Expansionary policy is a macroeconomic strategy employed by governments and central banks to stimulate a country's economy, particularly during periods of recession or slow growth. Its primary goal is to encourage economic growth by increasing the money supply and boosting aggregate demand. This strategy is rooted in Keynesian economics, which posits that a deficiency in aggregate demand is a primary cause of recessions. Let’s explore its two main forms, fiscal and monetary policy, and the risks involved in their implementation in this article.

This article outlines the key aspects of expansionary policy to help businesses gain a clearer understanding of its mechanisms and implications. We specialize in company formation and do not provide monetary policy or investment advice. For specific financial matters, please consult a qualified legal or financial expert.

What is an expansionary policy?

Expansionary policy, also known as loose policy, is a set of economic measures designed to boost economic activity and foster growth. It is typically implemented during economic downturns to moderate the negative impacts of business cycles. The core objective is to stimulate aggregate demand, business investment, and consumer spending by either increasing the money supply through monetary policy measures or increasing government spending and/or cutting taxes through fiscal policy.

The primary purpose of this macroeconomic strategy is to counteract economic slowdowns and recessions. By increasing the money supply and encouraging spending, expansionary policy aims to increase consumption, which in turn leads to greater economic growth and a reduction in unemployment.

How many types of expansionary policy?

There are two primary types of expansionary policy: fiscal and monetary. While both aim to stimulate the economy, they are implemented by different governing bodies and utilize distinct tools to achieve their goals. Fiscal policy is managed by the government, primarily through taxation and spending decisions, whereas monetary policy is handled by a country's central bank.

There are two primary types of expansionary policy

Expansionary fiscal policy

Expansionary fiscal policy involves the government's decisions regarding its budget to influence the economy. This approach aims to stimulate aggregate demand by directly or indirectly injecting money into the economy. The government employs several tools to achieve this goal, such as:

- Increased government spending: This involves the government spending more on various initiatives, such as infrastructure projects, social programs, and education. By doing so, it directly injects money into the economy, creating jobs and boosting demand for goods and services.

- Tax cuts: By reducing taxes on individuals and businesses, the government increases their disposable income. This encourages consumer spending and business investment, further stimulating economic activity.

- Transfer payments: These are direct payments from the government to individuals, such as stimulus checks, unemployment benefits, and welfare. These payments increase household income, leading to higher consumption, directly stimulating consumer demand.

Expansionary monetary policy

Expansionary monetary policy is conducted by a nation's central bank, like the U.S. Federal Reserve, to increase the money supply and ease credit conditions. This makes it cheaper for businesses and consumers to borrow money, thereby encouraging spending and investment. The main instruments of expansionary monetary policy include:

- Lowering interest rates: The central bank can lower its benchmark interest rates, such as the federal funds rate in the U.S. This reduction in borrowing costs for commercial banks is then passed on to their customers, making loans more affordable for businesses and consumers.

- Open market operations: This involves the central bank purchasing government securities, like Treasury bonds, on the open market. This action injects money into the financial system, increasing the reserves of banks and enabling them to lend more freely.

- Quantitative easing (QE): In severe economic downturns when interest rates are already near zero, central banks may resort to QE. This involves the large-scale purchase of financial assets to increase the money supply and lower long-term interest rates.

- Reducing reserve requirements: Central banks can lower the reserve ratio, which is the amount of money banks are required to hold in reserve relative to their deposits. This frees up more capital for banks to lend, thereby stimulating the economy, although it is less commonly used due to potential risks to bank stability.

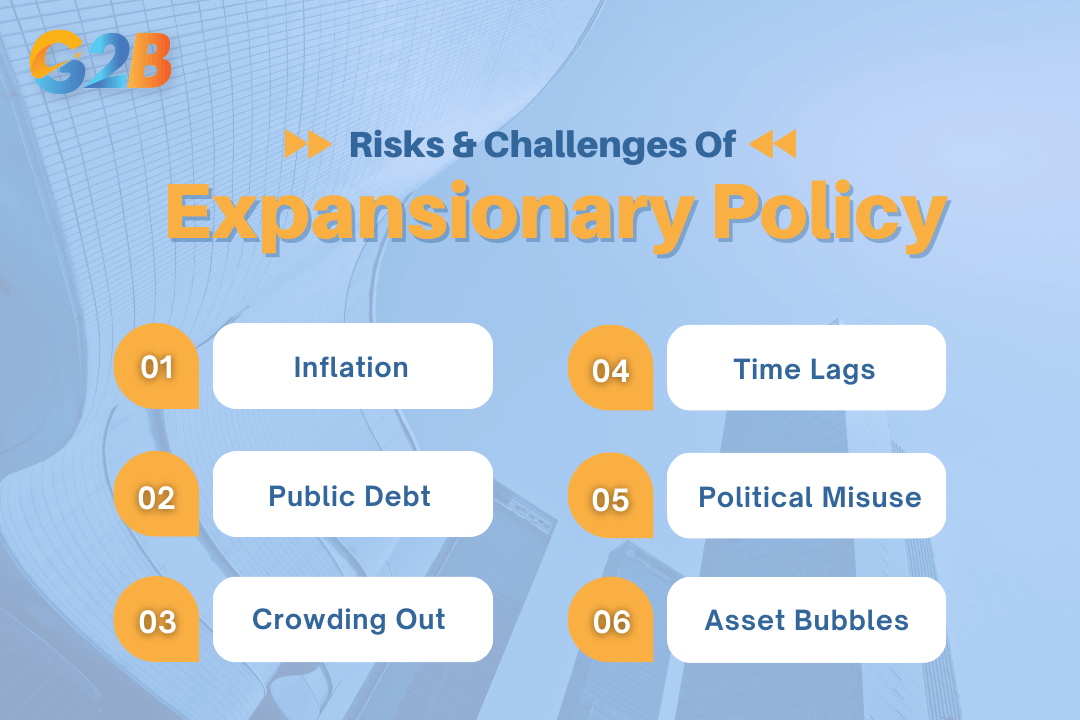

Risks and challenges of expansionary policy

While expansionary policy can be an effective tool for combating economic downturns, it is not without its risks and challenges. A careful balance must be struck to stimulate growth without causing unintended negative consequences.

- Inflation: The most prominent risk of an overly aggressive expansionary policy is high inflation. When aggregate demand outpaces aggregate supply, prices, wages, and input costs can rise. If not managed carefully, this can lead to hyperinflation, a situation where prices spiral out of control, eroding the value of savings and reducing the standard of living. Additionally, sustained high inflation may lead to increased long-term inflation expectations, complicating monetary policy.

- Increased public debt: Expansionary fiscal policy, particularly increased government spending and tax cuts, often leads to budget deficits, which contribute to a nation's public debt. High levels of debt can become unsustainable over the long term and may lead to damaging economic consequences.

- Crowding out: When the government increases its borrowing to finance expansionary fiscal policy, it can compete with private businesses for available capital. This can lead to higher interest rates, making it more expensive for private companies to invest and potentially dampening the intended stimulative effect of the policy.

- Time lags: There is often a significant delay between the implementation of an expansionary policy and when its effects are felt in the economy. This can make it challenging for policymakers to time their interventions correctly and can sometimes lead to policies exacerbating economic cycles rather than smoothing them.

- Political misuse: The tools of expansionary policy can be susceptible to political manipulation. There is a risk that policymakers may use these measures to achieve short-term political gains, even if they are not in the long-term best interest of the economy.

- Asset bubbles: Expansionary monetary policy, especially low interest rates, can sometimes lead to the formation of asset bubbles. This occurs when the prices of assets like stocks or real estate are driven to unsustainable levels, creating the risk of a sharp market correction. This is considered a potential side effect rather than a direct consequence of expansionary policy.

Expansionary policies have many negative impacts

Effects of expansionary policy on business

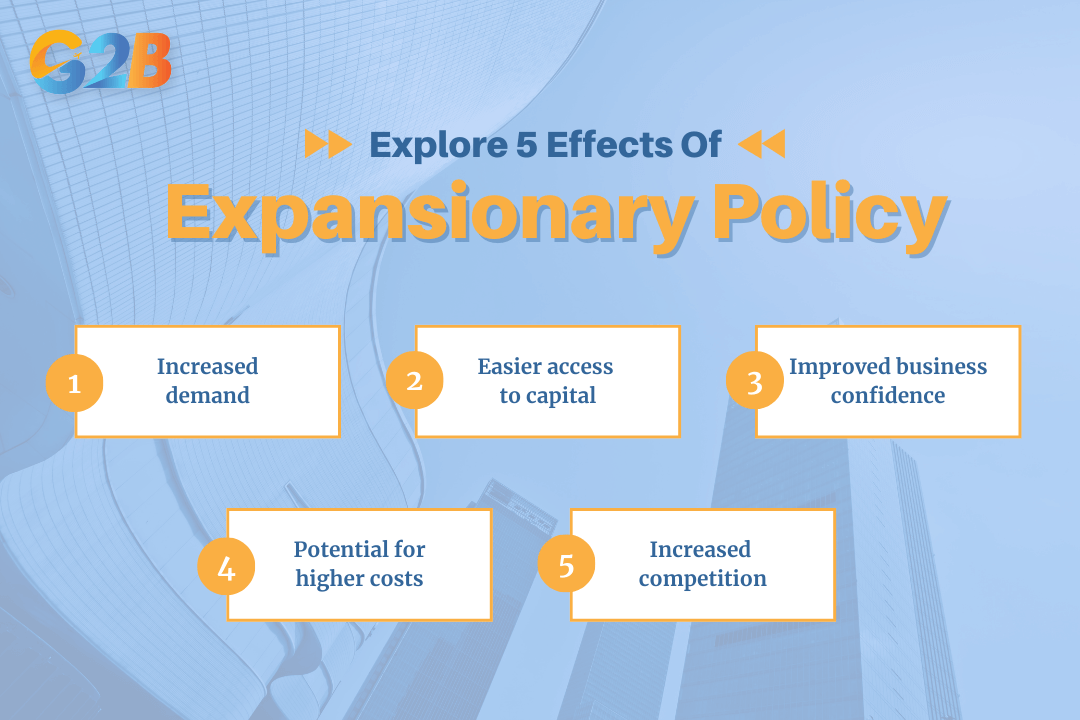

Expansionary policies have a direct and significant impact on the business environment, creating both opportunities and challenges:

- Increased demand: The primary benefit for businesses is a surge in consumer and business spending. As consumers have more disposable income from tax cuts or transfer payments and borrowing costs are low due to both fiscal and monetary expansionary policies, they tend to spend more on goods and services, leading to higher sales and revenue for businesses.

- Easier access to capital: Lower interest rates resulting from expansionary monetary policy make it cheaper for businesses to borrow money for capital expenditures. This improved access to funding is a critical factor for entrepreneurs looking into company formation in Vietnam to tap into growing markets. It encourages investment in new equipment, technology, and expansion, leading to increased job creation.

- Improved business confidence: A growing economy fostered by expansionary policies often leads to a more optimistic outlook among business leaders. This confidence can be the catalyst for strategic moves like company formation in Delaware to establish a U.S. presence, as businesses are more willing to invest and take risks when they anticipate future growth.

- Potential for higher costs: A significant downside for businesses is the risk of inflation. An increase in the money supply can lead to rising prices for raw materials, inventory, and labour, causing cost-push inflation. This can squeeze profit margins if companies are unable to pass these higher costs on to consumers.

- Increased competition: A stimulated economy often encourages new businesses to enter the market. While this is a sign of a healthy economy, it also means increased competition for existing companies, which may need to adjust their strategies to maintain market share. However, this also drives innovation and efficiency improvements within industries.

Expansionary policies have a direct and significant impact on the business environment

Expansionary policy is a potent instrument that governments and central banks use to steer their economies out of recessions and stimulate growth. By employing fiscal tools like increased government spending and tax cuts, and monetary tools such as lower interest rates and quantitative easing, policymakers can effectively boost aggregate demand and encourage economic activity. For businesses, understanding the nuances of expansionary policy is vital for navigating economic cycles, capitalizing on opportunities for growth, and mitigating potential risks.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom