A family office is a private advisory firm dedicated to managing the complex financial and personal affairs of ultra-high-net-worth families. Unlike traditional wealth management firms that serve many clients, a family office acts as a centralized command center, offering a deeply integrated and customized suite of services tailored to the unique goals and values of a single family or a small group of families. This guide explains the core definition and responsibilities of a family office to the different types available and the detailed steps required to set up.

This article outlines the key aspects of family offices to help high-net-worth individuals and families gain a clearer understanding. We specialize in company formation and do not provide investment advice. For financial or legal matters, please consult a qualified advisor or relevant authority.

What is a family office?

A family office is a private organization fully owned and controlled by a single wealthy family or a group of families that serves as the personal chief financial officer for ultra-high-net-worth individuals (UHNWIs) and their families. It moves beyond the scope of conventional financial institutions by creating a holistic, all-encompassing strategy for managing significant wealth. This structure is designed to address the intricate challenges and opportunities that come with substantial assets, ensuring that every financial decision aligns with the family's long-term vision. It acts as a centralized "command center" for a family's wealth, differentiating it from traditional wealth management by providing a fully integrated approach.

The primary purpose is to preserve and grow wealth across generations, handling a variety of complex needs, such as investment oversight, estate planning, and philanthropic coordination. Family offices can be categorized as single-family offices (SFOs), serving one family exclusively, or multi-family offices (MFOs), serving multiple families. By unifying all aspects of a family's financial life under one roof, a family office provides clarity, control, and a strategic framework to protect a family's legacy.

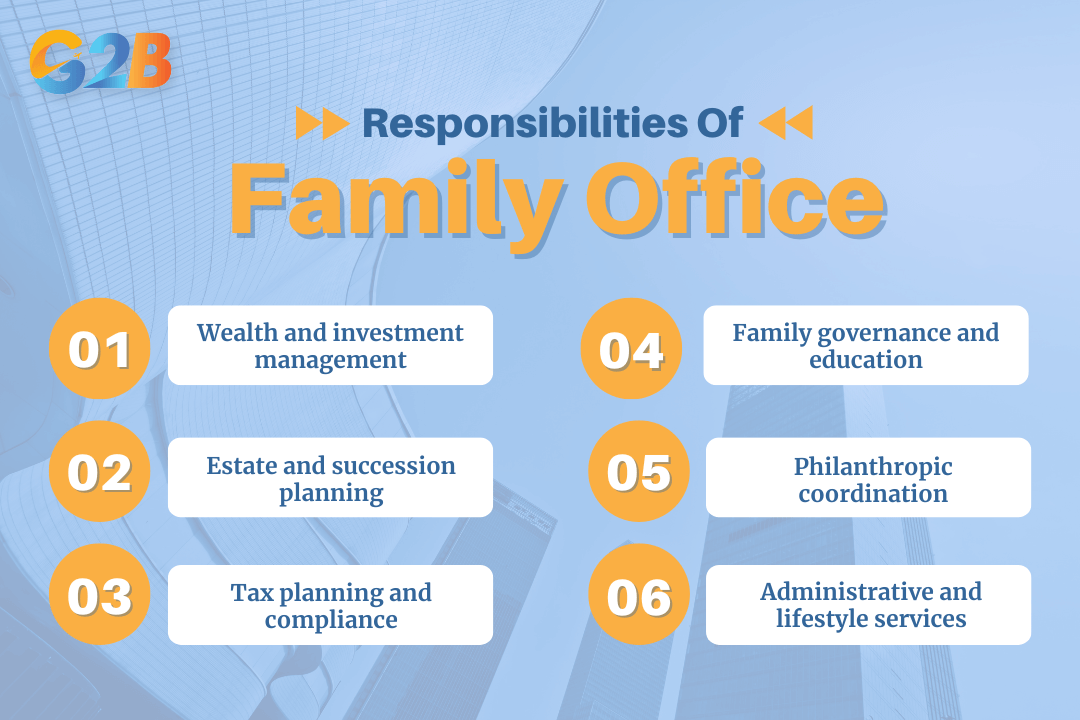

Responsibilities of a family office

The responsibilities of a family office are broad and deeply customized, extending far beyond simple investment advice to cover every facet of a family's financial and personal life. These organizations or entities coordinate a team of professionals from legal, investment, and tax disciplines to provide a seamless and comprehensive wealth management plan.

The responsibilities of a family office are broad and deeply customized

- Wealth and investment management: A core function is the sophisticated management of the family's assets. This involves creating a customized investment policy, performing rigorous asset allocation, and implementing advanced risk mitigation strategies. Family offices often provide access to exclusive deals in areas like private equity, venture capital, and real estate that are unavailable through traditional channels.

- Estate and succession planning: A primary responsibility is developing strategies for the smooth and tax-efficient transfer of wealth to future generations. This includes meticulous estate planning, the creation and administration of trusts, and crafting a clear succession plan to preserve the family's legacy and prevent future conflicts.

- Tax planning and compliance: Family offices employ dedicated tax specialists to navigate the complexities of national and international tax laws. They focus on optimizing the family's tax position and ensuring full compliance across all entities and jurisdictions, which is crucial for wealth preservation.

- Family governance and education: To ensure long-term success, a family office is responsible for establishing a clear governance framework that defines roles, responsibilities, and decision-making processes. This often includes educating younger family members on financial literacy, the responsibilities of wealth, and the family's core values to prepare them for their future roles.

- Philanthropic coordination: Many families have significant charitable goals, and the family office helps to translate these aspirations into a structured philanthropic strategy. This includes managing charitable foundations, advising on impactful giving, and ensuring philanthropic efforts align with the family's values and legacy.

- Administrative and lifestyle services: Family offices often handle a wide range of administrative and concierge-style tasks to simplify the family's life. These services can include managing household staff, coordinating travel, overseeing properties and other valuable assets like yachts or aircraft, and handling day-to-day bill paying and accounting.

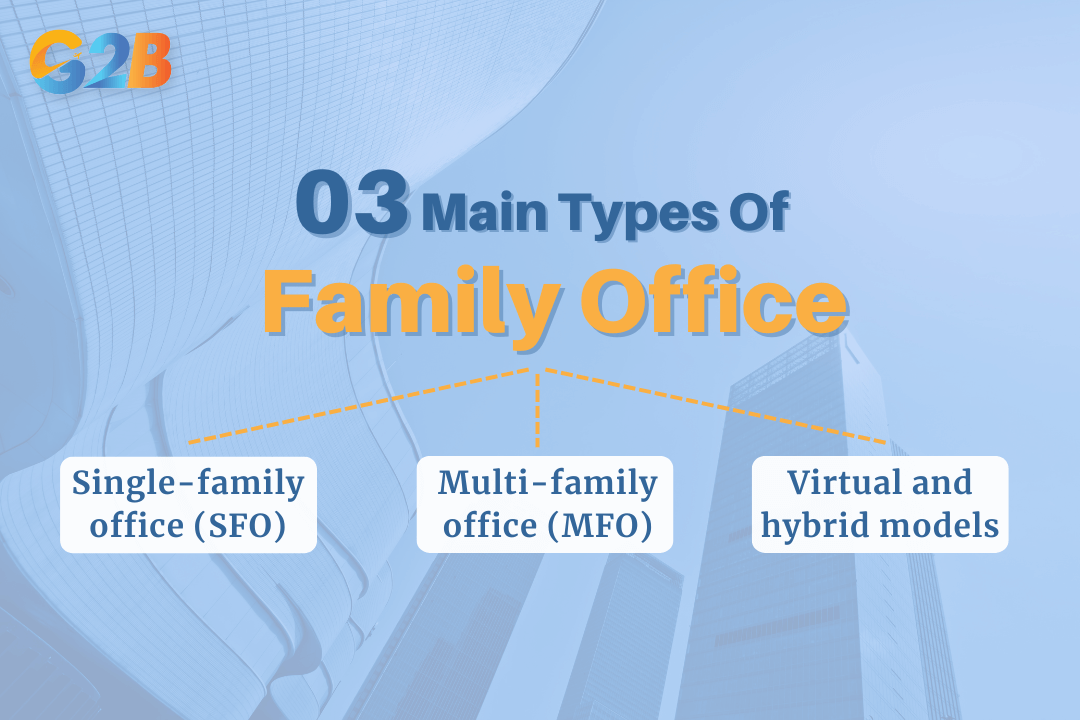

How many types of family offices?

Family offices are generally categorized based on the number of families they serve and their service delivery model and operational structure. The choice between them depends on a family's wealth, complexity, and desire for privacy and control. The main types include single-family offices, multi-family offices, and more modern virtual or hybrid models.

There are 3 main types of family offices

1. Single-family office (SFO)

A single-family office (SFO) is a private company established to exclusively manage the wealth and personal affairs of one ultra-high-net-worth family. This model offers the utmost privacy, control, and customization, as its entire staff and infrastructure are dedicated to the specific needs, goals, and values of that single family. Families often choose an SFO when their wealth and the complexity of their assets - such as managing a large family business, diverse international holdings, or highly specific philanthropic missions - require a dedicated, in-house team of experts working in perfect alignment.

2. Multi-family office (MFO)

A multi-family office (MFO) is a professional firm that provides family office services to multiple UHNW families simultaneously. MFOs deliver access to a similar comprehensive suite of services found in an SFO, including investment management, estate planning, and tax advisory, but through a shared platform. The primary benefits of this model are cost-sharing and access to a wider network of investment opportunities and professional expertise. By pooling resources, families can achieve economies of scale, making the MFO a more cost-effective option for those who do not require or cannot justify the expense of a dedicated SFO.

3. Virtual and hybrid models

A Virtual Family Office (VFO) leverages technology to coordinate a network of independent experts rather than employing a full in-house team. This model offers significant flexibility and can be more cost-efficient, as it allows a family to assemble a "best-of-breed" team of external advisors - such as lawyers, accountants, and investment managers - who are managed by a central coordinator, without the need for a traditional physical office. A Hybrid model combines elements of both the SFO and MFO. For instance, a family might maintain a small in-house team for managing daily financial affairs and governance while outsourcing specialized functions like global investment management or complex tax compliance to an MFO or other external experts.

What services does a family office offer?

The services offered by a family office are designed to be holistic and fully integrated, addressing every aspect of a family's financial and personal life. Unlike traditional wealth advisors who may focus solely on investments, a family office coordinates all professional services to ensure they work in harmony toward the family's long-term objectives. The goal is to centralize control, simplify complexity, and provide a single point of contact for the family's diverse needs, ensuring that all strategies - from investment portfolios to philanthropic endeavors - are perfectly aligned with the family’s overarching vision and values.

- Investment and wealth management

- Customized portfolio design and asset allocation

- Risk management and mitigation strategies

- Access to and due diligence on direct investments (private equity, real estate, venture capital)

- Consolidated performance reporting across all assets

- Estate, trust, and tax services

- Advanced estate and succession planning

- Trust administration and fiduciary services

- Comprehensive tax planning and compliance

- Strategies for intergenerational wealth transfer

- Governance and education

- Development of a family charter or constitution

- Succession planning for family businesses and leadership roles

- Financial education programs for the next generation

- Facilitation of family meetings and conflict resolution

- Philanthropy and legacy planning

- Management of family foundations and charitable trusts

- Guidance on strategic and impactful philanthropic giving

- Integration of philanthropic goals with financial and tax planning

- Administrative and lifestyle management

- Bill paying, personal accounting, and cash flow management

- Coordination of legal and insurance matters

- Oversight of high-value assets such as real estate, aircraft, and yachts

- Concierge services, including travel planning and personal security arrangements

Who is served by a family office?

The clients served by a family office are exclusively ultra-high-net-worth individuals (UHNWIs) and their families. This is a distinct client base with financial affairs that are too complex for traditional wealth management services to handle effectively. The substantial assets and intricate needs of these families - spanning multiple generations, jurisdictions, and asset classes - require the dedicated, comprehensive oversight that a family office provides. The high operational costs associated with running a family office mean that this model is typically reserved for those with a very high level of investable assets.

- Single-family office (SFO) clients:

- An SFO is typically viable for families with a minimum of $100 million to $250 million or more in investable assets. Some sources even suggest a net worth of at least $1 billion is generally understood for a standalone SFO. This threshold is necessary to justify the significant operational costs, which can exceed $1 million annually, for staffing, technology, and infrastructure.

- Multi-family office (MFO) clients:

- An MFO serves families who desire the comprehensive services of a family office but may not meet the asset threshold for an SFO or prefer a more cost-effective solution. The typical minimum for an MFO client is lower, often starting at $25 million to $50 million in investable assets.

- Typical client profile:

- Clients often include founding entrepreneurs, inheritors of dynastic wealth, and principals of financial funds. Their financial landscape usually includes a mix of liquid assets, business ownership, real estate holdings, and alternative investments, all requiring sophisticated management and strategic planning.

Legal and tax structures of a family office

Choosing the correct legal and tax structure is a foundational decision in establishing a family office, as it directly impacts liability, taxation, and regulatory compliance. The structure must be carefully designed to protect family assets, ensure tax efficiency, and align with the family's long-term wealth transfer goals. While various entities can be used, the most common choices in the United States are Limited Liability Companies (LLCs) and Family Limited Partnerships (FLPs) because they offer a blend of protection and favorable tax treatment.

- Limited Liability Company (LLC): An LLC is a popular structure due to its flexibility and robust liability protection. It separates the family office's activities from the personal assets of the family members, shielding them from potential business debts or legal actions. For tax purposes, an LLC offers pass-through taxation, meaning that income and expenses flow through to the individual members, avoiding the double taxation associated with C corporations.

- Family Limited Partnership (FLP): An FLP is another common structure, particularly effective for estate planning and wealth transfer. In this model, senior family members typically act as general partners with control over the assets, while junior members are limited partners. This structure allows for the gradual transfer of wealth to younger generations at potentially discounted values, which can reduce estate and gift tax liabilities. Like an LLC, it also provides pass-through taxation.

- C Corporation and S Corporation: While less common, a family office can be structured as a corporation. A C corporation provides strong liability protection but is subject to double taxation. An S corporation allows for pass-through taxation but comes with more restrictions on ownership than an LLC. The choice often depends on specific tax objectives, such as the deductibility of business expenses under IRC Section 162.

- Jurisdictional considerations: The choice of where to establish the family office is also critical. Different jurisdictions offer varying advantages regarding tax laws, liability protection, and regulatory requirements. Families with international assets may use multiple legal entities across different locations to optimize their global financial strategy.

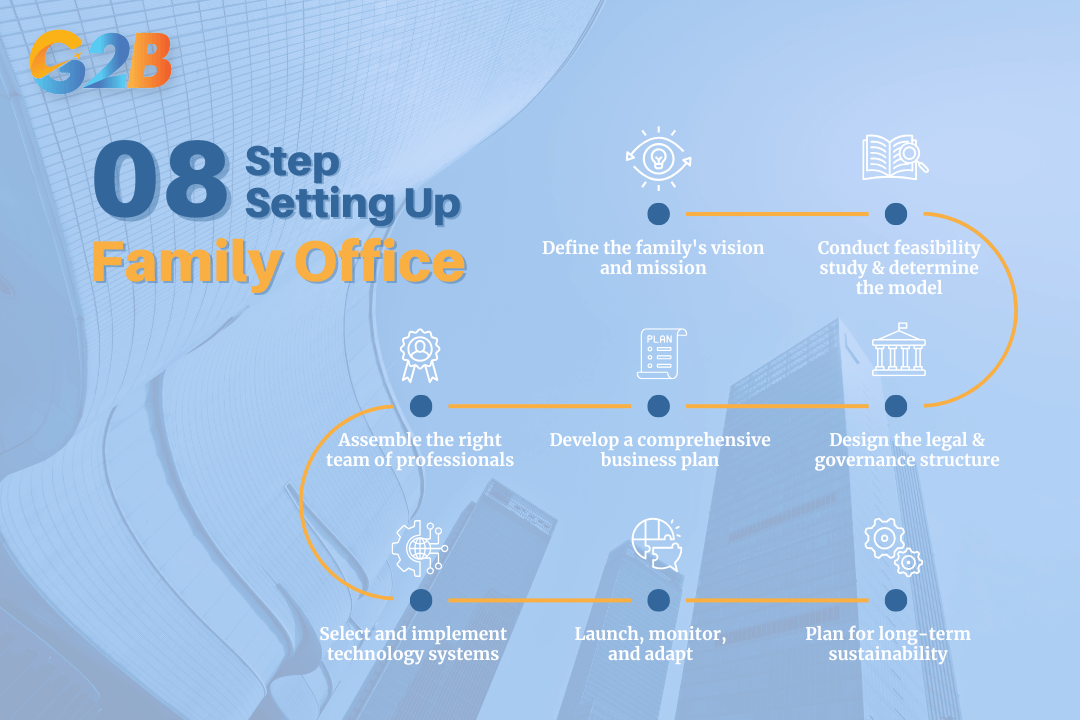

How to set up a family office

Setting up a family office is a strategic and methodical process that requires careful planning and a clear understanding of the family's long-term vision. It involves moving from an abstract mission to a fully operational entity with the right people, processes, and technology. The following steps provide a roadmap for creating a successful and enduring family office.

Setting up a family office is a strategic and methodical process that requires careful planning

- Define the family's vision and mission: The first and most critical step is to establish a clear purpose. This involves creating a family charter or mission statement that outlines the family's core values, long-term goals, and vision for its wealth. This foundational document will guide all future decisions, from investment strategy to philanthropic activities.

- Conduct a feasibility study and determine the model: Evaluate whether a family office is the right solution by analyzing the complexity of the family's assets and the associated costs. Determine the most suitable model - SFO, MFO, or a hybrid approach - based on the level of wealth, desire for control, and cost-effectiveness. It is important to carefully consider operational costs versus benefits, as SFOs especially can involve very high expenses. An SFO is typically only viable for families with at least $100 million in assets due to high operational expenses.

- Design the legal and governance structure: Choose the appropriate legal entity, such as an LLC or FLP, to ensure liability protection and tax efficiency. Simultaneously, develop a robust governance framework that defines roles, responsibilities, and decision-making protocols to prevent conflicts and ensure smooth operations.

- Develop a comprehensive business plan: Create a detailed business plan that outlines the services the family office will provide, whether in-house or outsourced. Clearly defining which functions to keep in-house versus outsource helps balance efficiency and cost control. This plan should include a detailed budget for staffing, technology, office space, and professional fees, providing a clear financial roadmap for the setup and ongoing operations.

- Assemble the right team of professionals: The success of a family office hinges on the quality of its team. Recruit key personnel who are not only highly skilled but also a cultural fit for the family. Core roles often include a Chief Investment Officer (CIO), a Chief Financial Officer (CFO), and legal and tax specialists. Other important roles can include risk management specialists, family governance advisors, and philanthropy experts if relevant.

- Select and implement technology systems: Modern family offices rely on sophisticated technology for efficiency and oversight. Select and implement integrated platforms for wealth aggregation, performance reporting, risk management, and secure document management. This technology is essential for providing a clear, consolidated view of the family's entire wealth landscape.

- Launch, monitor, and adapt: Once launched, the family office's performance must be continuously monitored against the goals set in the family mission statement. It is crucial to establish a process for regular reviews and adjustments, as the framework must be flexible enough to adapt to changing family dynamics, market conditions, and regulatory landscapes. Ongoing risk management and stringent information security protocols are vital to protect family assets and privacy.

- Plan for long-term sustainability: Develop a clear strategy for succession, leadership transition, and evolving family needs. Establish policies for onboarding new members, resolving conflicts, and adapting governance over time. This helps ensure the family office remains effective and aligned with the family’s vision across generations.

New investment and asset management trends in Vietnam

Vietnam's dynamic and rapidly expanding economy is creating a new generation of high-net-worth (HNW) and ultra-high-net-worth individuals. As this wealth accumulates, often through successful entrepreneurship and a thriving technology sector, there is a corresponding surge in the need for sophisticated asset management and wealth preservation structures. This economic growth is the primary driver behind the emerging demand for family office services, which are essential for managing newfound and increasingly complex fortunes.

One of the most significant trends is the formalization of asset management. As local entrepreneurs achieve substantial success, they recognize the necessity of creating formal structures to manage both their personal and business assets. This has led to a notable increase in company formation in Vietnam, not just for operational businesses but as holding companies to consolidate family wealth. These entities serve as the foundational building blocks for what can eventually evolve into a fully-fledged family office, providing a legal framework for investment, governance, and succession planning. However, the family office model as a fully integrated service combining financial, legal, and family governance aspects is still emerging and relatively nascent in Vietnam's market. Many wealthy families are just beginning to explore and adopt this approach.

Investment appetites among Vietnam's wealthy are also evolving. While real estate remains a traditional pillar, there is a growing interest in technology startups, venture capital, and sustainable or impact investing. Additionally, renewable energy, high-tech agriculture, and financial services sectors are attracting increasing attention. This diversification requires a level of due diligence and risk management that goes beyond traditional private banking, further fueling the need for the specialized expertise a family office can provide. Furthermore, as family businesses mature, the focus is shifting toward long-term legacy preservation, creating a strong demand for structured succession planning and governance to ensure a smooth transfer of wealth and leadership to the next generation.

A family office represents the pinnacle of personalized wealth management, providing a comprehensive, centralized structure to protect and grow the complex financial and personal affairs of ultra-high-net-worth families. Far more than a simple investment advisor, it acts as a strategic partner dedicated to preserving a family's legacy across generations. By integrating everything from sophisticated asset allocation and tax planning to family governance and philanthropic strategy, a family office ensures that all decisions are aligned with a unified vision.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom