Choosing between a representative office vs subsidiary in Vietnam is the first critical legal decision for foreign investors. This choice fundamentally shapes a company's operational capabilities, financial obligations, and long-term strategic potential within one of Southeast Asia's most dynamic economies. Understanding the nuances of this decision is paramount for a successful market entry. This definitive guide provides a deep analysis of the legal frameworks, including the Enterprise Law 2020 for subsidiaries and Decree 07/2016/ND-CP for representative offices, comparing setup timelines, capital requirements, tax liabilities (CIT/VAT/PIT).

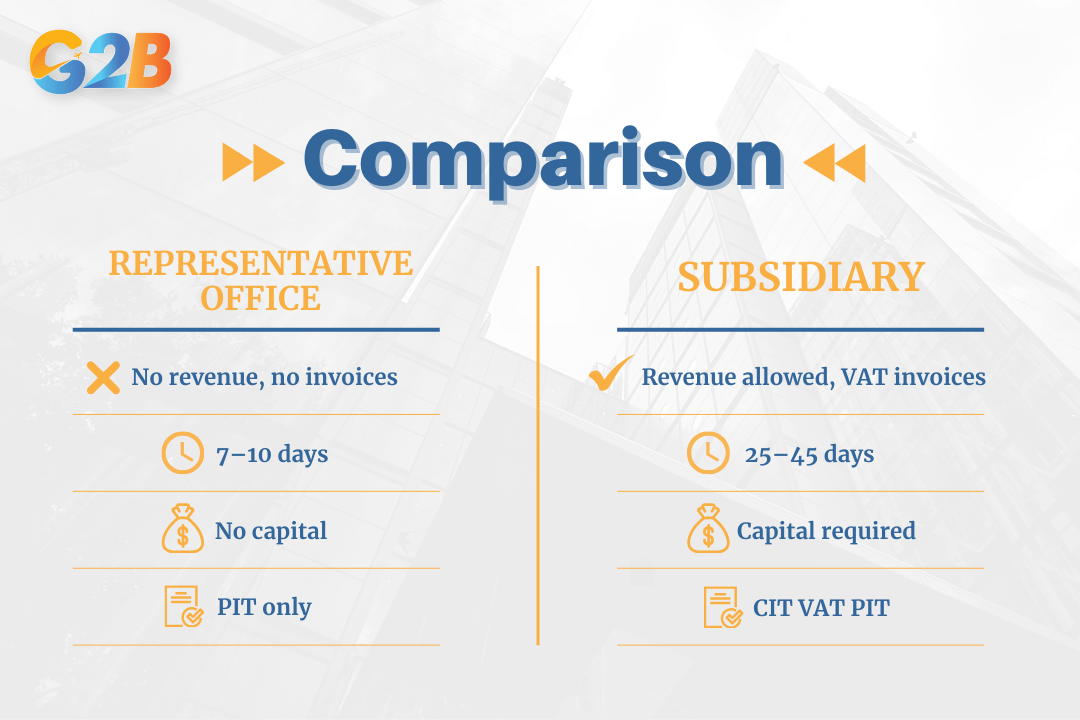

Quick comparison between Representative office vs Subsidiary in Vietnam

For investors requiring an immediate, high-level overview, this table presents the fundamental differences between establishing a Representative Office and a Subsidiary in Vietnam.

| Feature | Representative office (RO) | Subsidiary (LLC/FIE) |

|---|---|---|

| Commercial Activity | Forbidden (Non-profit): Strictly limited to market research, liaison work, and promoting parent company activities. | Allowed (Profit-generating): Full rights to conduct business, trade, manufacture, and provide services. |

| Invoicing | Cannot issue VAT invoices as it does not generate revenue. | Can issue Vietnamese red invoices (VAT invoices) for all commercial transactions. |

| Setup Time | 7–10 working days: A rapid and streamlined registration process. | 25–45 working days: A more complex process involving multiple licensing stages. |

| Capital Requirement | None: No minimum capital investment is required by law. | Required (Investment capital): While no universal minimum exists for many sectors, a "feasible" amount must be committed. |

| Tax Liability | PIT for employees only: The entity itself is exempt from corporate income tax. | CIT, VAT, & Business License Tax: Subject to the full spectrum of corporate taxes. |

| Legal Basis | Decree 07/2016/ND-CP: The primary regulation governing the establishment and operation of ROs. | Law on Enterprise 2020: The main legal framework governing the incorporation and management of companies. |

Key differences between a representative office and a subsidiary in Vietnam

Representative office in Vietnam

A representative office (RO) in Vietnam is the simplest form of legal presence a foreign company can establish. It is legally defined as a "dependent unit" of its parent company, meaning it does not have a separate legal personality. Its existence is entirely tied to the foreign parent, which bears full liability for its activities and obligations in Vietnam. The primary purpose of an RO is to facilitate the parent company's engagement with the Vietnamese market without conducting direct commercial activities.

Allowed activities

Under Decree 07/2016/ND-CP, the scope of an RO is strictly confined to non-profit-making functions. These activities are designed to build a market presence and gather intelligence. Permitted functions include:

- Market research: Collecting data and analyzing market trends, consumer behavior, and competitor activities to inform the parent company's strategy.

- Liaison office: Acting as a point of contact to facilitate communication and build relationships between the parent company and local Vietnamese partners, suppliers, or government agencies.

- Promoting parent company contracts: Promoting and seeking opportunities for the parent company's business, such as introducing products or services and assisting in contract negotiations, though the final contract must be signed by the parent company.

- Monitoring contract implementation: Supervising and coordinating the execution of contracts signed directly between the parent company and Vietnamese partners.

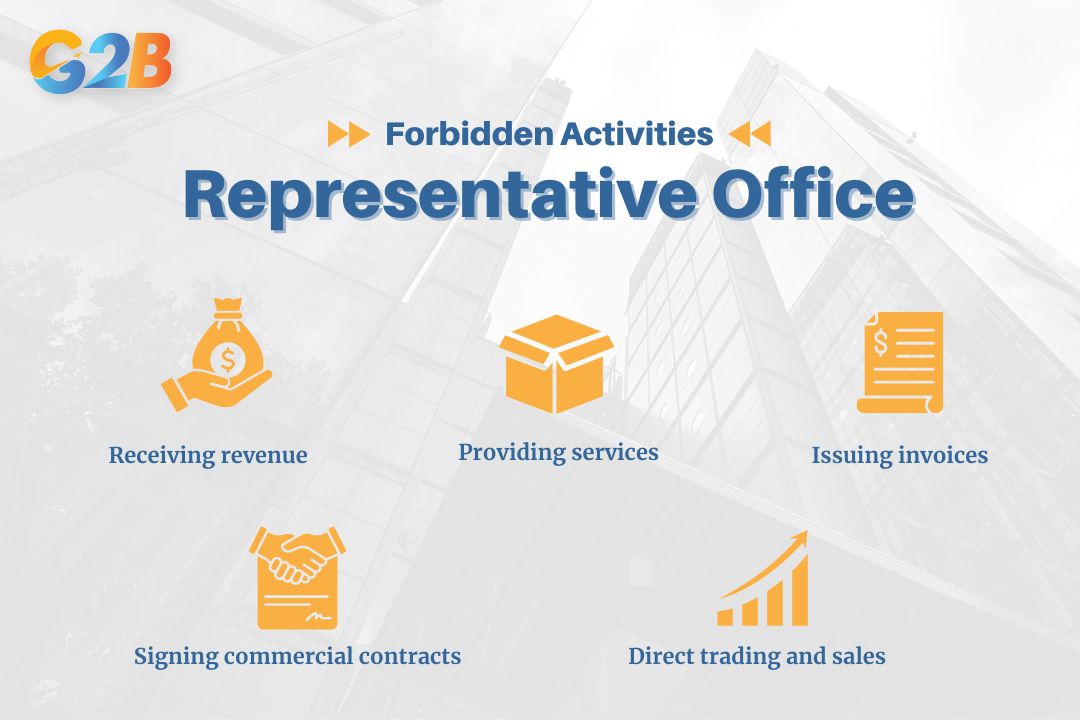

Forbidden activities

The most critical aspect for investors to understand is the limitations of an RO. An RO is explicitly forbidden from directly conducting profit-generating activities in Vietnam. This prohibition includes a range of commercial actions:

- Direct trading and sales: An RO cannot buy, sell, or trade goods or services.

- Providing services: It cannot render any services for a fee within Vietnam.

- Issuing invoices: Since it cannot generate revenue, an RO is not permitted to issue Vietnamese VAT invoices.

- Signing commercial contracts: The RO entity itself cannot be a party to a commercial contract. Any binding agreements must be signed directly by the parent company.

- Receiving revenue: The RO's bank account is for operational expenses only and cannot receive funds from commercial transactions.

Prohibited activities of a representative office in Vietnam

A key appointment for any RO is the Chief of representative office. This individual, who can be a foreign or local resident, is legally responsible for the RO's compliance and operations and acts on behalf of the parent company under a power of attorney.

Subsidiary in Vietnam

A Subsidiary in Vietnam is a fully-fledged, independent legal entity established by foreign investors. Unlike an RO, a subsidiary is a separate legal person from its parent company, meaning the parent company's liability is generally limited to its capital contribution. This structure is designed for investors who intend to conduct comprehensive, profit-generating business operations in Vietnam. The most common forms of subsidiaries for foreign direct investment (FDI) are the Limited Liability Company (LLC) and the Joint Stock Company (JSC).

100% Foreign-owned enterprise (FOE)

This is the most common structure for foreign investors, typically established as a single-member or multi-member Limited Liability Company. An FOE grants the foreign investor complete control over the company's management, operations, and strategic direction, without the need for a local partner. This structure is permissible in most business sectors under Vietnam's World Trade Organization (WTO) commitments.

Joint venture (JV)

A Joint Venture involves a partnership between a foreign investor and at least one local Vietnamese entity. This structure is mandatory in certain conditional sectors where foreign ownership is restricted, such as advertising or logistics. A JV can provide strategic advantages, including access to local market knowledge, existing networks, and land use rights.

Key attributes and licenses

Establishing a subsidiary is a two-step licensing process involving distinct certificates issued by Vietnamese authorities:

- IRC (Investment registration certificate): This is the initial and most crucial license for any foreign investment project. Issued by the Department of Planning and Investment, the IRC approves the investment project itself, detailing the investor, business objectives, location, and, most importantly, the amount of investment capital.

- ERC (Enterprise registration certificate): Once the IRC is granted, the investor applies for the ERC. This certificate officially establishes the new company as a legal entity in Vietnam and acts as its "birth certificate." The ERC contains the company's name, registered address, and legal representative, and its number doubles as the company's tax identification number.

The strategic advantage of a subsidiary is its complete operational freedom. It can engage in the full scope of business activities outlined in its licenses, such as manufacturing, importing and exporting goods, providing services directly to customers, issuing invoices, and ultimately repatriating profits back to the parent company.

Critical operational differences

The choice between an RO and a subsidiary has profound implications for daily operations, from tax and accounting to banking and human resources.

1. Taxation and accounting structure

- RO: The tax and accounting obligations for a Representative Office are minimal, reflecting its non-commercial nature. It is exempt from both Corporate Income Tax (CIT) and Value Added Tax (VAT) because it does not generate revenue. Its primary financial responsibilities are to manage its expense budget funded by the parent company and file an Annual Operation Report with the Department of Industry and Trade. The only direct tax obligation is to declare and pay Personal Income Tax (PIT) on behalf of its Vietnamese and expatriate employees.

- Subsidiary: A subsidiary, as a profit-making entity, is subject to the full Vietnamese accounting and taxation system. It must maintain audited financial statements and fulfill comprehensive tax obligations, including:

- Value added tax (VAT): Levied on the sale of goods and services, with standard rates applicable.

- Corporate income tax (CIT): The standard rate is 20% on taxable profits.

- Business license tax: An annual fixed fee paid to the local tax authority.

2. Banking and capital flows

- RO: A Representative Office operates a restricted Reimbursement account. This bank account can only be used to receive funds from the parent company to cover approved operational expenses, such as office rent and staff salaries. It cannot be used for any commercial transactions or to receive payments from third parties.

- Subsidiary: A subsidiary maintains a more complex banking structure to facilitate its commercial activities. It must establish a Direct investment capital account (DICA), which is a special-purpose foreign currency account used for receiving offshore capital injections from the parent company and for repatriating profits and dividends overseas. For daily business, it uses standard Vietnamese Dong (VND) current accounts to receive payments from customers and pay suppliers.

3. Hiring and visa sponsorship

- RO: A Representative Office is permitted to hire both local and foreign employees to carry out its limited functions. However, as a non-commercial entity, it may face greater scrutiny when sponsoring work permits for a large number of foreign staff.

- Subsidiary: A subsidiary has a much stronger legal standing to act as a sponsor for foreign talent. It can sponsor Work permits for foreign employees and Temporary residence cards (TRCs) for foreign investors and their dependents, providing a more stable and long-term basis for expatriates to live and work in Vietnam.

Setup process and timeline

The registration processes for an RO and a subsidiary differ significantly in complexity, required documentation, and timeline.

RO setup

- Authority: The governing body responsible for licensing ROs is the provincial Department of Industry and Trade (DOIT).

- Timeline: The process is remarkably efficient, typically taking only 7-10 Working days from the date of submitting a complete application dossier.

- Key requirement: A critical prerequisite is that the foreign parent company must have been legally established and operational for at least 1 year in its home country. The application requires legalized documents from the parent company, such as its Certificate of Incorporation and audited financial statements.

- RO license validity: License valid up to 5 years, renewable

Subsidiary setup

- Authority: The primary licensing body for foreign-invested subsidiaries is the provincial Department of planning and investment (DPI).

- Timeline: The setup process is substantially longer, ranging from 30-45 days, and sometimes more depending on the business sector. This timeframe accounts for the two-stage process of first obtaining the IRC and then the ERC. Furthermore, pre-approval for the office location via a formal lease agreement is required before the application can even be submitted.

- Key requirement: Investors must provide robust proof of financial capacity to fund the project. This typically involves submitting a recent bank statement from the parent company showing a balance that exceeds the proposed investment capital.

Which structure is right for you?

Applying this knowledge to practical business cases can clarify the optimal choice for your market entry strategy.

Scenario A: The sourcing office

A foreign apparel company needs a permanent presence in Vietnam to manage relationships with local garment factories, conduct quality control inspections, and oversee its supply chain. The team will not be involved in buying or selling but will act as the "eyes and ears" for the headquarters.

A representative office is the ideal structure. Its legal scope perfectly covers liaison and quality control activities. The low setup cost, minimal tax burden, and simple operational requirements make it a highly efficient and compliant choice for non-commercial sourcing operations.

Scenario B: The market seller

A software company wants to directly sell its products, provide technical support services to Vietnamese customers, and hire a local sales team. It needs to issue local contracts, receive payments in VND, and generate revenue within the country.

A subsidiary (trading company) is mandatory. Only a legally incorporated, profit-generating entity can perform commercial activities like signing sales contracts, issuing VAT invoices, and generating revenue. Attempting these activities through an RO would be a serious legal violation.

Scenario C: The "testing the waters" investor

A company sees potential in Vietnam but is not yet ready to commit to the capital investment of a full subsidiary or the physical office requirements of an RO. It wants to hire one or two local business development managers to explore the market for a year before making a larger decision.

Converting an RO to a Subsidiary

A common question from investors is whether a Representative Office can be "upgraded" or "converted" into a Subsidiary once their business goals evolve.

It is crucial to understand that you cannot legally "convert" an RO into a Subsidiary. They are fundamentally different legal structures governed by separate laws and licensing bodies. An RO is a dependent unit, while a subsidiary is a new, independent company.

The actual procedure is a two-step process:

- Dissolution: The Representative Office must be formally dissolved. This involves a formal closure process that includes finalizing all tax obligations (especially PIT for employees) with the tax authorities and returning the RO license to the Department of Industry and Trade.

- Incorporation: A completely new Subsidiary must be incorporated from scratch by following the full application process with the Department of Planning and Investment to obtain a new IRC and ERC.

This two-step process is both time-consuming and expensive. It underscores the importance of a well-considered market entry strategy, as choosing the correct structure from the outset can save significant administrative burdens and costs in the future.

Frequently asked questions (FAQ)

What is the minimum capital for a subsidiary in Vietnam? While Vietnamese law does not specify a hard minimum capital requirement for most business sectors, the Department of Planning and Investment (DPI) must approve the proposed amount. The capital must be deemed "feasible" and sufficient to cover the operational expenses of the business plan. For service-based companies, investors typically propose a charter capital in the range of $10,000 to $25,000 to ensure a smooth approval process.

Can a representative office sign contracts? This is a critical point of distinction. The RO entity itself cannot be a party to any commercial contract. However, the Chief Representative is permitted to sign contracts on behalf of the Parent Company, provided they have a specific, duly executed Power of Attorney from the parent for that particular transaction. The legal parties to the contract remain the foreign parent company and the Vietnamese third party, not the RO.

Does a representative office pay tax in Vietnam? The RO entity pays no corporate income tax (CIT) as it is legally prohibited from generating revenue. Its only tax-related duty is a compliance one: the RO must register with the local tax authority to obtain a tax code, and it is responsible for declaring and paying Personal Income Tax (PIT) on behalf of all its employees every month.

The strategic decision between a Representative Office and a Subsidiary in Vietnam is a fundamental trade-off between Risk/Cost vs. Functionality. An RO represents a low-cost, low-risk, and low-functionality entry point, perfectly suited for market exploration, sourcing, and liaison work. It allows a foreign company to establish a legal foothold with minimal administrative and tax burdens. The Subsidiary, in contrast, offers full commercial functionality and operational independence at the cost of a more complex setup process, higher capital commitment, and comprehensive tax and compliance obligations. It is the necessary vehicle for any investor intending to generate revenue and build a self-sustaining business within Vietnam.

G2B provides Incorporation services with an excellent customer experience, helping you do right from the start and minimising risk when setting up a company in this dynamic environment. Whether you need Vietnam company formation service or specific advice on the setup process and requirements in Vietnam, G2B is here to support your success!

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom