A Financial Institution is a company that provides financial services for its clients or members. These entities are fundamental to a functioning economy, acting as intermediaries for various monetary transactions. This comprehensive guide explores the core definition of financial institutions, vital functions in the economy, and the specific and crucial role these institutions play for businesses, particularly in the context of company formation.

This article outlines the key aspects of financial institutions to help businesses gain a clearer understanding of their roles, functions, and practical applications. We specialize in company formation services and do not provide financial advice. For specific matters related to accounting, taxation, or financial management, please consult a qualified financial expert.

What are financial institutions?

A financial institution (FI) is an organization that facilitates the flow of capital between savers and borrowers. These entities handle financial and monetary transactions such as deposits, loans, investments, currency exchange, insurance, asset management, and other financial services. They act as critical intermediaries, connecting those with surplus money (savers) to those who need capital (borrowers), which is essential for economic stability and growth, while also providing liquidity, reducing financial risks, and supporting the efficient allocation of resources.

By providing a wide range of products and services, financial institutions enable individuals, businesses, and governments to manage their money, invest for the future, and access the necessary capital to expand and operate. These entities form the backbone of the economy, offering services from basic savings accounts to complex corporate financing.

What are the main roles and functions of a financial institution in the economy?

Financial institutions are critical to economic stability and growth by performing several key functions. They are the primary conduits for the flow of money, ensuring that capital is allocated efficiently to productive investments.

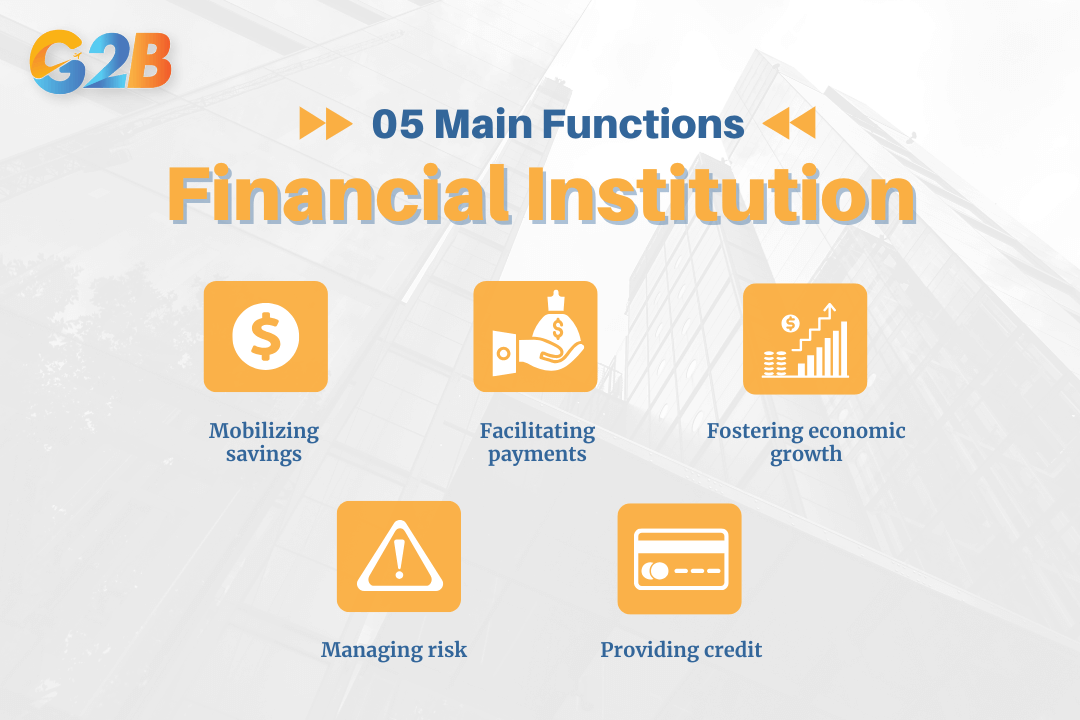

There are 5 main roles and functions of a financial institution in the economy

- Mobilizing savings: FIs collect surplus funds from individuals and businesses, pooling them into resources that can be used for lending and investment. They offer a variety of savings vehicles to encourage this, such as savings accounts, checking accounts, and certificates of deposit (CDs).

- Facilitating payments: They provide the infrastructure for the smooth transfer of funds between parties. They offer a variety of payment systems, including checking accounts, debit cards, and electronic transfers, which are essential for daily commerce.

- Providing credit: Access to credit is vital for both personal consumption and business investment. FIs evaluate creditworthiness and provide loans for various purposes, including home mortgages, personal loans, and business credit lines. This function fuels economic activity, from individual purchases to large-scale corporate expansion.

- Managing risk: Financial institutions offer tools and services that help individuals and businesses manage financial risks. They provide products like insurance policies and hedging instruments that protect against unforeseen events and market volatility.

- Fostering economic growth: By efficiently allocating capital to productive ventures, FIs are direct contributors to economic development. They finance new businesses, support infrastructure projects, and enable innovation, all of which lead to job creation and increased economic output.

Role of financial institutions in business registration in Vietnam

In Vietnam, financial institutions play a mandatory and critical role in the process of forming a company. This step is not optional; it is a legal requirement for completing the business registration process and ensuring financial compliance from the outset.

- Opening a corporate bank account: After obtaining the Enterprise Registration Certificate (ERC), one of the first and most critical post-licensing steps is to open a corporate bank account. This account is the official financial channel for the business, used for all transactions, including capital contributions, receiving payments, and handling payroll and taxes.

- Facilitating charter capital contribution: The law requires that all members or shareholders contribute their committed capital to this corporate account. This confirms the company's financial capacity. The charter capital is the total value of assets that owners commit to contributing when the company is established.

- Meeting the 90-day deadline: Vietnamese law mandates that the charter capital must be fully contributed within 90 days from the date the ERC is issued. Financial institutions are the vehicle for this transaction, providing the necessary documentation to prove the capital has been deposited in compliance with the law.

- Ensuring tax and financial compliance: The corporate bank account provides a clear and transparent record of all financial transactions, which is essential for tax reporting and compliance with Vietnamese authorities. This helps in accurate financial planning, analysis, and simplifies any potential audits. Navigating these requirements is a core part of the services offered by G2B's company formation package.

How many types of financial institutions and their services are there?

Financial institutions are broadly categorized into two main types: depository and non-depository. The primary distinction is whether they accept monetary deposits from consumers.

Financial institutions are broadly categorized into two main types

1. Depository institutions

These institutions are legally allowed to accept and manage monetary deposits from individuals and businesses and make loans. They are the most common type of FI that the public interacts with daily.

- Commercial banks: These are for-profit institutions owned by shareholders.

- Services: They offer a wide range of services, such as checking and savings accounts, personal loans, business credit lines, and credit cards. They also facilitate currency exchange and other international transactions for businesses.

- Credit unions: These are non-profit financial cooperatives owned and controlled by their members.

- Services: They provide similar services to commercial banks, including savings accounts, loan products, and checking services, but often offer more favorable interest rates and lower fees to their members.

- Savings and loan associations (thrifts): These institutions primarily focus on encouraging household savings and providing home mortgage loans.

- Services: Their main offerings include savings accounts and residential mortgage lending.

2. Non-depository institutions

These institutions do not accept traditional deposits but act as intermediaries between savers and borrowers through other means. They generate funds through premiums, investments, or fees.

- Investment banks: They specialize in complex financial transactions for corporations, governments, and other large entities.

- Services: Their primary services include underwriting new securities (stocks and bonds), facilitating mergers and acquisitions (M&A), and providing advisory services.

- Insurance companies: These companies provide protection against financial loss in exchange for regular payments (premiums).

- Services: They offer a variety of policies, such as life insurance, health insurance, property insurance, and liability insurance.

- Brokerage firms: These firms act as intermediaries for individuals and institutions to buy and sell securities.

- Services: They execute trades for stocks, bonds, and mutual funds and may also provide investment advice.

- Mortgage companies: These firms specialize in originating and/or servicing mortgage loans.

- Services: They focus exclusively on providing loans for purchasing real estate.

Financial institutions framework

Financial institutions operate within a heavily regulated environment to ensure economic stability and consumer protection. In the United States, this framework is overseen by multiple federal and state agencies.

Key regulatory bodies

- The Federal Reserve (the Fed): As the central bank of the U.S., the Fed is responsible for managing monetary policy, supervising banks, and maintaining the stability of the financial system.

- Federal Deposit Insurance Corporation (FDIC): The FDIC provides deposit insurance, which guarantees the safety of deposits in member banks up to a certain limit, currently $250,000 per depositor, per bank. It also supervises state-chartered banks that are not members of the Federal Reserve System.

- Office of the Comptroller of the Currency (OCC): The OCC charters, regulates, and supervises all national banks and federal savings associations.

- Securities and Exchange Commission (SEC): The SEC oversees securities markets, including the regulation of brokerage firms, investment advisors, and mutual funds to protect investors and maintain fair markets.

- Consumer Financial Protection Bureau (CFPB): Created by the Dodd-Frank Act, the CFPB is tasked with protecting consumers in the financial marketplace by enforcing federal consumer financial laws.

- National Credit Union Administration (NCUA): The NCUA is the independent federal agency that charters and supervises federal credit unions and insures deposits at all federal and most state-chartered credit unions.

Major banking regulations

- Bank Secrecy Act (BSA): This law requires financial institutions to assist U.S. government agencies in detecting and preventing money laundering. It mandates reporting for cash transactions exceeding $10,000 and the filing of suspicious activity reports.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: Enacted in response to the 2008 financial crisis, this comprehensive legislation aims to reduce systemic risk, increase transparency, and protect consumers from abusive financial practices.

- Gramm-Leach-Bliley Act (GLBA): Also known as the Financial Services Modernization Act of 1999, the GLBA governs how financial institutions handle the private information of individuals.

- Community Reinvestment Act (CRA): This act encourages banks to meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods.

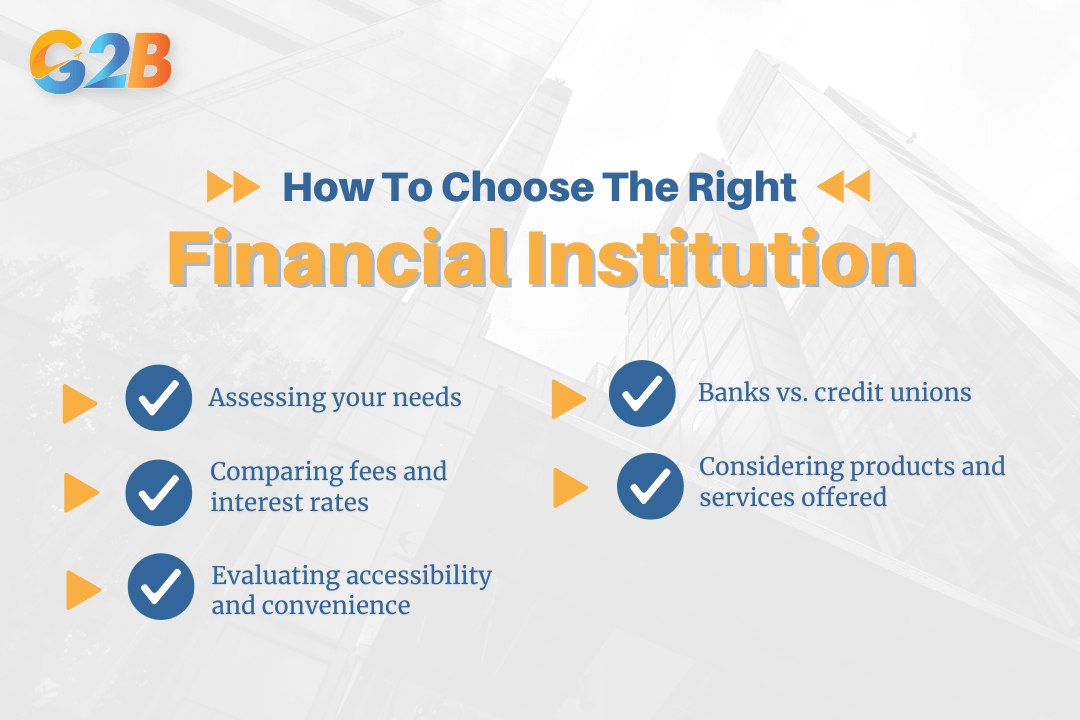

How to choose the right financial institution

Selecting the right financial institution is a critical decision for both individuals and businesses. The best choice depends on your specific financial needs, goals, and preferences.

Selecting the right financial institution is a critical decision for both individuals and businesses

- Assessing your needs: Before you begin your search, understand what you require. Consider the volume and type of your transactions, your need for loans or credit, and whether you require specialized services like international transfers, payroll management, or investment advice.

- Comparing fees and interest rates: Carefully examine the fee structures for accounts and services. Look for institutions that offer competitive interest rates on savings and favorable terms on loans and credit lines. Be aware of monthly maintenance fees, overdraft charges, and transaction limits.

- Evaluating accessibility and convenience: Consider how you prefer to do your banking. If you value in-person service, look for an institution with a convenient network of branches and ATMs. If you operate primarily online, prioritize a bank with robust and user-friendly online and mobile banking platforms.

- Considering products and services offered: Ensure the institution provides all the financial products you might need as you or your business grows. This could include everything from basic checking to more complex treasury management services or business loans.

- Banks vs. credit unions: Understand the fundamental difference. Banks are for-profit entities, which may offer a wider array of services and more advanced technology. Credit unions are non-profit, member-owned organizations that often provide better rates, lower fees, and a stronger community focus, but may have membership restrictions.

A financial institution is a cornerstone of modern economies, performing essential roles from mobilizing savings to fueling economic growth. The landscape is diverse, with depository institutions like commercial banks and credit unions serving everyday needs, while non-depository institutions such as investment banks and insurance companies handle more specialized functions. For entrepreneurs looking to register a company in Vietnam, understanding the different types of financial institutions, the regulatory environment they operate in, and how to choose the right one is key to sound financial management.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom