A Financial Plan is the essential roadmap for managing money and achieving life goals. This comprehensive guide will walk you through the definition, types, benefits, and step-by-step process of building a powerful financial plan for both personal and business life. Let’s explore from setting initial goals and creating a budget to developing investment strategies and knowing when to review your progress, ensuring to have the tools to take control of financial destiny.

This article outlines the key aspects of financial planning to help businesses gain a clearer understanding of its objectives, components, and practical applications. We specialize in company formation services and do not provide financial planning. For specific matters related to accounting, taxation, or financial management, please consult a qualified economic expert.

What is a financial plan?

A financial plan is a detailed document that serves as a strategic roadmap for an individual’s, family’s, or business’s financial life. It begins by outlining your current financial situation, including your income, expenses, assets, and liabilities. From there, it defines your short-term, medium-term, and long-term financial goals and establishes a detailed financial action plan with the specific steps you need to take to achieve them. This document is not static; it's a dynamic guide for making informed decisions about spending, saving, and investing, helping you navigate life's changes while staying on course toward financial security and success. It also involves regular review and adjustment to reflect changes in your financial circumstances and goals.

What is the purpose of a financial plan?

The primary purpose of a financial plan is to turn your financial goals into reality by providing a structured framework for your decisions. It helps you make the best use of your financial resources and guides your efforts over time, providing a means to monitor your progress toward major life objectives like buying a home or enjoying a comfortable retirement. A good plan helps you prepare for the future and manage your money effectively today.

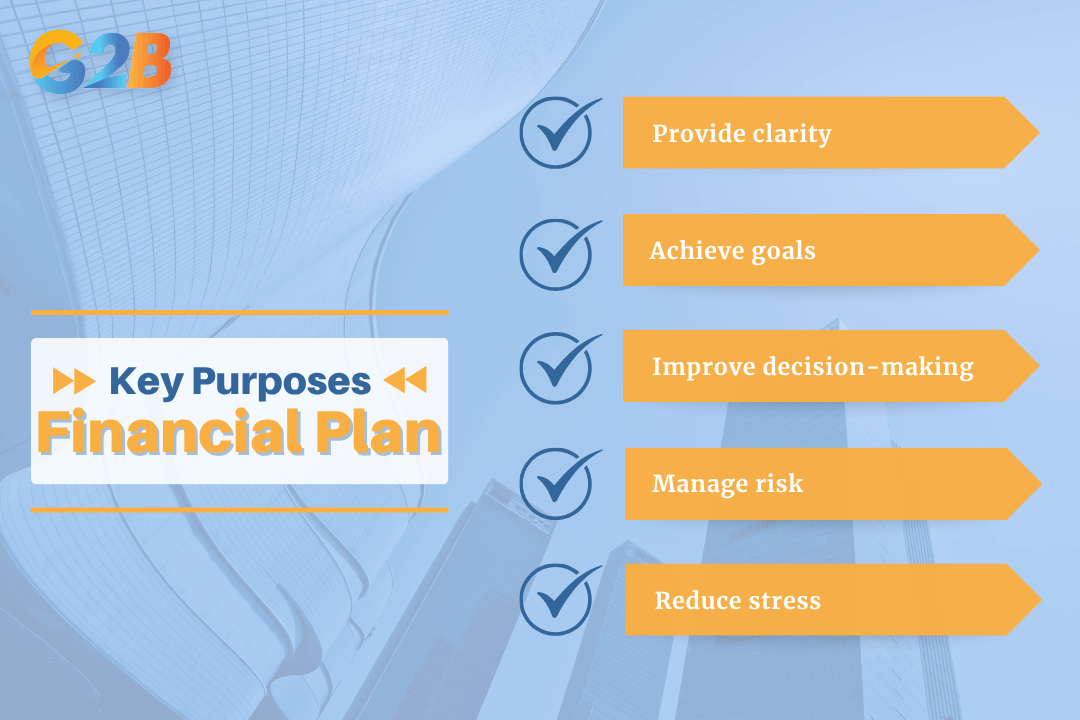

There are 5 key purposes of a financial plan

Here are the key purposes of a financial plan:

- Provide clarity: It gives you a clear and comprehensive understanding of your complete financial picture, including your income, expenses, assets, and liabilities.

- Achieve goals: It creates a structured and actionable path to reach your financial milestones, whether they are short-term objectives like paying off debt or long-term ambitions like funding a child's education or retiring early.

- Improve decision-making: It empowers you to make conscious, informed choices with your money that align directly with your objectives, preventing impulsive decisions that can derail your progress.

- Manage risk: It helps you identify potential financial risks and prepare for unexpected events. A well-rounded plan includes strategies for mitigating these risks, such as building an emergency fund and securing adequate insurance coverage.

- Reduce stress: It delivers peace of mind by giving you a sense of control over your financial future. Knowing you have a plan in place can significantly reduce financial anxiety and increase confidence in your ability to handle whatever comes your way.

Types of financial plan

Financial plans are not one-size-fits-all; they are tailored to the specific needs and goals of an individual or a business. For individuals, a plan focuses on personal milestones like retirement and wealth growth. For businesses, it centers on strategic objectives like profitability, expansion, and operational stability.

For individuals

A personal financial plan addresses every aspect of an individual's financial life to ensure long-term security and goal achievement. These plans are dynamic and should evolve as your life circumstances change. The main elements of a comprehensive personal financial plan include several specific types of planning.

- Retirement planning: This is one of the most common types of financial planning and focuses on building a sufficient nest egg to support your lifestyle after you stop working. It involves projecting future expenses, determining the amount of capital needed, and creating a savings and investment strategy to reach that goal.

- Investment planning: This plan outlines a strategy for growing your wealth through various financial instruments like stocks, bonds, and real estate. It is guided by your risk tolerance, time horizon, and specific financial goals.

- Estate planning: This area of planning details how your assets will be managed and distributed upon your death or incapacitation. It includes documents like wills, trusts, and powers of attorney to ensure your wishes are carried out and to minimize potential taxes for your heirs.

- Insurance planning: This component assesses your personal and financial risks to ensure you are adequately protected against unforeseen events. It covers various types of insurance, such as health, life, disability, and property insurance, safeguarding your financial stability.

- Tax planning: This is a strategic effort to minimize your tax liability through efficient financial strategies. It involves taking advantage of tax-advantaged accounts, deductions, and credits to keep more of your hard-earned money.

- Cash flow & budgeting plan: This plan is foundational to all other financial goals and focuses on managing your day-to-day income and expenses. It provides the financial stability needed to save and invest for the future.

For businesses

A business financial plan is critical for long-term success. It projects revenue, expenses, and cash flow to guide strategic decisions. This type of plan is essential for entrepreneurs, whether they are forecasting for the next five years or calculating the initial startup costs for their company formation in Vietnam. It provides a roadmap for growth and is often required to secure funding from investors or banks.

Common business plans include:

- Startup plan: This plan outlines the financial needs and projections required to launch a new company. It details everything from initial capital requirements and funding sources to projected revenue and break-even analysis.

- Growth plan: This financial strategy is designed for expansion, such as entering new markets, launching new products, or acquiring another business. It details the necessary investments and forecasts the financial impact of the growth initiatives.

- Operational plan: This is typically a short-term (annual) budget and forecast for managing the day-to-day finances of the business. It focuses on optimizing revenue, managing expenses, and ensuring sufficient cash flow to maintain smooth operations.

How to build an effective financial plan?

Building an effective financial plan involves a structured process of assessing where you are, defining where you want to go, and creating a detailed roadmap to get there. The steps differ slightly for individuals and businesses but follow the same core principles.

Build financial plan for individuals

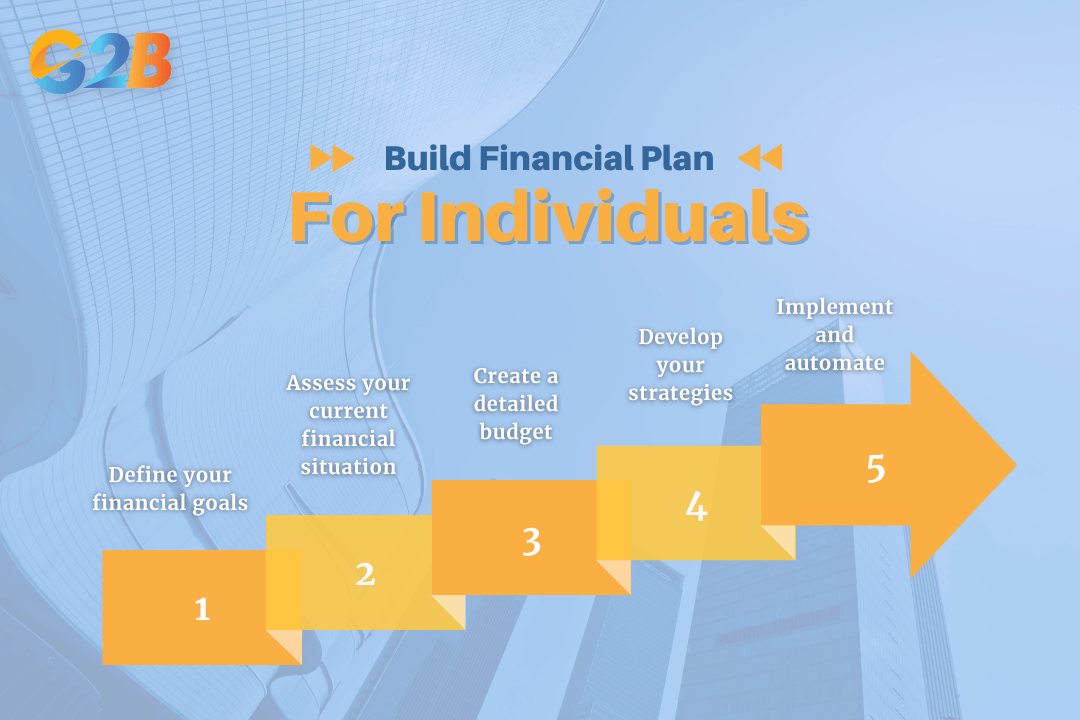

Creating a personal financial plan empowers you to take control of your financial future. Follow these five steps:

- Step 1: Define your financial goals: The first step is to set clear, SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals. Categorize them into short-term (1-2 years), medium-term (3-5 years), and long-term (5+ years) objectives, such as building an emergency fund, buying a car, or saving for retirement.

- Step 2: Assess your current financial situation: Gather all relevant financial documents to get a clear picture of your finances. Calculate your net worth by subtracting your liabilities (debts) from your assets (what you own). Track your monthly cash flow to understand where your money is coming from and where it's going.

- Step 3: Create a detailed budget: A budget is essential for planning how to use your money. Allocate your income toward all your expenses, including savings and debt repayment. This ensures you are living within your means and actively directing funds toward your goals.

- Step 4: Develop your strategies: Based on your goals and financial situation, create actionable strategies. This includes:

- Debt repayment: Create a plan to aggressively pay off high-interest debt, such as credit card balances.

- Emergency fund: Build a fund with enough money to cover 3-6 months of essential living expenses to protect you from unexpected events.

- Investment: Choose investments that align with your risk tolerance and time horizon to grow your wealth.

- Step 5: Implement and automate: Put your plan into action. One of the most effective ways to ensure consistency is to automate your savings and investments. Set up automatic transfers from your checking account to your savings, retirement, and other investment accounts each payday.

There are 5 steps to build a financial plan for individuals

Build a financial plan for businesses

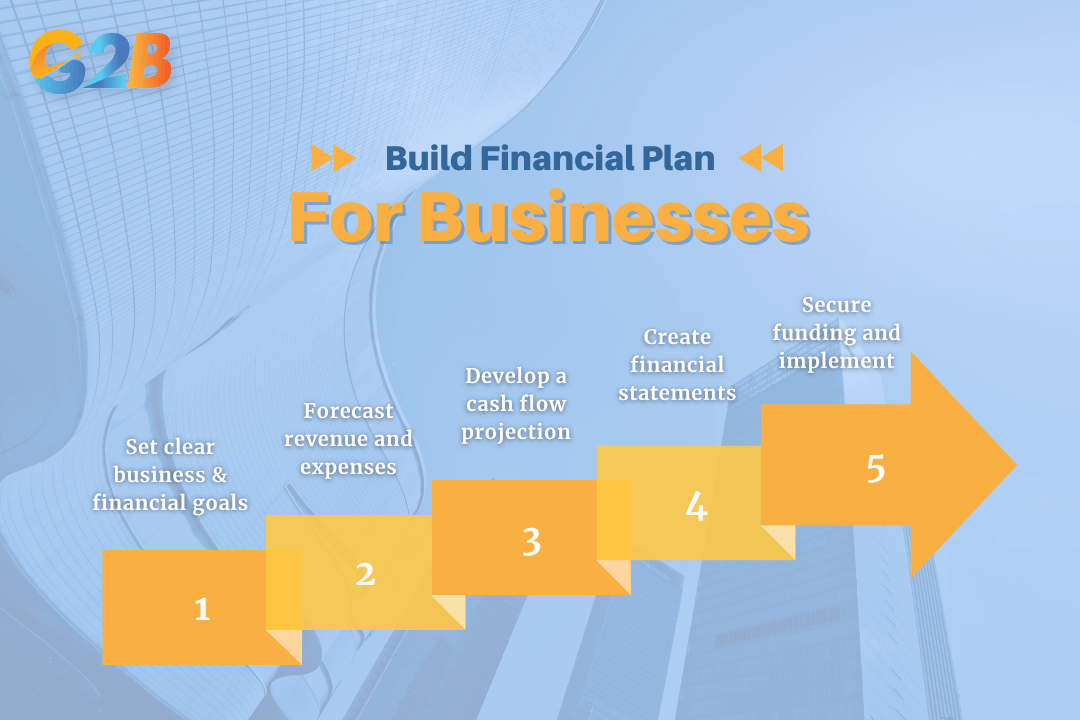

A business financial plan is a vital tool for strategic decision-making, securing funding, and measuring success.

- Step 1: Set clear business & financial goals: Define your company's strategic vision and align it with measurable financial targets. These can include specific revenue goals, desired profit margins, or market share objectives.

- Step 2: Forecast revenue and expenses: Project your future sales based on market analysis and historical data. Then, estimate your cost of goods sold (COGS) and all operating expenses. This is a critical step when you plan to register a business in Vietnam, as it helps determine your startup capital needs and operational budget.

- Step 3: Develop a cash flow projection: Create a cash flow statement to track and forecast the movement of money in and out of the business. This ensures you maintain enough liquidity to cover expenses and obligations, preventing cash shortfalls.

- Step 4: Create financial statements: Build a set of projected financial statements, including a pro forma income statement (P&L), balance sheet, and a break-even analysis. These documents provide a comprehensive financial overview of the business.

- Step 5: Secure funding and implement: Use your completed financial plan to approach lenders or investors if you need to secure funding. Once your plan is finalized and funded, put it into action and use it as a guide for your operational and strategic decisions.

There are 5 steps to build a financial plan for businesses

Benefits of having a financial plan

A well-crafted financial plan offers numerous benefits that contribute to both your financial well-being and overall quality of life. It acts as a powerful tool for building wealth and achieving security.

- Provides a clear path: It turns abstract financial goals into concrete, actionable steps. This clarity helps you stay focused and motivated on your journey toward achieving your objectives.

- Increases savings: By tracking income and expenses, a financial plan helps you identify areas where you can cut spending and allocate more money toward savings and investments. This discipline is crucial for wealth accumulation.

- Improves standard of living: Effective money management and goal-oriented saving allow for a more secure and comfortable lifestyle. It helps you afford the things that are important to you without accumulating stressful debt.

- Prepares you for emergencies: A key component of any good financial plan is an emergency fund, which provides a critical safety net for unexpected events like a job loss or medical emergency, preventing you from derailing your long-term goals.

- Achieves financial independence: Ultimately, a consistently executed financial plan is the most reliable path to building wealth and achieving financial freedom. It gives you control over your resources and the ability to live life on your own terms.

Reviewing and updating your financial plan

A financial plan is not a "set it and forget it" document. It requires regular reviews and updates to ensure it remains relevant and effective as your life and the economic environment change.

How often should you review?

A consistent review schedule is essential to stay on track. Financial experts recommend a tiered approach to monitoring your plan.

- Major annual review: You should conduct a deep and comprehensive review of your entire financial plan at least once a year. This is the time to assess your progress toward long-term goals, re-evaluate your investment strategy, and make adjustments based on the past year's performance and any life changes.

- Quarterly check-in: Every three months, it's a good practice to review your investment portfolio's performance and track your progress toward your short-term goals. This allows you to make timely adjustments without waiting a full year.

- Monthly monitoring: Monthly, you should check your budget and spending habits. This helps ensure you are staying within your budget, managing cash flow effectively, and hitting your monthly savings targets.

When to make immediate updates

In addition to scheduled reviews, certain major life events should trigger an immediate update to your financial plan to reflect your new circumstances. These events include:

- After any major life change, such as a marriage, divorce, or the birth of a child.

- Following a significant change in your income or employment status, like a promotion or job loss.

- When you make a large purchase or sale, such as buying or selling a house.

- If your financial goals or your tolerance for risk change significantly.

A financial plan is the cornerstone of financial well-being for both individuals and businesses. It transforms aspirations into actionable strategies, providing a clear path to achieving goals, managing risks, and building lasting wealth. By defining your objectives, creating a detailed roadmap, and consistently implementing your strategy, you gain control over your financial destiny.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom