For entrepreneurs seeking to scale operations, safeguard assets, and streamline management across multiple ventures, the holding company structure presents a compelling advantage. By centralizing ownership and control, this model enables greater flexibility in taxation, risk mitigation, and investment strategy. From enhanced legal protection to improved capital efficiency, the holding company has become a cornerstone of modern business architecture. This article delves into its definition, strategic benefits, legal implications, and the essential steps required to establish one effectively.

What is Holding Company

A holding company is a business entity that primarily exists to own and control other companies - referred to as subsidiaries - through majority shareholding, rather than engaging directly in the production of goods or services.

How Holding Companies work

The fundamental mechanism through which holding companies operate involves controlling interest in subsidiary businesses. This control allows the parent company to direct business strategies, align goals across subsidiaries, and implement unified business initiatives. By consolidating decision-making processes, a holding company simplifies the coordination of the subsidiaries, which can lead to increased efficiency and reduced administrative overhead.

Moreover, holding companies often leverage strategic asset allocation across subsidiaries to optimise resource utilization. This may involve reallocating capital from areas of surplus to areas needing investment, thus ensuring financial stability and growth potential across the entire group. Another layer of operational functionality includes risk management; by distributing liability across subsidiaries, a holding company can limit its overall exposure to business risks.

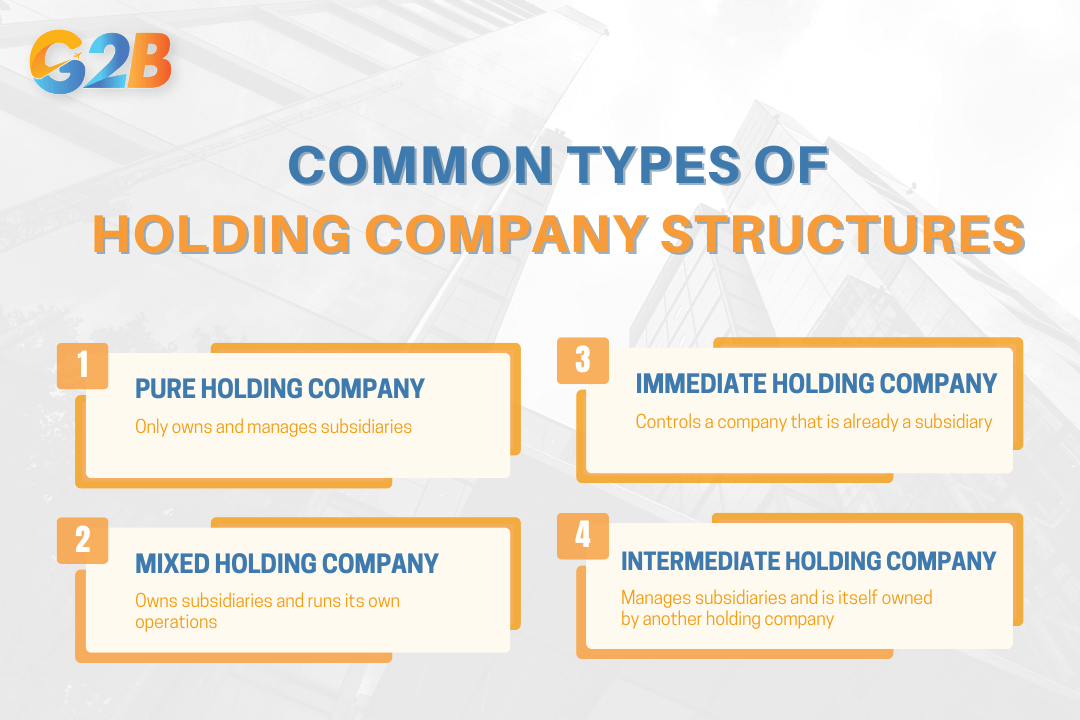

Common types of holding structures

Holding companies can adopt several structural models to achieve their organizational goals. Here are some prevalent types:

- Pure holding company: This type exclusively engages in owning and managing subsidiaries, without participating in any other business activities.

- Mixed holding company: In addition to owning subsidiaries, a mixed holding company may engage in its operational activities, such as manufacturing or services.

- Immediate holding company: This entity holds a controlling stake in another company, which is itself a subsidiary of a larger parent company.

- Intermediate holding company: Acting as a middle structure, this type manages a group of subsidiaries and falls under another holding company's influence.

Each structure offers distinct advantages and caters to different strategic needs. For example, a pure holding company could be ideal if the objective is solely asset protection and risk management. In contrast, a mixed holding company might suit organizations seeking to blend operational and managerial roles.

Common types of holding company structures include 3 features

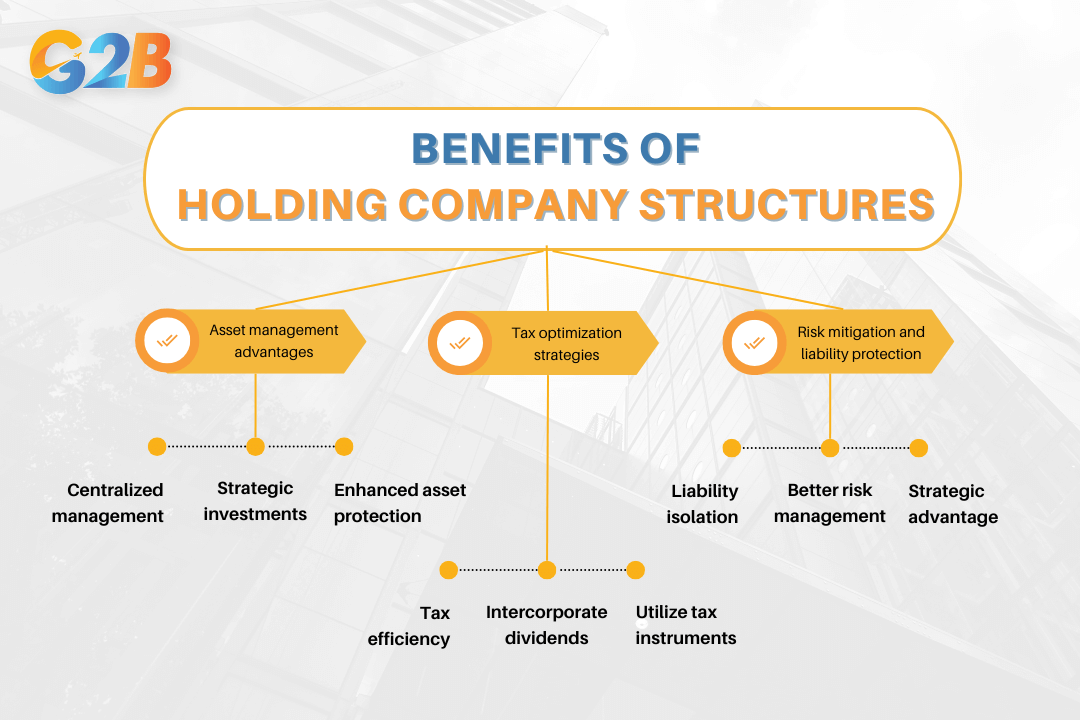

Benefits of Holding Company structures

The advantages of a holding company compel business owners and corporate finance professionals to often choose this structure for better control and efficiency.

Asset management advantages

One of the key benefits of a holding company structure is the streamlined management of assets. By consolidating the ownership of subsidiaries and assets under a single parent company, business owners can achieve more centralized control. This facilitates strategic asset allocation and enhances overall financial efficiency.

- Centralized management: Holding companies allow for a unified management approach across multiple subsidiaries. This can lead to more coherent strategic decisions and better use of resources. The centralized management system within a holding company can increase operational efficiency and improve the negotiation capacity with vendors and stakeholders.

- Strategic investments: Holding companies can leverage their structure to make strategic investments. They have the flexibility to acquire or divest subsidiaries based on market conditions and company strategy. This flexibility is vital for adapting to business landscapes and capitalizing on new opportunities.

- Enhanced asset protection: By segregating business lines into different subsidiaries, holding companies provide an extra layer of protection against risks. For instance, if one subsidiary faces liabilities, the other business units or the parent company itself are insulated against direct impacts.

Tax optimization strategies

Tax optimization is a significant benefit of holding companies, allowing for substantial savings and efficient financial management:

- Tax efficiency: Many holding companies are structured in such a way as to benefit from preferential tax treatment. By conducting activities in jurisdictions with favorable tax regimes, businesses can optimize their tax liabilities.

- Intercorporate dividends: A holding company structure allows for tax-efficient profit distributions. Intercompany dividends between the parent company and its subsidiaries are often exempt from heavy taxation, depending on jurisdictional regulations. This minimizes the tax burden on corporate earnings repatriation.

- Utilize tax instruments: Holding companies can also leverage tax instruments such as loss transfers to optimize tax positions across the group. For instance, losses in one subsidiary can often be offset against profits in another, reducing the overall tax liability.

Risk mitigation and liability protection

The isolation of liabilities and risk management is quintessential when considering the setup of a holding company:

- Liability isolation: By holding distinct business units as separate subsidiaries, the holding company structure limits liability exposure. If a subsidiary incurs debt or legal obligations, the liabilities are confined to that entity and do not impact the parent company or other subsidiaries.

- Better risk management: Holding companies enable more effective risk management strategies. The ability to segregate operations into different legal entities ensures that financial issues in one area do not jeopardize the entire organization.

- Strategic advantage: In terms of strategic risk, holding companies provide the advantage of diversification. Engaging in varied business domains distributed across subsidiaries can mitigate the risks inherent in concentrating operations within a single sector.

There are 3 benefits of Holding Company structures

Legal and regulatory requirements

The regulatory requirements are essential to ensure that the holding company is structured in compliance with jurisdictional laws and international regulations.

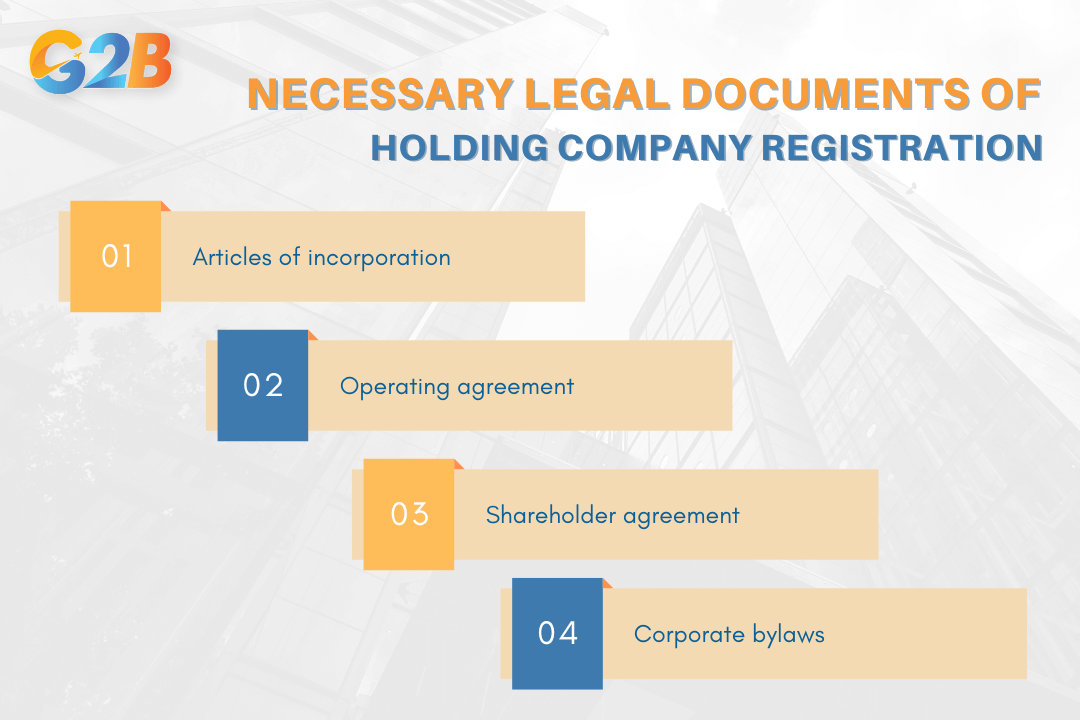

Necessary legal documents

To successfully set up a holding company, several essential legal documents are required. These documents lay the foundation of the company's legal status and operational framework:

- Articles of incorporation: This document is pivotal as it outlines the basic information about the holding company, such as its name, principal place of business, and purpose. It serves as a formal declaration to the regulatory agencies about the company’s existence and operational intent.

- Operating agreement: Especially crucial for limited liability companies, the operating agreement details the company’s ownership structure, management duties, and operational procedures. It is a legally binding contract between the members of the company that provides clarity on internal governance.

- Shareholder agreement: This agreement specifies the rights and responsibilities of the shareholders. It includes mechanisms for conflict resolution, share transferability, and dividend policies, thus safeguarding the shareholders' interests.

- Corporate bylaws: Serving as the internal manual for procedures, corporate bylaws outline the management structure, board of directors' responsibilities, meeting schedules, and other organizational formalities.

Several essential legal documents are required to successfully set up a holding company

Each jurisdiction may demand additional documents based on local laws, which a business owner must prepare in consultation with legal advisors.

Registration and compliance

Once the foundational documents are in place, the holding company must be registered with the appropriate government bodies. This process varies according to the jurisdiction and often includes:

- Choosing a business name: This involves selecting a unique business name that complies with the naming conventions of the jurisdiction. The name must reflect the nature of the business while not infringing on existing trademarks.

- Filing with the registrar: The company's Articles of Incorporation, along with any necessary supporting documents, must be submitted to the business registrar or the equivalent authority in the jurisdiction.

- Obtaining a business license and permits: Depending on the jurisdiction and business activities of the subsidiaries, specific licenses or permits may be required. Ensuring compliance with these licensing requirements is crucial to avoid legal complications.

- Adhering to tax regulations: Compliance with tax obligations is a critical aspect of holding company operations. Registration for relevant taxes, such as corporate tax, VAT, or specific sector-related levies, aligns the company with national tax laws.

Navigating international regulations

Operating across several jurisdictions adds a layer of complexity to a holding company’s regulatory landscape. Here are some considerations for international compliance:

- Understanding local laws: Each jurisdiction may have distinct legal frameworks. It’s imperative to understand local corporate governance norms, tax structures, and business operation guidelines to ensure compliance.

- Evaluating double taxation treaties: Many countries have double taxation treaties that prevent the same income from being taxed in multiple jurisdictions. Knowledge of these treaties can aid in tax planning and minimize financial liabilities.

- Anti-money laundering (AML) and know your customer (KYC) requirements: As holding companies often engage in cross-border transactions, adherence to AML and KYC regulations is mandatory to prevent illegal financial activities.

- Seeking expert guidance: Engaging with legal and financial experts familiar with international laws is crucial. Advisors provide specialized counsel to navigate international regulatory terrains effectively.

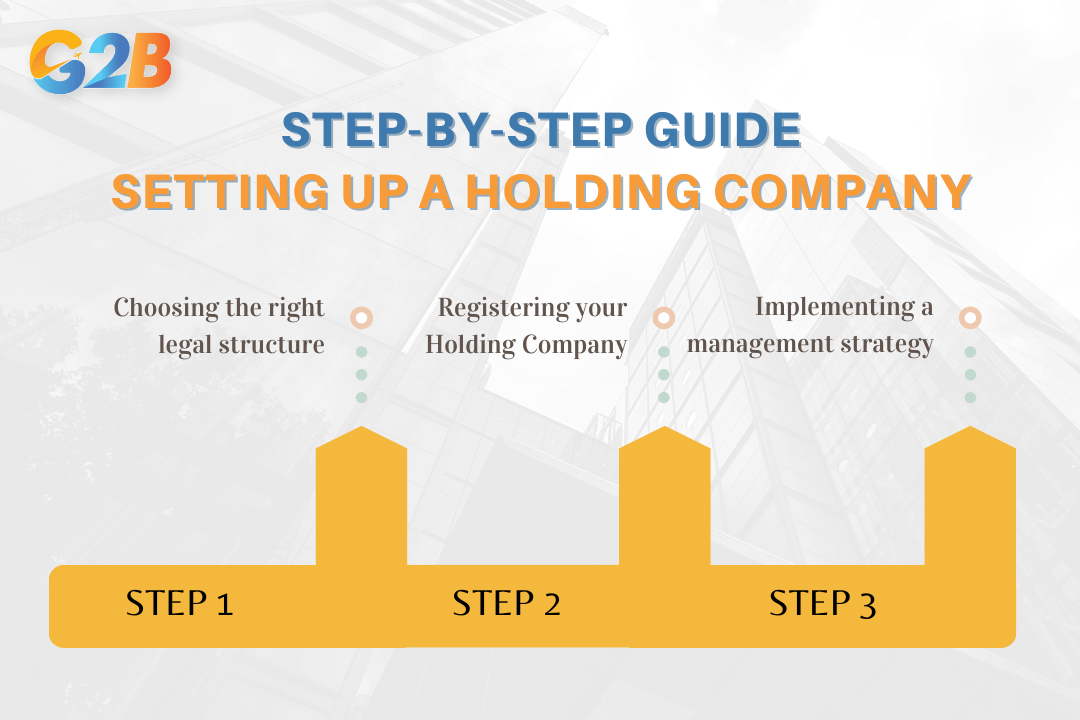

Step-by-step guide to set up a Holding Company

Let’s explore a detailed, step-by-step guide to establishing a holding company, with the support of professional business support services to ensure a smooth and efficient setup process.

Choosing the right legal structure

Selecting the appropriate legal structure is the foundation of a successful holding company. The choice typically revolves around forming a limited liability company (LLC) or a corporation, depending on your objectives and the legal environment of your jurisdiction.

- Limited Liability Company (LLC): LLCs are popular for their flexibility and pass-through taxation benefits. They offer protection for personal assets from company liabilities, making them an attractive option for many business owners.

- Corporations: Corporations provide more rigid structures with separate taxation, which may be beneficial for larger entities or those planning to seek public investment. The double taxation issue could be alleviated through various strategies.

- In the U.S., corporations are often classified as C Corporations or S Corporations. C Corporations are subject to double taxation (corporate level and shareholder dividends), while S Corporations allow profits and losses to pass through directly to shareholders, avoiding corporate tax-though they are subject to restrictions such as a limited number of shareholders and U.S. citizenship requirements

Registering your Holding Company

The registration process varies by jurisdiction, but it typically involves several key steps to ensure legal compliance:

- Name selection and reservation: Ensure the name is distinct and complies with state regulations. Most jurisdictions allow you to reserve a name before filing the formation documents.

- File articles of incorporation/organization: Submit these foundational documents to the appropriate state agency. They detail the company's name, purpose, and structural information.

- Obtain an Employer Identification Number (EIN): This federal tax identification number is necessary for opening a bank account and fulfilling tax obligations.

- Register for state taxes: Depending on your jurisdiction, you may need to register for state-level taxes, such as sales tax or employment tax.

- Open a corporate bank account: Keeping your business finances separate from personal finances is vital for maintaining liability protection.

Implementing a management strategy

A robust management strategy is vital to optimize the operations of your holding company. This requires careful consideration of both internal management structure and strategies for overseeing subsidiaries.

- Internal management: A clear governance model should outline the decision-making process within the holding company. This includes defining roles for shareholders, executives, and boards of directors.

- Subsidiary oversight: Develop standardized guidelines for evaluating subsidiary performance and align strategic objectives. Regular audits and performance reviews can ensure that subsidiaries meet the holding company’s overarching goals.

- Resource allocation: Establish procedures for capital allocation and resource distribution. Effective capital management can leverage a holding company's advantages in intercompany funding and asset mobility.

- Risk management: Implement a risk management framework to mitigate operational and financial risks across the holding and subsidiary companies. This may involve creating risk assessment protocols and intervention mechanisms.

Investigate the step-by-step guide to setting up a Holding Company

Organizational structure and governance

Let’s delve into the intricate roles involved in this structure and the necessary governance practices to fortify a holding company's operations.

Role of the parent company

The parent company holds a central, strategic position within the holding structure. As the apex entity, it is responsible for overarching management and strategic direction across its subsidiaries. The parent company typically exercises its control through:

- Strategic planning: Defining the vision, mission, and long-term goals for the entire corporate group. This involves aligning the objectives of individual subsidiaries with the overarching strategy to ensure coherence and synergy.

- Financial control: Consolidating financial reporting and budgeting to maintain transparency and efficiency. This allows the parent company to maximize financial oversight, allocate resources effectively, and leverage economies of scale for procurement and investments.

- Risk management: Identifying, assessing, and mitigating risks at both the parent and subsidiary levels. By centralizing risk management, the parent company ensures that all subsidiaries adhere to a unified risk strategy, thereby safeguarding the group's assets and reputation.

Subsidiary management

Managing subsidiaries under a holding company involves a delicate balance between autonomy and centralized control. Subsidiaries often function independently in their respective markets but must conform to the strategic framework set by the parent company. Key aspects of subsidiary management include:

- Autonomy vs. alignment: While subsidiaries are granted operational autonomy to drive innovation and responsiveness to local markets, they must align their business practices with the parent company's overarching policy framework. This balance fosters entrepreneurial initiatives while maintaining strategic coherence.

- Performance monitoring: The parent company implements robust performance metrics and reporting systems to evaluate subsidiary performance. This includes regular audits, benchmarking against industry standards, and implementing corrections where necessary to ensure optimal performance and compliance.

Corporate governance practices

Effective corporate governance underpins a holding company's success by ensuring ethical leadership, accountability, and stakeholder engagement. Implementing robust governance practices enhances transparency, which can bolster investor confidence and reduce regulatory risks. Essential components of governance include:

- Board composition and function: Establishing a well-balanced and experienced board of directors is crucial, as it provides strategic direction and enhances decision-making processes. Boards should include a mix of independent and executive directors to ensure diverse perspectives and impartial oversight.

- Regulatory compliance: Adhering to corporate laws and industry regulations in every jurisdiction where the company operates is paramount. The governance framework must include compliance monitoring mechanisms to avoid legal pitfalls and potential fines.

- Stakeholder engagement: Building robust communication channels with shareholders and other stakeholders fosters trust and ensures that the company considers their interests. This involves regular updates, transparent reporting, and timely meetings to address concerns and solicit feedback.

Tax strategies for Holding Companies

Understanding and implementing effective tax strategies is crucial for maximizing profitability while complying with legal obligations.

Tax planning essentials

Tax planning is a fundamental aspect for any holding company aiming to optimize its tax obligations. At the core of tax planning is the determination of how best to structure the organization to minimize tax liabilities legally. Effective tax planning revolves around three main objectives:

- Entity structure optimization: One of the first steps in tax planning is choosing the right legal structure for the holding company and its subsidiaries. Different jurisdictions offer various benefits, including tax incentives for specific activities or industries. Aligning the corporate structure with these jurisdictions can lead to significant tax savings.

- Income shifting: This involves allocating income and expenses among various entities within the holding company's structure to benefit from lower tax rates in different jurisdictions. It requires a thorough analysis of transfer pricing rules and compliance with international tax standards to avoid legal complications.

- Expense management: Proper documentation and categorization of expenses can lead to more deductions and reduced taxable income. Utilizing tax credits, allowances, and incentives offered by tax regulations can further optimize a company's tax position.

Utilizing international tax treaties

International tax treaties are bilateral or multilateral agreements between countries designed to prevent double taxation and encourage cross-border trade and investment. Holding companies with subsidiaries or operations in multiple countries can significantly benefit from these treaties. Here are a few ways to leverage them:

- Double taxation avoidance: Treaties often provide mechanisms to ensure that income is not taxed twice in two different jurisdictions, which is crucial for operations spanning multiple countries.

- Reduced withholding taxes: Dividend, interest, and royalty payments between entities in different countries may be subject to high withholding taxes. Tax treaties can lower these rates, leading to substantial savings.

- Permanent Establishment (PE) standards: Tax treaties define what constitutes a PE, thus affecting tax obligations. Understanding these definitions can help a holding company structure its activities to avoid unintended tax liabilities.

Avoiding common tax pitfalls

While aiming for tax efficiency, holding companies must be cautious to avoid common pitfalls that can lead to audits, penalties, and legal issues. These pitfalls include:

- Ignoring transfer pricing regulations: Transfer pricing is scrutinized by tax authorities worldwide. Failing to adhere to arm's length principles for transactions between related entities can result in significant penalties.

- Overlooking compliance requirements: Each jurisdiction has specific filing requirements and deadlines. Missing these can lead to fines and damage to the company's reputation.

- Inadequate documentation: Proper documentation is crucial to defend the company's tax positions during audits. This includes agreements, financial transactions, and supporting justifications for tax strategies applied.

- Over-reliance on tax havens: While tax havens offer attractive tax rates, excessive reliance can lead to reputational risks and increased scrutiny. Balancing operations in tax-efficient jurisdictions with transparent business practices is essential.

Utilizing effective tax strategies allows holding companies to manage their global tax profile proactively. By focusing on strategic planning, leveraging international tax treaties, and avoiding common pitfalls, holding companies can achieve sustainable tax efficiency while complying with legal requirements. This comprehensive approach not only enhances compliance but also supports the overarching financial objectives of the corporate group.

Strategic asset allocation

Strategic asset allocation involves the methodical division of holdings in a way that aligns with the overarching financial goals and risk tolerance of the holding company. The primary aim is to develop a diversified portfolio that balances high-return investments, such as equities or growth stocks, with safer assets like bonds or cash reserves. Holding companies have the advantage of using their broad investment pool, derived from subsidiaries in different sectors, to spread risk.

- Diversification: By owning various subsidiaries across multiple industries, a holding company can diversify its portfolio naturally, spreading exposure and reducing the impact of volatility in any single market.

- Centralized management: Asset management is streamlined through centralized decision-making, enabling a coherent and unified investment strategy across the entire corporate group, enhancing efficiency and control.

- Long-term perspective: Holding companies typically adopt a long-term investment outlook, benefiting from economies of scale and reinvesting subsidiary profits into high-value ventures.

Leveraging holding companies for investments

A holding company acts as a powerful vehicle for accumulating and deploying assets strategically. Its structure allows for significant flexibility in investment strategies, accommodating diverse financial instruments and opportunities.

- Pooling resources: A holding company can aggregate resources from subsidiary earnings, facilitating investment in larger, capital-intensive projects that individual subsidiaries might not pursue alone.

- Risk mitigation through subsidiaries: By distributing investments across its subsidiaries, a holding company not only limits exposure to any single investment but also enhances its negotiating power for better terms with vendors and suppliers.

- Tax efficiency: Investment in subsidiaries can present opportunities for tax optimization. Holding companies may capitalize on inter-company transactions and subsidiary payments to achieve favorable tax positions, often advised by tax experts and legal consultants.

FAQs on Holding Company setup

The complexity associated with setting up and managing a holding company can lead to many questions. Let's explore some of the most frequently asked questions surrounding holding company setups to provide clarity.

How can a Holding Company optimize taxes?

Tax optimization is often a significant incentive for setting up a holding company. By consolidating profits and losses across subsidiaries, a holding company might reduce taxable income through strategic financial reporting. Here are a few methods by which holding companies optimize taxes:

- Profit allocation: Shifting profits to subsidiaries located in jurisdictions with favorable tax rates via transfer pricing strategies.

- Dividend exemption: In many jurisdictions, dividends received from subsidiaries are exempt from taxation at the holding company level.

- Loss offsetting: Balancing profits from one subsidiary against losses from another to minimize overall tax liability.

What are the risks associated with Holding Company setups?

Although holding companies offer numerous benefits, there are inherent risks and challenges that must be managed:

- Regulatory compliance: Meeting the regulatory requirements across different jurisdictions can be complex and resource-intensive.

- Complex governance: Large conglomerates might face difficulties in maintaining a cohesive strategy and communication across multiple subsidiaries.

- Financial exposure: While a holding company structure can isolate risks, poor strategic decisions by any subsidiary can still impact the overall financial health of the group.

- Tax implications: Misuse of tax advantages can lead to legal ramifications, including penalties or charges for evasion.

The setup of a holding company involves careful consideration of both its benefits and challenges. By understanding how a holding company functions, optimizing tax strategies, and addressing potential risks, business owners and investors can harness the full potential of a holding structure to drive corporate success.

Thanks to its dynamic economy and investor-friendly policies, the United Kingdom (UK) continues to be a leading destination for international entrepreneurs pursuing growth and global expansion. For those aiming to establish a presence in the UK market, G2B offers offshore company formation service, providing tailored support and strategic guidance every step of the way. Contact G2B to open the door to new opportunities and accelerate global success!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom