Selecting the right business structure is a strategic decision that can shape your entrepreneurial journey. While Sole Proprietorship and Self-employment are often used interchangeably, they involve different legal, tax, and operational considerations. Understanding these distinctions is essential for entrepreneurs seeking to establish a foundation for sustainable growth. This article provides a clear comparison to help you choose the structure that best supports your business objectives.

What is a Sole Proprietorship?

A Sole Proprietorship is a specific type of business entity where a single individual owns and operates the entire business. In this structure, there is no legal distinction between the business and the owner, meaning the proprietor has complete control over all business decisions, keeps all profits, and bears full responsibility for all debts and liabilities. This business form generally does not require formal registration as a separate legal entity with local authorities, and allows the owner to conduct business under their own name or a chosen business name, providing a formal framework for ongoing commercial activities.

What is Self-employment?

Self-employment is a work or tax classification that describes individuals who work for themselves rather than as employees of another person or company. Self-employed individuals earn income directly from their own business activities, professional services, or independent contractor work, rather than receiving wages or salary from an employer. This status encompasses various work arrangements including freelancing, consulting, independent contracting, and business ownership. It is primarily used for tax and legal classification purposes rather than describing a specific business structure.

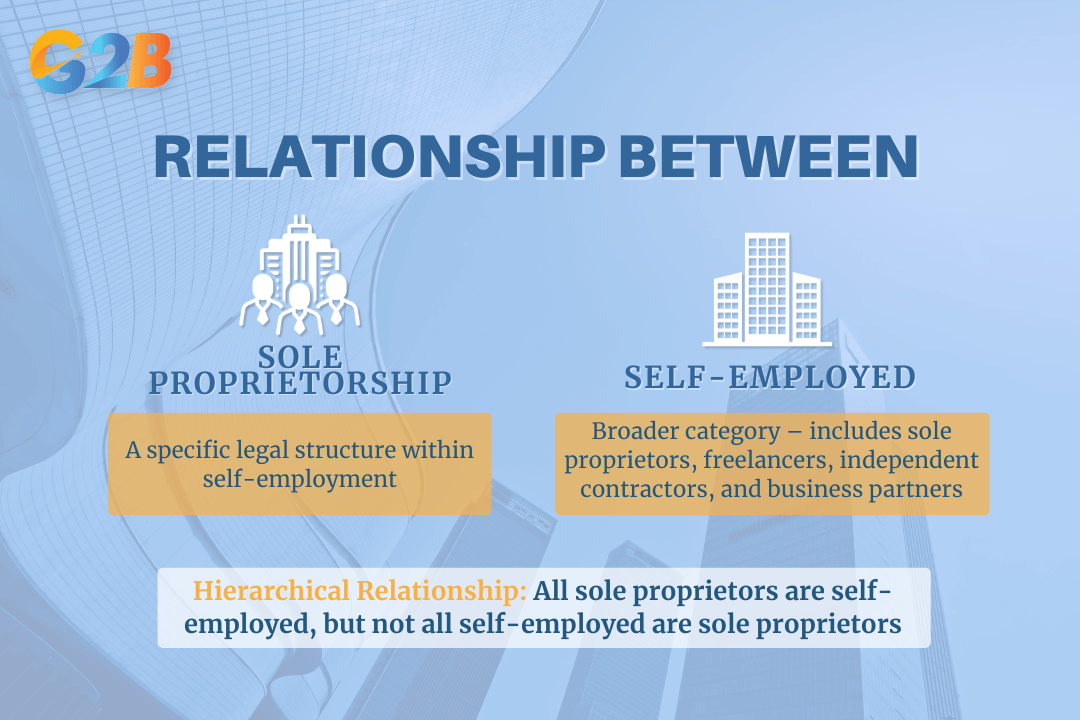

Relationship between Sole Proprietorship and Self-employed

The relationship between sole proprietorship and self-employment is hierarchical rather than equivalent. All sole proprietors are self-employed, but not all self-employed individuals are sole proprietors. Self-employment is a broader category that includes sole proprietors, independent contractors, freelancers, and business partners. A sole proprietorship is one specific way to structure a self-employed business, while self-employment encompasses all forms of independent work where individuals are not traditional employees receiving wages from an employer.

The relationship between sole proprietorship and self-employment is hierarchical

Key differences between Sole Proprietorship & Self-employed

While these terms are related, they serve different purposes and have distinct characteristics that affect your business operations, legal obligations, and tax responsibilities. Understanding these differences will help you choose the most appropriate approach for your independent work situation.

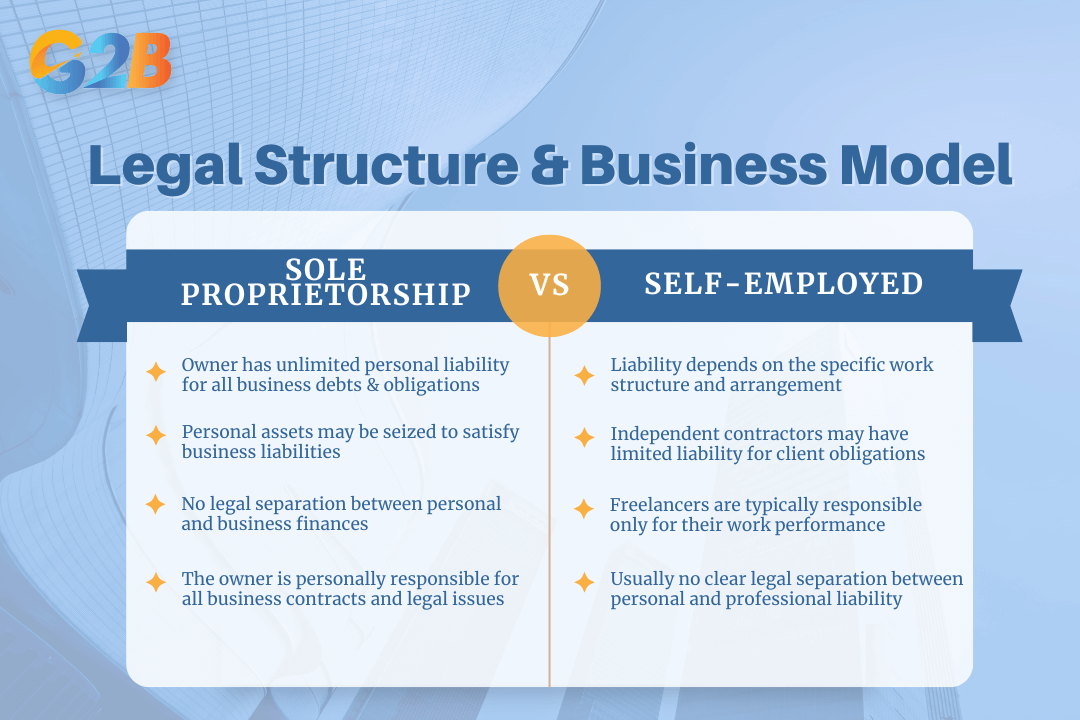

1. Legal structure and business model

Sole Proprietorship:

- A legally recognized business entity where the owner directly owns business assets

- Requires formal business registration with local or state authorities

- Creates a distinct business identity that can operate under a business name

- Establishes a legal framework for ongoing commercial activities and transactions

Self-employed:

- A work classification that encompasses various independent work arrangements

- May include sole proprietors, independent contractors, partners, or freelancers

- Does not necessarily require formal business registration in all cases

- Represents a tax and legal status rather than a specific business structure

Sole proprietorship is a formal business structure while self-employed is a broad work status

2. Taxes and financial reporting

Sole Proprietorship:

- Business income is reported directly on the owner's personal tax return using Schedule C

- The owner must pay self-employment tax covering both Social Security and Medicare

- All business expenses and deductions are claimed through the business entity on the owner’s personal tax return

- May require quarterly estimated tax payments based on business profits

Self-employed:

- Income is self-reported and subject to Self-employment tax regardless of business structure

- Income may come from multiple sources and not necessarily from a registered business

- Tax reporting varies depending on the specific type of Self-employment arrangement

- May use different tax forms depending on the nature of the work relationship

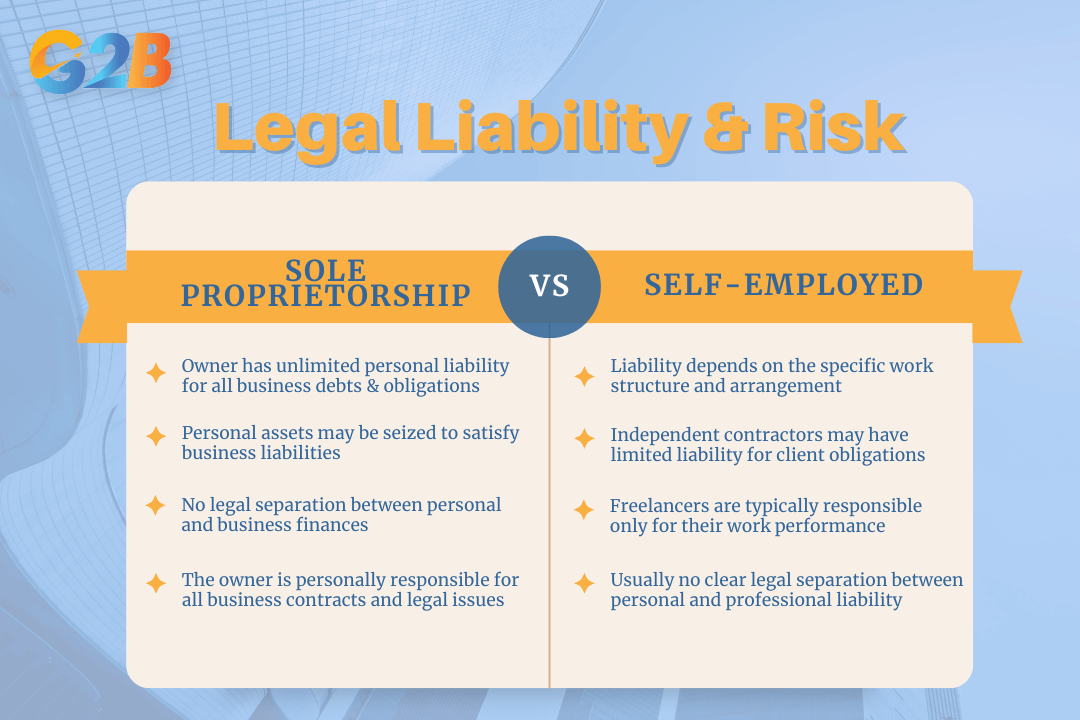

3. Legal liability and risk

Sole Proprietorship:

- The owner has unlimited personal liability for all business debts and obligations

- Personal assets may be seized to satisfy business liabilities

- No legal separation between personal and business finances

- The owner is personally responsible for all business contracts and legal issues

Self-employed:

- Liability depends on the specific work structure and arrangement

- Independent contractors may have limited liability for client obligations

- Freelancers are typically responsible only for their work performance

- Usually no clear legal separation between personal and professional liability

Sole proprietors are fully liable for all business debts while self-employed individuals have work-specific liability

4. Control and business operations

Sole Proprietorship:

- The owner has full control over all business operations and strategic decisions

- Can hire employees and expand business operations as needed

- May sell a wide range of products or services under the business umbrella

- Has the authority to make binding business contracts and commitments

Self-employed:

- Has the freedom to choose jobs, clients, and working hours

- May work under various contracts or run their own independent venture

- Control varies depending on specific work arrangements and client relationships

- Typically provides services or works on a contract basis rather than building a business entity

5. Key advantages and limitations

| Criteria | Sole Proprietorship | Self-employed |

|---|---|---|

| Legal structure | Legal business entity with unlimited liability | A working status, not necessarily tied to a business |

| Taxation | Reports business income on personal tax return; pays self-employment tax | Similar: taxes based on individual earnings |

| Legal liability | The owner is personally liable for business debts | Often personally liable, varies by work structure |

| Control | Full control over business operations | Freedom to choose work, clients, and schedule |

| Scope of work | May sell a wide range of products/services | Typically provides services or works on a contract basis |

Sole Proprietorship or Self-employed - Which is right for you?

The choice between establishing a sole proprietorship or simply being self-employed depends on your business goals, the nature of your work, and your long-term plans. Choose Sole Proprietorship when you want to own and operate a distinct business entity, plan long-term business activity with a simple structure, and are willing to accept personal financial liability for building a comprehensive business. Consider Self-employed status if you work independently without employer control, operate as a freelancer or independent contractor, or work without formal business registration while maintaining flexibility in your work arrangements and client relationships.

Understanding the distinction between sole proprietorship and Self-employment is crucial for anyone considering independent work. Your choice should depend on your business goals, the nature of your work, and your preference for formal business structure versus flexible work arrangements. Consider consulting with a business advisor to determine which option best serves your specific situation and long-term objectives. For those considering expanding internationally, exploring incorporation in Delaware can be a strategic move. G2B provides trusted offshore company formation services, ensuring a smooth and efficient setup so you can focus on growing your business.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom