Navigating the labyrinth of business funding options can often feel overwhelming for startup founders and small business owners striving to secure the capital necessary for growth and sustainability. Let’s investigate various funding options, from traditional bank loans and government grants to emerging alternatives, by diving into the eligibility criteria, application processes, and strategic advantages.

This article is provided for general informational purposes to help new business owners better understand basic concepts around business funding and bank loans. We are specialists in the field of company formation and do not operate in financial or credit advisory services. Therefore, this information should not be taken as professional financial guidance. For personalized advice, please consult with a licensed financial advisor or banking professional.

Understanding business funding options

Navigating the vast landscape of business funding options is crucial for both startups and established companies aiming to secure the necessary capital for growth and sustainability.

What are the main types of funding?

- Traditional funding sources: Traditional funding options, such as bank loans and government grants, have long been a staple in business financing. Bank loans are typically characterized by their relatively lower interest rates and structured repayment terms. According to the U.S. Small Business Administration, nearly 60% of small businesses rely on these loans as a primary source of capital. Such funding usually requires substantial documentation and proof, making it more accessible to established businesses with a track record of profitability.

- Government grants offer funding without the need for repayment, which can be a significant advantage. However, they are often highly competitive and come with stringent eligibility criteria and limitations on use. Grants are typically available for specific industries and projects, such as research, technology development, or environmental initiatives, and require substantial documentation to support the application.

- Alternative funding options: In contrast to traditional methods, alternative funding options include venture capital, angel investors, crowdfunding platforms, and microfinance institutions. Venture capital involves securing investment from firms in exchange for equity. This high-risk, high-reward strategy often requires surrendering some control over the company, but it provides large-scale funding critical for rapid growth.

- Angel investors are affluent individuals who invest in startups, typically offering more favorable terms than venture capitalists. These investments not only provide capital but often come with valuable mentorship and industry connections.

- Crowdfunding has emerged as a popular choice for startups and creative ventures. Platforms like Kickstarter and Indiegogo enable businesses to raise small amounts of money from a large number of people. This method is community-driven and can serve as a form of marketing by engaging a wide audience early.

- Microfinance institutions cater primarily to small ventures in developing regions, offering smaller loan amounts to aid businesses where traditional banking services might not reach.

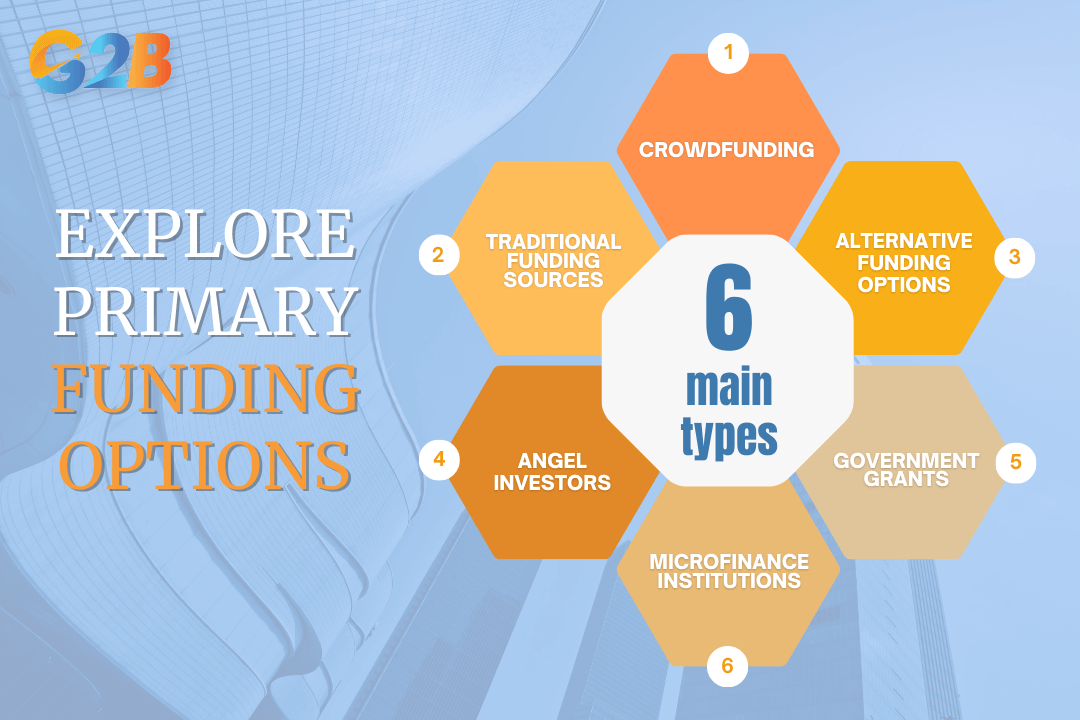

There are 6 main types of business funding options

Why is choosing the right funding crucial?

The decision around which funding route to pursue impacts a business's growth trajectory, control dynamics, and financial obligations. Several critical factors should guide this choice:

- Control and ownership: Different funding sources affect the degree of control business owners retain. Equity-based methods like venture capital and angel investments usually require giving up some degree of ownership. In contrast, loans and grants don’t typically affect ownership structure.

- Cost of capital: The cost associated with securing funds varies significantly. Interest rates on loans need consideration against the dilution of shares in venture capital or angel investing scenarios. Understanding these costs is crucial for long-term financial planning.

- Risk tolerance and business stage: The nature of the business, its stage of growth, and risk tolerance levels also dictate appropriate funding paths. Early-stage startups with disruptive potential might seek venture capital for rapid scaling, whereas sustainable but slower-growing businesses might opt for bank loans that offer predictable repayments.

- Speed and accessibility: Some funding options provide faster access than others. Crowdfunding and microloans can be quicker to secure compared to traditional loans and venture capital funding, which require more thorough vetting and negotiation.

Comparative analysis using a decision matrix

To facilitate a smart funding choice, businesses can construct a decision matrix aligning various funding options against core criteria like speed of funding, equity requirements, and degree of financial support beyond capital. Here's a simplified example:

| Funding source | Speed of funding | Ownership dilution | Additional support |

|---|---|---|---|

| Bank loans | Moderate | None | Financial advice |

| Venture capital | Slow to Moderate | High | Mentorship, networks |

| Angel investors | Moderate | Moderate | Industry insight |

| Government grants | Slow | None | Project-specific |

| Crowdfunding | Fast | None | High engagement |

| Microfinance | Fast | None | Community impact |

24 business funding options

There are many ways to fund a business. The best option depends on factors like your goals, legal entity type, stage of growth, and risk appetite. Below are 24 common business funding options – from traditional to modern – that entrepreneurs should know:

- Crowdfunding: A method of raising capital by collecting small amounts of money from a large number of people, typically via online platforms like Kickstarter or Indiegogo.

- SBA loans: Loans guaranteed by the U.S. Small Business Administration (SBA), offering favorable terms and lower interest rates for small businesses.

- Venture capital: Funding provided by firms or individuals to startups and early-stage businesses with high growth potential in exchange for equity.

- Bank loans: Traditional loans offered by banks, where businesses borrow a lump sum and repay it with interest over time.

- Grants: Non-repayable funds awarded by governments, foundations, or other organizations for specific purposes or projects.

- Angel investors: Wealthy individuals who provide capital to startups in exchange for ownership equity or convertible debt, often at early stages.

- Business grants: A type of grant specifically aimed at supporting businesses, usually offered by governments or non-profit institutions.

- Factoring: A financing method where a business sells its accounts receivable (invoices) to a third party (factor) at a discount to get immediate cash.

- P2P loans (Peer-to-peer lending): Loans funded by individual investors through online platforms, bypassing traditional financial institutions.

- Family and friends: Informal funding sourced from relatives or close friends, often based on trust and personal relationships.

- Line of credit: A flexible loan arrangement where businesses can draw funds as needed up to a certain limit and only pay interest on the amount used.

- Equity financing: Raising capital by selling shares of the company, giving investors partial ownership in exchange for funding.

- Merchant cash advance: A lump sum of money given to a business in exchange for a percentage of future daily credit card sales, plus fees.

- Equipment financing: Loans or leases used to purchase business equipment, where the equipment itself often serves as collateral.

- Internal financing: Using a business’s own profits or retained earnings to fund new projects or operations, without external borrowing.

- Private equity: Capital investment from private equity firms into mature companies, usually to restructure, grow, or take the business private.

- Asset finance: Using company assets (like machinery or inventory) to secure funding, either through leasing or using the asset as collateral.

- Bootstrapping: Funding a business using personal savings and revenue from the business, without outside investment.

- Business cards (Credit cards): Credit cards are specifically issued to businesses to manage purchases, cash flow, and short-term financing needs.

- Credit: A broad term for borrowed funds that businesses use and repay later, often from banks or credit institutions.

- Business incubator: Programs that support startups with mentorship, office space, and sometimes funding, to help them grow and succeed.

- Investors: Individuals or entities that provide capital to a business in exchange for equity or returns on investment.

- Invoice financing: Borrowing money against outstanding invoices, allowing businesses to improve cash flow before customers pay.

- Personal savings: Using an entrepreneur’s own personal funds to start or support a business, often as the first source of capital.

Traditional funding methods

Traditional funding methods remain a cornerstone in the realm of business financing, offering a structured approach that is both time-tested and familiar to businesses. Within this landscape, two major avenues stand out: bank loans and government grants.

Bank loans: Advantages and challenges

Bank loans serve as one of the most prevalent forms of traditional funding for businesses. They offer a straightforward mechanism where a business borrows a sum of money to be repaid with interest over a set period. Let's delve into both the advantages and challenges of utilizing bank loans for business funding.

Advantages:

- Controlled funding: Unlike some alternative methods, bank loans do not require giving up equity in the business. This means business owners retain full control and decision-making power.

- Predictability: Bank loans provide a clear repayment schedule with fixed or variable interest rates, allowing businesses to plan their finances accordingly.

- Establishing creditworthiness: Successfully managing a bank loan can help a business build a credit history, which is crucial for future borrowing needs.

Challenges:

- Stringent requirements: Banks often require a solid credit history, collateral, and detailed financial statements. This can be a significant barrier, especially for startups or businesses with less credit history.

- Interest rates and fees: Depending on the borrower's creditworthiness, interest rates can be burdensome. Additionally, there are often associated fees, including origination fees, which can increase the cost of borrowing.

- Rigid repayment structures: Unlike more flexible funding options, bank loans come with fixed repayment schedules that must be adhered to, regardless of the business's current cash flow situation.

Government grants: Opportunities and limitations

Government grants present an attractive funding option as they provide capital that does not need to be repaid. However, securing these funds comes with its own set of opportunities and limitations.

Opportunities:

- Non-dilutive funding: Government grants do not require businesses to relinquish any equity, maintaining ownership and control within the founding team.

- Support for innovation and growth: Many grants are designed to support specific sectors or initiatives, such as technology innovation, sustainability projects, or community development. This type of funding can be crucial for businesses operating in these areas.

- Enhanced credibility: Receiving a grant can serve as a seal of approval from government agencies, enhancing a business's credibility with investors and partners.

Limitations:

- Highly competitive: The grant application process is often highly competitive, with limited funds available. Businesses must meet specific criteria and demonstrate significant potential or impact.

- Complex application process: Preparing a grant application can be time-consuming and complex, requiring detailed proposals, budgets, and adherence to strict guidelines.

- Conditional funding: Grants often come with stipulations on how the funds can be used, which may limit a business's flexibility in deploying the capital.

Alternative funding sources

In the ever-evolving landscape of business financing, alternative funding sources have emerged as crucial complements to traditional bank loans and government grants. Let’s delve into the prominent alternative funding options: venture capital and angel investors.

Venture capital: High risk, high reward

Venture capital (VC) is synonymous with high-risk, high-reward investment strategies. Venture capitalists typically provide significant capital funding to startups that demonstrate explosive growth potential. In exchange, they often demand a substantial equity stake and active involvement in the company's strategic direction. VC funding stands out due to the following attributes:

- Access to substantial capital: Venture capitalists can invest millions of dollars, providing startups with the resources needed to accelerate growth and scale operations quickly.

- Strategic networking: VCs bring robust industry connections, offering startups opportunities to form strategic partnerships, enter new markets, and access key industry networks.

- High-risk tolerance: Although VCs are willing to face high risks, they anticipate high returns, targeting industries with significant growth potential such as technology, healthcare, and fintech.

However, this funding source isn’t without its challenges:

- Equity dilution: To secure funding, entrepreneurs often need to concede a considerable share of their company, resulting in reduced control over business decisions.

- Pressure to perform: High expectations from investors usually lead to pressure for rapid growth, which might divert focus from long-term stability to short-term metrics.

For a deeper comparison, see Angel Investors vs. Venture Capital: Understanding Investment Strategies for Startups

Angel investors: Tapping into seasoned expertise

Angel investors are typically affluent individuals who provide funding in exchange for shares or convertible debt. What sets them apart from traditional financiers is their particular emphasis on mentoring and guiding entrepreneurs.

Key aspects of angel investing include:

- Early-stage investments: Angel investors usually step in at the nascent stages of a business, often before it's eligible for VC funding. This makes them pivotal for startups still proving their business models.

- Mentorship and expertise: They often assume an advisory role, offering invaluable industry insights, management advice, and growth strategies fueled by their own experiences.

- Flexible investment terms: Unlike VCs, angel investors tend to have more flexible terms and are generally less demanding in terms of equity, allowing entrepreneurs to retain a higher degree of control.

Despite their advantages, there are considerations business owners should be mindful of:

- Smaller capital amounts: Funds from angel investors are typically lower than venture capital, which may be insufficient for startups needing immediate large-scale funding.

- Finding the right match: The success of this relationship hinges significantly on finding an angel investor whose vision aligns with that of the entrepreneur.

Modern funding approaches

Modern funding approaches have revolutionized the landscape of business financing, providing entrepreneurs with more diverse options than ever before. Two notable methods within this paradigm are crowdfunding platforms and microfinance institutions.

Crowdfunding platforms: Community-driven finance

Crowdfunding platforms have democratized access to capital, enabling businesses to raise funds directly from the public. Platforms like Kickstarter, Indiegogo, and GoFundMe allow entrepreneurs to pitch their ideas to a global audience, who can contribute financially in exchange for rewards, equity stakes, or simply the satisfaction of supporting a burgeoning venture. This method empowers small businesses and creative projects to gain traction without traditional financial intermediaries.

- Diverse funding sources: Crowdfunding opens doors to a myriad of potential backers. Entrepreneurs can tap into networks of individuals who are passionate about their projects, increasing the potential pool of funds and leveraging the power of community enthusiasm.

- Validation & market reach: Launching a successful crowdfunding campaign serves as market validation. If a project garners widespread support, it indicates strong market interest and customer backing, enhancing credibility with future investors.

- Minimal financial risk: Unlike debt financing, crowdfunding does not typically require repayment, nor does it obligate businesses to relinquish equity, though some platforms offer equity crowdfunding options. This allows entrepreneurs to focus on growth without the immediate pressure of financial return.

Microfinance institutions: Supporting small ventures

Microfinance institutions (MFIs) cater specifically to small enterprises and entrepreneurs who may not qualify for traditional bank loans. Pioneered by organizations like Grameen Bank, microfinance offers vital financial services to underserved communities, driving economic development from the ground up.

- Accessibility for low-income entrepreneurs: MFIs target entrepreneurs in developing regions or economically disadvantaged areas, providing small loans, savings accounts, and other financial services to those who lack access to conventional banking.

- Boosting local economies: By financing micro-enterprises, microfinance spurs local economic activity and employment. Successful repayment cycles strengthen the credit profiles of borrowers, fostering sustainable community growth.

- Comprehensive support services: Many MFIs pair financial services with educational programs, offering training in business planning, financial literacy, and management. This holistic approach enhances the long-term success of borrowers.

These modern funding approaches offer compelling alternatives to traditional financing, each addressing different needs within the entrepreneurial ecosystem. Crowdfunding thrives on community involvement and serves as a testbed for innovative ideas, while microfinance fills critical financial gaps for small vendors and underserved populations, promoting inclusivity and grassroots economic development.

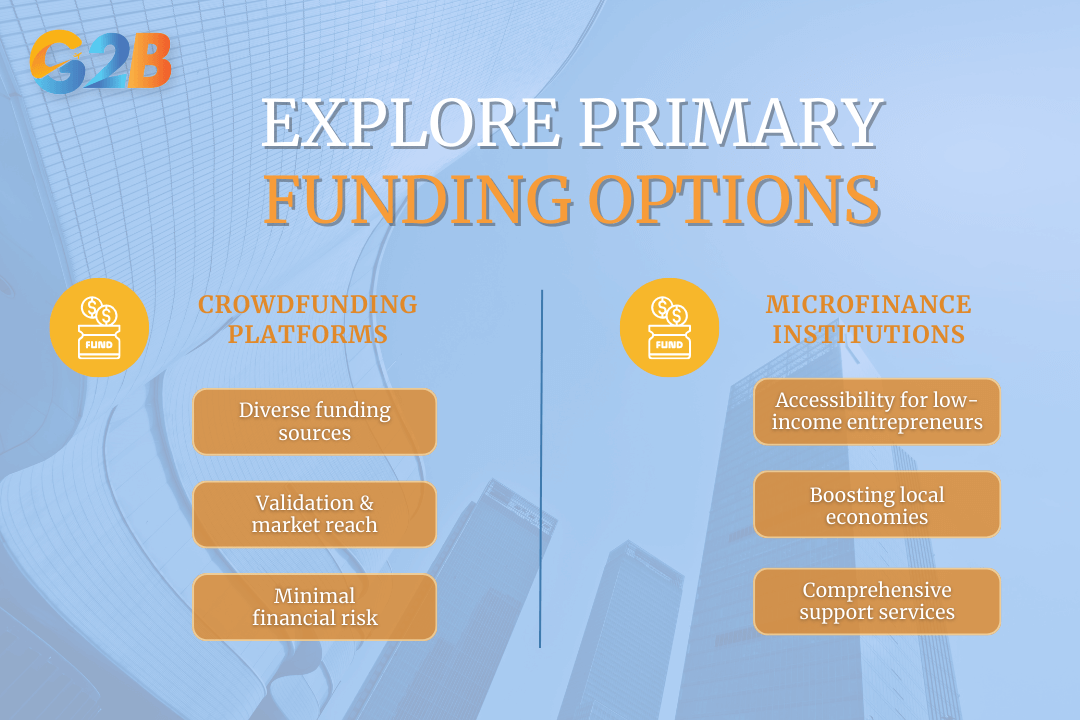

Two notable modern funding approaches are crowdfunding platforms and microfinance institutions

Comparative analysis of funding options

Each funding avenue presents unique characteristics that can significantly impact a business strategy and its financial health.

Weighing the risks and benefits of each option

Business funding method carries distinct advantages and potential drawbacks. A clear evaluation of these factors is essential to determine the most suitable option for the company’s specific needs and circumstances:

- Bank loans vs. Venture capital:

- Bank loans: These traditional financing methods involve borrowing money that must be repaid with interest. The main advantage is that the entrepreneur retains complete ownership and control over the business. However, the risk includes high debt levels and an obligation to repay regardless of the business's financial situation. Due to their stringent eligibility requirements, bank loans are more often accessible to established businesses with a robust financial history.

- Venture capital: This option involves exchanging equity for capital, meaning entrepreneurs share ownership with investors. The primary benefit is access to significant funds and business expertise, with a potential for rapid growth. The risk is equity dilution and losing some control over business decisions. Venture capitalists seek high-growth potential ventures, often making it suitable for startups in innovative sectors.

- Crowdfunding and grants:

- Crowdfunding platforms: Platforms like Kickstarter allow businesses to raise capital from a large pool of investors or customers who contribute small amounts. This method is low-risk concerning financial obligations since contributions often do not need to be repaid. The challenge is the requirement for an effective marketing strategy to stand out among many projects seeking funding.

- Government grants: These are often sought after because they do not require repayment. They are highly competitive and have specific usage criteria, which can limit flexibility. Grants present minimal financial risk but come with the risk of time-consuming application processes and potential restrictions on business operations.

- Angel investors:

- Angel investors provide funding in exchange for equity and often offer mentorship and guidance. This option involves risk concerning ownership dilution and influence over business strategy. However, the benefit lies in the strategic advisement and networks that seasoned investors can provide, potentially accelerating business growth.

Cost and control implications

Different funding options can affect both the cost of capital and the level of control retained over the business. Understanding these implications is crucial when choosing the right financing path:

- Equity vs. debt financing:

- Equity financing (venture capital, angel investors): While there is no obligation to repay the capital, the cost comes as equity dilution. Investors often want a say in significant business decisions, impacting control. The potential for high returns needs to be balanced against the cost of shared ownership.

- Debt financing (bank loans, microfinance): Here, the cost is represented by interest payments. Although the entrepreneur maintains full control, the obligation to fulfill repayments could strain cash flow, especially if the business faces downturns.

- Crowdfunding and grants:

- As non-traditional methods, they often do not fit neatly into equity or debt categories. Crowdfunding might have implicit costs in marketing efforts, while the cost of grants can include adhering to strict compliance and specific project execution guidelines.

Eligibility requirements and process

Securing funding is a pivotal moment for any business, but navigating the eligibility requirements and application processes can be daunting. Understanding these requirements will enhance your chances of successfully obtaining the necessary capital.

Criteria for securing different types of funding

Securing business funding often depends on meeting specific criteria, which can vary widely between funding sources. Factors such as credit history, business stage, and revenue potential all play a role in eligibility.

- Traditional bank loans

- Credit score and financial history: Banks typically require a strong credit score and a robust financial history. According to the U.S. Small Business Administration, nearly 60% of small businesses turn to bank loans, making a good credit score crucial.

- Collateral: Tangible assets like real estate or inventory may be necessary to secure the loan.

- Business plan: A comprehensive business plan showcasing your market analysis and projected financials is essential.

- Venture capital and angel investors

- Scalability and unique value proposition: These investors look for businesses with the potential for high returns. Your business should have a unique edge and growth trajectory that promises scalability.

- Strong team: The caliber of your leadership and team is scrutinized. Investors are more likely to back a business led by experienced entrepreneurs.

- Market potential: Demonstrating a large addressable market increases attractiveness.

- Crowdfunding platforms

- Community engagement: Demonstrating prior engagement or a strong following can boost Crowdfunding success rates.

- Product viability: A developed prototype or a proof of concept is advantageous.

- Transparent goals: Clear financial goals and timelines are imperative to gain trust from prospective funders.

- Government grants

- Specific eligibility criteria: These often vary based on the grant and governmental objectives, typically focusing on innovation or community impact.

- Compliance and reporting: Once secured, ongoing compliance and reporting are necessary to maintain grant funding.

Preparing your business for funding applications

Preparation is the key to smoothly sailing through the application process. Here's how to get ready:

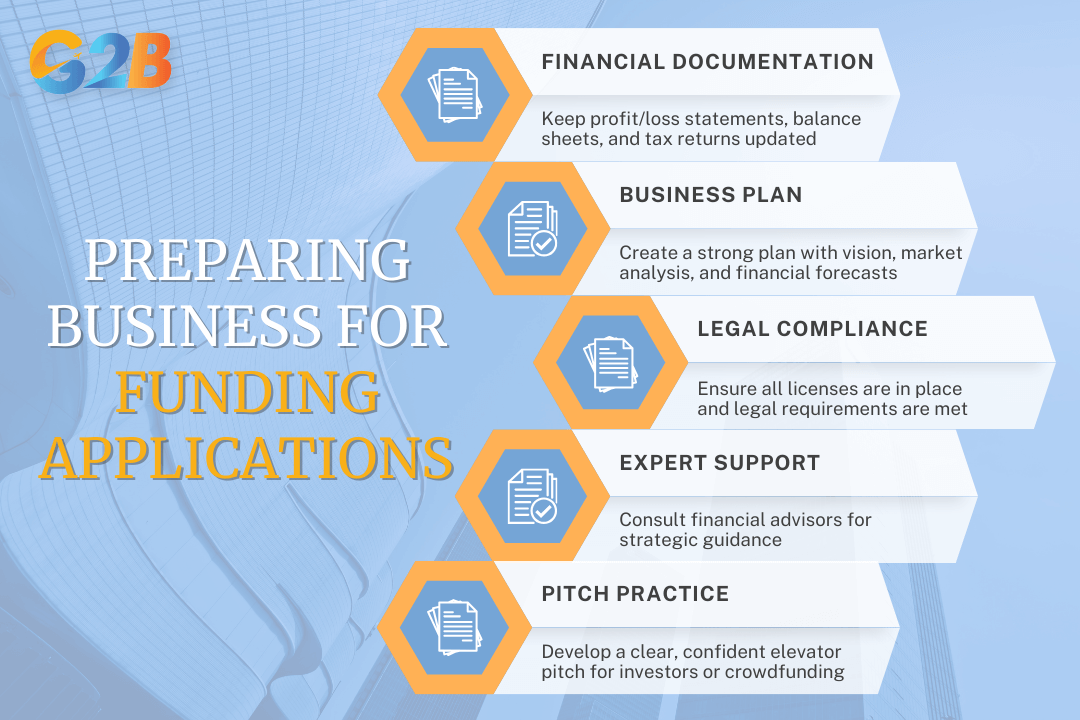

- Financial documentation: Ensure all your financial records, including profit and loss statements, balance sheets, and tax returns, are accurate and up-to-date. This is critical, particularly for bank loans and government grants.

- Crafting a business plan: Develop a robust business plan with a clear vision, market research, competitive analysis, and financial projections. A well-articulated plan strengthens your application for almost any funding type.

- Legal and compliance readiness: Verify that your business complies with all legal requirements and possesses necessary licenses. This can prevent unnecessary delays in the application process.

- Engage experts: Consider hiring financial advisors or consultants who specialize in startup financing. They can provide invaluable insights and help refine your funding strategy.

- Practice your pitch: Whether you're approaching venture capitalists or launching a Crowdfunding campaign, how you present your business - your "elevator pitch" - can determine success or failure. Confidence and clear communication are key.

Funding application preparation is the key to sailing through the process

The landscape of business funding is diverse and complex, influenced by both traditional and emerging financial trends. For businesses aiming to navigate successfully, understanding the nuances of each option is essential. This knowledge allows for informed decision-making that aligns with strategic goals, balancing the immediate need for financing with long-term growth and sustainability objectives.

Once again, this article is for informational purposes only, with the aim of helping newly established individuals and businesses better understand key concepts related to business funding and bank loans. As such, it should not be considered as a substitute for professional advice from licensed financial advisors or financial institutions.

Ready to establish your offshore company in the US (Delaware), UK, Singapore, or Hong Kong? G2B is here to guide you every step of the way with our professional business support services. Contact G2B today and take the first step toward international success!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom