The procedure to close a Representative Office (RO) in Vietnam is a multi-stage legal process requiring formal approvals from at least two key government bodies: the Tax department and the Department of industry and trade (DOIT). The primary objective is to finalize all financial obligations, particularly Personal income tax (PIT) for employees, before officially terminating the RO's license. This guide provides a detailed breakdown of every step, document, and obligation involved.

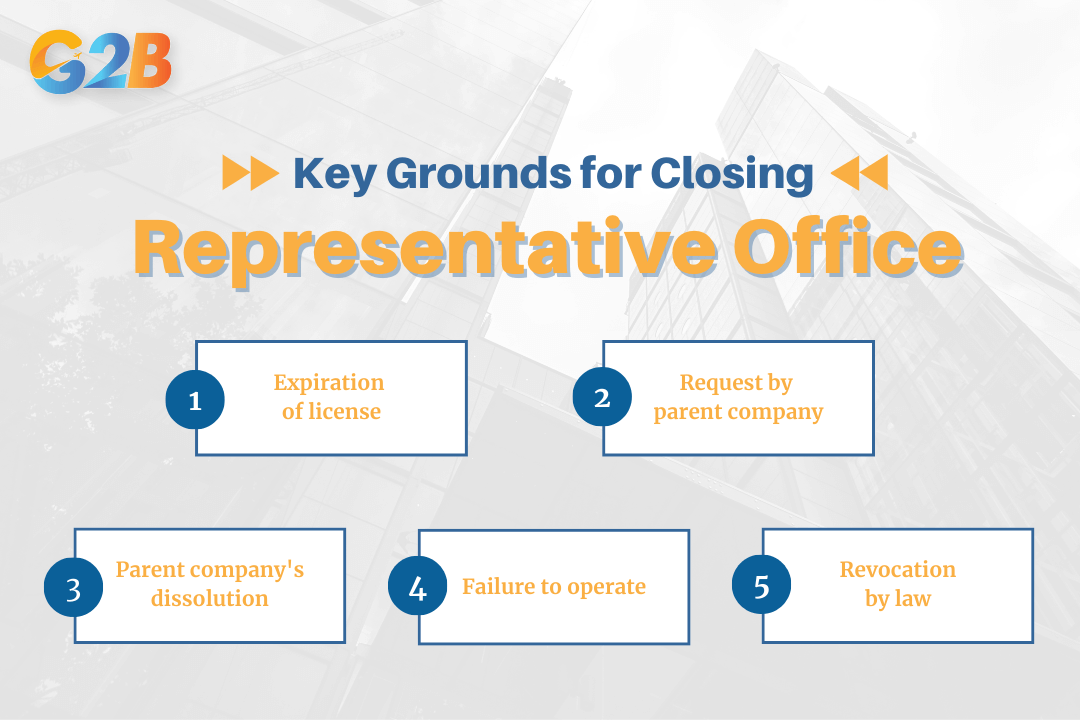

Key legal grounds for closing a representative office

An RO must be closed when certain legal conditions are met. The termination is not optional in these cases.

- Expiration of license: The operation license is valid for 5 years. If the parent company does not submit an application for renewal, it must initiate the closure procedure.

- Request by the parent company: The foreign company decides to withdraw from the market or restructure its presence (e.g., upgrading to a Limited Liability Company).

- Parent company's dissolution: If the parent company ceases to exist (due to bankruptcy or mergers and acquisitions), its dependent units, including the RO in Vietnam, must also be dissolved.

- Failure to operate: If the RO does not commence operations within a specified period after licensing, the authorities can revoke the license.

- Revocation by law: The DOIT can force a closure if the RO violates Vietnamese law. The most common violation is conducting profit-generating activities, which is strictly forbidden.

Key legal grounds for closing a representative office

Comprehensive document checklist for RO dissolution

The accuracy and completeness of your dossier are non-negotiable. Each document serves a specific purpose in proving the RO has fulfilled its obligations.

1. Core legal forms

- Notification of termination of operation (Form MD-5): This is the central application form, issued by the Ministry of Industry and Trade. It must be signed by the legal representative in Vietnam of the parent company or an authorized person.

- Original representative office license: The physical certificate issued by the DOIT upon establishment. If lost, a formal request for a certified copy must be made.

2. Financial & tax clearance documents

- Tax completion certificate: This is the most critical document. It is issued by the local Tax Department managing the RO, confirming that all tax liabilities (primarily PIT for staff and any other potential levies) have been fully paid. The dissolution process cannot proceed to the final step without this certificate.

- List of creditors and paid debts: A formal declaration, signed by the Chief of the RO, confirming that all debts to landlords, suppliers, and service providers have been settled.

- Bank confirmation: A letter from the bank confirming the opening a bank account in Vietnam has been reversed.

3. Employee & social insurance documents

- List of employees and settled benefits: A document detailing that all employment contracts have been legally terminated.

- Proof of settled obligations: Evidence of final salary payments, severance allowances (if any), and full payment of Social Insurance (SI), Health Insurance (HI), and Unemployment Insurance (UI) contributions to the Social Insurance Agency.

4. Other essential items

- Original office seal (the stamp): The physical circular stamp of the RO.

- Letter of authorization (power of attorney): Required if the parent company hires a third-party consultancy to handle the dissolution procedure. This document must be notarized and consular legalized.

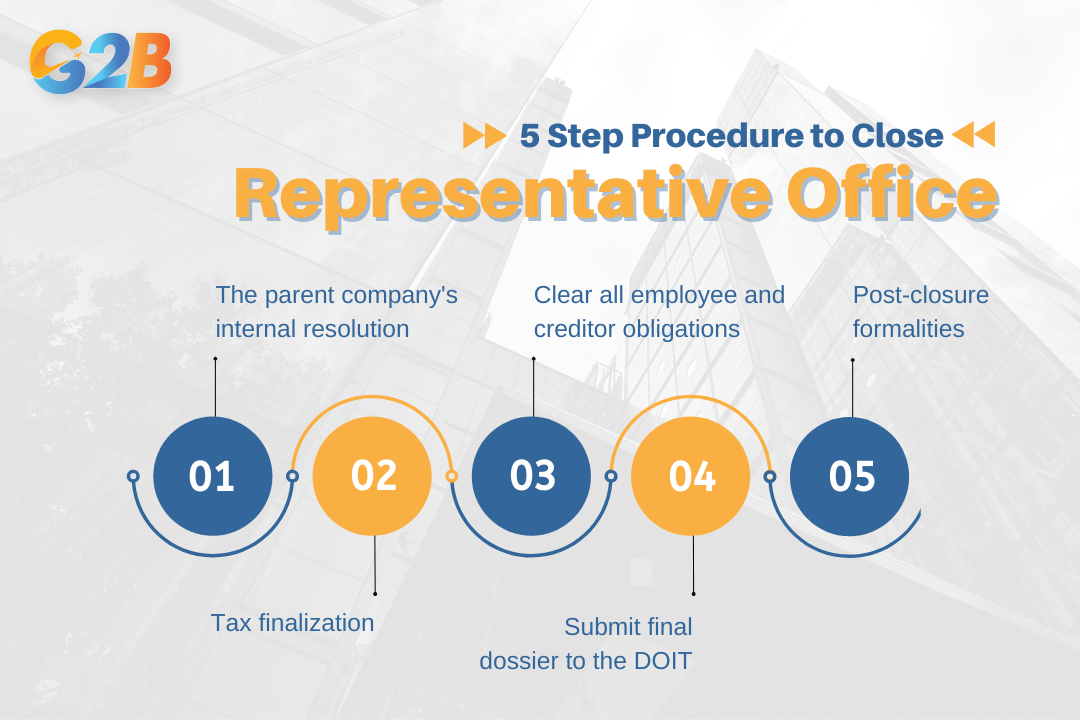

The 5-step procedure to close an RO in Vietnam

The closure process is strictly sequential. Attempting to bypass a step will result in rejection.

Step 1: The parent company's internal resolution

Before engaging with any Vietnamese authorities, the parent company must formalize its intent.

- Action: The Board of Directors or the legal representative of the parent company must issue an official, signed "Decision on the Termination of the Representative Office in Vietnam."

- Content: This document should clearly state the reason for closure and the effective date. It acts as the legal mandate for the Chief of the RO and any appointed service providers to proceed.

Step 2: Tax finalization

This phase involves working directly with the local Tax Department and is the most common source of delays.

- Cease operations & prepare records: Stop all operational activities. Gather all financial records, including bank statements, payroll documents, employee contracts, and office lease contracts. Ensure compliance with Vietnam accounting standards during this review

- Submit tax finalization dossier: The RO submits a request for tax code closure to the Tax Department. This includes the final PIT declarations and all supporting accounting books.

- Tax review or audit: The Tax Department will review the RO's entire operational history. They will check for discrepancies between declared income for employees and actual payments. They may decide to conduct a tax audit at the RO's office. This involves a direct inspection of records and interviews.

- Settle outstanding liabilities: If the tax authority finds any unpaid PIT, late payment penalties, or administrative fines, the RO must pay them immediately.

- Obtain the tax completion certificate: Once the Tax Department is fully satisfied that all obligations have been met, they will issue the crucial Tax completion certificate. This can take anywhere from 30 days to several months.

Step 3: Clear all employee and creditor obligations

This step runs in parallel with Step 2.

- Terminate employment contracts: The RO must issue termination notices to all employees in accordance with the labor law in Vietnam, respecting the required notice periods. Please refer to our guide on terminating employees in Vietnam to avoid disputes.

- Settle final payments: Calculate and pay all final salaries, unused annual leave, and any applicable severance pay.

- Finalize social insurance: Report the decrease in labor to the Social Insurance Agency and pay all outstanding insurance contributions for employees up to the final month of employment. This is a mandatory step to protect employee rights.

- Pay all creditors: Liquidate all remaining debts, including final payments for office rent, utilities, and other third-party services.

Step 4: Submit final dossier to the Department of Industry and Trade (DOIT)

With the Tax Completion Certificate in hand, the final administrative step can be taken.

- Action: Submit the complete dissolution dossier (as listed in the checklist) to the DOIT office that issued the original license.

- Review process: The DOIT officer will verify that every required document is present, especially the tax clearance certificate. They will check the validity of signatures and the consistency of information.

- Issuance of termination notice: According to law, the DOIT has 03 working days from receiving a valid and complete dossier to issue the Official notification of termination. This document officially revokes the RO's license and removes it from the national database.

Step 5: Post-closure formalities

The process is not complete until the RO's legal symbols are nullified.

- Return the seal: The RO must return its physical stamp to the Police Department for administrative management of social order (PC06) that initially registered it. They will issue a certificate confirming the seal has been returned.

- Close bank account: If not already done, provide the bank with the DOIT's termination notice to formally close the RO's bank account.

5-step procedure to close an RO in Vietnam

Estimated timeline and cost analysis

| Phase | Description | Estimated Timeline | Associated Costs |

|---|---|---|---|

| Step 1 & 2: Tax Finalization | The most unpredictable phase. Depends on the tidiness of the RO's financial records and the tax authority's workload. | 1 - 3 Months | - Payment of any outstanding PIT or fines found. - Accounting service fees for preparation. |

| Step 3: Clearing Obligations | Can be done concurrently with tax finalization. | 30 - 45 Days | - Final salary and severance payments. - Final social insurance contributions. |

| Step 4: DOIT Submission | A quick administrative step once all other documents are ready. | 3 - 5 Working Days | - Nominal state application fees. |

| Step 5: Post-Closure | Returning the seal and closing the bank account. | 3 - 5 Working Days | - None. |

| Total Estimated Time | 2 - 4 Months | ||

| Professional Service Fees | If hiring a law firm or consultancy to manage the entire process. | Varies based on complexity, but typically a fixed-fee package. |

Common questions on RO dissolution

1. What happens to the assets of the Representative Office? An RO does not own significant assets as it cannot engage in direct business. Office equipment (laptops, furniture) can be sold, transferred, or shipped back to the parent company. Any sale must be documented properly, though it generally does not trigger CIT as the RO is a cost center.

2. What if the chief of the RO has already left Vietnam? This complicates the process. The Chief is often required to sign final documents. If they have left, the parent company must issue a legalized Power of Attorney to appoint another person in Vietnam (e.g., a law firm representative) to act on their behalf.

3. Can the dissolution process be expedited? No. The timeline is dictated by the government agencies, primarily the Tax Department. The only way to "speed up" the process is to have perfectly organized accounting, payroll, and tax records from the very beginning to facilitate a smooth tax review.

4. What are the consequences of abandoning an RO without proper closure? Abandoning an RO is a serious violation. The parent company will be blacklisted, preventing it from making any future investments in Vietnam. The Chief of the RO may be barred from re-entering Vietnam, and unresolved tax debts will continue to accrue penalties. It is a far more costly option in the long run.

Ready to enter the Vietnam market? G2B provides Incorporation services with an excellent customer experience, helping you do right from the start and minimising risk when setting up a company in this dynamic environment.

Whether you need a full Vietnam Incorporation Service or specific advice on company setup process and requirements in Vietnam, G2B is here to support your success!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom