A general partner is a central figure in many business and investment structures, wielding significant control but also shouldering immense responsibility. They are the hands-on managers, the decision-makers, and the individuals who are ultimately accountable for a partnership's fortunes and failures. As partnership models remain a popular option in company formation in Vietnam, understanding how a general partner operates - and the extent of their rights and liabilities - is crucial for both local and foreign investors. Let’s explore a comprehensive breakdown of a general partner in this article.

What is a general partner?

A general partner (GP) is an owner of a partnership who is actively involved in the daily management of the business. In both general partnerships and limited partnerships, the GP must be an individual who bears unlimited liability for the partnership’s debts and obligations with all of their assets and has the authority to make decisions and act on behalf of the partnership. This active management role is a defining characteristic and is often seen in professional service firms like law or medical practices, as well as in investment fund structures such as private equity and Angel Investors vs Venture Capital.

This is consistent with Article 177, Clause 1 of the Vietnamese Enterprise Law 2020, which states that a general partner must be an individual who is fully liable with all of their personal assets for the partnership’s obligations, and the partnership must have at least two general partners acting as co-owners.

Unlike a passive investor, a general partner is responsible for the strategic direction and operational execution of the partnership's goals. However, this control comes with a significant trade-off: The general partner has unlimited personal liability for the partnership's debts and obligations, meaning there is no legal distinction between the business and the general partner, putting their personal assets at risk.

According to Article 180 of the Vietnamese Enterprise Law 2020, a general partner cannot simultaneously own a private enterprise or be a general partner of another partnership without consent from all other general partners, nor conduct business in the same industry for personal gain or for others without approval, which restricts conflicts of interest. In the context of an investment fund, the GP is the fund manager, responsible for making investment decisions and overseeing the fund's operations, often receiving management fees and performance-based incentives.

The core responsibilities of a general partner

The duties of a general partner are extensive and span the entire lifecycle of the business or fund. They are ultimately responsible for the partnership's success and must act in its best interests.

The duties of a general partner are responsible for the partnership's success

Key responsibilities include:

- Strategic decision-making and day-to-day management: General partners are at the helm of the business, guiding its overall business plan and overseeing daily operations. This can range from hiring employees and purchasing goods to entering into contracts on behalf of the partnership.

- Fiduciary duty: A GP owes a fiduciary duty to the partnership and its partners, which includes the duty of care, the duty of loyalty, and the duty of disclosure. Although the Vietnamese law does not explicitly use the term “fiduciary duty,” general partners must carry out business honestly, diligently, and in good faith, complying with the law, the partnership's charter, and the members' resolutions.

- Capital raising and financial management: In investment funds, a primary role of the GP is to raise capital from investors, known as limited partners. They are also responsible for managing the partnership's finances, keeping accurate accounts, and ensuring the business remains solvent.

- Binding the partnership: A general partner has the authority to enter into legally binding agreements on behalf of the partnership. This power underscores the importance of trust among partners, as the actions of one GP can have significant financial and legal consequences for all others. According to Article 177 of the Vietnamese Enterprise Law 2020, general partners bear unlimited and joint liability with their personal assets for all debts and obligations of the partnership.

- Investment management (in fund contexts): For venture capital and private equity funds, GPs are responsible for the entire investment process. This includes sourcing deals, performing feasibility study on potential investments, and managing portfolio companies to drive growth and generate returns.

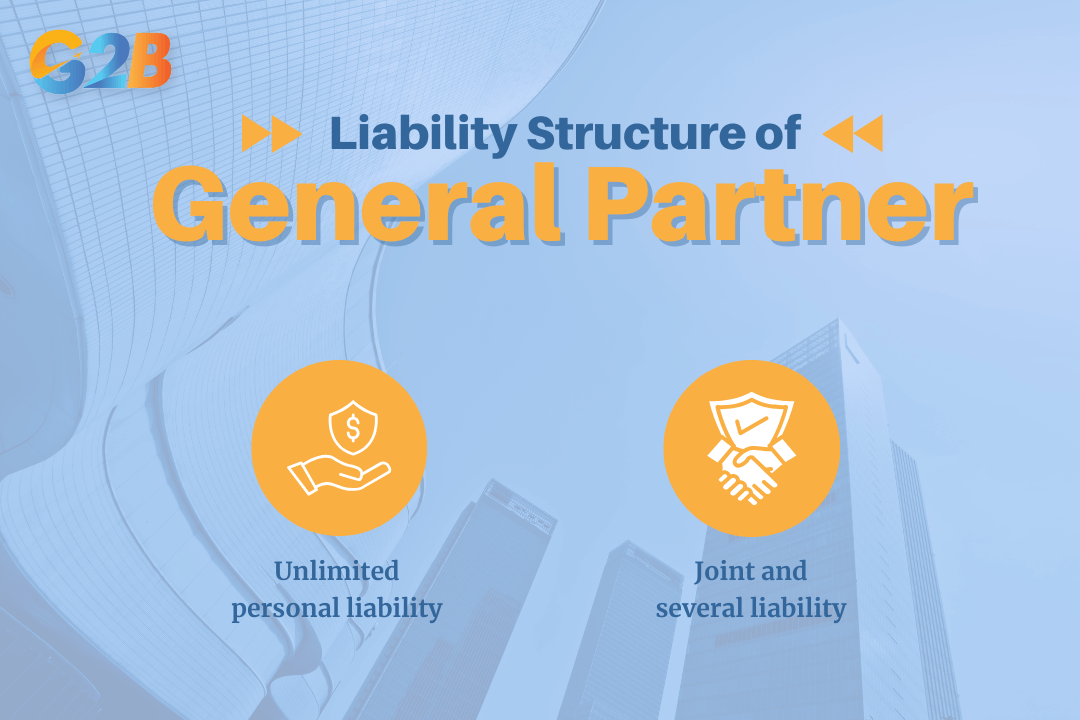

The critical aspect of liability

The most significant risk for a general partner is their liability structure. Understanding this is crucial for anyone considering the role.

Unlimited personal liability

Unlimited personal liability means that a general partner is personally responsible for all of the business's debts and legal obligations. If the partnership's assets are insufficient to cover these liabilities, a creditor can pursue a general partner's personal assets, such as their home, savings, or investments, to satisfy the business debts. According to Article 185, Clause 5 of the Vietnamese Enterprise Law 2020, this liability continues for 2 years even after the general partner ceases to be a member, covering debts incurred before termination. This lack of separation between the individual and the business is a hallmark of general partnerships and the GP role within a limited partnership.

To mitigate this risk, general partners should be well-versed in asset protection strategies to safeguard their personal wealth where possible.

Joint and several liability

Adding another layer of risk, general partners are subject to joint and several liability. This legal concept means that each partner is individually liable for the full extent of the partnership's debts, regardless of their percentage of ownership or involvement in the decision that led to the debt. A creditor can choose to sue one or all partners for the entire amount owed. If one partner is forced to pay more than their share, they may have a right to seek compensation from the other partners. In Vietnam, general partners bear unlimited joint and several liability for partnership debts and obligations as stipulated in Article 185 of the Enterprise Law 2020.

Understanding the general partner’s liability structure is crucial

How general partners get paid

The compensation for a general partner reflects their high level of responsibility and risk. It typically comes from multiple sources, especially within an investment fund structure.

- Capital contribution: General partners are usually required to invest their own money into the partnership or fund, often referred to as "skin in the game." This capital contribution, typically ranging from 1% to 5% of a fund's total size, aligns their interests with those of the other investors.

- Management fees: In private equity and venture capital funds, GPs receive an annual fee for management. This fee, often around 2% of the fund's committed capital, is intended to cover the operational expenses of the fund, including salaries and overhead. However, under the Vietnamese Enterprise Law, there are no specific provisions regulating management fees for general partners in general partnerships or partnerships, and such fees depend on contractual agreements.

- Carried interest (carry): The most significant potential for financial gain for a GP comes from carried interest. This is a share of the fund's profits, typically 20%, that is paid to the GP after the limited partners have received their initial investment back, and often after a predetermined minimum return (hurdle rate) has been met. Carried interest serves as a powerful performance incentive. For tax purposes, carried interest is often treated as a capital gain, which can be more favorable than ordinary income. This concept is generally not regulated in Vietnamese law for partnerships except in specialized investment fund frameworks.

- Profit distributions: In a general partnership, partners receive distributions from the business's profits as outlined in the partnership agreement. Under Vietnamese law, profit distributions are made according to the proportion of capital contribution or as stipulated in the partnership charter.

General partner vs. limited partner

The roles of a general partner and a limited partner (LP) are fundamentally different. A limited partnership structure is designed to bring together active managers (GPs) and passive investors (LPs).

| Feature | General Partner (GP) | Limited Partner (LP) |

|---|---|---|

| Management Role | Active involvement in day-to-day operations and strategic decisions. | Passive investor with no management authority or involvement in daily operations. |

| Liability | Unlimited personal liability for all partnership debts and obligations. | Limited liability; personal assets are protected. Risk is capped at the amount of their investment. |

| Authority | Can legally bind the partnership and make decisions on its behalf. | Lacks the authority to bind the partnership or make management decisions. |

| Primary Contribution | Management expertise, operational skills, and industry knowledge. | Capital. |

| Taxation | Profits and losses are passed through to personal tax returns; may be subject to self-employment taxes. | Profits and losses are passed through; not typically subject to self-employment taxes. |

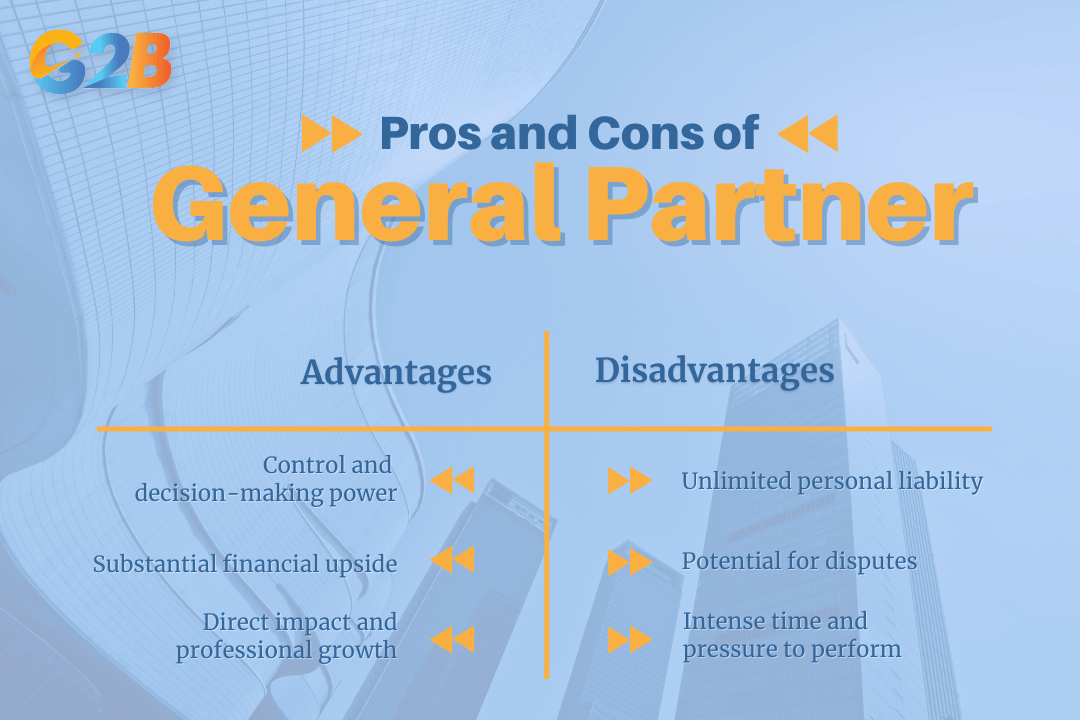

Weighing the pros and cons

The role of a general partner stands at the intersection of opportunity and exposure. It delivers substantial influence and potential rewards, but equally demands acceptance of significant personal risk. This trade-off is often compared in discussions about Sole Proprietorship vs General Partnership, where the level of liability and control are key factors.

The role of a general partner offers a unique combination of high reward and risk

Advantages

- Control and decision-making power: GPs have significant autonomy and influence over the direction and success of the business or fund.

- Substantial financial upside: Through carried interest and profit sharing, successful GPs can achieve significant financial rewards.

- Direct impact and professional growth: The role provides an opportunity to actively build companies, foster innovation, and develop a prominent reputation in the industry.

Disadvantages

- Unlimited personal liability: The risk of losing personal assets is the most significant drawback.

- Potential for disputes: Disagreements among partners over strategy, management, or finances can be challenging to resolve and may threaten the business.

- Intense time and effort: Managing a partnership or fund is an extremely demanding and time-consuming responsibility.

- Pressure to perform: GPs are under constant scrutiny from their partners and investors to deliver strong returns.

The general partner occupies a role of immense authority and equally substantial risk. They are the engine of the partnership, driving strategy and operations while accepting full personal liability for the outcomes. This starkly contrasts with the passive, financially-shielded role of a limited partner. For entrepreneurs, investors, and business students, understanding this duality is fundamental to navigating the world of partnerships. Aspiring to this position requires a deep understanding of the responsibilities, a high tolerance for risk, and a proven ability to create value.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom