Geographical diversification stands as a fundamental strategy for enhancing resilience in investment portfolios and business operations alike. By strategically spreading assets, operations, or market presence across multiple regions, organizations and investors can mitigate the impact of localized economic, political, or environmental disruptions while tapping into broader growth opportunities. This guide provides an exploration of geographical diversification, detailing its importance, potential risks, and practical approaches for effective implementation.

This article explains the key concepts of geographical diversification, helping businesses and investors gain a clearer understanding of how it works. We specialize in company formation and not in investment strategy consulting. For technical guidance on diversification strategies, please consult a qualified financial or business expert.

What is geographical diversification?

Geographical diversification is a fundamental risk management strategy that involves spreading investments or business activities across various countries and regions. The core principle is to minimize potential over-concentration in any single market, thereby reducing vulnerability to localized economic or political events.

- For investors: For those managing an investment portfolio, this strategy means holding securities from a variety of international markets. The premise is that financial markets in different parts of the world may not move in perfect unison. For instance, a global recession might impact developed nations severely while an emerging market economy like China or India continues to grow. By investing across these different economic cycles, investors can reduce exposure to the volatility of a single region.

- For businesses: In a corporate context, geographical diversification is the process of expanding a company's operations - such as manufacturing, sales, or sourcing - into different countries. This approach helps businesses mitigate operational risks and regulatory risks, create a more resilient global supply chain management system, and access new and growing customer bases.

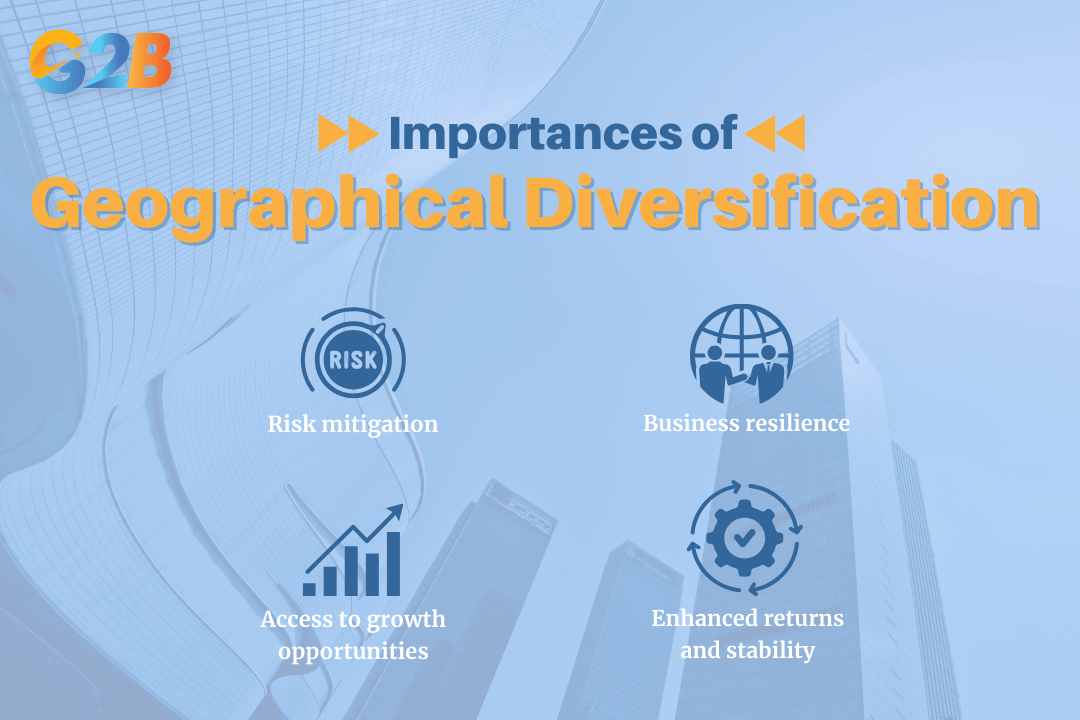

Importances of geographical diversification

Implementing a strategy of geographical diversification offers compelling advantages for both investors and businesses, primarily centered around enhancing stability and unlocking new avenues for growth.

- Risk mitigation: The primary benefit of geographical diversification is the reduction of portfolio and operational risk. By spreading interests across different economies, you can shield your assets from adverse localized events, such as economic downturns, political instability, social unrest, or sudden regulatory changes, that could heavily impact a single market. Concentrating all investments in one country exposes an investor to its specific challenges, while a global portfolio lessens the impact of these events on overall returns.

- Access to growth opportunities: Different parts of the world grow at different rates. Geographical diversification allows investors and businesses to tap into high-growth emerging markets, which may offer significantly greater potential than more mature, developed economies. These developing markets can often be less competitive, presenting unique opportunities for expansion and higher returns.

- Enhanced returns and stability: Investing in economies with different cycles can lead to more stable and consistent long-term returns. When one market is underperforming, another may be thriving, which helps to balance the overall portfolio's performance and smooth out volatility. This balancing act is crucial for building a resilient investment strategy capable of weathering various economic climates.

- Business resilience: For companies, a global footprint reduces dependency on the economic health of a single nation. It creates strategic advantages by allowing a business to build a robust global supply chain, source materials from multiple locations, and reach a wider, more diverse customer base. This operational spread ensures that a disruption in one region does not halt the entire business.

04 Importances of geographical diversification

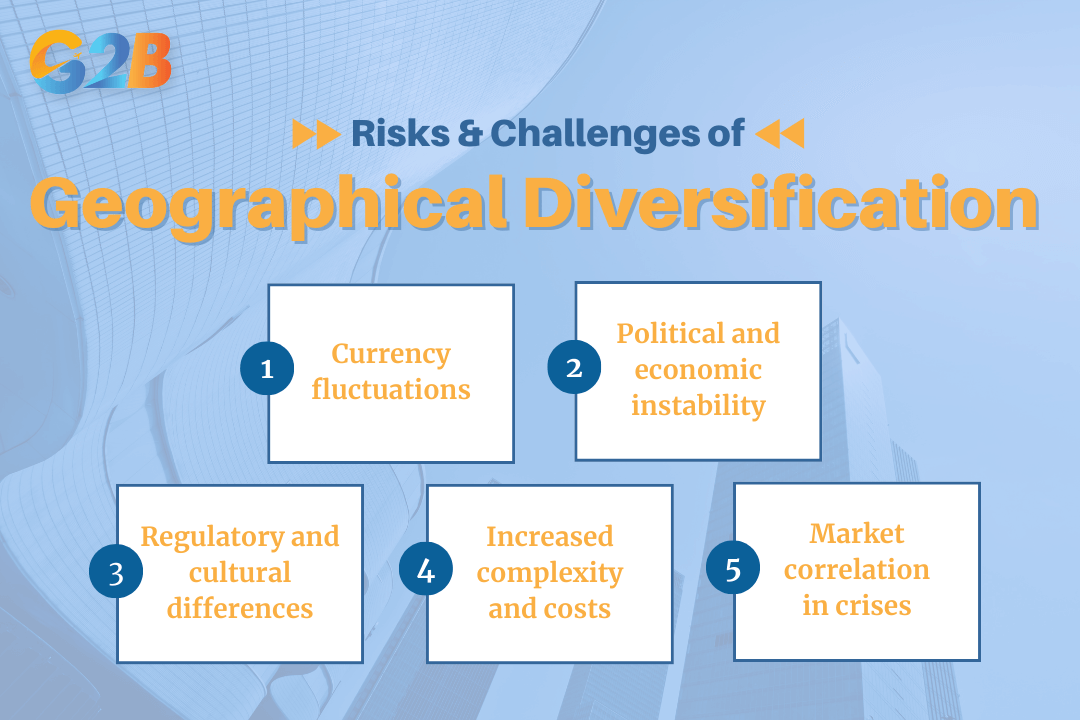

Risks and challenges of geographical diversification

While geographical diversification is a powerful strategy, it is essential to approach it with a clear understanding of the potential downsides and complexities involved.

- Currency fluctuations (exchange rate risk): One of the most significant risks is the impact of changing exchange rates on investment returns. When you invest in a foreign asset, its value is in the local currency. If that currency weakens against your home currency, the returns on your investment will diminish when you convert them back. These fluctuations can erode gains or amplify losses unexpectedly.

- Political and economic instability: While emerging markets are attractive for their high growth potential, they often come with higher risks. These can include elevated political turmoil, economic instability, or social unrest, all of which can jeopardize investments and disrupt business operations. Sudden changes in government policy or leadership can create an unpredictable environment.

- Regulatory and cultural differences: Expanding a business globally requires navigating a complex web of varying legal systems, tax laws, labor regulations, and cultural norms. Adapting products, marketing, and business practices to align with local consumer behavior and preferences is crucial but can be a complex and costly endeavor. Failure to understand these nuances can lead to significant operational hurdles.

- Increased complexity and costs: Managing a geographically diversified portfolio or business is inherently more complex and can involve higher costs. For investors, this can mean higher transaction fees, international taxes, and administrative overhead. For businesses, the costs of establishing and managing international operations, including logistics and compliance, can be substantial.

- Market correlation in crises: A major criticism of geographical diversification is that during global financial crises, international markets can become highly correlated. This means that they may all fall in value simultaneously, diminishing the diversification benefits precisely when they are most needed. The 2008 financial crisis is a prime example, where equity markets across the globe spiraled downward in lockstep.

Risks and challenges of geographical diversification

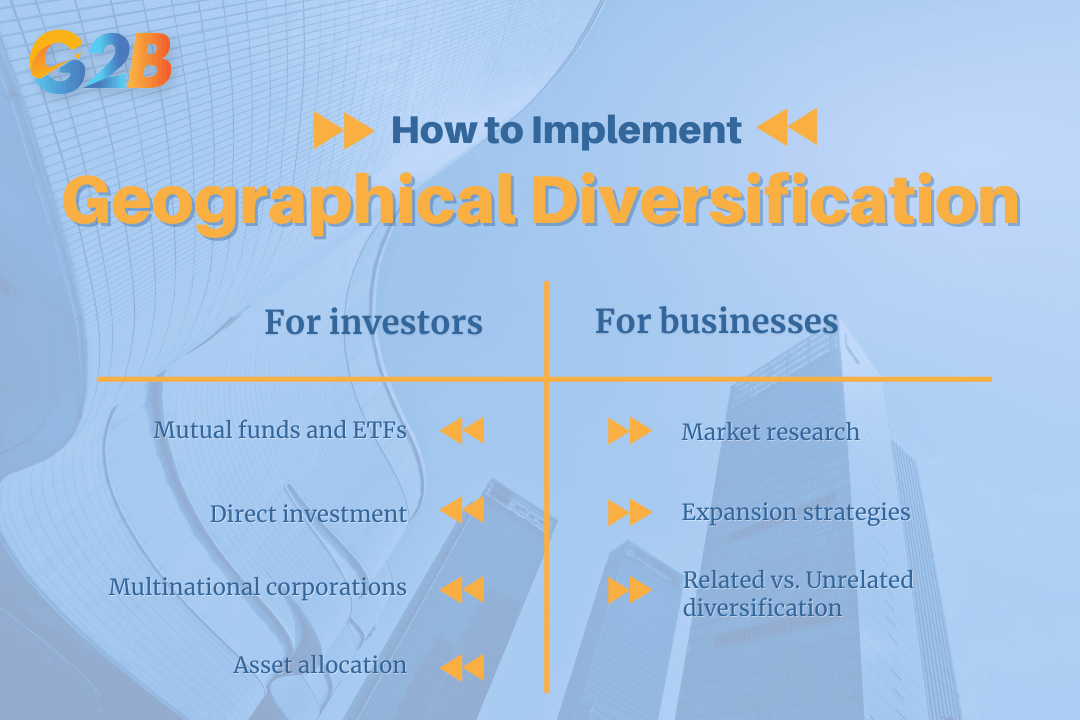

How to implement geographical diversification

Successfully implementing geographical diversification requires a clear and strategic approach tailored to whether you are an individual investor or a business.

For investors:

- Mutual funds and ETFs: The most accessible method for most investors is through international mutual funds or exchange-traded funds (ETFs). These funds provide instant diversification by holding a broad portfolio of securities across various global markets, saving you the complexity of buying individual foreign stocks. Some funds specifically target foreign portfolio investment opportunities, giving retail investors access to markets they couldn't reach alone.

- Direct investment: More experienced investors might choose to buy stocks and bonds directly in foreign markets. This requires a specialized global brokerage account and a deeper understanding of individual international companies and markets.

- Multinational corporations: An indirect yet effective strategy is to invest in large multinational corporations, such as those in the Fortune 500, that have extensive global operations. These companies derive their revenue from numerous countries, providing a built-in layer of geographical diversification.

- Asset allocation: A crucial step is to determine the appropriate allocation based on your risk tolerance. For example, conservative investors might allocate 15-20% of their portfolio to international assets, while aggressive investors might allocate 50% or more. This allocation should be regularly reviewed and rebalanced to align with your financial goals and changing market conditions.

For businesses:

- Market research: Before expanding, a business must conduct thorough market research to identify viable new markets. This research should analyze key factors such as economic conditions, political stability, local competition, regulatory environments, and cultural fit.

- Expansion strategies: Companies can choose from several strategies to enter foreign markets. Common methods include exporting goods, licensing products to a foreign partner, forming joint ventures with local companies, or engaging in foreign direct investment (FDI) by establishing new facilities abroad. Building a new facility from scratch, known as a greenfield investment, offers maximum control but requires significant time and capital.

- Related vs. Unrelated diversification: A business needs to decide on its diversification approach. It can expand into new geographic markets with its existing products (related diversification), which leverages its core competencies. Alternatively, it can venture into entirely new industries in different regions (unrelated diversification), which presents different opportunities and challenges.

Strategic approach to implement geographical diversification

Real-world examples of geographical diversification

Studying successful companies and investment strategies provides a clear picture of geographical diversification in action.

Corporate examples:

- McDonald's: A classic example of successful global expansion is McDonald's, which has adeptly adapted its offerings to local tastes while maintaining its core brand identity. This includes offering kosher food in Israel, the McArabia in the Middle East, and vegetarian options like the McAloo Tikki burger in India. McDonald's employs a glocalization strategy, which involves tailoring its menu, operating hours, and service models to local cultures and preferences. Over 90% of its restaurants operate under a franchisee system, reducing corporate financial risk while allowing rapid expansion.

- Amazon: Amazon transformed from a U.S.-based online bookseller into a global e-commerce and cloud computing giant. It leveraged technology to build a vast logistics network that serves customers worldwide, demonstrating how a digital-first approach can facilitate massive geographical diversification.

- Toyota: Toyota implements a "local production for local consumption" strategy by operating regional production networks. This allows the company to manufacture vehicles closer to their intended markets, enabling quicker adjustments to local demand, regulations, and consumer preferences while ensuring consistent quality through its famed Toyota Production System.

- Apple and Nike: These companies exemplify supply chain diversification. To reduce their heavy reliance on manufacturing in China, both have been actively expanding their production operations into other countries, such as Vietnam and India. This strategy mitigates risks associated with concentrating manufacturing in a single region.

Investor example:

- A well-diversified portfolio might be structured to capture growth from different global economies. For example, "An investor in the US might hold an S&P 500 ETF for domestic exposure, but also allocate funds to an international ETF tracking developed markets (like the MSCI EAFE Index) and another ETF focused on emerging markets (like the MSCI Emerging Markets Index) to capture global growth potential." This approach balances the stability of developed economies with the higher growth prospects of emerging ones.

Geographical diversification stands as a fundamental strategy for managing risk and supporting long-term growth. While it offers benefits like risk reduction and global opportunities, success requires careful planning and monitoring. For businesses seeking to expand regionally, a practical step can be to register a company in Vietnam, leveraging the country’s emerging market potential as part of a diversified strategy.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom