a purpose other than making a profit. Instead of distributing earnings to owners or shareholders, nonprofits reinvest their revenue into their mission, which can be related to charity, education, religion, science, health, social welfare, or other public benefits.

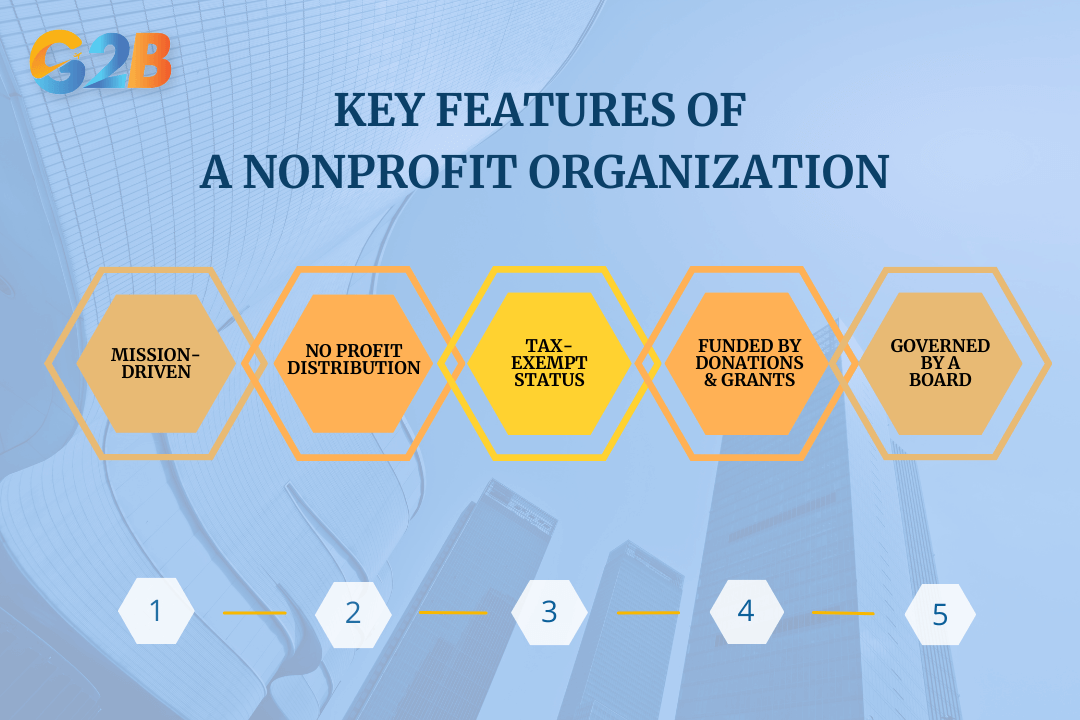

Key features of a Nonprofit Organization

- Mission-driven: Focuses on a specific social, educational, or humanitarian cause.

- No profit distribution: Any surplus revenue is used to further the organization’s goals rather than being shared among owners or investors.

- Legal entity: A nonprofit is a registered legal entity, capable of owning assets, entering contracts, and operating independently - similar in structure to for-profit businesses or even offshore companies

- Tax-exempt status: Many nonprofits qualify for tax-exempt status (e.g., 501(c)(3) in the U.S.) if they serve the public good.

- Funded by donations & grants: Revenue often comes from donations, grants, membership fees, or fundraising events.

- Governed by a board: Usually led by a board of directors rather than private owners.

The key features of a nonprofit organization encompass five main elements

Unlike other business structures or offshore companies, nonprofits are not designed for profit generation or tax minimization but rather to serve public interest without distributing earnings to individuals

Examples of Nonprofit Organizations:

- Charities: Red Cross, UNICEF, World Wildlife Fund (WWF)

- Educational institutions: Public universities, scholarship foundations

- Religious organizations: Churches, mosques, temples

- Healthcare & research: American Cancer Society, hospitals

- Social welfare & advocacy: Human Rights Watch, environmental groups

Overview of what Nonprofit Organization registration entails

The process of registering a nonprofit organization is essential for gaining legal recognition. This section covers the key steps involved, the legal significance and advantages of registration, and the main entities that play a role in the approval process.

The NPO’s registration process

The registration process is a structured procedure involving several critical steps and key entities. Here's a closer look at what registering a nonprofit entails:

- Drafting and filing articles of incorporation: This foundational document outlines the organization's name, mission, and operational structure. It's submitted to a government agency, such as the Secretary of State's office in the U.S., establishing the organization's legal identity.

- Developing bylaws: These are internal rules that govern the nonprofit's operations and management. Bylaws typically cover board meetings, officer roles, and voting procedures.

- Appointing a board of directors: A group of individuals is selected to oversee the organization's operations, ensuring compliance with bylaws and strategic direction. Their role is integral to governance and accountability.

- Applying for tax-exempt status: In the U.S., this involves submitting Form 1023 to the IRS. Approval grants the organization a 501(c)(3) designation (A specific type of Nonprofit Organization in the United States - Not all Nonprofit Organizations (NPOs) are 501(c)(3), but all 501(c)(3) organizations are nonprofit), making it exempt from federal income tax and allowing donors to deduct contributions from their taxes.

- State and local registrations: Depending on the location, nonprofits might need additional licenses or permits, such as fundraising certificates or state tax registrations.

Legal significance and benefits of registering a nonprofit

Registering a nonprofit organization gives it a formal legal status, which provides several critical advantages. Importantly, registration allows the entity to apply for tax-exempt status under IRS Section 501(c)(3) in the United States, which is vital for financial efficiency and attracting donations:

- Provides credibility and trust: A registered nonprofit is more likely to gain support from donors, volunteers, and partners. It assures stakeholders that the organization adheres to legal and ethical standards.

- Grants eligibility for government and foundation grants: Many grantmaking entities, including government agencies, require organizations to have formal nonprofit status as a prerequisite for eligibility.

- Offers limited liability protection: Board members and officers are generally shielded from personal liability for the nonprofit's debts and lawsuits, provided they act within their roles' legal and ethical boundaries.

Key entities involved in the registration process

The registration of a non-profit organization involves coordination among various key entities, ensuring a smooth and compliant foundation is set for the nonprofit's operations. Some of these entities include:

- Government regulatory bodies: In the U.S., the IRS and state agencies like the Secretary of State play crucial roles. The IRS oversees tax-exemption applications, while state agencies handle incorporation and other state-specific requirements.

- Legal advisors: Attorneys specializing in nonprofit law are instrumental in ensuring compliance with the myriad laws and regulations guiding nonprofit operations. They assist in drafting legal documents, advising on governance structures, and navigating the tax-exemption application process.

- Financial advisors and accountants: These professionals help establish sound financial practices. They assist in budgeting, financial reporting, and ensuring adherence to accounting standards.

- Board members and founders: These individuals, often highly motivated and experienced, guide strategic planning and organizational policies. Their insight into the mission and community needs is invaluable during the registration process.

Legal framework and eligibility criteria for nonprofits

The legal landscape surrounding the registration of nonprofit organizations is multifaceted, involving a comprehensive set of regulations influenced by local, national, and sometimes international laws.

Legal definitions and types of nonprofit organizations

A nonprofit organization is legally defined as an entity that operates for a collective, public, or social benefit rather than to accrue profits for owners or investors. Within this domain, several variations exist:

- Charitable organizations: Often classified under the U.S. Internal Revenue Code Section 501(c)(3), these entities are established for religious, charitable, scientific, or educational purposes and are eligible for tax-exempt status. Globally, similar structures exist, such as charities in the UK recognized by the Charity Commission.

- Foundations: These are typically endowed by individuals or businesses and focus on specific philanthropic goals, distributing grants to causes or projects that align with their mission.

- Social welfare organizations: Classified under 501(c)(4) in the U.S., these organizations promote social improvement, civic betterment, and the common good. While they can engage in lobbying and political activities, they primarily serve community-centric objectives.

Eligibility criteria for nonprofit registration

To legally register a nonprofit, several critical criteria must be met, often mirroring the organization’s intended impact and operational purpose:

- Purpose statement: The nonprofit must clearly define its mission and objectives, ensuring alignment with the public or mutual benefit criteria outlined by regulatory bodies.

- Organizational structure: Nonprofits typically require a defined structure, including a board of directors to provide governance and oversight. The board composition should reflect diversity in skills and perspectives relevant to the nonprofit’s mission.

- Incorporation document: Known as Articles of Incorporation in the U.S., this document must be filed with state authorities, setting forth the organization's name, purpose, duration, and governance structure.

- Bylaws: These are the rules governing the nonprofit’s internal management, covering board meetings, membership requirements, and procedures for decision-making.

- Tax-exempt status application: To receive tax-exempt status, nonprofits must file with relevant authorities, such as the IRS in the U.S. This often involves submitting Form 1023 or 1024 and providing detailed financial and operational plans.

International considerations for NGOs and charities

For organizations intending to operate internationally, additional considerations come into play:

- Cross-border regulations: NGOs must adhere to the legal requirements both in their home country and in the countries where they operate. This may include registration with local government bodies and compliance with international laws.

- Funding and compliance: International NGOs often need to navigate complex funding regulations and anti-terrorism financing laws, requiring meticulous financial reporting and transparency.

- Cultural and legal adaptation: Successfully operating across borders requires understanding and integrating cultural norms and legal practices into the NGO’s strategic operations, ensuring both compliance and cultural sensitivity.

Step-by-step guide to nonprofit registration

To navigate this path successfully, it is essential to understand the process thoroughly, with detailed preparation and adherence to regulatory frameworks.

Initial preparations and feasibility assessment

Before initiating the registration process, conduct a feasibility assessment to ensure your nonprofit idea is viable and aligns with your strategic goals. This involves:

- Vision and mission clarity: Clearly define the mission and objectives of your nonprofit, emphasizing the social issues you aim to address. This will guide your organization’s direction and help communicate your purpose to stakeholders.

- Market research: Analyze similar organizations within your sector to gauge competition and identify gaps you might fill. Knowing the landscape will aid in positioning your nonprofit effectively and identifying potential supporters.

- Stakeholder engagement: Engage with key stakeholders such as community members, potential donors, and beneficiaries to validate your ideas and align support early on. Their feedback can be invaluable during the development of foundational strategies.

Detailed steps for incorporating a nonprofit

Once your feasibility study underscores potential success, the next step is incorporation. The process involves several crucial steps:

- Choose a name: Select a unique and relevant name for your nonprofit. This name must align with your mission and stand out to avoid conflicts with existing entities.

- Draft articles of incorporation: This legal document is vital to establishing the nonprofit’s existence. It typically includes your nonprofit’s name, purpose, registered office, and initial directors. Tailor it according to state requirements.

- Appoint an initial board of directors: Your board will govern your nonprofit, so assembling a competent and diverse group committed to your mission is essential. They are responsible for strategic decisions and compliance oversight.

- Develop bylaws: Bylaws function as your organization's operational manual. They outline governance structures, roles and responsibilities, and procedures for meetings. Ensure they are comprehensive and aligned with legal requirements.

- Filing with the state: Submit your signed Articles of Incorporation to the designated state office (often the Secretary of State) along with appropriate fees. Upon approval, you receive confirmation of your legal status.

Application process for obtaining tax-exempt status

Acquiring tax-exempt status can significantly enhance your organization’s ability to attract funding. For U.S.-based nonprofits, this commonly means qualifying under Internal Revenue Code Section 501(c)(3).

- File form 1023: This form is comprehensive and requires detailed information about your organization’s structure, operations, planned activities, and finances. Smaller organizations may qualify for the simpler Form 1023-EZ.

- Prepare financial statements: Even newly formed nonprofits need to provide financial documentation, including budget projections and descriptions of expected funding sources.

- Submit to the IRS: With your Form 1023 or 1023-EZ completed, submit it with relevant documents and the filing fee to the IRS. Expect a processing period which can vary but typically takes several months.

- State-level exemptions: Depending on your location, state-level tax exemptions might require separate filings. Research and comply with local regulations to maximize tax benefits.

Required documentation for nonprofit registration

Securing nonprofit registration involves a comprehensive understanding of the legal paperwork. Here’s a detailed list of essential documents required for nonprofit registration, along with guidelines and common pitfalls to avoid.

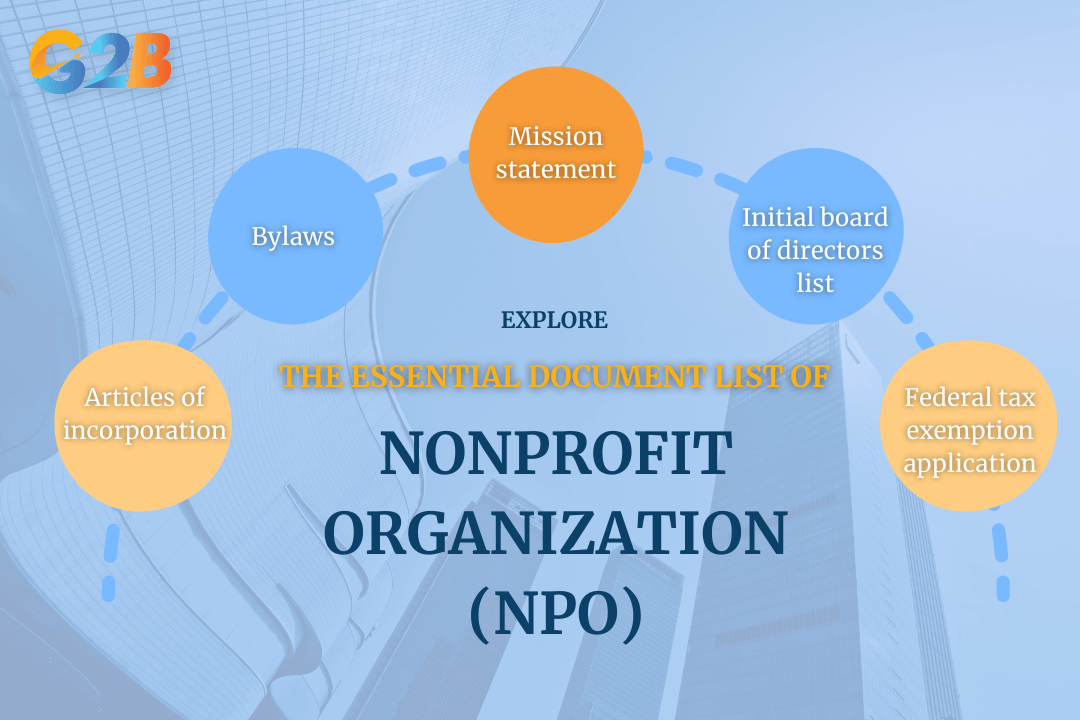

Detailed list of essential documents

- Articles of incorporation: It includes key elements such as the organization’s name, mission, duration of existence, and the processes in place for dissolving the organization. Depending on your jurisdiction, you may need to include specific language to comply with state and federal requirements for tax-exempt status. This document must be filed with your state's Secretary of State office.

- Bylaws: Bylaws provide the governing rules of the nonprofit. They detail how decisions are made, the responsibilities and powers of board members, meeting schedules, and conflict-of-interest policies. Crafting clear and thorough bylaws can prevent governance issues later, ensuring smooth operations and compliance with legal standards.

- Mission statement: Although technically not a legal document, the mission statement articulates the core purpose and values of your nonprofit. It is critical for guiding the organization's objectives and strategies and serves as a crucial element in funding applications and stakeholder communications. This statement must be clear, concise, and reflective of your nonprofit's goals.

- Initial board of directors list: The identities of those governing the nonprofit must be officially documented. This list typically includes names, addresses, and roles within the organization, serving as a record of accountability and decision-making authority.

- Federal tax exemption application: To acquire tax-exempt status, particularly in the U.S., filing IRS Form 1023 or 1023-EZ is necessary, depending on the size and scope of your organization. This form requires detailed information on your organizational structure, finances, and operational plans to demonstrate eligibility.

Explore the required documentation list for nonprofit registration

Guidelines on drafting bylaws and mission statements

Creating effective bylaws and mission statements requires alignment with legal standards and strategic vision. Begin drafting your bylaws by consulting legal advisors specializing in nonprofit law to ensure they meet both state-specific and federal requirements. Clear definitions of the roles and responsibilities of board members, quorum rules, and voting processes can safeguard your nonprofit from internal conflicts. This statement should reflect your purpose in a compelling manner, able to resonate with donors, volunteers, and regulatory bodies.

Common mistakes and how to avoid them

- Inadequate articles of incorporation: A common error is failing to include necessary legal clauses for tax exemptions, which can lead to delays or denials in your application. Always verify that your articles align with the specific tax exemption requirements of your jurisdiction, referencing IRS guidelines or equivalent authorities.

- Vague bylaws: Bylaws that are overly broad can lead to governance challenges. Avoid ambiguity by clearly defining operational procedures and board obligations, thus protecting against misinterpretations and legal issues.

- Misaligned mission statement: A mission statement that is too broad or lacks clarity can dilute your nonprofit's purpose. Ensure it precisely captures your core objectives and inspires collective action, reflecting the change you aim to effect in the community.

Compliance requirements and reporting obligations

This section will dive deep into the specifics of what nonprofit organizations must adhere to regarding compliance requirements and necessary reporting obligations.

Understanding IRS and local government requirements

A nonprofit organization must meet certain compliance standards set by the Internal Revenue Service (IRS) and local government entities to retain its tax-exempt status. Failure to adhere can lead to penalties or revocation of the nonprofit's status. These requirements typically include:

- Tax-ei identification number (ein) application: Nonprofits must apply for an EIN from the IRS. This serves as a form of identification similar to a Social Security number but for organizations, which is essential for tax filings.

- 501(c)(3) compliance: For U.S.-based nonprofits, compliance under section 501(c)(3) of the tax code is necessary. This involves adhering to rules regarding political activities, prohibiting the distribution of earnings to private shareholders, and ensuring operations are within their stated charitable purposes.

- State-level registration: Nonprofits often need to register with state government agencies, which might include the State Attorney General's office or Secretary of State, depending on the jurisdiction. Each state may have a unique set of rules and filing requirements.

- Charitable solicitation compliance: Organizations must ensure compliance with local and federal regulations regarding fundraising activities and solicitation efforts.

Annual reporting and record-keeping best practices

Meticulous record-keeping and regular reporting are essential practices for maintaining good standing. Nonprofits are required at a minimum, annually to file several reports:

- Form 990 series: Most registered nonprofits must file a Form 990, 990-EZ, or 990-N, which provides the IRS with information on financial activities. The choice of form depends on the organization's annual gross receipts and assets.

- Financial statements: Accurate and transparent financial statements, such as balance sheets and statements of activities, are crucial for both internal management and external auditing. These documents help in ensuring accountability to stakeholders, including donors and regulatory bodies.

- Internal record-keeping: Maintaining detailed records such as meeting minutes, accounting ledgers, and donor acknowledgments is considered best practice. These records provide a clear paper trail, streamline audits, and enhance organizational transparency.

- Compliance calendars: Developing a compliance calendar can be beneficial for tracking important filing deadlines and ensuring all requirements are met on time. This reduces the risk of late filings and associated penalties.

Penalties for non-compliance and how to mitigate risks

Non-compliance can have severe repercussions, including penalties, fines, and even loss of tax-exempt status. Organizations must understand these potential issues and implement strategies to avoid them:

- Common penalties: These can include monetary fines, loss of tax-exempt status, and public disclosure of non-compliance issues, which might affect the nonprofit's reputation and ability to attract donors.

- Risk mitigation strategies:

- Regular compliance audits: Schedule periodic reviews of compliance policies and procedures. This can help identify and rectify potential issues before they become problematic.

- Hiring experts: Engage with legal advisors and accountants specializing in nonprofit law to ensure all reports and documentation meet regulatory requirements.

- Staff training: Regular training for staff and board members on compliance requirements can ensure everyone is informed and understands the importance of maintaining good standing.

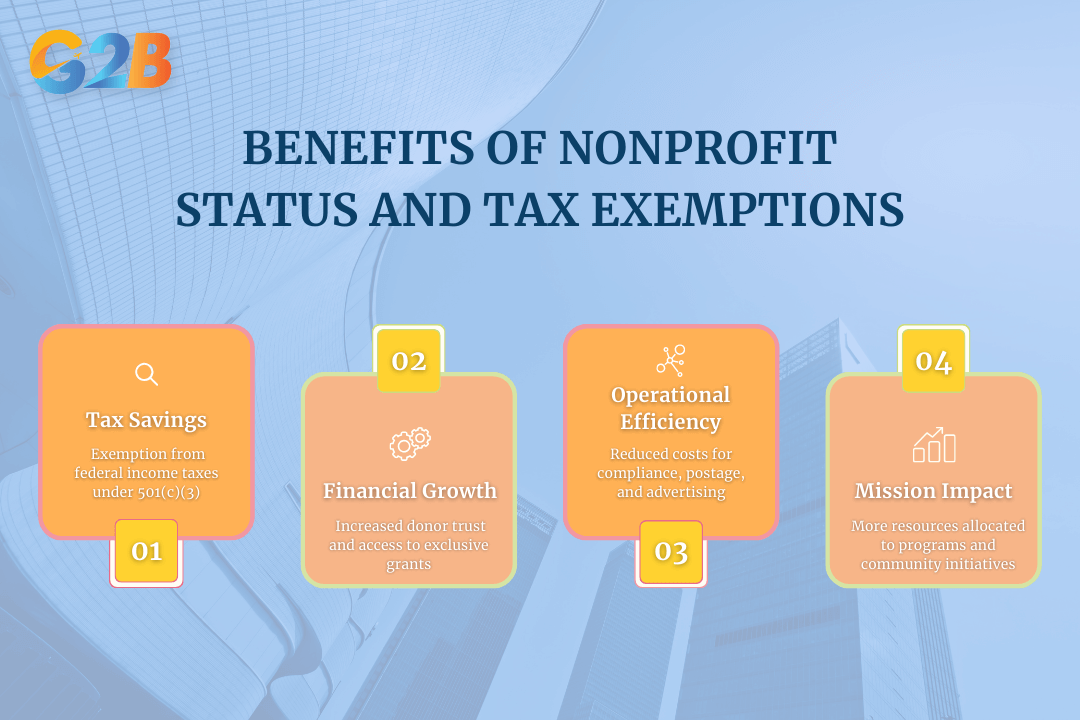

Benefits of nonprofit status and tax exemptions

Let’s delve into the major benefits of obtaining nonprofit status and how tax exemptions can elevate a nonprofit's operational efficiency and impact.

4 Benefits of nonprofit status and tax exemptions

Financial and operational benefits of tax-exempt status

One of the most appealing aspects of obtaining a tax-exempt status under section 501(c)(3) of the Internal Revenue Code in the United States is the potential for enhanced financial management. This status allows nonprofits to be exempt from federal income taxes on funds related to their exempt purposes, thereby enabling a more focused allocation of resources towards program delivery and expansion. Additionally, tax-exempt status can bolster an organization’s credibility, making it more attractive to potential donors.

Tax-exempt nonprofits also have the opportunity to apply for a broader range of grants and public funding that are unavailable to taxable entities, further expanding their financial toolkit. Operationally, tax exemption can reduce the overhead associated with compliance and reporting, as nonprofits may be eligible for reduced postage, advertising, and other operational costs. These cost reductions allow greater flexibility in how nonprofits deliver services and engage with community initiatives, fostering a more dynamic approach to achieving their mission.

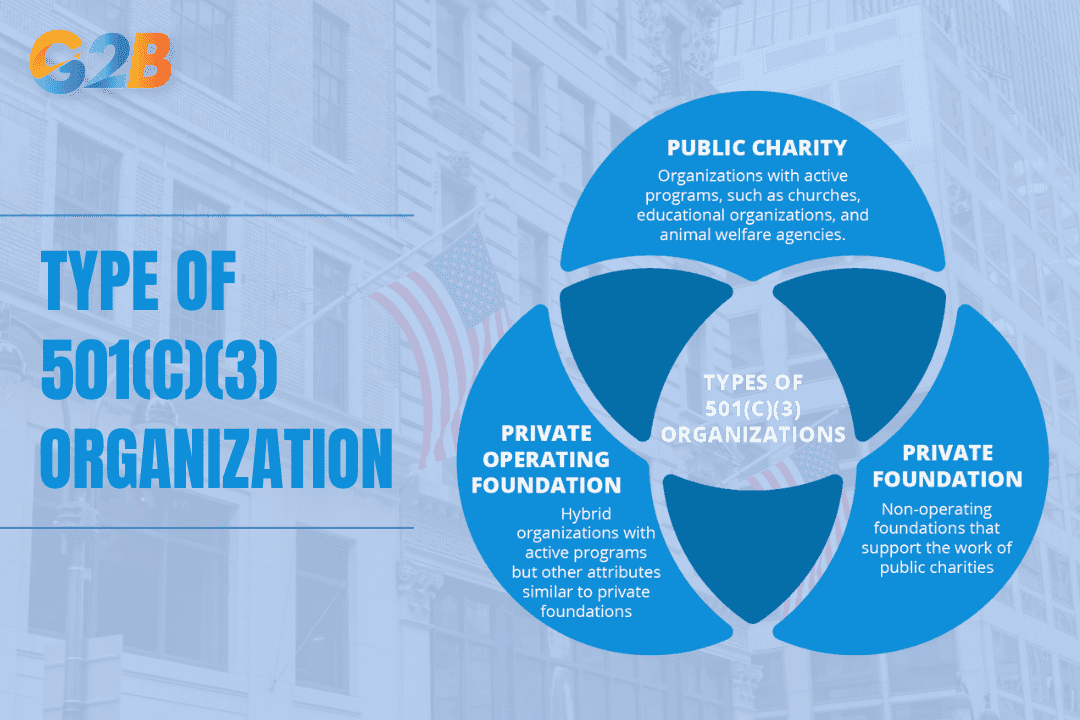

Overview of 501(c)(3) and other tax exemption statuses

While 501(c)(3) is the most well-known tax exemption status, there are several others, each with its unique benefits and qualifications. For instance, section 501(c)(4) covers organizations focused on social welfare or advocacy, while section 501(c)(6) applies to business leagues and chambers of commerce. The specific category under which a nonprofit falls can dictate its operational focus and the specific advantages it may access. Each status has distinct requirements and offers different benefits. Understanding these nuances is crucial for organizations to choose the most fitting status, maximizing their potential benefits.

There are three distinct types of 501(c)(3) organizations with specific purpose

Maintaining nonprofit compliance and governance

Effectively maintaining compliance and governance in a nonprofit organization is critical to its success and sustainability.

Role and responsibilities of the board of directors

The board of directors plays a pivotal role as the steering entity of a nonprofit organization. Their primary responsibilities include:

- Strategic direction and oversight: The board ensures that the organization has a clear mission and strategic goals. They review and approve major policies and ensure that programs are aligned with the strategic objectives.

- Financial oversight: It’s vital for the board to monitor the financial health of the organization. This includes approving the budget, reviewing financial statements, and ensuring that adequate financial controls are in place.

- Compliance and legal accountability: Board members must ensure that the organization operates within the legal and ethical boundaries set by government regulatory bodies such as the IRS in the United States or the Charity Commission in the UK.

- Executive leadership: The board is often responsible for hiring, evaluating, and, when necessary, terminating the executive director. They provide support and counsel to leadership as needed.

Strategies for effective nonprofit governance

Effective governance requires a strategic approach encompassing various practices to enhance an organization’s operational efficiency and impact:

- Diverse and skilled board members: A diverse board brings varied perspectives and skills, which can lead to more comprehensive decision-making. Board development programs can be instrumental in equipping members with the necessary skills.

- Regular training and education: Keeping board members informed about the latest nonprofit industry trends, legal requirements, and governance practices is crucial. Regular workshops and training sessions can be beneficial.

- Transparency and accountability: Open communication, both within the organization and with the public, fosters transparency. Regular updates, clear reporting, and stakeholder engagement are essential strategies.

- Effective meeting practices: Regular, well-structured meetings with clear agendas and follow-up actions ensure that board discussions translate into effective organizational action.

Real-world cases of registered nonprofits

Let's delve into three real-world examples that demonstrate how strategic registration and governance can lead to impactful social contributions:

- Charity: Water: This organization was founded by Scott Harrison in 2006 with a clear mission to bring clean and safe drinking water to people in developing countries. Their success hinges on a robust registration process and transparency. Upon registration, Charity: Water achieved tax-exempt status under section 501(c)(3) by preparing meticulous documentation, including articles of incorporation and a well-articulated mission statement. Their successful registration enabled them to attract large donors and corporate sponsorships, vital for operational funding.

Charity: Water achieved tax-exempt status under section 501(c)(3)

- Doctors without Borders: Known globally for providing medical care in crisis zones, their effective registration as a nonprofit entity has allowed them to maintain operations in multiple countries. Their strategic partnership with legal advisors helped navigate diverse international regulatory landscapes, ensuring that they met all regional criteria for nonprofit operation. This case illustrates the importance of comprehensive legal knowledge and documentation in maintaining 501(c)(3) tax-exempt status, which permits redirection of maximum resources toward their humanitarian activities rather than tax liabilities.

- Habitat for Humanity: Originated in 1976, Habitat for Humanity focuses on building homes for those in need. Their registration process emphasized community involvement and collaboration with local governments, critical for obtaining necessary permits and zoning approvals. By thoroughly understanding legal requisites and eligibility criteria in their areas of operation, they have effectively scaled their operations globally. This underscores the significance of aligning nonprofit registration with local and federal regulations to optimize community engagement and impact.

How nonprofits can prepare for future regulatory shifts

Preparing for forthcoming regulatory changes involves strategic adjustments in both policy and operations. Nonprofits can take proactive steps to ensure they remain compliant and adapt to the anticipated shifts.

- Invest in technology and training: Organizations should invest in modernizing their tech infrastructure to efficiently handle compliance tasks. This includes adopting accounting software, compliance management systems, and digital document storage solutions. Staff training in these areas is equally important to ensure proper usage and cybersecurity awareness.

- Legal and financial readiness: Engaging legal advisors and financial auditors who specialize in nonprofit law can help organizations stay abreast of regulatory changes. Conducting regular audits and compliance checks can preempt potential compliance issues.

- Strategic governance practices: Nonprofits should strengthen governance structures by embracing practices that exceed minimum compliance standards. This could involve diversifying board membership, instituting clear governance policies, and developing strategic risk management plans focused on regulatory compliance.

Preparing for forthcoming regulatory changes involves strategic adjustments in both policy and operations

Establishing a nonprofit organization requires a clear understanding of its legal definition, a structured registration process, and strict adherence to compliance requirements. Successfully navigating these steps ensures legal recognition, access to tax benefits, and long-term sustainability. With careful planning and the right professional guidance, an NPO can effectively fulfill its mission while maintaining transparency and regulatory compliance.

With the dynamic economy and pro-business policies, the United States remains a top choice for foreign investors seeking growth and global expansion. For entrepreneurs looking to establish a business in the U.S. market, G2B provide an offshore company formation service in Delaware with the expertise and dedicated guidance. Take the next step toward global success - Contact G2B and unlock limitless opportunities today!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom