A Family Limited Partnership (FLP) is a powerful legal entity that enables families to protect assets, reduce estate taxes, and manage the transfer of generational wealth. By combining the flexibility of a limited partnership with the strategic benefits of estate and tax planning, FLPs allow families to consolidate assets, streamline management, and protect their legacy. Let’s explore the definition of an FLP, the key features, benefits, and common use cases for modern families and business owners.

This article outlines the key aspects of Family Limited Partnerships (FLPs) to help families and business owners gain a clearer understanding of their structure and benefits. We specialize in company formation and do not provide estate planning, tax, or investment advice. For specific legal or financial matters, please consult a qualified professional advisor.

What is a family limited partnership?

Family Limited Partnership (FLP) is a legal entity structured as a business partnership among family members to hold and manage family-owned assets. It is a sophisticated estate planning and asset protection tool designed to consolidate family assets, such as business interests, real estate, or securities, into a single, managed entity. The FLP is formed by at least two family members who contribute assets in exchange for partnership interests.

The primary purpose of an FLP is to facilitate the transfer of wealth to younger generations in a tax-efficient manner while allowing senior family members to retain control over the assets. It centralizes the management of family assets, protects them from creditors, provides protection from creditors primarily for Limited Partners through limited liability, and provides a structured framework for business succession. The key players are divided into two distinct roles, and the partnership is designed to hold specific types of assets to achieve its goals.

- The key players: General Partners vs. Limited Partners: In an FLP, there are two classes of partners. General Partners (GPs), typically senior family members, are responsible for the day-to-day management and investment decisions of the partnership. They have unlimited personal liability for the partnership's debts and obligations. Limited Partners (LPs), usually children or grandchildren, are passive owners who have no management authority. Their liability is limited to the amount of their investment in the partnership.

- Common assets held in an FLP: An FLP can hold a variety of assets, making it a flexible tool. Suitable assets often include income-producing real estate, stock portfolios, ownership stakes in other companies, or valuable collectibles. However, certain assets should be avoided. It is strongly discouraged to place a personal residence into an FLP, as this can jeopardize personal residence tax exclusion benefits and suggest a lack of legitimate business purpose to the IRS, potentially leading to adverse tax and legal consequences.

Who should consider a family limited partnership?

- High-net-worth families: For families with significant wealth, an FLP is a powerful tool to preserve assets and minimize taxes. By transferring assets into the partnership, senior members can gift limited partnership interests to their heirs over time. These gifts are often valued at a discount because they represent a minority interest with no control and limited marketability, allowing more wealth to be transferred free of estate and gift taxes. This strategy helps preserve generational wealth that might otherwise be eroded by high tax liabilities.

- Family business owners: An FLP provides an excellent structure for business succession planning. It allows the senior generation (as general partners) to gradually transfer ownership of the family business to the next generation (as limited partners) while retaining exclusive management and control through the general partner role. This ensures a smooth transition, allows younger family members to learn the business without the risk of mismanagement, and helps keep the business within the family by placing restrictions on the transfer of partnership interests to outsiders.

- Individuals seeking asset protection: Professionals in high-liability fields, such as doctors or entrepreneurs, can use an FLP to shield personal assets from business-related lawsuits and creditors. By transferring assets into the FLP, those assets are no longer owned by the individual but by the partnership. If a limited partner faces a personal lawsuit, a creditor's remedy is typically limited to a "charging order," which only gives them the right to receive distributions made to that partner, but does not grant them voting rights or the ability to seize partnership assets.

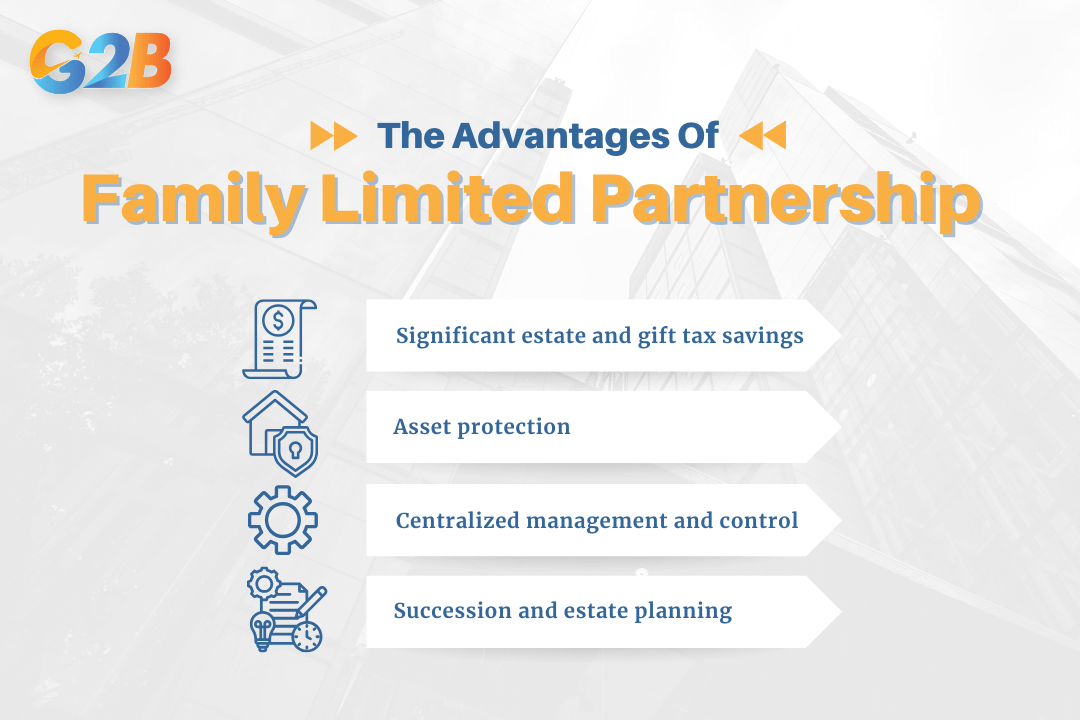

Advantages of a family limited partnership

A properly structured and managed Family Limited Partnership offers four primary advantages that make it a cornerstone of advanced estate planning for many families. These benefits range from significant tax efficiencies and asset protection to centralized control and streamlined succession planning.

A properly structured and managed Family Limited Partnership offers four primary advantages

Significant estate and gift tax savings

One of the most compelling reasons to establish an FLP is its ability to generate substantial tax savings. By gifting limited partnership interests, families can transfer wealth to the next generation while minimizing federal estate and gift tax liabilities, primarily through two key mechanisms.

- Valuation discounts: Gifts of limited partnership interests can often be valued at a discount for tax purposes. Because these interests lack both marketability (they cannot be easily sold) and control (limited partners have no say in management), their fair market value is considered less than the direct value of the underlying assets. These discounts, which often range from approximately 30% to 35% or more depending on circumstances, allow senior family members to transfer more wealth to their heirs while using less of their lifetime gift and estate tax exemption.

- Annual gift tax exclusion: The FLP structure simplifies the process of making annual gifts to family members. Parents or grandparents can gift limited partnership interests valued up to the annual gift tax exclusion amount to as many individuals as they wish each year without incurring gift tax or using their lifetime exemption.

Asset protection

An FLP creates a formidable barrier between partnership assets and the personal creditors of the partners, particularly the limited partners. This separation of assets is a critical benefit for protecting family wealth from unforeseen liabilities, lawsuits, or divorces.

- Protection from creditors: Assets transferred to an FLP are legally owned by the partnership, not the individual partners. Therefore, if a limited partner is sued, their personal creditors generally cannot seize the assets inside the FLP. The creditor's typical remedy is a "charging order," which only grants them the right to receive any distributions made to that specific partner. Since the general partner controls distributions, they can choose not to make any, rendering the charging order ineffective and protecting the partnership's assets.

Centralized management and control

The FLP allows senior family members to transfer economic ownership to their heirs without immediately relinquishing control over the underlying assets. This structure ensures that experienced family members continue to manage the family's wealth and business interests.

- Maintained control: Senior family members, acting as general partners, retain exclusive authority over all management and investment decisions for the assets held within the FLP. They can decide when to buy or sell assets and whether to distribute income to the partners. This allows them to groom the next generation and transfer ownership gradually while ensuring the assets are managed prudently.

Succession and estate planning

An FLP provides a clear and legally binding framework for the transfer of a family business or other significant assets from one generation to the next. It helps avoid the disputes and complications that can arise without a formal plan.

- Structured transfer: An FLP formalizes the process of business succession. It allows for the gradual transfer of ownership through gifts of limited partnership interests, giving younger family members time to learn about the business and their responsibilities before taking full control.

- Family continuity: The partnership agreement can include provisions that prevent partnership interests from being sold or transferred to non-family members, such as in the event of a divorce or a partner's desire to sell their share. This ensures that the family's assets and business remain under family control for future generations.

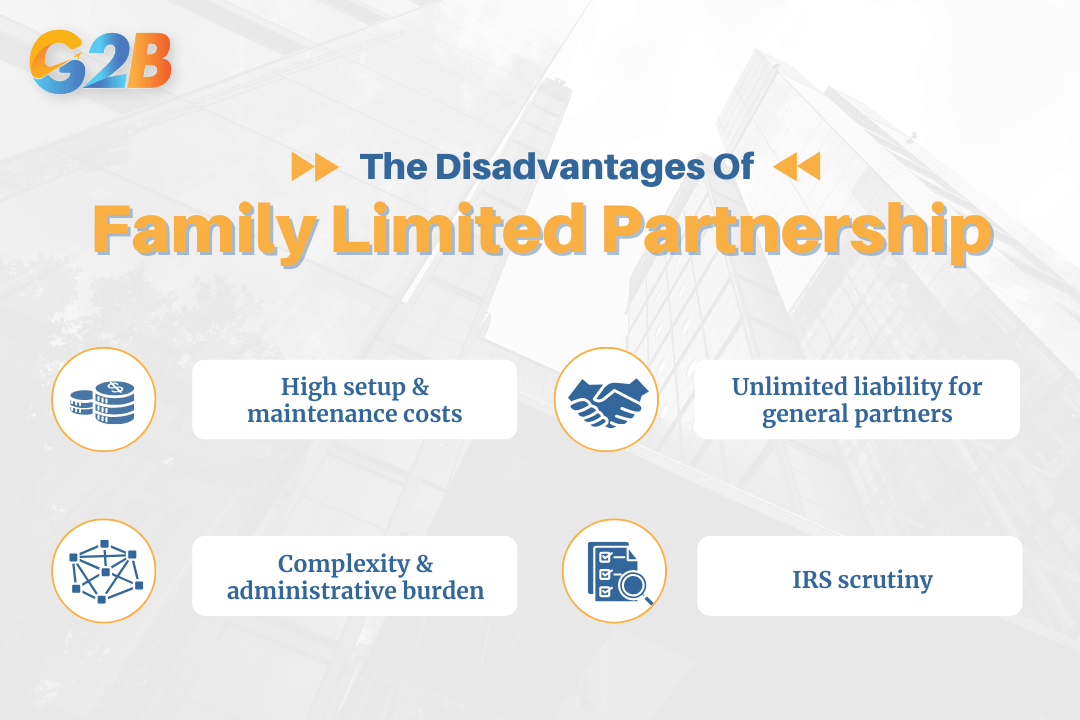

Disadvantages of a family limited partnership

While FLPs offer significant benefits, they are also complex and come with notable drawbacks. Families should carefully consider these four disadvantages, which include high costs, administrative complexity, liability risks for general partners, and the potential for close examination by the IRS.

FLPs are also complex and come with notable drawbacks

High setup and maintenance costs

Creating and operating an FLP is not a simple or inexpensive undertaking. The process requires significant professional assistance to ensure it is structured correctly and remains compliant with state and federal laws, leading to substantial ongoing expenses. Initial setup costs can easily range from $8,000 to $15,000 or more, depending on the complexity of the assets involved. This includes legal fees for drafting the partnership agreement, accounting fees for setting up financial records, and appraisal fees to value the assets being transferred.

Complexity and administrative burden

An FLP is a formal business entity and must be operated as such to maintain its legal and tax benefits. This creates a significant administrative burden that families must be prepared to handle. The partnership must maintain separate bank accounts and meticulous financial records, and it is required to file an annual partnership tax return. Regular meetings should be held and documented. Failure to adhere to these ongoing formalities can jeopardize the asset protection and tax benefits the FLP is designed to provide.

Unlimited liability for general partners

A critical distinction within an FLP is the different liability levels for its partners. While limited partners enjoy liability protection, the same is not true for general partners. General partners are personally liable for all the debts, obligations, and legal liabilities of the partnership. This means if the partnership's assets are insufficient to cover its debts, the personal assets of the general partners - such as their homes, cars, and personal bank accounts - could be at risk. This unlimited liability is a significant drawback and a risk that must be carefully managed.

IRS scrutiny

Because of their potential for significant tax savings, FLPs are often subject to close scrutiny by the Internal Revenue Service (IRS). The IRS frequently challenges FLPs, particularly those that appear to have been created solely for tax avoidance rather than for a legitimate business purpose. If the IRS determines that an FLP lacks a valid non-tax reason for its existence or that the formalities have not been properly followed, it may disregard the partnership entity for tax purposes, resulting in the loss of valuation discounts and potentially significant back taxes and penalties.

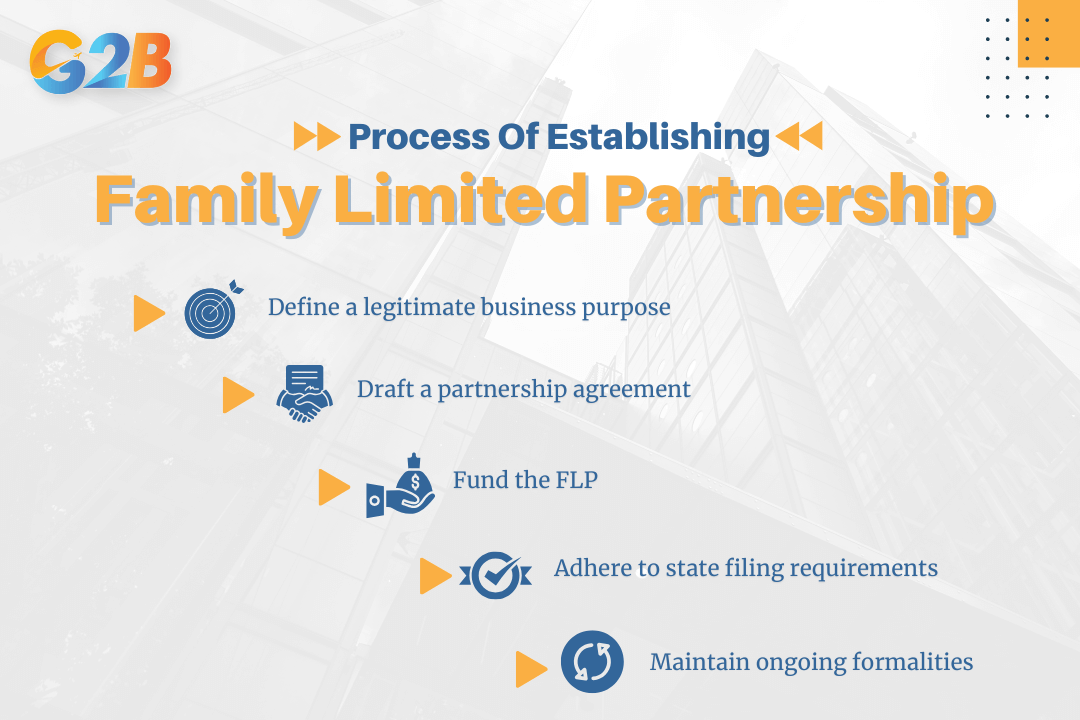

How to set up a family limited partnership

Establishing a Family Limited Partnership is a formal legal process that requires careful planning and execution to ensure it meets your family's goals and withstands potential scrutiny from the IRS. The process involves several critical steps, from defining its purpose to maintaining its operations as a legitimate business entity.

The process of establishing a Family Limited Partnership involves several steps

- Define a legitimate business purpose: This is the foundational step and arguably the most important for the FLP's long-term success. The IRS requires an FLP to have a valid non-tax reason for its existence. Simply stating a desire to save on estate taxes is not sufficient and will likely be challenged. Legitimate business purposes include centralizing management of family assets, streamlining a family business succession, or protecting assets from creditors. A clear, well-documented business purpose is your primary defense against an IRS audit.

- Draft a partnership agreement: This is the core legal document that governs the FLP. It should be drafted by an experienced attorney and will meticulously outline the rights and responsibilities of all partners. Key provisions include defining the roles of general and limited partners, detailing how profits and losses will be distributed, establishing rules for transferring partnership interests, and stipulating the conditions for dissolving the partnership. This agreement acts as the blueprint for the FLP's operations and is essential for its legal validity.

- Fund the FLP: Once the agreement is in place, assets must be formally transferred into the partnership. This process, known as funding, involves retitling assets - such as real estate deeds, investment accounts, or business ownership certificates - into the name of the FLP. It is crucial that all contributed assets are professionally appraised to establish their fair market value at the time of transfer. Valuations must be accurate and comply with IRS rules to avoid penalties, including proper documentation for any applicable valuation discounts. This independent appraisal is vital for accurately calculating the value of partnership interests for gifting and tax purposes.

- Adhere to state filing requirements: An FLP is a legal entity created under state law, which means you must comply with your state's specific filing requirements. This typically involves filing a Certificate of Limited Partnership with the Secretary of State or an equivalent state agency. Each state has its own set of rules and fees, and failure to comply can invalidate the partnership. An attorney can ensure all necessary paperwork is filed correctly and on time.

- Maintain ongoing formalities: Setting up the FLP is just the beginning. To preserve its legal protections and tax benefits, you must operate it as a legitimate business. This includes maintaining a separate bank account for the partnership, keeping detailed financial records and meeting minutes, and filing annual partnership tax returns. Personal and partnership funds must never be commingled. Treating the FLP with this level of formality demonstrates to the IRS and the courts that it is a genuine business entity.

FLP vs. other estate planning tools

Choosing the right estate planning vehicle depends on a family's specific goals regarding control, liability, and taxes. A Family Limited Partnership is a powerful option, but it's important to understand how it compares to other common tools like Trusts and Limited Liability Companies (LLCs).

| Feature | Family Limited Partnership (FLP) | Trust/LLC |

|---|---|---|

| Control | Retained by senior family members as general partners, who manage all assets and decisions. | In a trust, control is transferred to a trustee who manages assets for beneficiaries. In an LLC, control can be held by members or designated managers. |

| Liability protection | Limited partners have liability protection. General partners have unlimited personal liability. | An LLC provides liability protection to all members. An irrevocable trust can offer strong asset protection by separating assets from the grantor's estate. |

| Asset protection | Strong protection from creditors of limited partners, often limited to a "charging order." Partnership assets are shielded. | An irrevocable trust offers robust protection from creditors of the grantor and beneficiaries. An LLC also provides good protection through charging order limitations. |

| Tax benefits | Significant estate and gift tax savings through valuation discounts for lack of marketability and control. Pass-through taxation. | A revocable trust offers no direct tax benefits during the grantor's life. An irrevocable trust can remove assets from the taxable estate. An LLC offers pass-through taxation but lacks the unique gifting valuation discounts of an FLP. |

| Complexity/Cost | High setup and ongoing administrative costs. Requires strict adherence to legal and business formalities. | Trusts can range from simple and inexpensive (revocable) to highly complex and costly (irrevocable). LLCs are generally less complex and less expensive to set up and maintain than FLPs. |

- Family Limited Partnership vs. Trust: The fundamental difference lies in their purpose and management structure. An FLP is essentially a family-run business entity designed for active management and the gradual transfer of wealth while retaining control. In contrast, a trust is a fiduciary arrangement where a trustee manages assets on behalf of beneficiaries according to the terms of a trust document. While an FLP involves ongoing family participation in a business structure, a trust typically involves more passive asset management by a third party for the beneficiaries' benefit.

- Family Limited Partnership vs. LLC: The key distinctions between an FLP and a Family LLC are liability protection and tax benefits. An LLC provides limited liability protection to all of its members, whereas in an FLP, only the limited partners are protected - the general partners face unlimited personal liability. However, the FLP structure is uniquely suited to provide significant estate and gift tax advantages through valuation discounts on gifted interests, a benefit not typically associated with LLCs. Family LLCs, however, offer greater flexibility in management and liability protection compared to traditional FLPs.

When considering global business opportunities, forming a Limited Liability Company (LLC) is also a popular choice in emerging markets like Vietnam. Entrepreneurs who register a company in Vietnam under the LLC structure benefit from limited liability protection, a straightforward governance model, and flexibility in ownership arrangements. Unlike FLPs, which are often used for family wealth management, LLCs in Vietnam are primarily designed for commercial operations, making them a practical option for foreign investors seeking both legal protection and access to one of Asia’s fastest-growing economies.

A Family Limited Partnership is a remarkably effective, albeit complex, tool for wealth preservation, tax reduction, and succession planning. For high-net-worth families and business owners, its ability to provide centralized management, asset protection, and significant estate tax savings is unparalleled. However, the benefits come with considerable responsibilities, including high costs, a heavy administrative burden, and the risk of IRS scrutiny. Success with an FLP requires meticulous planning, adherence to formalities, and a clear, legitimate business purpose.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom