Choosing the right business structure is one of the most critical decisions an entrepreneur must make. The comparison between an S Corporation (S Corp) and a Sole Proprietorship highlights two fundamentally different models of business ownership, each with its own set of advantages and potential drawbacks. This comprehensive guide will help you understand the key distinctions, tax implications, and strategic considerations to make an informed decision for your business venture.

What is an S Corp?

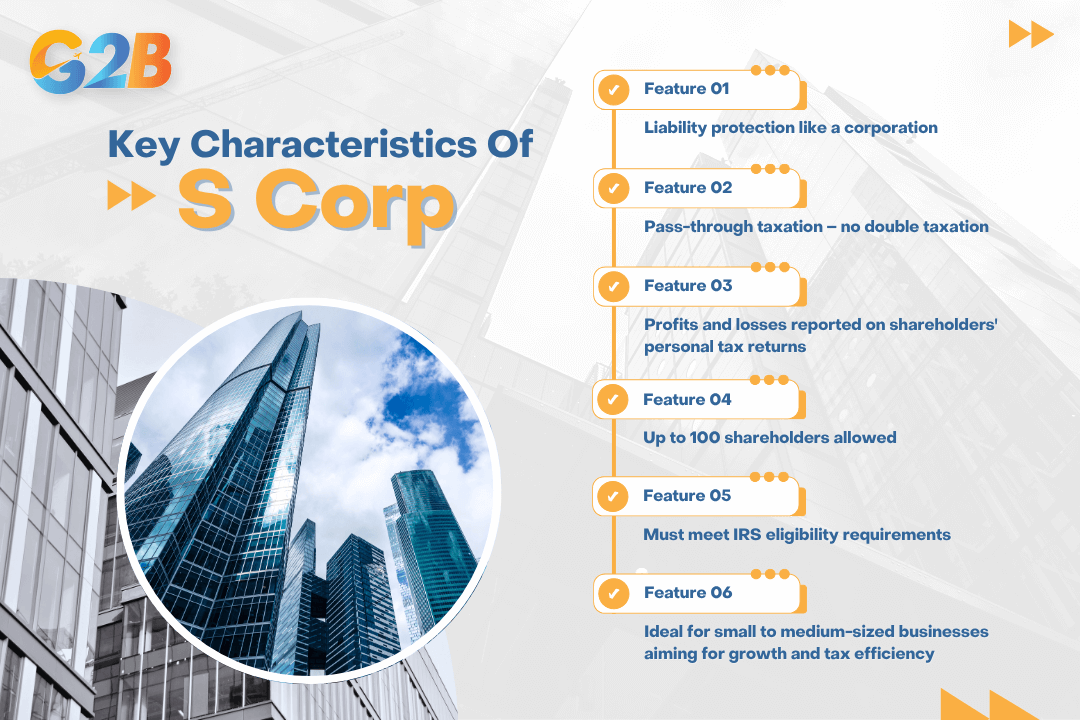

An S Corporation is a special tax designation that allows businesses to combine the liability protection of a corporation with the tax benefits of a partnership. This hybrid structure enables income, losses, deductions, and credits to pass through directly to shareholders' personal tax returns, avoiding the double taxation typically associated with traditional corporations. S Corps can have up to 100 shareholders and must meet specific IRS requirements, making them an attractive option for small to medium-sized businesses seeking growth potential while maintaining tax efficiency. If you are planning to form an S Corporation, G2B’s Delaware incorporation service provides a seamless setup in one of the most business-friendly states in the U.S.

S Corporation has 6 main characteristics

What is a Sole Proprietorship?

A Sole Proprietorship is the simplest and most common business structure, where an individual owns and operates a business without creating a separate legal entity. In this arrangement, the business and owner are considered the same for legal and tax purposes. The owner reports all business income and expenses on their personal tax return, maintains complete control over business decisions, and assumes full personal responsibility for all business debts and obligations. This structure appeals to solo entrepreneurs, freelancers, and small business owners who prioritize simplicity and direct control.

A Sole Proprietorship is the most common business structure with 8 main characteristics

Key differences between S Corp and Sole Proprietorship

This section highlights the main contrasts between S Corporations and Sole Proprietorships in terms of control, liability, setup, management, taxation, growth potential, and overall benefits. Understanding these differences will guide you toward the right structure for your business.

1. Ownership structure

- Sole Proprietorship: Features a single owner with no shareholders, creating the simplest possible ownership arrangement. The business exists solely through the individual owner, with no separate legal identity or complex ownership documentation required.

- S Corporation (S Corp): Can accommodate up to 100 shareholders with a clear, legally defined shareholding structure. This enables multiple investors, partnership opportunities, and structured ownership distribution, facilitating business growth and attracting investment.

2. Legal liability

- Sole Proprietorship: The owner faces unlimited personal liability, meaning personal assets such as homes, cars, and savings accounts can be seized to satisfy business debts. This creates significant financial risk, as there's no legal separation between personal and business obligations.

- S Corp: Shareholders benefit from limited liability protection, creating a legal barrier between personal assets and business obligations. This corporate veil protects individual shareholders from most business debts and legal claims, though personal guarantees on loans can still create liability exposure.

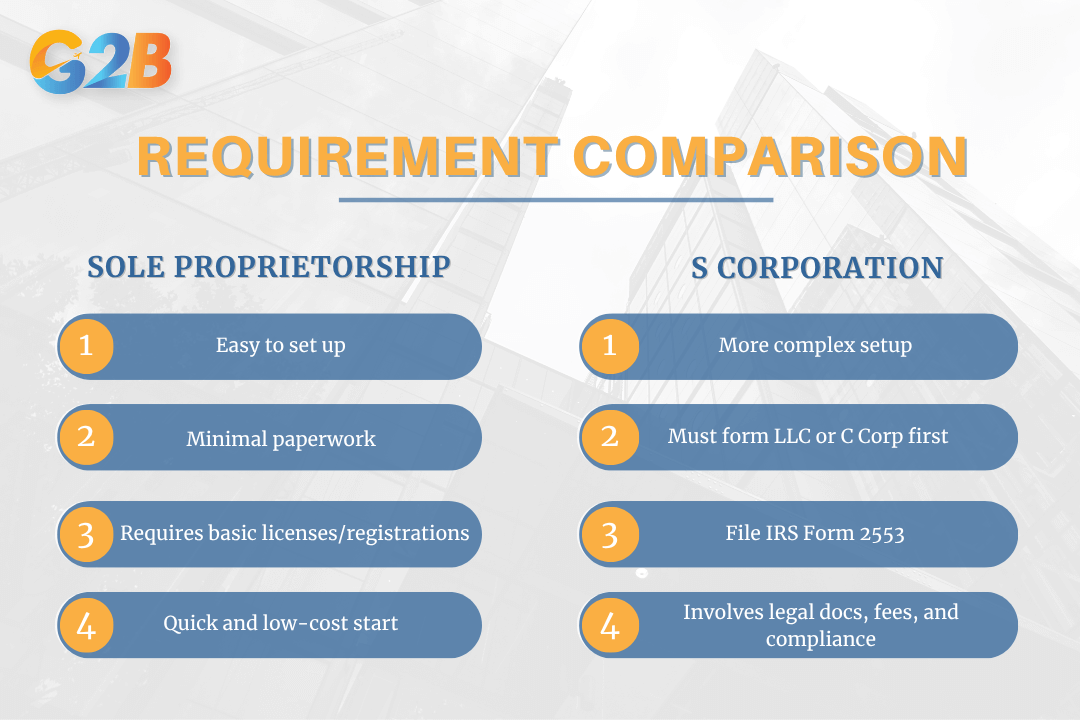

3. Formation process and legal requirements

- Sole Proprietorship: Extremely easy to establish with minimal paperwork and licensing requirements. Most sole proprietorships can begin operating immediately with just a business license and basic registrations, making it the most accessible business structure for new entrepreneurs.

- S Corp: Requires a more complex formation process, starting with establishing either an LLC or C Corporation, then filing Form 2553 with the IRS to elect S Corp tax status. This process involves state filing fees, legal documentation, and ongoing compliance requirements, making it more expensive and time-consuming to establish.

A quick comparison of legal requirements between Sole Proprietorship and S Corp

4. Management and operation

- Sole Proprietorship: Offers complete operational simplicity with full control retained by the owner. Decision-making is streamlined, with no board meetings, shareholder approvals, or complex management structures required for day-to-day operations.

- S Corp: Involves a more structured management approach, potentially including a board of directors, formal meetings, and strict compliance with corporate formalities. While this creates more administrative burden, it also provides professional credibility and systematic decision-making processes.

5. Taxation and income structure

Sole Proprietorship:

- Business income flows directly to the owner's personal tax return via Schedule C

- The owner pays self-employment tax (15.3%) on all business profits

- No separate business tax return required

- Simplified tax preparation with fewer compliance requirements

S Corp:

- Income is distributed as a combination of salary and dividends to owner-employees

- Owner-employees pay FICA taxes (Social Security and Medicare) on their salary portion

- Dividends are not subject to self-employment tax, creating potential tax savings

- S Corps file separate tax returns (Form 1120S) but don't pay federal corporate income tax

- Income passes through to shareholders' personal returns, avoiding double taxation

6. Scalability and growth potential

Sole Proprietorship:

- Limited ability to raise capital due to single-owner structure and unlimited liability concerns

- Difficult to transfer ownership or sell the business as it's tied to the individual owner

- Growth potential constrained by personal resources and borrowing capacity

- Business typically ends when the owner retires or dies

S Corp:

- Enhanced ability to raise funds through multiple shareholders and professional business structure

- Asset separation and limited liability improve credibility with lenders and investors

- Shares can be transferred or sold more easily, facilitating business transitions

- Professional structure supports systematic growth and expansion strategies

7. Overall pros and cons

| Criteria | Sole Proprietorship | S Corporation |

|---|---|---|

| Ease of formation | Very simple, minimal paperwork and costs | Complex process requiring IRS registration and state filings |

| Legal liability | Unlimited personal liability creating high risk | Limited liability protection for personal assets |

| Taxation | Personal income tax plus self-employment tax on all profits | Pass-through taxation with potential self-employment tax savings |

| Scalability | Limited growth potential and capital access | Better access to capital and professional credibility |

| Management | Complete control with simple decision-making | Structured management with formal requirements |

| Ongoing compliance | Minimal regulatory requirements | Extensive record-keeping and filing obligations |

Sole Proprietorship or S Corporation - Which should you choose?

The choice between these business structures depends on your specific circumstances, growth plans, and risk tolerance. Choose a Sole Proprietorship if you're running a small business or startup with low liability risk, prioritize simplicity and low costs, and don't need external capital in the near term. This structure works well for freelancers, consultants, and small service-based businesses. On the other hand, opt for an S Corp if you're planning business expansion, need to raise capital from investors, want personal asset protection from business liabilities, or can benefit from tax optimization strategies, particularly avoiding self-employment taxes on dividend distributions.

The decision between S Corp and Sole Proprietorship will align your business structure with your long-term vision and risk management strategy. While Sole Proprietorship offers unmatched simplicity and low startup costs, S Corp provides superior liability protection and tax optimization opportunities that can become increasingly valuable as your business grows. Consider consulting with a qualified accountant or business attorney to evaluate your specific situation.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom