Anti-dumping duty serves as a crucial trade protection mechanism that governments worldwide use to shield domestic industries from unfair foreign competition. This comprehensive guide explores the definition, application process and calculation methods of anti-dumping duties in Vietnam.

This G2B article provides key aspects of anti-dumping duty in Vietnam to help businesses gain a better understanding of its impact on trade activities. We specialize in company formation services and do not provide tax advice. For detailed guidance or compliance with anti-dumping duty, please consult a professional tax firm.

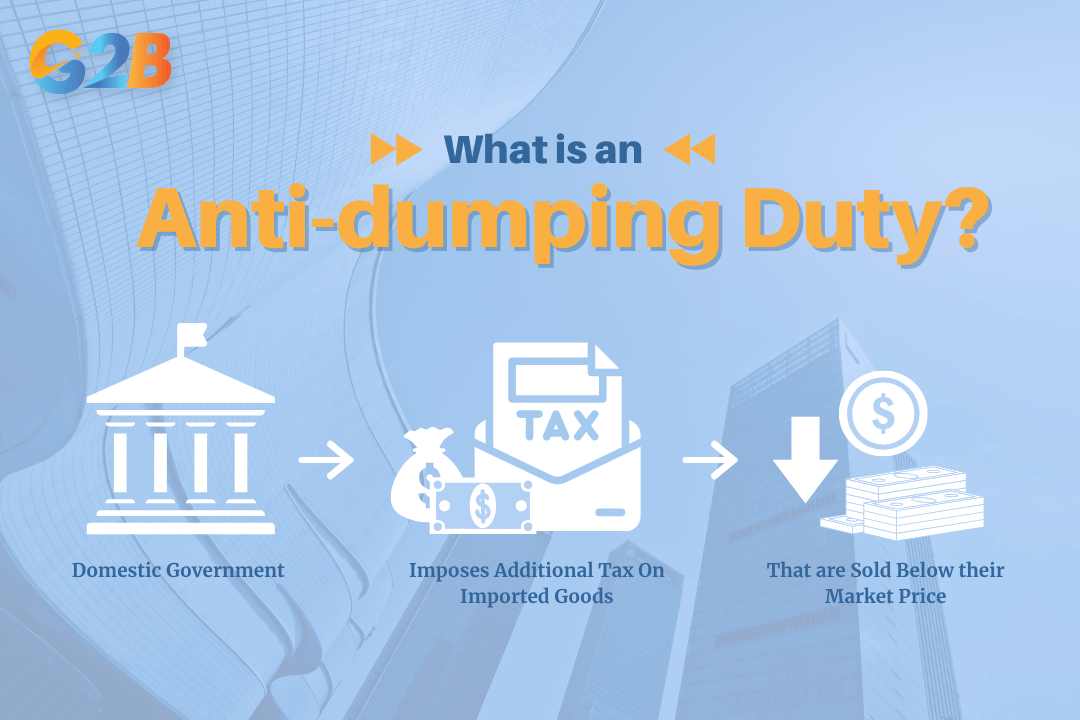

What is an anti-dumping duty?

Anti-dumping duty is a special tariff imposed by the government on imported goods that are believed to be sold below their normal value, usually the price charged for the same product in the domestic market of the exporting country, aimed at protecting domestic industries from unfair competition. This protective measure ensures that foreign companies cannot undercut domestic producers by selling products at artificially low prices that would be unsustainable in their home markets.

The concept of dumping occurs when a company exports a product at a price lower than the price it normally charges in its own home market. This practice can severely damage domestic industries in the importing country, leading to job losses, reduced production capacity, and potential market monopolization by foreign entities.

Anti-dumping duty is a special tariff imposed by the government on imported goods sold below their normal value

The role of the anti-dumping duty

Anti-dumping duties serve multiple critical functions in maintaining fair international trade practices and protecting domestic economies from harmful foreign competition.

1. Protect domestic production from damage caused by dumped goods

When foreign companies sell products at a price below the normal value, they create an unfair competitive advantage that can drive domestic manufacturers out of business. Anti-dumping duties level the playing field by increasing the cost of dumped imports to the normal value.

2. Maintain fair competition in the domestic market

By imposing these duties, governments ensure that competition is based on legitimate factors such as efficiency, quality, and innovation rather than artificially suppressed prices that distort market dynamics.

3. Prevent unemployment and protect domestic jobs.

Dumping practices often lead to significant job losses in affected industries as domestic companies struggle to compete with unfairly priced imports. Anti-dumping measures help preserve employment opportunities and maintain industrial capacity.

4. Ensure long-term benefits for the economy and consumers

While anti-dumping duties may increase import prices in the short term, they prevent the establishment of foreign monopolies that could exploit consumers once domestic competition is eliminated. This maintains healthy market competition and protects consumer interests over time.

Conditions for applying the anti-dumping duty

The application of anti-dumping duties requires meeting specific criteria to ensure that these protective measures are justified and comply with international trade law.

- Evidence confirms that imported goods are being sold at prices lower than their normal value: Authorities must establish a clear dumping margin, which is the difference between the normal value of the product in the exporter's home market and the export price. This requires a detailed investigation and comparison of pricing structures across different markets.

- Proof of dumping behavior causing material injury or threat of material injury to the domestic manufacturing sector: The investigation must demonstrate that dumping practices have resulted in material injury to domestic producers, such as lost sales, reduced profits, declining market share, or threats to the establishment of domestic manufacturing capabilities.

- The application of tariffs must be based on transparent investigation results and compliance with international and national laws: All anti-dumping measures must follow established procedures, provide due process to affected parties, and adhere to World Trade Organization (WTO) agreements to ensure legitimacy and avoid trade disputes.

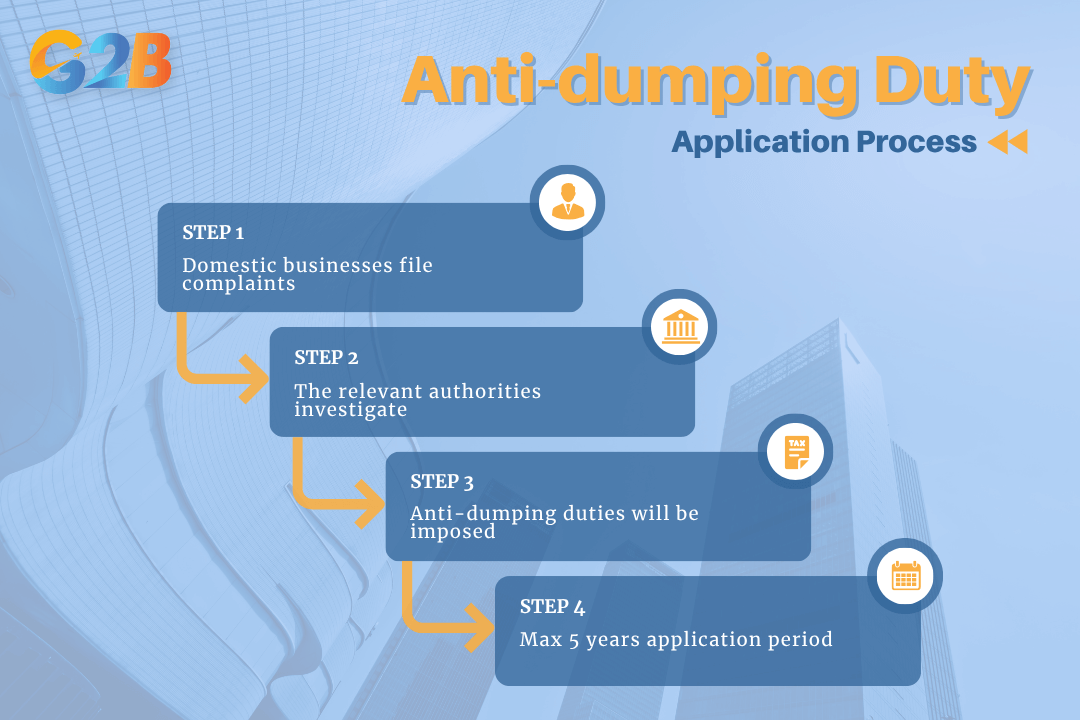

Anti-dumping duty application process

The implementation of anti-dumping duties follows a structured, multi-step process designed to ensure thorough investigation and fair treatment of all parties involved.

The implementation of anti-dumping duties follows multi-step process

Step 1: Domestic businesses file complaints about dumping practices

The process typically begins when domestic industry representatives who represent a substantial portion of domestic production submit formal complaints to relevant government authorities, providing evidence of dumping activities and their harmful effects on the domestic market. According to international trade rules, the complaint must be made by or on behalf of domestic producers accounting for a major proportion of total domestic output of the like product.

Step 2: The relevant authorities investigate, determining the extent of dumping and the damage caused

Government agencies conduct a preliminary review to ensure that the complaint is supported by sufficient evidence. If the evidence is adequate, they officially initiate a comprehensive investigation, examining pricing data, market conditions, and the impact on domestic industries. This phase involves gathering evidence from multiple sources and may include on-site visits to affected facilities.

Step 3: If the conditions are met, anti-dumping duties will be imposed at a rate determined by the difference between the export price and the normal value

Provisional anti-dumping duties may be applied based on preliminary findings. After the final determination and due process, authorities impose definitive anti-dumping duties at a rate determined by the lesser of the dumping margin or injury margin.

Step 4: The application period is typically a maximum of 5 years, potentially renewable if damage continues

Anti-dumping duties are temporary measures with defined periods, subject to review and possible extension if continued protection is warranted. Regular monitoring ensures that duties remain necessary and proportionate.

Tax calculation methods and forms

Anti-dumping duties can be calculated and applied using various methods, depending on the specific circumstances of each case and the policy preferences of the implementing country. Taxes can be calculated as a percentage of the value of goods (ad valorem) or as a fixed amount per unit of goods (specific duty). The tax amount is usually equal to or less than the difference between the export price and the domestic market price (normal value) of the exporting country.

Forms of anti-dumping duty

Anti-dumping duties are imposed in several forms, depending on the country and the specific case, each offering different advantages in terms of administration and effectiveness.

Ad valorem duty represents a percentage of the value of the imported goods, such as 62.5% of the import value. This method is particularly effective for products with varying values, as it automatically adjusts the duty amount based on the product's worth. Ad valorem duties are easier to administer and understand, making them popular among trade authorities worldwide.

Specific duty involves a fixed monetary amount per unit of the imported product, such as $100 per ton. This approach is particularly suitable for commodity-type products where units are standardized and easily measurable. Specific duties provide predictable revenue streams and are less susceptible to valuation disputes.

Variable duty is calculated as the difference between a reference value (often the normal value in the exporting country) and the actual export price. If the export price falls below the reference, the difference is imposed as duty. This method ensures that duties precisely address the dumping margin while allowing for price fluctuations in legitimate trade. This is sometimes implemented through minimum price undertakings.

Calculation methods

1. Determining the dumping margin

The dumping margin calculation forms the foundation of anti-dumping duty determination and requires careful analysis of pricing data from multiple sources.

Dumping margin = Normal value – Export price

- Normal value: The price of the product in the exporter's domestic market under normal conditions of trade. This includes all costs associated with production, distribution, and a reasonable profit margin that would be expected in the home market.

- Export price: The price at which the product is exported to the importing country, commonly calculated on a Free On Board (FOB) basis. This price should reflect all costs and charges up to the point of loading onto the vessel or aircraft for export.

2. Lesser duty rule

The lesser duty rule ensures that anti-dumping measures are proportionate and do not exceed what is necessary to address the identified injury to the domestic industry. The duty imposed is the lower of the dumping margin or the injury margin (the amount needed to remove injury to the domestic industry). This approach prevents over-protection of domestic industries while ensuring adequate relief from unfair competition. The injury margin is calculated based on the minimum price increase needed to eliminate the material injury caused by dumped imports.

3. Application

The application of calculated duties involves several considerations to ensure fair treatment of different exporters and effective protection of domestic industries. Duties can be applied to individual exporters (if sampled) or as a residual rate for all others. This approach recognizes that different exporters may have varying dumping margins and allows for more precise targeting of protective measures. Cooperative exporters who provide complete information during investigations may receive individual rates, while non-cooperative parties face higher residual rates.

Some countries set a minimum price: If the import price is below this threshold, the duty equals the difference; if above, no duty applies. This minimum price undertaking system provides an alternative to traditional duty collection while achieving the same protective effect for domestic industries.

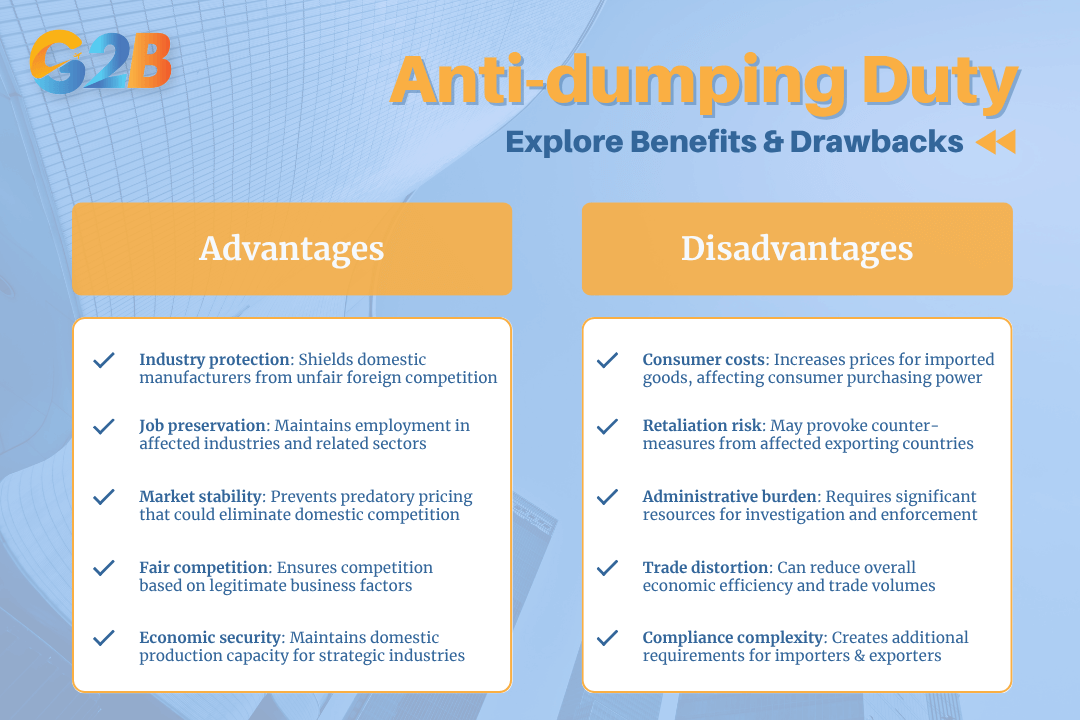

Advantages and disadvantages of anti-dumping duty

Understanding both the benefits and drawbacks of anti-dumping duties helps policymakers and businesses make informed decisions about trade protection measures and their economic implications.

Benefits of anti-dumping duty

- Industry protection: Shields domestic manufacturers from unfair foreign competition

- Job preservation: Maintains employment in affected industries and related sectors

- Market stability: Prevents predatory pricing that could eliminate domestic competition

- Fair competition: Ensures competition based on legitimate business factors

- Economic security: Maintains domestic production capacity for strategic industries

Disadvantages of anti-dumping duty

- Consumer costs: Increases prices for imported goods, affecting consumer purchasing power

- Retaliation risk: May provoke counter-measures from affected exporting countries

- Administrative burden: Requires significant resources for investigation and enforcement

- Trade distortion: Can reduce overall economic efficiency and trade volumes

- Compliance complexity: Creates additional regulatory requirements for importers and exporters

Understanding both the benefits and drawbacks of anti-dumping duties helps businesses make informed decisions

Anti-dumping duty in Vietnam

Vietnam has developed a comprehensive framework for implementing anti-dumping duties that aligns with international standards while addressing the specific needs of its developing economy and growing industrial base. Understanding these trade regulations is a critical aspect for foreign investors, much like understanding the legal procedures for company formation in Vietnam.

Overal information of anti-dumping duty in Vietnam

Vietnam applies anti-dumping duties according to the Law on Import and Export Taxes and guiding decrees, only after a clear investigation conclusion regarding dumping and damage. The Vietnamese government has established detailed procedures that ensure thorough investigation of dumping allegations while providing due process to all affected parties. These procedures include public hearings, information requests, and opportunities for interested parties to present their cases.

The maximum application period is 5 years, may be extended only after a review confirms that removal of the duties would likely result in continuation or recurrence of dumping and injury to the domestic industry. This time-limited approach ensures that anti-dumping measures remain temporary and are subject to regular review. Before extending duties, Vietnamese authorities must demonstrate that the removal of duties would likely lead to the continuation or recurrence of dumping and injury to the domestic industry.

Some industries frequently subject to anti-dumping duties include steel, aluminum, chemicals, and consumer goods. Vietnam has been particularly active in protecting its steel industry, which is crucial for the country's infrastructure development and manufacturing sector. The aluminum sector has also received protection against dumped imports from various countries, helping to maintain domestic production capacity.

The Vietnamese anti-dumping system has evolved to include sophisticated economic analysis and consultation with industry stakeholders. This approach ensures that protective measures are based on solid evidence and economic rationale rather than political considerations or protectionist sentiment.

Impact on Vietnamese industries and trade

- The implementation of anti-dumping duties in Vietnam has had significant effects on various sectors of the economy, influencing industrial development, trade patterns, and competitive dynamics.

- The steel industry has been one of the primary beneficiaries of anti-dumping protection in Vietnam. With the country's rapid infrastructure development and growing manufacturing sector, steel demand has increased substantially. Anti-dumping duties on imported steel have helped Vietnamese producers maintain market share and invest in modernization and capacity expansion. This protection has been particularly important given the global overcapacity in steel production and the aggressive pricing strategies of some foreign manufacturers.

- In the aluminum sector, anti-dumping measures have supported the development of domestic production capabilities and encouraged investment in value-added processing. Vietnamese aluminum producers have been able to compete more effectively with foreign suppliers, leading to increased domestic production and reduced dependence on imports for basic aluminum products.

- The chemicals industry has also benefited from anti-dumping protection, with measures on products like caustic soda helping to maintain domestic production capacity. This protection has been crucial for supporting downstream industries that rely on these chemicals as inputs, including textiles, paper, and various manufacturing sectors.

- Consumer goods sectors, particularly agricultural products, have seen mixed effects from anti-dumping duties. While protection has helped some domestic producers maintain market share, it has also led to higher prices for consumers and potential supply chain disruptions for companies that rely on imported inputs.

Challenges and considerations

- Despite the benefits of anti-dumping protection, Vietnam faces several challenges in implementing these measures effectively while maintaining its commitments to international trade agreements.

- One significant challenge is the complexity of determining normal values and export prices, particularly when dealing with non-market economy countries or companies with complex corporate structures. Vietnamese authorities must develop sophisticated analytical capabilities to handle these complex cases while ensuring that their determinations are defensible under international trade law.

- Another challenge is balancing protection for domestic industries with the need to maintain competitive markets and reasonable prices for consumers. Excessive protection can lead to complacency among domestic producers and higher costs for downstream industries that rely on protected products as inputs.

- Vietnam also faces pressure to ensure that its anti-dumping measures comply with its commitments under various free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the European Union-Vietnam Free Trade Agreement (EVFTA). These agreements include specific provisions regarding anti-dumping procedures and standards that must be met.

- The administrative burden of conducting thorough anti-dumping investigations while maintaining transparency and due process is another significant challenge. Vietnam must invest in training investigators, developing analytical capabilities, and establishing efficient procedures for handling cases on time.

This comprehensive understanding of anti-dumping duties and their application in Vietnam provides valuable insights for policymakers, businesses, and other stakeholders involved in international trade. As Vietnam continues to develop its economy and strengthen its position in global markets, the effective use of trade protection measures such as anti-dumping duties will remain an important tool for ensuring fair competition and supporting sustainable industrial development.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom