Common stock represents the ultimate ownership stake in a corporation, offering investors a path to partake in its growth and profits. This comprehensive guide will help you master important aspects of this fundamental asset class, from its definition, the rights and risks involved, a direct comparison to preferred stock, and the strategic reasons companies issue stock in the first place.

This article outlines essential aspects of common stock to provide businesses with a clearer understanding of its definition and practical implications. We specialize in company formation and do not offer legal or financial advice. For tailored guidance or compliance-related matters concerning common stock, please consult a financial expert.

What is common stock?

Common stock is a security that represents ownership equity in the residual assets and earnings of a company. These shares, also known as ordinary or voting shares, grant stockholders a fractional interest in the company, which in turn owns or controls the corporate assets. This means shareholders do not hold direct ownership of specific items such as equipment or furniture, they possess a residual claim on the company’s profits and assets once all other financial obligations have been satisfied.

Issuing common stock is a primary method for corporations to raise capital to fund expansion, pay down debt, or invest in new projects. Companies typically sell their initial shares to the public through an Initial Public Offering (IPO). After the IPO, these shares trade on the secondary market, such as the New York Stock Exchange (NYSE) or NASDAQ, where investors buy and sell them from one another. In Vietnam, major stock exchanges include HOSE, HNX, and UPCoM.

The value of common stock is directly linked to the company's performance and market conditions, offering potential for significant returns but also carrying inherent risks. Before any shares can be issued or traded, a company must first be properly incorporated under Vietnamese laws and regulations. Utilizing a professional incorporation service in Vietnam helps businesses establish this foundation effectively, paving the way for issuing common stock and building long-term growth.

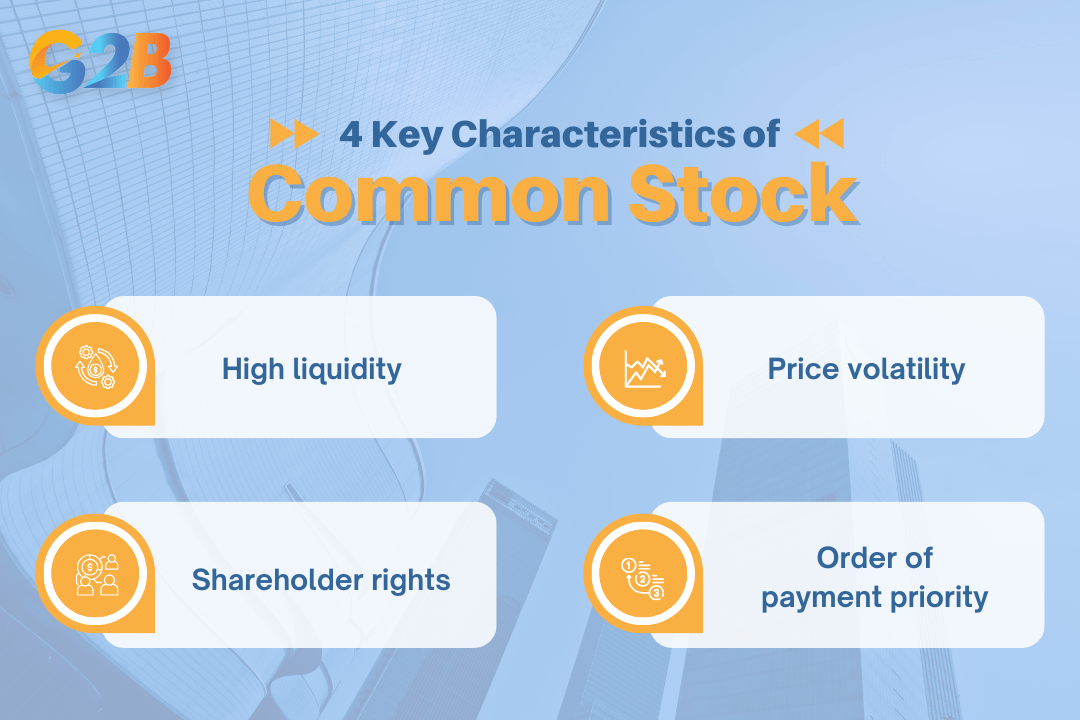

4 key characteristics of common stock

Common stock is defined by a unique set of features that distinguish it as an investment. Understanding these characteristics is fundamental for any investor.

Common stock is defined by 4 features that distinguish it as an investment

High liquidity

Common stock is generally a highly liquid asset, meaning it can be bought and sold with relative ease on public stock exchanges. This ability to quickly convert shares to cash is a significant advantage for investors who may need to access their funds or wish to reallocate their investments based on market changes. The ease of transfer is a core right of stockholders.

Price volatility

The price of common stock can be highly volatile, fluctuating based on a myriad of factors. These can include the company's earnings and performance, broader economic conditions, industry trends, and overall market sentiment. While this volatility creates the potential for high returns and capital appreciation, it also introduces a significant level of risk, as share prices can fall just as quickly as they rise.

Shareholder rights

Ownership of common stock confers several key rights to the shareholder, most notably voting rights. Common stockholders have the power to influence corporate governance by voting on major issues, such as electing the board of directors and approving significant corporate actions like mergers. This gives them a say in the company's direction and leadership.

Order of payment priority

In the event of a company's liquidation, common stockholders have the lowest priority for claims on assets. This means they are last in line to be paid, after creditors, bondholders, and preferred stockholders. If a company goes bankrupt, it is common for these shareholders to receive nothing after all other debts are settled, making it a riskier investment from a capital preservation standpoint compared to debt holders or preferred shareholders.

Rights and risks of holding common stock

Owning common stock is a dual-edged sword. It grants shareholders specific legal rights that reflect their status as part-owners, but it also exposes them to considerable financial risks.

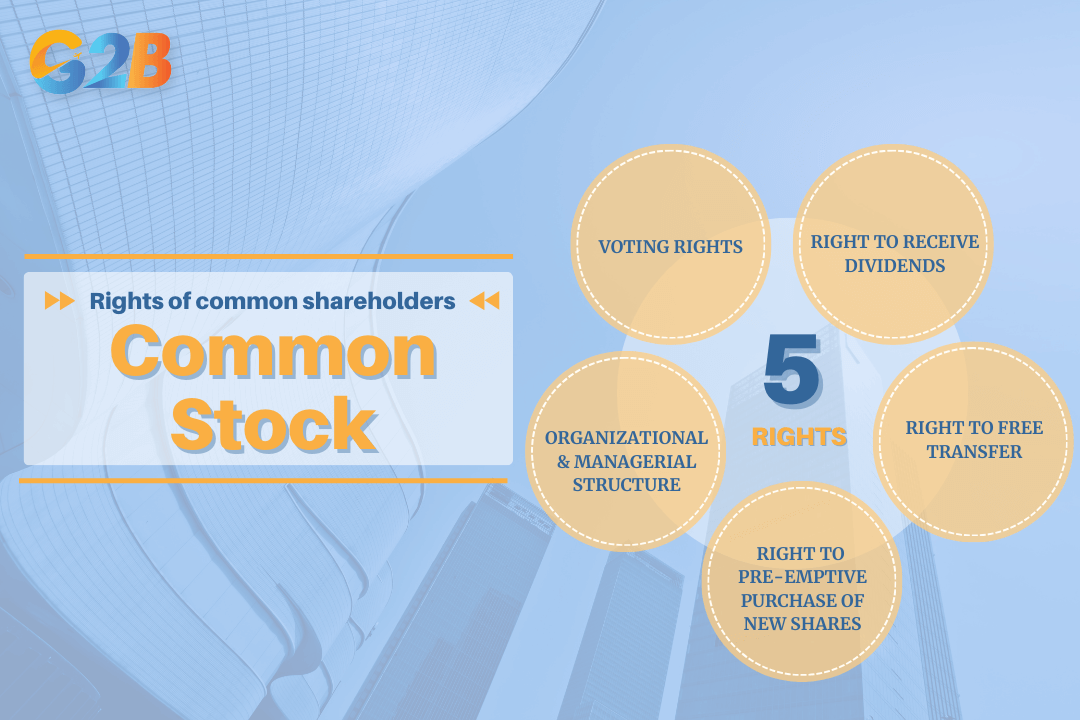

Rights of common shareholders

Holding common stock provides key shareholder rights, such as the right to vote on corporate policy, the right to receive dividends, and the right to claim a portion of residual assets during a liquidation.

- Voting rights: Common stockholders have the right to vote on significant corporate matters. This is a cornerstone of their ownership, allowing them to participate in electing the board of directors and approving major corporate policies or transactions, such as mergers and acquisitions. Voting power is typically proportional to the number of shares owned.

- Right to receive dividends: Shareholders have a right to a share of the company's profits, which are often distributed as dividends. A dividend is a payment, which can be in the form of cash or additional stock, that a company makes to reward its investors. The board of directors decides if and when to issue dividends based on the company's profitability.

- Right to benefit from value growth: Investors in common stock can profit from capital appreciation. As a company succeeds and grows, the value of its stock can increase, allowing shareholders to sell their shares for a higher price than their initial purchase price.

- Right to pre-emptive purchase of new shares: In some cases, common stockholders have a pre-emptive right, depending on the company's bylaws and local laws, which allows them to purchase newly issued shares before they are offered to the public. This right helps existing shareholders maintain their proportional ownership in the company, protecting them from share dilution.

- Right to free transfer: Shareholders have the right to freely transfer ownership of their stock by selling it on a stock exchange. This ensures liquidity and allows investors to manage their holdings efficiently.

Holding common stock provides key shareholder rights

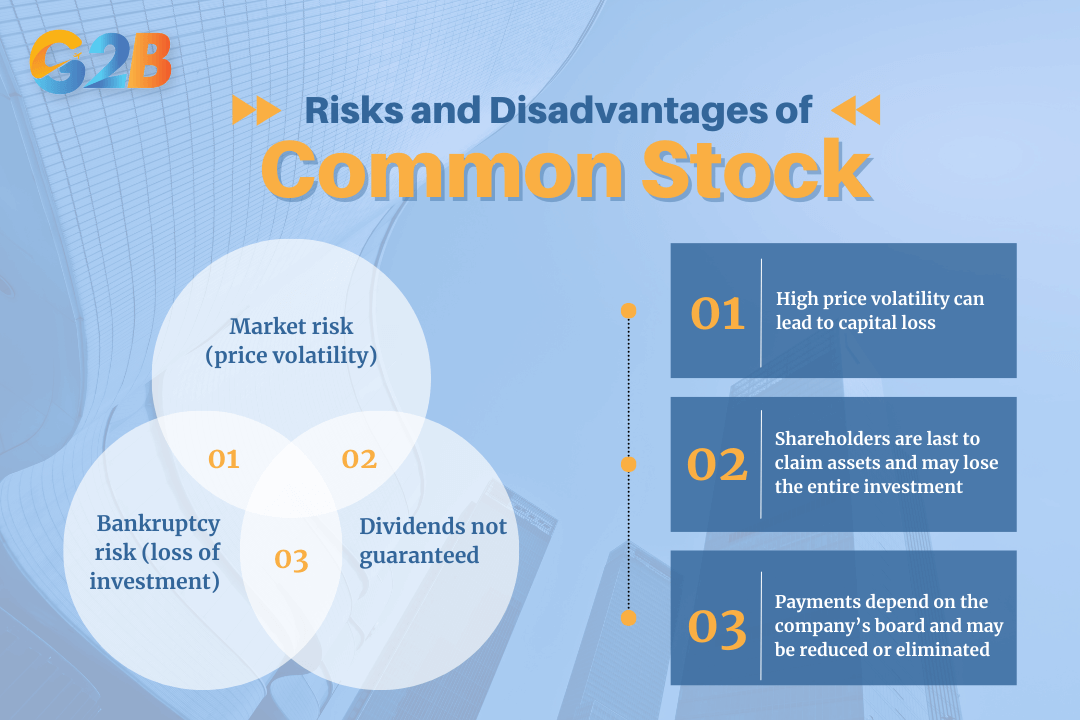

Risks and disadvantages

While the potential rewards are high, investors must be aware of the inherent risks associated with common stock.

- Market risk (price volatility): The primary risk is market volatility, as stock prices can fluctuate dramatically based on company performance, economic factors, and investor sentiment. This means the value of an investment can decrease significantly, potentially leading to a capital loss if the stock is sold for less than its purchase price.

- Bankruptcy risk (loss of investment): In a corporate bankruptcy, common stockholders are last in line to claim any of the company's remaining assets. After the company pays its creditors, bondholders, and preferred shareholders, there is often little to no money left for common stockholders, who can lose their entire investment.

- Dividends not guaranteed: Dividends are not guaranteed and are paid at the discretion of the company's board of directors. A company can reduce or eliminate its dividend payments at any time, especially during periods of financial difficulty, which removes a potential source of income for the investor.

Investors should be aware of the inherent risks associated with common stock

Comparison of common stock and preferred stock

While both are forms of equity, common stock and preferred stock have fundamental differences that investors need to understand. The choice between them often depends on an investor's goals, risk tolerance, and desire for income versus growth.

| Criteria | Common stock | Preferred stock |

|---|---|---|

| Voting rights | Has voting rights, allowing shareholders to influence corporate policy and elect the board of directors. | Usually does not have voting rights, giving shareholders less say in company governance. |

| Dividends | Dividends are variable and not guaranteed. They depend on the company's profitability and board decisions. | Dividends are typically fixed and paid out before common stock dividends. Some preferred shares are "cumulative," meaning any missed dividends must be paid out before common shareholders receive anything. |

| Priority in liquidation | Last in line to receive assets in the event of bankruptcy or liquidation, after creditors and preferred shareholders. | Has a higher claim on company assets than common stock. Preferred shareholders are paid before common stockholders during liquidation. |

| Potential for appreciation | Offers higher potential for capital appreciation. The stock's value can grow significantly as the company succeeds. | Has generally less potential for capital appreciation. Its value is more stable and behaves more like a bond. |

| Volatility | Generally more volatile, with prices fluctuating based on market performance and company news. | Generally less volatile due to fixed dividends and a higher claim on assets, making it a lower-risk investment. |

| Convertibility | Cannot be converted into other forms of security. | May be convertible into a predetermined number of common shares, offering a path to benefit from future growth. |

Classification of common stock

Not all common stock is created equal. Companies can issue different classes of shares to maintain control over the company's direction while still raising capital.

- Voting common stock: This is the standard form of common stock that grants shareholders the right to vote on corporate matters. Typically, one share equals one vote, allowing investors to have a direct impact on the company's governance structure.

- Non-voting common shares: Some companies issue a class of common stock that does not carry any voting rights. While these shareholders still have a claim on earnings and assets, they do not have the ability to influence corporate decisions through voting. This is often done to raise capital without diluting the voting power of existing control groups.

- Dual-class shares: A dual-class structure involves creating two or more classes of common stock with different voting rights. This allows the founding group to retain majority voting control even if they own a minority of the total equity.

In Vietnam, the most common stock issued and traded is of the voting type, as non-voting shares and dual-class share structures are generally uncommon and not widely supported by current laws and regulations. Vietnamese companies typically issue a single class of common stock with equal voting rights to all holders. This limits the ability of founders or insiders to retain disproportionate voting control compared to their economic ownership, a practice that is more common in some international markets.

Frequently asked questions (FAQS)

Investing in common stock requires a solid understanding. To help clarify these important aspects, here are some frequently asked questions (FAQs) related to common stock in the context of the Vietnamese market.

Can common stock be valued using financial metrics like the Price-to-Earnings (P/E) ratio in Vietnam?

Yes. In Vietnam, investors commonly use financial metrics such as the P/E ratio, alongside analysis of financial statements and growth prospects, to value common stock.

Are the rights of common shareholders in Vietnam regulated by law?

Yes. The rights of common shareholders in Vietnam are regulated by the Law on Enterprises, the Law on Securities, the company’s charter, and internal regulations.

Is there a difference between over-the-counter (OTC) stocks and stocks listed on Vietnamese stock exchanges?

Yes. OTC stocks in Vietnam are traded outside the main exchanges like HOSE or HNX, usually have lower liquidity, less stringent disclosure requirements, and are considered riskier than listed stocks.

Common stock stands as the bedrock of equity investing, offering a direct ownership share in a company's journey of growth and innovation. It empowers investors with voting rights and the potential for substantial capital gains and dividends, serving as a powerful engine for wealth creation. However, this potential is balanced by significant risks, including market volatility and a subordinate claim on assets in the event of bankruptcy. Understanding this intricate balance of rights and risks is crucial for any investor.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom