Selecting an appropriate business structure is an operational decision that determines ownership and management responsibilities. Among the most common options for small-scale ventures are the Sole Proprietorship and the General Partnership. Both structures offer simplicity and cost-efficiency, yet they still differ significantly in many aspects. This guide will outline the key differences between the two structures and provide essential considerations for choosing the most suitable option.

What is a Sole Proprietorship?

A Sole Proprietorship is the simplest and most common business structure, where an individual owns and operates a business without creating a separate legal entity. In this arrangement, the business and owner are considered the same for legal and tax purposes. The owner reports all business income and expenses on their personal tax return, maintains complete control over business decisions, and assumes full personal responsibility for all business debts and obligations. This structure appeals to solo entrepreneurs, freelancers, and small business owners who prioritize simplicity and direct control. For entrepreneurs seeking to establish a Sole Proprietorship company in the U.S., G2B provides incorporation services in Delaware with professional support to ensure a smooth and compliant setup process.

What is a General Partnership?

A General Partnership is a business jointly owned and operated by two or more individuals who share profits, responsibilities, and risks according to their partnership agreement. In this structure, partners combine their resources, skills, and capital to operate the business collectively, with each partner having the authority to make binding decisions on behalf of the partnership, usually requiring the consent of all partners or as specified in the partnership agreement. Partners share both the profits and losses of the business based on their ownership percentages or as specified in their partnership agreement. This structure enables shared management responsibilities and distributed financial investment, while maintaining the simplicity of pass-through taxation.

Key differences between Sole Proprietorship & General Partnership

While both structures offer simplicity and flexibility, they differ significantly in several key areas that can impact your business operations, financial obligations, and long-term success. Understanding these differences will help you determine which structure best suits your business needs and personal circumstances.

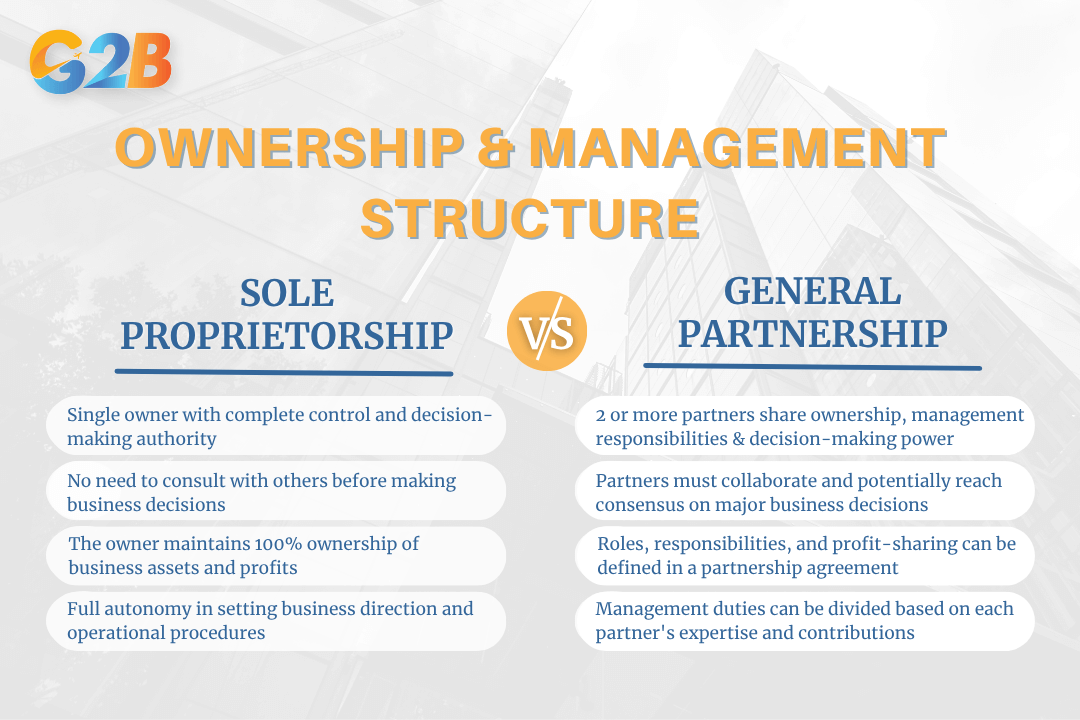

1. Ownership and management structure

Sole Proprietorship:

- Single owner with complete control and decision-making authority

- No need to consult with others before making business decisions

- The owner maintains 100% ownership of business assets and profits

- Full autonomy in setting business direction and operational procedures

General Partnership:

- Two or more partners share ownership, management responsibilities, and decision-making power

- Partners must collaborate and potentially reach consensus on major business decisions

- Roles, responsibilities, and profit-sharing can be defined in a partnership agreement

- Management duties can be divided based on each partner's expertise and contributions

The ownership and management structure of Sole Proprietorship vs General Partnership

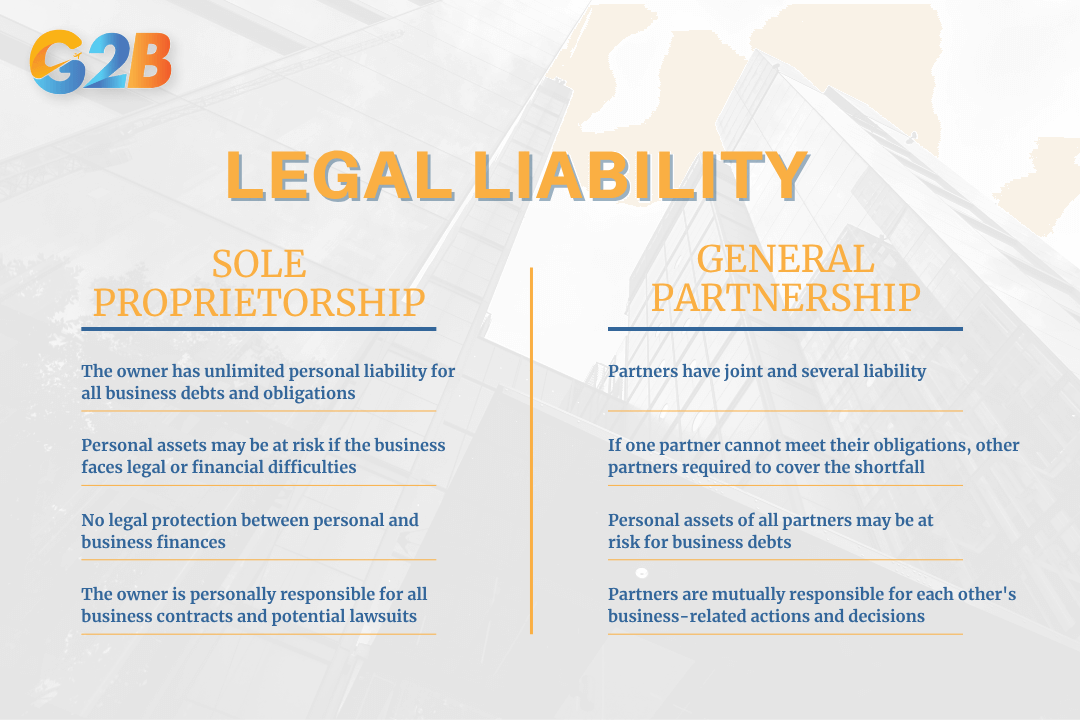

2. Legal liability

Sole Proprietorship:

- The owner has unlimited personal liability for all business debts and obligations

- Personal assets may be at risk if the business faces legal or financial difficulties

- No legal protection between personal and business finances

- The owner is personally responsible for all business contracts and potential lawsuits

General Partnership:

- Partners have joint and several liability, meaning each partner can be held fully responsible for partnership obligations

- If one partner cannot meet their obligations, other partners may be required to cover the shortfall

- Personal assets of all partners may be at risk for business debts

- Partners are mutually responsible for each other's business-related actions and decisions

Sole Proprietorship and General Partnership have different legal liabilities

3. Formation process

Sole Proprietorship:

- Extremely easy to set up with minimal formal requirements

- Typically requires no formal registration beyond obtaining necessary business licenses

- May need to file a DBA (Doing Business As) if operating under a name other than the owner's legal name

- Low startup costs and minimal ongoing administrative requirements

General Partnership:

- Simple to form and can be established automatically when two or more people start doing business together

- No formal registration is required in most jurisdictions, though some states may require filing

- Strongly recommended to create a written partnership agreement to clarify roles, responsibilities, and profit-sharing arrangements

- A partnership agreement helps prevent future disputes and establishes clear operational guidelines

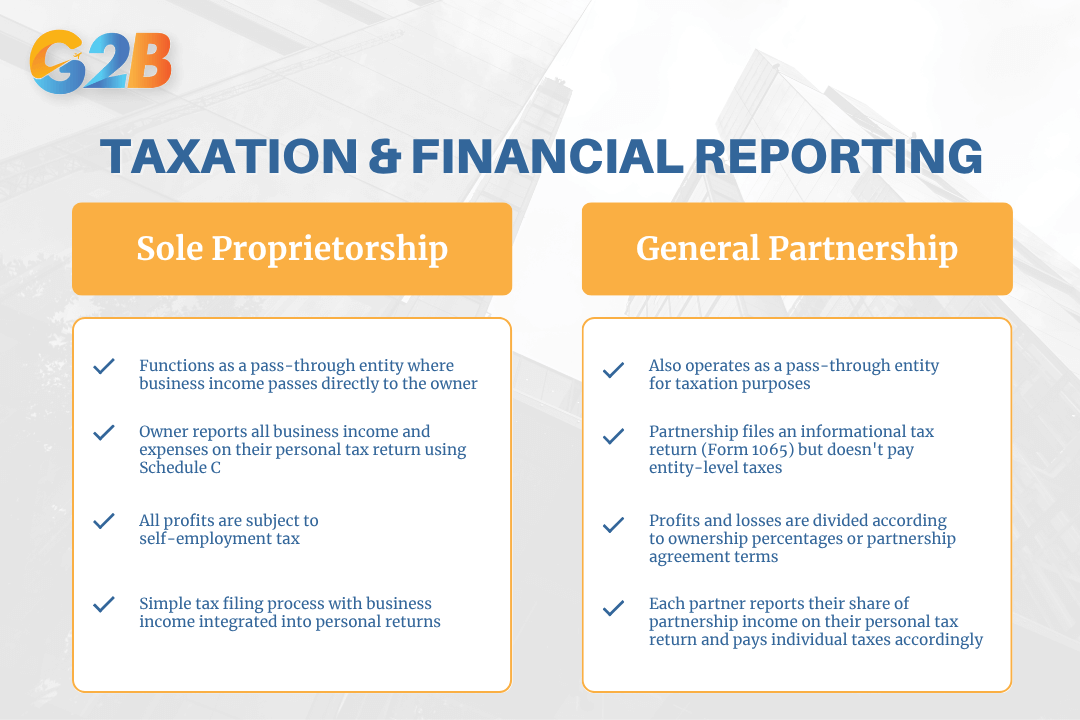

4. Taxation and financial reporting

Sole Proprietorship:

- Functions as a pass-through entity where business income passes directly to the owner

- Owner reports all business income and expenses on their personal tax return using Schedule C

- All profits are subject to self-employment tax

- Simple tax filing process with business income integrated into personal returns

General Partnership:

- Also operates as a pass-through entity for taxation purposes

- Partnership files an informational tax return (Form 1065) but doesn't pay entity-level taxes

- Profits and losses are divided according to ownership percentages or partnership agreement terms

- Each partner reports their share of partnership income on their personal tax return and pays individual taxes accordingly

Taxation and financial reporting of Sole Proprietorship vs General Partnership

5. Risk management and capital raising

Sole Proprietorship:

- High risk exposure due to the unlimited personal liability of the single owner

- Limited ability to raise capital since there is only one owner contributing resources

- Growth potential constrained by the owner's personal financial capacity

- All business risks are concentrated on one individual

General Partnership:

- Business risks are shared among partners, distributing the financial burden

- Easier to raise capital due to multiple contributors and shared resources

- Partners can combine their creditworthiness and financial resources for better funding opportunities

- Shared expertise and skills can reduce operational risks and improve business performance

6. Pros and cons overview

| Criteria | Sole Proprietorship | General Partnership |

|---|---|---|

| Number of owners | One | Two or more |

| Control | Full control, no sharing | Shared management, potential conflicts |

| Legal liability | Unlimited, personal liability | Joint and several liability |

| Formation process | Very simple, minimal formalities | Simple, but a partnership agreement is advised |

| Taxation | Reported on personal tax return | Income is passed through and reported on each partner's personal tax return |

| Capital raising | Limited | Better potential due to multiple partners |

| Risk | The owner bears all risks | Risks are shared but partners may affect each other |

Should I choose Sole Proprietorship or General Partnership?

The decision between Sole Proprietorship and General Partnership depends on your business goals, available resources, and willingness to share control and responsibilities. Choose a Sole Proprietorship for small or new businesses wanting full control, to simplify procedures and minimize costs, and when there is no need to raise significant capital or share responsibility with others. Choose a General Partnership when you want to combine resources, skills, and capital with others, are willing to share control and responsibilities, and have business expansion plans or require diverse expertise that can benefit from multiple partners' contributions and perspectives.

Both Sole Proprietorship and General Partnership offer viable options for entrepreneurs seeking simple, flexible business structures with pass-through taxation benefits. Sole Proprietorship provides complete control and simplicity for individual business owners, while General Partnership offers the advantages of shared resources, expertise, and responsibilities. Your choice should align with your business goals, risk tolerance, and need for collaboration. Consulting with a business attorney or accountant can help ensure you make the best choice for your specific situation.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom