When starting a business, one of the most important decisions to make is choosing the right business structure. Two of the most common and straightforward options are Partnership and Sole Proprietorship. Each structure offers distinct advantages and challenges that can significantly impact your business operations, legal responsibilities, and financial outcomes. This comprehensive guide will help you understand the key differences between these two business models and determine which one is the best fit for your entrepreneurial venture.

What is Partnership

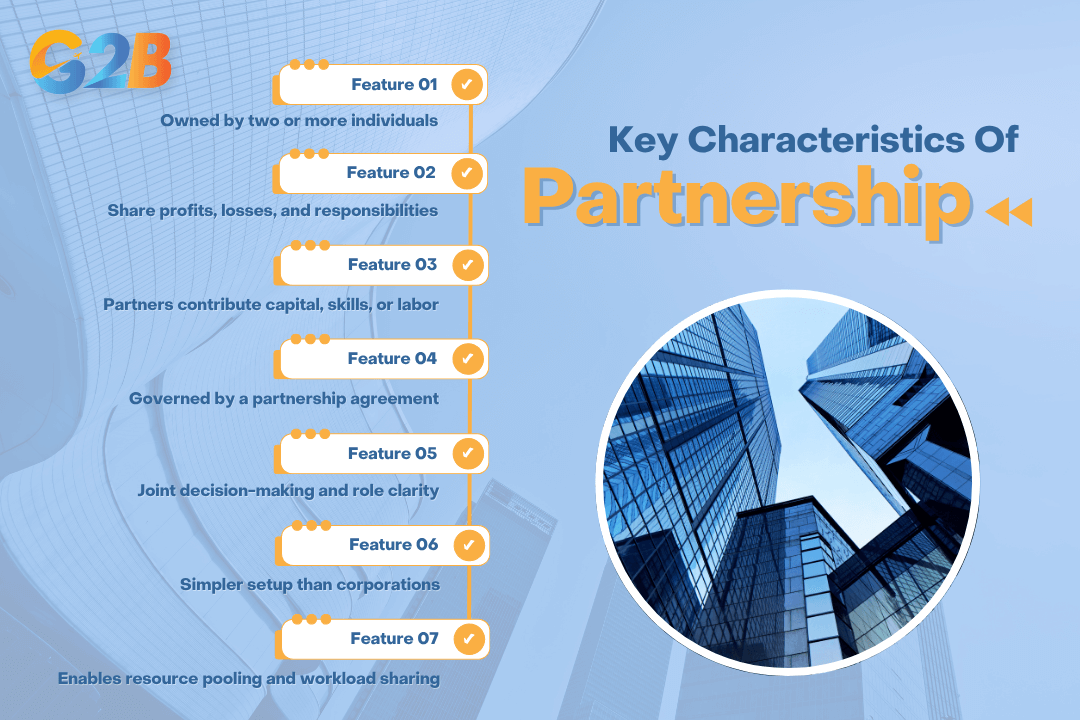

A Partnership is a business structure where two or more individuals come together to operate a business, sharing ownership, responsibilities, profits, and losses. In this arrangement, partners contribute resources such as capital, skills, or labor, and typically formalize their relationship through a partnership agreement that outlines each partner's roles, profit-sharing arrangements, and decision-making processes.

Partnerships allow entrepreneurs to combine their strengths, pool resources, and share the workload while maintaining relatively simple formation requirements compared to corporations. For entrepreneurs seeking to establish a company in the U.S., G2B provides incorporation services in Delaware with professional support to ensure a smooth and compliant setup process.

A Partnership has 7 main features playing an important role

What is a Sole Proprietorship

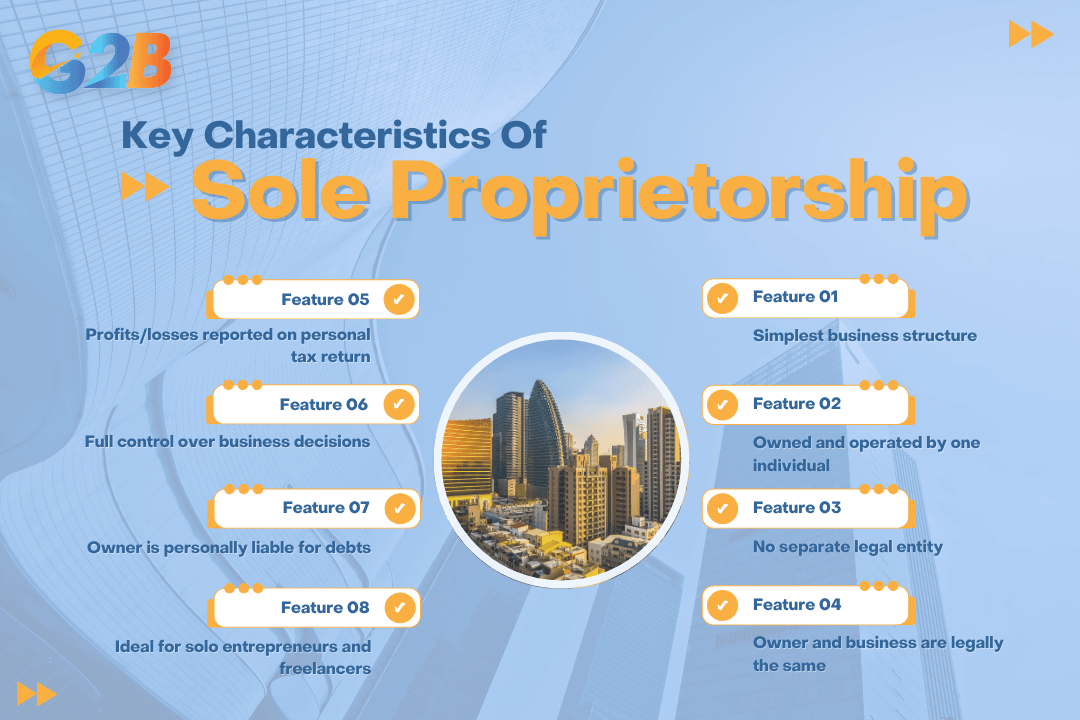

A Sole Proprietorship is the simplest and most common business structure, where an individual owns and operates a business without creating a separate legal entity. In this arrangement, the business and owner are considered the same for legal and tax purposes. The owner reports all business income and expenses on their personal tax return, maintains complete control over business decisions, and assumes full personal responsibility for all business debts and obligations. This structure appeals to solo entrepreneurs, freelancers, and small business owners who prioritize simplicity and direct control.

A Sole Proprietorship has 8 main characteristics

Key differences between Partnership and Sole Proprietorship

Understanding the fundamental differences between these two business structures will help you make an informed decision. Here are the main aspects that distinguish Partnership from Sole Proprietorship across various operational and legal dimensions.

1. Ownership structure

Sole Proprietorship:

- Has a single owner with complete ownership rights

- No shareholders or co-owners involved

- The owner maintains 100% equity in the business

- Business identity is legally tied to the individual owner

Partnership:

- Owned and managed by two or more individuals

- Ownership is shared according to the partnership agreement

- Partners typically contribute different amounts of capital or resources

- Multiple parties have a stake in business success and decision-making

2. Control and decision-making

Sole Proprietorship:

- The owner has full and sole decision-making authority

- No need for consultation or consensus with others

- Complete autonomy in business operations and strategy

- Quick decision-making process without bureaucratic delays

Partnership:

- Decisions are shared among partners based on the agreement terms

- May require consensus or majority vote for major decisions

- Partners must communicate and collaborate on business choices

- Potential for disagreements that could slow the decision-making process

3. Legal liability

Sole Proprietorship:

- The owner has unlimited personal liability for all business debts

- Personal assets may be seized to satisfy business obligations

- No legal separation between business and personal finances

- High personal risk exposure in case of lawsuits or financial troubles

Partnership:

- Liability is shared among partners according to partnership type

- In general partnerships, all partners have joint and several liability

- Limited partnerships (LPs) offer some liability protection for silent partners

- Limited liability partnerships (LLPs) provide additional protection depending on the jurisdiction

4. Taxation and income distribution

Sole Proprietorship:

- Functions as a pass-through entity with no separate business taxes

- The owner pays personal income tax on all business profits

- Business losses can offset other personal income

- Simple tax filing using personal tax returns with business schedules

Partnership:

- Also operates as a pass-through entity for tax purposes

- Profits and losses are divided based on ownership percentages or agreement terms

- Each partner pays individual income tax on their share of partnership income

- Partnership files informational tax return but doesn't pay entity-level taxes

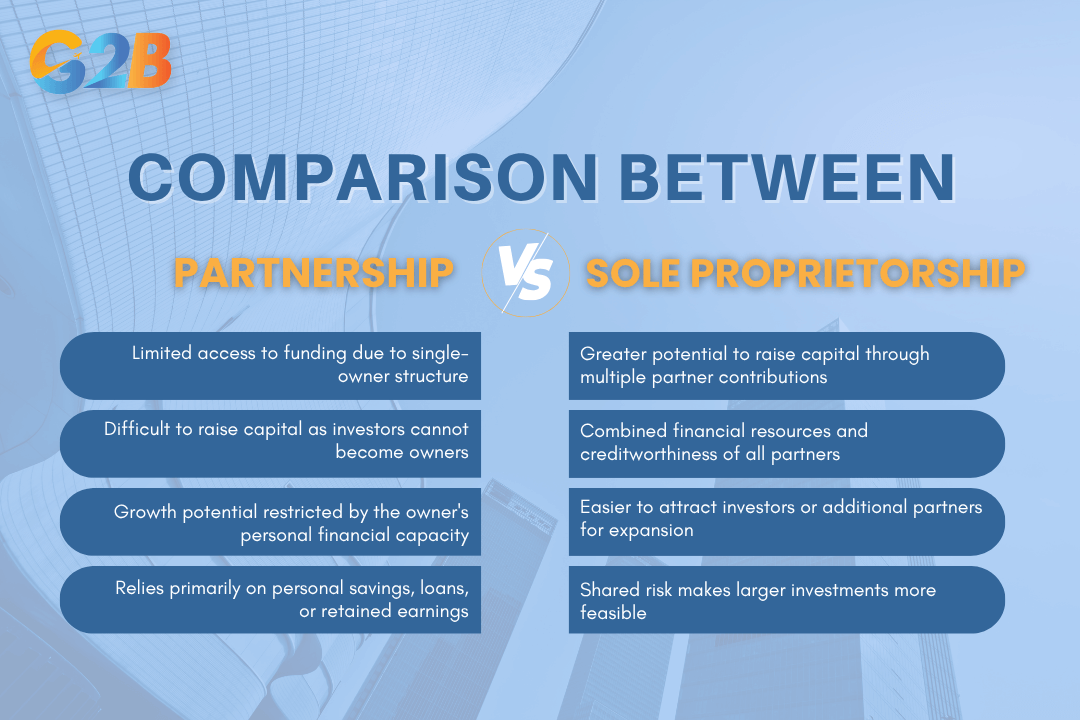

5. Capital raising and growth potential

Sole Proprietorship:

- Limited access to funding due to single-owner structure

- Difficult to raise capital as investors cannot become owners

- Growth potential restricted by the owner's personal financial capacity

- Relies primarily on personal savings, loans, or retained earnings

Partnership:

- Greater potential to raise capital through multiple partner contributions

- Combined financial resources and creditworthiness of all partners

- Easier to attract investors or additional partners for expansion

- Shared risk makes larger investments more feasible

Capital raising and growth potential comparison between Sole Proprietorship and Partnership

6. Formation and operational requirements

Sole Proprietorship:

- Extremely easy to form with minimal legal requirements

- Low startup costs and a simple registration process

- No formal agreements or documentation required

- Minimal ongoing compliance and administrative burden

Partnership:

- Requires a partnership agreement outlining roles and responsibilities

- More complex formation process involving multiple parties

- Need for clear documentation of profit-sharing and decision-making

- Ongoing management of partner relationships and agreements

7. General pros and cons

| Criteria | Sole Proprietorship | Partnership |

|---|---|---|

| Number of owners | One owner | Two or more owners |

| Control | Full, individual control | Shared control, potential for disagreements |

| Legal liability | Unlimited, high personal risk | Shared liability; may be limited depending on type |

| Taxation | Personal income tax on all profits | Personal income tax on each partner's share |

| Capital raising | Limited | Easier through combined partner resources |

| Formation process | Simple, low cost | Requires agreement, potentially more complex |

| Best fit for | Small businesses seeking full control | Teams sharing resources and complementary skills |

Sole Proprietorship or Partnership - Which is right for you?

The choice between Sole Proprietorship and Partnership depends on your specific business needs, risk tolerance, and growth objectives. Choose Sole Proprietorship if you are starting a small, low-risk business or are a first-time entrepreneur who wants full control with minimal bureaucracy, especially when capital needs are limited. Opt for Partnership when you want to combine financial and professional resources with others, are willing to share control and responsibilities, and need diverse skills and perspectives for a growing business that requires substantial capital or expertise beyond what you can provide alone.

Both Partnership and Sole Proprietorship offer unique advantages for different types of entrepreneurs and business situations. Sole Proprietorship provides simplicity, full control, and minimal regulatory requirements, making it ideal for individual entrepreneurs with limited capital needs. Partnership offers the benefits of shared resources, combined expertise, and greater growth potential, though it requires more complex management and shared decision-making.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom