Selecting the appropriate corporate structure is a foundational decision for any entrepreneur looking to establish or expand a business presence. For global entrepreneurs, startup founders, and growing SMEs, choosing the right business structure - like a C corporation - can unlock major advantages. From attracting investors through stock issuance to ensuring strong legal protection, a C corp positions business for serious growth. This overview outlines the key factors to evaluate before incorporation to make the right decisions.

What is a C Corporation?

A C Corporation (C corp) is a legal business entity that exists separately from its owners (shareholders) and is taxed independently under Subchapter C of the U.S. This distinct separation creates a corporate shield that protects owners' personal assets from business liabilities while enabling the company to raise capital through stock issuance.

Formal definition and simple explanation

A C corporation exists as a standalone legal entity owned by shareholders but managed by a board of directors and officers. The corporation can enter into contracts, own assets, incur liabilities, and engage in business activities independently from its owners. This separation provides the fundamental benefit of limited liability protection - shareholders typically risk only their investment in the company, not their personal assets.

C corps possess unique characteristics that distinguish them from other business entities:

- Separate taxation: The corporation pays taxes on profits at the corporate rate

- Stock issuance capability: Can issue multiple classes of stock to various investors

- Unlimited shareholders: No restrictions on the number or nationality of shareholders

- Perpetual existence: Continues regardless of ownership changes or the deaths of shareholders

Key components and structure

The C corporation structure includes several essential components that must be established and maintained:

| Component | Description | Importance |

|---|---|---|

| Articles of Incorporation | Legal document filed with the state government | Officially creates a corporation and defines basic parameters |

| Corporate Bylaws | Internal rules governing operation | Establishes procedures for management and shareholder rights |

| Board of Directors | Elected governance body | Provides oversight and makes major strategic decisions |

| Officers | Appointed a management team | Handles day-to-day operations and execution |

| Stock Structure | Authorized and issued shares | Determines ownership allocation and rights |

| EIN (Employer ID Number) | Tax identification number | Required for filing taxes and opening business accounts |

Additional requirements include:

- Maintaining a registered agent in the state of incorporation

- Filing annual reports and paying franchise taxes

- Holding required meetings (director and shareholder)

- Keeping corporate records and minutes

- Maintaining separation between corporate and personal finances

These formalities must be strictly followed to preserve the liability protection and legal status of the corporation.

Finding a trustworthy Delaware incorporation service? Let G2B simplify the process - Book your free consultation now!

Types of C Corporations: Stock vs. non-stock

C corporations operate under two main structures: stock corporations (for-profit entities that issue shares) and non-stock corporations (typically non-profit organizations without share issuance). This classification determines how the C corp raises capital, distributes profits, and fulfils its organizational mission.

Stock corporations (for-profit)

Stock C corps represent the most common corporate structure for businesses seeking growth and capital investment. These corporations issue shares to shareholders who become partial owners of the company.

These entities offer several distinct advantages:

- Ability to raise substantial capital by selling shares to investors

- No limitations on the number or type of shareholders

- Option to create multiple classes of stock (common and preferred)

- Greater flexibility in ownership transfer and business continuity

- Attractive structure for venture capital firms and angel investors

Stock C corps maintain a formal governance structure where shareholders elect a board of directors that oversees corporate officers handling day-to-day operations. This separation of ownership and management creates clear roles and responsibilities within the organization. For entrepreneurs planning to scale rapidly or eventually go public, stock corporations provide the necessary framework to accommodate multiple funding rounds and complex ownership arrangements. The tradable nature of shares also creates liquidity options for early investors and founders.

Non-stock corporations (non-profit)

Non-stock C corps serve fundamentally different purposes than their for-profit counterparts. These entities organize around charitable, educational, religious, or similar missions rather than generating profits for shareholders. Without issuing shares, non-stock corporations may instead have members who participate in organizational governance.

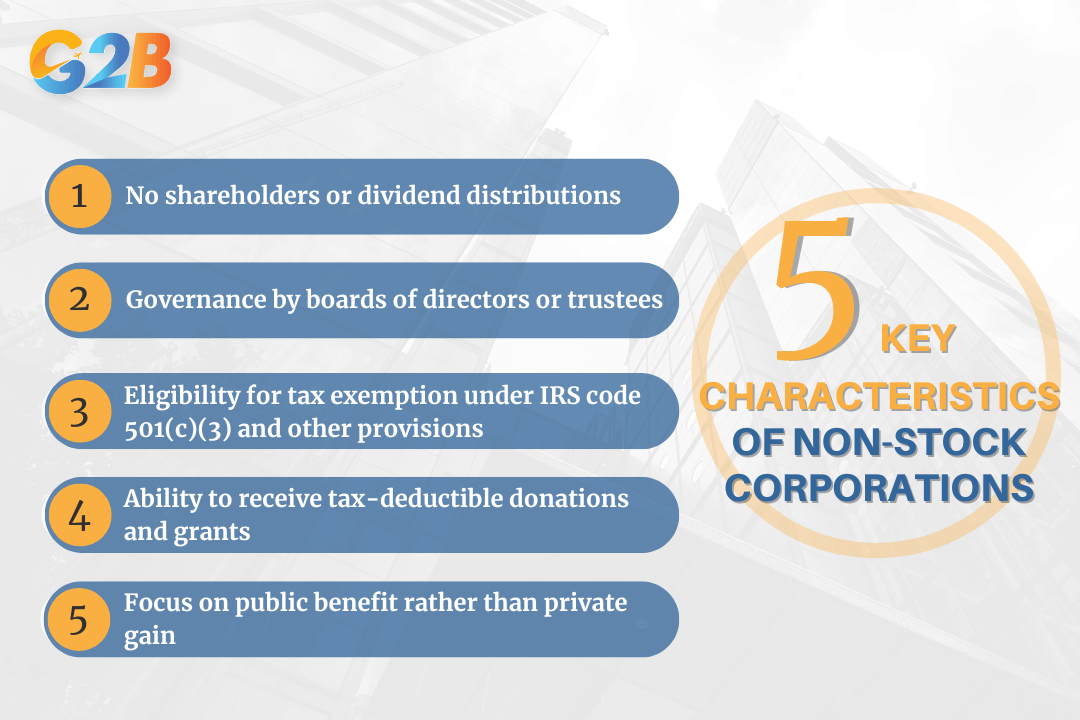

Key characteristics of non-stock corporations include:

- No shareholders or dividend distributions

- Governance by boards of directors or trustees

- Eligibility for tax exemption under IRS code 501(c)(3) and other provisions

- Ability to receive tax-deductible donations and grants

- Focus on public benefit rather than private gain

05 key characteristics of non-stock corporations

Non-stock corporations must reinvest any surplus funds back into their organizational mission rather than distributing profits to individuals. This reinvestment requirement ensures the entity remains focused on its stated purpose rather than enriching private interests. The formation process for non-stock corporations involves additional steps beyond standard C corp registration, including applying for tax-exempt status with the IRS and adhering to strict operational requirements to maintain that status.

Roles and responsibilities: Shareholders, directors, and officers

C corps maintain a three-tiered governance structure that separates ownership from management. Shareholders own the corporation, directors provide oversight and strategic guidance, while officers handle day-to-day operations.

Shareholders: Owners and their rights

Shareholders constitute the foundation of a C corporation's ownership structure through their stock holdings. They possess specific rights that allow them to influence corporate direction without managing daily operations. These rights include voting on critical corporate matters such as mergers, acquisitions, or amendments to the articles of incorporation. The primary power shareholders wield comes through electing the board of directors, effectively choosing who will guide the company's strategic direction. Additional shareholder rights include:

- Receiving dividends when declared by the board

- Inspecting certain corporate records and financial statements

- Attending and participating in annual meetings

- Voting on fundamental changes to the corporation

While shareholders bear the ultimate financial risk, they benefit from the limited liability protection that C corps provide, shielding their personal assets from company debts and legal obligations.

Board of directors: Oversight and strategic direction

The board of directors serves as the corporation's governing body, elected by shareholders to represent their interests. Directors shoulder significant legal responsibilities and must make decisions that advance the company's welfare rather than their personal interests. Directors operate under two primary fiduciary duties:

- Duty of care: Making informed, prudent decisions after reasonable investigation

- Duty of loyalty: Prioritizing the corporation's interests over personal gain

Key board responsibilities include:

- Setting strategic goals and corporate policies

- Selecting, evaluating, and compensating executive officers

- Declaring dividends

- Approving major financial decisions and corporate transactions

- Ensuring regulatory compliance

- Protecting shareholder interests

Boards typically meet quarterly, though the frequency varies based on corporate needs. All board activities must be properly documented in meeting minutes to maintain legal protection and demonstrate proper governance.

Officers: Day-to-day management

Corporate officers implement the board's vision through hands-on management of business operations. Appointed by the board of directors, officers typically include:

| Position | Primary responsibilities |

|---|---|

| CEO/President | Overall company leadership and strategic execution |

| CFO/Treasurer | Financial management, reporting, and compliance |

| COO | Operational management and process optimization |

| Secretary | Corporate record maintenance and meeting documentation |

Officers execute the policies established by the board while managing teams, resources, and daily business functions. They must regularly report progress to the board and operate within the scope of authority granted to them. Legal responsibilities of officers include:

- Maintaining accurate corporate and financial records

- Ensuring regulatory compliance across operations

- Executing contracts and legal obligations

- Managing corporate assets responsibly

- Upholding fiduciary duties to the corporation

Many smaller C corps have individuals serving in multiple capacities - sometimes as shareholder, director, and officer simultaneously. However, maintaining proper separation of these roles through documentation and formal procedures helps preserve the liability protection that makes the C corp structure valuable.

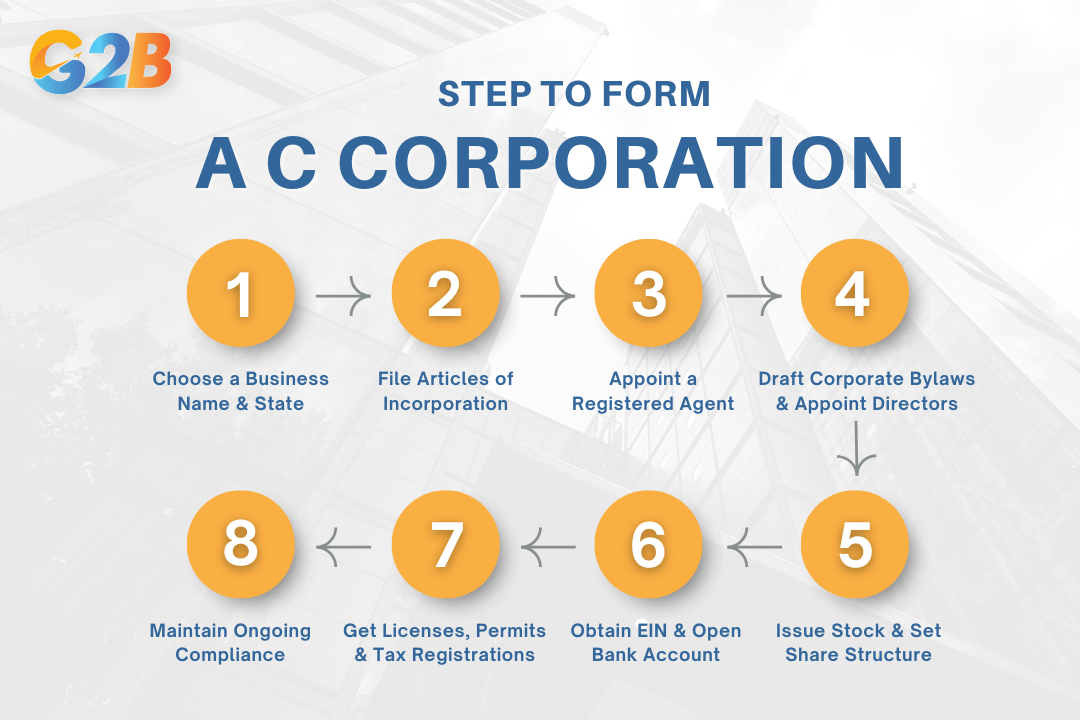

Step-by-step guide: How to form a C Corporation?

Forming a C corporation involves several steps that establish the foundation for business operations. The following comprehensive guide outlines the essential steps entrepreneurs must complete when establishing a C corp.

Choosing a business name and state of incorporation

Selecting an appropriate business name represents the first critical decision in C corp formation. Corporate names must include designators such as "Corporation," "Inc.," or "Limited" to indicate the business structure. Before committing to a name, conduct thorough availability searches through state business registries to avoid trademark conflicts.

State selection significantly impacts taxation and governance requirements. Delaware offers business-friendly courts and corporate law flexibility, making it popular among larger enterprises and startups seeking venture capital. Nevada provides tax advantages with no state income tax and strong privacy protections. Companies primarily operating in California often incorporate there despite higher fees to avoid "doing business" registration requirements in multiple states.

Need a free consultation with Delaware incorporation service? Let G2B help you navigate the process with confidence!

Filing articles of incorporation

Articles of Incorporation establish the C corp's legal existence and require submission to the Secretary of State office in your incorporation state. These documents typically include:

- Corporation name and principal business address

- Corporate purpose statement

- Number and classes of authorized shares

- Registered agent information

- Names and addresses of initial directors

- Incorporator information and signature

Filing fees vary by state, ranging from $50 to $500, with processing times between 1-15 business days depending on state efficiency and expedited options. Some states offer online filing systems while others require paper submissions.

Appointing a registered agent

A registered agent serves as the C corporation's official point of contact for legal documents, official correspondence, and service of process. This designated representative must:

- Maintain a physical address (not a P.O. box) in the state of incorporation

- Be available during standard business hours to receive documents

- Promptly forward important communications to corporate leadership

Many entrepreneurs choose professional registered agent services rather than serving personally. These services typically cost $100-300 annually and provide consistent document handling, privacy benefits, and compliance reminders across multiple states.

Drafting corporate bylaws and appointing directors

Corporate bylaws function as the internal governance rulebook for C corporations. This document establishes:

- Board of directors structure and responsibilities

- Officer roles and appointment procedures

- Shareholder meeting requirements and voting protocols

- Stock certificate procedures

- Amendment processes for corporate documents

The initial board appointment typically occurs during the organizational meeting, where directors approve bylaws, authorize stock issuance, and elect corporate officers. Documenting these actions through formal meeting minutes creates essential corporate records that demonstrate proper governance.

Issuing stock and defining share structure

Stock issuance establishes ownership rights in the C corporation. Articles of Incorporation must specify:

- Total authorized shares (maximum number the corporation can issue)

- Par value (minimum price per share, if applicable)

- Share classes (common vs. preferred) and respective rights

When issuing initial stock, the corporation must:

- Establish fair market value for shares

- Create and execute stock purchase agreements

- Collect payment for shares (cash or assets)

- Record transactions in the corporate stock ledger

- Issue physical or electronic stock certificates

Proper documentation of these transactions helps prevent future ownership disputes and establishes basis values for tax purposes.

Obtaining an EIN and opening a business bank account

An Employer Identification Number (EIN) functions as the C corporation's federal tax ID number. Apply for this identifier through the IRS website, by mail, or by fax. This nine-digit number enables the corporation to:

- File corporate tax returns

- Open business bank accounts

- Hire employees and process payroll

- Apply for business licenses and permits

Once secured, use the EIN to establish dedicated business bank accounts. This critical step:

- Maintains the corporate veil protecting personal assets

- Simplifies accounting and tax preparation

- Establishes business credit history

- Facilitates proper cash flow management

Securing licenses, permits, and state tax registration

C corporations must obtain various licenses and registrations before commencing operations:

| Requirement Type | Issuing Authority | Purpose |

|---|---|---|

| Business license | City/County | General permission to operate |

| Professional license | State Boards | Industry-specific authorization |

| Sales tax permit | State Revenue Dept. | Collection of sales taxes |

| Zoning permits | Local Planning Dept. | Location compliance |

| Foreign qualification | Other States | Operating outside home state |

Industry-specific permits may apply for businesses in regulated sectors like food service, healthcare, or financial services. Research requirements thoroughly to avoid penalties for non-compliance.

Maintaining ongoing compliance

C corporation compliance extends beyond formation. Key ongoing requirements include:

- Annual/biennial reports filed with state agencies

- Franchise tax payments based on corporate structure or income

- Regular board meetings with documented minutes

- Annual shareholder meetings and records

- Corporate record maintenance (bylaws, stock ledger, minutes)

- Separate financial records and tax filings

- Maintaining adequate capitalization

Failure to meet these obligations can result in penalties, loss of good standing, or even involuntary dissolution of the corporation. Establishing compliance calendars and considering professional assistance helps ensure adherence to all requirements.

Forming a C corporation involves several steps

C Corporation taxation explained: Double taxation, deductions, and strategies

C corps face a unique tax structure that impacts overall business profitability. Its taxation involves multiple layers, available deductions, and strategic opportunities that business owners must navigate to optimize their tax position.

How C Corps are taxed: The double taxation issue

Double taxation represents one of the most significant tax considerations for C corp owners. This occurs when corporate profits are taxed twice - first at the corporate level and again at the individual level when distributed as dividends to shareholders. The process works in two distinct stages. First, the corporation pays federal income tax on profits at a flat 21% rate. Then, when remaining profits are distributed as dividends, shareholders must report this income on their personal tax returns, where it's taxed according to their individual tax brackets.

Tax deductions and planning opportunities

C corporations benefit from numerous tax deductions unavailable to other business structures, potentially offsetting the double taxation disadvantage:

Available deductions:

- 100% of salaries, bonuses, and commissions paid to employees

- Complete deduction for employee health insurance and benefits packages

- Charitable contributions up to 10% of taxable income

- Unlimited carryforward of business losses

- Legal and professional service fees

- Business travel, meals (50%), and entertainment expenses

- Rent for business property and equipment

- Business insurance premiums

These deductions provide substantial tax planning opportunities. C corps can establish retirement plans like 401(k)s with higher contribution limits than sole proprietorships. Additionally, they may deduct 100% of health insurance premiums and qualified medical expenses, creating tax-advantaged benefits packages for employees and shareholder-employees. Foreign-operating corporations may access specialized deductions like Foreign-Derived Intangible Income (FDII).

Mitigating double taxation: Practical strategies

Smart tax planning can minimize the impact of double taxation through several practical approaches:

Effective tax strategies:

- Earnings retention - Keep profits within the corporation to finance growth rather than distributing dividends

- Reasonable compensation - Pay shareholder-employees market-rate salaries and bonuses (fully deductible to the corporation)

- Fringe benefits - Provide tax-advantaged health insurance, retirement plans, and other benefits to shareholder-employees

| Strategy | Tax benefit | Implementation complexity |

|---|---|---|

| Qualified small business stock | Up to 100% exclusion on capital gains | Medium (requires 5+ year holding period) |

| Tax-exempt investments | Income exempt from corporate tax | Low |

| Income timing | Strategic income/expense recognition | Medium |

The Qualified Small Business Stock (QSBS) exemption offers particularly powerful benefits, allowing up to 100% exclusion of gains from stock sales after a five-year holding period (capped at $10 million or ten times the adjusted basis). This applies to businesses with less than $50 million in assets, making it valuable for growing companies. Strategic planning also involves avoiding holding appreciating assets within the corporation, making thoughtful charitable contributions, and carefully timing income recognition and expense payments to minimize tax exposure.

C Corp vs. other business structures: LLCs, S Corps, and partnerships

Choosing the right business structure significantly impacts a company's taxation, liability protection, and growth potential. C corporations offer distinct advantages and limitations compared to other entity types.

C Corp vs. LLC

Limited Liability Companies (LLCs) and C corporations both provide liability protection, but they differ substantially in taxation and operational requirements. C corps face double taxation - profits are taxed at the corporate level and again when distributed as dividends to shareholders. LLCs, however, enjoy pass-through taxation where business profits flow directly to owners' personal tax returns, avoiding this double tax burden. This tax difference alone often drives many small businesses toward the LLC structure.

You can learn more about the differences between LLCs and Corporation to better understand the key aspects of each type.

The management structures contrast sharply between these entities. C corporations maintain rigid formalities with required shareholders, board of directors, and officers. They must conduct annual meetings, maintain detailed minutes, and follow strict corporate governance protocols. LLCs offer significantly more flexibility with member-managed or manager-managed options and fewer ongoing compliance requirements.

Capital raising comparison:

| Feature | C Corporation | LLC |

|---|---|---|

| Stock issuance | Can issue multiple stock classes | Cannot issue stock |

| Investor appeal | Preferred by VCs and investors | Limited outside investment options |

| Public offering | Can be listed on stock exchanges | Cannot go public |

| Ownership transfer | Easy transfer through stock sales | May require amending operating documents |

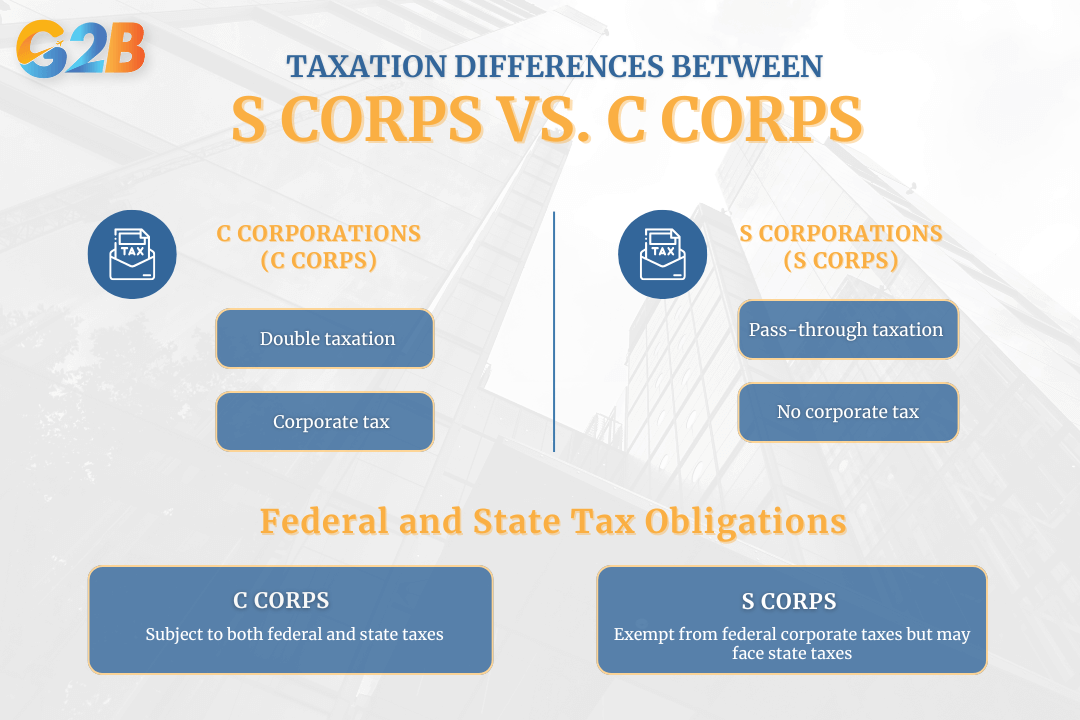

C Corp vs. S Corp

S corporations represent a hybrid structure that attempts to combine C corporation benefits with pass-through taxation advantages. The primary distinction between C corps and S corps lies in taxation. S corps avoid double taxation through pass-through taxation, where business profits and losses flow directly to shareholders' personal tax returns. C corps, meanwhile, pay corporate taxes on profits and shareholders pay personal taxes on dividends received.

Maybe you are interested in the difference between S Corps and C Corps

Ownership restrictions create another significant difference. C corporations allow unlimited shareholders with no citizenship requirements and permit multiple classes of stock, features essential for complex fundraising. S corporations face strict limitations: No more than 100 shareholders, all of whom must be US citizens or residents, and only one class of stock permitted. These restrictions make S corps unsuitable for businesses seeking substantial outside investment or planning an eventual public offering.

The primary distinction between C corps and S corps lies in taxation

C Corp vs. partnerships and sole proprietorships

Partnerships and sole proprietorships represent simpler business forms that contrast sharply with the corporate structure of C corporations. The liability protection distinction is the most critical difference. C corporation shareholders' personal assets remain protected from business debts and legal claims. Partners in general partnerships and sole proprietors bear unlimited personal liability for business obligations, putting their personal assets at risk. This fundamental protection difference often justifies the additional compliance requirements of maintaining a C corp.

Maybe you are interested in the detail comparison between Corporations and partnerships

Business continuity varies significantly across these structures. C corporations maintain perpetual existence regardless of ownership changes, creating stability that attracts investors. Partnerships may dissolve with partner departures, and sole proprietorships terminate upon the owner's retirement or death, creating potential succession challenges.

Entity comparison by business need:

- Capital-intensive growth: C corporation (stock issuance, investor appeal)

- Professional services: Partnership (simplicity, profit-sharing flexibility)

- Single-owner, low-risk business: Sole proprietorship (minimal formalities)

- Tax minimization focus: LLC or S corporation (pass-through taxation)

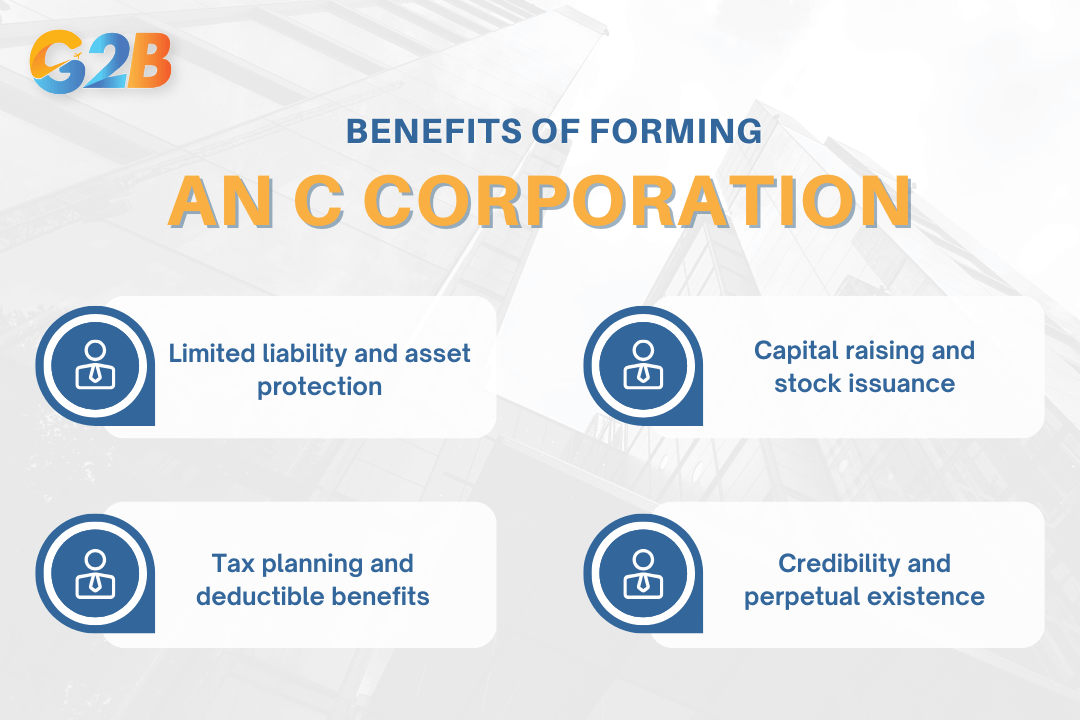

Benefits of a C Corporation: Why choose this structure?

C corporations (C corps) offer entrepreneurs a powerful business structure with significant advantages for growth-oriented companies. These entities provide a formal legal framework that separates business operations from personal finances.

Limited liability and asset protection

C corps provide robust asset protection by creating a legal separation between the business and its owners. Shareholders' personal assets - homes, vehicles, savings accounts, and investments - remain protected from business creditors and legal claims against the corporation. This protection extends even if the business faces bankruptcy or substantial lawsuits.

This shield functions as a corporate veil that insulates owners from personal responsibility for company debts and obligations. For example, if a C corp cannot pay its suppliers or defaults on a business loan, creditors generally cannot pursue the personal holdings of shareholders. This protection proves especially valuable for businesses operating in high-risk industries or those with significant potential liabilities. The limited liability protection also transfers to new owners when shares change hands, maintaining this crucial benefit regardless of ownership transitions.

Capital raising and stock issuance

C corps excel at attracting investment capital through their flexible stock structure. Unlike other business entities, C corps can issue multiple classes of stock with different rights and privileges, accommodating various investor preferences and requirements.

- Unlimited shareholders: C corps can have any number of investors, both domestic and foreign

- Stock classes: Can issue preferred shares with priority dividend payments and common shares with voting rights

- Public market access: Only C corps can be publicly traded on major exchanges like NYSE and NASDAQ

- Convertible securities: Ability to offer convertible notes and warrants to early investors

Venture capitalists and angel investors typically prefer investing in C corps due to this flexibility and the established legal precedents governing corporate structures. The ability to issue preferred stock with liquidation preferences protects early investors while still allowing founders to maintain control through common shares with voting rights.

Tax planning and deductible benefits

C corps possess unique tax advantages that benefit certain business scenarios despite the well-known issue of double taxation. These corporations can deduct a wider range of business expenses than other entity types, creating significant tax-planning opportunities. C corps can fully deduct:

- 100% of qualified employee benefits like health insurance, life insurance, and disability plans

- Charitable contributions (up to 10% of taxable income)

- Business travel, meals, and entertainment expenses

- Retirement plan contributions

- Business losses carried forward to future tax years

The flat 21% federal corporate tax rate benefits companies that reinvest substantial profits into growth. By strategically timing distributions and retaining earnings within the corporation, businesses can effectively manage their overall tax burden. High-income business owners may find that a combination of reasonable salary payments and strategic dividend timing results in lower overall taxation than pass-through structures.

Credibility and perpetual existence

C corps project stability and reliability to potential partners, customers, and investors. The formal structure signals commitment and professionalism, enhancing business credibility in competitive markets. The perpetual existence of C corps represents a significant advantage for business continuity. Unlike sole proprietorships or partnerships that may dissolve when owners depart, C corps continue operating regardless of changes in ownership or management. This continuity ensures:

- Uninterrupted business operations during ownership transitions

- Simplified succession planning for family businesses

- Increased business value for potential acquisition

- Protection of established customer relationships and contracts

The corporate structure creates a lasting entity that transcends individual participants, allowing businesses to build long-term value across generations. This permanence appeals particularly to founders planning eventual exits while ensuring their company legacy continues.

C corps offer significant advantages for growth-oriented companies

Choosing the best state for incorporation: Pros, cons, and practical guidance

Selecting the right state for C corp incorporation significantly impacts tax obligations, legal protections, and operational costs. Each jurisdiction offers distinct advantages and disadvantages that align with different business needs and growth trajectories.

Popular states for incorporation: Delaware, Nevada, California, and others

Delaware stands as the premier choice for C corps seeking investor backing or planning public offerings. The state offers a specialized Court of Chancery dedicated exclusively to business matters, creating predictable legal outcomes backed by extensive case precedent. Delaware corporations benefit from flexible corporate statutes, minimal disclosure requirements, and no state corporate income tax for operations conducted outside Delaware.

Start with confidence - our incorporation service in the US is professional, supportive, and with you from day one!

Nevada attracts entrepreneurs prioritizing privacy and tax advantages. The state imposes no corporate income tax, no franchise tax, and no personal income tax. Nevada corporations enjoy strong privacy protections with no public disclosure of officers or directors. Though Nevada lacks Delaware's specialized business courts, its asset protection laws and minimal regulatory oversight appeal to small and mid-sized businesses seeking operational flexibility.

California represents a practical choice for businesses with significant in-state operations. Despite higher registration fees and an $800 minimum franchise tax, incorporating in California eliminates the need to register as a foreign entity when conducting business there. Local corporations benefit from simplified compliance, established banking relationships, and local market credibility.

Other contenders include Wyoming, with low taxes and strong privacy protections, and Florida, offering no personal income tax and business-friendly regulations.

Factors to consider when choosing a state

Physical location and operations should guide incorporation decisions. C corps operating primarily in one state typically register there, avoiding foreign qualification requirements and additional fees. Companies with multi-state operations may benefit from incorporating in business-friendly jurisdictions like Delaware.

Tax implications vary dramatically across states. Delaware imposes a franchise tax (calculated by authorized shares) but no state income tax for out-of-state operations. Nevada offers no corporate income or franchise taxes. California and New York maintain higher tax burdens but may provide other advantages for locally-focused businesses.

Legal protections and governance differ in quality and scope. Delaware's Court of Chancery provides specialized business dispute resolution with over 200 years of corporate case law. Nevada offers strong liability protections for officers and directors. These legal environments directly impact shareholder rights, board authority, and dispute resolution processes.

Compliance requirements and costs include annual reports, franchise taxes, and regulatory filings that accumulate over time. Delaware corporations pay annual franchise taxes and report fees. Nevada requires annual lists and business license fees. California mandates annual reports and minimum $800 franchise tax payments.

C Corporation formation checklist: Action steps for entrepreneurs

This checklist guides entrepreneurs through the essential steps to properly form and maintain a C corporation, ensuring compliance with state and federal regulations from day one.

- Business name and formation preparation

- Choose a distinctive business name and verify availability through state database searches

- Conduct trademark searches to avoid infringement issues

- Select the state of incorporation based on business needs and tax considerations

- Determine initial capitalization and stock structure

- Filing formation documents

- Prepare and file Articles of Incorporation with the Secretary of State

- Pay the required filing fees

- Designate a registered agent with a physical address in the state of incorporation

- Draft comprehensive corporate bylaws governing internal operations

- Establishing corporate governance

- Appoint the initial board of directors

- Hold and document organizational meeting to:

- Adopt bylaws

- Appoint corporate officers

- Authorize stock issuance

- Set the fiscal year and accounting method

- Create and maintain corporate record book with meeting minutes

- Stock issuance and ownership structure

- Issue stock certificates to initial shareholders

- Record all ownership in the stock transfer ledger

- Prepare and execute shareholder agreements (if applicable)

- File Form 2553 if electing S corporation status (optional)

- Government registrations

- Obtain Federal Employer Identification Number (EIN) from the IRS

- Register for state tax accounts (income, sales, payroll)

- Apply for business licenses and permits at federal, state, and local levels

- File initial reports as required by state law

- Financial infrastructure

- Open dedicated corporate bank account with formation documents

- Establish an accounting system and procedures

- Set up a payroll system if hiring employees

- Implement expense tracking for tax purposes

- Ongoing compliance requirements

- Calendar annual report deadlines and franchise tax payments

- Schedule regular board and shareholder meetings

- Maintain corporate formalities to preserve liability protection

- File federal and state tax returns by applicable deadlines

- Additional considerations

- Secure business insurance (general liability, D&O, etc.)

- Register trademarks and protect intellectual property

- Review and comply with industry-specific regulations

- Establish clear employment policies and procedures

This C corp formation checklist helps entrepreneurs avoid costly mistakes and establish a solid foundation for business growth. Consulting with qualified legal and tax professionals during this process is highly recommended to address specific circumstances and ensure full compliance with all regulations.

Frequently asked questions (FAQs) about C Corporations

The C corporation structure offers unique advantages for business owners but comes with specific requirements and considerations. Here are answers to the most common questions entrepreneurs have when considering or managing a C corp.

What are the tax advantages and disadvantages of a C Corporation?

C corps face double taxation - profits are taxed at the corporate level and again when distributed as dividends to shareholders. However, they offer significant tax advantages:

Advantages:

- Broader range of tax-deductible business expenses

- Ability to retain earnings at corporate tax rates

- Medical insurance premium deductibility

- Retirement plan contribution deductions

- Income splitting between the corporation and shareholders

Disadvantages:

- Double taxation on distributed profits

- Required quarterly estimated tax payments

- More complex tax filings and reporting requirements

- Higher preparation costs for tax compliance

How does C Corporation governance work?

C corporation governance follows a specific hierarchical structure:

- Shareholders own the corporation and elect directors

- Board of Directors oversees management and sets policy

- Officers (CEO, CFO, etc.) handle daily operations

Required governance activities include:

- Annual shareholder meetings

- Regular board meetings with formal minutes

- Maintaining corporate records and resolutions

- Following bylaws for decision-making processes

- Documenting major corporate actions

Failure to maintain proper governance can risk "piercing the corporate veil," potentially exposing shareholders to personal liability.

When should a business choose a C Corporation instead of an LLC or S Corporation?

Businesses should consider a C corporation when:

- Planning to raise capital through venture funding

- Expecting to eventually go public

- Needing to issue multiple classes of stock

- Requiring more than 100 shareholders

- Wanting to attract foreign investors

- Planning to reinvest significant profits into growth

- Seeking certain fringe benefit deductions

LLCs and S corporations typically work better for businesses seeking pass-through taxation, simpler compliance requirements, or flexibility in management structure.

How do C Corporations compare to S Corporations for small businesses?

| Feature | C Corporation | S Corporation |

|---|---|---|

| Taxation | Corporate level + shareholder level | Pass-through taxation |

| Ownership | Unlimited shareholders, no restrictions | Max 100 shareholders, US citizens/residents only |

| Stock | Multiple classes allowed | One class of stock only |

| Fiscal year | A flexible fiscal year allowed | Calendar year required |

| Fringe benefits | More tax-deductible benefits | Limited deductible benefits |

| Foreign investment | Can have foreign shareholders | No foreign shareholders |

| Complexity | Higher compliance requirements | Moderate compliance requirements |

| Ideal for | High-growth companies, capital raising | Small to medium businesses with US owners |

Embracing a C corp structure empowers entrepreneurs with a secure foundation, offering protection and growth potential through stock issuance and compliance with complex regulations. It aligns seamlessly with an investor's need for credibility while optimizing tax positions. For those with an entrepreneurial spirit, the C corp stands as an emblem of ambition and foresight, anchoring businesses in a legacy of scalability and respect in the competitive world of commerce.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom