Euro is one of the world's most significant currencies, serving as the backbone of economic integration for millions of Europeans. As a cornerstone of the European Union's Single Market, it has reshaped trade, travel, and economic policy across the continent and established itself as a major force in the global financial system. This comprehensive guide by G2B explores everything you need to know about the Euro, from its definition and the countries that use it to its history, management, and global impact.

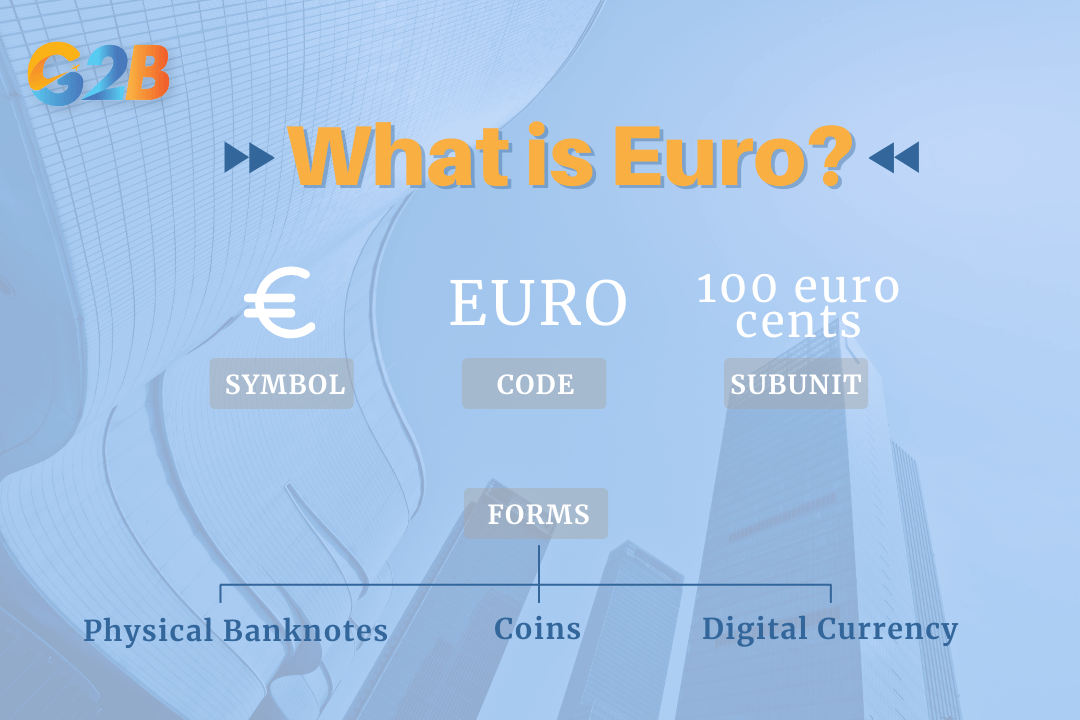

What is Euro?

Euro is the official currency of the Eurozone, a monetary union of 20 out of the 27 member states of the European Union (EU). It was introduced as an electronic currency on January 1, 1999, before physical banknotes and coins entered circulation on January 1, 2002. The Euro exists as both physical cash and electronic currency, facilitating a vast range of transactions daily.

- Symbol: The internationally recognized symbol for the Euro is €.

- Code: Its official three-letter currency code, used in foreign exchange markets, is EUR.

- Subunit: The Euro is divided into 100 euro cents.

- Key function: It replaced former national currencies, such as the German Mark, the French Franc, and the Italian Lira, to create a single, unified currency for participating EU member states.

- Forms: The Euro circulates in two forms: physical banknotes and coins, and as an electronic currency for digital transactions.

The Euro is the official currency of the Eurozone

Which countries use the Euro?

The Euro is the primary currency for over 350 million people in Europe. The group of European Union (EU) member states that have adopted the euro as their primary currency is known as the Eurozone or euro area. This union allows for simplified trade and travel among member nations.

- Definition of the eurozone: The Eurozone consists of the EU member states that have officially adopted the Euro.

- Number of countries: Currently, 20 EU member states form the Eurozone.

- List of member states: The member countries are Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. Croatia was the most recent country to join, adopting the Euro on January 1, 2023.

- Non-EU users: Several microstates have formal agreements with the EU to use the Euro as their official currency and even issue their own coins. These include Andorra, Monaco, San Marino, and Vatican City. Additionally, Kosovo and Montenegro have unilaterally adopted the Euro as their currency without a formal agreement.

- EU members NOT using the Euro: Seven EU countries have not yet adopted the Euro: Bulgaria, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden. Denmark has a legal opt-out, while the others are generally obligated to join once they meet the necessary economic criteria. Bulgaria is expected to become the 21st member of the Eurozone.

History and purpose of the Euro

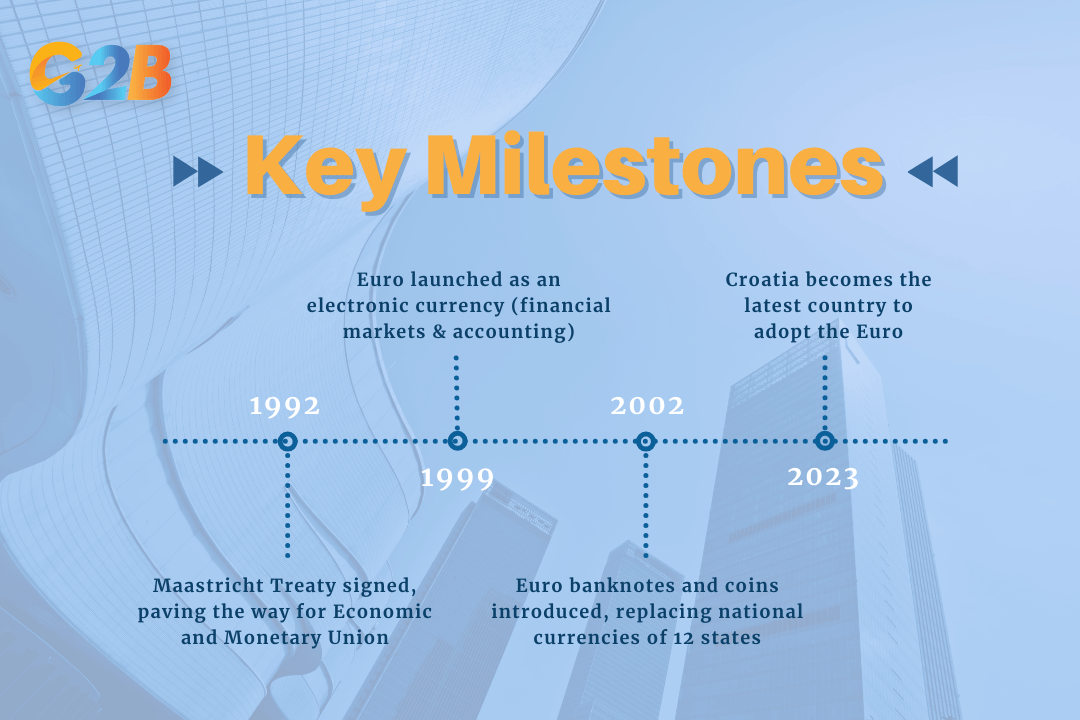

The Euro's creation was a landmark step in the process of European integration, an ambition that dates back to the late 1960s. It was conceived to deepen the connections within the Single Market and promote economic stability across the continent. The foundations for the single currency were laid out in the Maastricht Treaty of 1992, which established the framework and convergence criteria for Economic and Monetary Union (EMU).

- Core objectives: The primary goals for creating the Euro were to eliminate the risks and costs associated with exchange rate fluctuations, which would in turn make cross-border trade easier and more efficient. It was also designed to increase price transparency for consumers and businesses, foster greater competition, and serve as a tangible symbol of a shared European identity.

- Key milestones:

- 1992: The signing of the Maastricht Treaty sets out the path toward Economic and Monetary Union.

- 1999: The Euro is officially launched as an electronic currency for financial markets and accounting purposes on January 1.

- 2002: Physical Euro banknotes and coins enter circulation on January 1, replacing the national currencies of the initial 12 member states.

- Subsequent adoptions: The Eurozone has continued to expand, with Croatia being the latest country to adopt the currency in 2023.

The Euro's creation was a landmark step in the process of European integration

How is the Euro managed?

The stability and integrity of the Euro are maintained by a network of independent institutions that collectively manage the Eurozone's monetary policy and financial system. These bodies work together to ensure price stability and the smooth functioning of the single currency.

- The European Central Bank (ECB): Based in Frankfurt, Germany, the ECB is the central bank for the Euro and the primary institution in Eurozone governance. Its main mandate is to maintain price stability, aiming for an inflation rate of close to 2% over the medium term. The ECB sets key interest rates for the Eurozone, manages foreign currency reserves, and holds the exclusive right to authorize the issuance of Euro banknotes by national central banks.

- The Eurosystem: This is the central banking system of the euro area, comprising the ECB and the national central banks of the 20 EU member states that use the Euro. The national central banks act on the ECB's monetary policy decisions. Together, they work to implement policy, conduct foreign exchange operations, and ensure the smooth operation of payment systems.

- The Eurogroup: This is an informal body where the finance ministers of the Eurozone member states meet to coordinate economic policies. While it doesn't have formal legislative power, its discussions play a crucial role in the political oversight of the Euro and the management of the Eurozone economy.

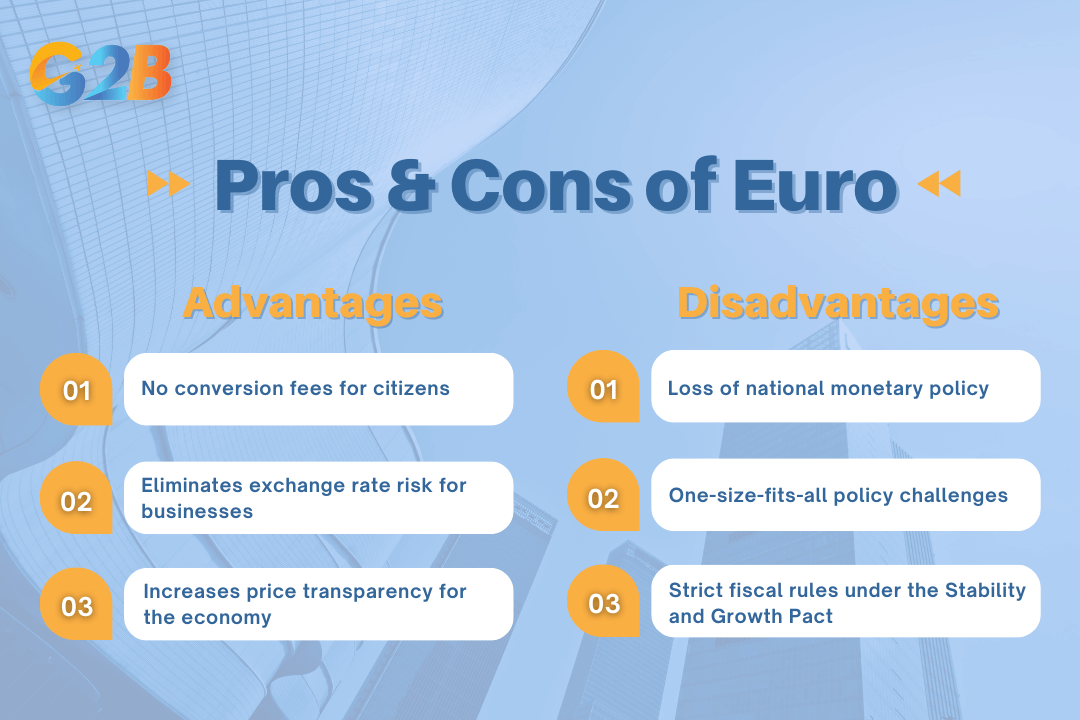

Advantages and disadvantages of a single currency

Adopting a single currency like the Euro brings significant economic benefits but also presents unique challenges for member states.

Advantages (Pros):

- No conversion fees for citizens: For individuals, this makes travelling, shopping, and working across the Eurozone simpler and cheaper, as there is no need to exchange money.

- Eliminates exchange rate risk for businesses: Companies can trade and invest across borders without the uncertainty and cost of currency fluctuations, fostering a more stable business environment.

- Increases price transparency for the economy: Consumers and businesses can easily compare prices in different countries, which stimulates competition and helps keep prices stable. Additionally, a single currency promotes increased trade and economic integration between member countries.

Disadvantages (Cons):

- Loss of national monetary policy: Member countries can no longer set their own interest rates or devalue their currency to respond to specific national economic challenges.

- "One-size-fits-all" policy challenges: The ECB's single monetary policy may not be perfectly suited for the economic conditions of every member state at all times. What works for a booming economy might not be ideal for one in a recession.

- Strict fiscal rules under the Stability and Growth Pact: Member states are bound by rules that limit government deficits and debt, which can restrict their ability to use fiscal policy to stimulate their economies during a downturn.

The Euro has significant economic benefits and unique challenges

The Euro's global role

Beyond the borders of the Eurozone, the Euro has established itself as a pivotal currency in the international financial system. Its influence extends to global trade, finance, and central bank reserves, making it a key component of the world economy.

- International status: The Euro is the second most important currency in the world after the U.S. Dollar.

- Reserve currency: It is the second most widely held reserve currency, with central banks and financial institutions around the globe holding significant amounts as part of their foreign exchange reserves. This provides an alternative to the U.S. dollar and promotes diversification in global finance.

- Trade and invoicing: The Euro is widely used for invoicing and paying for international trade, even between countries outside the Eurozone. While the exact share varies, approximately 20-40% of global cross-border payments are denominated in Euros according to different sources.

- Symbol of economic power: The Euro represents the collective economic and financial strength of the Eurozone, giving the EU a more powerful voice in the global economy.

For multinational corporations managing treasury in both EUR and USD, establishing a corporate presence in both economic blocs is a common strategy. While operating in Europe is streamlined by the single currency, expansion into the U.S. market often involves strategic decisions like pursuing company formation in Delaware due to its favorable corporate laws and status as a major hub for international business

Euro banknotes and coins

The physical currency of the Euro was designed with both unity and diversity in mind, reflecting the shared identity and individual character of the member states.

- Banknotes: Euro banknotes have a common design across all countries. The seven denominations (€5, €10, €20, €50, €100, €200, and €500) feature symbolic architectural styles from different periods in Europe's history, such as Classical, Romanesque, Gothic, and Renaissance. The fronts depict windows and doorways, symbolizing a spirit of openness, while the backs show bridges, representing cooperation and communication.

- Coins: Euro coins are produced in eight denominations (€1, €2, and 1, 2, 5, 10, 20, 50 cents). They have a common side and a national side. The common side displays a stylized map of Europe that has been updated to reflect the European Union's development without national borders visible. The national side features a design unique to the issuing country, often showcasing national symbols, monarchs, or landmarks. Despite the different national designs, all Euro coins are legal tender throughout the entire Eurozone.

The Euro is far more than just a medium of exchange; it is a powerful symbol of European cooperation and a critical pillar of the global economy. It has successfully eliminated exchange rate volatility for its members, simplified cross-border commerce, and provided price stability for over 340 million citizens. While the loss of national monetary policy presents challenges, the Euro's role as the world's second-largest reserve currency underscores its international importance.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom