A fee is a fundamental concept in commerce, representing the price a customer pays for a specific service, right, or product. It's a term that everyone encounters, yet the complexities behind what a fee entails, how it differs from a charge, and the strategies businesses use to set them can be intricate. Let’s explore the various types of fees, clarify the difference between a fee and a charge, and provide actionable strategies for managing these financial components effectively.

This article outlines the key aspects of fees in business to help entrepreneurs and companies gain a clearer understanding of their types, differences, and practical applications. We specialize in company formation services and do not provide financial or investment advice. For specific accounting, legal, or tax-related matters, please consult a qualified professional.

What is a fee in business?

A fee is a price or charge, which can be fixed or variable, paid in exchange for services, rights, or products, serving as compensation for the provider's time, expertise, or resources. This payment is a core component of countless transactional relationships in business. For instance, a business might pay a fee to an accountant for managing its books or to a security company for protecting its premises.

These fees are crucial for a company's financial health, as they are structured to cover operational costs - such as overhead, salaries, and materials - while also generating a profit. They are prevalent across numerous industries, including legal services, banking, real estate, and consulting. A fee can manifest as a one-time payment, like the cost to file taxes, or as a recurring cost, such as a monthly gym membership or software subscription.

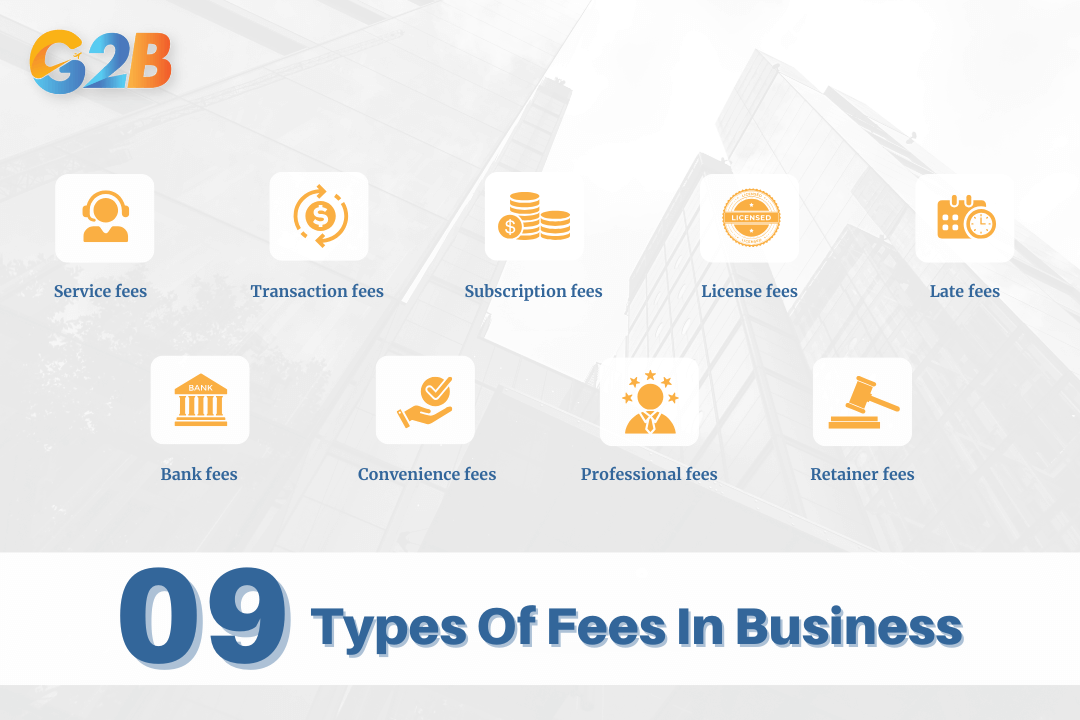

How many types of fees in business?

In the commercial world, fees are categorized based on their purpose and the context in which they are applied. Recognizing these distinctions is key to financial literacy for any business owner or consumer.

- Service fees: This is a broad category for charges paid for work performed. Examples range from a mechanic charging for labor to a consultant providing strategic advice. These fees compensate for the provider's expertise and time. Another example is that entrepreneurs who use a company formation service in Vietnam typically pay service fees for legal consultation, business registration, and compliance support.

- Transaction fees: These are costs incurred during the exchange of value, often to a third party facilitating the transaction. Common examples include credit card processing fees that merchants pay to financial institutions or fees charged by e-commerce platforms for each sale made.

- Subscription fees: A recurring fee paid at regular intervals - monthly or annually - for ongoing access to a product or service. This model is foundational to businesses like software-as-a-service (SaaS) companies, streaming platforms, and membership organizations.

- License fees: These are payments made to obtain legal permission to use, own, or operate something. Businesses may pay license fees for software, intellectual property, or to comply with government regulations, such as a restaurant needing a liquor license. License fees often relate to legally authorized usage or intellectual property rights.

- Late fees: A penalty charged when a payment is not made by its due date. This fee is intended to incentivize timely payments and compensate the business for the delay and administrative effort of collecting the debt.

- Bank fees: Financial institutions charge a variety of fees for their services. Common examples include account maintenance fees, overdraft fees for withdrawing more money than is in an account, and charges for using an out-of-network ATM. These are fees for various banking services that customers may incur.

- Convenience fees: This fee is charged when a customer uses a non-standard or more convenient payment method, such as paying a utility bill online with a credit card instead of mailing a check. It helps the business cover the costs associated with processing these alternative payment types.

- Professional fees: These are charges for the services of professionals who offer specialized knowledge and expertise, such as lawyers, accountants, architects, or consultants. The fee structure can be hourly, a flat rate for a project, or a retainer.

- Retainer fees: An upfront payment made to secure the future services of a professional, often a lawyer or consultant. This fee acts as a guarantee of the professional's availability and is typically drawn against as work is performed.

The types of fees are categorized based on their purpose and the context

The differences between fee and charge

While often used interchangeably, the terms "fee" and "charge" have distinct meanings. A lack of clarity can lead to confusion in contracts and billing. The primary distinction is that a fee is typically a specific, fixed price for a service or right, whereas a "charge" is a broader term for any amount of money requested for goods or services. Essentially, all fees are a type of charge, but not all charges are fees.

Here is a table to clarify the comparison:

| Aspect | Fee | Charge |

|---|---|---|

| Definition | A fixed, specific price paid for a particular service, privilege, or right. | A broader term for the amount of money required in exchange for goods or services. |

| Scope | Narrow and specific. It often relates to professional services or penalties. | General and comprehensive. It can encompass fees, prices, taxes, and other costs. |

| Pricing structure | Typically a specific or pre-defined amount (e.g., flat rate, hourly rate). | Can be fixed or variable, often depending on usage or consumption. |

| Common examples | Legal fees, bank fees, subscription fees, late fees. | Service charge, delivery charge, charges for goods purchased. |

| Context of use | Often used for services, licenses, and penalties. | Used universally for any transaction involving payment for goods or services. |

The issue of hidden fees

Hidden fees are a persistent source of frustration for consumers and a significant ethical issue in the business world. These charges undermine trust and can have substantial financial consequences.

What are hidden fees?

Hidden fees are unexpected charges that are not clearly disclosed upfront and often appear at the final stage of a transaction. Also known as "junk fees," they obscure the true price of a product or service, making it difficult for consumers to make informed purchasing decisions. These fees can turn an attractively advertised price into a much more expensive final cost.

What is the purpose of hidden fees?

Businesses primarily use hidden fees mainly for a few strategic, though often criticized, reasons:

- To advertise a lower initial price to attract more customers.

- To increase the total transaction amount after a customer has already committed to the purchase.

- To cover operational costs without raising the sticker price of the core product or service.

Example of hidden fees?

Hidden fees are prevalent across many industries. Common examples include:

- Hotel "resort fees": Mandatory daily charges for amenities like Wi-Fi or pool access, often not included in the initial room rate.

- Ticket "service fees": Additional charges added by ticketing platforms during checkout for concerts or sporting events, which can significantly inflate the final price.

- Airline fees: Charges for services that were once standard, such as checked baggage, seat selection, and priority boarding.

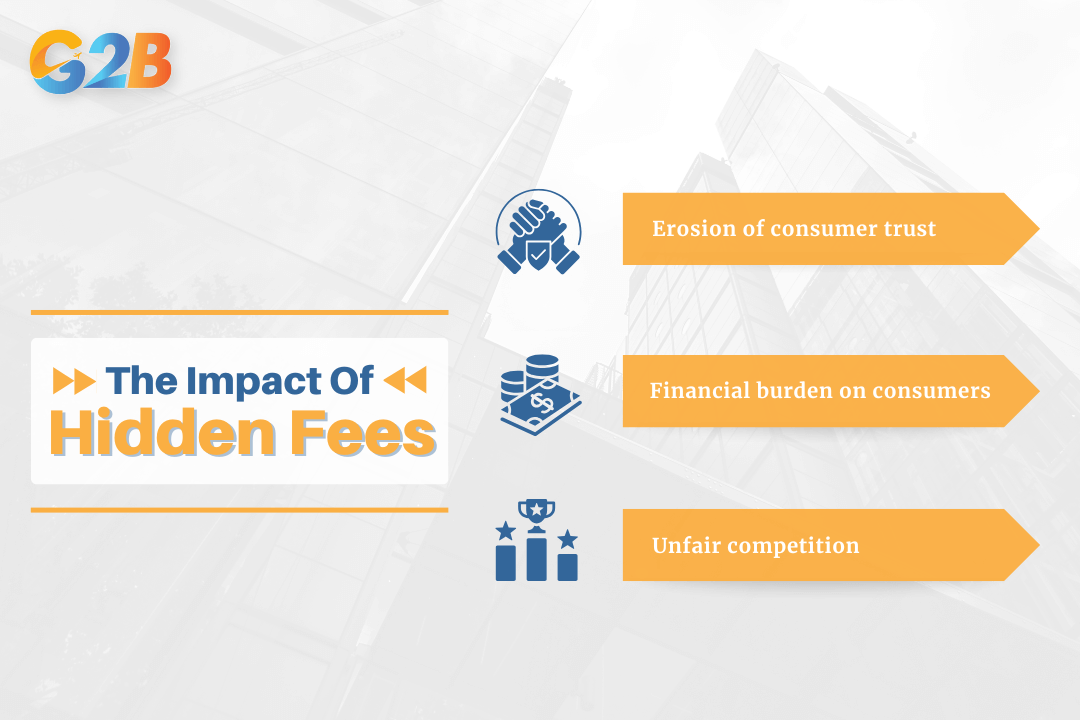

What is the impact of hidden fees?

The consequences of hidden fees are significant for both consumers and the broader market:

- Erosion of consumer trust: Unexpected charges create a negative customer experience and damage a brand's reputation.

- Financial burden on consumers: These fees can add up to billions of dollars annually, placing an extra financial strain on households.

- Unfair competition: Businesses that are transparent about their pricing may appear more expensive than competitors who hide fees, creating a market imbalance.

While the fees themselves may be legal if disclosed in the fine print, the lack of transparent disclosure can sometimes violate consumer protection laws designed to prevent deceptive business practices. In response, regulations are evolving, with some jurisdictions requiring businesses to display the "all-in" price upfront.

The consequences of hidden fees are significant for both consumers and the broader market

How do businesses strategically set their fees?

Setting the right fees is a critical decision that directly impacts a business's profitability, market position, and customer perception. Businesses employ a variety of pricing strategies to determine the optimal amount to charge.

- Cost-plus pricing: This is one of the simplest methods, where a business calculates the total cost (including fixed and variable costs) of providing a service and adds a standard markup to ensure a profit margin.

- Value-based pricing: Here, fees are set based on the customer's perceived value, needs, and benefits of the service or product, rather than the cost to produce it. This strategy is common for unique or highly specialized offerings.

- Competition-based pricing: This strategy involves setting fees in line with what competitors are charging for similar services. The goal is to stay competitive, though it can lead to price wars if not managed carefully.

- Flat-rate pricing: A single, upfront fee is charged for a well-defined project or service. This approach provides clarity and predictability for both the business and the client, regardless of time spent or resources used.

- Hourly rate: Professionals like consultants and lawyers often charge based on the actual number of hours they work. This method directly ties the fee to the time and effort expended.

- Retainer: A client pays a consistent, recurring retainer fee to have access to a professional's services for a set period. This model ensures the professional's availability and provides the business with predictable revenue.

- Tiered pricing: Offering different service levels at varied price points designed to appeal to multiple customer segments with different needs and budgets. This allows businesses to appeal to various customer segments with different needs and budgets.

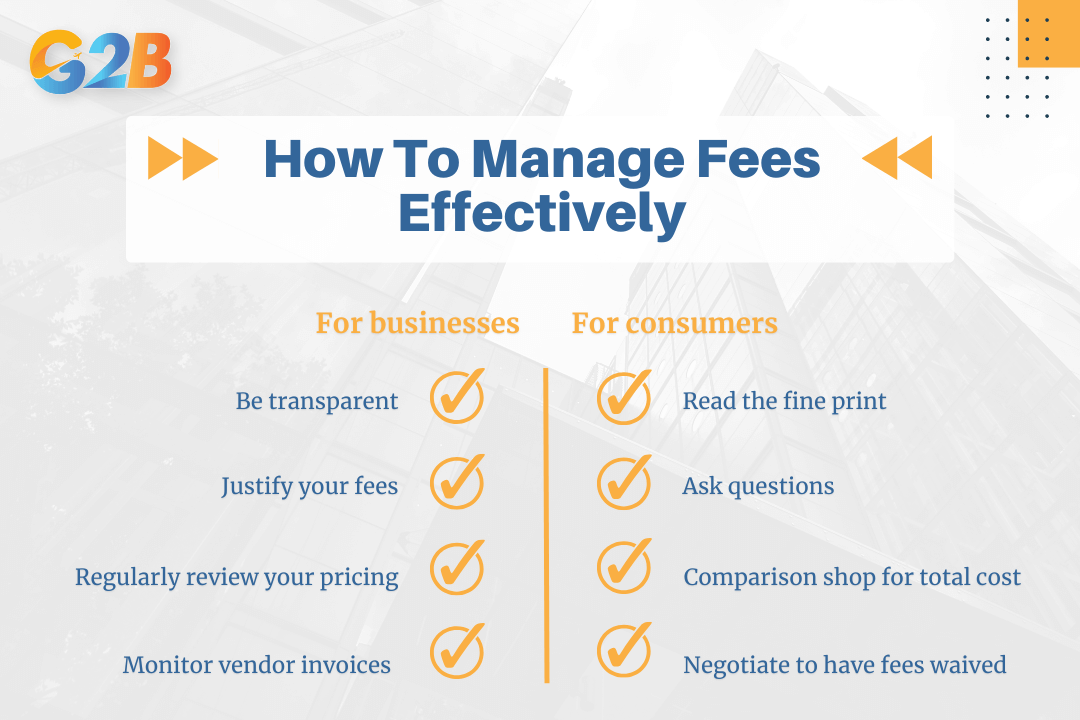

How to manage fees effectively?

Effective fee management is a two-way street, requiring diligence from both businesses and consumers. A transparent and fair approach builds trust and fosters a healthy marketplace.

For businesses

- Be transparent: Clearly disclose all mandatory fees upfront in your pricing. A lack of transparency erodes consumer trust and can lead to legal issues.

- Justify your fees: Be prepared to explain what a fee covers. When customers understand the value they are receiving, they are more likely to accept the cost.

- Regularly review your pricing: Periodically analyze your fee structure to ensure it remains competitive, covers your costs, and aligns with the value you provide.

- Monitor vendor invoices: Scrutinize invoices from your own suppliers and service providers to identify and challenge any hidden or unnecessary fees.

For consumers

- Read the fine print: Always review contracts, terms of service, and agreements carefully before purchasing to identify any potential fees.

- Ask questions: If you see a fee you don't understand, ask for a clear explanation before you pay.

- Comparison shop for the total cost: When comparing options, look at the total price, including all mandatory fees, not just the advertised rate.

- Negotiate to have fees waived: In some cases, especially with banking or credit card fees, you may be able to negotiate to have a charge waived, particularly if you are a long-standing customer.

Effective fee management is a two-way street requiring diligence from businesses & consumers

Transparent and fair fees are the bedrock of a healthy and sustainable business ecosystem. When businesses are upfront about their pricing, it builds invaluable customer trust and loyalty, turning a simple transaction into a long-term relationship. This honesty becomes a powerful competitive advantage, distinguishing a brand in a crowded marketplace. A well-structured fee strategy is not just about covering costs; it is about reflecting the true value delivered, which ensures business profitability and long-term viability. For customers, clear and justifiable pricing empowers them to make informed decisions, fostering a market where value, not deception, drives success.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom