IRC in Vietnam is the decisive first step for foreign investors aiming to tap into one of Southeast Asia’s most dynamic economies. Whether you are a multinational corporation or an individual entrepreneur, understanding the nuances of the Investment Registration Certificate (IRC) is not just a legal formality - it is the foundation of your business's legality and future success. Navigating the legal landscape in a foreign country can be daunting. From distinguishing between an IRC and an ERC to preparing a watertight dossier that satisfies the Department of Planning and Investment, the process requires precision.

What is an IRC?

The IRC (Investment Registration Certificate) is a physical or electronic legal document issued by the competent state agency of Vietnam (specifically the Department of Planning and Investment or Management Boards of Industrial Zones). It records the registration information of a foreign investor regarding a specific investment project.

Think of the IRC as your "ticket of entry." It serves as the official "investment license" that grants you the right to implement a project legally within Vietnamese territory. Without this document, foreign capital cannot legally enter the country for the purpose of setting up a new project.

Distinguishing between IRC and ERC

One of the most common confusions for new investors is the difference between the IRC and the ERC (Enterprise Registration Certificate). While they are often applied for consecutively, they serve distinct legal functions.

- Investment Registration Certificate (IRC): This validates the project. It focuses on who is investing, how much capital is involved, and where the project will operate. It acts as a license for the investment activity itself.

- Enterprise Registration Certificate (ERC): This validates the company. It is the "birth certificate" of the legal entity (the company) that will manage and operate the investment project.

Key difference: The IRC is a license for an investment project, whereas the ERC is a 0license for the establishment and operation of an enterprise. Generally, foreign investors must obtain the IRC first, and then proceed to obtain the ERC.

The role and importance of the IRC

Why is the IRC in Vietnam so critical? It is not merely a bureaucratic hurdle; it is a protective legal shield for your assets.

- Legal basis for project implementation: The IRC serves as the primary legal basis for foreign investors to conduct business. It proves to the government and third parties that your project is sanctioned by the state.

- Prerequisite for company establishment in VN: You cannot establish a Foreign-Invested Enterprise (FIE) without first securing an IRC (except in specific M&A cases). It is the first document required in the incorporation sequence.

- State management and supervision: The IRC helps state agencies manage and supervise foreign investment activities. It ensures that projects align with Vietnam’s economic development master plans and national security regulations.

- Incentive eligibility: If your project is located in a disadvantaged area or a high-tech sector, the IRC will record the specific investment incentives (tax breaks, land rent reductions) you are entitled to.

Who needs an IRC?

The Law on Investment 2020 clearly stipulates which entities must apply for an IRC. Understanding your classification is vital to saving time and avoiding unnecessary procedures.

Cases requiring an IRC

You are mandatory required to obtain an IRC in Vietnam if you fall into one of the following categories:

- Investment projects of foreign investors: Any individual or organization holding a foreign nationality starting a new project in Vietnam.

- Specific economic organizations: Domestic companies that are already heavily foreign-owned. Specifically, if an economic organization has foreign investors holding more than 50% of charter capital, or if the majority of general partners are foreign individuals (in partnerships), any new project they start is treated as a foreign investment and requires an IRC.

Cases not requiring an IRC

Vietnam has simplified procedures for certain activities to encourage capital flow:

- Domestic investors: Projects funded entirely by Vietnamese nationals or entities do not need an IRC.

- Capital contribution & share purchase (M&A): If a foreign investor contributes capital, purchases shares, or buys stakes in an existing Vietnamese company (M&A), they generally do not need an IRC. They only need to register the capital contribution if they hit certain ownership thresholds.

- Below threshold foreign-owned companies: Economic organizations with foreign investment holding less than or equal to 50% of charter capital are treated as domestic investors for the purpose of new project setup and do not need a new IRC.

Procedures for obtaining an Investment Registration Certificate

The procedure for obtaining an IRC in Vietnam varies significantly depending on the scale and nature of your project. The law divides projects into two main categories: those requiring Investment Policy Approval and those that do not.

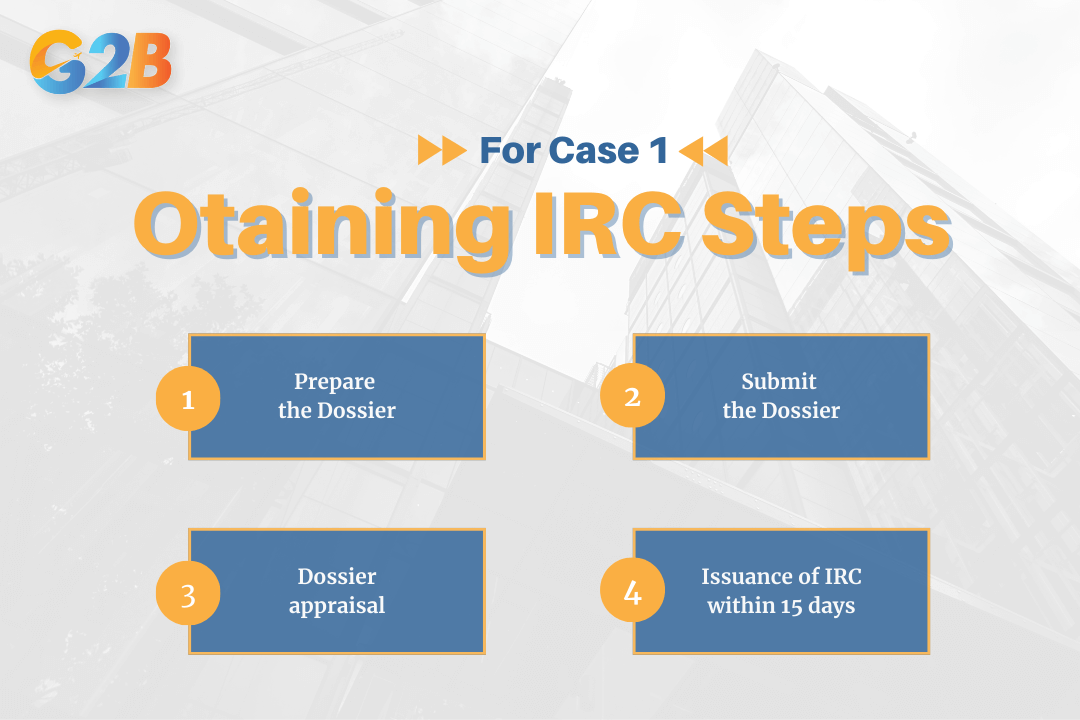

Case 1: For projects NOT subject to investment policy approval

This applies to most standard SMEs, consulting firms, IT companies, and trading companies.

- Step 1 - Prepare the dossier: The investor prepares a complete dossier as prescribed by the Law on Investment. This includes legalizing foreign documents and translating them into Vietnamese.

- Step 2 - Submit the dossier: The dossier is submitted online via the National Investment Portal regarding information, and physical files are submitted directly to the Department of Planning and Investment (DPI) or the Management Board of the Industrial Park where the project is located.

- Step 3 - Dossier appraisal: The investment registration authority receives the file and checks its validity. They may request clarifications regarding financial capacity or location legality.

- Step 4 - Issuance of IRC: Within 15 working days from the date of receipt of a valid dossier, the Department of Planning and Investment will issue the IRC.

Procedures for obtaining an Investment Registration Certificate for case 1

Case 2: For projects subject to investment policy approval

Large-scale projects (e.g., constructing airports, casinos, housing developments, or projects in sensitive areas) require higher-level approval before the IRC can be issued.

- Step 1 - Apply for investment policy approval: The investor submits a dossier requesting investment policy approval to the competent authority. Depending on the scale, this could be the National Assembly, the Prime Minister, or the Provincial People's Committee.

- Step 2 - Issuance of IRC: Once the "Decision on Investment Policy Approval" is granted, the investment registration authority will issue the IRC within 5 working days.

Documents required for IRC application

A standard application dossier is extensive. Inconsistencies here are the top cause of rejection:

- Written request for project implementation: A standard form outlining the request to invest.

- Legal documents of the investor:

- For individuals: A certified copy of the passport.

- For organizations: A copy of the Certificate of Incorporation (COI) or business license confirming legal status. Note: These must be consular legalized.

- Investment project proposal: A detailed document covering objectives, scale, investment capital, location, duration, and project schedule. This is the core of your application.

- Proof of financial capacity: You must prove you have the money to fund the registered capital.

- Documents accepted: Financial statements for the last 2 years of the investor, a commitment of financial support from a parent company, or a confirmation of bank account balance equal to the investment amount.

- Location documents: Evidence that you have a legal place to operate. This usually includes a lease agreement and the landlord’s land use rights documents (LURC).

- Technology explanation: Required only for projects subject to technology appraisal (e.g., manufacturing involving toxic chemicals or technology transfer).

- BCC contract: A Business Cooperation Contract is required only if the investment is in the form of a BCC (no new legal entity created).

Key information on the Investment Registration Certificate

Once issued, your IRC in Vietnam will contain specific data points. It is crucial to verify these immediately upon receipt, as they dictate your operational boundaries:

- Investment project code: A unique ID number for your project.

- Name and address of the investor: Who owns the project?

- Name of the investment project: The official designation of your venture.

- Location of implementation & land area: Where you are allowed to operate.

- Objectives and scale: What business lines you are permitted to engage in (e.g., Management Consulting, Software Development).

- Total investment capital: This includes contributed capital (equity) and mobilized capital (loans).

- Project operation duration: Typically 50 years (up to 70 years in special economic zones).

- Implementation schedule: The timeline by which you must contribute capital and begin operations.

- Incentives: Any applicable tax holidays or support conditions.

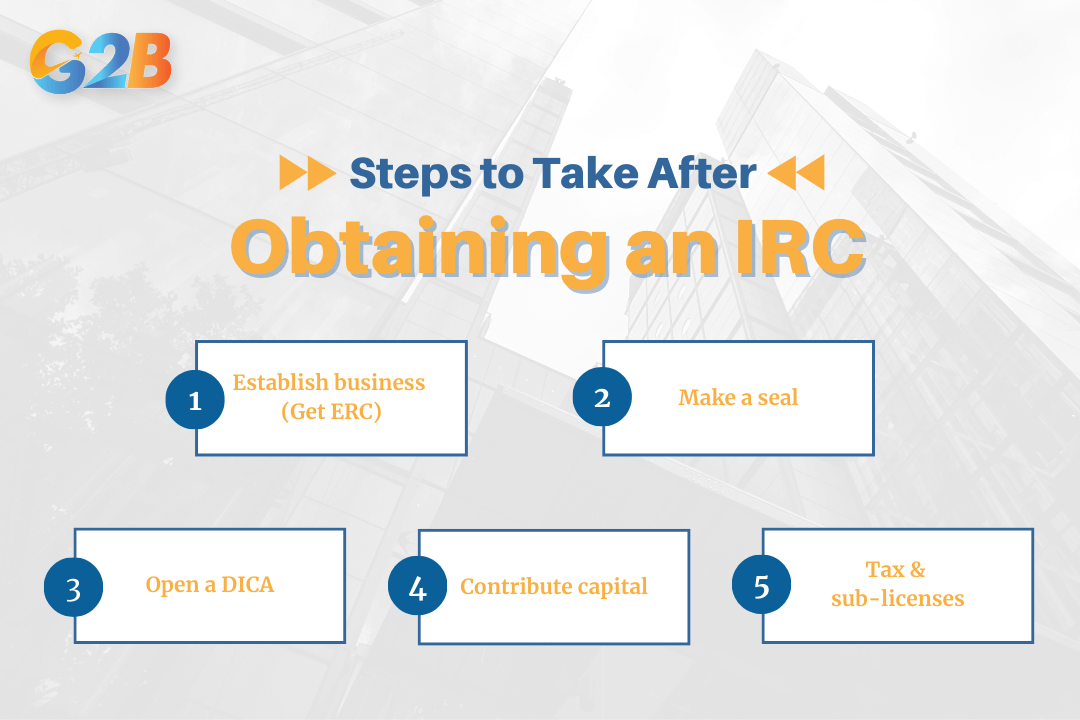

Steps to take after obtaining an IRC

Obtaining the IRC is a milestone, but it is not the finish line. To become fully operational, you must complete the following post-licensing procedures:

- Establish a business (Get the ERC): Submit the file to the Business Registration Office to obtain the Enterprise Registration Certificate (ERC). This creates your legal entity.

- Make a seal: Carve the company seal and manage it according to internal regulations.

- Open a direct investment capital account (DICA): This is mandatory. You must open a specialized capital account (DICA) at a bank in Vietnam. All capital contribution and profit repatriation must flow through this specific account.

- Contribute capital: Transfer your investment funds into the DICA within 90 days of the ERC issuance date. Failure to do so incurs heavy penalties.

- Tax & sub-licenses: Register a digital signature (Token), make initial tax declarations (License tax), and apply for sub-licenses if your business line is conditional (e.g., retail trading, education, tourism).

Five steps to take after obtaining an IRC

Important notes and common challenges

We have witnessed many investors face delays due to avoidable errors. Here are critical notes to ensure a smooth process:

Notes when preparing the dossier

- Consular legalization: All documents issued by foreign authorities (Passports, Charters, Bank Statements) must be consular legalized by the Vietnamese Embassy in the host country and translated into Vietnamese.

- Consistency: The name, address, and passport numbers must be identical across all documents. Even a small typo can lead to a dossier return.

- Financial proof: The bank balance confirmation must explicitly state the amount is available. Blocked funds or credit lines are often rejected.

Common challenges

- Extended processing time: While the law says 15 days, in reality, the dossier processing time may be longer due to internal consultations between government departments.

- Requests for explanations: Authorities often request explanations regarding the feasibility of the project or the proposed location (especially if utilizing a Virtual Office).

- Market access conditions: Some sectors are restricted or conditional for foreign investors (e.g., logistics, advertising). You must ensure your nationality allows access to these sectors under WTO or CPTPP commitments.

Frequently asked questions (FAQ)

1. What is the duration of an IRC? The operation duration of an investment project is typically maximum 50 years. In disadvantaged areas or special economic zones, the duration may be extended up to 70 years.

2. Which agency has the authority to issue IRCs? Authority depends on location. Inside Industrial Parks (IPs), it is the Management Board of the IP. Outside IPs, it is the Department of Planning and Investment (DPI) of the province or city.

3. What is the cost of applying for an IRC? According to current regulations, the state administrative fee for issuing an IRC is free of charge. However, investors will incur costs for document translation, legalization, and legal consulting services.

4. Is it possible to amend the contents of the IRC? Yes. Investors must carry out the procedure to amend the IRC whenever there is a change in the registered contents (e.g., increasing capital, changing the address, or adding new business lines).

5. Can I use a virtual office to register an IRC? It is becoming increasingly difficult. The DPI often requires a physical location with a distinct space to approve an IRC.

IRC in Vietnam is the gateway to your business success in this thriving market. While the procedures involve strict regulations and detailed documentation, the opportunities that follow are immense. By preparing thoroughly and understanding the legal framework, you can navigate the system with confidence.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom