The term domestic corporation often confuses foreign entrepreneurs in Vietnam. Unlike in the U.S., where it refers to a company's state of incorporation, in Vietnam, it simply means a company established under Vietnamese law, regardless of its owners' nationality. This guide will explain how a 100% foreign-owned Vietnam LLC for foreigners is treated as a domestic entity, and the establishment process, grounded in the Law on Enterprises (2020).

What is a domestic corporation?

A domestic corporation is a company that operates under the laws of the country where it was formed. In the context of Vietnam, this means any company that is legally registered within the country is considered a "domestic" entity. This is true even if the business is 100% owned and controlled by foreign investors. However, such a company is classified as a foreign-invested enterprise (FDI), not a traditional domestic enterprise.

The domestic corporation definition in the U.S.

In the United States, a domestic corporation is a business entity formed under the laws of one of the 50 states, such as Delaware or California. It is subject to both federal and state taxation, must file annual reports, and maintain a registered agent. Ownership can include foreign nationals, but the company itself is “domestic” because it was incorporated domestically. For example, a tech founder from South Korea can incorporate a C-corp in Delaware, and the company is still a U.S. domestic corporation, even with 100% foreign ownership.

The domestic corporation in Vietnam

Vietnam does not use the term “domestic corporation” in its legal codes. Instead, one common type of domestic legal entity is the Private Limited Liability Company (LLC). Once registered with the Department of Planning and Investment (DPI), this LLC becomes a domestic legal entity under Vietnamese law.

A Vietnam-incorporated company is 'domestic' even with 100% foreign ownership. This means that when a Japanese investor incorporates an LLC in Ho Chi Minh City, that company is treated as a domestic business, not a foreign entity. It pays corporate income tax (CIT) at 20%, opens local bank accounts, signs contracts in its own name, and enjoys the same legal standing as a Vietnamese-owned firm.

The difference is that the initial registration requires an Investment Registration Certificate (IRC) before obtaining the Enterprise Registration Certificate (ERC), a two-step process designed to verify foreign investment compliance. But once completed, the company operates as a fully recognized domestic entity.

Can foreigners own a domestic corporation in Vietnam?

Foreigners can fully own a Vietnam foreign-invested enterprise (FDI) via a 100% foreign LLC. Under the Law on Investment (2020), foreign individuals and organizations can establish a wholly foreign-owned enterprise in Vietnam, provided their business line is not on the negative list (prohibited or conditionally permitted sectors like defense, media, or real estate development without special licenses).

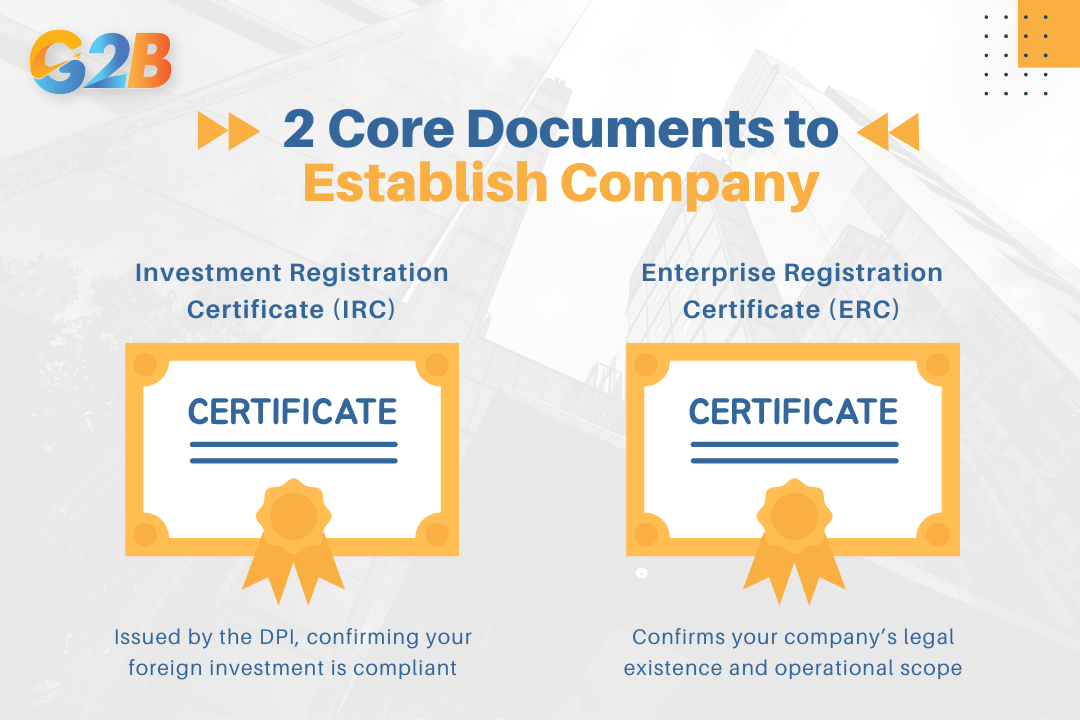

To do so, foreign entrepreneurs must obtain two core documents:

- Investment Registration Certificate (IRC) - issued by the DPI, confirming your foreign investment is compliant.

- Enterprise Registration Certificate (ERC) - confirms your company’s legal existence and operational scope.

Foreign entrepreneurs must obtain 2 core documents

These documents allow you to open a corporate bank account, hire staff, sign leases, and invoice clients, all under your company’s name. Your company will have:

- A legal representative (can be you or a locally appointed director)

- Charter capital (minimum amount depends on business type; some industries may have specific minimum capital requirements, but there is no fixed nationwide minimum)

- A registered office address in Vietnam

Common misconceptions:

- Myth 1: Only Vietnamese citizens can own a domestic company

Truth: No, foreigners can fully own a Vietnamese 'domestic corporation' through a 100% foreign LLC. The Law on Enterprises (2020) grants equal legal status to foreign-owned LLCs. - Myth 2: Need a local partner to register

Truth: No mandatory local partner is required for most industries. While joint ventures exist, they are optional, not compulsory.

Domestic corporation vs. other business structures in Vietnam

Choosing the right structure determines your tax burden, operational freedom, and scalability. Below is a direct comparison of the most common options for foreign investors.

| Feature | 100% Foreign-owned LLC | Branch office | Representative office | Joint venture |

|---|---|---|---|---|

| Legal entity status | Yes (domestic) | Yes (extension of foreign parent) | No (not independent) | Yes (new domestic entity) |

| Can it generate revenue? | Yes | Yes (limited to parent’s scope) | No | Yes |

| Full profit repatriation? | Yes | Yes (after tax) | N/A (no revenue) | Yes (based on ownership share) |

| Local partner required? | No | No | No | Yes |

| Setup time | ~15 business days | ~20 days | ~10 days | 20-30 days |

| Tax rate | 20% CIT | 20% CIT | No CIT (no income) | 20% CIT |

| Minimum charter capital | None (sector-dependent) | None | None | None |

| Business flexibility | High | Medium | Low | Medium |

| Suitable for | Revenue-generating operations | Market expansion, service delivery | Market research, liaison | Strategic partnerships in restricted sectors |

A 100% foreign-owned LLC is optimal for revenue-generating operations. It offers full ownership, legal independence, and seamless integration into Vietnam’s economy. Branch offices are useful for service delivery but lack autonomy. Representative offices cannot sell or invoice, they can only conduct research. Joint ventures require sharing control and profits.

Explore more: Business Structure Comparison: Sole Proprietorship, Partnership, LLC, C Corporation, S Corporation

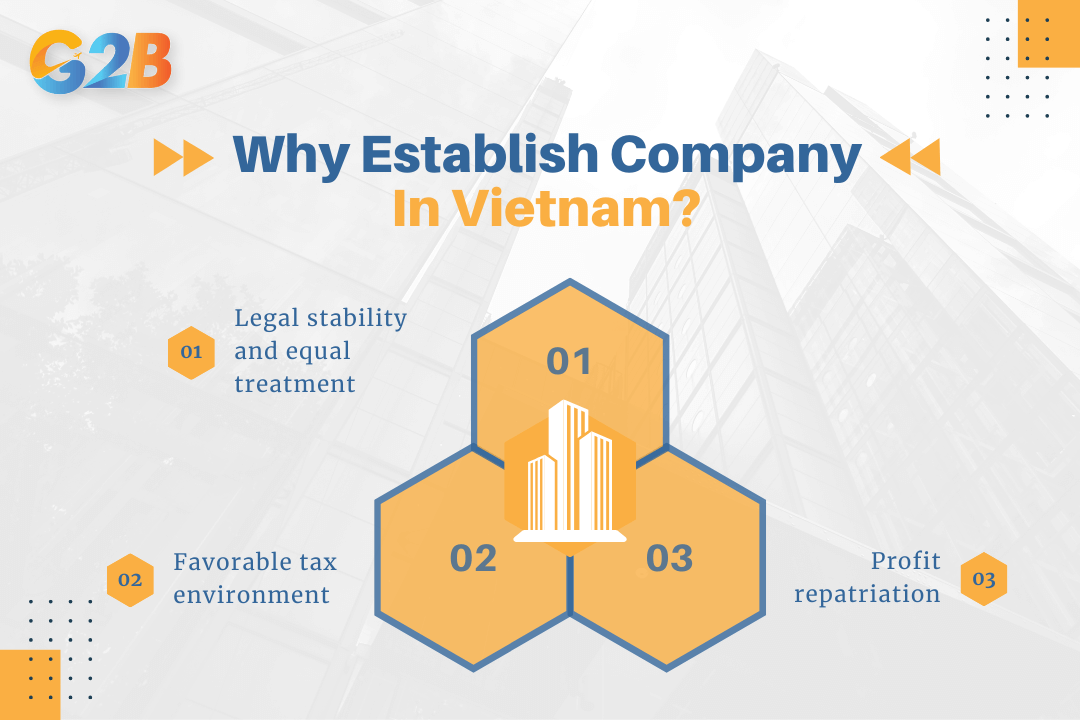

Why choose a Vietnam domestic company?

Establishing a Vietnamese legal entity, i.e., a 100% foreign-owned LLC, offers strategic advantages that foreign entrepreneurs consistently leverage.

Why you should establish a company in Vietnam

1. Legal stability and equal treatment

Once registered, your LLC is a Vietnamese legal entity under Vietnamese law. This means:

- Equal access to contracts, permits, and public tenders

- Protection under the Law on Enterprises (2020)

- Ability to sue and be sued in local courts

Unlike branch offices, which are seen as foreign extensions, your LLC is a standalone Vietnamese entity, giving you credibility with suppliers, banks, and government agencies.

2. Favorable tax environment

Vietnam offers competitive corporate taxation:

- Standard CIT rate: 20% (one of the lowest in Southeast Asia)

- Incentives for high-tech, green energy, and export-oriented firms (down to 10-15% for 9-15 years)

- VAT refunds for exporters

- Double taxation avoidance treaties with many countries

For example, a Singaporean tech founder launching a software company in Da Nang pays 20% CIT, and may qualify for additional incentives if exporting services.

3. Profit repatriation

Yes, foreign owners can legally transfer profits abroad. After filing annual tax returns and paying CIT, dividends can be remitted through authorized banks, in compliance with the State Bank of Vietnam's foreign exchange regulations. The process requires:

- Audited financial statements

- Tax clearance certificate

- Board resolution on profit distribution

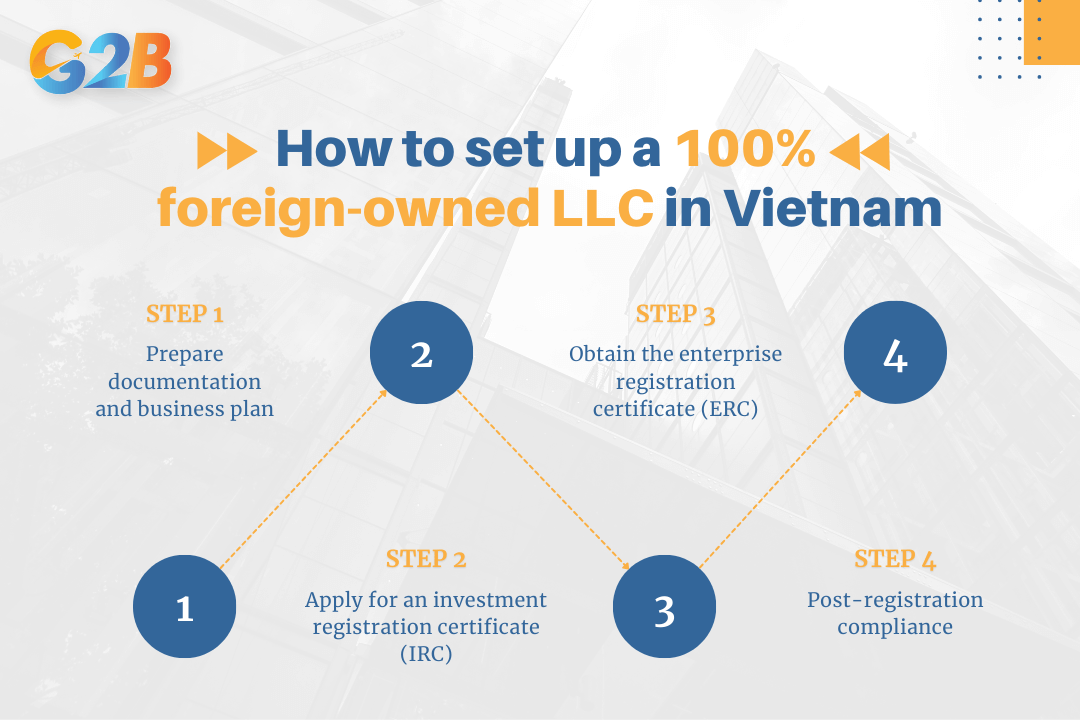

How to set up a 100% foreign-owned LLC (Vietnamese legal entity) in Vietnam

Setting up a 100% foreign-owned LLC (Vietnamese legal entity) in Vietnam is a four-step process. Most foreign entrepreneurs often need licensed consultants for company formation services in Vietnam to avoid delays and rejections.

How to set up a 100% foreign-owned LLC in Vietnam

Step 1: Prepare documentation and business plan

- Passport copies of shareholders and the legal representative

- Proof of address (utility bill or bank statement)

- Detailed business plan (activities, location, staffing)

- Charter capital declaration (no minimum, but a realistic amount required, some sectors may require minimum capital as per law)

- Office lease agreement or proof of address

Step 2: Apply for an investment registration certificate (IRC)

Submit to the Department of Planning and Investment (DPI) at the provincial level, where the company’s head office will be located. The IRC confirms:

- Foreign investor status

- Business scope compliance

- Charter capital plan

Processing time: 5-7 business days.

Step 3: Obtain the enterprise registration certificate (ERC)

With the IRC in hand, apply for the ERC, your company’s legal ID. Includes:

- Company name

- Address

- Legal representative

- Business lines

- Charter capital

Step 4: Post-registration compliance

Complete these within 30 days of ERC issuance:

- Company seal registration (digital or physical)

- Tax code issuance (automatic with ERC)

- Bank account opening (requires ERC, IRC, passport, seal)

- Public announcement on National Business Registration Portal

FAQs about domestic corporations in Vietnam

Q: Is a foreign-owned company considered a domestic corporation in Vietnam?

A: Yes, a 100% foreign-owned LLC is legally a Vietnamese legal entity once registered with the DPI.

Q: Can foreigners start a company in Vietnam without a local partner?

A: Yes, foreigners can fully own a company incorporated in Vietnam via a 100% foreign LLC in most sectors.

Q: What is the difference between an IRC and an ERC?

A: The IRC approves foreign investment; the ERC registers the company. Both are required for foreign-owned LLCs.

Q: How long does it take to set up a company in Vietnam as a foreigner?

A: 15 business days with complete documents and expert assistance.

Q: Are there restrictions on profit repatriation for foreign-owned companies?

A: No, profit repatriation is allowed after tax compliance and audit.

In Vietnam, a domestic corporation refers to any company legally incorporated under Vietnamese law, including 100% foreign-owned LLCs. Such companies enjoy full legal recognition, operational independence, and equal treatment with local firms. Foreign investors can establish and fully own companies without a local partner in most sectors, making Vietnam a welcoming destination for international business.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom