Finance encompasses a broad range of activities, from an individual budgeting their monthly income to a multinational corporation making strategic investment decisions. Understanding finance is essential not only for professionals in the field but for anyone looking to make sound economic choices. This comprehensive guide will demystify the world of finance, explaining what it is, how it works, its different forms, and its critical impact on business success.

This article outlines the key components of finance to help businesses gain a clearer understanding of its concepts, functions, and practical applications. We specialize in company formation service in Vietnam and do not provide financial or investment advice. For specific matters related to accounting, taxation, or financial management, please consult a qualified legal, financial, or industry expert.

What is finance?

Finance is fundamentally the management of money, involving activities like investing, borrowing, lending, budgeting, saving, and forecasting. It is the process of channeling funds from those who have a surplus (savers and investors who provide capital) to those who are in need of capital (borrowers). At its core, finance seeks to allocate resources optimally over time under conditions of uncertainty to maximize value or utility. This discipline is not just about handling money; it's a forward-looking field that uses data and analytical tools to guide strategic planning and achieve specific goals.

Its scope is vast, applying to the financial decisions of individuals, businesses, and governments. For an individual, it might mean planning for retirement. For a business, it could involve raising capital to fund a new project. For a government, it means managing national revenue, expenditures, and debt. In academia, finance is often considered a branch of economics but also a distinct academic discipline focusing on resource allocation, capital markets, and investment analysis.

How does finance work?

The fundamental process of finance revolves around the efficient channeling of money from savers and investors to borrowers, while managing risk and return. This flow of capital is what enables economies to grow and individuals and businesses to achieve their goals. When individuals or institutions have excess funds, they can save or invest them. These accumulated savings provide a pool of capital that can be loaned out to others who need it for expenditures or investments, or invested in various financial assets. Financial institutions like banks act as intermediaries in this process, gathering deposits from savers and lending them to businesses or individuals, including banks, insurance companies, investment funds, and capital markets.

This mechanism allows individuals to purchase homes through mortgages or businesses to fund expansion and operations. The transfer of funds is facilitated by financial instruments, which are assets that can be traded, such as stocks, bonds, and loans. For example, a person deposits their savings into a bank account. The bank then pools this money with deposits from others and lends it to a small business looking to buy new equipment. The business pays interest on the loan, a portion of which is returned to the saver as interest on their deposit, while the bank keeps the remainder as profit. This simple example illustrates the core function of finance: making money productive by moving it from where it is idle to where it can be used to generate value.

How many types are there in finance?

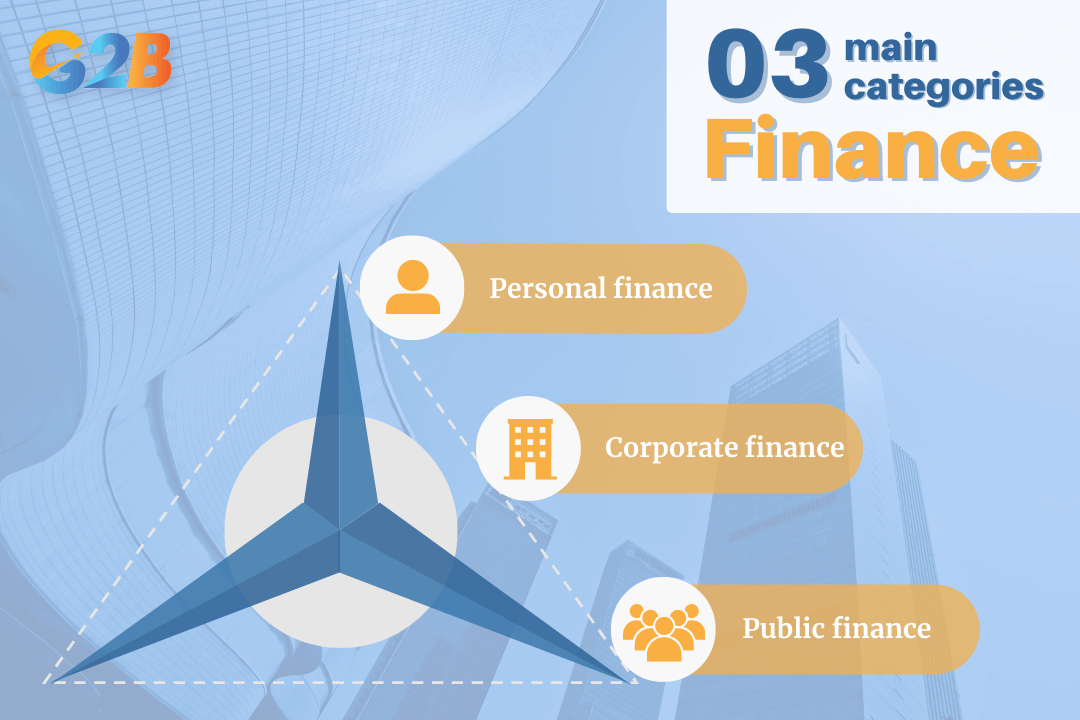

The broad field of finance is generally broken down into three main categories or disciplines: Personal finance, corporate finance, and public finance. Each area has its own specialized procedures and goals, though they often overlap and interact within the broader economic system.

The broad field of finance is generally broken down into three main categories or disciplines

Personal finance

Personal finance involves the management of an individual's or a household's financial resources to meet their financial goals. This discipline covers a wide array of activities focused on budgeting, saving, and investing money over time, while considering various financial risks and future life events. Key areas of personal finance include:

- Budgeting: Tracking income and expenses to manage cash flow effectively.

- Saving: Setting aside money for short-term goals and emergencies.

- Investing: Purchasing assets like stocks, bonds, or real estate with the expectation of generating income or appreciation.

- Insurance: Protecting against unforeseen events through products like health, life, and disability insurance.

- Retirement Planning: Accumulating wealth to support oneself after finishing a career.

Corporate finance

Corporate finance, also known as business finance, deals with the financial activities related to running a company. Its primary goal is to maximize shareholder value through sound financial planning and implementation, balancing the interests of shareholders and other stakeholders. This involves managing the company's assets and liabilities, sourcing funds, and making strategic investment decisions to ensure profitability and long-term growth.

Key functions of corporate finance include capital budgeting, determining the best mix of debt and equity financing, and managing day-to-day working capital. A foundational example of this is the process to register a company in Vietnam, which requires securing initial capital and making crucial financial decisions about the business's structure. Foreign investors must prove they have sufficient funds to meet their investment commitments as part of this process.

Public finance

Public finance is the area of finance concerned with the management of a country's revenue, expenditure, and debt, and plays a critical role in resource allocation, income redistribution, and economic stabilization. This field examines the role of government in the economy and encompasses all financial activities of public authorities at the federal, state, and local levels. It is crucial for providing essential public services and maintaining economic stability. The core components of public finance include:

- Taxation: The primary source of government revenue, including income, corporate, and sales taxes.

- Government spending: Allocating funds for public goods and services such as infrastructure, defense, education, and healthcare.

- Public debt: Managing the funds borrowed by the government to cover budget deficits.

- Fiscal policy: Using government spending and taxation decisions to influence the broader economy.

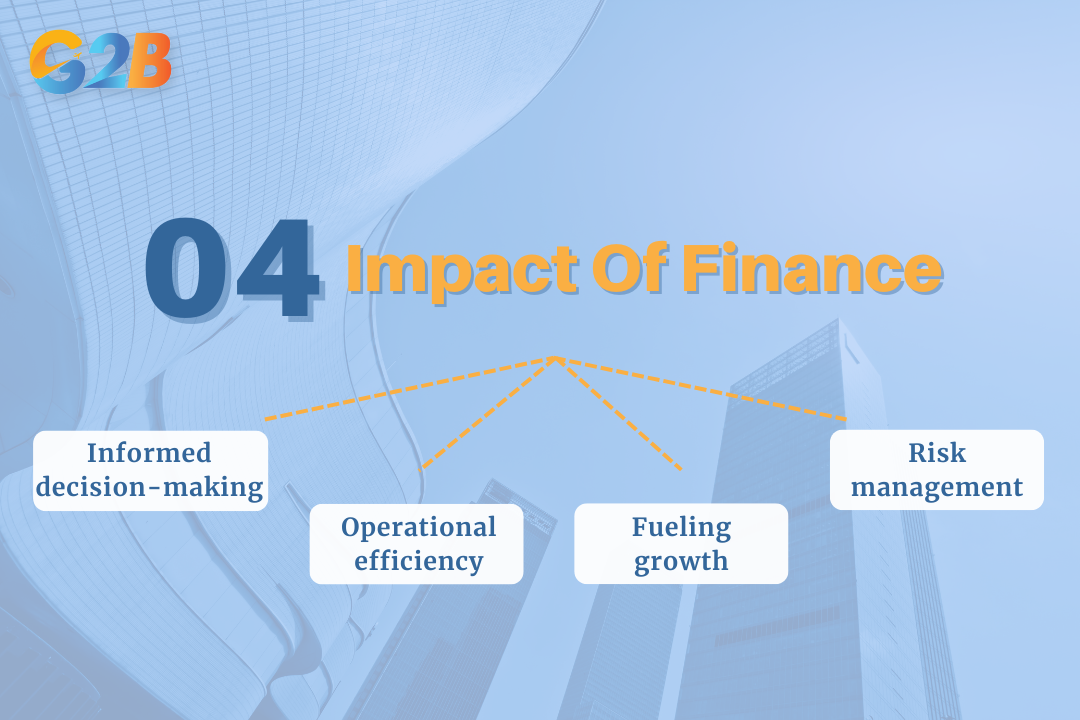

The impact of finance on business

Finance is the lifeblood of a business, providing the necessary capital for operations, investment, and expansion, and managing financial risks. Proper financial management is not merely an administrative task; it is a critical driver of business success and sustainability. Without it, even the most promising ventures can struggle to survive. The impact of finance is felt across every facet of an organization.

- Informed decision-making: Finance provides the data and analysis necessary for strategic decision-making. By evaluating financial statements and performance metrics, leaders can make sound choices about product launches, market expansion, and resource allocation.

- Operational efficiency: Effective financial management ensures a business operates smoothly, including managing both short-term and long-term cash flows. This includes managing cash flow to cover daily expenses like salaries and supplies, optimizing the use of assets, and controlling costs to improve profitability.

- Fueling growth: Growth requires investment, and finance is the function responsible for securing the necessary funding. Whether through debt financing, such as bank loans, or equity financing from investors, finance makes it possible for companies to scale operations, acquire new assets, and enter new markets, while optimizing capital structure to minimize financing costs.

- Risk management: Every business faces financial risks, from market volatility to unexpected cost increases, including credit risk, liquidity risk, and regulatory risks. The finance function is responsible for identifying, analyzing, and mitigating these risks through strategies like creating contingency plans and managing debt wisely to protect the company's financial stability.

The impact of finance is felt across every facet of an organization

The role of financial markets

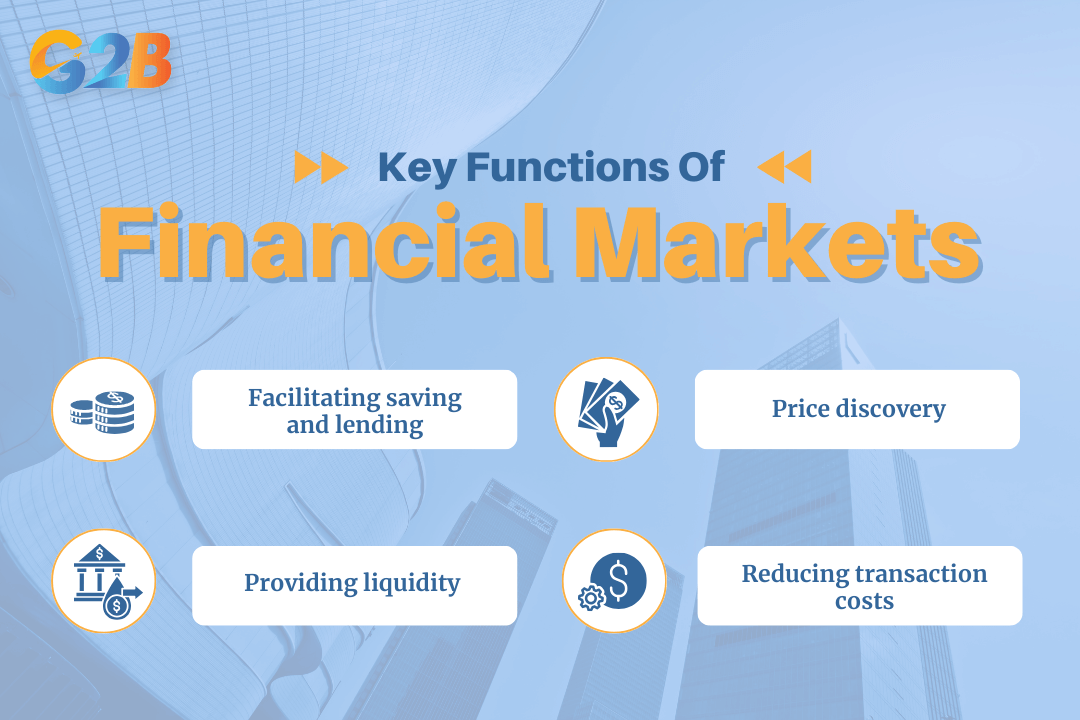

Financial markets are the marketplaces where financial instruments are traded, including primary and secondary markets. These markets are the infrastructure that facilitates the large-scale flow of capital, connecting savers and investors with borrowers, connecting those with capital (savers and investors) to those who need capital (borrowers). Examples include stock markets, where shares of public companies are bought and sold, and bond markets, where governments and corporations borrow money. Financial markets play a crucial role in the economy by efficiently allocating capital to its most productive uses. Their key functions include:

- Facilitating saving and lending: They provide a secure and regulated platform for individuals and institutions to save their money by lending it out in the form of investments.

- Price discovery: The interaction between buyers and sellers in a financial market determines the prices of financial assets, reflecting their value and risk.

- Providing liquidity: Financial markets ensure that investors can easily buy and sell their financial assets, converting them into cash when needed, providing liquidity, although liquidity levels may vary across different assets.

- Reducing transaction costs: By bringing buyers and sellers together in one place, financial markets reduce the time and cost associated with finding trading partners.

There are 4 key functions of financial markets

The importance of financial regulation

Financial regulation consists of the rules and laws that govern financial institutions and markets, and the supervision and enforcement mechanisms that ensure compliance. These regulations are essential for ensuring the stability and integrity of the financial system. Regulatory bodies, like the U.S. Securities and Exchange Commission (SEC), are established by governments to oversee financial activities and enforce these rules, varying by jurisdiction and covering different sectors of the financial system. The primary goals of financial regulation are to:

- Consumer protection: Regulations are designed to protect consumers and investors from fraudulent or unfair practices. This includes ensuring transparency and fairness in the sale of financial products and promoting financial literacy.

- Maintaining financial stability: By setting rules for banks and other financial institutions, such as capital requirements, regulation helps prevent excessive risk-taking that could lead to a systemic crisis, monitoring liquidity and risk management practices.

- Ensuring market confidence: A well-regulated financial system fosters trust among participants, encouraging saving and investment, which are vital for economic growth, and promoting market transparency.

- Promoting fair competition: Regulation can prevent monopolies and ensure a level playing field, which encourages innovation and efficiency in the financial sector, and prevents market manipulation.

Finance is a dynamic and essential discipline that governs the management and allocation of money across every level of our economy. From personal budgeting and retirement planning to corporate investment strategies and government fiscal policy, its principles are fundamental to achieving growth and stability. Understanding the core types of finance, the function of financial markets, the necessity of regulation, and its strategic role in business provides a powerful framework for making sound financial decisions.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom