Golden Shares are a unique and powerful tool in corporate governance, allowing a single shareholder to wield disproportionate control over a company's critical decisions. This special class of shares effectively grants its holder veto power, enabling them to block major corporate actions even without holding a majority of the company's equity. Let’s delve into how this mechanism works, why it is both celebrated as a safeguard and criticized as a market distortion, and how it compares to state control methods used in Vietnam.

This article assists businesses and investors in gaining a clearer understanding of golden shares. We specialize in company formation and not in securities trading or investment consulting. For technical guidance on structuring or managing golden shares, please consult a qualified legal or financial expert.

What are golden shares?

A golden share is a special class of share that grants its holder specific veto or governance rights beyond those of ordinary shareholders, usually in limited or defined circumstances under the company's charter. Although typically held by a government entity in a newly privatized company, its primary purpose is to allow the state to retain influence over strategic assets and national interests, a golden share can also be issued to private entities or nonprofit organizations to ensure mission protection or minority rights.

Unlike common stock, which primarily provide economic rights to profits and proportional voting power, the golden share is an instrument of control and usually carries minimal or no economic value. Its holder can veto or block certain fundamental decisions or always hold a board seat, effectively safeguarding the company from takeovers or strategic shifts that might conflict with public policy or national security. This mechanism is most commonly applied to industries considered vital to the nation's functioning, such as defense, energy, telecommunications, media, and critical infrastructure.

The concept is not without controversy. In jurisdictions like the EU (European Union), golden shares have faced significant legal challenges. The European Court of Justice has ruled against several government-held golden shares, arguing they may create unjustified restrictions on the free movement of capital when they exceed what is strictly necessary, a core principle of the EU single market.

Powers vested in a golden share

The specific powers granted by a golden share are defined in the company's articles of association and can be tailored to specific objectives. These powers give the holder a decisive voice in the company's most critical moments, transcending their often-minimal financial stake.

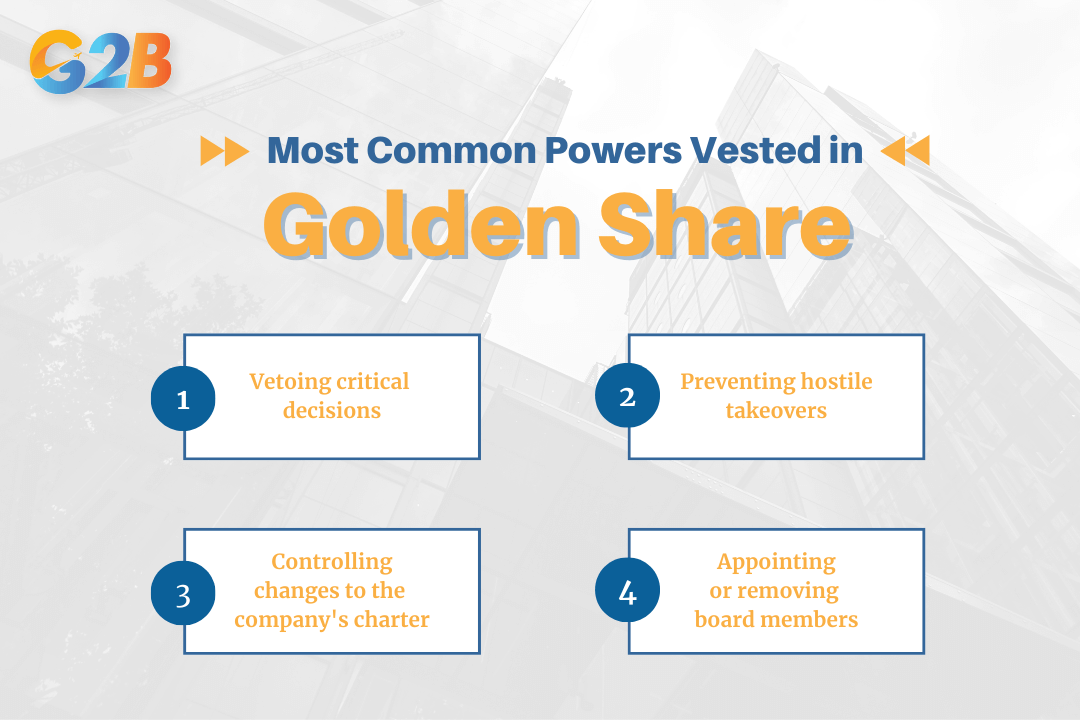

04 most common powers vested in a golden share

The most common powers include:

- Vetoing critical decisions: This is the core power of a golden share. The holder can block major corporate resolutions, even if all other shareholders approve them. This includes veto power over decisions such as a merger or acquisition, the sale of significant company assets, or a voluntary liquidation.

- Preventing hostile takeovers: A golden share can include provisions that prevent any single shareholder from acquiring more than a threshold specified in the corporate charter without the golden shareholder's consent. This acts as a powerful defence against unwelcome takeover bids, particularly from foreign entities.

- Controlling changes to the company's charter: The holder can block any amendments to the company's articles of association. This ensures that the rules governing the company and the special rights of the golden share itself cannot be altered or removed without the holder's approval.

- Appointing or removing board members: In some cases, a golden share grants the holder the right to appoint one or more directors to the board, to veto particular appointments, or to always hold at least one board seat. This provides direct influence over the company's day-to-day governance and strategic direction.

Historical roots of the golden share

The concept of the golden share emerged prominently in the 1980s during the sweeping privatizations in the United Kingdom under the government of Margaret Thatcher. As the British government transitioned massive state-owned enterprises (SOEs) into private ownership, it sought a mechanism to facilitate this economic shift while still protecting national interests in strategic sectors. The golden share was the solution.

By retaining a single, special share in newly privatized entities like British Aerospace, Rolls-Royce, and British Telecom, the government could reassure the public and policymakers that these critical companies would not fall under undesirable control or make decisions detrimental to the nation's security or economy. This approach allowed the government to embrace free-market principles without completely relinquishing its oversight role. The model proved popular and was subsequently adopted by many other countries in Europe and beyond as they embarked on their own privatization programs.

Benefits of a golden share

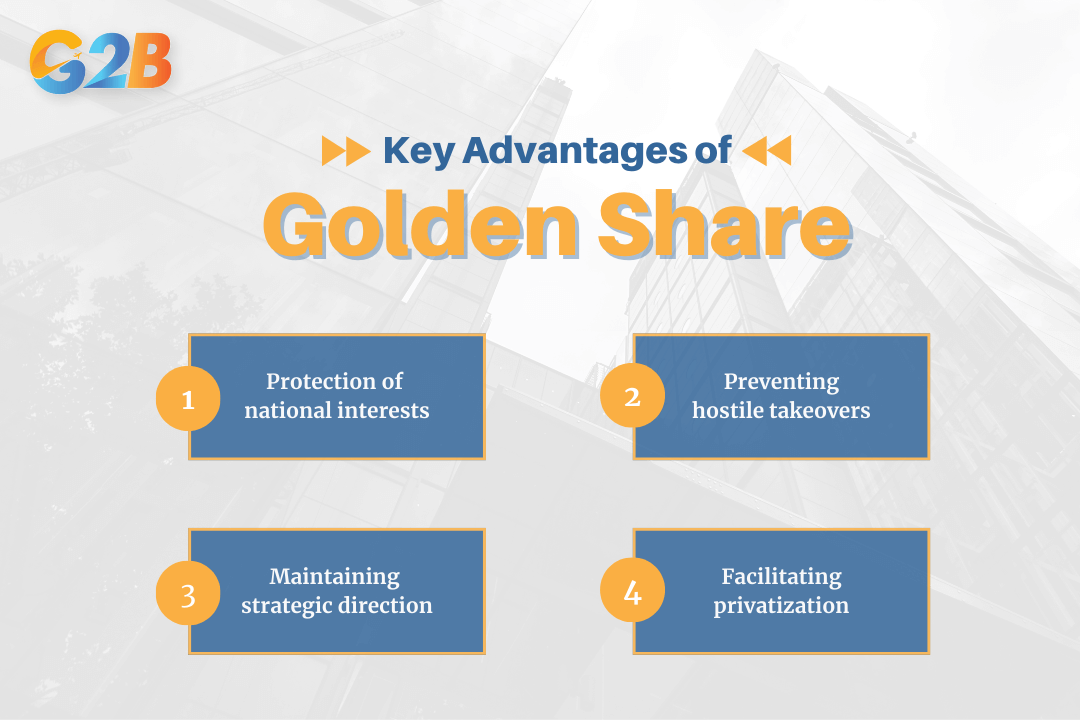

From the perspective of its holder, a golden share offers several key advantages, primarily serving to protect national interests and provide stability against hostile takeovers.

Golden share offers several key advantages

- Protection of national interests: Golden shares are a crucial tool to protect industries vital to a country's security and well-being. They prevent strategically important assets, such as national airlines, energy grids, and defense contractors, from falling into foreign ownership or being managed in a way that conflicts with public policy.

- Preventing hostile takeovers: One of the most common applications of a golden share is to act as a "poison pill" against hostile takeovers. By capping the percentage of shares any single entity can own, the government can ensure the company's stability and prevent disruptive changes in ownership that could harm its long-term strategy during mergers and acquisitions.

- Maintaining strategic direction: The veto power allows the holder to guide the company's long-term strategy. For example, a government can block a decision to sell off a critical research and development division or move essential operations offshore, ensuring the company continues to contribute to the national economy and technological base.

- Facilitating privatization: Golden shares can make the process of privatization more politically acceptable. They offer a compromise, allowing governments to transfer state-owned enterprises to the private sector to improve efficiency while simultaneously retaining a level of control to calm fears about losing oversight of essential services.

Role of the state in enterprises in Vietnam

While the "golden share" concept as a single, unique instrument is not a common feature of Vietnam's corporate landscape, the Vietnamese state maintains significant control over key enterprises through direct majority ownership. This approach, particularly within the framework of equitization, achieves similar strategic objectives. A state-owned enterprise (SOE) under Vietnam's Law on Enterprises (2020) is defined as an enterprise in which the state holds more than 50% of the capital or voting shares.

This majority stake effectively gives the state the power to direct the company's strategy, appoint key personnel, and approve major decisions, much like a golden share but through the mechanism of conventional corporate control. The process of "equitization" - Vietnam's term for privatizing SOEs - often involves the state selling off a portion of its shares while deliberately retaining a controlling interest (over 50%) in companies deemed strategically important. In many cases, the state manages these stakes through a dedicated holding company structure like SCIC (State Capital Investment Corporation) to oversee its portfolio professionally.

Prominent examples of this strategy can be seen in major corporations operating as a Joint Stock Company such as:

- Sabeco (Saigon Beer Alcohol Beverage Corporation)

- Habeco (Hanoi Beer Alcohol Beverage Corporation)

- Vinamilk (Vietnam Dairy Products JSC)

In these cases, even after successful equitization that attracted significant foreign investment, the state has retained substantial shareholdings, ensuring its continued influence over these market-leading companies. This method allows the government to guide key industries in line with national economic policies, protect domestic brands, and ensure social objectives are met, all without resorting to the legal complexities of a special class of shares.

Golden Shares represent a complex and fascinating intersection of corporate law, economic policy, and national security. They serve as a powerful safeguard for governments to protect strategic assets during and after privatization, but this power comes at a cost. The risk of deterring investment, interfering with free-market principles, and concentrating unaccountable power means they must be used judiciously.

In Vietnam, the state has opted for a more direct path to control, using majority ownership in equitized enterprises to achieve similar strategic ends. This approach reflects a different philosophy but underscores the universal desire of governments to balance economic liberalization with the protection of national interests. As the landscape of corporate control continues to evolve, understanding mechanisms like the golden share is essential for investors and businesses alike. For expert guidance on establishing a company in Vietnam, contact the G2B team today.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom