Financing is the essential process of acquiring funds to achieve specific personal or business goals. Whether you're an individual looking to purchase a home, a startup seeking capital to launch, or an established company aiming to expand, understanding the financing landscape is fundamental to success. Let’s break down everything you need to know about the different types of financing, the step-by-step application process, and exactly what lenders and investors look for.

This article outlines the key aspects of financing institutions to help businesses gain a clearer understanding of their roles, functions, and practical applications. We specialize in company formation service in Vietnam and do not provide financing advice. For specific matters related to accounting, taxation, or financial management, please consult a qualified financial expert.

What is financing?

Financing, in its simplest terms, is the process of obtaining, providing, and managing funds for a specific purpose. It encompasses the methods and procedures used by individuals, businesses, and governments to raise capital for various expenditures when they do not have the necessary funds immediately available. This process can be for a wide range of needs, from covering operational expenses and funding large purchases like a new facility to investing in new business ventures. Financing bridges the gap between available resources and financial requirements, enabling economic activity and growth that would otherwise be impossible.

Types of financing

Securing funding is a critical step for any major personal purchase or business initiative. The most suitable type of financing depends on a variety of factors, such as the amount of capital needed, the borrower's financial situation, and their risk tolerance. Generally, financing options fall into two primary categories: debt financing and equity financing.

Financing options fall into two primary categories

Debt financing

Debt financing is the act of borrowing funds from a lender with the promise to repay the principal amount, plus interest, over a predetermined period. This is a common method for both individuals and businesses to acquire capital without surrendering ownership. The terms of debt financing, including the interest rate and repayment schedule, are outlined in a loan agreement. Lenders assess a borrower's creditworthiness to determine these terms.

Common forms of debt financing include:

- Personal loans: Unsecured or secured loans given to individuals for various personal expenses, repaid in fixed monthly instalments.

- Business loans: Capital provided to companies for operational needs or expansion, which can be secured by assets.

- Lines of credit: A flexible form of borrowing where a lender approves a certain credit limit, and the borrower can draw funds as needed, paying interest only on the amount used.

- Mortgages: Long-term loans used to purchase real estate, where the property itself serves as collateral.

- Bonds: A formal contract where a company or government issues debt to investors and agrees to pay interest payments (coupons) and repay the principal at a future maturity date.

Advantages:

- Retain ownership: You maintain full ownership and control of your business or personal assets, as the lender has no say in your operational decisions.

- Tax benefits: The interest paid on business debt is often tax-deductible, which can lower your overall tax liability.

- Predictable payments: Loan agreements typically have fixed repayment schedules, which makes financial planning and budgeting more straightforward.

- Temporary relationship: Once the loan is fully repaid, the relationship and any obligations to the lender are concluded.

Disadvantages:

- Repayment obligation: The borrowed funds, along with interest, must be repaid regardless of your business's profitability or your personal financial situation, which can strain cash flow.

- Collateral required: Many loans, especially for significant amounts, require collateral, meaning you could risk losing personal or business assets if you default on the loan.

- Impact on credit: Failing to make timely payments can negatively affect your personal or business credit score, making future borrowing more difficult and expensive.

- Restrictive covenants: Lenders may impose conditions or covenants that can limit certain business activities until the loan is paid off.

Equity financing

Equity financing is the process of raising capital by selling an ownership stake in your company to investors. In return for their investment, these investors become part-owners (shareholders) and are entitled to a portion of the company's future profits. Unlike debt, this capital does not have to be repaid. This method is particularly common for startups and high-growth businesses that may not qualify for traditional loans or require substantial capital for expansion.

Common sources of equity financing include:

- Angel investors: Wealthy individuals who provide capital to startups in exchange for ownership equity. They often bring valuable industry experience and mentorship.

- Venture Capital (VC) Firms: Professional investment firms that fund startups and small businesses with high growth potential in exchange for an equity stake.

- Crowdfunding: Raising smaller amounts of money from a large number of people, typically via online platforms, in exchange for equity.

- Initial Public Offering (IPO): The process of offering shares of a private corporation to the public for the first time on a stock exchange to raise significant capital.

Advantages:

- No repayment obligation: Unlike debt financing, you are not required to repay the funds you receive from investors. This can significantly improve cash flow, especially for new businesses.

- Access to expertise: Investors often bring more than just capital; they provide valuable skills, industry connections, and strategic guidance that can accelerate business growth.

- Shared risk: Investors share in the financial risks of the business. If the company fails, there is no obligation to return the capital.

- Enhanced credibility: Securing funding from reputable investors can boost your company's credibility, making it easier to attract customers, talent, and further investment.

Disadvantages:

- Dilution of ownership: You will have to give up a portion of your ownership and control of the company to your investors.

- Sharing profits: Investors are entitled to a share of the company's profits, which reduces the earnings available to the original owners.

- Potential for conflict: Disagreements over business strategy and decision-making can arise between founders and investors, who may have different visions for the company's future.

- Time and complexity: The process of finding the right investors and negotiating the terms of the deal can be lengthy and complex.

Step-by-step guide to financing

Securing financing can seem like a daunting task, but breaking it down into a structured process can make it much more manageable. Following a clear set of steps ensures that you are well-prepared, approaching the right sources, and presenting a compelling case.

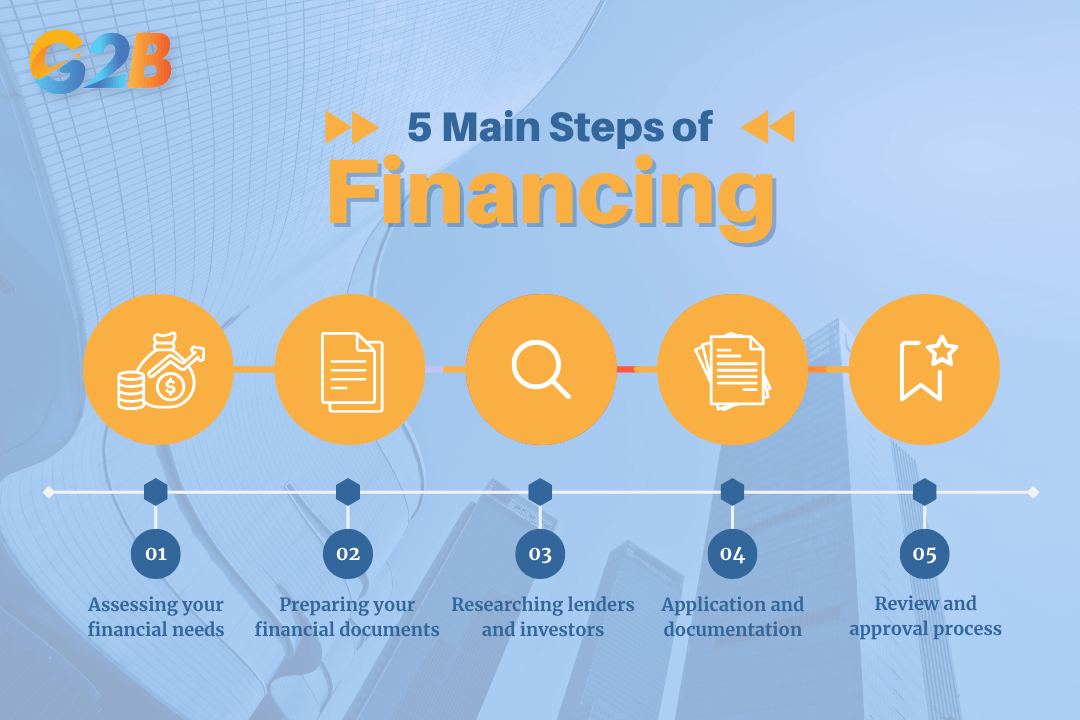

There are 5 main steps of financing

Step 1: Assessing your financial needs

Assessing your financial needs is the crucial first step to determine the exact amount of money you need and for what purpose. Before approaching any lender or investor, you must have a clear and detailed understanding of your capital requirements. This involves creating a comprehensive budget, forecasting future expenses, and identifying how the funds will be used - whether for purchasing equipment, increasing working capital, or funding a specific growth project. A precise assessment not only demonstrates professionalism but also prevents you from borrowing too little, which could leave your project underfunded, or too much, which would result in unnecessary interest costs or excessive equity dilution.

Step 2: Preparing your financial documents

Preparing your financial documents is essential to prove your financial health and repayment capability to potential funders. This stage involves gathering and organizing all relevant financial records. A business financing application requires several key documents, such as your business plan, recent financial statements (income statement, balance sheet, cash flow statement), and personal and business tax returns. For individuals, this typically includes proof of income (pay stubs, W-2s), bank statements, and tax returns. Having these documents in order demonstrates your preparedness and allows lenders or investors to conduct a thorough evaluation of your financial history and stability.

Step 3: Researching lenders and investors

Researching lenders and investors helps you identify the most suitable sources of capital for your specific needs. Not all funders are the same; they have different criteria, risk appetites, and preferred investment sectors. Research various options, such as traditional banks, credit unions, online lenders, angel investor networks, and venture capital firms. Compare their terms, interest rates, and eligibility requirements. For equity financing, it's vital to find investors whose goals and expertise align with your business vision. A targeted approach saves time and significantly increases your chances of securing a favorable financing agreement.

Step 4: Application and documentation

Submitting your application and documentation is the formal step where you present your case to the selected lenders or investors. After meticulous preparation, you will complete the official application form, ensuring all information is accurate and complete. You will then submit this form along with your entire package of prepared financial documents. For online applications, this involves uploading digital copies, while traditional institutions may require physical paperwork. Attention to detail is critical at this stage, as incomplete or inaccurate applications are a common reason for rejection.

Step 5: Review and approval process

Navigating the review and approval process requires patience as the lender or investor conducts their due diligence. During this underwriting process, they will thoroughly analyze your application, credit history, financial statements, and business plan to assess the risk of the loan or investment. They may request additional information or clarification. If your application is approved, you will receive a formal offer outlining the terms of the financing, including the amount, interest rate, repayment schedule, and any covenants or conditions. It is crucial to review this offer carefully before accepting to ensure it aligns with your financial goals.

How to qualify for financing?

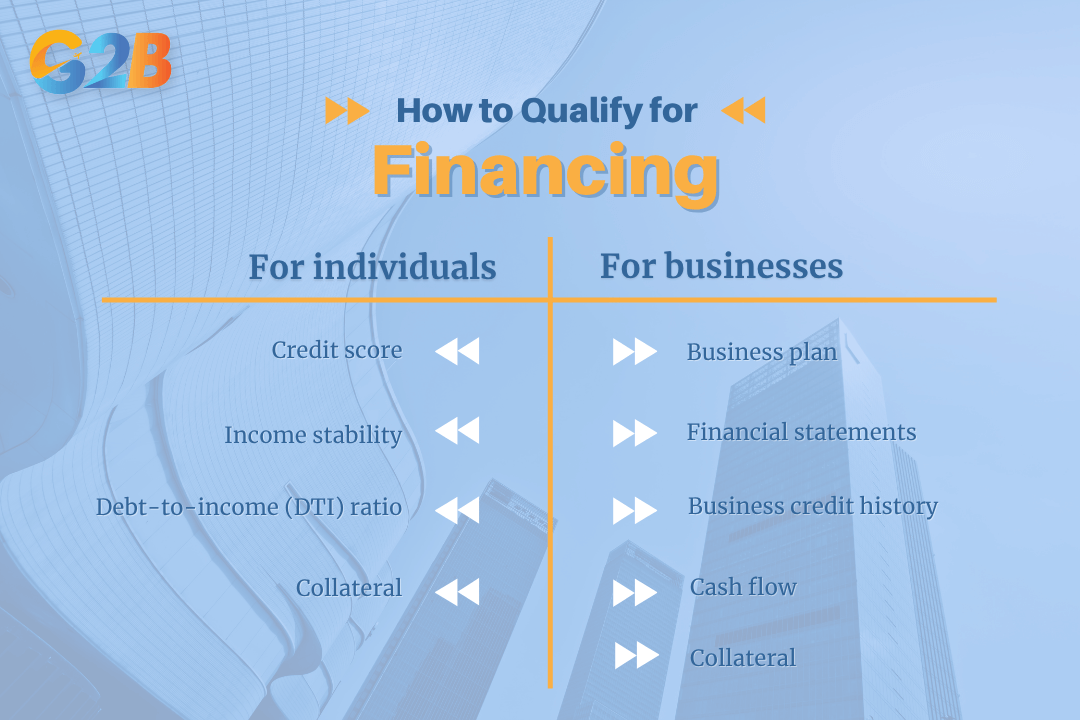

Qualifying for financing depends on a lender or investor's assessment of your ability to repay a loan or generate a return on their investment. While specific requirements vary, several core factors are universally considered. Whether you are an individual seeking a personal loan or a business looking for capital, demonstrating financial responsibility and a viable plan is key.

For individuals

When individuals apply for financing, lenders are primarily assessing personal financial stability and reliability.

- Credit score: A strong credit score is one of the most important factors as it reflects your history of repaying debts reliably. Lenders use this three-digit number to gauge your creditworthiness. A higher score generally leads to better loan terms and a higher chance of approval.

- Income stability: Lenders need to see that you have a consistent and reliable source of income sufficient to cover the new loan payments on top of your existing obligations. They will verify this through documents such as pay stubs, tax returns, and employment verification.

- Debt-to-income (DTI) ratio: This ratio compares your total monthly debt payments to your gross monthly income. A lower DTI ratio indicates that you have a healthy balance between debt and income, making you a less risky borrower.

- Collateral: For secured loans, such as mortgages or auto loans, the asset you are purchasing serves as collateral. Providing valuable collateral can make it easier to qualify for a loan and may result in a lower interest rate because it reduces the lender's risk.

For businesses

For businesses, funders look at both the health of the company and the viability of its future plans.

- Business plan: A well-developed business plan is crucial to show lenders how you intend to use the funds and generate revenue for repayment. It should include your company's mission, market analysis, organizational structure, financial projections, and marketing strategy.

- Financial statements: Lenders and investors will meticulously review your company's financial statements, including the income statement, balance sheet, and cash flow statement, to assess its profitability, liquidity, and overall financial health.

- Business credit history: Just like individuals, businesses have credit histories. A strong business credit report, showing a track record of paying vendors and creditors on time, is a significant advantage.

- Cash flow: Positive and consistent cash flow is a critical indicator that your business can meet its operating expenses and handle new debt repayments. Lenders want to see that your business generates enough cash to comfortably cover its obligations.

- Collateral: For business loans, lenders often require collateral in the form of business assets. These can include real estate, inventory, accounts receivable, or equipment.

- Owner's Personal Credit: Especially for new or small businesses, lenders will often examine the personal credit scores and financial history of the business owners as an indicator of their financial responsibility.

Qualifying for financing depends on a lender or investor's assessment of the ability to repay a loan

Navigating the world of financing is a critical skill for achieving significant personal and business milestones. Understanding the fundamental differences between debt and equity financing allows you to choose a path that aligns with your tolerance for risk, desire for control, and long-term strategic goals. By systematically assessing your needs, preparing thorough documentation, researching the right partners, and understanding the qualification criteria, you can demystify the process and substantially increase your chances of success.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom