Business license for retail in Vietnam is a specialized legal instrument required for Foreign-Invested Enterprises (FIEs) that wish to engage in retail distribution activities within the Vietnamese territory. Unlike domestic companies, which can register retail business lines relatively freely, foreign investors must navigate a complex layer of sub-licenses governed by Decree No. 09/2018/ND-CP. This decree serves as the primary legal framework regulating the goods trading and directly related activities of foreign investors in Vietnam.

What is a business license for retail in Vietnam?

A business license for retail for foreign investors is a document issued by the competent state agency - typically the Department of Industry and Trade (DOIT) - allowing a foreign-invested economic organization to exercise its right to retail goods under Decree No. 09/2018/ND-CP. In the context of Vietnamese Commercial Law, "retail" is defined as the act of selling goods to individuals, households, or other organizations for consumption or daily use purposes. This differs fundamentally from "Wholesale" (selling goods to organizations or individuals for trading purposes) (Business-to-Business or B2B), which often does not require a separate Business License if the FIE already possesses an Enterprise Registration Certificate (ERC) covering wholesale distribution rights.

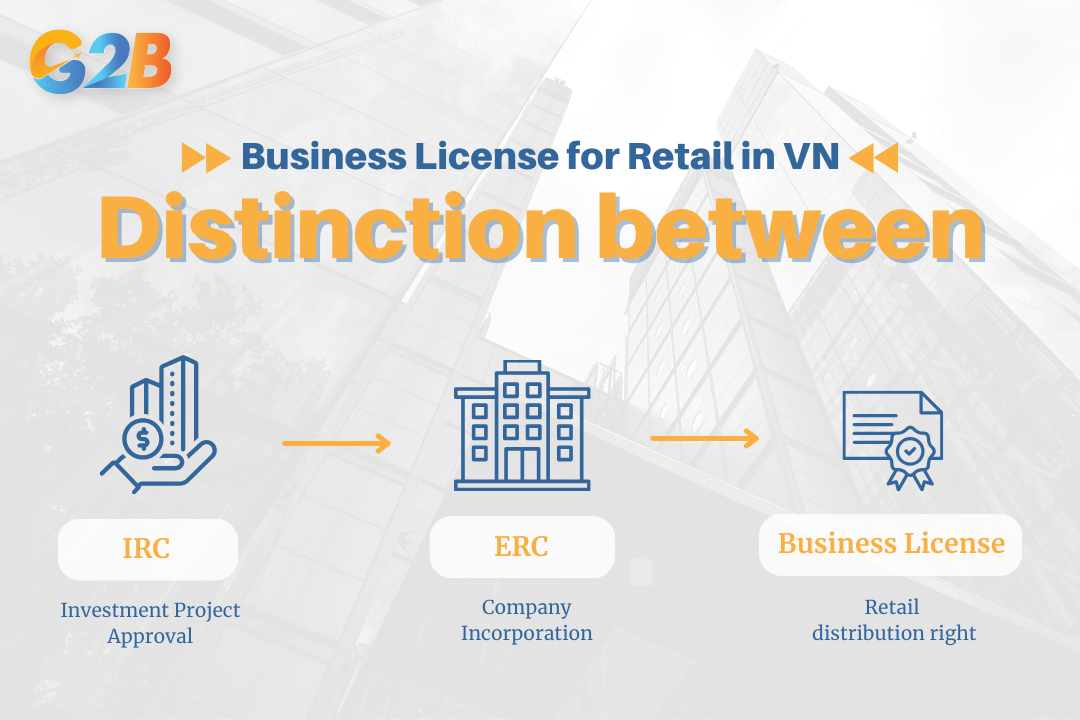

Distinction between ERC, IRC, and business license

To establish a retail presence, an investor must distinguish between three critical documents:

- Investment Registration Certificate (IRC): Issued by the Department of Planning and Investment (DPI). It approves the foreign investment project concept, location, and capital.

- Enterprise Registration Certificate (ERC): Also issued by the DPI. It certifies the legal existence of the company (incorporation) and lists registered business lines.

- Business license (BL): Issued by the Department of Industry and Trade (DOIT). It specifically grants permission for conditional business sectors, such as the retail distribution of goods.

Important note: An FIE can hold an IRC and ERC but still be legally prohibited from selling a single product to a consumer until the Business License is physically obtained.

Understanding IRC / ERC / business license for retail

Legal basis

The regulations governing this license are anchored in the following legal documents:

- Law on Investment 2020

- Law on Commerce 2005

- Decree No. 09/2018/ND-CP: Regulating details on the Law on Commerce and Law on Foreign Trade Management regarding goods purchase and sale activities of foreign investors, as amended by Decree 128/2021/ND-CP.

- Circular No. 34/2013/TT-BCT: Announcing the roadmap for goods trading.

Who needs a business license for retail?

The requirement for a Business license for retail in Vietnam applies strictly to Foreign-invested enterprises (FIEs).

Subjects of application

The obligation to obtain this license falls upon:

- Enterprises with foreign capital established in Vietnam (FDI companies)

- Foreign investors contributing capital or purchasing shares in existing Vietnamese companies, thereby converting them into FIEs that engage in retail activities

- FIEs that wish to add "Retail distribution" to their existing operational scope (e.g., a manufacturing company that now wants to open a showroom to sell directly to consumers)

Exemptions vs. Requirements

It is crucial to note that purely domestic Vietnamese companies do not need to apply for this specific "Business License" under Decree 09/2018/ND-CP. They simply register the business line with the business registration office. However, for FIEs, the retail sector is classified as a conditional business line. Therefore, even if the IRC and ERC mention "Retail of goods," the Business License is the final operational key. Without it, issuing VAT invoices to end consumers for retail purposes is non-compliant.

Conditions for obtaining a retail business license

To successfully acquire a Business License for retail in Vietnam, foreign investors must satisfy a rigorous set of financial, legal, and tax-related conditions.

1. Nationality and international treaties

The foreign investor must be a national or legal entity of a country or territory that is a signatory to an international trade treaty to which Vietnam is a member. Common treaties facilitating this include:

- WTO (World Trade Organization) commitments

- CPTPP (Comprehensive and progressive agreement for trans-pacific partnership)

- EVFTA (EU-Vietnam free trade agreement)

If the investor belongs to a country without such a treaty, the approval relies on the specific discretion of the Minister of Industry and Trade, making the process significantly harder.

2. Financial capacity

The FIE must demonstrate that it has no outstanding tax debts to the Vietnamese state.

- For new companies: Proof of chartered capital injection as per the IRC

- For operating companies: Audited financial statements showing solvency and a confirmation letter from the tax authority certifying no overdue tax liabilities

3. Business plan compliance

The proposed retail plan must comply with:

- Sector development planning: The goods must not disrupt the local market stability

- Infrastructure requirements: The enterprise must have a physical location suitable for retail (though the specific outlet license is a subsequent step)

4. Goods suitability

The goods intended for retail must not be on the list of prohibited goods or goods excluded from Vietnam’s distribution service commitments.

Goods restricted vs. Permitted for retail distribution

Not all products are treated equally under Vietnamese law. The Business License application must specify the exact HS Codes (Harmonized System Codes) of the goods the FIE intends to retail.

The importance of HS codes

Ambiguity is the enemy of approval. Investors cannot simply apply for "retail of consumer goods". They must list specific 4-digit or 8-digit HS Codes. Authorities use these codes to verify if the goods are unrestricted or "sensitive".

Sensitive goods requiring ministerial approval

Certain goods are not automatically approved by the local DOIT but require consultation with the Ministry of Industry and Trade (MOIT) and other relevant line ministries. These include:

- Rice

- Cane sugar and beet sugar

- Cigarettes and cigars

- Crude oil and processed oil

- Pharmaceuticals (Often highly restricted or prohibited for direct foreign retail).

- Explosives

- Books, newspapers, and magazines

- Video recordings

For these items, the timeline for obtaining the license extends significantly because the dossier moves from the provincial level to the central government level for vetting.

Analysis of retail rights

"Retail rights" do not equate to "Retail rights for everything." For example, an FIE might be granted a license to retail apparel and electronics (standard goods) but denied the right to retail pharmaceuticals due to protectionist policies favoring local pharmacies.

Economic needs test (ENT) for retail outlets

One of the most complex semantic entities in Vietnamese retail law is the Economic Needs Test (ENT). It is a barrier specifically designed to control the proliferation of foreign-owned retail outlets to protect small local businesses.

What is the ENT?

The Economic Needs Test is a mandatory evaluation procedure applied when an FIE wishes to establish its second retail outlet onwards in Vietnam (the first outlet is exempt only if under 300m²).

ENT criteria

When an FIE applies for the second shop, the authorities establish a council to evaluate the application based on the following criteria:

- Effect on the scale of the geographical market: Will this new shop dominate the local area?

- Number of existing retail establishments: Is the market already saturated?

- Impact on market stability: Will it harm local wet markets or small family businesses?

- Density of population: Does the area have enough people to support another store?

The "500 square meters" exemption

There is a critical exemption to the ENT under Decree 09/2018/ND-CP. The ENT is not required for retail outlets that meet both of the following conditions:

- The outlet is less than 500 square meters in size

- The outlet is located within a commercial center (shopping mall) and is not a standalone street-front shop or a "minimart"

This exemption is a vital strategic element for foreign retailers. By locating stores within recognized malls (e.g., Vincom, Takashimaya, Lotte Mart), investors can bypass the lengthy and uncertain ENT process.

Application procedures for a retail business license

The procedure to obtain a Business License for retail in Vietnam involves strict administrative protocols.

Step 1: Preparing the dossier

A complete dossier is the foundation of success. Incomplete files are returned, resetting the clock. The required documents include:

- Application form: Standard form (Form No. 01 of Decree 09)

- Explanation report on compliance:

- Capacity compliance: Proof of financial strength

- Experience: Profile of the investor in retail

- Technology: Systems used to manage inventory/sales

- Explanation report on financial capacity: Audited financial statements or bank certification

- Tax certification: Proof of no overdue tax debts (for existing entities)

- Copy of IRC and ERC

- Certificate of land use rights (LUR) or lease agreement: For the headquarters

Step 2: Submission and processing

The dossier is submitted to the Department of Industry and Trade (DOIT) where the FIE is headquartered.

- Scenario A (Standard goods): The DOIT reviews and consults with the Ministry of industry and trade (MOIT) regarding the conformity with industry planning

- Scenario B (Sensitive goods): The DOIT sends the dossier to the MOIT, which then consults with other ministries (e.g., Ministry of Health for supplements)

Step 3: Receiving the license

Upon approval, the DOIT issues the Business License

- Statutory timeline: Up to 150 working days (no MOIT consultation) or 180 working days (with MOIT consultation). Practical timeline: In reality, due to inter-ministerial communication, the process often takes 1 to 3 months. Services from consulting firms often involve expedited follow-ups to keep the application moving through these bureaucratic channels.

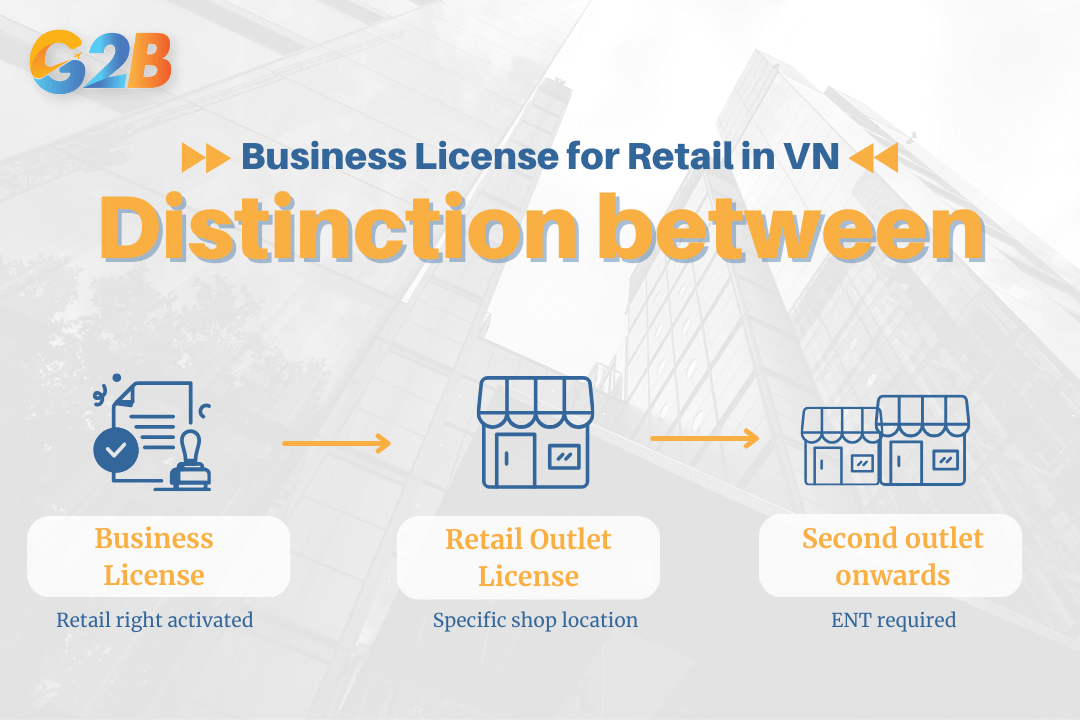

Retail business license vs. Retail outlet license

A common misconception is that the Business License allows you to open shops immediately. This is semantically incorrect within the legal framework.

The distinction

- Business license (BL): Grants the legal capacity or the "right" to engage in retail activities. It allows the company to buy goods and issue retail invoices. It effectively "activates" the retail business line in the ERC.

- Retail outlet license (ROL): Grants the permission to operate a specific physical location (a brick-and-mortar store).

The sequence

The hierarchy is strict:

- Obtain business license (General trading right)

- Obtain retail outlet license (Specific location approval)

Each new shop requires its own Retail Outlet License. The first shop's ROL is usually processed alongside the Business License. Subsequent shops require new ROL applications, triggering the ENT discussed earlier (unless exempt).

Relationship between business license vs retail outlet license and ENT

Post-licensing compliance for retailers

Obtaining the license is not the end of the legal journey. FIEs must adhere to strict reporting regimes to maintain the validity of their Business License for retail in Vietnam.

Reporting obligations

Retailers must submit annual reports to the issuing Department of Industry and Trade

- Deadline: Before January 31st of the following year.

- Content: The report must detail the operational situation, financial results, and compliance with the registered goods list.

Amendments and modifications

If the FIE undergoes any of the following changes, the Business License must be amended within 10 days:

- Change of Legal representative

- Change of Headquarters address (even within the same district)

- Change of Company name

- Changes to the Controlling owner

- Changes to the Charter capital

Failure to amend the license results in administrative penalties and can impede customs clearance for imported retail goods.

Common challenges and mistakes

Foreign investors often encounter hurdles due to the nuanced nature of Vietnamese Commercial Law.

1. Incorrect HS code classification

Choosing a generic HS code or one that conflicts with Vietnam’s WTO exclusion list will lead to immediate rejection. For example, attempting to retail "second-hand goods" (refurbished electronics/machinery) is often prohibited or highly restricted, whereas new goods are permitted.

2. Operating with only an ERC

Many investors assume that because their ERC says "Retail of other goods in specialized stores," they are compliant. This is a fatal error. Without the separate Business License (green paper/A4 certificate from DOIT), the retail operation is illegal.

3. Ignoring the ENT for expansion

Opening a second shop on a high street without applying for the ENT or ROL is a common violation. Authorities perform random market surveillance checks. If caught, the shop may be sealed, and profits confiscated.

4. Financial reporting mismatches

If the financial statements submitted for the license do not match the capital data in the IRC, the DOIT will request a full audit explanation, delaying the process by months.

FAQs about the business license for retail

Q: How long is the Business License for retail valid? A: The Business License generally has a validity period matching the duration of the investment project listed in the IRC (usually up to 50 years). However, for sensitive goods, the license may be issued for a shorter term (e.g., 5 years) requiring renewal.

Q: Is a Business License required for E-commerce? A: Yes. If an FIE sells goods via a website or app to consumers (E-commerce), it is considered a form of retail. The FIE must obtain a Business License and notify/register the website with the Vietnam E-commerce and Digital Economy Agency (iDEA) under the MOIT.

Q: Can I apply for the Business License before the company is incorporated? A: No. You must first obtain the IRC and ERC to establish the legal entity. Only the established legal entity can apply for the Business License.

Q: Do I need a Business License if I only sell to other businesses (Wholesale)? A: Generally, No. If you strictly engage in wholesale (B2B) and do not sell to end consumers, you typically only need the registered business line in your ERC and IRC. However, strict adherence to B2B invoicing is required.

Securing a Business License for retail in Vietnam is a critical milestone for any foreign investor aiming to capture market share in this Southeast Asian powerhouse. It requires more than just capital; it demands a strategic understanding of Decree 09/2018/ND-CP, precise HS Code classification, and careful navigation of the Economic Needs Test. The distinction between the IRC, ERC, and Business License must be clear from the outset to avoid costly compliance pitfalls. While the procedure involves multiple layers of bureaucratic scrutiny - from the local DOIT to the central MOIT - the result is a fully legal, operational retail presence in one of Asia's fastest-growing consumer markets.

G2B provides Incorporation services with an excellent customer experience, helping you do right from the start and minimising risk when setting up a company in this dynamic environment. Whether you need Vietnam company formation service or specific advice on the setup process and requirements in Vietnam, G2B is here to support your success!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom