Crowdfunding is reshaping how entrepreneurs and innovators access capital. Founders, small business owners, and investors are drawn to its potential for market validation and community engagement. Unlike traditional loans, crowdfunding offers flexibility and reduced financial burden through diverse models like equity and reward-based options. Let's dive into the definition of crowdfunding and explore a comprehensive guide to how it works in this article.

This article is for general information to help entrepreneurs understand the fundamentals of crowdfunding. We specialize in company formation and do not offer financial or fundraising advisory services. For personalized advice, please consult a qualified crowdfunding expert or financial advisor.

What is crowdfunding?

Crowdfunding has revolutionized business financing by enabling entrepreneurs to raise capital from numerous individuals rather than relying on traditional funding sources. This modern fundraising approach collects small contributions from a large pool of people - typically via online platforms - to finance business ventures, products, or projects.

Formal definition and origins

Crowdfunding emerged as a direct response to tightened lending practices following the 2008 financial crisis. The term itself was coined in 2006, predating the widespread adoption that would follow in subsequent years. As traditional financing sources became increasingly restrictive, entrepreneurs sought alternative methods to fund their ventures.

The 2016 JOBS (Jumpstart Our Business Startups) Act marked a watershed moment for the crowdfunding industry in the United States. This legislation formally legalized equity crowdfunding for small businesses, establishing regulatory frameworks that allowed companies to offer ownership stakes to non-accredited investors. Prior to this act, businesses faced significant legal limitations when raising capital through crowdfunding channels.

How crowdfunding works for businesses

The crowdfunding process involves three essential stakeholders working in concert: the project initiator (the business or entrepreneur), the backers or investors, and the platform facilitating the exchange. Business owners create campaign pages on platforms like Kickstarter or Indiegogo, detailing their vision, funding goals, and timeline for project completion.

Campaign structure typically includes:

- A compelling project description and business case

- A specific funding target and deadline

- Tiered incentive structures (rewards, equity shares, or repayment terms)

- Visual assets such as videos, prototypes, or demonstrations

- Regular updates and backer communication channels

The funding process follows different models depending on the platform:

- All-or-nothing funding (funds are only released if the entire goal is met)

- Flexible funding (the business keeps all funds raised regardless of meeting goals)

- Subscription or recurring funding models

For businesses, crowdfunding extends beyond mere capital acquisition. Successful campaigns provide market validation, build customer communities, generate pre-sales, and create marketing buzz - benefits that traditional financing rarely offers in a single package. This multi-dimensional value proposition explains why crowdfunding continues to gain popularity among entrepreneurs seeking both financial support and market traction simultaneously.

Finding a trustworthy incorporation service in the US? Let G2B simplify the process - Book your free consultation now!

Types of crowdfunding for startups and businesses

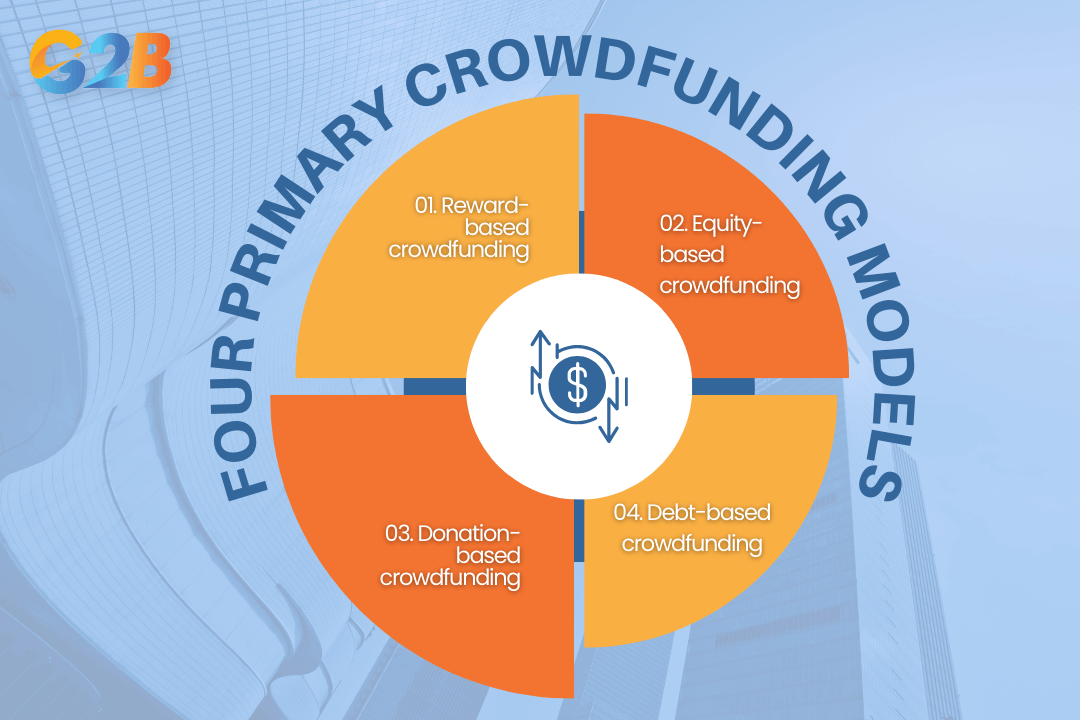

The four primary crowdfunding models - reward-based, equity-based, donation-based, and debt-based - each serve different business needs and come with distinct mechanics, benefits, and regulatory considerations.

Four primary crowdfunding models serve different business needs

Reward-based crowdfunding

Reward-based crowdfunding operates on a simple premise: Backers contribute funds in exchange for non-financial rewards or early access to products. Platforms like Kickstarter and Indiegogo dominate this space, making it particularly valuable for product-focused startups and creative ventures. This model allows businesses to validate market demand while generating capital without sacrificing equity or taking on debt. Typical rewards include early product versions, exclusive merchandise, or tiered perks based on contribution levels.

Benefits for businesses:

- Market validation before full production

- No equity dilution or debt obligation

- Built-in marketing and customer acquisition

- Retained intellectual property rights

Equity-based crowdfunding

Equity crowdfunding transforms backers into actual investors who receive ownership stakes in the business proportional to their investment. This model operates under strict regulatory frameworks, such as the JOBS Act in the United States, which allows companies to raise up to $5 million annually from both accredited and non-accredited investors.

Platforms like SeedInvest, StartEngine, and Wefunder facilitate these transactions while ensuring compliance with securities regulations. Businesses must prepare detailed disclosure documents, financial statements, and business plans before launching campaigns. This model suits growth-stage startups seeking substantial capital for expansion who are comfortable with sharing ownership and governance rights.

| Regulation | Key features | Funding limits |

|---|---|---|

| Regulation CF | For non-accredited investors | Up to $5M annually |

| Regulation D | For accredited investors only | No funding cap |

| Regulation A+ | "Mini-IPO" with fewer requirements | Up to $75M annually |

Donation-based crowdfunding

Donation-based crowdfunding relies on contributors giving funds with no expectation of financial return or material compensation. This model thrives on emotional connection and social impact rather than commercial incentives. Social enterprises, nonprofits, and mission-driven businesses benefit most from this approach. Platforms like GoFundMe, Causes, and Chuffed.org host campaigns where backers support initiatives aligned with their values. The absence of reward fulfilment or equity management makes this model administratively simpler.

Key success factors:

- Clear social impact or purpose

- Transparent use of funds

- Strong visual storytelling

- Existing community relationships

Debt-based (peer-to-peer lending) crowdfunding

Debt-based crowdfunding functions as distributed lending, connecting businesses with individuals willing to loan capital in exchange for repayment with interest. Platforms like Funding Circle, Lending Club, and Kiva facilitate these transactions with varying interest rates and terms.

This model appeals to established businesses with proven revenue streams seeking working capital or expansion funding. Loan amounts typically range from $5,000 to $500,000 with terms of 1-5 years. Interest rates vary based on business creditworthiness, usually falling between 5-30%. Unlike traditional bank loans, approval decisions often consider factors beyond credit scores, including business model viability and growth potential.

Application process:

- Business submits financial documentation

- The platform underwrites and rates the loan

- The loan is listed for investor funding

- Multiple investors fund portions of the total

- Business repays principal and interest according to a fixed schedule

Emerging and hybrid models

The crowdfunding landscape continues evolving with innovative models that combine elements of traditional approaches. Revenue-sharing arrangements allow backers to receive a percentage of future sales rather than equity or fixed repayment. Security Token Offerings (STOs) utilize blockchain technology to tokenize investment, offering greater liquidity and fractional ownership.

Hybrid platforms like Republic and Fundable now support multiple funding types on single platforms, allowing businesses to choose the most appropriate model or combine approaches for different funding stages. Some platforms also integrate subscription-based funding for recurring revenue businesses or royalty-based models for creative and intellectual property assets. These emerging models provide more flexible capital structures tailored to specific business models, growth stages, and industry requirements, expanding crowdfunding's utility across the business spectrum.

Crowdfunding vs. Traditional funding: A comparative overview

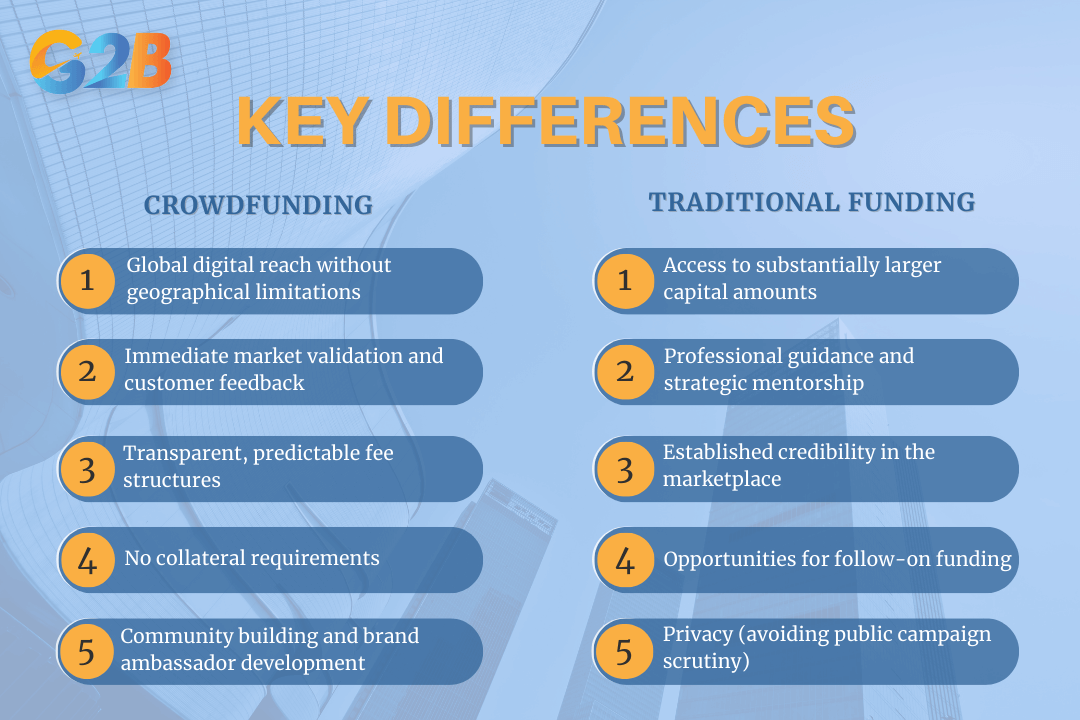

Each approach offers distinct advantages depending on a business's stage, goals, and circumstances. While crowdfunding provides flexibility and market validation, traditional funding delivers established credibility and larger capital injections.

Key differences and decision matrix

Crowdfunding and traditional funding diverge significantly across several critical dimensions. Crowdfunding platforms typically process applications faster, often launching campaigns within days versus the months required for traditional loan approvals or investment deals. The success rate for crowdfunding campaigns averages 22.4% across platforms, while traditional business ventures face a 50% failure rate within five years.

Key crowdfunding advantages include:

- Global digital reach without geographical limitations

- Immediate market validation and customer feedback

- Transparent, predictable fee structures (typically 5-10% of funds raised)

- No collateral requirements (for most models)

- Community building and brand ambassador development

Traditional funding strengths include:

- Access to substantially larger capital amounts

- Professional guidance and strategic mentorship

- Established credibility in the marketplace

- Opportunities for follow-on funding

- Privacy (avoiding public campaign scrutiny)

The advantages of Crowdfunding vs Traditional funding

The decision matrix centers on core trade-offs:

| Factor | Crowdfunding | Traditional funding |

|---|---|---|

| Control | Greater autonomy (especially reward-based) | Often requires equity or governance concessions |

| Speed | Weeks from setup to completion | Months of due diligence and negotiations |

| Exposure | Public campaign (marketing benefit but risk of failure) | Private process with confidentiality |

| Requirements | Compelling story and online presence | Strong financials and business track record |

When to choose each model

Entrepreneurs should select crowdfunding when market validation represents a primary objective alongside capital raising. Early-stage startups with minimal financial history but strong visual or story-driven products perform particularly well on crowdfunding platforms. The model excels for businesses seeking to build communities around their offerings while maintaining ownership control.

Traditional funding becomes the optimal choice when scaling requires substantial capital infusions or when strategic expertise carries equal importance to funding itself. Businesses with established financial history, significant collateral assets, or complex B2B models typically find better alignment with bank loans or venture capital.

Traditional funding works best when:

- Capital needs exceed $1 million for expansion phases

- The business model has proven revenue and profitability

- Strategic partnerships or industry connections are crucial

- The venture requires sustained, multi-stage funding

- The target market consists primarily of enterprise clients

- Founders possess strong credit histories and business credentials

The funding approach selection ultimately depends on balancing immediate capital needs against long-term strategic objectives, weighing ownership dilution concerns against growth acceleration opportunities.

Legal and regulatory considerations in crowdfunding

Crowdfunding platforms operate under complex regulatory frameworks that vary significantly by model and jurisdiction. Entrepreneurs must navigate these requirements to ensure full compliance and avoid potential penalties or campaign shutdowns.

Equity crowdfunding: Securities law and compliance

Equity crowdfunding operates under strict securities regulations worldwide. In the United States, the SEC and FINRA oversee these platforms through Regulation Crowdfunding, which permits eligible companies to raise up to $5 million in a 12-month period. Businesses must file Form C with the SEC before launching a campaign and provide scaled financial disclosures based on offering size.

Companies must conduct all transactions through registered intermediaries - either broker-dealers or funding portals. These gatekeepers verify investor eligibility and enforce contribution limits for non-accredited investors. Additionally, securities purchased through equity crowdfunding typically cannot be resold for one year, creating liquidity constraints investors should understand. International frameworks share similar protective measures. The UK Financial Conduct Authority, European Securities and Markets Authority, and regulatory bodies in Canada, Australia, and Singapore have established comparable oversight mechanisms tailored to their markets.

Reward, donation, and debt models: Key legal points

Reward-based and donation crowdfunding campaigns face fewer regulatory hurdles but must comply with consumer protection laws and truth-in-advertising regulations. Campaign creators must accurately represent their products or causes and deliver on promised rewards or face potential legal action. Most platforms require clear terms of use agreements that establish delivery timeframes, refund policies, and dispute resolution procedures. These contractual obligations create binding commitments between campaign creators and backers.

Debt-based crowdfunding (peer-to-peer lending) encounters lending regulations in most jurisdictions. Platforms must typically register as financial intermediaries, and campaigns must include transparent loan agreements specifying interest rates, payment schedules, and default consequences. Some regions restrict participation to accredited investors or impose caps on total lending amounts.

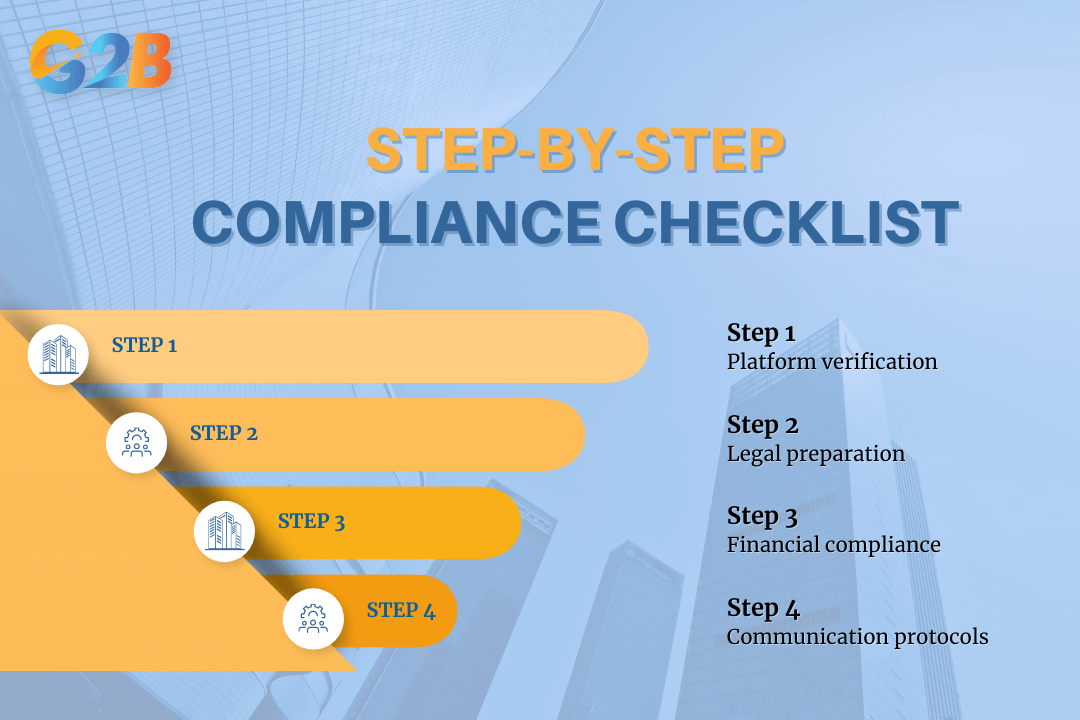

Step-by-step compliance checklist

Before launching any crowdfunding campaign, entrepreneurs should complete this essential compliance checklist:

- Platform verification

- Confirm SEC/FINRA registration for equity platforms

- Review platform reputation and compliance history

- Understand all platform-specific rules and requirements

- Legal preparation

- Secure intellectual property rights (patents, trademarks)

- Draft proper disclosure documents

- Establish clear terms for backers/investors

- Prepare privacy policy for data collection

- Financial compliance

- Organize financial statements according to regulatory requirements

- Set up separate bank account for crowdfunding proceeds

- Consult with tax professional about implications

- Implement record-keeping systems for future audits

- Communication protocols

- Create transparent update schedule for backers

- Develop crisis communication plan for potential delays

- Document all backer/investor communications

Entrepreneurs who neglect these compliance steps risk campaign termination, legal penalties, and significant reputational damage that could permanently impact their business prospects.

Step-by-step compliance checklist before launching a crowdfunding campaign

How to launch a successful crowdfunding campaign

Launching a successful crowdfunding campaign requires strategic planning and execution.

Planning and setting goals

Setting realistic, well-researched funding targets forms the foundation of any successful crowdfunding campaign. Campaigns achieving at least 30% of their funding goal within the first week significantly increase their chances of overall success. This early momentum signals market interest and attracts additional backers.

When establishing funding goals, entrepreneurs should:

- Research similar campaigns in their industry to establish realistic benchmarks

- Calculate exact costs including production, fulfilment, marketing, and platform fees

- Create a clear breakdown showing how funds will be utilized

- Develop a realistic timeline with specific milestones

- Set minimum viable product (MVP) thresholds if the campaign uses flexible funding

Crafting your campaign page and incentives

The campaign page serves as the digital storefront and must immediately capture attention. Campaigns with personal videos raise 150% more than those without, while the optimal word count for high-performing campaigns ranges from 300-500 words. These statistics demonstrate the importance of concise, visual storytelling.

Effective campaign pages include:

- A compelling narrative that connects emotionally with potential backers

- High-quality images and videos demonstrating products or services

- Concise text broken into scannable sections with subheadings

- Infographics explaining technical concepts

- Authenticity that builds trust with potential backers

When designing reward tiers, structure them to appeal to different backer segments. The average donation to successful crowdfunding campaigns is $99, suggesting backers respond to value-driven incentives. Create 5-7 reward tiers ranging from affordable entry points to premium offerings, ensuring each provides clear value and exclusivity that motivates participation.

Marketing and community engagement

Pre-campaign community building dramatically impacts success rates. Campaigns shared fewer than twice have a 97% failure rate, while those with strong social media engagement see significantly higher success rates. For every order of magnitude increase in Facebook friends (10, 100, 1000), success probability increases from 9% to 40%.

Effective marketing strategies include:

- Building an email list before launch

- Creating a content calendar for a consistent social media presence

- Leveraging PR outreach to relevant publications

- Implementing referral incentives for supporters

- Utilizing crowdfunding thermometers (which increase giving by 35%)

During the campaign, regular updates drive additional funding. Campaign owners who update supporters every five days raise three times more than those who don't, and campaigns receive 126% more donations when owners provide regular updates. The data suggests posting at least four substantial updates throughout the campaign lifecycle.

Post-campaign obligations and follow-through

Once funding concludes, delivering on promises becomes crucial for business reputation. Whether the campaign succeeds or falls short, maintaining transparent communication with backers builds credibility and may create opportunities for future funding.

Post-campaign responsibilities include:

- Providing regular progress updates on production and fulfillment

- Managing backer expectations regarding timelines

- Creating systems for tracking reward fulfillment

- Addressing challenges or delays transparently

- Maintaining financial transparency regarding fund allocation

- Preparing for tax implications and reporting requirements

For equity campaigns, establish clear investor communication channels and reporting processes. For reward-based campaigns, develop efficient fulfillment systems that can handle the logistics of delivering rewards to potentially hundreds of backers. Regardless of campaign type, the follow-through phase represents a critical opportunity to convert backers into long-term customers and brand advocates.

Risks, challenges, and common pitfalls in crowdfunding

Crowdfunding presents entrepreneurs with significant risks alongside its potential benefits. The path involves navigating operational challenges, legal compliance issues, intellectual property concerns, and avoiding common misconceptions that derail many campaigns.

Operational and market risks

Campaign execution remains the primary hurdle for most businesses attempting crowdfunding. Statistics reveal that less than one-quarter of all crowdfunding initiatives reach their goals, with the majority achieving only 1-20% of their funding objectives. This high failure rate stems from several critical factors:

- Insufficient pre-campaign marketing and audience building

- Lack of compelling storytelling or a clear value proposition

- Unrealistic funding goals disconnected from market realities

- Poor timing or campaign duration planning

- Inadequate response to backer questions and feedback

Market validation through crowdfunding is not guaranteed. Many entrepreneurs discover that their product concept generates insufficient interest despite strong personal conviction about its potential. The public nature of failure compounds this risk, as unsuccessful campaigns become permanently visible online, potentially affecting future fundraising efforts.

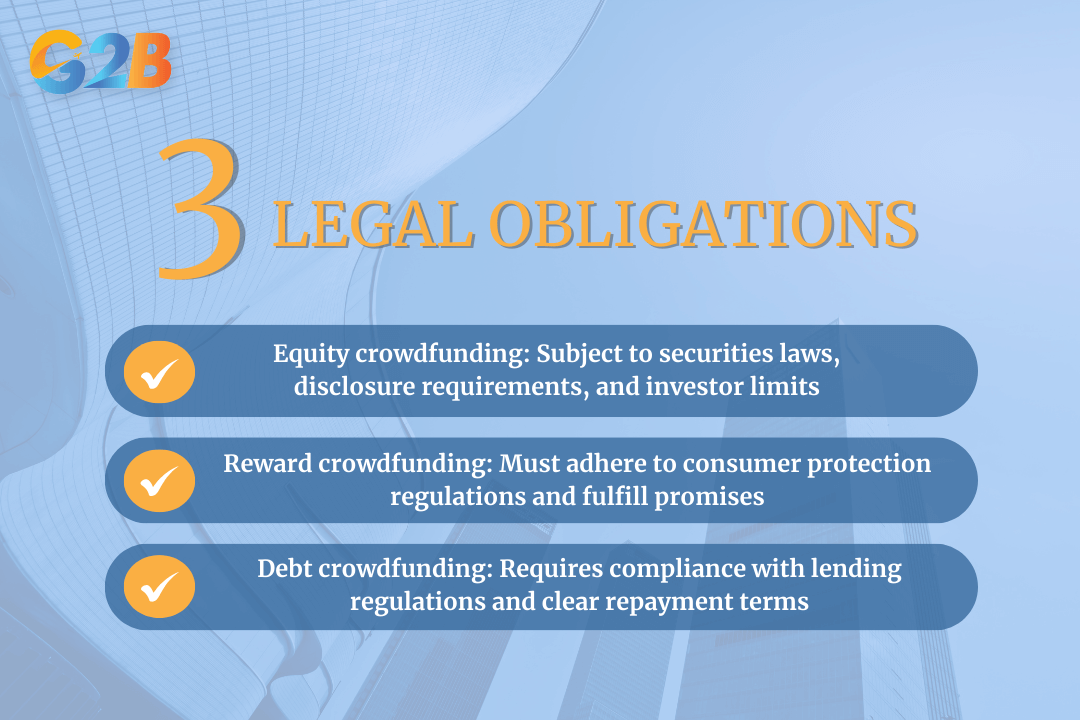

Legal and compliance risks

Non-compliance with applicable regulations represents a serious threat to crowdfunding entrepreneurs. Each crowdfunding model carries distinct legal obligations:

- Equity crowdfunding: Subject to securities laws, disclosure requirements, and investor limits

- Reward crowdfunding: Must adhere to consumer protection regulations and fulfill promises

- Debt crowdfunding: Requires compliance with lending regulations and clear repayment terms

Failure to meet these obligations can result in regulatory penalties, lawsuits from backers or investors, and platform removal. The financial consequences of legal missteps often far exceed the initial savings from bypassing traditional legal counsel. Entrepreneurs should budget for proper legal guidance before launching any crowdfunding campaign, particularly for equity or debt models where regulatory complexity increases significantly.

Each crowdfunding model carries distinct legal obligations

Intellectual property and idea theft

Publicly showcasing business concepts creates inherent vulnerability to copying and IP theft. Crowdfunding platforms require detailed descriptions, visual demonstrations, and often technical specifications that competitors can analyze and potentially replicate. Protecting intellectual assets requires proactive measures:

- File provisional patents before campaign launch

- Register trademarks for distinctive brand elements

- Execute copyright protection for content and creative materials

- Use non-disclosure agreements with manufacturers and partners

- Consider strategic information withholding (revealing enough to validate without exposing proprietary elements)

Monitoring for potential infringement throughout and after the campaign remains essential. Entrepreneurs should develop a response plan for addressing IP violations, including cease-and-desist communications and potential legal action when necessary.

Establish a company in Delaware? Let G2B simplify the process - Book your free consultation now!

Crowdfunding platforms: Comparison and selection guide

Selecting the right crowdfunding platform significantly impacts campaign success rates for entrepreneurs. Not all crowdfunding platforms serve the same purpose, with each designed to accommodate specific business models, funding goals, and target audiences.

Top platforms for each crowdfunding model

Rewards-based crowdfunding thrives on platforms like Kickstarter, which operates on an all-or-nothing model with a 5% platform fee plus 3-5% transaction fees. This platform excels for creative projects and product launches. Indiegogo offers more flexibility with funding options, making it suitable for various business needs without strict project categories.

Equity crowdfunding platforms connect businesses with investors looking for ownership stakes. StartEngine, backed by Kevin O'Leary, has facilitated over $900 million in startup funding. Republic takes a more curated approach, featuring high-quality startups and offering unique features like community Q\&As and founder AMAs. Wefunder, as the original Regulation CF platform, maintains a strong market presence.

For donation-based campaigns, GoFundMe leads with a 0% platform fee for personal and charitable causes (with only 2.9% + $0.30 processing fees) and no campaign deadlines. Specialized platforms like Mightycause offer customizable campaign pages and donor engagement tools designed specifically for nonprofits.

Alternative models include real estate crowdfunding through CrowdStreet and RealtyMogul, while content creators often leverage Patreon's recurring funding model for sustainable income.

Platform fees, eligibility, and unique features

Platform selection requires careful consideration of fee structures. Standard platform fees range from 0-5%, with additional transaction charges typically between 2.9-5% plus fixed fees per transaction. Some platforms like Zeffy operate on a tip model with no mandatory fees, while others like Kickstarter require successful funding to charge fees.

| Platform | Platform fee | Transaction fee | Funding model |

|---|---|---|---|

| Kickstarter | 5% | 3-5% + $0.30 | All-or-nothing |

| GoFundMe | 0% (personal) | 2.9% + $0.30 | Keep-what-you-raise |

| Republic | 6% | 2.9% + $0.30 | Various equity models |

| Patreon | 5-12% | 2.9% + $0.30 | Recurring subscription |

Eligibility requirements vary significantly, particularly for equity platforms. Regulation CF platforms typically accept only U.S.-based companies (corporations and LLCs), exclude investment companies, prohibit "bad actors" with securities violations, and limit fundraising to $5 million in a 12-month period. These platforms require proper SEC filings through Form C.

Platform-specific features often become deciding factors. Kickstarter provides access to a large, active backer community. Republic offers profit-sharing tokens and highly-curated startups. GoFundMe includes fraud protection and instant withdrawals, while Patreon specializes in recurring funding models for consistent creator income.

Checklist: How to choose the right platform

Start by matching your business type to the appropriate platforms. Creative projects align well with Kickstarter or Indiegogo. Startups seeking equity should explore StartEngine, Republic, or Wefunder. Personal or charitable causes benefit from GoFundMe or Fundly, while real estate ventures require specialized platforms like CrowdStreet.

Evaluate your preferred funding model carefully:

- All-or-nothing vs. flexible funding options

- One-time contributions vs. recurring support

- Rewards-based, equity-based, or donation-based structures

- Campaign duration requirements

Analyze fee structures comprehensively, considering: • Platform fees (typically 0-5%) • Payment processing charges (2-5% + fixed fees) • Premium feature costs • One-time vs. recurring fees

Assess platform capabilities that support campaign success:

- Social sharing tools and community features

- Donor/investor management systems

- Marketing support and promotional tools

- Mobile accessibility

- Integration with existing business systems

Consider geographic limitations carefully. Some platforms operate exclusively in the U.S. (particularly equity platforms), while others accommodate international campaigns. Regional specialists like Crowdcube serve specific markets (UK/Europe) with targeted expertise and investor networks.

Frequently asked questions (FAQs) about crowdfunding for business

Crowdfunding has revolutionized capital access for entrepreneurs seeking alternatives to traditional financing. These answers address the most common questions business owners encounter when considering this funding approach.

What is crowdfunding and how does it work for businesses?

Crowdfunding enables businesses to raise capital from numerous individuals through online platforms. The process typically involves creating a campaign page that presents the business concept, funding goals, and timeline. Entrepreneurs then promote this campaign to potential backers who contribute funds.

Most business crowdfunding campaigns operate on an exchange principle. Depending on the model chosen, businesses offer rewards (products or services), equity stakes, or repayment terms in exchange for financial contributions. Successful campaigns reach their funding targets through small investments from many supporters rather than large sums from a few investors.

What are the main types of crowdfunding?

Each crowdfunding model serves different business needs and involves distinct obligations:

| Type | Description | Best for |

|---|---|---|

| Reward-based | Backers receive products, experiences, or recognition | Product launches, creative projects |

| Equity-based | Investors receive ownership shares in the business | Growth-stage startups seeking significant capital |

| Donation-based | Contributors give without material compensation | Social enterprises, charitable causes |

| Debt-based | Lenders provide funds that businesses repay with interest | Established businesses with revenue streams |

These models operate under different regulatory frameworks, with equity crowdfunding facing the most stringent oversight due to its investment nature.

Is crowdfunding legal for startups?

Crowdfunding operates legally within established regulatory frameworks across most countries. However, compliance requirements vary significantly by model:

- Equity crowdfunding falls under securities regulations (SEC oversight in the US) and requires using registered platforms, filing appropriate disclosures, and adhering to investor limitations.

- Reward and donation models face fewer regulatory hurdles but must comply with consumer protection laws, tax regulations, and platform-specific rules regarding campaign transparency.

- Debt-based crowdfunding must adhere to lending regulations that vary by jurisdiction, often requiring clear loan agreements and interest rate disclosures.

Entrepreneurs should consult legal advisors familiar with crowdfunding regulations in their specific location before launching campaigns.

Do I have to pay back crowdfunding money?

Repayment obligations depend entirely on the crowdfunding model selected:

- Debt-based crowdfunding requires full repayment of principal plus interest according to predetermined terms.

- Reward-based campaigns involve no monetary repayment, but businesses must deliver promised products, services, or perks to backers.

- Donation-based funding carries no repayment obligations, though regular updates on progress are considered best practice.

- Equity crowdfunding exchanges ownership shares rather than requiring repayment, but brings ongoing shareholder relationships and potential dividend expectations.

Failing to meet obligations in any model can result in legal repercussions and significant reputational damage.

How do I choose the best crowdfunding platform for my business?

Platform selection should align with business goals and campaign type:

- Funding model compatibility - Ensure the platform supports your preferred crowdfunding approach (reward, equity, donation, or debt).

- Industry focus - Some platforms specialize in specific sectors like technology, food, or creative arts.

- Fee structures - Compare platform fees (typically 5-10%), payment processing charges, and any subscription costs.

- Audience demographics - Research whether the platform's user base matches your target market.

- Success rates - Examine the platform's track record for campaigns similar to yours.

- Support services - Consider whether the platform offers campaign guidance, promotion tools, or investor networks.

Leading platforms include Kickstarter and Indiegogo (reward-based), StartEngine and SeedInvest (equity), and Lending Club (debt-based).

What are the risks and disadvantages of crowdfunding?

Entrepreneurs should carefully weigh these potential challenges:

- Campaign failure - Approximately 60-70% of crowdfunding campaigns fail to reach their funding goals.

- Intellectual property exposure - Public campaign materials may expose business concepts to potential competitors.

- Fulfillment challenges - Many successful reward campaigns struggle with manufacturing, shipping, and timeline management.

- Regulatory compliance - Mishandling legal requirements can result in penalties, especially with equity crowdfunding.

- Tax complications - Crowdfunded capital may create complex tax obligations that require professional guidance.

- Reputation risks - Underdelivering on promises can permanently damage business credibility.

Risk mitigation requires thorough preparation, realistic goals, transparent communication, and appropriate legal counsel. Crowdfunding transforms the financial landscape by granting entrepreneurs, from spirited startup founders to seasoned SME managers, a beacon of hope in acquiring capital. This innovative financing option not only bypasses the traditional barriers of bank loans but also fosters community engagement and market validation. In a world seeking innovation and impact, crowdfunding stands as a testament to collective empowerment and digital synergy.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom