A financial guarantee is a legally binding promise from a third party to cover a debt or obligation if the original borrower defaults. This instrument is a cornerstone of modern commerce, acting as a critical credit enhancement tool that facilitates transactions by mitigating risk for lenders and creditors. For any business involved in contracts, trade, or financing, understanding this instrument is critical. Let’s explore the various types of guarantees, positive and negative impacts, the essential components of a guarantee agreement, and the legal landscape that governs them in this article.

This article outlines the key aspects of financial guarantees to help businesses gain a clearer understanding of their definition, purpose, and practical applications. We specialize in company formation services in Vietnam and do not provide financial guarantee issuance or investment advice. For specific matters related to accounting, taxation, or financial management, please consult a qualified legal or financial expert.

What is a financial guarantee?

A financial guarantee is a legally binding promise, often irrevocable or with limited cancellation rights, from a guarantor to cover a borrower's (the principal debtor's) obligations to a creditor (the beneficiary) if the borrower fails to meet their financial or contractual commitments. Its primary purpose is to reduce risk for the creditor, assuring that payment or performance will be rendered as contracted. The 3 key parties in any financial guarantee are the principal debtor (the party whose obligation is guaranteed), the creditor or beneficiary (the party receiving the guarantee), and the guarantor (the third party, often a bank or insurance company, making the promise).

This instrument enhances the principal debtor's credibility, making it easier for them to secure loans, win contracts, or engage in trade. It facilitates transactions where trust is low, such as in international trade between unfamiliar parties, by substituting the guarantor's creditworthiness for the debtor's. Financial guarantees are a common requirement in industries with high-value contracts and significant performance risks, including construction, large-scale manufacturing, and international project finance.

How many types of financial guarantees?

There are several specialized financial guarantees, each designed for different commercial scenarios and to mitigate specific risks. They act as a vital mechanism for ensuring contractual obligations are met, whether those obligations are financial or performance-related. Understanding the distinctions between these types is crucial for selecting the right instrument for your business needs.

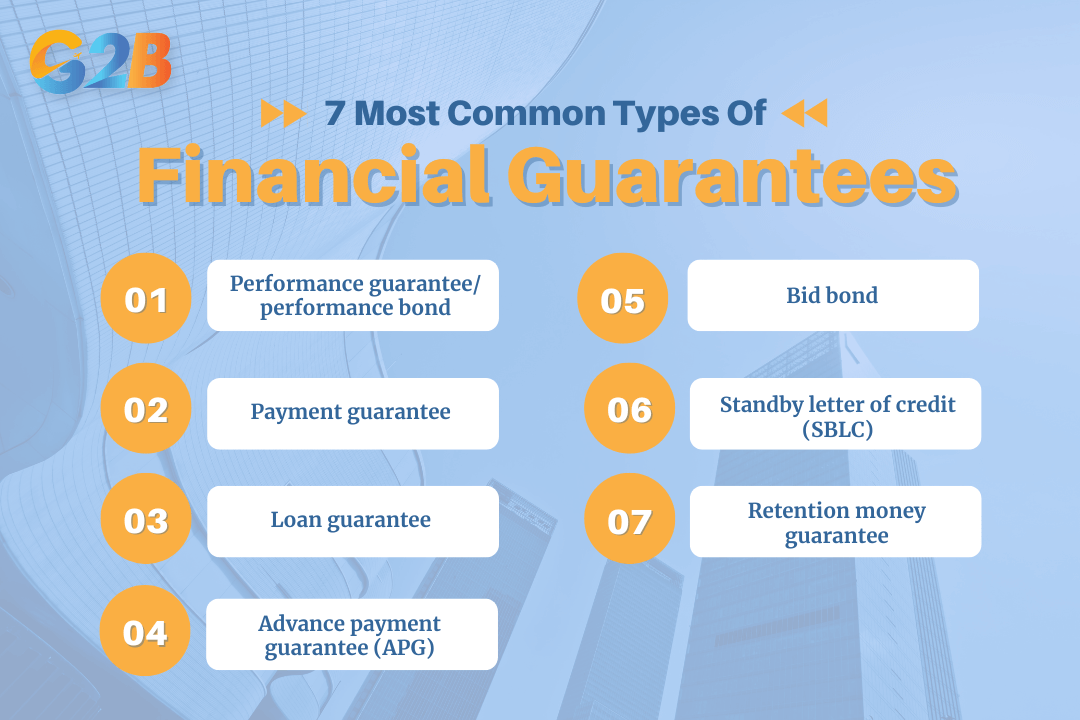

There are 7 most common types of financial guarantees

Here are the most common types of financial guarantees:

- Performance guarantee/performance bond: This ensures the completion of a project or delivery of services as specified in a contract. If the contractor or service provider (the principal) fails to perform, the guarantor compensates the project owner (the beneficiary) for the resulting financial loss, up to the guarantee amount. These are fundamental in the construction industry.

- Payment guarantee: This provides a straightforward assurance that a sum of money will be paid by a certain date. If the buyer (principal) defaults on payment for goods or services received, the guarantor steps in to pay the seller (beneficiary), ensuring the seller's revenue is protected.

- Loan guarantee: This is an assurance given to a lender that a loan will be repaid. If the borrower defaults on their loan payments, the guarantor is obligated to cover the outstanding debt. Government agencies often use these to encourage lending to small businesses or specific sectors.

- Advance payment guarantee (APG): An APG protects a buyer who has made an upfront or advance payment to a seller or contractor. If the seller fails to deliver the goods or services as per the contract, the guarantor refunds the advance payment to the buyer, securing the buyer's initial investment.

- Bid bond: Used in competitive bidding processes, a bid bond guarantees that the winning bidder will enter into the contract and furnish the required performance bonds. If the winning bidder backs out, the guarantor compensates the project owner for the difference between that bid and the next-highest one.

- Standby letter of credit (SBLC): An SBLC is a flexible instrument issued by a bank that serves as a standby payment guarantee. It is often used in international trade to assure a seller that they will be paid if the buyer defaults. While similar to a bank guarantee, an SBLC is a secondary payment mechanism, activated only upon the applicant's failure to perform.

- Retention money guarantee: In many construction contracts, a portion of the payment (retention money) is held back until the project is fully completed and any defects are rectified. This guarantee allows the contractor to receive the full payment immediately by providing the project owner with a guarantee for the retention amount.

What are the impacts of financial guarantees on business?

Financial guarantees are a double-edged sword; they can unlock significant opportunities but also introduce new costs and obligations. For businesses, they serve as a powerful tool for building trust and securing transactions that might otherwise be deemed too risky. However, it's essential to weigh the strategic advantages against the financial and operational considerations.

Financial guarantees have several impacts on business

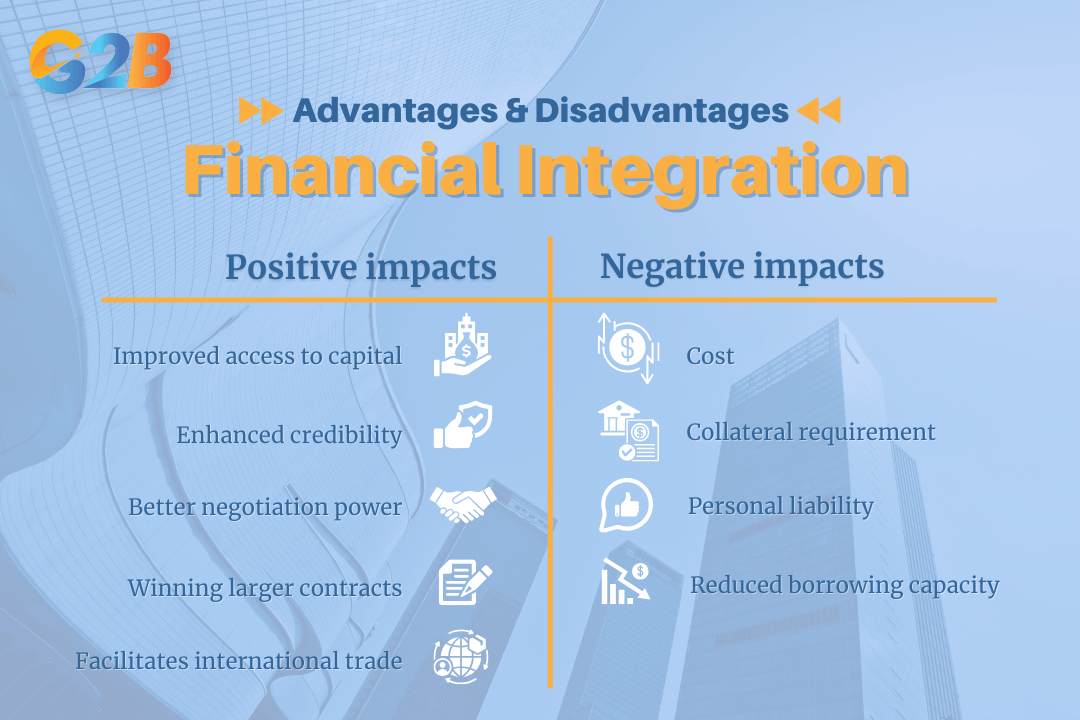

Positive impacts (advantages)

Financial guarantees offer significant strategic benefits that can accelerate growth and enhance market position. They act as a catalyst, enabling businesses to punch above their weight and engage in more ambitious projects.

- Improved access to capital: By mitigating the lender's risk of default, a guarantee makes it easier for businesses, especially smaller or newer ones, to secure loans and credit lines. Lenders are more willing to provide financing, often at more favorable interest rates, when a reputable third party backs the loan.

- Enhanced credibility: A guarantee from a well-known bank or insurer signals financial stability and reliability to potential partners, clients, and suppliers. This boosts the company's reputation and creditworthiness, making it a more attractive counterparty in negotiations.

- Better negotiation power: With a guarantee in place, a business can often negotiate better terms in contracts. For example, a buyer with a payment guarantee may secure a lower price or better payment terms from a supplier, while a contractor with a performance bond can command more favorable project terms.

- Winning larger contracts: Many large-scale projects, particularly government and public works contracts, mandate that bidders provide performance or bid bonds. Having the ability to obtain these guarantees allows businesses to compete for and win more substantial and lucrative contracts.

- Facilitates international trade: Guarantees are indispensable in global trade, where parties often operate in different legal jurisdictions and have limited knowledge of each other. Instruments like Standby Letters of Credit bridge the trust gap, ensuring exporters get paid and importers receive the goods they ordered.

Negative impacts (disadvantages & considerations)

Despite the clear benefits, businesses must carefully consider the drawbacks and potential liabilities associated with financial guarantees before committing. These instruments are not without cost or risk and require prudent financial management.

- Cost: Issuing a financial guarantee is not free. Guarantors, typically banks, charge a fee, which is usually a percentage of the guaranteed amount (often 0.5% to 2.5% annually). This cost must be factored into the overall project budget or transaction price.

- Collateral requirement: To issue a guarantee, banks or sureties often require the business to provide collateral. This can tie up valuable assets, such as cash or property, that could otherwise be used for other operational needs or investments.

- Personal liability: For small business owners, there is a risk that they may need to provide a personal guarantee. This means the owner's personal assets, including their home, could be at risk if the business defaults on the guaranteed obligation.

- Reduced borrowing capacity: The guarantee is often treated as a contingent liability on a company's balance sheet. This can reduce the business's overall borrowing capacity, as lenders will consider the guarantee a potential future debt when assessing the company's creditworthiness.

What's included in the guarantee?

A formal guarantee is a precise legal document where every clause matters to prevent ambiguity and disputes. The clarity and specificity of the agreement are paramount to its enforceability and function. A well-drafted guarantee meticulously outlines the rights and obligations of all parties, leaving no room for misinterpretation when a claim is made.

The following are key components that must be clearly defined in the guarantee agreement:

- Identification of all parties: The document must explicitly name the three core entities: the Principal Debtor (the party whose performance or payment is guaranteed), the Beneficiary (the party receiving the protection of the guarantee), and the Guarantor (the bank or institution issuing the guarantee).

- The guaranteed amount: This specifies the maximum financial liability of the guarantor. The document must state the exact sum and currency that the guarantor is obligated to pay if the guarantee is invoked. This amount may or may not cover the entire value of the underlying contract.

- Scope of the obligation: The agreement must precisely define what obligation is being guaranteed. Is it the repayment of a loan, the completion of a construction project by a specific date, or the payment for a shipment of goods? This section should reference the underlying contract and the specific duties of the principal debtor.

- Duration (tenor): Every guarantee must have a clear effective date and an expiry date. The tenor defines the period during which the beneficiary can make a claim. The guarantee automatically becomes void after the expiry date, providing certainty to all parties.

- Conditions for claim (invocation clause): This is a critical section that details exactly what the beneficiary must do to make a claim. For a "demand guarantee," a simple written demand may suffice. For a "conditional guarantee," the beneficiary might need to provide evidence of the principal's default, such as a court judgment or an architect's certificate of non-performance.

- Governing law and jurisdiction: The document must state which country's laws will govern the guarantee and where any legal disputes will be settled. This is especially important in international transactions to avoid conflicts of law and establish a clear legal framework.

- Exclusions: The guarantee may list specific circumstances under which the guarantor will not be liable. This could include events like force majeure (unforeseeable circumstances that prevent someone from fulfilling a contract), fraud by the beneficiary, or material changes to the underlying contract made without the guarantor's consent.

What are the risks involved?

When dealing with financial guarantees, it's crucial to understand the risks from both sides of the table. While these instruments are designed to mitigate risk for the beneficiary, they create new liabilities for the guarantor and the principal debtor. A comprehensive risk assessment is essential for all parties before entering into such an agreement.

Risks for the guarantor

The entity providing the guarantee, whether a bank, insurance company, or a parent corporation, assumes significant financial and operational risks. These must be carefully underwritten and managed.

- Financial loss: The most direct risk is the guarantor having to pay out the full amount of the guarantee if the principal debtor defaults. This can result in a substantial financial loss, especially if the collateral held is insufficient to cover the debt.

- Legal costs: If a claim is disputed, the guarantor can incur significant legal fees in defending their position or in pursuing the defaulted debtor to recover the funds paid out. The legal process can be lengthy and expensive.

- Credit damage: A bank or surety company that frequently has its guarantees called upon may suffer reputational damage. This can impact its credit rating and perceived reliability in the market, making it harder to attract clients.

- Opportunity cost: The capital and collateral held against a guarantee cannot be used for other profitable activities. This represents an opportunity cost, as those assets could have been invested elsewhere to generate returns.

Risks for the business (debtor)

For the business obtaining the guarantee (the principal debtor), the instrument enables transactions but also creates serious obligations and potential vulnerabilities.

- Loss of collateral: The primary risk is losing the assets pledged as collateral to the guarantor if the business defaults. This could be cash, property, or other valuable business assets essential for operations.

- High costs: The fees for obtaining a guarantee, typically ranging from 0.5% to 2.5% of the guaranteed sum, can be substantial, especially for long-term projects. These costs add to the project's overhead and can reduce profitability.

- Personal asset seizure: If a business owner has provided a personal guarantee, their personal assets, including their home, savings, and investments, are at risk. A business failure could lead to personal bankruptcy.

- Contractual default trigger: The terms of the guarantee agreement itself might contain clauses that could trigger a default. For example, a drop in the business's financial health could breach a covenant, allowing the guarantor to seize collateral even before the underlying obligation is defaulted upon.

The process & legal landscape

Navigating the world of financial guarantees involves a structured application process and adherence to a complex legal framework, which can include both national laws and international standards. Understanding these elements is key to successfully obtaining and managing a guarantee.

The process of obtaining a guarantee

Securing a financial guarantee is similar to applying for a loan and involves rigorous due diligence by the issuing institution.

- Application: The process begins when the principal debtor (the business) submits an application to a guarantor, typically their bank or a surety company. The application will detail the need for the guarantee, the amount, the beneficiary, and the underlying contract.

- Assessment & due diligence: The guarantor conducts a thorough credit assessment of the applicant. This involves reviewing the business's financial statements, credit history, business plan, and experience in the relevant field to evaluate the risk of default.

- Collateral & fees: If the assessment is positive, the guarantor will specify the collateral requirements and the fee. The business must pledge assets or provide cash collateral and agree to the fee structure, which is typically a percentage of the guarantee amount.

- Drafting the agreement: The guarantor's legal team drafts the guarantee document. This agreement will contain all the key components, including the parties, amount, tenor, and claim conditions. Both the applicant and, in some cases, the beneficiary will review and agree to the terms.

- Issuance: Once all parties agree, the collateral is secured, and the fee is paid, the guarantor officially issues the guarantee to the beneficiary. This formalizes the guarantor's commitment to cover the obligation in case of a default.

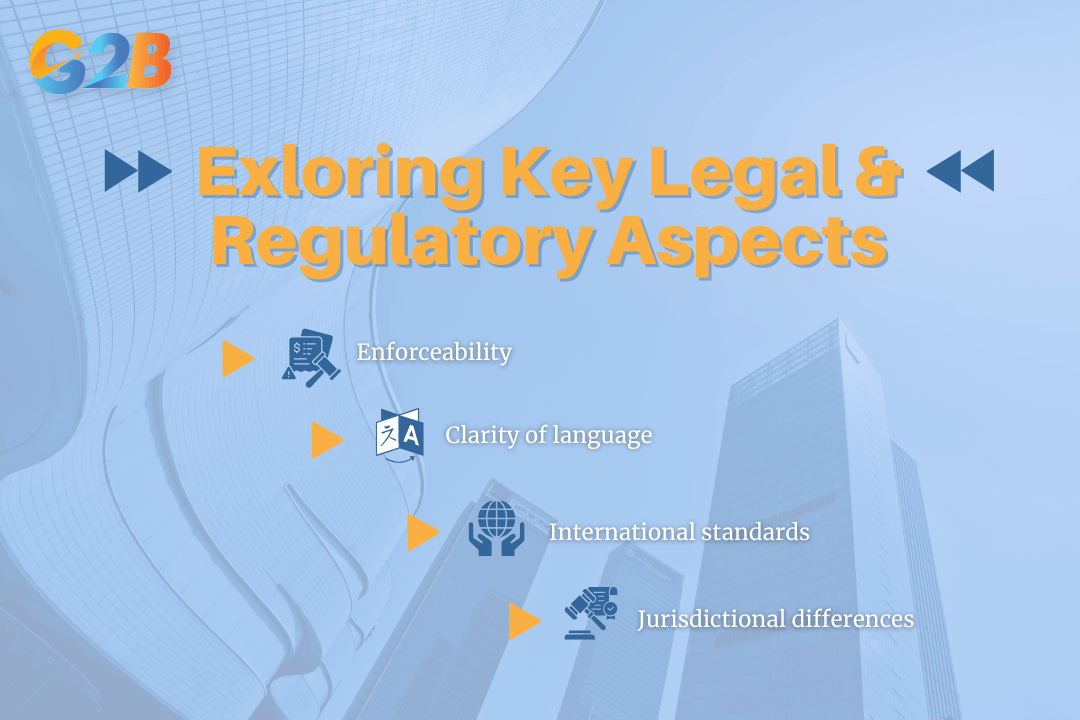

Key legal & regulatory aspects

The effectiveness of a financial guarantee rests on its legal soundness and adherence to established rules.

- Enforceability: For a guarantee to be legally binding, it must be in writing and signed by the guarantor. Oral promises to guarantee a debt are generally not enforceable in court.

- Clarity of language: The wording of the guarantee must be precise and unambiguous. Courts interpret any ambiguity against the party that drafted the document (usually the guarantor), so clarity is essential to prevent disputes.

- International standards: In global trade, many guarantees are governed by rules set by the International Chamber of Commerce (ICC). The most prominent are the Uniform Rules for Demand Guarantees (URDG 758) and the International Standby Practices (ISP98), which provide a standardized framework for handling claims and disputes, ensuring all parties understand their rights and obligations.

- Jurisdictional differences: National laws can significantly impact how guarantees are treated. For example, for businesses undergoing company formation in Vietnam in the real estate sector, the Law on Investment requires developers to obtain a bank guarantee to protect the down payments of homebuyers before selling off-plan properties, ensuring buyers are refunded if the project is not delivered.

The effectiveness of a financial guarantee rests on its legal soundness and adherence to established rules

A financial guarantee is an exceptionally powerful tool in the arsenal of modern business, serving as a catalyst for growth, trust, and opportunity. By providing a formal promise of payment or performance from a credible third party, it mitigates risk, enhances creditworthiness, and enables companies to secure contracts and financing that might otherwise be out of reach. From performance bonds that ensure massive infrastructure projects are completed to standby letters of credit that facilitate global trade, these instruments are woven into the very fabric of commerce.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom