Business forecasting is the essential practice of using historical data and analysis to predict future outcomes for a company. It is a critical component of informed business management, transforming raw data into strategic intelligence. For entrepreneurs looking to register a company in Vietnam, understanding and applying forecasting techniques can help identify market opportunities, anticipate challenges, and build a more resilient business strategy. This article will explore the core definition and its importance, along with specific methods to make more informed, data-driven decisions.

This article outlines the key aspects of business forecasting to help companies and investors gain a clearer understanding of this essential strategic planning tool. We specialize in company formation and do not provide financial advisory or forecasting consultancy services. For in-depth forecasting implementation, please consult a qualified financial analyst or relevant expert.

What is business forecasting?

Business forecasting is the process of estimating future events and trends by analyzing past and present data. Its primary goal is to provide businesses with a reliable foundation for strategic decision-making and planning. The process involves a detailed examination of historical data, the identification of patterns, and the application of statistical models to project future performance. Forecasting involves analyzing various data points, such as past sales figures, economic indicators, and market trends, and can also incorporate qualitative information and external market insights. By anticipating market changes and future business conditions, companies can better prepare for what lies ahead, turning uncertainty into opportunity.

The importance of forecasting in business and finance

Forecasting is a critical business function because it serves as the bedrock of strategic planning and sound financial management. It empowers organizations to allocate resources effectively, manage cash flow efficiently, and identify potential growth opportunities or risks before they materialize. Without a clear forecast, a business operates reactively, vulnerable to market shifts and competitive pressures. With a forecast, it can proactively chart its course, set realistic goals, and build a resilient strategy. Ultimately, its importance lies in providing a data-driven framework for navigating business uncertainty and making proactive decisions. This forward-looking perspective is indispensable for securing a competitive edge and achieving long-term sustainability.

Business forecasting vs. budgeting

While often used interchangeably, business forecasting and budgeting are distinct financial concepts with different purposes. A budget is a financial plan that outlines a company's expected revenue and expenditures over a specific period. It is a target - a destination the company aims to reach. A forecast, on the other hand, is a projection of future financial performance based on historical data and anticipated market conditions. It is a dynamic tool used for performance tracking and strategic adjustments. The key difference is their function: A budget sets a target of what you want to happen, whereas a forecast is an estimate of what you think will happen. A budget is static, while a forecast is regularly updated to reflect new information.

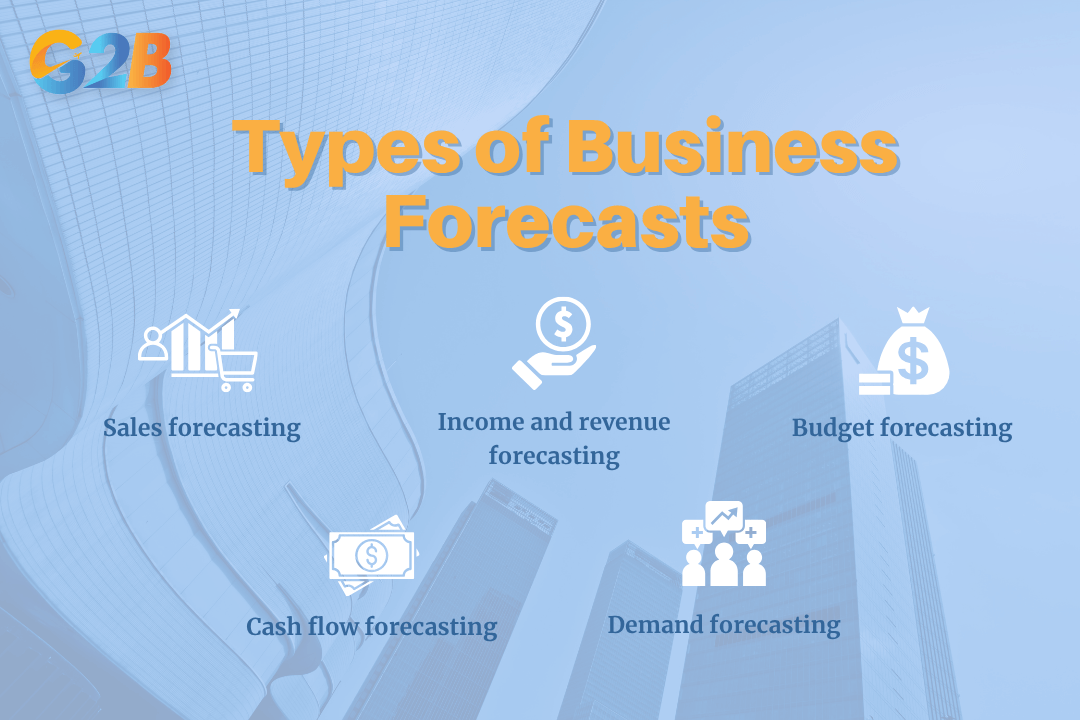

Types of business forecasts

Businesses use several types of forecasts to gain a complete and multi-faceted view of their future performance. Each type focuses on a different area of the organization, providing specialized insights that contribute to a holistic strategic plan.

Businesses use several types of forecasts to gain a complete and multi-faceted view of their future performance

1. Sales forecasting

Sales forecasting is the process of estimating future sales revenue. This forecast is foundational for nearly all other business planning, as it directly influences decisions related to inventory, staffing, and marketing spend. An accurate sales forecast helps companies manage their sales pipeline and set realistic targets for their sales teams.

2. Cash flow forecasting

Cash flow forecasting predicts the movement of cash into and out of a business over a specific period. Its importance is paramount for maintaining liquidity and managing working capital effectively. This forecast ensures a company has enough cash on hand to meet its obligations, such as payroll and supplier payments, preventing potential financial shortfalls.

3. Income and revenue forecasting

This type of forecast projects a company's profitability by estimating future revenues and expenses. It combines revenue data with projected costs to offer insights into profitability and cash flow, helping leaders understand potential profits and make strategic decisions about pricing, cost control, and investment opportunities.

4. Budget forecasting

Budget forecasting involves comparing actual financial performance against the established budget. This process helps managers stay on track with their financial goals and identify variances early. It provides the necessary insights to make timely adjustments to spending or operational strategies to ensure financial targets are met.

5. Demand forecasting

Demand forecasting is the process of estimating future customer demand for a product or service. This forecast has a significant impact on key operational areas, including inventory management, production scheduling, and supply chain logistics. By accurately predicting demand, businesses can optimize stock levels, avoid stockouts, and improve customer satisfaction.

Business forecasting methods

The best approach to business forecasting often depends on data availability, the desired accuracy, and the specific context of the business. The methods are broadly categorized into two main groups: qualitative and quantitative. The most effective strategies often blend elements from both.

The methods are broadly categorized into two main groups

Qualitative forecasting methods

Qualitative methods are subjective and are typically employed when historical data is scarce or irrelevant, such as when launching a new product or entering a new market. These methods rely on expertise and judgment rather than complex statistical computations.

- Delphi method: This is an iterative process that involves surveying a panel of experts to reach a group consensus. Experts provide their forecasts anonymously, and a facilitator shares the aggregated results, allowing them to revise their opinions over several rounds until a stable consensus emerges.

- Market research: This method involves gathering data directly from customers and the broader market to gauge future demand and trends. Common market research techniques include surveys, focus groups, and customer interviews, which provide direct insight into consumer behavior and preferences.

- Expert opinion: This approach relies on the intuition, experience, and judgment of one or more key internal or external experts. It can be a quick and straightforward way to generate a forecast, often used for high-level strategic planning.

Quantitative forecasting methods

Quantitative methods utilize historical numerical data and statistical models to predict future outcomes. These methods are objective and are best suited for situations where sufficient, reliable data is available and patterns are expected to continue into the future.

- Time series analysis: This method involves analyzing a sequence of data points collected over time to identify underlying patterns, such as trends, seasonal variations, and cyclical movements. The assumption is that past patterns will repeat in the future.

- Straight-line method: This is one of the simplest forecasting techniques, projecting a steady, linear rate of change based on historical data. It assumes that the variable being forecast will continue to increase or decrease at the same rate it has in the past.

- Moving average: This method is used to smooth out short-term fluctuations in data to highlight longer-term trends or cycles. It calculates the average of a specific number of the most recent data points, with the average being updated as new data becomes available.

- Regression analysis: This is a powerful statistical method used to model the relationship between a dependent variable (what you are trying to predict) and one or more independent variables (factors that influence the dependent variable). It helps in understanding how changes in the independent variables impact the outcome.

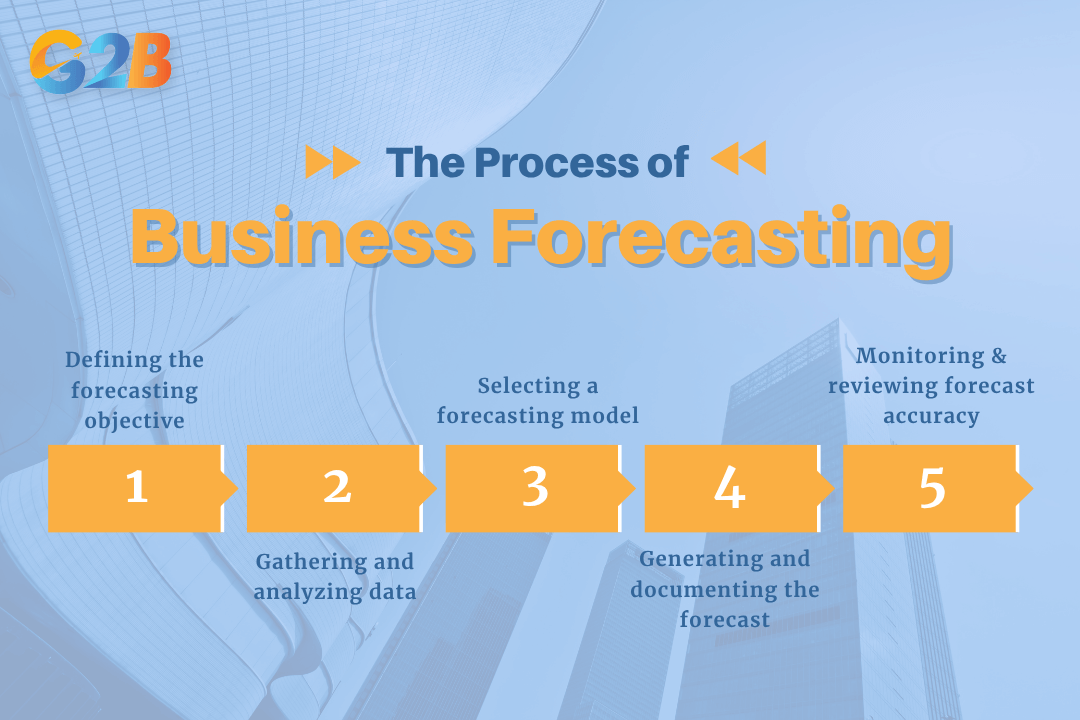

The business forecasting process

A structured, systematic process is essential for creating accurate and reliable forecasts. Following a clear set of steps ensures that the forecast is well-researched, properly documented, and consistently reviewed, leading to greater confidence in the results.

A systematic process is essential for creating accurate and reliable forecasts

Step 1: Defining the forecasting objective

The first step is to clearly identify what needs to be forecast and for what purpose. This involves defining the specific metric (e.g., quarterly sales revenue), the time horizon (e.g., the next 12 months), and how the forecast will be used to support business decisions.

Step 2: Gathering and analyzing data

This step involves collecting all relevant historical data. Once gathered, the data must be cleaned to remove errors or anomalies and then analyzed to identify patterns, trends, and relationships that will inform the forecast.

Step 3: Selecting a forecasting model

Based on the objective defined in the first step and the nature of the available data, the appropriate forecasting method is chosen. The decision hinges on several factors, such as the forecast horizon, data availability, and the required level of accuracy. Often, multiple models are tested to see which one performs best.

Step 4: Generating and documenting the forecast

Using the selected model, the forecast is generated. It is crucial at this stage to document all assumptions made during the process. This documentation provides context and transparency, making it easier to understand the forecast and evaluate its accuracy later.

Step 5: Monitoring and reviewing forecast accuracy

A forecast is not a one-time event. The final step is to continuously monitor the forecast by comparing it to actual results as they become available. This review process, known as variance analysis, helps identify inaccuracies and refine the forecasting process for the future, leading to continuous improvement.

Challenges and best practices in business forecasting

While the benefits are clear, the forecasting process is not without its difficulties. Acknowledging these challenges and adopting best practices is key to developing a reliable and effective forecasting capability.

Common forecasting challenges

Businesses face several forecasting challenges, such as poor data quality, sudden market volatility, and human bias.

- Data quality and availability: Inaccurate or incomplete historical data is a primary cause of faulty forecasts.

- Market volatility and unforeseen events: External shocks, like economic recessions or global pandemics, can render historical data irrelevant and disrupt even the most carefully prepared forecasts.

- Over-reliance on historical data: A common pitfall is assuming that future conditions will perfectly mirror the past, which is rarely the case in dynamic markets.

- Human bias: Personal optimism, pessimism, or departmental agendas can unconsciously skew assumptions and lead to inaccurate results.

Best practices for effective forecasting

To overcome these challenges and improve accuracy, businesses should adopt a set of proven best practices.

- Combining qualitative and quantitative methods: Using a hybrid approach creates a more balanced and robust forecast. Quantitative models provide an objective baseline, while qualitative insights add crucial context and expert judgment.

- Regularly updating and revising forecasts: Forecasts are living documents that should be updated frequently as new information becomes available. A static annual forecast is insufficient in today's fast-paced environment.

- Utilizing technology and software: Leveraging dedicated forecasting software can automate complex calculations, reduce human error, and improve the overall accuracy and efficiency of the process.

- Fostering collaboration across departments: Involving key stakeholders from sales, marketing, finance, and operations ensures that the forecast incorporates diverse perspectives and information. This cross-functional collaboration leads to a more holistic and reliable prediction.

Business forecasting is not about predicting the future with 100% certainty; that is an impossible task. Instead, its true power lies in its ability to help businesses make more informed, evidence-based, and strategic decisions in the face of uncertainty. It is a fundamental discipline that reduces ambiguity, enabling better planning, more efficient resource allocation, and proactive risk management. By embracing forecasting, a company transforms from being a passive reactor to market forces into an active architect of its own success.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom