Fiscal policy is one of the most powerful tools governments use to influence a nation’s economic performance. Through decisions on taxation, public spending, and borrowing, fiscal policy shapes growth, employment, inflation, and overall stability. This article explores the foundations of fiscal policy, its primary goals, the main types in practice, critical factors to consider, and its far-reaching impact on both domestic and global markets.

This article outlines the key aspects of fiscal policy to help businesses and individuals gain a clearer understanding of its definition, objectives, and practical applications. We specialize in company formation services in Vietnam and do not provide fiscal policy consulting or investment advice. For specific matters related to accounting, taxation, or financial planning, please consult a qualified legal or financial expert.

What is fiscal policy?

Fiscal policy is the use of government spending and taxation to manage aggregate demand and influence overall economic activity. It essentially encompasses the government's budget policy, impacting everything from job creation to price stability and economic growth by controlling inflation and unemployment. Understanding fiscal policy is crucial for businesses as it directly affects the economic environment in which they operate. For example, changes in tax rates can significantly impact a company's profitability, while increased government spending on infrastructure projects can create new market opportunities and stimulate economic growth.

Goals of fiscal policy

The overarching goals of fiscal policy are diverse and aimed at fostering a stable and prosperous economy. These include:

- Economic growth: Fiscal policy aims to increase GDP, raise living standards, and improve productivity. Economic growth is needed for long-term prosperity. For instance, government investment in research and development can foster innovation and drive economic expansion.

- Full employment (low unemployment): Fiscal policy seeks to minimize joblessness, maximize workforce participation, and reduce poverty. This is important for social stability and individual well-being. Expansionary fiscal policies, such as tax cuts or increased government spending, can stimulate job creation.

- Price stability (controlling inflation): Fiscal policy aims to maintain a stable price level, preventing rapid price increases (inflation) or decreases (deflation). Inflation erodes purchasing power, while deflation discourages spending. Independent central banks manage monetary policy to directly control inflation, but governments also play their part, with lower spending and higher taxes being effective in controlling inflationary pressures.

- Income redistribution (equity): Fiscal policy works to reduce income inequality and provide a safety net for the vulnerable. This promotes fairness and social cohesion. Progressive tax systems, where higher earners pay a larger percentage of their income in taxes, are a common tool for income redistribution. Social welfare programs, such as unemployment benefits and food stamps, also contribute to this goal.

- Sustainable development (long-term focus): Fiscal policy strives to promote economic growth while protecting the environment and natural resources. This ensures future generations can meet their needs. Examples include investing in renewable energy, providing subsidies for energy-efficient technologies, and implementing carbon taxes to discourage pollution.

3 Types of fiscal policy

Fiscal policy can be categorized into three main types. Each type has distinct objectives and methods.

Fiscal policy can be categorized into three main types

1. Expansionary fiscal policy

Expansionary fiscal policy is defined as an increase in government spending and/or a decrease in taxes to stimulate economic activity. It's typically used during recessions or periods of slow economic growth. Examples include infrastructure projects, tax cuts, and increased unemployment benefits.

The goal of expansionary fiscal policy is to increase aggregate demand and boost economic output. This can be achieved through various measures that put more money into the hands of consumers and businesses. During an economic downturn, the government might launch a large-scale infrastructure project, such as building new highways or bridges. This creates jobs, boosts demand for materials and services, and injects money into the economy. Tax cuts, particularly for low- and middle-income households, can also stimulate spending and encourage businesses to invest.

2. Contractionary fiscal policy

Contractionary fiscal policy is defined as a decrease in government spending and/or an increase in taxes to slow down economic activity and combat inflation. This type of policy is implemented when the economy is growing too rapidly, leading to unsustainable price increases. Examples include spending cuts, tax increases, and reduced government programs.

The primary purpose of contractionary fiscal policy is to reduce inflationary pressures and prevent the economy from overheating. By decreasing government spending or increasing taxes, the government aims to reduce aggregate demand and slow down the pace of economic growth. For instance, if inflation is soaring, the government might reduce its spending on non-essential programs and raise taxes to curb consumer spending. This helps to cool down the economy and prevent prices from spiraling out of control.

3. Neutral fiscal policy

Neutral fiscal policy is defined as a situation where government spending and tax revenues remain relatively constant. This results in a balanced budget or stable government debt. While rare, a neutral fiscal policy suggests the government is neither actively stimulating nor restraining the economy through fiscal measures.

While seemingly passive, a neutral fiscal policy plays an important role in maintaining economic stability by avoiding drastic shifts in aggregate demand. Instead of actively intervening, the government focuses on maintaining the status quo. For example, if the government maintains current spending levels and tax rates from the previous year, it is pursuing a neutral fiscal policy. This approach can be appropriate when the economy is already operating at or near its potential and there are no significant inflationary or recessionary pressures.

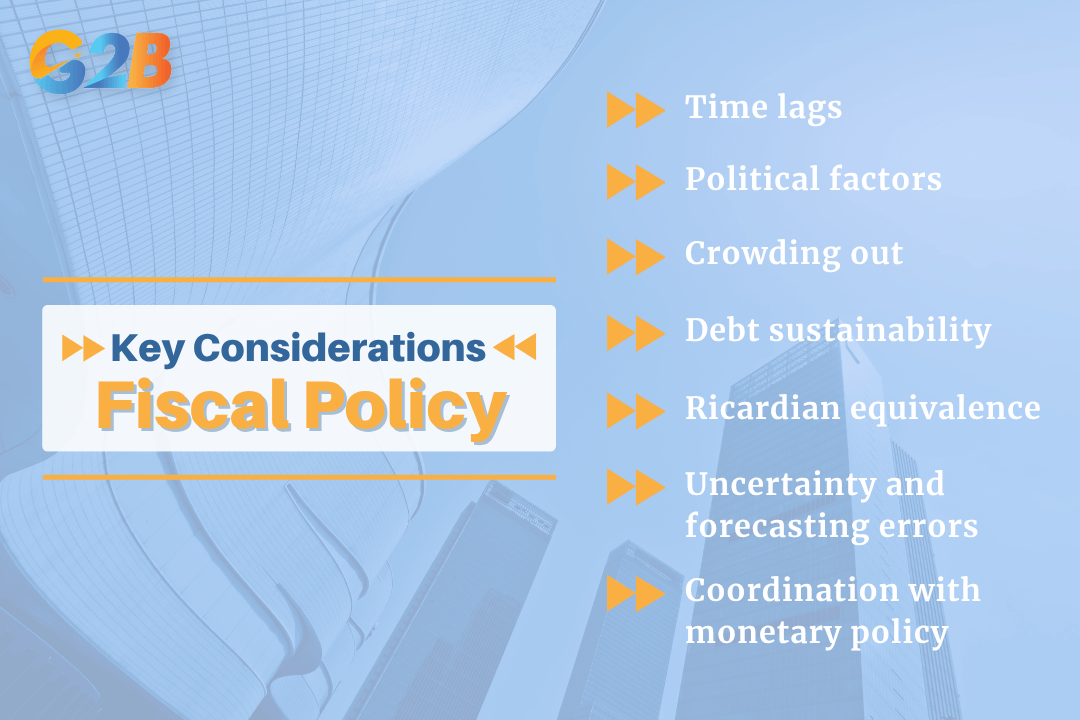

Key considerations about fiscal policy

Successfully implementing fiscal policy requires careful consideration of several factors that can impact its effectiveness:

- Time lags:

- Recognition lag: The time it takes to identify the problem requiring fiscal intervention.

- Implementation lag: The time it takes to approve and enact policies.

- Impact lag: The time for the policy to affect the economy. These lags can significantly delay the impact of fiscal policy. For instance, it can take months to gather enough economic data to accurately identify a recession (recognition lag). Then, it can take additional time for politicians to agree on a fiscal response and pass legislation (implementation lag). Finally, even after a policy is enacted, it can take several months or even years for its effects to fully materialize (impact lag).

- Political factors: Fiscal policy decisions are often influenced by special interest groups, election cycles, and ideological biases. This can lead to inefficient or ineffective policies. For example, a government facing an upcoming election might implement short-term tax cuts to boost popularity, even if they are not economically sound in the long run.

- Crowding out: Government borrowing to finance fiscal stimulus can increase interest rates, reducing private investment, resulting in less capital formation. This occurs because the government competes with private businesses for available loanable funds.

- Debt sustainability: High debt levels can lead to higher interest payments, reduced fiscal flexibility, and potential economic crises. Responsible debt management is essential. A country with a high debt-to-GDP ratio may find it difficult to borrow money at affordable rates, limiting its ability to respond to future economic shocks.

- Ricardian equivalence: The theory that individuals save tax cuts anticipating future tax increases to pay for government debt. This limits the effectiveness of tax cuts as a stimulus. If people believe that a tax cut today will be offset by higher taxes in the future, they may choose to save the extra money instead of spending it, thus negating the intended stimulative effect.

- Uncertainty and forecasting errors: Economic forecasts are imperfect, leading to policy mistakes. Unexpected events (shocks) can disrupt policy effectiveness. For example, a sudden global pandemic can completely undermine the effectiveness of a previously planned fiscal stimulus package.

- Coordination with monetary policy: Fiscal and monetary authorities need to work together to achieve common goals. Conflicting policies can undermine economic stability. If the government is pursuing expansionary fiscal policy while the central bank is raising interest rates to combat inflation, the two policies may cancel each other out. Therefore, governments must coordinate their strategies for the best possible results.

Successfully implementing fiscal policy requires careful consideration of several factors

Tools of fiscal policy

Governments utilize a variety of tools to implement fiscal policy, primarily focusing on government spending and taxation:

- Government spending:

- Infrastructure Projects: These include roads, bridges, public transportation, etc.. Government spending on infrastructure can create jobs and stimulate economic activity.

- Education and healthcare: This covers schools, hospitals, research, etc.. Investing in education and healthcare can improve human capital and boost long-term productivity.

- Defense: This includes military spending and national security.

- Social Welfare Programs (Transfer Payments): These include unemployment benefits, Social Security, food stamps, etc. Social welfare programs provide a safety net for vulnerable populations and can help to stabilize demand during economic downturns.

- Taxation:

- Income taxes (Individual and corporate): These are taxes on earnings and profits.

- Sales taxes (VAT): These are taxes on consumption.

- Property taxes: These are taxes on real estate and other property.

- Excise taxes: These are taxes on specific goods (e.g., gasoline, alcohol).

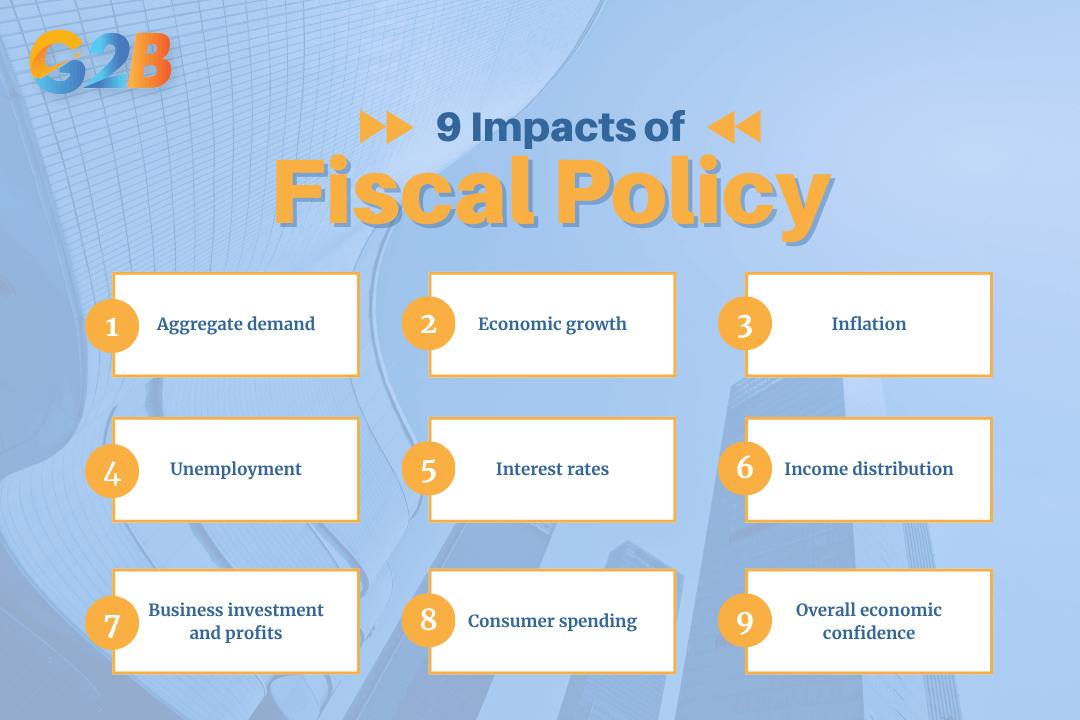

9 Impacts of fiscal policy on businesses

Fiscal policy has wide-ranging effects on businesses, impacting everything from demand and growth to inflation and investment.

There are 9 impacts of fiscal policy on businesses

1. Aggregate demand

Increased government spending boosts overall demand. Tax cuts increase disposable income, leading to higher consumer spending. For example, if the government invests heavily in infrastructure projects, it increases demand for construction materials, equipment, and labor, benefiting businesses in those sectors. Similarly, if individuals have more disposable income due to tax cuts, they are likely to spend more on goods and services, boosting revenue for businesses across various industries.

Aggregate demand significantly influences a business's potential revenue and profitability. When the government implements expansionary fiscal policy, it can lead to increased aggregate demand, benefiting businesses in many sectors. For instance, businesses in the consumer discretionary sector may experience higher sales as consumers have more disposable income due to tax cuts or increased government benefits.

2. Economic growth

In the short-term, fiscal policy can provide stimulus from increased spending/tax cuts. In the long-term, investment in infrastructure, education, and technology increases productivity. Effective fiscal policy provides increased long-term growth through government spending on public projects and the reduction of unemployment through fiscal policy.

Economic growth is a critical factor determining the long-term viability and success of businesses. Fiscal policies that promote economic growth, such as investments in infrastructure, education, and technology, can enhance productivity and competitiveness. For example, businesses may benefit from improved infrastructure, leading to reduced transportation costs and increased access to markets.

3. Inflation

Excessive expansionary policy can lead to rising prices. Companies face higher costs for inputs. If the government injects too much money into the economy through expansionary fiscal policy, it can lead to inflation, which erodes the purchasing power of consumers and increases the cost of inputs for businesses.

Inflation can have a detrimental impact on businesses by increasing input costs and reducing consumer purchasing power. Businesses may need to raise prices to maintain profit margins, which can lead to decreased sales and competitiveness. For instance, businesses in industries with high energy or raw material costs may be particularly vulnerable to inflation.

4. Unemployment

Expansionary policy creates jobs. Increased demand for goods and services leads to hiring. When the government implements expansionary fiscal policies, it can stimulate economic activity and create jobs. This increased demand can lead to new hires from companies.

Unemployment rates directly affect the availability of skilled labor and wage levels. Expansionary fiscal policy can lead to reduced unemployment, benefiting businesses by increasing the pool of potential employees. However, low unemployment can also put upward pressure on wages, increasing labor costs for businesses.

5. Interest rates

Government borrowing can push up interest rates, increasing borrowing costs for businesses due to the crowding-out effect. As the government issues bonds to finance its spending, it can drive up interest rates, making it more expensive for businesses to borrow money for investment and expansion.

Higher interest rates can discourage business investment and expansion. Businesses that rely on borrowing to finance capital expenditures may find it more difficult to obtain financing at affordable rates. This can lead to decreased investment and slower economic growth.

6. Income distribution

Tax policies can impact the distribution of income, affecting consumer spending patterns. Changes in tax rates and social welfare programs can alter the distribution of income, affecting the amount of disposable income available to different segments of the population. This, in turn, influences consumer spending patterns and demand for various goods and services.

The distribution of income influences the demand for various goods and services. Businesses need to understand how fiscal policies affect income distribution to anticipate changes in consumer spending patterns. For example, businesses that cater to high-income consumers may benefit from tax cuts that disproportionately favor wealthy individuals.

7. Business investment and profits

Tax incentives can encourage investment. Higher demand and lower taxes can boost profits. Fiscal policy can encourage business investment through tax incentives, such as tax credits for research and development or accelerated depreciation schedules for new equipment.

Fiscal policy can directly impact business investment and profitability. Tax incentives, such as tax credits for research and development, can encourage businesses to invest in innovation and expand their operations. Higher demand and lower taxes can also boost profits, providing businesses with more resources to reinvest in growth.

8. Consumer spending

Tax cuts and increased government benefits increase disposable income, leading to higher spending. This impacts businesses in consumer goods and services sectors. Consumers who have more disposable income spend it. This encourages growth for business in the consumer goods and services sectors.

Consumer spending is a critical driver of economic growth. Fiscal policies that boost consumer spending, such as tax cuts or increased government benefits, can have a significant impact on businesses in the consumer goods and services sectors. For example, businesses that sell non-essential goods or services may experience higher sales when consumers have more disposable income.

9. Overall economic confidence

Effective fiscal policy can boost confidence among businesses and consumers, leading to increased investment and spending. When businesses and consumers feel confident about the economic outlook, they are more likely to invest and spend, driving economic growth.

Economic confidence is a crucial factor driving business investment and consumer spending. Fiscal policies that foster a stable and predictable economic environment can boost confidence, encouraging businesses to invest in new projects and consumers to increase their spending. This can create a virtuous cycle of economic growth and prosperity.

From its core goals of fostering economic growth and maintaining price stability to the various tools and considerations involved in its implementation, fiscal policy significantly impacts business decisions and outcomes. Whether it's navigating the effects of expansionary or contractionary measures, assessing the implications of government spending and taxation, or anticipating the influence of political factors and economic uncertainty, businesses need to stay informed and adapt their strategies accordingly.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom