Expropriation is the inherent power of a state to seize private property for a purpose deemed to be in the public interest. For any company or investor, particularly those operating internationally, understanding this power is not just an academic exercise - it's a critical component of risk management. The act of a government taking privately owned property can have profound financial and operational consequences. This guide breaks down the entire concept, from the legal foundations and step-by-step process to its impact on businesses and the rights available.

This article outlines the key aspects of expropriation to help businesses and investors gain a clearer understanding. We specialize in company formation and do not provide legal or dispute resolution advice. For legal matters, please consult a qualified lawyer or relevant authority.

What is expropriation?

Expropriation is the act of a government or one of its agencies taking private property, be it from an individual or a company, for a purpose determined to be for public benefit. This sovereign power is a fundamental aspect of law, but it is not absolute; it is typically conditioned on the payment of prompt, adequate, and effective compensation to the property owner. The seizure must be justified by a clear public purpose, such as the development of infrastructure or for public health and safety reasons, and this public purpose must be explicitly authorized by law to prevent abuse of power.

This state power is known by several names, including 'eminent domain' in the U.S., 'compulsory purchase' in the U.K., and 'condemnation' to describe the legal process itself. While the terminology varies, the core concept remains the same: the state can compel the transfer of private property to public ownership to serve a broader societal need, provided legal conditions are met. Additionally, property owners are generally entitled to due process and the right to challenge the expropriation or the amount of compensation in a court of law.

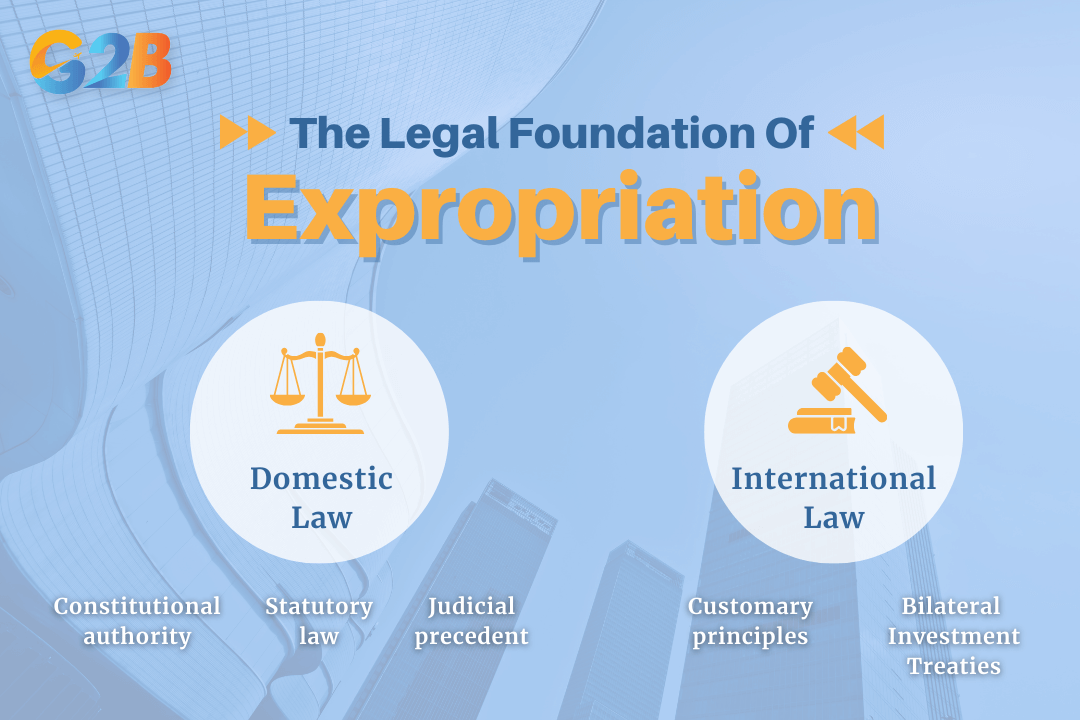

The legal foundation of expropriation

The power of a state to expropriate property is firmly rooted in both domestic and international law, creating a framework that grants the authority while also establishing crucial protections for property owners.

The power of a state to expropriate property is firmly rooted in both domestic and international law

- Domestic law:

- Constitutional authority: National constitutions are often the primary source of expropriation power. A prominent example is the Takings Clause of the Fifth Amendment to the U.S. Constitution, which explicitly permits the taking of private property for "public use," provided "just compensation" is paid and subject to legal limits under the rule of law.

- Statutory law: Specific legislation governs the expropriation process, defining what constitutes public use, outlining the procedural steps authorities must follow, and establishing the methodology for calculating compensation. These laws also provide for remedies and appeal procedures to protect property owners.

- Judicial precedent: Court decisions play a critical role in interpreting the scope of expropriation powers. Landmark cases shape the legal understanding of what qualifies as "public use" and the standards for "just compensation," creating binding precedents for future actions and ensuring judicial oversight over expropriatory acts.

- International law:

- Customary international law principles: For foreign-owned property, a set of established norms governs expropriation to ensure fairness and prevent arbitrary seizures. These principles mandate that any expropriation:

- Must be for a legitimate public purpose.

- Must be non-discriminatory.

- Must be conducted with due process of law.

- Must include "prompt, adequate, and effective" compensation, often referred to as the Hull formula, derived from the Hull v. United States case.

- Bilateral investment treaties (BITs): These are international agreements between two countries that provide significant protections for foreign investors against unlawful expropriation. They establish clear limits on a host country's ability to seize foreign assets and typically grant investors the right to pursue dispute resolution through independent international arbitration rather than local courts. For entrepreneurs considering company formation in Vietnam, understanding the protection offered by BITs is a vital part of legal due diligence, as these treaties enhance investor confidence and mitigate potential risks.

- Customary international law principles: For foreign-owned property, a set of established norms governs expropriation to ensure fairness and prevent arbitrary seizures. These principles mandate that any expropriation:

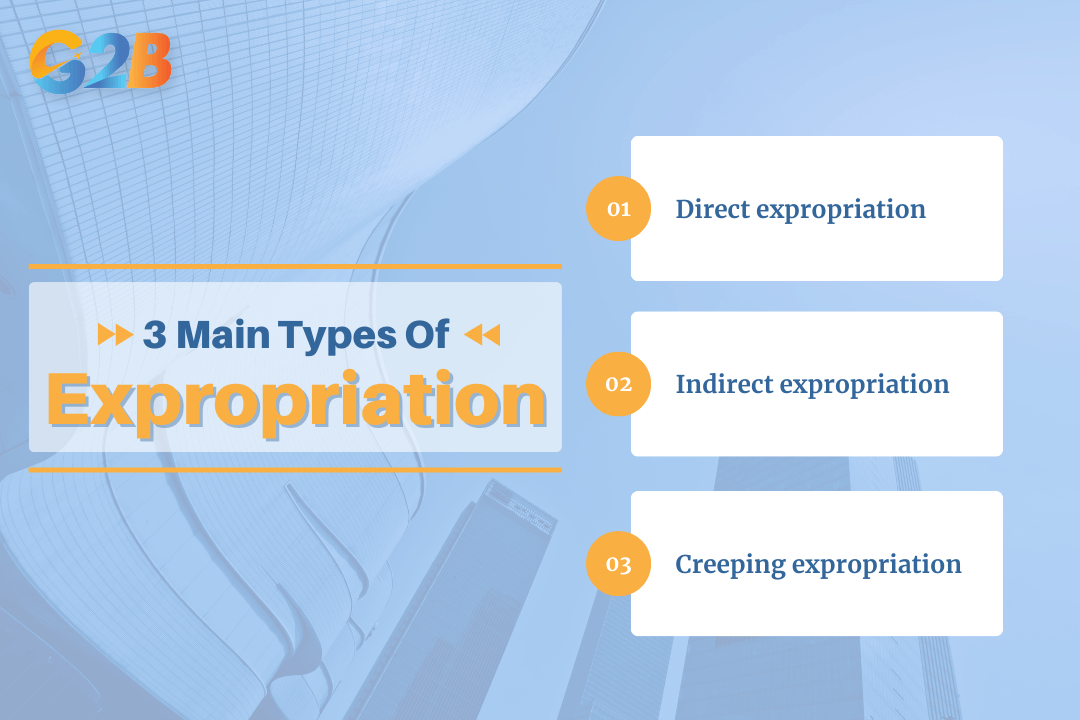

How many types of expropriation?

There are three main types of expropriation, distinguished by the nature and subtlety of the government's action, while creeping expropriation is considered a form of indirect expropriation characterized by gradual and cumulative effects.

There are three main types of expropriation

Direct expropriation

Direct expropriation is an open, formal, and unambiguous seizure of property by the state. In this form of taking, the legal title and ownership of the assets are officially transferred from the private owner to the government. It is the most straightforward and easily identifiable type of expropriation.

This type of action is often used for major public works projects. Clear examples include the government taking a parcel of land to construct a highway, seizing a property to build a new school or military installation, or the nationalization of an entire industry, such as oil and gas or telecommunications.

Indirect expropriation

Indirect expropriation occurs when government actions, short of an outright seizure, effectively deprive the owner of the economic value, use, or enjoyment of their property. While the owner retains the legal title, the government's measures render the property or business economically useless. This form of expropriation is often more complex to identify and prove.

Examples of indirect expropriation include the imposition of prohibitive or discriminatory taxes that make a business unprofitable, the denial of essential licenses or permits required for operation, or the implementation of new, targeted regulations that completely undermine the economic viability of an investment.

Creeping expropriation

Creeping expropriation is a gradual and cumulative form of indirect expropriation that happens gradually through a series of government actions over time. No single measure on its own may constitute a taking, but their cumulative effect is the substantial deprivation of the owner's property rights. This incremental nature makes it particularly challenging to pinpoint the exact moment of expropriation.

The effect of creeping expropriation is that the investor is slowly "squeezed out" of their investment. This can occur through a combination of escalating taxes, increasingly burdensome regulations, denial of permits, or other administrative hurdles that, taken together, destroy the economic value of the asset or deprive the investor of control over their investment.

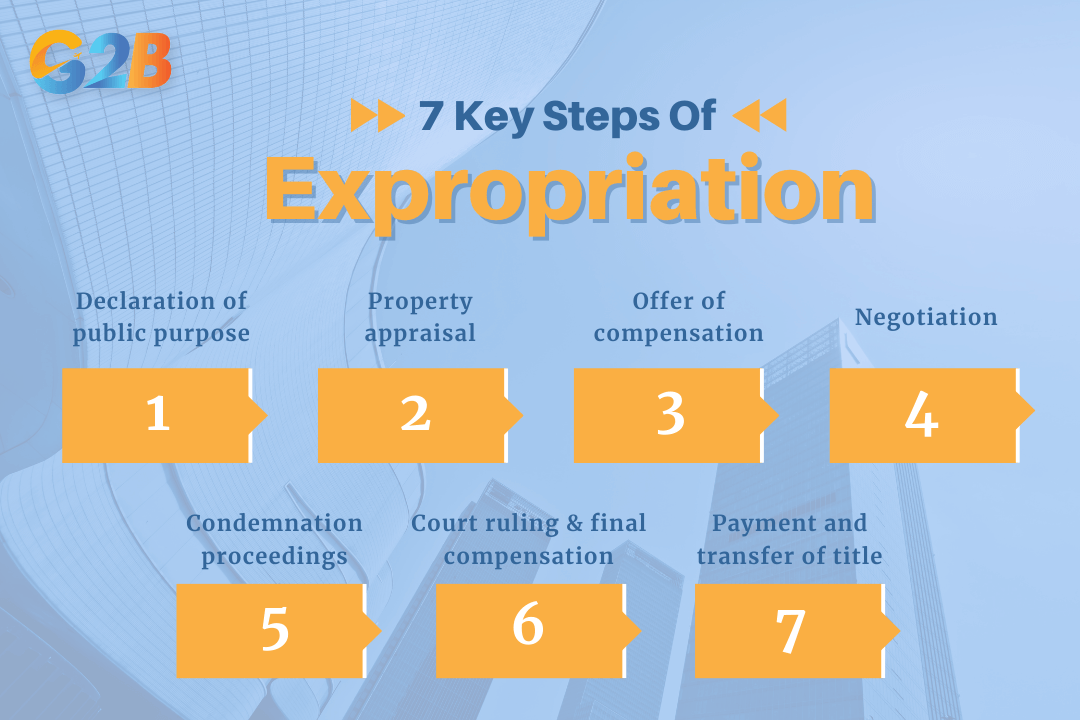

How many steps of expropriation?

The expropriation process typically follows seven key steps, designed to ensure legal compliance and balance the interests of the state with the rights of the property owner.

The expropriation process typically follows seven key steps

Step 1: Declaration of public purpose

The process begins when the expropriating authority - a government body at the federal, state, or municipal level - formally identifies a need for private land for a specific public project. This involves comprehensive planning to confirm that the taking is necessary to achieve a legitimate public objective, such as the construction of roads, schools, or other vital infrastructure. The authority must demonstrate that the expropriation is fair, sound, and reasonably necessary for the project to proceed.

Step 2: Property appraisal

Once the need is established, an independent and objective appraisal of the property is conducted to determine its fair market value. Appraisers consider various factors, including the property's current use, development potential, and recent sales of comparable properties in the area. This step is critical for establishing a baseline for the compensation that will be offered to the owner and is designed to reflect the property's value as if it were sold in an open market by a willing seller to a willing buyer.

Step 3: Offer of compensation

Following the appraisal, the government extends a formal offer of compensation to the property owner. This offer is based on the determined fair market value and may also include additional funds to cover costs associated with the displacement, such as relocation expenses or business losses directly caused by the taking, or other statutorily mandated compensations. The goal is to provide "just compensation" that puts the owner in the same financial position they would have been in had the expropriation not occurred.

Step 4: Negotiation

After the initial offer is made, a period of negotiation typically ensues. The property owner has the right to review the government's appraisal and may conduct their own valuation. If the owner believes the offer is inadequate, they can present their counter-appraisal and negotiate for a higher amount. This phase allows both parties to attempt to reach a mutually acceptable agreement on compensation without resorting to legal proceedings.

Step 5: Condemnation proceedings

If negotiations fail and the property owner rejects the final offer, the government will initiate formal legal action known as condemnation proceedings. The authority files a case in court to legally acquire the property. It's important to note that these proceedings are typically focused on determining the amount of just compensation, not on challenging the government's right to take the property, unless there is a credible claim that the taking is not for a legitimate public purpose.

Step 6: Court ruling and final compensation

During the court proceedings, both the government and the property owner will present evidence and expert testimony regarding the property's value. The court will then make a final, binding determination on the amount of just compensation owed to the owner. This ruling establishes the legal amount that the government must pay to acquire the property.

Step 7: Payment and transfer of title

The final step is the payment of the court-determined compensation to the property owner and the formal transfer of the property's title to the government. The transfer of legal ownership only occurs once the owner has received full payment or upon court order, completing the expropriation process. Once this is done, the expropriating authority can proceed with its public use project.

Impact of expropriation on the company

For a business, expropriation is a significant event that can have severe and far-reaching consequences. The impacts extend beyond the simple loss of property and can disrupt every facet of an organization.

- Financial impacts:

- Direct loss of physical and intangible assets: This includes the seizure of land, buildings, and machinery, as well as the loss or restriction of rights over intellectual property and goodwill associated with the location.

- Loss of future revenue and profitability: The inability to operate at the expropriated site leads to a direct loss of income streams and market share.

- Costs associated with business disruption and relocation: These include expenses for finding a new location, moving equipment, and re-establishing operations.

- Potentially inadequate or delayed compensation from the government: The "just compensation" offered may not fully cover the true economic loss, including lost future profits, and payments can be delayed by lengthy legal processes.

- Significant legal fees incurred fighting the expropriation or compensation amount: Challenging the taking or negotiating a fair settlement requires substantial investment in legal and appraisal experts and can be time-consuming, further straining cash flow.

- Operational impacts:

- Complete or partial shutdown of operations: Expropriation can force a business to cease its activities entirely until a new facility can be established.

- Severe disruption to supply chains and customer relationships: A forced relocation can damage carefully built logistical networks and may lead to the loss of loyal customers.

- Loss of strategic location or resources: The expropriated property may have offered unique advantages, such as proximity to key markets, suppliers, or natural resources, that cannot be easily replicated.

- Negative impact on employee morale and retention: The uncertainty and disruption can lead to stress among employees, potentially causing key staff members to seek other employment, which may reduce productivity and negatively affect company culture in the long term.

- Legal and strategic impacts:

- Diversion of management focus to legal battles instead of core business activities: Senior leadership must dedicate significant time and energy to managing the expropriation case rather than focusing on growth and innovation.

- Creation of significant political risk for future investments in the region: An unfair expropriation can signal an unstable investment climate, deterring the company and other potential investors from future projects in that country. This political risk can impact the broader investment environment beyond the individual company.

- Damage to relationships with government bodies: A contentious expropriation dispute can harm a company's relationship with regulatory and governmental authorities, creating long-term obstacles.

Rights of property owners and dispute resolution

When facing expropriation, property owners are not without recourse. Both domestic and international law afford them fundamental rights and provide specific avenues for resolving disputes.

- Fundamental rights of the owner:

- The right to challenge the legality of the taking: Owners have the right to question whether the expropriation serves a legitimate public purpose. However, in many legal systems, the state's power to expropriate is presumed valid if the statutory procedures are followed, limiting this right to exceptional cases. If it can be proven that the taking is for private benefit or not truly necessary, it may be contested in court.

- The right to receive "just compensation": This is a cornerstone of expropriation law. The owner is entitled to be paid the fair market value of their property and, in many jurisdictions, damages related to business disruption and relocation.

- The right to a fair process (due process): The owner must be given proper notice of the government's intent, an opportunity to be heard, and the right to have their case reviewed by an impartial authority.

- Avenues for dispute resolution:

- Negotiation and mediation: The first and often most efficient approach is direct negotiation with the expropriating authority. Involving a neutral third-party mediator can help facilitate discussions and lead to a mutually agreeable settlement on compensation, avoiding costly litigation.

- Domestic courts: If negotiations fail, property owners can take their case to the national court system. These courts have the authority to rule on the legality of the taking and, more commonly, to determine the final amount of just compensation.

- International arbitration: For foreign investors protected by a Bilateral Investment Treaty (BIT), international arbitration is a critical option. This allows the investor to bring a claim against the host state before a neutral international tribunal, such as the International Centre for Settlement of Investment Disputes (ICSID), rather than relying on the domestic courts of the country that expropriated their property. This option typically requires that arbitration provisions be included in the BIT or investment agreement.

Expropriation is a powerful and essential tool of state governance, but it is one that directly intersects with the fundamental rights of private property owners. For businesses and investors, understanding its nuances is not optional - it is a core component of effective risk management and strategic planning. This guide has detailed the legal foundations, the procedural steps, and the critical rights that come into play when a government exercises this power.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom