Evaluating the options of 501(c)(3) vs 501(c)(4) is crucial for nonprofit founders and executive leaders. Understanding this distinction helps determine the best legal structure for fulfilling organizational goals while balancing tax implications and advocacy capabilities. The right choice impacts grant access, fundraising potential, and operational compliance. Let’s dive in for a full comparison and a closer look at the compliance considerations that define each path.

This content is for general informational purposes to help clarify the key differences between 501(c)(3) and 501(c)(4) organizations. We provide formation services and do not offer legal or tax advice specific to nonprofit governance or compliance. For tailored guidance, please consult a qualified attorney or tax advisor experienced in U.S. nonprofit law and IRS regulations.

501(c)(3) and 501(c)(4) - Legal definitions and IRS criteria

The 501(c)(3) vs 501(c)(4) designation represents a critical fork in the road for nonprofit organizations. Understanding these fundamental classifications provides the foundation for sound organizational decision-making and compliance strategy.

What is a 501(c)(3)?

501(c)(3) organizations represent the most common nonprofit designation, specifically formed to serve charitable, religious, educational, scientific, or literary purposes, testing for public safety, fostering national or international amateur sports competition, or preventing cruelty to children or animals. These entities receive comprehensive tax exemption from federal income taxes and offer donors a significant advantage: Contributions made to qualified 501(c)(3) organizations generally qualify as tax-deductible charitable donations, subject to IRS rules and donor limitations.

The IRS imposes strict operational constraints on 501(c)(3) entities. They must devote their resources primarily to exempt purposes and face substantial limitations regarding political activities. Direct campaign intervention is explicitly prohibited, while lobbying activities must remain "insubstantial" relative to overall operations - typically interpreted as less than 20% of organizational efforts unless electing the 501(h) expenditure test for more precise lobbying limits.

Key characteristics of 501(c)(3) organizations include:

- Federal tax exemption under IRC Section 501(c)(3)

- Tax-deductible donations for contributors (with certain exceptions)

- Eligibility for foundation and government grants

- Stringent political activity restrictions

- Public disclosure requirements via annual IRS filings (Form 990), except for certain religious organizations and very small nonprofits

There are 3 main types of 501(c)(3) organizations

Simplify your business launch with our Delaware incorporation service - Start your application today!

What is a 501(c)(4)?

501(c)(4) organizations operate as social welfare entities dedicated to the promotion of social welfare, primarily benefiting the community as a whole through advocacy, education, and civic engagement. While they enjoy federal tax exemption similar to their charitable counterparts, they are exempt from federal income tax on income related to their exempt purposes, but must pay tax on unrelated business income. Donations to 501(c)(4) organizations are generally not tax-deductible for donors - a critical distinction affecting fundraising strategy.

The defining feature of 501(c)(4) designation lies in its greater operational flexibility regarding political activity. These organizations may engage in unlimited lobbying efforts directly related to their social welfare mission. They may also engage in limited partisan political activities, provided such activities do not become the organization’s primary purpose or activity. Limited partisan political activities are permissible, provided they don't constitute the organization's primary purpose or activity.

Essential characteristics of 501(c)(4) organizations include:

- Federal tax exemption under IRC Section 501(c)(4)

- Non-deductible donations (contributors cannot claim tax benefits)

- Unlimited lobbying permissions when aligned with a social welfare mission

- Limited partisan political activity allowed (but not as the primary purpose)

- Less restrictive funding source requirements

The IRS recognizes three primary categories of 501(c)(4) organizations

Comparison table of 501(c)(3) vs 501(c)(4)

This comprehensive comparison illuminates the key differences between these two popular tax-exempt designations, helping decision-makers evaluate which structure best serves their organization's mission and long-term goals.

Key criteria between two organizations

| Criteria | 501(c)(3) | 501(c)(4) |

|---|---|---|

| Main purpose | Charitable, religious, etc. | Social welfare, advocacy |

| Tax-exempt | Yes | Yes |

| Donations | Tax-deductible to donors | Not tax-deductible |

| Lobbying | Highly restricted | Allowed without limit |

| Political activity | Prohibited (except nonpartisan) | Permitted (within scope) |

| Public support | Must pass the public support test | No donor base requirement |

| Formation cost | $600+ (Form 1023/1023-EZ, lawyer/filing fees) | $50–$600+ (Form 1024 plus state fees) |

| Ongoing filings | Annual IRS Form 990/990-EZ/N | Annual IRS Form 990/990-EZ/N |

| Audit risk | Higher if political/lobbying | Higher if general noncompliance |

The fundamental distinction lies in organizational purpose - 501(c)(3)s must operate primarily for charitable, religious, educational, or scientific purposes, while 501(c)(4)s focus on promoting social welfare through advocacy and community improvement. Both enjoy tax exemption, but only 501(c)(3)s offer donors the benefit of tax-deductible contributions.

Advocacy capabilities represent another critical difference. 501(c)(3) organizations face substantial restrictions on lobbying activities and cannot engage in partisan political campaigns. In contrast, 501(c)(4) organizations may conduct unlimited lobbying and participate in political activities as long as these efforts align with their social welfare mission.

Donation and funding implications

The tax-deductible nature of donations creates a significant funding advantage for 501(c)(3) organizations. Donors receive immediate tax benefits for their contributions, which often translates to broader appeal and higher donation amounts. Additionally, 501(c)(3)s qualify for foundation and government grants that typically exclude 501(c)(4) organizations. 501(c)(4) organizations must develop alternative funding strategies to offset the lack of tax incentives for donors. Many rely heavily on:

- Membership dues from committed supporters

- Non-deductible donations from individuals passionate about advocacy

- Program service revenue from mission-related activities

- Major gifts from donors who prioritize impact over tax benefits

For organizations contemplating either structure, the funding implications extend beyond immediate financial considerations. The 501(c)(3) designation requires maintaining a diverse donor base to pass the public support test, while 501(c)(4)s can operate with more concentrated funding sources, offering strategic flexibility for advocacy-focused organizations with strong individual or corporate backers.

Compliance, governance, and legal risk

Ongoing IRS compliance requirements create significant governance considerations for both 501(c)(3) and 501(c)(4) organizations. The distinction between these two nonprofit structures affects how boards must approach annual reporting, advocacy activities, and adaptation to evolving federal regulations.

Annual filings and transparency

Both 501(c)(3) and 501(c)(4) organizations must file appropriate Form 990-series returns to maintain their tax-exempt status. The specific version required depends on the organization's gross receipts and total assets:

- Form 990-N (e-Postcard): For organizations with gross receipts normally ≤$50,000

- Form 990-EZ: For organizations with gross receipts <$200,000 and total assets <$500,000

- Form 990: For organizations with gross receipts ≥$200,000 or total assets ≥$500,000

The filing deadline falls on the 15th day of the fifth month after the close of the organization's tax year. Missing this deadline for three consecutive years triggers automatic revocation of tax-exempt status, requiring a new application and payment of all associated fees.

Financial reporting errors or omissions can lead to substantial penalties, including excise taxes on board members in cases of severe negligence. This accountability extends to the public sphere, as all Form 990 filings become publicly viewable through nonprofit tracking services, creating reputational vulnerabilities for organizations with filing issues.

Lobbying, political activity, and IRS rules

The starkest compliance distinction between 501(c)(3) and 501(c)(4) organizations involves political and lobbying activities:

| Activity type | 501(c)(3) rules | 501(c)(4) rules |

|---|---|---|

| Direct lobbying | Limited to "insubstantial" amount (generally <5-20% of resources) | Unlimited (as long as related to the social welfare mission) |

| Grassroots lobbying | Severely restricted | Unlimited (as long as related to the social welfare mission) |

| Political campaigns | Strictly prohibited (no support/opposition to candidates) | Permitted as a secondary activity (not the organization’s primary role) |

| Voter education | Allowed only if strictly nonpartisan | Can include partisan elements |

501(c)(3) organizations facing accusations of prohibited political activity risk immediate investigation, potential loss of exempt status, and excise taxes. Many adopt the 501(h) election to establish clearer lobbying expenditure limits rather than relying on the vague "insubstantial" standard. For 501(c)(4) organizations, political activities must remain secondary to the social welfare mission. Excessive campaign involvement can trigger reclassification as a political action committee, with corresponding disclosure requirements and potential penalties.

When to choose 501(c)(3) vs 501(c)(4)

Making the right choice between 501(c)(3) and 501(c)(4) status depends heavily on your organization's mission, funding needs, and advocacy goals. Let's explore practical scenarios that illustrate when each structure works best.

Charity, education & grant-focused missions

Organizations focused primarily on charitable or educational activities should strongly consider 501(c)(3) status. The 501(c)(3) designation provides access to foundation grants, which often specifically require this status as a funding prerequisite. Organizations seeking substantial support from institutional funders will find this structure essential for financial sustainability. Additionally, the tax-deductible nature of donations creates a powerful incentive for individual contributors, particularly those making larger gifts, who seek to maximize their philanthropic impact while reducing tax liability.

Consider the 501(c)(3) path when:

- Foundation grants will form a significant portion of your funding strategy

- Donor tax deductions are critical for attracting financial support

- Your core activities align with IRS-recognized charitable purposes

- You can maintain a diverse donor base to meet public support tests

Policy or advocacy-driven initiatives

Organizations prioritizing legislative change, policy influence, or community organizing will find 501(c)(4) status offers greater flexibility for advocacy activities. This structure removes the strict lobbying limitations that constrain 501(c)(3) organizations. For advocacy-centered missions, the ability to engage in unlimited lobbying represents a critical advantage. While donations aren't tax-deductible, 501(c)(4)s don't face public support test requirements, allowing funding from a concentrated donor base or even a single major supporter. This structure works particularly well for organizations responding rapidly to policy developments or mobilizing community action around specific causes.

The 501(c)(4) structure makes sense when:

- Direct legislative influence forms a core organizational strategy

- Lobbying activities would exceed IRS limitations for 501(c)(3)s

- Tax deductibility of donations isn't essential to your funding model

- Your organization receives substantial support from membership dues or a small number of donors

The formal registration process proceeds of 501(c)(4) organization

Hybrid and paired structures

Some organizations maximize impact by creating both 501(c)(3) and 501(c)(4) entities. This dual structure allows separation of charitable and advocacy activities while capitalizing on the advantages of each designation. The paired approach requires maintaining strict financial and operational separation between entities. The 501(c)(3) arm focuses on education, research, and charitable activities, while the connected 501(c)(4) conducts advocacy work. This structure enables access to foundation funding and tax-deductible donations while simultaneously pursuing unrestricted lobbying efforts.

Effective implementation requires:

- Separate legal incorporation and IRS recognition for each entity

- Distinct boards (though some overlap may be permissible)

- Careful accounting systems tracking resource allocation

- Clear communication to stakeholders about each entity's role

- Legal guidance to ensure compliance with IRS separation requirements

Actionable decision matrix & flowchart

Making this choice systematically involves evaluating several key factors through a structured decision process:

Mission priority assessment:

- Does your organization primarily conduct charitable/educational activities? → 501(c)(3)

- Is substantial lobbying central to your mission? → 501(c)(4)

- Do you need both charitable activities and significant advocacy? → Consider hybrid structure

Funding strategy evaluation:

- Will you rely heavily on foundation grants? → 501(c)(3) essential

- Are tax deductions important for your donor base? → 501(c)(3) advantageous

- Can you secure adequate funding without deductibility? → 501(c)(4) viable

Governance capacity analysis:

- Can you maintain separate entities with proper firewalls? → Hybrid possible

- Limited administrative capacity? → Choose a simpler single-entity structure

- Compliance resources available? → More complex structures are feasible

This systematic approach ensures selection of a structure aligned with your organization's mission, funding realities, and operational capabilities.

Get expert guidance with G2B’s Delaware incorporation service - Schedule your free consultation today!

Pitfalls, penalties, and compliance risks

Organizations choosing between 501(c)(3) vs 501(c)(4) status must understand the serious compliance risks that accompany tax exemption. The IRS actively monitors nonprofit operations, and overlooked regulations or poor governance practices frequently lead to penalties, audits, and public scandals.

Typical mistakes: Activity overlap and inadequate firewalls

Resource sharing between affiliated 501(c)(3) and 501(c)(4) organizations creates significant legal exposure. When charitable resources fund advocacy work, or when social welfare funds support charitable programs without proper accounting, the IRS often intervenes with harsh consequences. A prominent environmental organization learned this lesson when auditors discovered their 501(c)(3) arm had subsidized lobbying activities conducted by their affiliated 501(c)(4). The failure to implement proper financial firewalls resulted in:

- $250,000 in penalties

- Required repayment of misallocated funds

- Board members facing personal liability for breaching fiduciary duty

- Three-year enhanced compliance monitoring

Organizations operating both structures must maintain separate:

- Bank accounts

- Financial systems

- Board minutes

- Staff time allocations

- Office space costs

- Communications with clear disclaimers

Non-compliance: Missed filings, failure to meet public support tests

Administrative oversights frequently trigger automatic penalties. The most common compliance failures involve the annual Form 990 series and public support requirements for 501(c)(3) organizations. Missing the Form 990 filing deadline for three consecutive years triggers automatic revocation of tax-exempt status. Restoration requires:

- Complete reapplication for exemption

- Payment of IRS reinstatement fees ($600+)

- Explanation of reasonable cause

- Potential back taxes on revenue received during non-exempt periods

- Donors unable to claim tax deductions during lapsed periods

For 501(c)(3) public charities, failing the public support test can force reclassification as a private foundation, bringing stricter operational limitations and reporting requirements. A regional healthcare nonprofit recently experienced this transition when large corporate donations exceeded 33% of total support for two consecutive testing periods, dramatically increasing their compliance burden.

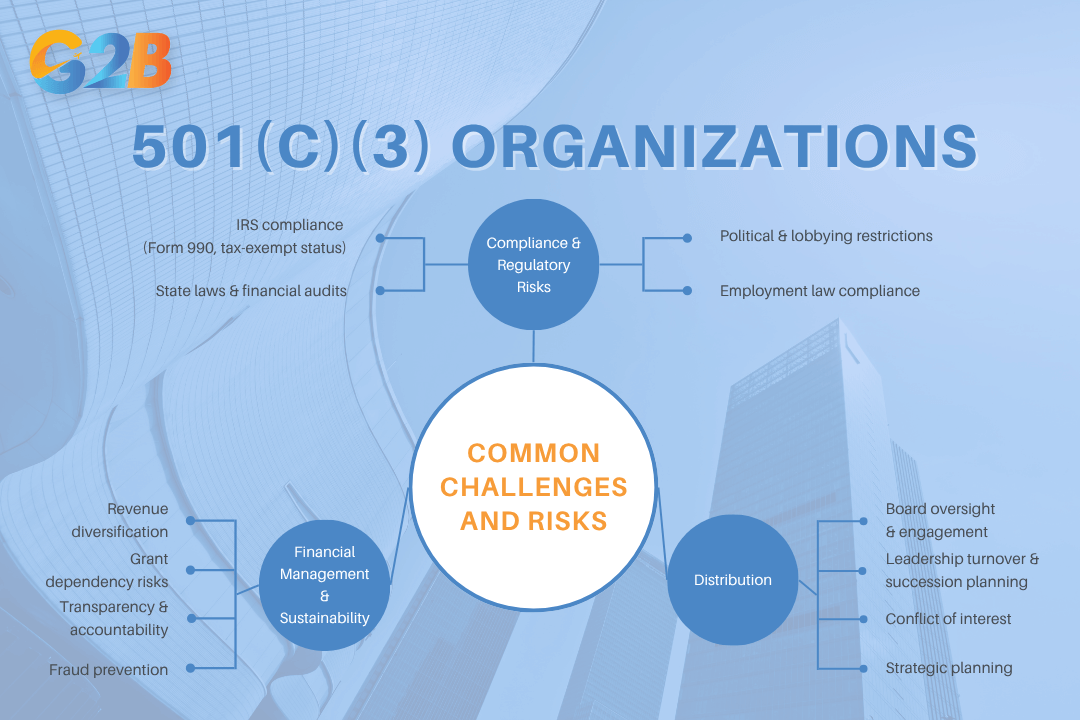

501(c)(3) organizations will grow stronger when addressing these challenges proactively

How to switch from 501(c)(3) to 501(c)(4) (and vice versa)

Converting between nonprofit designations requires far more than completing a simple form. The transition demands dissolving the existing organization and establishing an entirely new entity - a process fraught with potential complications. For 501(c)(3) organizations transitioning to 501(c)(4) status, the process typically involves:

- Formally dissolving the 501(c)(3) according to state law

- Creating a new 501(c)(4) entity with appropriate governing documents

- Filing Form 8976 with the IRS within 60 days of formation

- Distributing charitable assets according to strict IRS requirements

- Developing new donor communications that accurately reflect non-deductible status

Conversely, organizations shifting from 501(c)(4) to 501(c)(3) status must:

- Amend Articles of Incorporation to reflect charitable purposes

- Submit Form 1023 (not the simplified 1023-EZ) with comprehensive documentation

- Provide detailed explanations regarding operational history and conversion rationale

- Address the public charity versus private foundation classification

- Implement systems to track donor deductibility and restricted funds

Navigating the complexities between 501(c)(3) vs 501(c)(4) is essential for those steering the course of impactful organizations. Each designation carries distinct implications for tax-exempt status, lobbying activities, and funding potential, making them pivotal choices for nonprofit founders and executive directors. Understanding these differences not only enhances compliance but also empowers mission-driven leaders to optimize their organizational structures, cultivating a robust foundation for enduring public trust and successful advocacy.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  Ras Al Khaimah (UAE)

Ras Al Khaimah (UAE)  United Kingdom

United Kingdom