Joint venture Vietnam serves as the critical strategic gateway for foreign investors aiming to enter specific restricted sectors or leverage local assets in one of Southeast Asia’s fastest-growing economies. While 100% foreign ownership is permitted in many industries, specific conditional business lines mandate collaboration with a local Vietnamese partner to satisfy market access conditions outlined in Vietnam’s WTO Commitments and the Law on Investment 2020.

What is a joint venture in Vietnam?

A Joint Venture in Vietnam is a commercial enterprise established through the collaboration of at least one foreign investor and one Vietnamese party, where foreign ownership is typically capped between 49% and 99%, depending on the industry sector.

Unlike a standard merger, a JV creates a synergistic entity that combines foreign capital and technology with local land rights and market knowledge. Under the Law on Enterprise 2020 and Law on Investment 2020, a JV is not a distinct legal form itself but acts as an operational model that adopts one of the following legal entities:

- Limited Liability Company (LLC): The most common structure, where liability is limited to capital contributions.

- Joint Stock Company (JSC): A share-based structure required for larger projects intending to list on the stock exchange.

- Business Cooperation Contract (BCC): A contractual arrangement engaging in profit-sharing without creating a new legal entity.

When is a joint venture mandatory in Vietnam?

Foreign investors cannot always establish a Wholly Foreign-Owned Enterprise (WFOE). The Vietnamese government maintains a "Negative List" or "Conditional Business Lines" where foreign direct investment (FDI) is restricted to protect national security, cultural integrity, or local industry competitiveness. In these sectors, a Joint Venture is the only legal vehicle for market entry.

Which sectors require a local partner?

- Advertising services: Foreign ownership is generally capped. Investors must partner with a Vietnamese entity that is already licensed for advertising.

- Logistics and transportation:

- Road transport: Foreign ownership often capped at 51%.

- Inland waterways: Capped at 49%.

- Rail freight: Subject to strict limitations.

- Tourism and travel services: While inbound tour operation is open, certain outbound or specialized travel services may require local joint venture partners to meet statutory capital and licensing requirements.

- Telecommunications: Infrastructure-based services usually require a JV with a state-owned enterprise or licensed local carrier, often capping foreign equity at 49%.

- Electronic games & entertainment: Providing electronic gaming services requires a JV with a local Vietnamese partner who holds the appropriate content licenses.

Semantic context: These restrictions are governed by Vietnam’s specific Schedule of Specific Commitments in Services (WTO) and local decrees, with 2025 Investment Law amendments reducing conditional lines effective July 2026. Attempting to bypass these via nominee structures is illegal and carries severe penalties, including license revocation.

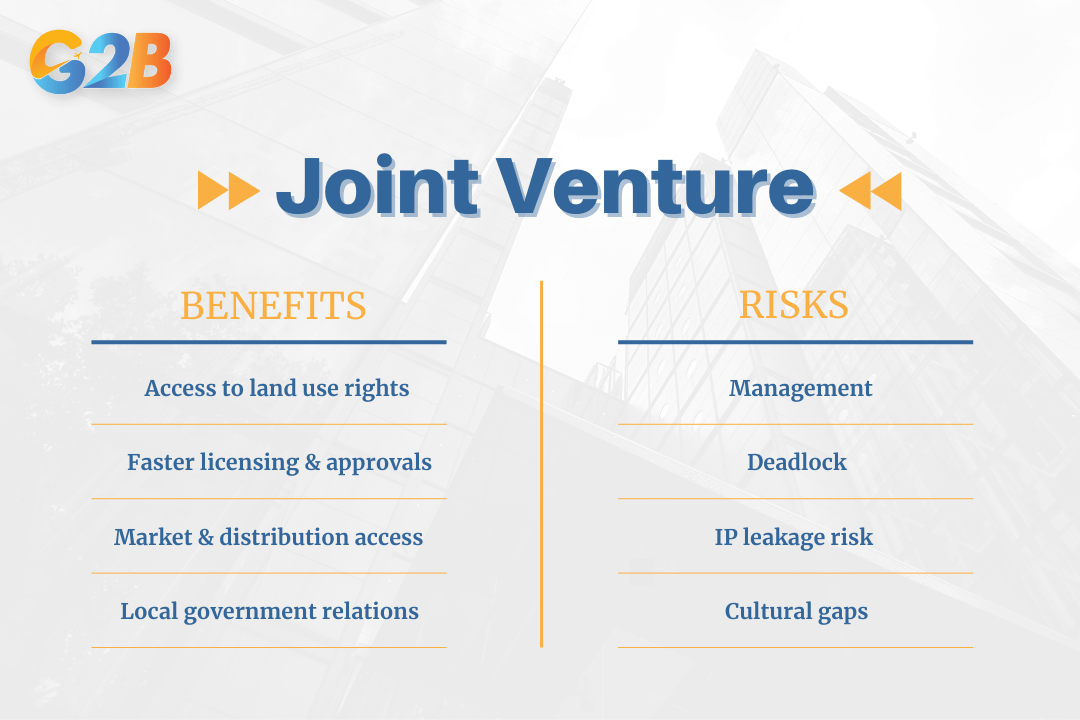

Advantages and disadvantages of forming a joint venture

Choosing a JV structure involves a trade-off between market access and operational control. Below is a comparative analysis of the strategic value versus the inherent risks.

Pros and cons of a joint venture in Vietnam

Benefits of partnering with Vietnamese companies

- Access to land use rights (LURs): Foreign entities cannot own land in Vietnam; they can only lease it. However, many local Vietnamese partners already possess long-term Land use rights (LURs) or "Golden Land" locations. A JV allows the foreign investor to utilize these assets as part of the local partner's capital contribution.

- Government relations & bureaucracy: The Department of planning and investment (DPI) and specialized ministries involve complex licensing procedures. A local partner often possesses the "institutional knowledge" and relationships to expedite the Investment Registration Certificate (IRC) and sub-licenses.

- Market penetration: Leveraging an existing distribution network reduces the "Time to Market." The local partner provides immediate access to supply chains, labor pools, and customer bases that would take a WFOE years to build.

Common risks and challenges for foreign investors

- Management deadlocks: A 51% (Foreign) / 49% (Local) split is dangerous. Under the Law on Enterprise 2020, specific critical decisions (e.g., selling assets, restructuring) require a 65% supermajority. A 49% partner can effectively block these decisions, creating a deadlock.

- Cultural differences: Conflicts often arise regarding transparency, compliance standards, and speed of execution. Western "contract-first" approaches may clash with Vietnamese "relationship-first" business cultures.

- Loss of IP control: Technology transfer is often a requirement or natural consequence of a JV. Without strict IP clauses and non-compete agreements, there is a risk of the local partner replicating the business model independently.

Legal structures for Vietnam joint ventures

Selecting the correct corporate "container" for your JV is critical for governance and tax efficiency.

Joint venture Limited Liability Company (LLC)

- Structure: An LLC can be a Single-Member LLC (if one partner holds 100%, though this is a WFOE) or a Multi-member LLC (2 to 50 members).

- Governance: Managed by a Members' Council. Voting power is strictly proportional to capital contribution.

- Suitability: This is the most common structure for SMEs and manufacturing projects due to its simplified compliance requirements and restriction on public share issuance, which keeps control within the founders.

Joint venture Joint Stock Company (JSC)

- Structure: JSC Requires a minimum of 3 shareholders. Capital is divided into shares.

- Governance: Managed by a General Meeting of Shareholders, a Board of Management, and a Control Board.

- Suitability: Mandatory for projects planning to list on the Ho Chi Minh City stock exchange (HOSE) or those requiring high liquidity for investors to exit by selling shares.

Business cooperation contract (BCC)

- Structure: A BCC is not a legal entity. It is a contract between parties to share profits/losses while operating independently.

- Suitability: Often used in telecommunications or oil & gas where creating a new company is administratively burdensome or restricted.

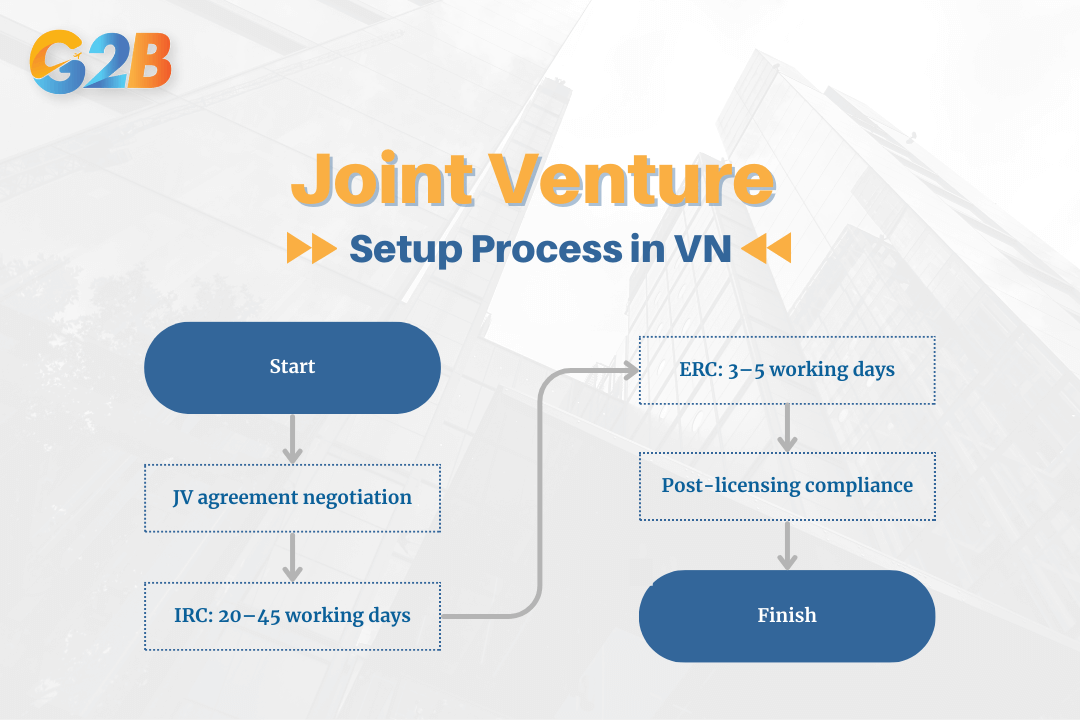

How to set up a joint venture in Vietnam

Establishing a JV involves a strict "Two-Step Licensing Process" overseen by the Department of planning and investment (DPI).

Step 1: Pre-licensing and JV agreement (JVA) negotiation

Before filing, parties must negotiate the Joint venture agreement (JVA) and the Company charter (Articles of Incorporation).

- Action: Conduct legal due diligence on the local partner to verify their legal standing and asset ownership (specifically Land Use Rights).

Step 2: Applying for the Investment Registration Certificate (IRC)

This is the approval of the project.

- Entity: Submitted to the provincial DPI or Industrial Zone Management Board.

- Requirement: The investor must prove financial capacity (bank statements) and project location (Lease Agreement or MOU).

- Timeline: Statutory time is 15 days, but in practice, this takes 20–45 working days if ministry consultations are required for restricted sectors.

Step 3: Obtaining the Enterprise Registration Certificate (ERC)

This is the incorporation of the company.

- Action: Once the IRC is issued, the investor applies for the ERC. This document generates the company's Tax Identification Number.

- Timeline: Typically 3–5 working days after IRC issuance.

Step 4: Post-licensing procedures

The setup is not complete upon receiving the ERC.

- Seal registration: Making the company seal (stamp).

- Bank account: Opening a Direct Investment Capital Account (DICA).

- Capital injection: The most critical compliance rule - investors must inject the full charter capital within 90 days of the ERC issuance date. Failure to do so results in heavy fines.

- Tax registration: Payment of the Business License Tax (License Fee).

Main steps to establish a joint venture in Vietnam

Key clauses in the Joint Venture Agreement (JVA)

The JVA is the constitutional document of the partnership. A generic template is insufficient for Vietnam's legal environment.

Capital contribution and ownership ratios

Clearly define not just the amount, but the form of contribution.

- Foreign partner: Usually cash or machinery/technology.

- Local partner: Usually cash, Land use rights, or "market knowledge" (though "goodwill" is hard to value legally, it must be quantified).

Management structure and veto rights

Because the Law on Enterprise 2020 requires a 65% vote for major decisions, a 51% majority shareholder does not have total control.

- Strategy: The JVA must list Reserved Matters that require unanimous consent or high supermajority (e.g., 75%), such as appointing the General Director, changing the business scope, or approving loans above a certain threshold.

Dispute resolution and exit strategy

If the marriage fails, how do you divorce?

- Deadlock mechanism: Define a "Put option" or "Call option" (Russian Roulette clause) to buy out the other partner.

- Arbitration: Do not rely on local courts. It is advised to stipulate the Vietnam International Arbitration Centre (VIAC) or the Singapore International Arbitration Centre (SIAC) for impartial dispute resolution.

Frequently asked questions (FAQ) about Vietnam JVs

The following frequently asked questions address common concerns and practical issues related to establishing and operating a joint venture in Vietnam.

Can a foreigner own 99% of a joint venture?

Yes. In sectors not fully open under WTO commitments but not requiring a specific floor for local ownership, a foreigner can own 99% while the local partner owns 1%. This is often done to satisfy the technical requirement of having a "joint venture" without ceding control.

What is the difference between a JV and a WFOE?

A WFOE (Wholly foreign-owned enterprise) is 100% owned by foreign investors and allows for full control. A JV (Joint Venture) involves partial ownership by a Vietnamese entity. JVs are usually mandatory for restricted sectors (like advertising or logistics) or strategic for accessing land; WFOEs are preferred for manufacturing and unrestricted services.

How long does it take to form a JV in Vietnam?

The standard timeline is 1 to 3 months. This includes 3-4 weeks for the Investment Registration Certificate (IRC) and 1 week for the Enterprise Registration Certificate (ERC). Complex sectors requiring Ministry approval (e.g., education, healthcare) can take 4-6 months.

Can a joint venture own land in Vietnam?

No company, foreign or local, can "own" land in Vietnam. The land belongs to the people, managed by the State. A Joint Venture can hold Land Use Rights (LURs) for a specific period (usually 50 years). These rights allow the JV to build factories, lease the land, and mortgage the assets attached to the land.

Establishing a joint venture in Vietnam is a high-stakes strategic move that offers immense rewards - access to a 100-million-strong consumer market, strategic geography, and a growing industrial base. However, the complexity of the Law on Investment 2020, combined with the intricacies of partner negotiations and restricted sector compliance, demands precise execution. A poorly structured JV can lead to management deadlocks and asset loss. A well-structured JV, governed by a robust agreement and clear operational protocols, creates a powerful engine for growth.

Ready to enter the Vietnam market? G2B provides Incorporation services with an excellent customer experience, helping you do right from the start and minimising risk when setting up a company in this dynamic environment.

Whether you need a full Vietnam Incorporation Service or specific advice on company setup process and requirements in Vietnam, G2B is here to support your success!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom