Financial Structure refers to the specific mix of debt and equity a company uses to finance its assets and operations. It is the blueprint of a company's financial foundation, dictating how it pays for everything it owns and does. Understanding and optimizing this structure is not just a task for the finance department; it's a critical strategic imperative for any business aiming for sustainable growth and long-term success. Let’s explore the key building blocks of debt and equity, and clarify the distinction between financial and capital structure.

This article outlines the key aspects of financial structure to help businesses gain a clearer understanding of its elements, functions, and practical applications. We specialize in company formation services and do not provide financial structuring or investment advice. For specific matters related to accounting, taxation, or financial management, please consult a qualified legal or financial expert.

What is financial structure?

At its core, a company's financial structure is the composition of all its financial resources, representing the blend of different financial liabilities and equity sources used to finance the company's assets and operations. Think of it as a company's funding strategy, detailing how its liabilities and equity finance its assets and operations. This entire framework is visible on the right-hand side of a company’s balance sheet, which lists its liabilities (both short-term and long-term) and shareholders' equity. This structure directly influences a company's cost of capital, risk exposure, valuation, and overall performance.

A well-planned financial structure provides a complete picture of how a company is capitalized, balancing the use of borrowed funds (debt) with owners' capital (equity). This balance is crucial because it affects the company's risk profile, financial leverage, and profitability. For instance, a heavy reliance on debt increases financial risk but can amplify returns for shareholders. Conversely, a structure dominated by equity is less risky but may dilute ownership and result in a higher cost of capital. Ultimately, the financial structure is fundamental to a business's ability to run smoothly, manage economic fluctuations, and seize growth opportunities.

Core components of financial structure

A company's financial structure is built from various sources of capital, each with its own characteristics, costs, and risks. These components can be broadly categorized into debt capital, equity capital, and, in some cases, hybrid instruments.

- Debt capital: This involves borrowing funds that must be repaid over a specific period, almost always with interest. Debt financing is attractive because interest payments are typically tax-deductible, which can lower the effective cost of borrowing. Debt can be classified into two main types:

- Short-term debt: These are financial obligations due within one year. Examples include trade credit from suppliers, short-term bank loans, and lines of credit.

- Long-term debt: These obligations are due in more than one year. Common forms of long-term debt include term loans, bonds, and mortgages.

- Equity capital: This represents the funds invested in the company by its owners or shareholders in exchange for an ownership stake. Unlike debt, equity capital does not have to be repaid and does not involve fixed interest payments. The two primary sources of equity capital are:

- Share capital (or contributed capital): This is the money raised by selling shares of the company to investors, including its founders, venture capitalists, or the public through a stock offering.

- Retained earnings: These are the cumulative profits that the company has reinvested back into the business instead of distributing them to shareholders as dividends.

- Hybrid instruments: Some financial instruments combine features of both debt and equity. The most common example is convertible bonds, which are initially issued as debt but can be converted into a predetermined number of company shares at the discretion of the bondholder.

There are essentially 3 categories of a company’s financial structure

Importance of a sound financial structure

A well-planned and sound financial structure is not merely an accounting concept; it is a strategic asset that is vital for a company's stability and growth. It underpins a company's ability to manage its operations efficiently, navigate economic uncertainties, and achieve its long-term objectives. The key benefits of a robust financial structure include:

- Cost of capital optimization: One of the most significant impacts of financial structure is on the cost of capital - the blended cost of debt and equity financing. By finding the optimal mix, a company can minimize its Weighted Average Cost of Capital (WACC), making it cheaper to fund new projects and operations, which in turn enhances profitability.

- Risk management: A balanced financial structure helps mitigate financial risks. Over-reliance on debt increases insolvency risk, as the company is legally obligated to make interest and principal payments regardless of its earnings. A healthy amount of equity provides a cushion during economic downturns when cash flows may be volatile.

- Enhanced profitability and growth: A structure that lowers the cost of capital allows a company to invest more in growth opportunities, innovation, and market expansion. This financial stability and access to capital lay the foundation for sustainable long-term growth.

- Investor confidence: A well-managed financial structure signals financial prudence and stability to investors, lenders, and other stakeholders. Companies with a healthy balance of debt and equity are often seen as lower-risk investments, which boosts investor confidence and can lead to a higher company valuation.

- Financial flexibility: A sound financial structure provides the flexibility to adapt to changing market conditions and seize new opportunities. Whether it's securing additional funding for an acquisition or having the resources to weather a recession, a flexible structure ensures the company can make strategic moves without being constrained by its financial obligations.

There are 5 key benefits of a robust financial structure

Financial structure vs. capital structure

The terms "financial structure" and "capital structure" are often used interchangeably, but they refer to two distinct concepts. Understanding the difference is crucial for precise financial analysis and strategic planning. Financial structure represents the entire mix of liabilities and equity a company uses to finance its assets. This includes all sources of funds shown on the liabilities and equity side of the balance sheet, encompassing both short-term and long-term funds.

In contrast, capital structure is a subset of the financial structure, focusing only on the long-term sources of funds. Specifically, capital structure is concerned with the mix of long-term debt and equity that a company uses to finance its operations and growth over the long haul. Here is a simple breakdown to highlight the key difference:

| Feature | Financial structure | Capital structure |

|---|---|---|

| Scope | Broad and comprehensive. | Narrow and focused. |

| Components | Includes all liabilities (short-term and long-term) and all equity. | Includes only long-term debt, shareholder equity, and retained earnings. |

| Perspective | Provides a complete view of a company's total financing strategy. | Focuses on the permanent and long-term financing of the company. |

Essentially, the financial structure gives a holistic view of how a company finances its assets in both the short and long term, while the capital structure zooms in on the strategic, long-term funding decisions that form the company's financial foundation.

Analyzing and evaluating financial structure

Analyzing a company's financial structure is essential for assessing its financial health, risk exposure, and operational efficiency. This evaluation typically involves a combination of financial ratio analysis and trend analysis, which together provide a comprehensive picture of the company's financial standing.

Key financial ratios for analysis

Several leverage ratios provide insight into a company's financial risk, such as the debt-to-equity ratio, the debt-to-assets ratio, and the debt-to-capital ratio.

1. Leverage ratios

Leverage ratios measure the extent to which a company uses debt to finance its assets. A high degree of leverage can amplify returns but also increases financial risk.

- Debt-to-equity ratio (D/E): This is one of the most common leverage ratios, comparing a company's total liabilities to its total shareholder equity.

- Formula: Total Liabilities / Shareholder Equity

- Interpretation: A high D/E ratio indicates that the company is financed more by debt than by its owners' funds, suggesting higher risk for creditors and investors. What constitutes a "good" ratio varies significantly by industry.

- Debt-to-assets ratio: This ratio measures the proportion of a company's assets that are financed through debt.

- Formula: Total Debt / Total Assets

- Interpretation: A ratio greater than 1 means that a company has more debt than assets, indicating a high degree of leverage and financial risk. A lower ratio (e.g., below 0.5) suggests that the company's assets are funded more by equity.

2. Liquidity ratios

Liquidity ratios assess a company's ability to meet its short-term obligations (those due within one year). A healthy financial structure ensures sufficient liquidity to cover immediate liabilities.

- Current ratio: This ratio compares all of a company's current assets to its current liabilities.

- Formula: Current Assets / Current Liabilities

- Interpretation: A ratio above 1 generally indicates that the company has enough short-term assets to cover its short-term liabilities. A ratio below 1 can signal potential liquidity problems.

3. Profitability ratios

While not a direct measure of financial structure, profitability ratios indicate how effectively the structure is working to generate profits.

- Return on equity (ROE): This ratio measures the return generated on the shareholders' investment.

- Formula: Net Income / Shareholder Equity

- Interpretation: A high ROE can be a positive sign, but if it is driven by a very high debt-to-equity ratio, it could also signal excessive risk.

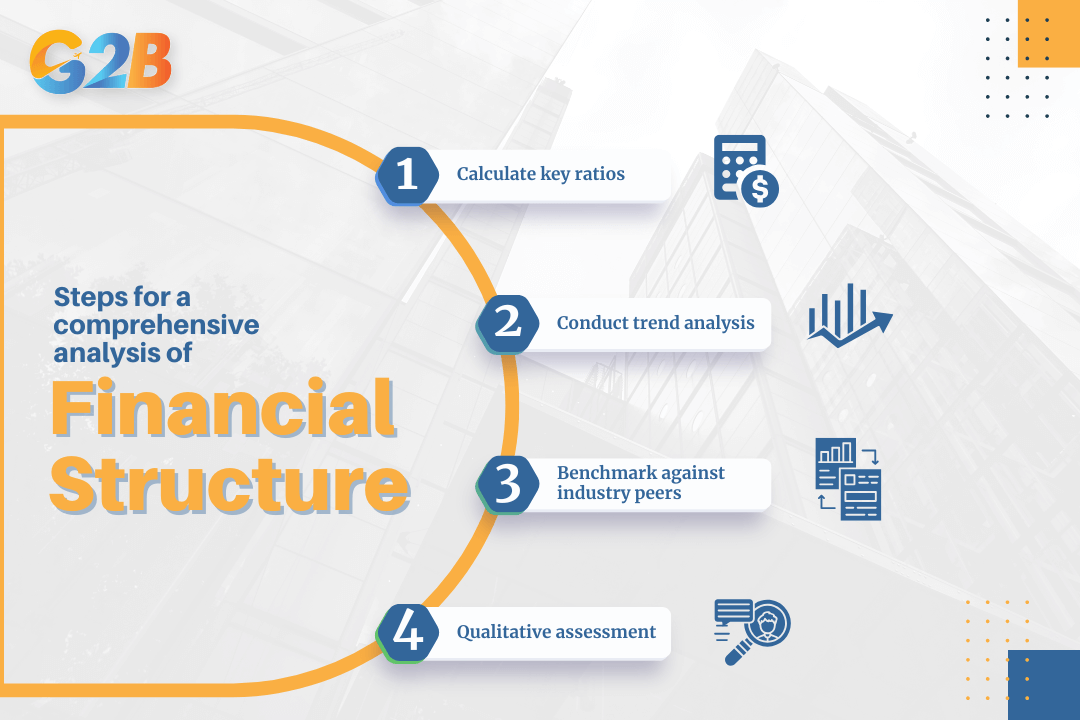

Steps for a comprehensive analysis

- Calculate key ratios: Start by calculating the relevant leverage and liquidity ratios for the company over several periods (e.g., the last 3-5 years).

- Conduct trend analysis: Analyze how these ratios have changed over time. An increasing debt-to-equity ratio, for example, indicates that the company is taking on more debt relative to its equity base, which could be a red flag.

- Benchmark against industry peers: Compare the company's ratios to the average ratios of its industry. A company with a significantly higher leverage ratio than its competitors may be taking on undue risk.

- Qualitative assessment: Look beyond the numbers. Consider factors like the stability of the company's cash flows, its growth stage, and prevailing economic conditions, as these can influence what is considered an optimal financial structure.

There are 4 steps for a comprehensive analysis

Mastering a company's financial structure is fundamental to its overall health and long-term viability. It is far more than just a configuration of debt and equity on a balance sheet; it is the strategic engine that powers a company's operations, influences its risk profile, and dictates its capacity for growth. By understanding its core components, recognizing its strategic importance, and continuously analyzing its effectiveness through key financial ratios, a business can build a resilient foundation.

A well-structured financial framework enables a company to optimize its cost of capital, enhance profitability, and maintain the flexibility required to navigate a dynamic business environment. For those preparing to register a company in Vietnam or seeking to strengthen an existing enterprise, the insights and strategies outlined in this guide are designed to support informed decision-making, foster stability, inspire investor confidence, and ultimately create sustainable value.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom